What is a crypto trading bot and how does it work?

Crypto markets operate 24/7, which creates opportunities at all hours, but no trader can monitor the market nonstop. This is where crypto trading bots come in. These automated, no-code tools execute trades based on predefined rules, allowing users to react instantly to price movements without manually placing orders.

Crypto bots have become a standard part of digital-asset trading, much like algorithmic systems used in traditional finance. The difference today is accessibility: exchange-native bots, such as Bybit’s Trading Bots, remove the complexity of third-party API setups and allow anyone to automate a strategy directly within the platform. Once configured, a bot can run continuously, follow strict parameters and eliminate emotionally influenced trading. That said, poorly configured bots can still result in losses, making proper setup and risk management essential.

This guide walks you through how trading bots work, the different types available and how Bybit’s built-in solutions simplify automated trading for every skill level.

Key Takeaways:

Crypto trading bots automate buying and selling based on predefined rules, helping traders operate in a 24/7 market.

Bybit’s no-code bots are safer and easier to use than third-party API bots.

Bots improve consistency and remove emotionally based decision-making, but configuration quality matters.

Bybit offers Spot Grid, Futures Grid, Martingale, Combo and DCA Bots for different market conditions.

What are crypto trading bots?

A crypto trading bot is a type of automated software that monitors the market, analyzes price movements and executes trades based on predefined rules. These bots often rely on strategies such as grid trading, trend following and mean reversion, enabling them to respond to market conditions without manual execution.

Market-making algorithms aim to maintain a steady bid-ask spread by buying at lower prices and selling at higher prices, helping to generate liquidity.

Trend-following algorithms analyze momentum and place trades that move with the prevailing trend.

Mean-reversion algorithms look for prices that deviate from longer-term averages, and identify points where they may pull back or rebound.

Earlier bots required API key connections and manual security management. Today, exchange-native systems like Bybit’s suite of trading bots integrate directly into the trading environment, offering safer execution, faster response times and simpler configuration with no coding required.

Trading bots help reduce human error, maintain discipline and react quickly during volatility, but outcomes still depend upon strategy selection, market conditions and risk settings.

Types of crypto trading bots

Cryptocurrency trading bots automate well-known market strategies, allowing traders to react to price movements without constant monitoring. While early bots required complex API setups and custom programming, most modern traders now prefer exchange-native bots, which run directly on platforms like Bybit and do not require API keys or external software.

Below is an overview of the main types of crypto trading bots available today, followed by Bybit’s official bot lineup.

Exchange-native trading bots

Most users now deploy bots directly inside their exchange accounts. These bots are safer, easier to configure and optimized for real-time execution because they operate within the exchange’s own infrastructure.

Benefits of exchange-native bots:

No API key management

Faster, more reliable order execution

Lower technical setup requirements

Built-in strategy presets for beginners

Bybit offers one of the most complete no-code bot suites in the crypto industry.

Bybit’s official Trading Bots

Below are the five core automated strategies available on Bybit’s Trading Bot dashboard.

Spot Grid Bot

The Spot Grid Bot automates buy-low, sell-high trading by dividing your chosen price range into multiple “grids.” When the market dips into a lower grid, the bot buys, and when the price rises into a higher grid, it sells, locking in small profits each time. Users can either set the range and grid count manually, or let AI suggest parameters based on market conditions.

The bot works best when the market moves sideways, creating repeated profit cycles. Advanced options — such as stop loss, take profit, trailing up and entry price — allow users to manage risk and adapt as conditions change. Once activated, the bot runs 24/7.

Futures Grid Bot

The Futures Grid Bot applies a grid strategy to long or short futures positions, allowing traders to profit from repeated price swings in volatile markets. You define a price range, grid count and leverage, and the bot automatically opens and closes positions as price moves between each level. This creates frequent small gains while keeping risk parameters fixed.

Users can choose Neutral, Long or Short modes, depending upon market direction, with options to add trailing stops, entry price rules or stop-top and stop-bottom limits. Because the bot uses leverage, potential returns are higher — but so are the risks, making it essential to carefully configure your bot.

