Akash Network (AKT): A Decentralized AI Compute Supercloud

The currently unfolding revolution in artificial intelligence (AI) has created a lot of enthusiasm, both among consumers and businesses. However, supporting all this enthusiasm and pushing the boundaries of what AI can do comes at a significant cost, as AI algorithms often require tremendous computing resources and processing capacity. Centralized servers and even traditional cloud service providers struggle to meet the ever-growing demands of AI computations. Fortunately, blockchain platforms that enable crypto-based trade in decentralized computing resources provide a great alternative to Web 2.0–based solutions.

In the niche of decentralized computing services, few projects can rival the fame and efficiency of Akash (AKT), one of the pioneers of blockchain-based trade in cloud computing resources. Launched in 2018, Akash is a leading decentralized cloud computing platform, offering flexible and affordable access to GPU, CPU, memory and storage resources sourced from a network of providers worldwide. In essence, the Akash network operates as a decentralized cloud computing marketplace.

In 2023, Akash took its cloud services to a completely new level with the launch of the Akash Supercloud — a "cloud of clouds" that enables the distributed trade of GPU computing power with a focus on AI use cases.

Key Takeaways:

Akash (AKT) is a blockchain platform that facilitates the decentralized trade of computing resources, such as CPU, GPU, memory and storage capacity.

Begun in 2018, the platform added AI-focused GPU capacity trade functionality with the launch of its Supercloud in August 2023.

The platform's native crypto asset, AKT, is used for governance, staking, purchasing access to computing resources and incentive payments to resource providers.

What Is Akash?

Akash (AKT) is a blockchain-based distributed cloud computing marketplace that enables the trade of hardware resources, such as GPU, CPU, memory and storage. To achieve this goal it brings together resource providers, incentivized by crypto rewards, and resource consumers who need access to such capacity on a flexible, affordable and easy-to-use basis. Akash was built using the Cosmos SDK and Tendermint Core, and is part of the broader ecosystem of Cosmos-based blockchains. It uses a delegated proof of stake (DPoS) block validation model.

The Akash project was founded in 2018 by Overclock Labs, a software development outfit founded by Greg Osuri and Adam Bozanich. The platform's mainnet was launched in September 2020. Originally, the Akash network offered access to distributed CPU, memory and storage capacities. In 2023, recognizing the explosive growth of AI services and the importance of GPU computing in enabling resource-hungry AI computations, the platform launched its Supercloud, part of the sixth iteration of the Akash mainnet. The Supercloud introduced the functionality to trade GPU capacity on the network.

The pivotal sixth mainnet upgrade also introduced the option for resource consumers to pay for access to computing capacity in USDC stablecoin, in addition to the option to pay in AKT coins. This helped ensure cost stability for resource users who had previously depended upon AKT's market price fluctuations when leasing Akash's services on a long-term basis.

How Does Akash Work?

Akash Network Architecture

Akash's architecture includes four principal components.

Blockchain Layer: Provides the core security and consensus mechanism.

Application Layer: Manages and regulates deployment and resource allocation.

Provider Layer: Includes tools and applications that help resource providers supply their computing capacity to the network.

User Layer: Comprises the interface and tools for resource consumers, known as tenants, to utilize the computing capacity offered by the platform to deploy their apps.

Besides providers and tenants, another key role on the network is that of validators. Akash validators don't participate in the distributed hardware resource trade. Instead, their job is to provide transaction validation services to keep the overall platform functioning and free from security threats.

Interacting With the Akash Network

Akash uses a reverse auction system in its decentralized marketplace to enable trade in computing resources. Tenants can deploy apps in three easy steps:

Choose a template or customize their app.

Find a provider according to their preferences.

Deploy and manage the apps.

Resource providers then offer their bids to meet the users’ requirements. The lowest bidder gains the right to provide the requested resources. Thanks to the competitive reverse auction mechanism, Akash represents a cost-effective alternative to traditional cloud providers for resource consumers.

