After Gold and Silver's crash, is this the new safe haven?

The recent crashes in Gold and Silver are still fresh in the market's collective memory.

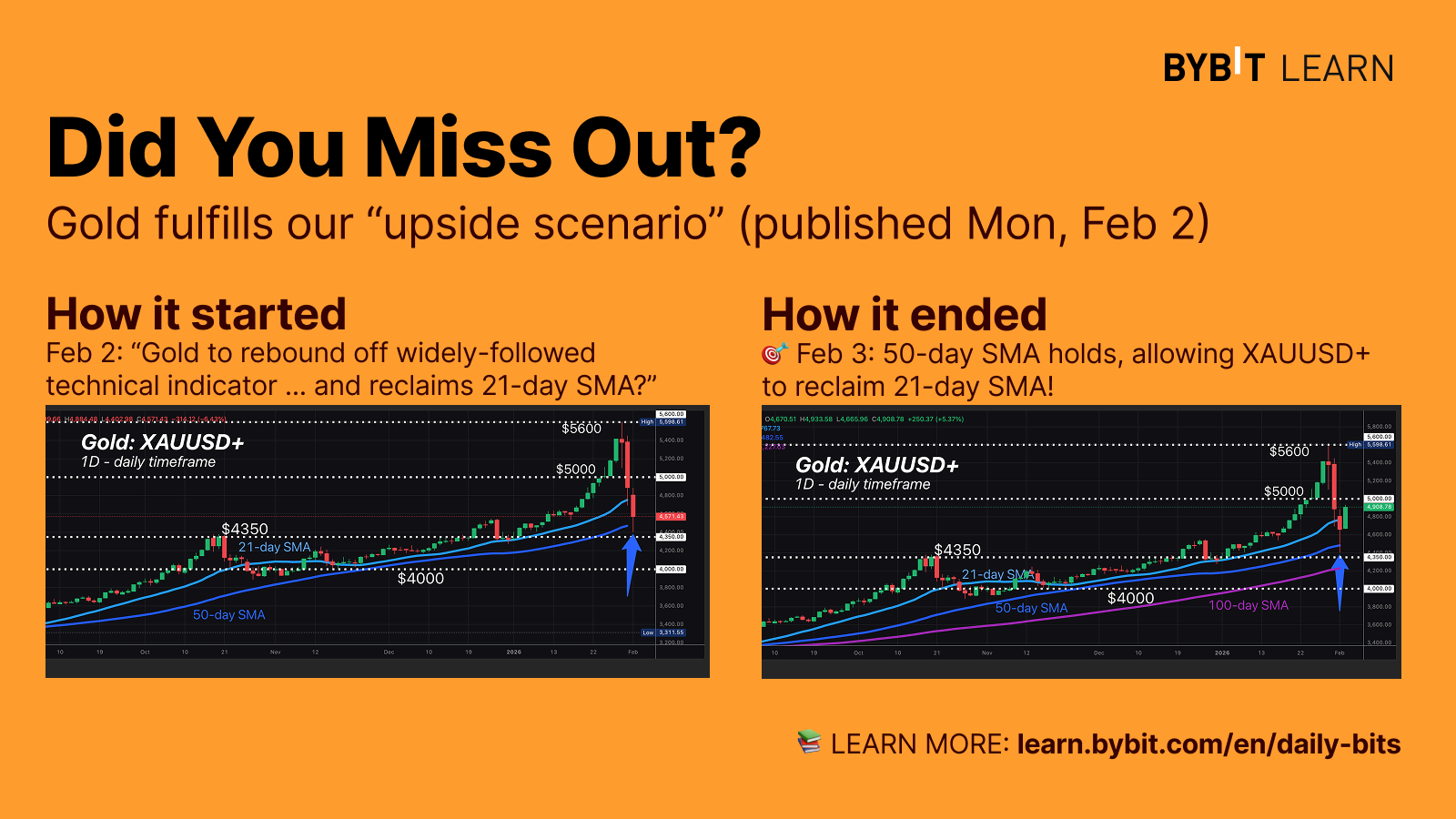

Recall, as we wrote yesterday (Monday, Feb 2):

On Friday (Jan 30), Gold (XAUUSD+) saw its biggest intraday decline since the early 1980s

Also on Friday (Jan 30), Silver (XAGUSD) posted its biggest-ever intraday decline!

Today though (Tuesday, Feb 3), both these precious metals are rebounding as market participants enter to "buy the dip" (one of 2 strategies we highlighted in yesterday's article that can be used to take advantage of falling prices).

At the time of writing, Gold has fulfilled our upside scenario published yesterday (Mon, Feb 2), and rebounded back above the psychologically-important $4900 level.

SP500 a whisker away from new record high

However, amidst the rapid declines in commodities, currencies, and even cryptos, US stock indices have been largely unperturbed.

At the time of writing, the SP500 is less than 0.2% away from posting a new record high!

NOTE: Bybit's SP500 tracks the benchmark S&P 500 index - which is the most popular measure of the overall US stock market's performance, specifically via some 500 of the biggest industry leaders in the US.

