Wild Wednesday? SP500 hits new record high ahead of Fed decision, Big Tech earnings

We had already outlined the key risks for this week in our article published Monday (Jan 26).

Before we share more details and insights into today's potentially market-moving events, let's first do a quick check-in on 2 of our "3 Assets to Watch" listed at the onset of this week.

1) SP500 posts new record high - as expected!

Bybit's SP500 has today posted never-seen-before prices above the psychologically-important 7,000 level.

This new record high fulfills the SP500 scenario highlighted at the onset of this week.

SP500 has risen as much as 2.4% so far this week. And that's even before the big events for the week have transpired.

Stocks are climbing today (Mon, Jan 28) after the Netherlands-based ASML, Europe's AI poster child, announced record orders in Q4 for its most sophisticated chip-making machines.

This news has further stoked AI euphoria and lifted tech stocks, including big tech companies included in the SP500 and NAS100 indices.

2) Nat Gas pulls back as expected - but yet to reach downside target

When we wrote Monday's article, Natural Gas (Bybit: NG-C) was trading at 5.113.

At the time of writing, prices are trading at 4.866 - a decline of about 4.8%.

With today being the final trading day of the current NatGast active futures contract, with a rollover due tomorrow to the March contract that's currently priced at 3.70.

In what's set to be a pivotal week for markets, there was a glitch on the New York Mercantile Exchange, which hosts the most active US gas contract. The trading halt which typically lasts only 5 seconds, went on for 2 minutes.

And with US weather forecasts from the National Oceanic and Atmospheric Administration pointing to a let up in the winter blast next week, it remains to be seen whether NG-C will make it all the way down to its 50-day simple moving average (SMA).

And now, onto the main events slated for today (Wednesday, Jan 28) ...

Fed drama ahead despite no-change to rates?

The US central bank is widely expected to keep US rates unchanged - anything else today would be a shocker!

However, markets are eager to receive any clues about when the next Fed rate cut might happen.

The Fed rate decision is due at 7:00PM UTC, with Fed Chair Jerome Powell's press conference set to begin 30 minutes later.

POTENTIAL SCENARIOS:

If the Fed suggests that the next US rate cut may happen SOONER than June 2026, that could send stocks, gold, even cryptos moving up!

If the Fed suggests that the next US rate cut may happen only later in the year (2H 2026), that could pull stocks, gold, even cryptos lower.

As things stand, markets now PREDICT an 82% chance that the next Fed rate cut will only happen in June, while 95% odds are being given to TWO Fed rate cuts total for 2026.

Also, look out for any comments during Fed Chair Jerome Powell's press conference about the legal battles between the US central bank and the White House - that could rock markets as well.

Then, just hours after Chair Powell wraps up his press conference ...

Meta, Microsoft, Tesla earnings due after US markets close Wed, Jan 28.

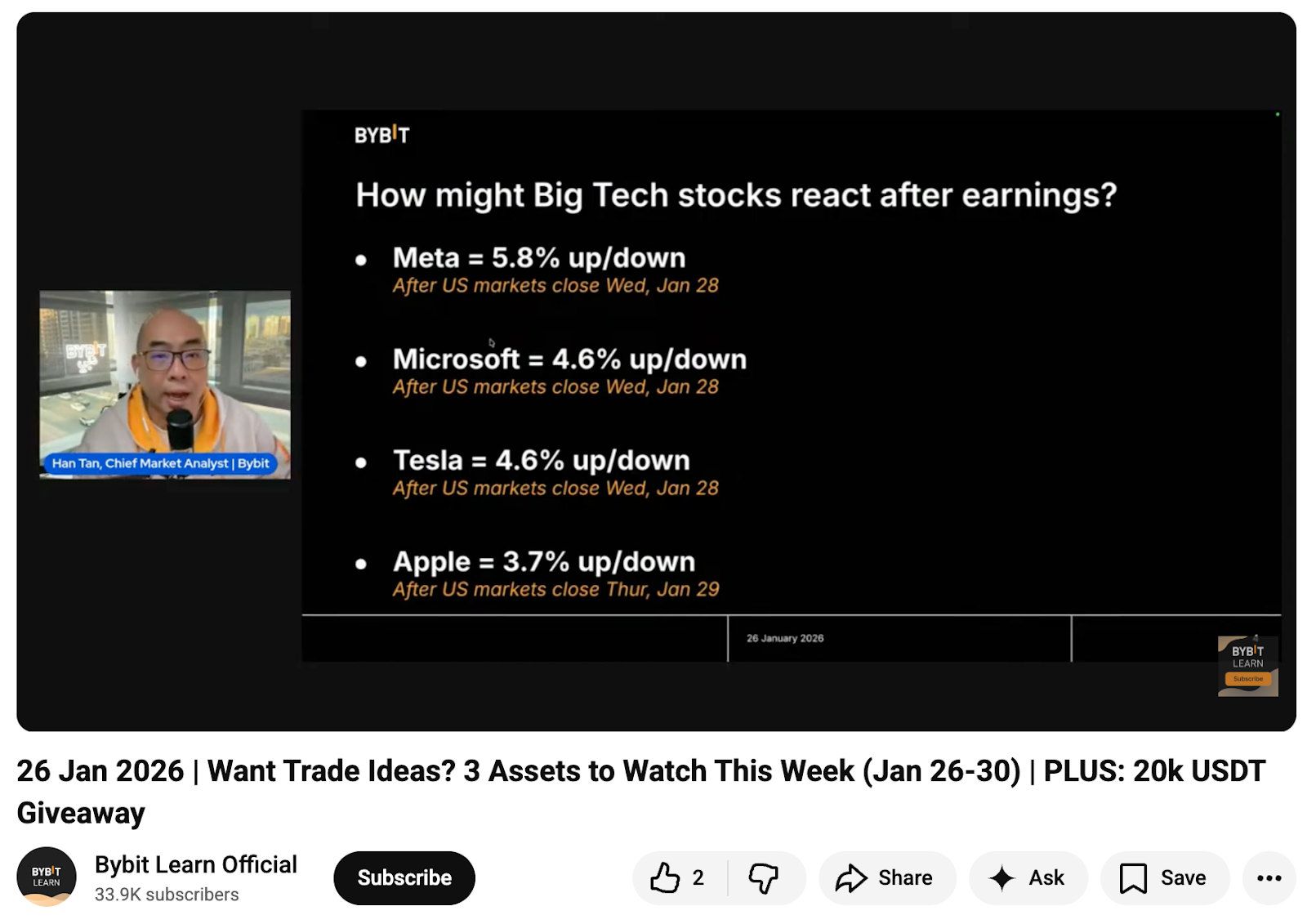

These are the latest market forecasts for how each of these Big Tech stocks may react to their respective earnings announcements this week:

Microsoft: 4.7% up/down

Tesla: 5.2% up/down

Meta: 6.2% up/down

Apple: 3.4% up/down (after US markets close Thur, Jan 29).

The above are updated figures from the ones shared during our Week Ahead PREVIEW Livestream on Monday, January 26.

Still, it remains to be seen whether these incoming Big Tech earnings can sustain the uplift on tech stocks and US indexes after it shares its Q4 results and earnings outlook.