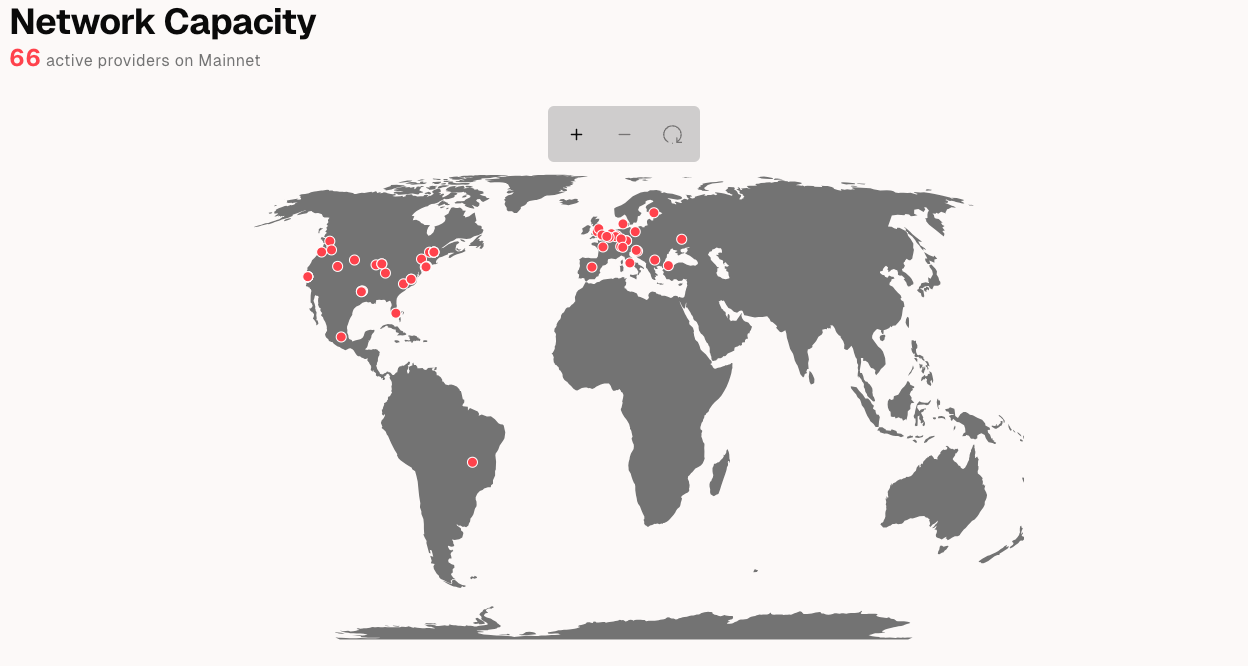

Providers can gain access to reverse auctions held on the network by installing and running provider node software and staking AKT coins. The number of active providers on the network fluctuates depending upon the ongoing activity. As of Aug 15, 2024, there are close to 70 resource providers offering their services on the Akash network from locations all over the world.

Akash Ecosystem

Akash boasts a thriving ecosystem of tools and apps. Below are some of the main apps deployed on its network.

Dev Tool

Akash Console

Akash Console provides tenants with the tools to easily source computing capacity from the network. In order to start leasing hardware resources on Akash, users first need to create a virtual container that specifies their resource requirements. Alternatively, they can choose from pre-made templated containers. The Console app makes it easy to deploy containers, evaluate bids from providers, choose a provider and monitor their performance.

Praetor App

Praetor App is the main interface for resource providers to offer bids and manage their capacity provision on the platform. It allows providers to interact with the network using a set of easy-to-use graphical user interfaces (GUIs) as alternatives to command-line options. Using Praetor App, providers can set up virtual machines and join the network as multi-server or single-server resource suppliers.

