Bitcoin set for 5th weekly decline, but stocks are rising. Can these upcoming events flip the script for cryptos?

Risk appetite is creeping back into markets as AI enthusiasm stirs a tech rally, lifting stocks and giving Bitcoin a modest bounce.

But don't let today's slight green candlestick fool you:

Bitcoin is still on track for its longest losing streak since 2022.

Crypto prices are unwilling to draw too much inspiration from news that the likes of Goldman Sachs CEO David Solomon, long a crypto skeptic, just revealed that he now owns Bitcoin, albeit a "very, very limited" amount.

Furthermore, it's been reported that Abu Dhabi sovereign wealth fund, Mubadala Investment Co., has increased its exposure to the world's biggest crypto, via ETFs (exchange-traded funds) in Q4 2025.

But spot Bitcoin prices apparently didn't get the memo, at least not yet.

Why Crypto Isn't Following Risk-On Moves?

There's still an apparent lack of confidence in crypto, especially among retail investors.

US-listed crypto ETFs saw about US$ 360 million withdrawn last week - marking a 4th straight week of net outflows.

Furthermore, there's an apparent lack of liquidity that greatly supresses crypto prices.

According to a new report from crypto investment firm and market maker Keyrock, Treasury bill issuance is the primary liquidity metric that impacts Bitcoin's price.

Every 1% change in global liquidity levels impacts BTC's price by 7.6% the following business quarter, with Treasury bill issuances having an 80% correlation with Bitcoin prices.

In short, if liquidity isn't flowing, Bitcoin isn't pumping.

Well, What's Actually Moving Now?

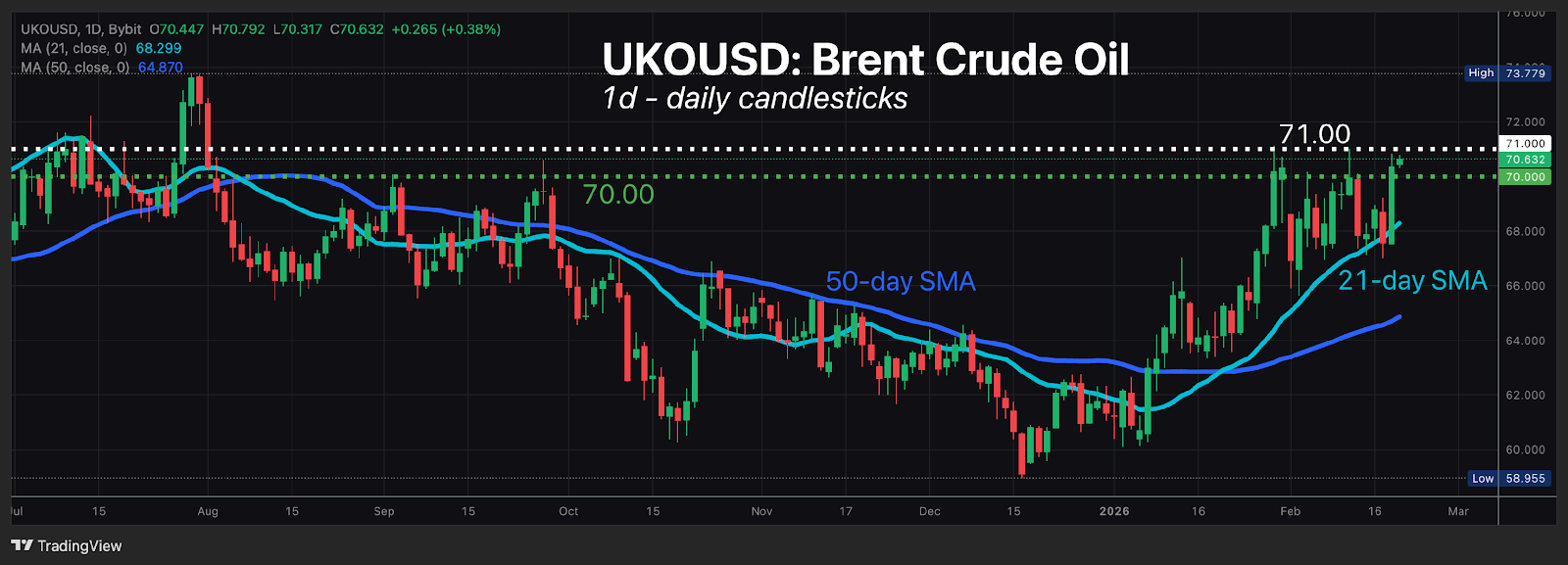

Brent Crude oil (UKOUSD) is coming off the back of its biggest one-day gain since October.

The global oil benchmark surged 4.1% yesterday (Wed, Feb 18) following news reports of looming US military action against Iran.

Such a conflict may threaten global oil prices, sending prices higher.

At the time of writing, the global oil benchmark is embarking on its 3rd attempt to test the $71/bbl big, round number for resistance.

