Here's why Silver's crashing! BTC hits our downside target. EURGBP could see most volatility since Nov.

Oh, how the mighty has fallen.

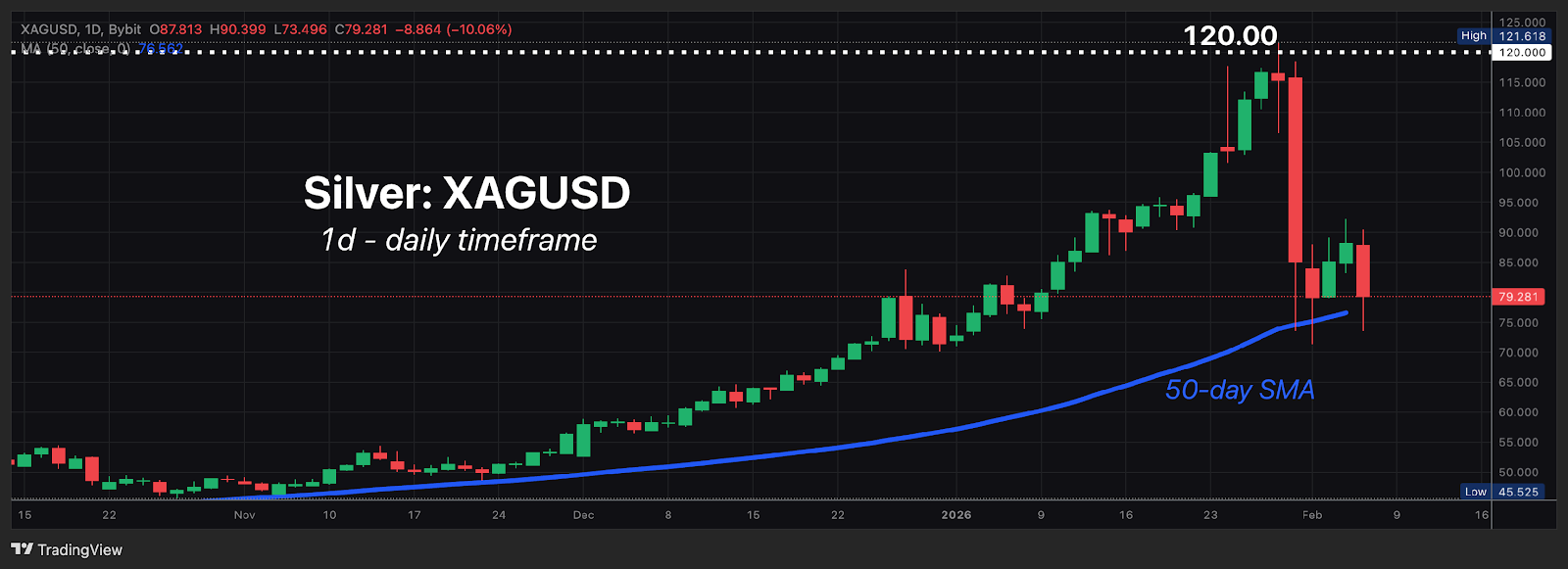

Silver was 2025's outstanding performer, climbing 148% last year to register its biggest annual gain since 1979.

2026 also kicked off in similar fashion: XAGUSD soared as much as 70% to post multiple new record highs.

Then, it all came undone.

From that intraday peak of $121.618 registered on Jan 29th, it has fallen by as much as 40% in recent sessions.

Today alone (Thur, Feb 5), Silver has sunken as much as 17%, though is attempting to find support around its 50-day simple moving average (SMA).

3 reasons why Silver is sinking

1) Stronger US dollar

Silver is priced in US dollars, hence its ticker: XAGUSD.

When the US dollar strengthens, the XAG/USD price tends to fall, as it takes fewer dollars to purchase an ounce of silver. Conversely, when the dollar weakens, the XAG/USD price tends to rise."

2) Easing Geopolitical Tensions

News of upcoming U.S.-Iran talks in Oman on Friday dampened safe-haven demand for precious metals.

Any easing of tensions involving Iran could prompt investors to reduce their positions in safe havens, such as Gold (XAUUSD+) and Silver (XAGUSD).

3) Fragile Sentiment and Thin Liquidity

Following its historic rout (Jan 30: Silver posted its biggest-ever intraday decline), market sentiment remains fragile amid thin liquidity (i.e. it doesn't take much selling to see a big drop in prices)

Furthermore, the market behavior today reflects a classic risk-off rotation.

Investors have been aggressively trimming exposure to high-beta assets, booking profits, and seeking safety in the dollar:

So far this month (February 2026), the US dollar has strengthened against all of its G10 peers (e.g. EUR, GBP, JPY, etc.) except against the Australian Dollar (AUD).

Bybit's SP500, which tracks the benchmark S&P 500, is also falling, though finding support around its 50-day SMA in recent sessions.

READ MORE: "After Gold and Silver's Crash, Is This The New Safe Haven?" (published Tue, Feb 3)

NOTE:

Gold and Silver are both precious metals and broadly seen as 'safe havens', though the former is the more illustrious safe haven than the latter.

Silver is also a lot more volatile than gold, as today's (Thursday, Feb 5) price action once again illustrates.

Even Bitcoin (BTC/USDT) has sunken to its lowest prices since 2024, fulfilling the downside scenario we outlined on Monday, Feb 2:

"If BTC fails to hold around that $74,500 crucial support, prices may next move to the $70k big, round number for psychological support - levels not seen since early November 2024."

Since October 2025, crypto bears have firmly been in control, capitalising on the slightest of excuses to keep prices in a downtrend (lower highs and lower lows).

Crypto sentiment has eschewed risk-on narratives in recent months, at a time when precious metals and global equities were posting multiple record highs, even as confidence-boosting catalysts appear scant along crypto's near-term horizon.

EURGBP+ braces for BoE, ECB decisions

Today, 2 major central banks are set to decide on their respective interest rates:

Bank of England (BoE) @ 12:00 PM UTC

European Central Bank (ECB) @ 1:15 PM UTC

Here are the market's forecasts surrounding today's central bank meetings and the expected EURGBP reaction:

Both the BoE and ECB are widely expected to leave their respective interest rates unchanged today - anything else would be a shocker!

Markets currently predict just a 22% chance of another ECB rate cut by end-2026.

Markets currently predict a 71% chance that the BOE might cut again in April 2026.

In the 6 hours after today's rate decisions, markets predict that EURGBP+ can move either 0.18% up, or 0.5% down.

For the next one-week period, Bloomberg's FX model predicts a 79% chance that EURGBP will trade between 0.859 - 0.874.

NOTE: A currency tends to weaken at the thought of its country's interest rates going down.

EURGBP+ remains firmly in the downtrend (lower highs and lower lows) since mid-November 2025.

Over the past 2 daily sessions, EURGBP+ has rebounded (Euro getting stronger vs. British Pound) to resurface above its 200-day simple moving average (SMA).

Astute FX traders will be closely monitoring the policy signals emanating out of the BoE and the ECB today, especially as markets forecast the most 1-week volatility for EURGBP in over 2 months (since late-Nov).