Why Is It Important to Understand Crypto Market Sentiment?

Market sentiment is an evaluation of the attitude and emotions of traders regarding a particular asset or investment. Whereas technical and fundamental analysis takes a structured approach to understand price behavior, sentiment analysis aims to understand how individual perspectives impact the market price. Perspectives do not necessarily reflect measurable metrics but instead convey the shared feeling of a group.

Performing market sentiment analysis requires researching social channels, industry news, transaction alerts, and reading sentiment indicators to gauge current or forthcoming market movements. Unlike in conventional stock or Forex markets with significant institutional involvement, cryptocurrency market sentiment analysis grants more insight due to the social nature of the industry. After all, a single tweet or road map update has been known to send a coin to the moon or bring markets crashing down.

We’ll show you how to measure market sentiment with major indicators and use it as part of your trading strategy. Just as with fundamental and technical analysis, it cannot be overlooked.

What Is Crypto Sentiment?

The term “sentiment” in the finance context is a view or an opinion expressed about the condition of a market. Crypto market sentiment describes the general emotional opinions and attitudes of investors toward the asset. It conveys the crowd psychology of those involved in the trading and development of the cryptocurrency as reflected through social and trading metrics.

Essentially, crypto market sentiment analysis is a psychological evaluation of factors that influence the price movement of cryptocurrency.

The way investors feel about a cryptocurrency can have tangible effects on the market cycles and price of a cryptocurrency. If enough traders act on these ideas, thoughts, and feelings that they share (whether or not they are based on real-world information), it can have serious consequences. A prime example of this is how Elon Musk’s tweets have impacted the price of Bitcoin (a bullish sentiment).

How to Gauge the Market Sentiment

There are several notable statistics to use for analyzing cryptocurrency market sentiment. Funding rates, sentiment indices, social media and community analytics, and whale monitoring all unlock vital information regarding the trajectory and movements of cryptocurrency assets.

Here’s a breakdown of the main factors every sentiment analysis should include.