AI & ML

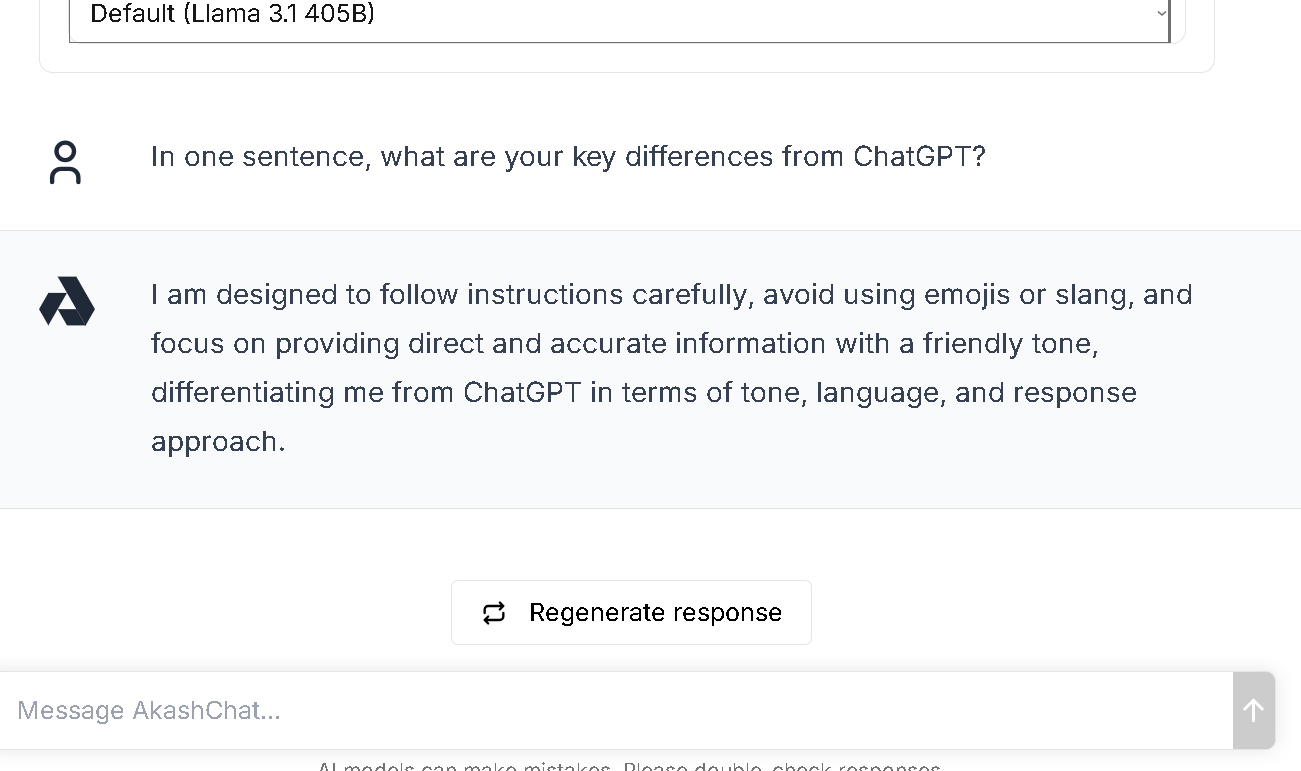

AkashChat

AkashChat is a generative AI tool similar in concept to the highly popular ChatGPT. It operates on the Akash Supercloud and supports various large language models (LLMs), with Llama 3.1 as the default model as of Aug 15, 2024. This setup provides users with a quick, free and privacy-focused chat experience without having to sign in. We asked AkashChat how it differs from its legendary Web 2.0 competitor, and below is what we received in response.

SDXL on Akash

Another resident of the AI-focused Akash Supercloud, SDXL is a text-to-image generative AI tool. Developed by Stability AI, SDXL utilizes high-grade GPUs on Akash’s network to generate quality images in response to user prompts. We provided a prompt to the app to "Generate the image of a cat that would resemble the famous Dogecoin dog." SDXL found a provider with the GPU capacity to process the request within seconds, and it took a few more seconds to generate the image below. Our view: not too bad, for a quick prompt where we haven't further refined or tested alternatives (which is also possible in SDXL).

What Is the Akash Network Token (AKT)?

The AKT coin, Akash’s native cryptocurrency, is used for several key functions.

Governance: AKT holders can participate in on-platform governance processes by casting votes on proposals concerning changes and improvements to the network and its operational rules.

Staking: Users who stake AKT help secure the network and facilitate validators’ work.

Payments to resource providers: Hardware resource providers are incentivized with AKT payments.