Futures Martingale Bot

The Futures Martingale Bot increases position size after each loss to accelerate recovery when the market rebounds. It automates averaging-down by adding larger orders as price moves against the position, then closes the entire cycle once the profit target is hit.

Traders can choose Long or Short modes, adjust parameters such as price-decrease triggers, position multipliers, max additions and leverage, and enable looping for continuous cycles.

This bot is best suited to users who expect a bounce or trend reversal and want a systematic way to recover drawdowns, with built-in stop loss and position controls for managing risk.

Futures Combo Bot

The Futures Combo Bot builds a balanced long-short portfolio and automatically rebalances positions as markets move. Instead of manually adjusting exposure, the bot maintains preset ratios across two to ten contracts, keeping your strategy aligned in trending or sideways conditions. Users can customize contract selection, direction, proportions, leverage and rebalance triggers, such as deviation thresholds or time intervals.

When allocations drift from the target mix, the bot executes proportional trades to restore balance. This hybrid approach helps reduce micromanagement, smooth volatility and maintain consistent exposure, making it suitable for traders who want diversified futures strategies without constant manual oversight.

Dollar-cost averaging (DCA) Bot

The DCA Bot automates long-term accumulation by purchasing crypto at fixed intervals, regardless of market price. Instead of trying to time entries, the bot spreads purchases across days, weeks or months, helping smooth out volatility and reduce the impact of sudden price swings. Users simply choose the asset, investment amount and frequency, and the bot executes consistently in the background.

This approach is ideal for investors who want disciplined, hands-off buying and a simple way to grow positions over time. It also pairs well with portfolio strategies that prioritize stability over short-term trading.

What does a trading bot look like?

Every trading bot has its own interface, but most resemble a simplified version of a cryptocurrency trading screen. Users typically see basic market data, configuration fields and strategy options, rather than a full manual order panel. Bybit’s trading bots use clean, no-code interfaces that resemble simplified trading panels. Users see only the parameters needed for setup, supported by risk reminders and AI suggestions where applicable.