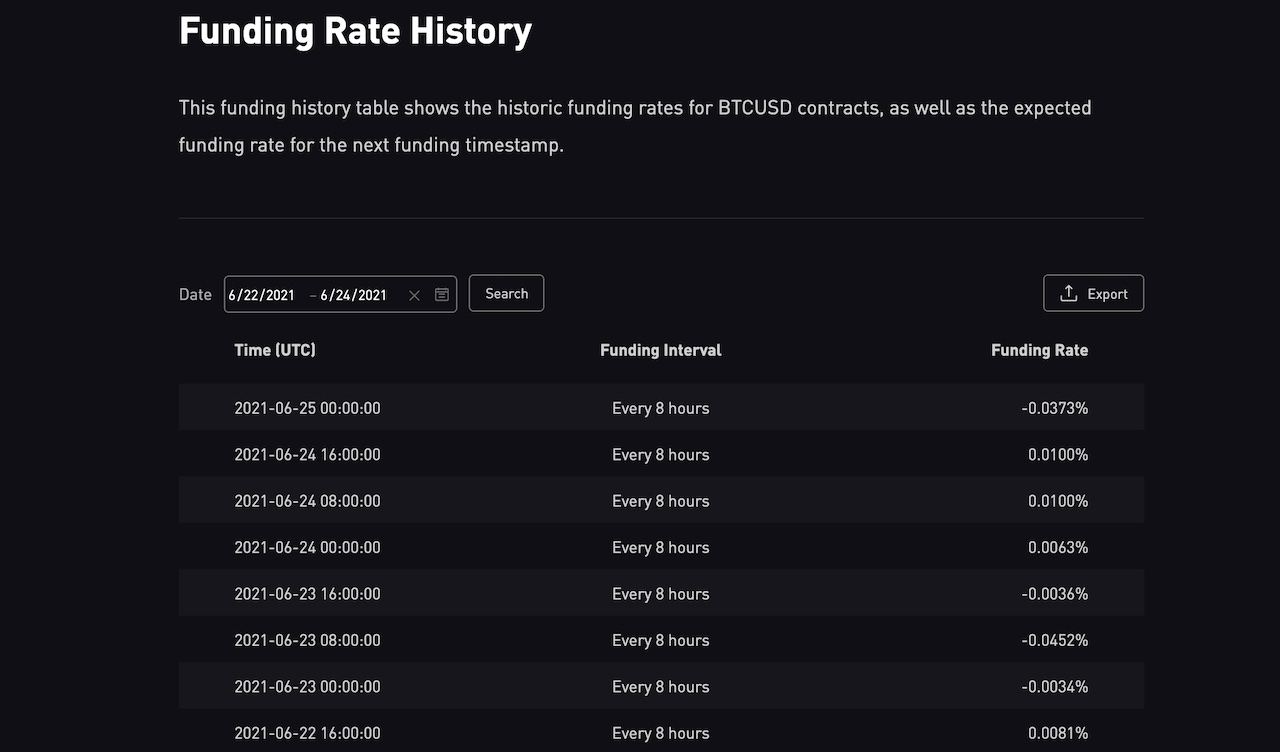

Funding Rates

The funding rate of a cryptocurrency is a trackable metric that often aligns with market sentiment. Funding rates reflect the periodic payments disbursed to traders based on the price differences that arise between cryptocurrency perpetual contracts and the spot price of currencies or tokens.

When funding rates are positive, this often indicates that the market is bullish and long traders will be paying short traders. Conversely, negative funding typically shows that short traders will be paying long traders in a bearish market.

The funding difference occurs due to traders borrowing USD in a bullish market to buy Bitcoin or another cryptocurrency. Consequently, when traders are successfully shorting the market, funding rates for cryptocurrency exceed those of Fiat currencies. There are many tools available to track funding rates on futures exchanges.

Be sure to check your preferred crypto-derivatives exchange or consult any of the following sources on funding rate data.

Understanding Sentiment Indices

Sentiment indices help you assess the current state of cryptocurrency markets by using a numerical indicator. A sentiment index aims to show whether investors will behave fearfully or greedily and can be influenced by volatility, market momentum, investor responses to surveys, Google Trends, junk bond demand, and more.

Generally, a fearful market is considered a good opportunity to buy if you know how to pick the right asset, while a greedy market indicates that it is a good time to sell.

Social Media and Communities Analysis

Social media may present mixed statistics, but the activity on Twitter, Discord Channels, Telegram, and Reddit is important when assessing crypto market sentiment. An active and engaged social community will have a significant number of followers and meaningful social interaction across platforms.

Another popular method to gauge cryptocurrency market interest is Google Trends. Google Trends shows search activity for a specific keyword phrase, and you can see whether searches about a specific cryptocurrency are trending upward or downward.

In general, look for any hype following the crypto asset and how investors feel regarding current developments and road map progress. A hype usually attracts more market participants and naturally indicating a bullish sentiment is coming. But in the end, comparing activity across various channels can reveal widespread support motivating present or upcoming market movements. Still, the best way to formulate objective trading strategies requires technical analysis.

Whale Monitoring

A cryptocurrency whale is an investor who holds and carries out large value transactions across various blockchains. Whale monitoring refers to keeping an eye on big players in the crypto space. Whale watchers identify the trades of major market participants and then trade accordingly.

Blockchain explorers are available to help you analyze the exchange of cryptocurrency across various markets. However, analyzing on-chain metrics concerning supply and demand takes specialized insight.

Here are several popular resources for tracking crypto whale trading activity, eliminating much of the technical knowledge needed to isolate its impact:

Indicators for Market Sentiment Analysis

Market sentiment analysis is a core component of accurately assessing the growth or decline of a cryptocurrency coin or token. While investors can consult many resources to gain market insight, here are the main must-have indicators for every cryptocurrency market sentiment analysis.

Technical Analysis

Technical analysis aims to forecast future prices in the short term by looking at previous prices and trade volumes of a certain cryptocurrency. Analysts believe that trading patterns follow identifiable trends and that these trends usually repeat themselves. Examples include moving averages, Bollinger bands, and Elliot Wave patterns.

Fundamental Analysis

Analysts from this school of thought seek to determine the intrinsic value of a cryptocurrency. Their approach is to decide whether the asset is overvalued or undervalued. This includes studying metrics like the team behind a project, the application of the technology, how widely it is being adopted, case studies using that technology or cryptocurrency, and blockchain and financial metrics.

Fear & Greed Index

In conventional stock markets, the Fear & Greed Index provides a global market sentiment indicator. The sentiment index has a numerical value that ranges from 0 to 100, with 0 being a state of extreme fear and 100 being a state of extreme greed. It aims to show whether investors are behaving fearfully or greedily. The rating is influenced as described in the section above entitled “Understanding Sentiment Indices.”

The Bitcoin Fear & Greed Index similarly gauge the prevailing attitude toward cryptocurrency in cryptocurrency markets and is calculated using six indicators. These include volatility, market momentum, social media, surveys, Bitcoin dominance, and Google Trends.