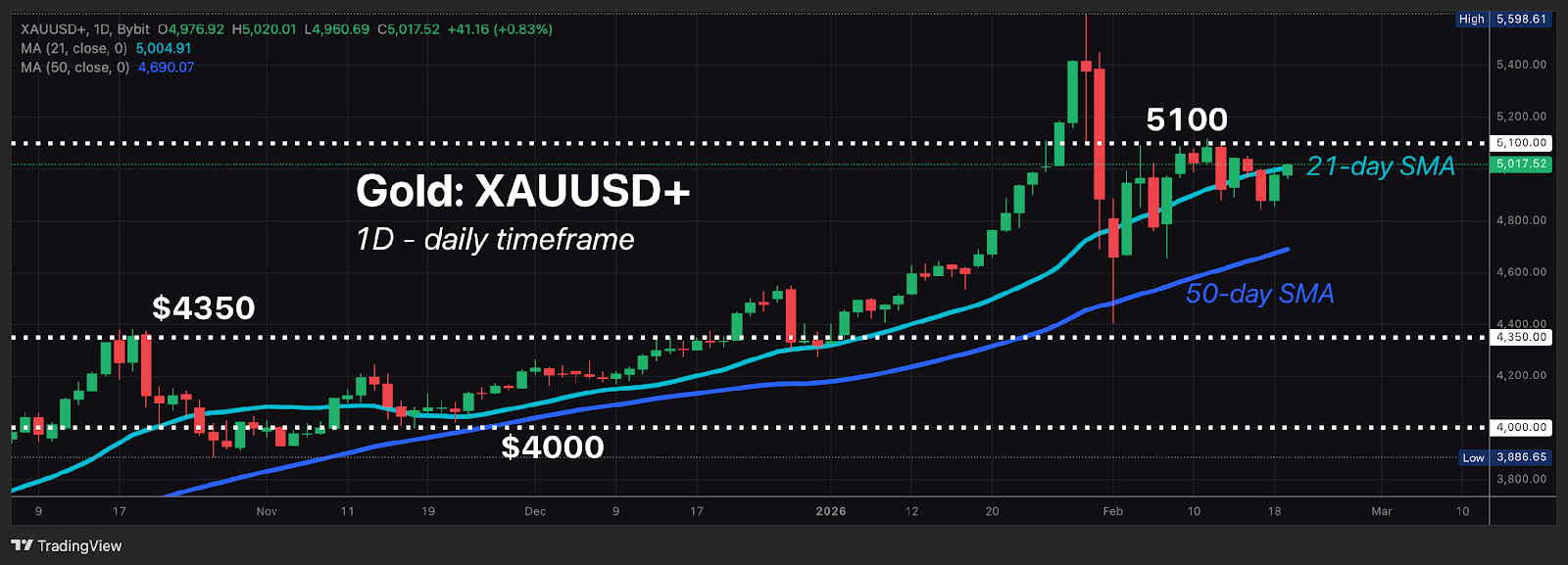

Gold (XAUUSD+) has rebounded back above the psychological $5k level, though testing resistance at is 21-day SMA

Most G10 currencies (except the Japanese Yen) are catching a slight lift today, after weakening against the US dollar yesterday (Wed, Feb 18).

The US dollar strengthened after the latest FOMC meeting minutes were released yesterday (Wed, Feb 18) - a key event for this week we'd highlighted since Monday, feb 16.

The minutes from the late-January FOMC meeting suggested that the Fed may have to contemplate raising interest rates if inflation remains high.

Talk of US rate hikes is a surprise shift from the Fed rate cuts that have long dominated market expectations.

The stronger US dollar sent GBPUSD+ (British Pound vs. US dollar) tumbling below our downside target, and keeps the British Pound as G10's worst-performer against the "buck" so far in February 2026 (GBPUSD+ down 1.4% month-to-date).

NOTE: A currency tends to strengthen at the idea of its country's interest going up/staying higher.

Bybit's SP500 - which tracks the benchmark S&P 500 stock index - is testing its 50-day simple moving average (SMA) as resistance once more.

A daily close above the 50-day SMA could see the SP500 re-test the 7,000 psychological level for resistance once more.

The overall vibe?

There's cautious optimism in stock markets as AI overspending fears fade, but crypto remains under pressure from persistent outflows and a lack of liquidity.

What Could Rock Markets Before the Weekend?

1) Walmart earnings: before US markets open today (Thursday, Feb 19)

Walmart shares could see a 6% move up/down when US markets open today (following Walmart's latest quarterly earnings).

A 6% post-earnings move is the updated figure, bigger than the 5% number cited in our "3 Assets to Watch" article published Monday, Feb 16.

Why Walmart matters?

Walmart is:

The world's biggest retailer

The biggest private employer in the US

Part of the so-called "Trillion-Dollar Club", with a market cap of US$ 1.009 trillion as of US market close on Wed, Feb 18)

Among the top-10 biggest gainers on the Dow Jones Industrial Average index (Bybit: DJ30) so far this year.

2) US Supreme Court ruling on Trump tariffs: Friday, Feb 20

SCOTUS has returned from a four-week recess, and is set to issue opinions on President Trump's trade tariffs on Feb 20th, 24th, and 25th.

If the Supreme Court rules against Trump, that could alleviate US economic pressures as tariffs are estimated to cost importers over US$ 16 billion per month.

Such a ruling could see a knee-jerk bounce in risk assets, even though markets are aware that the White House may have other legal tools at its disposal to reinstate trade tariss.

3) US December PCE and 4Q GDP data: 1:30PM UTC time Friday, Feb 20

The US Personal Consumption Expenditure index is the Federal Reserve's preferred way to measure inflation.

Here's what economists predict for this top-tier economic data release:

PCE month-on-month (Dec 2025 vs. Nov 2025): 0.3%

If so, 0.3% would be faster growth than November 2025's 0.2% month-on-month number

PCE year-on-year (Dec 2025 vs. Dec 2024): 2.8%

If so, 2.8% would match November 2025's year-on-year number

Core PCE (excludes food and energy prices) month-on-month: 0.3%

If so, 0.3% would be faster growth than November 2025's 0.2% Core PCE month-on-month number

Core PCE year-on-year: 2.9%

If so, 2.9% would be faster growth than November 2025's 2.8% y/y number

US 4Q GDP: 3%

If so, 3% would be notably slower economic growth than 4.4% in Q3 2025

Gold, stock indices, and cryptos may move lower if sluggish US economic growth, along with still-stubborn inflation, prevents the Fed from lowering US interest rates this year.