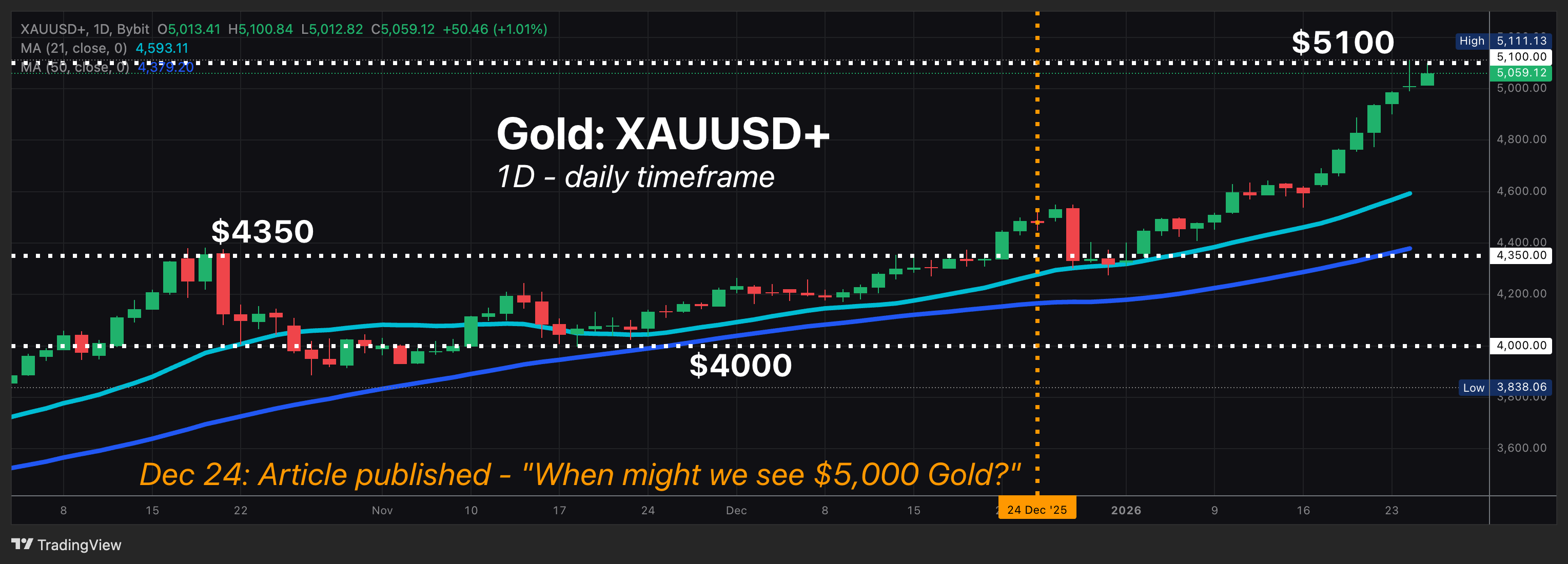

Gold now above $5000 (told ya)! How high can XAUUSD+ go?

Gold (Bybit: XAUUSD+) has posted yet another record high, even briefly breaching the $5100 level this week.

However, that big, round $5100 number is acting as a psychological resistance level for the time being.

Admittedly, $5k gold arrived sooner than expected, following our article titled "When Might We See $5000 Gold?" - published on Christmas Eve (December 24th, 2025).

Gold's surge even surprised banking titans, from OCBC to Goldman Sachs, smashing past their end-2026 targets of $4800 and $4900 respectively (see their updated end-2026 targets below) .

To put in proper context, gold has now advanced:

- +13.6% since our Dec 24th article

- +17% so far in 2026

This comes after spot gold rose over 64% in 2025 - its biggest annual gain since 1979!

Here's an updated list of the main drivers behind gold's surge, though what we'd cited in last month's article remains largely intact:

[UPD] 3 Reasons Why Gold is Soaring

1) Rising geopolitical fears

Gold has roared higher in the new year, given the tide of rising geopolitical fears across markets.

Before the first month of 2026 has even come to a close, the world has already witnessed:

- US capture of Venezuelan President Nicolas Maduro

- Greenland Crisis (although President Trump has reached a framework deal with European leaders with regards to Greenland).

- Trump's tariff threats: POTUS has once again brandished his trade tariffs weapon against European nations (e.g. Greenland 8), Canada, and most recently South Korea.

Reawakened turmoil on the geopolitical stage has sent investors scurrying towards safe havens, including gold.

2) Weaker US dollar

The US dollar (as measured by the Bloomberg dollar index) has now reached its weakest levels since March 2022, while the benchmark US dollar index (DXY) is also threatening to do the same.

The "buck" has weakened as:

- President Trump looks to increasingly isolate the world's biggest economy from the global stage.

- The US administration threatens to erode the Federal Reserve's independence.

- Markets are wary that the US government may sell dollars and buy Japanese Yen to help support the latter.

- Markets expect an 84% chance that the Federal Reserve a.k.a. The Fed a.k.a. the world's most influential central bank will cut US interest rates twice more in 2026 (Note: A currency tends to weaken at the thought of its country's interest rates going down).

With the benchmark spot price (XAUUSD+) denominated in US dollars, the weaker quote currency (right side of the pair) has helped fuel gold's prices.

3) "Debasement trade"

Gold has benefitted as investors shed traditional currencies and sovereign bonds, from the US to Japan, amid growing concerns about rising government debt levels and unsustainable fiscal policies (government spending).

And since gold doesn't have a counterparty, its value isn't tied to the credit rating of an economy or the success/failure of a government, unlike say stocks or bonds.

This places gold as a prime candidate for investors to shift their funds into gold as major concerns surround the governments of large economies.

The above-listed factors have fueled rising demand for gold, evident in bullion-backed exchange-traded funds (ETFs) net buying 1.4 million ounces of gold so far this year.

Even central banks' sustained purchases of gold have contributed to the price surge!

How high could Gold go?

Options markets are turning increasingly bullish on gold prices, expecting higher prices ahead, while money managers are the most bullish on the precious metal since October.

Hedge funds and big-time speculators raised their net-long positions on gold to the highest in 16 weeks, according to CFTC data.

Here's a snapshot of gold price predictions for end of 2026:

- Goldman Sachs: $5400

- OCBC: $5600

- Deutsche Bank: $6000

- Bloomberg model: $6400 (73.5% chance spot gold trades between $4080.90 - $6400, assuming current momentum holds)

Overall, as long as the macro backdrop remains conducive, while central banks and ETF investors sustain their purchases, gold should have little trouble posting fresh all-time highs in 2026.