Berachain (BERA): An EVM-Identical L1 Powered by Proof of Liquidity

Liquidity fragmentation and capital inefficiency create critical bottlenecks for decentralized finance (DeFi) growth. Over $120 billion in value remains scattered across chains, with proof of stake (PoS) systems locking assets away from productive use. To address this fundamental challenge, Berachain has introduced a novel Proof-of-Liquidity consensus mechanism that aligns network security with ecosystem liquidity.

This article explores Berachain's innovative architecture, tri-token system and native DeFi applications that could reshape liquidity provision. We'll examine the project's evolution from an NFT collection to a $142 million-backed Layer 1, and evaluate its potential impact as it approaches mainnet launch.

Key Takeaways:

Berachain is a high-performance Layer 1 blockchain that utilizes a Proof-of-Liquidity consensus mechanism to align network security with ecosystem liquidity, while maintaining EVM-identical execution for seamless Ethereum compatibility.

It features three native decentralized applications, namely BEX, BEND and BERPS.

Looking to trade Berachain tokens? Bybit now offers the BERA/USDT Spot trading pair.

What Is Berachain?

Berachain is a high-performance Layer 1 blockchain that utilizes a Proof-of-Liquidity consensus mechanism to align network security with ecosystem liquidity, while maintaining EVM-identical execution for seamless Ethereum compatibility.

What Is Proof-of-Liquidity?

Proof-of-Liquidity (PoL) addresses a critical flaw in traditional PoS systems: the misalignment of incentives. PoS validators earn rewards without engaging with protocols or users while projects retain most tokens for themselves, creating a fragmented ecosystem that limits growth.

PoL establishes a framework whereby network security and liquidity work together. The system requires validators and liquidity providers to collaborate, with validators distributing rewards to liquidity pools and providers earning governance rights through active participation.

On Berachain, PoL operates through a simple cycle:

Validators stake BERA tokens to earn block production rights.

When selected, validators earn BGT, which they distribute to Reward Vaults.

Liquidity providers deposit assets into these vaults to earn BGT.

Providers delegate earned BGT back to validators, boosting their future rewards.

This innovative mechanism ensures that all Berachain ecosystem participants share in the network's success. Validators seek delegations to boost rewards, protocols offer incentives to attract liquidity and providers earn governance rights through active participation. The result is an ecosystem in which security, liquidity and growth reinforce each other.

History of Berachain

Berachain began unexpectedly as Bong Bears, a community-driven NFT project launched in August 2021 by anonymous developers Papa Bear and Smokey the Bera. What started as a playful experiment with a 0.0694 ETH mint price evolved into serious innovation.

The team, joined by Dev Bear, transformed their thriving NFT community into a foundation for tackling DeFi's fundamental challenges, developing a sophisticated L1 platform powered by a PoL consensus. The project's ambition has attracted substantial investment across multiple rounds. In December 2022, Polychain Capital led a $42 million Series A with participation from Hack VC, dao5, Tribe Capital and others.

Following continued development and an undisclosed raise of funds in April 2023, Berachain secured a $100 million Series B in March 2024, backed by Brevan Howard, Framework Ventures, Samsung Next and other prominent investors through a Simple Agreement for Future Tokens (SAFT).

What Does Berachain Aim to Achieve?

Berachain aims to advance DeFi through critical infrastructure improvements:

Liquidity Fragmentation: While the Ethereum DeFi ecosystem holds approximately $80 billion in total value locked (TVL), this liquidity is scattered across multiple chains and protocols. Berachain integrates core DeFi elements at the protocol level to consolidate this fragmented liquidity.

Application Incentives: Traditional blockchain rewards primarily benefit validators, overlooking the value contributed by applications and developers. Berachain redirects blockchain emissions to applications during block production, creating more substantial incentives for ecosystem development.

Barriers to Access: Due to technical complexities, many projects struggle with blockchain migration. Berachain's EVM-identical architecture enables seamless deployment of existing Ethereum applications, with no need for code modifications.

By addressing these core challenges, Berachain attempts to establish a new foundation for DeFi whereby network security, capital efficiency and application development work harmoniously to drive sustainable growth.

How Does Berachain Work?

Berachain operates via the following three key mechanisms.

EVM-Identical

Unlike EVM-compatible chains that require modifications, Berachain maintains perfect identity with Ethereum's execution layer. Using unmodified clients, such as Geth and Nethermind, Berachain automatically inherits all of Ethereum's capabilities and upgrades.

