3 Huge Trading Opportunities You May Have Missed As Markets Crashed This Week

In case you'd been under a rock this week, markets tanked!

Concerns about the eventual ROI on AI + the US dollar's rebound + thin liquidity led to widespread selling across multiple asset classes, including many recent crowd favourites.

Still, amid falling prices, astute traders who exercise proper risk management stand to reap outsized gains.

Read more: What is "short selling"?

Here's a recap of some big moves you may have missed:

1) Bitcoin (BTC/USDT) sank all the way down to $60,000 - its lowest price since October 2024 - before rebounding slightly at the time of writing.

The 13.1% drop yesterday (Thursday, Feb 5) was its biggest single-day decline since November 2022.

The world's biggest and oldest crypto has now fallen as much as 52.45% from its all-time intraday high of $126.195.5 posted on October 6th, 2025.

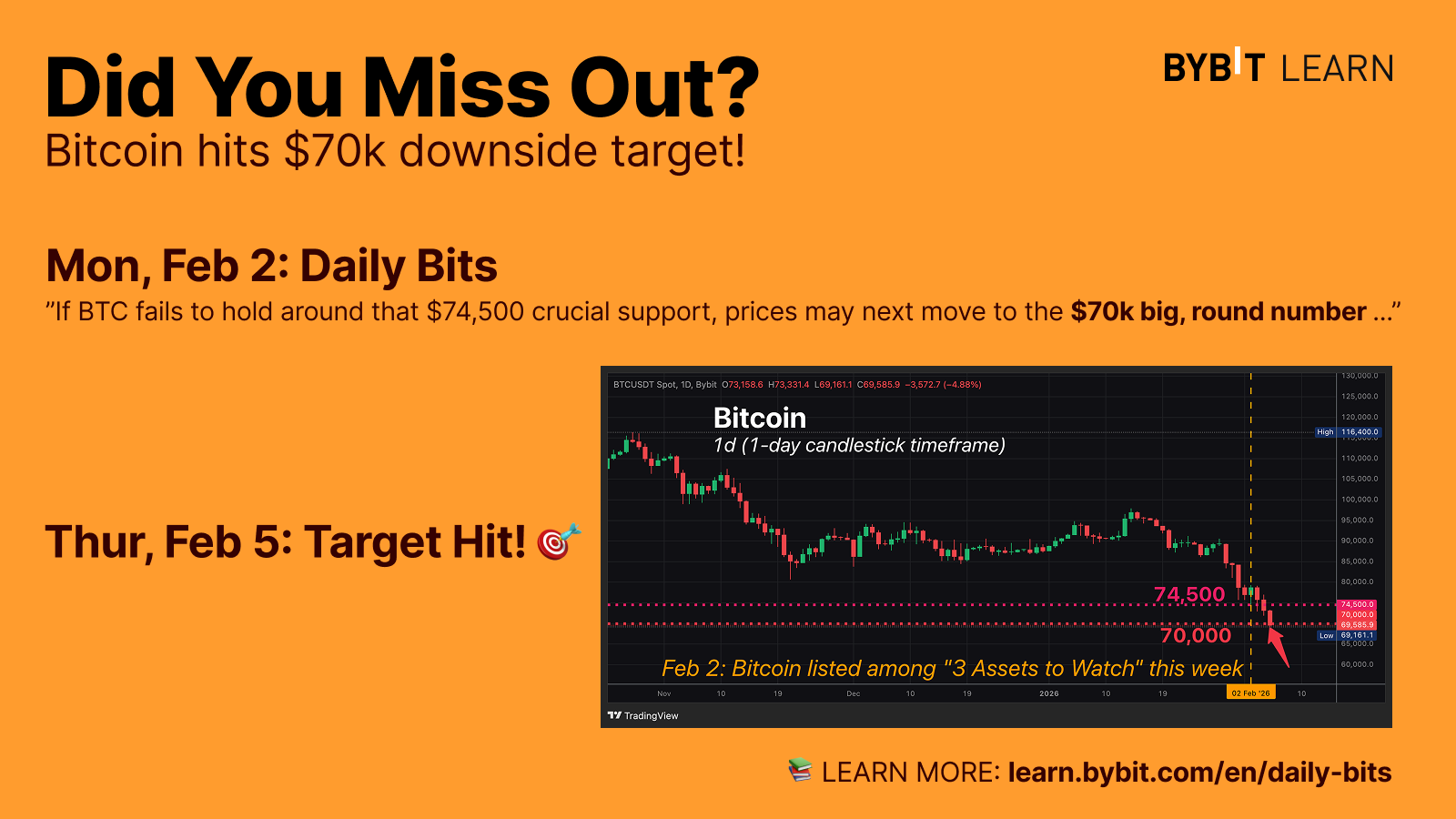

Bitcion even surpassed the $70k downside target we had cited at the onset of this week (Monday, Feb 2).

RECAP: Bitcoin listed among "3 Assets to Watch Amind Plunging Prices" (published Monday, Feb 2)

As Han Tan, Chief Market Analyst at Bybit Learn shared with the media this week:

"Crypto bears have been firmly in control, capitalising on the slightest of excuses to keep prices in a downtrend. Crypto sentiment has eschewed risk-on narratives in recent months, at a time when precious metals and global equities were posting multiple record highs.

There's still a notable lack of confidence-boosting catalysts along crypto's near-term horizon, even as sentiment has clearly detached from the constructive fundamentals."

2) Silver (XAGUSD) saw its 2nd-largest, single-day drop in its history yesterday.

The 19.6% drop on Thursday, Feb 5, was a stunning follow up to its biggest-ever intraday decline on record when it fell 26.4% last Friday, Jan 30th.

Like Bitcoin, Silver has lost about half of its value since their respective record highs - XAGUSD has fallen 47.3% since breaching the $120 level for the first time ever on Jan 29th.