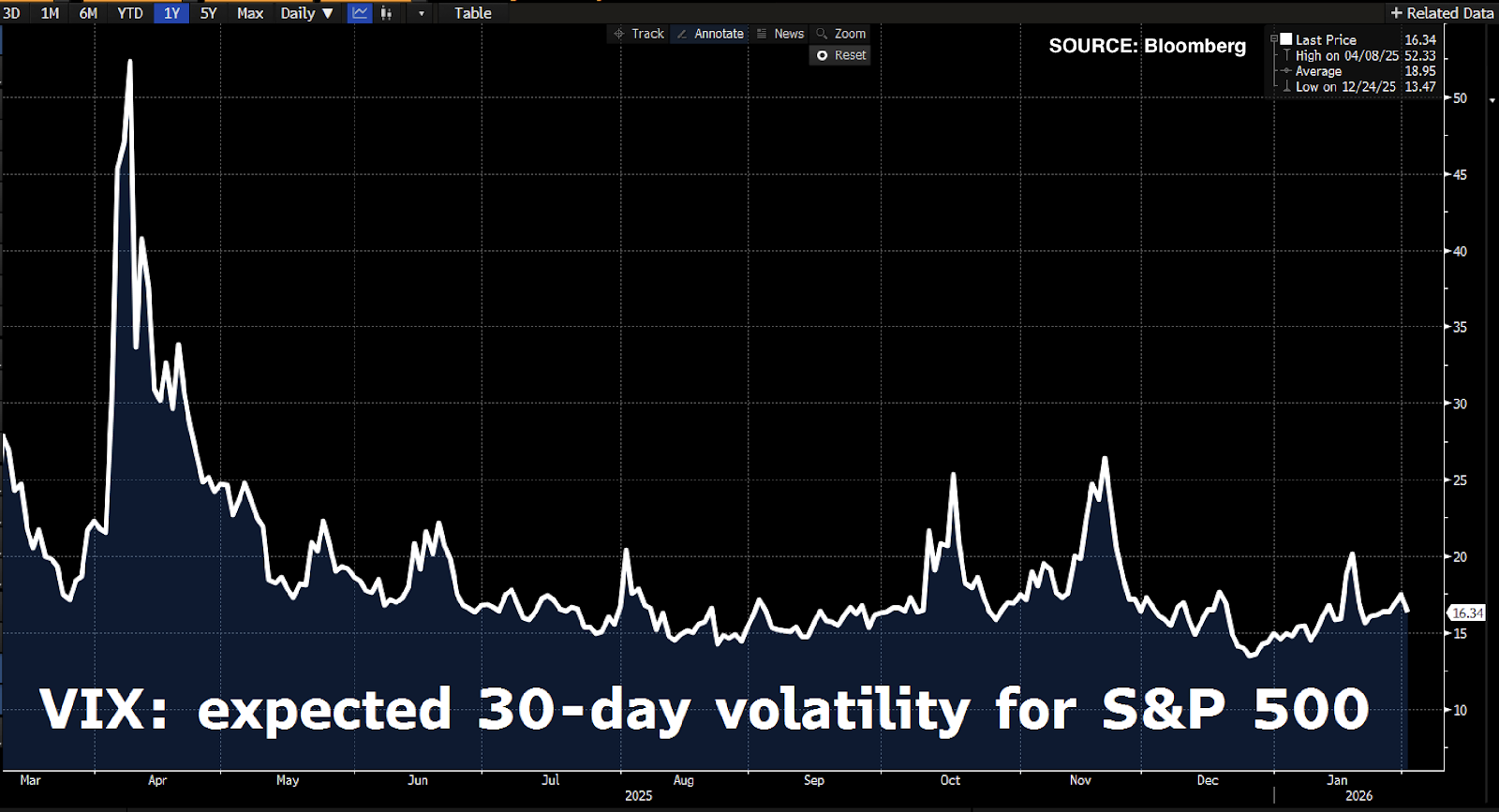

Then, consider the VIX - which measures market expectations for volatility for the S&P 500 over the next 30 days.

Despite the recent turmoil across other major assets, the VIX has remained largely unperturbed, still well below the 20 level which typically denotes "stability".

At 16.34, the VIX is now also below its average reading over the past 12 months of 18.95 (read: the S&P 500 is expected to show lower-than-usual volatility going into March 2026).

As we know, a hallmark of "safe haven" assets is its price stability during times of market turmoil.

To be clear, the S&P 500 is not considered a safe haven asset, and can be prone to wild price swings (volatility).

However, the SP500's recent stability relative to precious metals, FX and cryptos perhaps can offer some solace to investors and traders who are still raw from the violent price swings of late.

3 major events that could move the SP500 this week (Feb 3 - 6)

1) Feb 4th: Alphabet earnings

Google's parent company is due to release its financial results from Q4, along with its latest earnings outlook, after US markets close on Wednesday, February 4th.

From its most recent closing price (Monday, Feb 2):

Alphabet's stocks are predicted to move 4.9% up/down after its earnings announcement.

Given its market cap of US$ 4.15 trillion, which is about US$ 1 trillion bigger than Microsoft, the market's reaction to Alphabet's past and future earnings has enough heft to sway the broader S&P 500 index as well.

NOTE: Recall how Microsoft's 10% plunge on Thursday, Jan 29th - after its own earnings announcement - in turn dragged the SP500 down to its 50-day simple moving average (SMA).

2) Feb 5th: Amazon earnings

This tech giant is due to release its financial results from Q4, along with its latest earnings outlook, after US markets close on Thursday, February 5th.

From its most recent closing price (Monday, Feb 2):

Amazon's stocks are predicted to move 6.5% up/down after its earnings announcement.

NOTE: Amazon, with its bigger forecasted post-earnings move relative to Alphabet's, is also featured among our "3 Assets to Watch" for this week.

3) Feb 6th: US jobs report (nonfarm payrolls - NFP)

The US labour market is the primary driver of the world's biggest economy, and holds great influence over what the Federal Reserve - the world's most influential central bank - decides on US interest rates.

Bloomberg Intelligence predicts a measly January NFP headline number of 0-30k, while the US jobless rate is slated to remain at 4.4% - matching December's 2025 unemployment rate.

A stronger-than-expected US jobs report may offer cheer for the SP500 and solidify its quest for new record highs, and vice versa.