This EVM-identical architecture enables:

instant adoption of Ethereum upgrades, such as Dencun

native compatibility with all remote procedure call (RPC) namespaces and endpoints

direct deployment of Ethereum smart contracts without modification

seamless integration of existing developer tools and infrastructure

Proof-of-Liquidity

Berachain's PoL consensus mechanism establishes a sophisticated framework that aligns network security with ecosystem liquidity through a multi-stage process:

1. Validator Participation

Validators secure the network by bonding BERA tokens

Active validators receive equal opportunities for block proposal

Block proposers earn the right to distribute governance tokens (BGT)

2. Reward Distribution

Validators direct BGT emissions to specific Reward Vaults

Distribution weight depends upon each validator's delegated BGT holdings

Protocols can offer incentives to attract BGT distributions

3. Liquidity Provision

Users deposit assets into Reward Vaults to earn BGT

Receipt tokens represent liquidity positions

Staked receipt tokens qualify for governance token rewards

BeaconKit

BeaconKit is Berachain's modular consensus framework that integrates CometBFT with any EVM execution environment. Through the Engine API, it enables perfect EVM identity while delivering significant performance improvements.

Performance Advantages:

Single-slot finality (vs. Ethereum's ~13 minutes)

40% faster block times through parallel execution

Full EIP and Eth2 modularity compliance

Seamless execution client compatibility

Built for extensibility, BeaconKit's modular architecture supports custom block builders, rollup layers and data availability solutions. This flexibility serves as a foundation for both L1 and Layer 2 implementations.

Berachain Native DApps

Berachain launches with three native decentralized applications (DApps) to showcase the platform's PoL mechanics while providing essential DeFi infrastructure.

BEX

BEX is Berachain's flagship decentralized exchange (DEX), built on an advanced automated market maker model. It features dynamic trading fees (0.05–1%) that adjust to asset volatility, while directing 0.1% of all volume to BGT holders.

BEX's innovative gasless transaction system allows users to pay fees in their traded assets rather than in BERA, reducing friction for new users. It enables complex trading strategies through account abstraction (a feature of blockchain that allows users to manage accounts and wallets via smart contracts) and off-chain relayers while maintaining cost efficiency.

BEND

Bend serves as Berachain's native lending protocol, exclusively utilizing HONEY (the Berachain ecosystem’s native stablecoin) as its borrowing currency. This focused approach creates a natural demand for HONEY while maintaining lending market efficiency.

Bend’s risk-adjusted borrowing system lets users collateralize various crypto assets to access HONEY loans. Uniquely, borrowers receive BGT rewards directly through the protocol, creating a powerful incentive for participation while strengthening the platform's governance structure.

BERPS

Berps is Berachain's decentralized perpetuals trading platform, in which all positions, collateral and payouts are denominated in HONEY. The platform supports leveraged trading up to 100x, while maintaining a simple, unified experience.

Berps demonstrates Berachain's PoL in action. Liquidity providers deposit HONEY into the bHONEY vault to serve as trade counterparties, earning both trading fees and BGT emissions. This creates a sustainable balance between trading activity and liquidity depth.

Berachain Tokens

Berachain implements a tri-token architecture to optimize network operations:

BGT

BGT (Berachain Governance Token) is a nontransferable token that powers network governance. Unlike traditional governance tokens, BGT can only be earned through active liquidity provision in approved Reward Vaults, creating a merit-based system in which influence scales with contribution.

BERA

BERA is Berachain's foundational token with two critical functions: powering network transactions as the native gas token and securing the network through validator staking. The total value of staked BERA creates the base layer of security that BGT's liquidity incentives enhance.

HONEY

HONEY, Berachain's native stablecoin, is soft-pegged to the U.S. dollar. The stablecoin maintains its value through a dynamic collateralization process with the following features:

Multi-collateral backing system

Vault router for collateral management

DAO-governed minting parameters

Integration across all native DeFi protocols

Berachain Road Map

Over the past few months, the Berachain team has playfully hinted that the Berachain project would be launched on mainnet in "Q5" (community shorthand for Q1 2025), following which , community members can start engaging through pre-mainnet vaults managed by crypto staking protocols Concrete, Lombard and StakeStone.

These vaults will feed into the upcoming Boyco program, whereby protocols establish liquidity commitments before launch. Shortly after Boyco's completion, Berachain will deploy its mainnet, with vault positions automatically transitioning to native protocols like Kodiak and Dolomite.

On Feb 5, 2025, the team announced on its official X page that the project would be launched on mainnet the next day, along with an airdrop of 80 million BERA tokens.