RECAP: 3 Reasons Why Silver Is Sinking (published Thursday, Feb 5)

3) Amazon stocks sank as much as 11.6% after its earnings announcement after US markets closed on Thursday, Feb 5th.

That double-digit move far surpasses the 6.5% up/down post-earnings reaction for this stock that markets had forecasted.

This tech giant's share price even briefly dipped below $200 for the first time since May 2025.

RECAP: Amazon listed among "3 Assets to Watch Amind Plunging Prices" (published Monday, Feb 2)

A primary driver of the dramatic selloff across markets this week has been investors' fears that all these hundreds of billions in AI investments may not eventually pay off.

Amazon alone has just committed to spending US$ 200 billion in 2026 on data centers, chips, property, and other AI equipment.

Microsoft's capital spending in its fiscal 2nd quarter alone was a higher-than-expected US$ 37.5 billion, which is 66% more than what this tech behemoth spent a year earlier. Its full fiscal year's capex may exceed US$100 billion.

Alphabet intends to invest as much as US$ 185 billion this year - which is double what it spent in 2025.

Meta's full-year capex is slated to be in the region of US$ 115 billion - US$ 135 billion.

Essentially, the 3 major reasons for the market selloff we outlined a week ago (since Friday, Jan 30th) remains intact.

US jobs report delayed till Feb 11th

Besides the assets listed above, the likes of Gold (XAUUSD+) and US stock indices (SP500, NAS100, etc.) are attempting to find a more solid footing this Friday morning, Feb 6.

Still, investors and traders wishing for more fundamental reasons to bid up major assets may have to wait a bit longer.

The monthly US jobs report, initially slated for today - Friday, Feb 6th - has now been delayed to Wednesday, February 11th!

Also note that Japan is set to hold its snap elections this Sunday, Feb 8th, with mainstream markets ready to react once trading resumes on Monday, Feb 9th.

Coupled with the mid-week US jobs report and the US inflation data due Friday, Feb 13th ...

Be ready for another potentially volatile week ahead!

And stay up to date with Bybit Learn.