Bybit Trading Bot interface examples

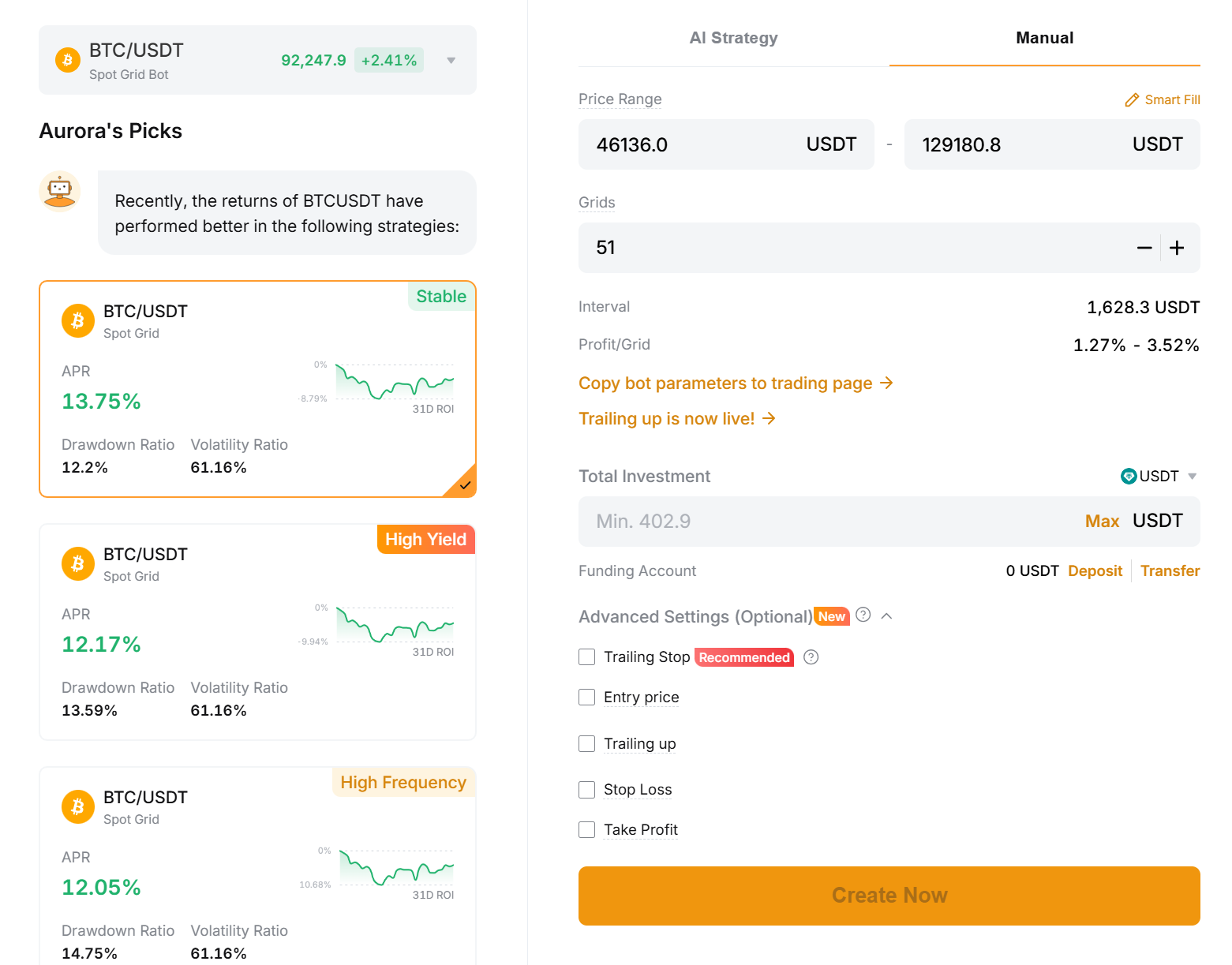

Spot Grid Bot interface

The Spot Grid Bot layout highlights your chosen price range, grid levels and projected performance. Users can adjust the range and grid count manually or apply AI-suggested parameters, with optional risk tools for customization.

Key controls include:

Price-range selector

Grid-count slider

AI parameters

Optional stop loss, take profit, trailing up

Estimated APR and backtested band

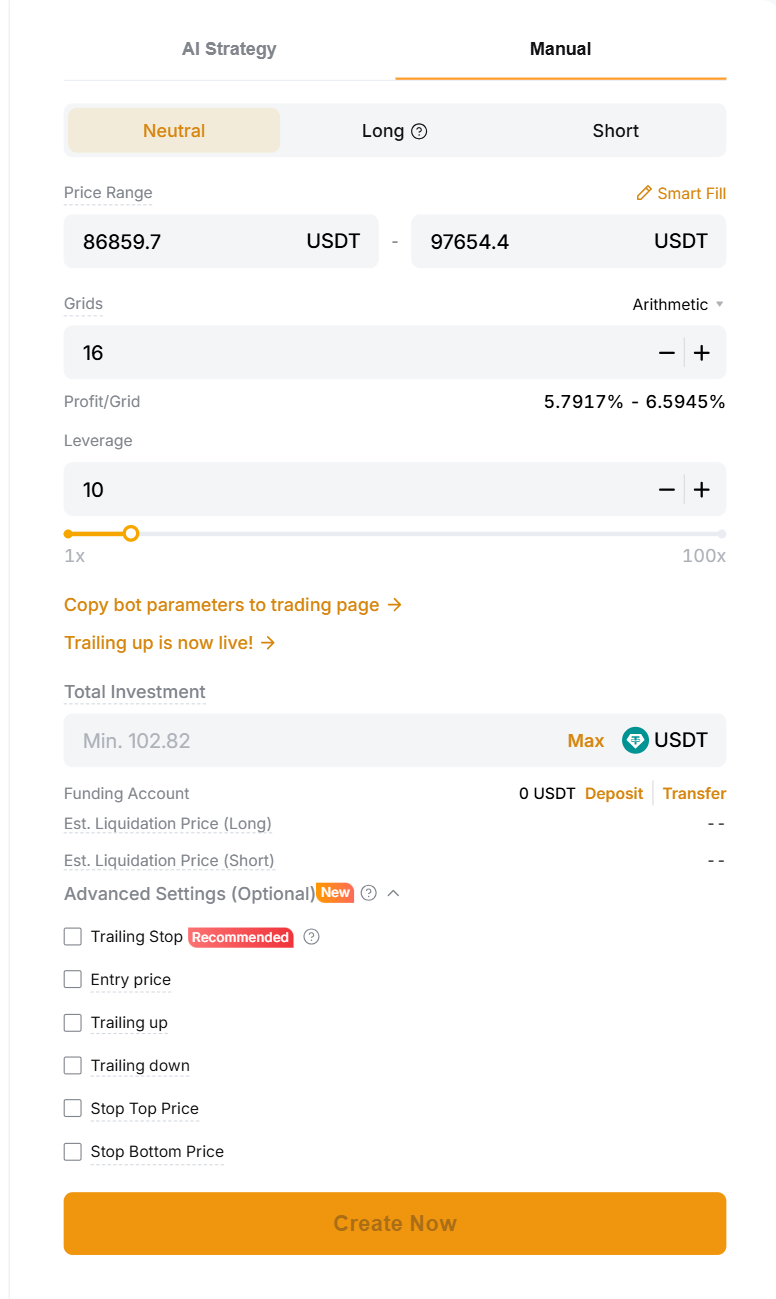

Futures Grid Bot interface

This panel mirrors the Futures trading screen, but converts complex order placement into automated logic. Traders select direction, leverage and grid settings, supported by real-time reminders on risk and liquidation.

Key controls include:

Long, Short or Neutral mode

Leverage, range and grid configuration

Stop-top, stop-bottom and entry rules

Risk and liquidation indicators

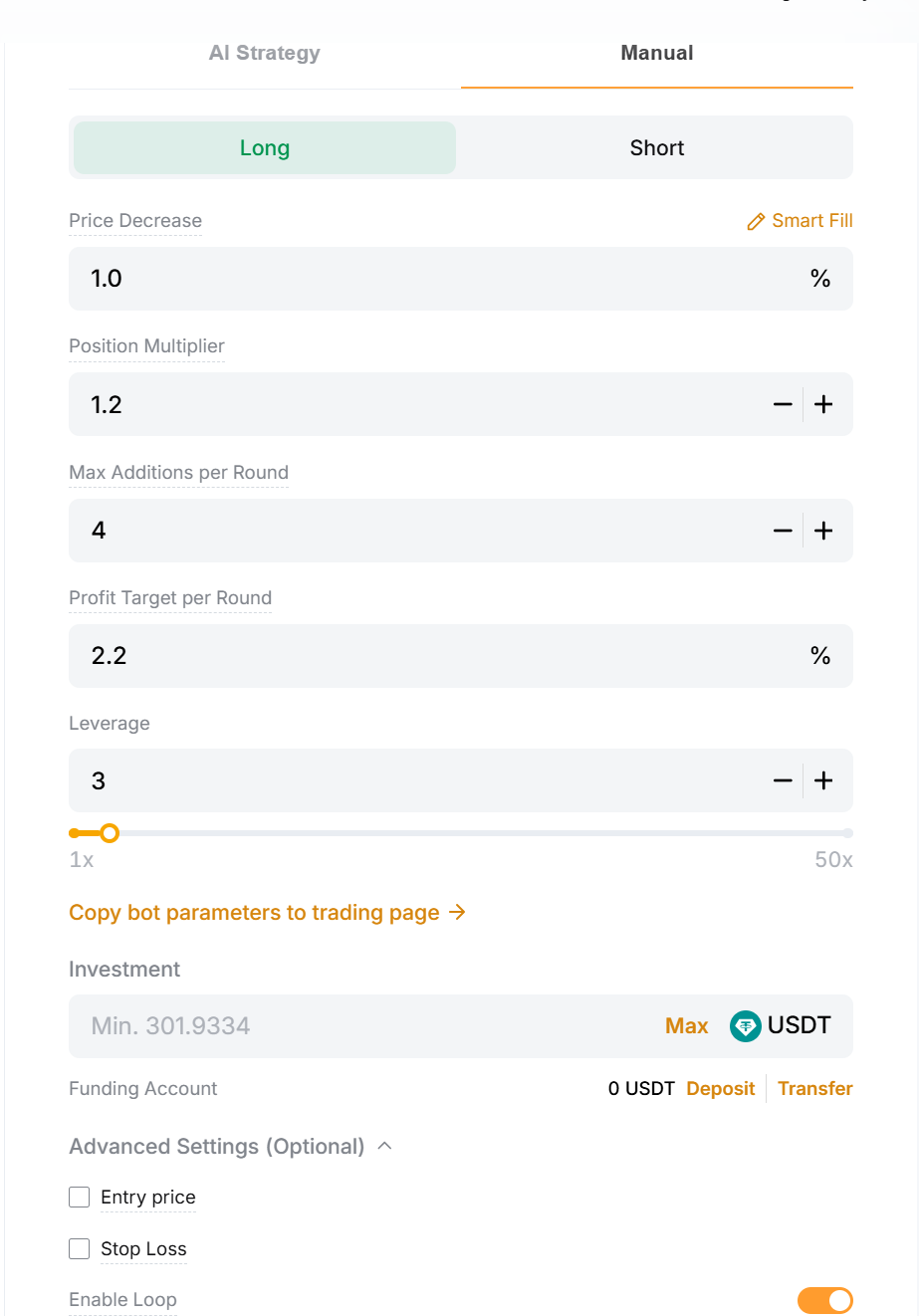

Futures Martingale Bot interface

This interface offers AI or manual setup with transparent risk parameters. Users define how the bot adds positions during drawdowns, and determine whether it repeats cycles automatically.

Key controls include:

Price-decrease trigger

Position multiplier

Max additions

Loop mode toggle

Stop-loss ratio, leverage and investment display

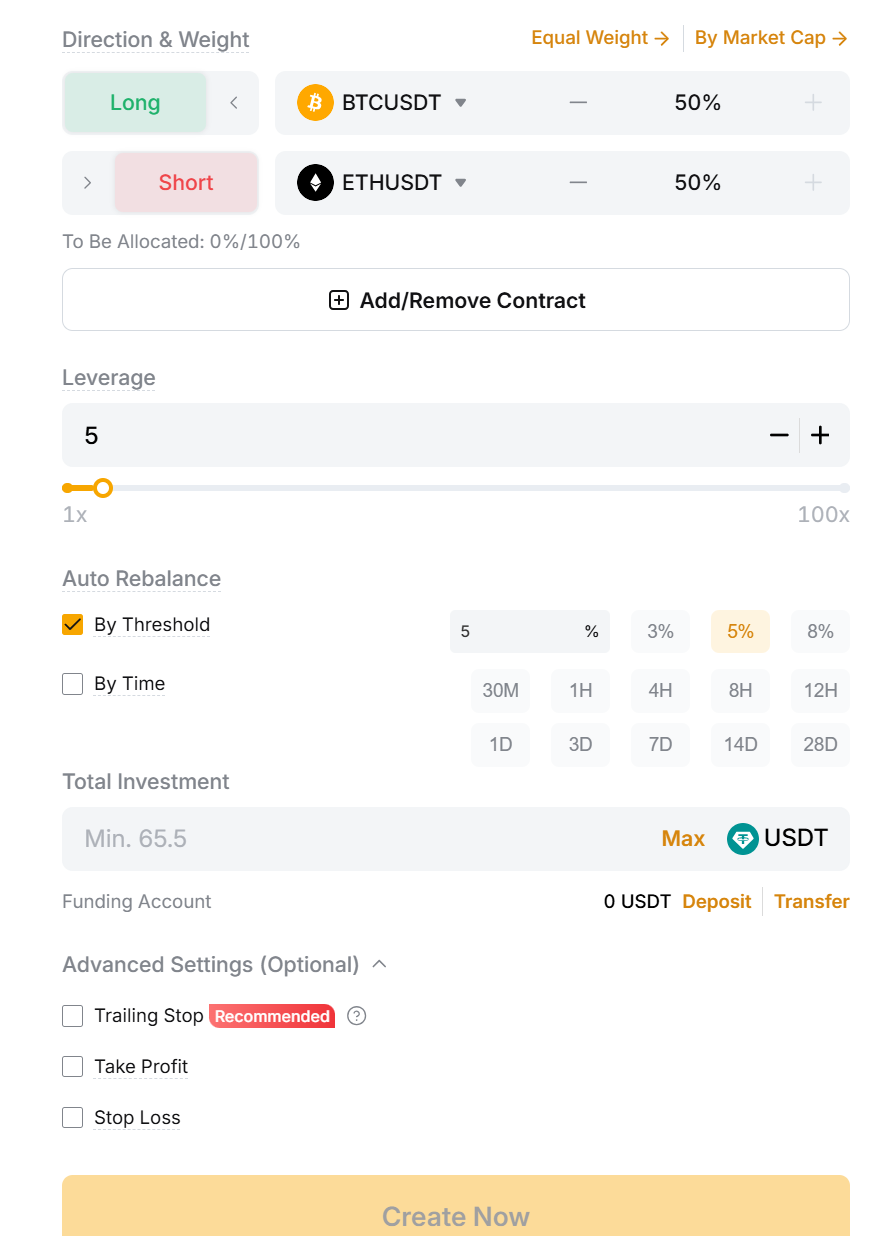

Futures Combo Bot interface

This bot focuses on allocation rather than single-position management. Users build a long–short portfolio and set conditions for when the bot should rebalance.

Key controls include:

Add 2–10 contracts with custom ratios

Target allocations and deviation thresholds

Rebalance timing

Portfolio-weight preview chart

This interface focuses on allocation management, rather than individual order placement.