Payments for accessing the platform's services: AKT is also used by tenants to pay for access to computing resources. As noted earlier, users can also pay in USDC, starting from Akash’s sixth iteration.

AKT has a maximum supply specified at 388,539,008. The coin's total supply is over 248 million, with its circulating supply close to 248 million.

Where to Buy the Akash Network Token (AKT)

AKT is available on Bybit's Derivatives market through a USDT Perpetual futures contract (AKTUSDT), with which you can trade AKT with up to 25x leverage.

Bybit's Derivatives market provides access to flexible trading opportunities with leverage using hundreds of cryptocurrencies. To start your Derivatives trading on Bybit, you can register for a Unified Trading Account, which provides access to key markets and products available on Bybit, including Spot market, Margin trading, USDT Perpetuals, USDC Perpetuals and Options.

Akash Network Price Prediction

As of Aug 15, 2024, the AKT coin is trading at $2.57, which is 68.2% lower than its all-time high (ATH) of $8.07, achieved on Apr 6, 2021, and 1,454.7% higher than its all-time low (ATL) of $0.165, recorded on Nov 21, 2022.

Long-term price forecasts for AKT are generally bullish. PricePrediction expects the coin to trade at $5.21 in 2025 and $34.92 in 2030, whileDigitalCoinPrice predicts an average rate of $6.64 in 2025 and $19.37 in 2030.

Is Akash a Good Investment?

Depending upon your investment approach, risk tolerance and overall portfolio composition, you might consider the AKT coin for the following reasons:

- Established brand and performance: Akash is among the oldest and most-recognized platforms in at least two high-growth categories of the crypto market — AI, and decentralized physical infrastructure networks (DePINs). As of the time of writing on Aug 11, 2024, the AKT coin is in the top 10 highest-capped cryptos in both of these booming categories (in seventh and ninth position in AI and DePIN, respectively). The AI category is represented by crypto projects that enable the utilization of AI algorithms and models for a variety of use cases, while the DePIN category consists of projects that enable users to buy and sell computing resources in a distributed way over blockchain networks. While not among the very top coins in either category, AKT has been operating in these niches longer than most of its larger competitors, and has built a solid reputation in both.

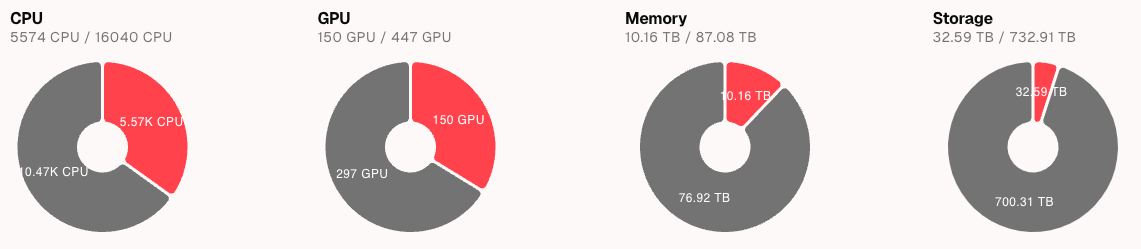

Scalability and capacity: While some DePIN platforms might struggle to meet market demand due to their inefficient networks, Akash features a highly scalable and robust underlying platform. The project currently has ample underutilized cloud capacity in all four key resource categories — CPU, GPU, memory and storage.

This is a clear indication that Akash is well-prepared to meet future demands for GPUs and/or other resources. With the pace of growth in the AI sector increasing by the day, GPU capacity is widely expected to be an asset in strong demand. As such, the AKT coin may be among the biggest beneficiaries of the AI revolution.

Closing Thoughts

Akash is a long-time veteran of the DePIN niche. It’s been a major player in the competitive field of cloud management services for a number of years, and with the launch of its Supercloud in August 2023, Akash aims to spread its reach to another highly lucrative sector — artificial intelligence (AI). All indications are that the project is accomplishing this mission successfully.

Trade in cloud resources has helped make Akash a major entity in the blockchain industry. Enabling the Supercloud and the GPU capacity trade might just take this well-respected longtimer to even greater heights.

#LearnWithBybit