US CPI Countdown: Markets Already Reacting. Are You?

At the start of this week, we had sounded an optimistic note for risk assets following last Friday's (Feb 6th) rebound for stock indices and cryptos.

However, such risk-taking appetite was dented as the week progressed.

Sure, there was the surprise display of resilience in the mid-week release of the US jobs report, which forced markets to dilute bets for Fed rate cuts.

However, Wednesday's reaction to the NFP was relatively muted compared to yesterday's (Thursday, Feb 12) declines:

Bitcoin (BTC/USDT) tumbled towards the $65k level on Thursday, paring more of its rebound from last Friday (Feb 6th), though is holding above $66k at the time of writing this Friday, Feb 13th.

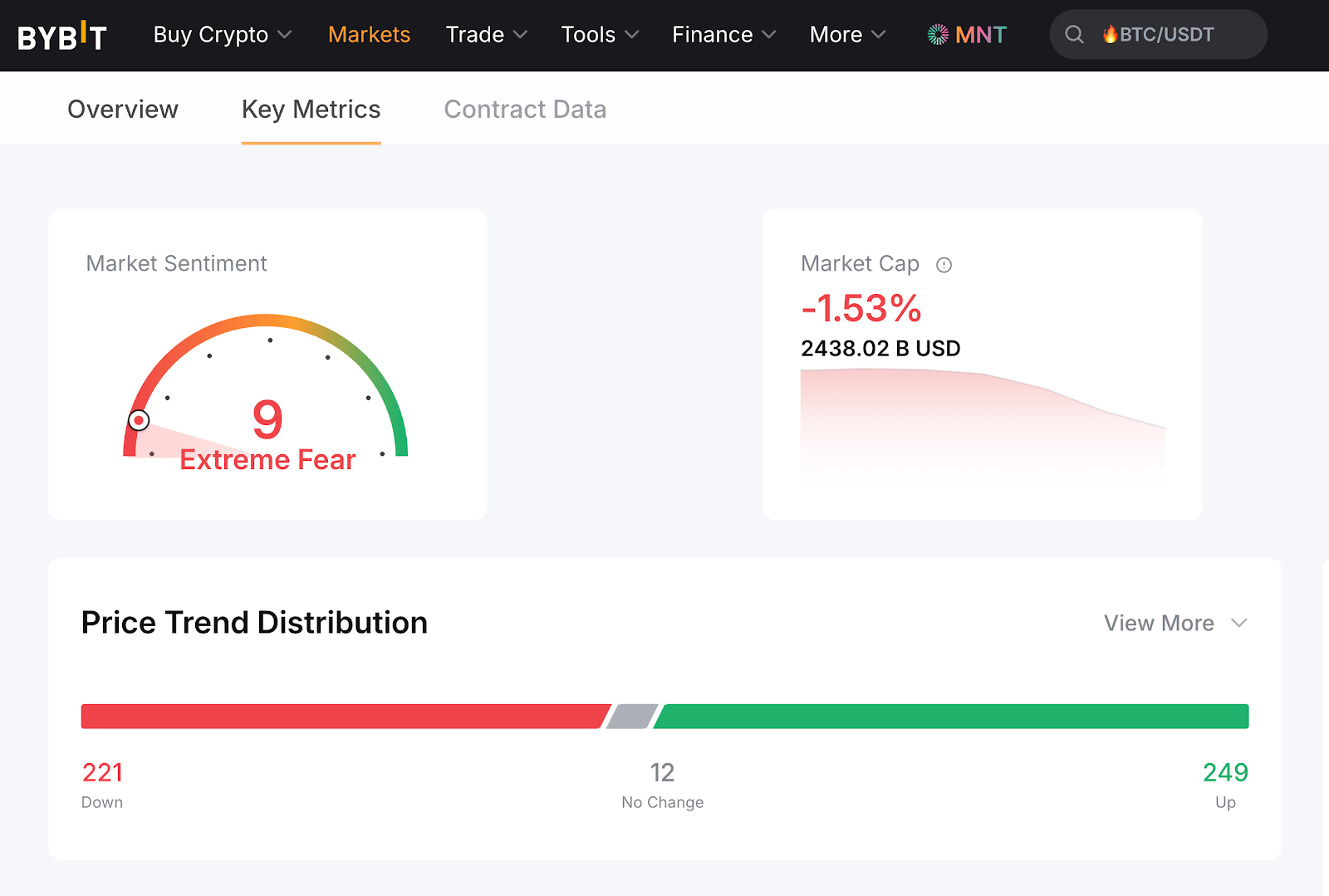

The broader CoinDesk 20 index is also catching a slight lift, though broader crypto sentiment is still wallowing in "extreme fear".

READ MORE: Bitcoin Bear Market - Is The End Near? (published Feb 11, 2026)

Bybit's SP500 - which tracks the benchmark S&P 500 index - has once again been resisted around the 7,000 psychological level, before tumbling to its 100-day simple moving average (SMA) for crucial support.

This fulfills the downside scenario we had outlined on Monday, Feb 9:

"The SP500 may re-test its 100-day SMA for critical support once more if markets sense that future Fed rate cuts are harder to come by ..."

Even Gold (XAUUSD+) fell alongside broader markets yesterday (Thur, Feb 12), though is clinging to its 21-day SMA ahead of today's crucial CPI release.

Why did markets fall on Thur, Feb 12? It was all rather odd.

What's rather puzzling about Thursday's price action is there was no clear outright catalyst for yesterday's selloff.

Instead, financial media once again pointed to the so-called AI "scare trade" - where investors dump stocks of companies that could be threatened by the disruptive forces of artificial intelligence (think real estate firms, tax advisories, software makers, and many other industries).

Market commentators even point to algos and commodity trading advisors (CTA) embarking on systematic selling as part of their momentum-chasing strategies.

Perhaps markets were wary ahead of today's CPI release, opting to de-risk/reduce exposures/take profits ahead of such a pivotal market catalyst, especially after Wednesday's nonfarm payrolls (NFP) data turned out to be a shocker.

Whatever the reason, Thursday's "odd" selloff now sets up a nervy countdown to the January US inflation data's release due 1:30 PM UTC today (Fri, Feb 13)