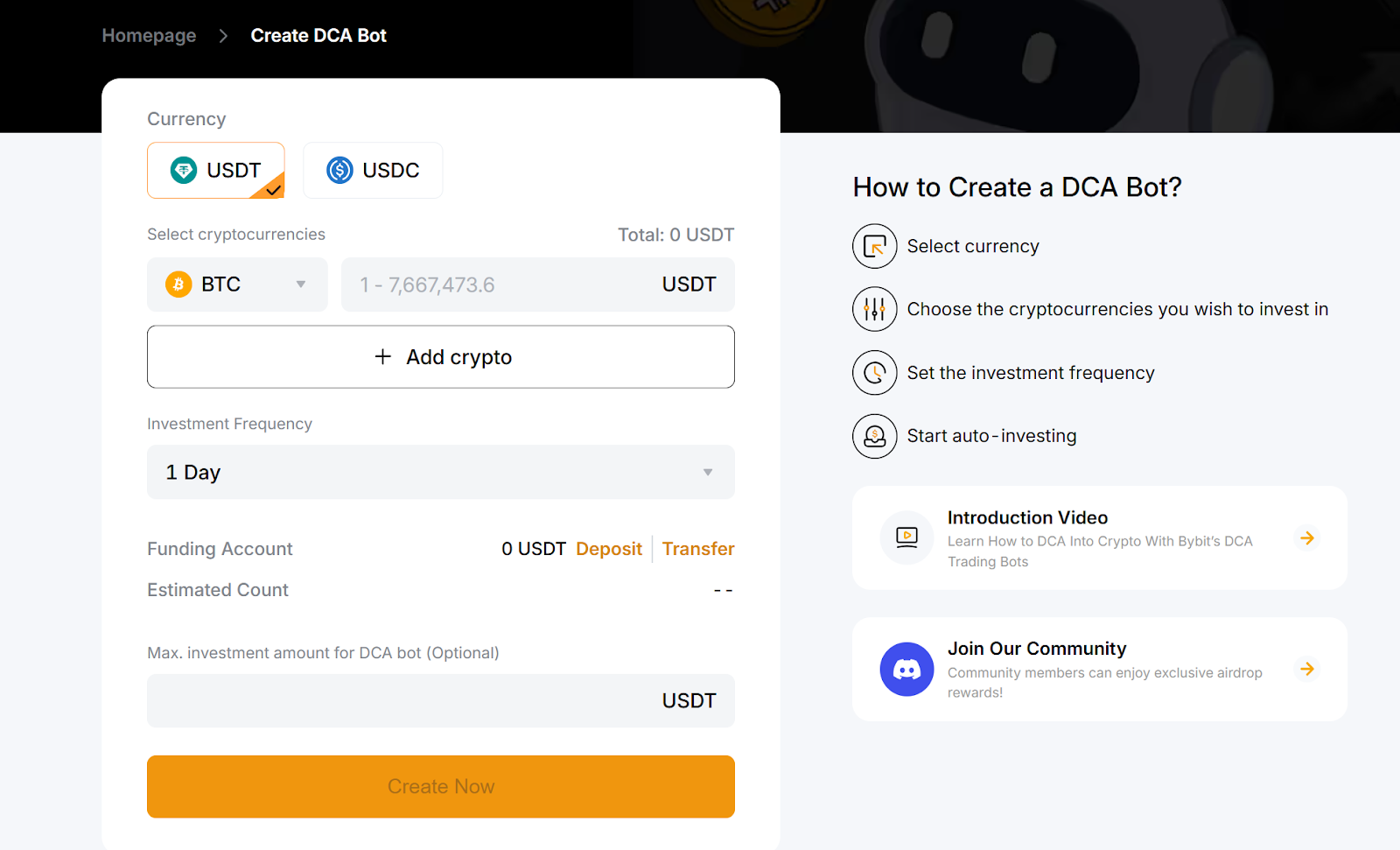

DCA Bot interface

The DCA Bot presents a simple, long-term accumulation workflow. Users choose an asset, the amount and the purchase frequency, with optional protection settings and a clean accumulation preview.

Key controls include:

Asset, amount and interval

Optional stop loss or take profit

Projected accumulation preview

How do crypto trading bots work?

Trading bots automate execution based on predefined rules. They scan price data, check for triggers and place orders instantly. Traditional bots use API keys to access an exchange, but Bybit’s native bots remove this step and operate directly within its platform.

Real-time pricing and instant order execution

Trigger-based actions, such as grid fills, martingale additions or DCA scheduling

Leverage and margin management for futures bots

Risk controls, including stop loss, take profit and liquidation alerts

Regardless of the platform, all trading bots follow three core steps:

Signal generation: Identifies potential trades by using indicators, price movement rules or preset triggers

Risk allocation: Decides position size, leverage and capital distribution based on user-defined parameters.

Execution: Submits and manages orders automatically, adjusting positions whenever the strategy conditions are met

This structure keeps strategies running 24/7, removes emotionally motivated decision-making and ensures consistent execution across fast-moving markets.

When should I use crypto trading bots?

Use crypto trading bots when you need fast, consistent execution that’s difficult to maintain manually. Bots automate tasks such as rebalancing, recurring buys, price-based triggers and multi-order strategies, making them ideal for repeatable, rule-driven trading. They’re especially useful in the following market conditions:

Sideways markets: Spot Grid Bots capture frequent buy-low/sell-high cycles

Trending markets: Futures Grid Bots automate long or short setups as the price moves

Long-term investing: DCA Bots accumulate assets at fixed intervals, reducing timing risk

Hands-off strategies: Bots monitor conditions 24/7 and execute instantly when triggers are met

If you regularly miss entries, spend too much time adjusting positions or need disciplined execution, a trading bot provides a structured, automated alternative.

Benefits of using trading bots

Trading bots offer speed, consistency and round-the-clock execution that manual trading simply can’t match. They follow predefined rules, react instantly to market conditions and remove emotionally based decision-making from the process.