Bull & Bear Index

Another popular, reliable Bitcoin sentiment indicator that focuses on social media metrics is the Bull & Bear Index (BBI) developed by Augmento, an AI initiative that quantifies crowd psychology. The BBI correlates data from Bitcoin Forum, Reddit, Twitter, and the market movement of the digital assets, analyzing 93 sentiments by using artificial intelligence to evaluate topics and conversations. Zero indicates an extreme bear market, while 1 is extremely bullish.

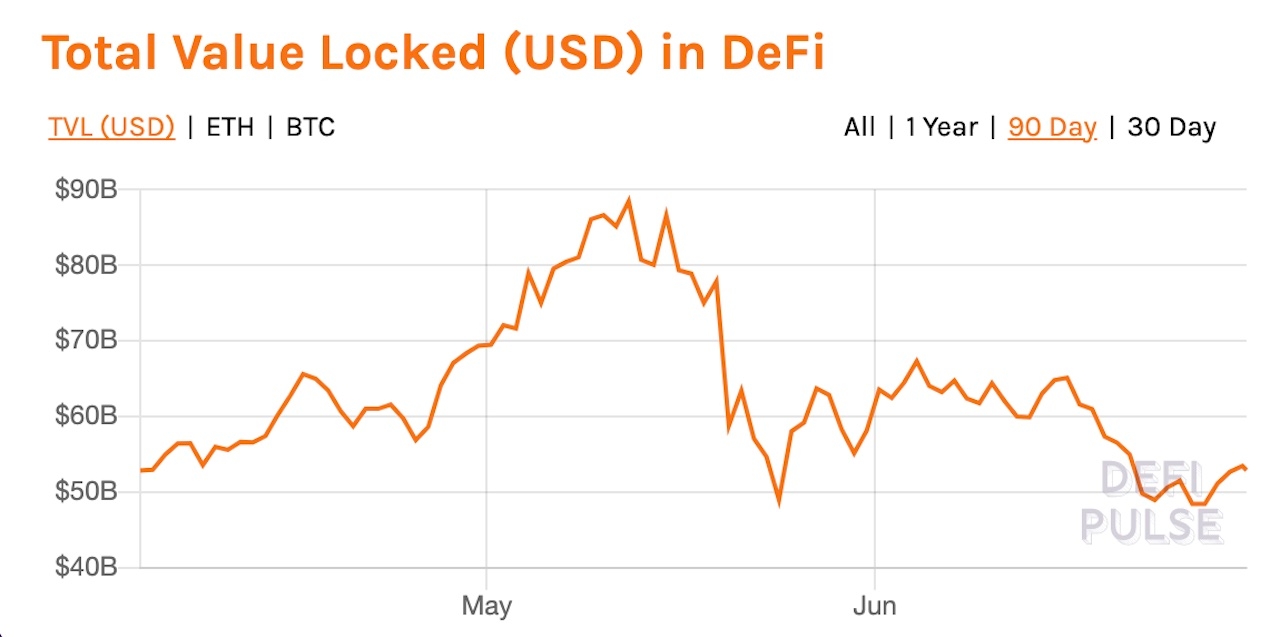

DeFi Total Value Locked

DeFi total value locked (TVL) is an accurate representation of the health of DeFi and its markets. TVL factors in the total current supply, the maximum supply, and the current cryptocurrency value. Traders use the TVL ratio to assess whether an asset is overvalued or undervalued.

To calculate the TVL ratio, multiply the current supply in circulation by the current trading price. Divide the resulting product by the market capitalization value, and you have your TVL ratio. When the TVL ratio falls below 1, it typically indicates an undervalued DeFi asset.

Altcoin Gainers and Losers

Like a constantly changing scoreboard, Altcoin gainers and losers are the top-performing or crashing coins across various time periods. Instead of charting gains and losses across various cryptocurrencies manually, investors can use numerous available cryptocurrency investment trackers.

Here are some of the best altcoin gainers and losers trackers to aid your crypto investment strategies:

How Reliable Is Crypto Market Sentiment?

Crypto market sentiment can be an incredibly useful tool to add to your arsenal. However, the indefinite nature of aggregating public opinions, attitudes, moods, and outlooks means that there is no one correct model for measuring market sentiment. When you combine sentiment analysis with technical and fundamental analysis, a clearer picture of price action emerges.

Closing Thoughts

Cryptocurrency market sentiment analysis empowers the proactive investor with broad market insight applicable to each and every trade. As with any financial investment, the more information you have, the better chance you have of understanding the market. That translates to better chances for you to plotting successful trading strategies. After all, markets based on supply and demand are heavily influenced by psychology. Following barometers for market sentiment keeps you plugged in and ready to place informed trades.