BERA Tokenomics

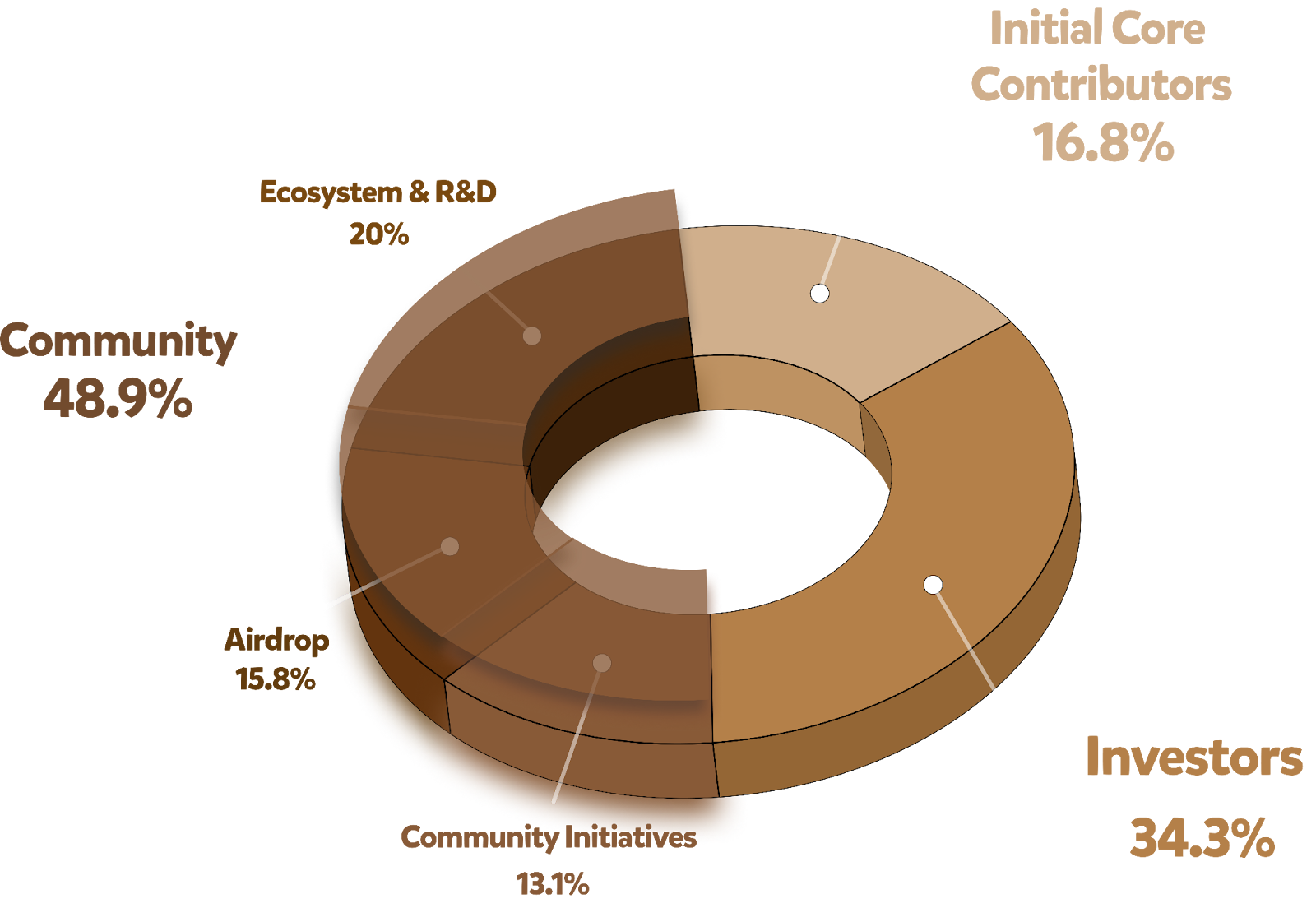

BERA has a total supply of 500 million tokens, to be distributed as follows:

Investors: 34.3%

Ecosystem and R&D: 20%

Initial core contributors: 16.8%

Airdrop: 15.8%

Community initiatives: 13.1%

BERA Airdrop

On Feb 5, 2025, the Berachain Foundation officially unveiled its long-anticipated BERA airdrop, distributing 15.8% of the total supply to dedicated community members, DApp developers, liquidity providers and other key contributors. This initiative recognizes their pivotal role in shaping Berachain’s pre-launch ecosystem and turning the "fake chain" into reality.

Eligible recipients span various categories, including testnet users, NFT holders and participants in ecosystem initiatives, such as the Request for Brobrosal (RFB) and Boyco. Notably, Binance HODLers will also receive a portion of the allocation, reflecting Berachain’s deepening ties with the broader crypto community. To check eligibility and claim airdrop rewards, users can visit the official airdrop checker on the Berachain website.

Where to Buy BERA

Looking to trade Berachain tokens? Bybit now offers the BERA/USDT Spot trading pair. To get started, you’ll first need to create a Bybit account, then fund it with cryptocurrency and navigate to the BERA/USDT Spot trading page.

Closing Thoughts

Berachain introduces a fundamental rethinking of DeFi liquidity through its novel Proof-of-Liquidity consensus. By weaving liquidity incentives into core network operations, the platform creates an ecosystem in which validators, protocols and users naturally collaborate toward sustainable growth.

With this architectural breakthrough, the Berachain network could potentially establish a new standard for Layer 1 platforms whereby sustainable liquidity becomes a catalyst for innovation, rather than a constraint.

#LearnWithBybit