Emotion-free execution: Bots trade strictly based on logic and rules. They ignore fear, greed and hesitation, allowing strategies to run exactly as designed.

High degree of efficiency and accuracy: Bots process data and place orders faster than any human can, reducing errors and delays. They scan markets continuously, and react the moment conditions are met.

Consistent, disciplined trading: Once bots are configured, they follow the same approach every time, which is ideal for traders who want rule-based execution across volatile markets.

24/7 automation: Crypto trades nonstop, and bots monitor markets and act around the clock — even when you're away.

Multi-market execution: Automated systems can manage several pairs or contracts simultaneously, far more than a manual trader can track at once.

Pre-tested and preset strategies: Many exchange-native bots, including Bybit’s Spot Grid, Futures Grid and DCA Bots, come with AI or pre-tested configurations to help users deploy proven setups quickly.

Built-in risk controls: Bots on Bybit operate inside the platform, giving users access to native protection tools such as stop loss, take profit, leverage limits and liquidation alerts.

Beginner-friendly setup: Bybit’s simplified templates allow new users to launch bots with minimal configuration, while experienced traders can customize parameters for advanced strategies.

Are crypto trading bots profitable?

Crypto trading bots can be profitable, but they don’t guarantee results. A bot simply follows the rules you set, so performance depends upon the strategy, market conditions and risk controls. Bots help with timing and discipline, but they don’t predict the market.

Profitability often hinges on various factors, such as:

Whether the strategy fits current market conditions

How much leverage is used on futures bots

How often settings are reviewed and updated

Whether the bot has been over-optimized for past data

How widely used a strategy is among other traders

Exchange-native bots on Bybit offer safer execution and built-in risk tools, but success still relies on choosing the right approach and monitoring your positions.

Limitations of crypto trading bots

Crypto trading bots are powerful tools, but they also come with important limitations. Their performance depends entirely upon the strategy you choose, and how well the settings match current market conditions. Bots don’t guarantee profits; they simply automate your rules.

Key limitations include:

Strategy dependence: Bots won’t perform well if the underlying strategy is weak or not suited to the market. Settings that work in trending markets may fail in choppy or sideways conditions.

No automatic adaptation: Bots follow fixed parameters. They don’t adjust to regime changes, such as moving from volatility spikes to low-range trading, unless you update the configuration.

Leverage exposure: Futures Grid, Martingale and Combo Bots use leverage. Incorrect sizing or sudden volatility can accelerate losses quickly, even with stop-loss settings.

Over-optimization (curve fitting): Strategies tuned too closely to historical data often break down in live markets. Backtests help, but they’re not a guarantee of future performance.

Crowded strategies: Simple grid or DCA approaches can lose effectiveness when many traders are using the same templates, reducing the edge.

Learning curve and oversight: Even no-code bots require correct setup and monitoring. Poor configurations or unrealistic expectations can lead to losses, especially when bots are executing trades rapidly.

List of recommended trading bots

Bybit offers a full suite of built-in, no-code bots that execute directly on its exchange:

Spot Grid Bot: Automates buy-low/sell-high strategies within a price range

Futures Grid Bot: Applies grid logic to long or short futures positions with leverage

DCA Bot: Automates recurring purchases for long-term accumulation

Futures Martingale Bot: Averages down systematically to target recovery cycles

Futures Combo Bot: Builds balanced long-short portfolios, with automated rebalancing

These bots run inside Bybit’s infrastructure, offering faster execution and stronger security.

The bottom line

Crypto trading bots offer a practical way to automate strategies. They react faster to market movements, and they stay active 24/7. Modern no-code systems, including Bybit’s native bot suite, make automation accessible without technical setup. However, bots aren’t a shortcut to guaranteed profits.

Success still depends upon choosing the correct bot for the market environment, applying proper risk controls and reviewing performance regularly. When used with discipline and clear parameters, bots can help traders execute more consistently and manage fast-moving markets with greater efficiency.

#LearnWithBybit