What is a spot market for crypto trading?

Introduction

With an increasing number of institutions beginning to invest in cryptocurrency, it’s inevitable that more users have started to take an interest in it. To begin a journey in cryptocurrency investing/trading, one would typically wish to start with the basics, understanding how to buy and sell cryptocurrencies before moving on to trading.

Spot trading is the most basic and simplest method for trading cryptocurrency. New traders usually start their cryptocurrency trading journey by interacting with spot markets. Compared to investing in crypto, which typically means holding a cryptocurrency for a prolonged period of time, spot trading involves buying and selling a range of cryptocurrencies in an attempt to generate regular short-term profits.

In this article, we’ll explore spot trading.

Key Takeaways:

Spot trading refers to buying and selling cryptocurrencies at the current market price with the intention of immediate delivery of the cryptocurrency traded.

Some of the advantages of spot trading include it being a relatively low risk and straightforward process as well as its transparent pricing.

What Is Cryptocurrency Spot Trading?

Spot trading refers to buying and selling cryptocurrencies at the current market price, also known as the spot price, with the intention of immediate delivery of the cryptocurrency traded. “Delivery” in this context refers to the buyer and seller fulfilling their commitment to the transaction, with the buyer offering the payment and the seller offering the cryptocurrency traded.

Spot traders typically buy cryptocurrencies at the current market price with existing capital, hold onto the cryptocurrency for a period of time in hopes of the price increasing so they can eventually sell their crypto to realize a profit. Spot trading is popular among traders, given that they can open short-term positions with low spreads and no expiration date.

Spot traders can also short the cryptocurrency spot market. This involves selling a cryptocurrency and repurchasing it when the price decreases.

Taking ownership of the actual cryptocurrencies that are being bought and sold differs from trading derivatives, such as a cryptocurrency contract for difference (CFD), in which the asset traded only tracks the price of the cryptocurrency and doesn’t confer ownership of the cryptocurrency upon traders.

Details on Cryptocurrency Spot Trading

What Is Spot Price?

A spot price refers to the present market rate for immediate purchase or sale of a particular asset.

What Are Crypto Spot Trading Pairs?

Trading pairs describe assets that can be exchanged for one another. There are two main types of trading pairs in the cryptocurrency spot market: crypto-to fiat pairs (e.g., ETH/USD) and crypto-to-crypto pairs (e.g., ETH/USDT).

What Is an Order Book?

An order book gives traders information regarding the depth of a given market. It displays a real-time list of open buy and sell orders for a selected cryptocurrency. There are two sides to the order book:

Buy side: Shows all open buy orders below the last traded price. Offers from buyers are known as “bids.”

Sell side: Shows all open sell orders above the last traded price. The sell price offered is known as an “ask.”

An open order refers to unfilled orders that have yet to be executed.

Different Kind of Orders

There are different kinds of orders that can be made in a cryptocurrency spot market.

Limit Order

This allows spot traders to prepare spot trades in advance. Users can set the desired price at which they wish to buy or sell the cryptocurrency, known as the limit price. Once the market price reaches that price, the trader’s order will be executed, made possible through conditional agreements that have been specified by the trader.

Market Order

A market order is executed immediately at current market prices. This order type is used by traders when they wish to complete their trade orders as quickly as possible. Spot traders can make this order easily, without having to enter a price. Once a market order has been executed, a trader can purchase or sell their holdings immediately at the best available spot price.

There is no guarantee that the market price won’t change while the order is being executed, especially given the volatile market conditions of cryptocurrency.

Traders can refer to the transaction history to keep track of the type of orders they’ve made.

What Are Maker and Taker Fees?

Most exchanges charge a transaction fee for each spot trade order. The amount of fees to be paid depends on whether the trader is a maker or taker.

Taker Fee

Takers are traders who remove liquidity from the order book. A buyer who inputs a market order is considered to be a taker. A trader whose order is matched immediately with an existing buy or sell offer subjects them to a taker fee.

Maker Fee

A maker is a trader who provides liquidity to the market by increasing the market depth of the order book. A maker fee is applied when a trade order is placed in advance with limit orders.

However, not all limit orders are charged a maker fee. For example, when a trader is matched with an order straightaway, they might be charged a taker fee instead. To ensure that a maker fee is charged, traders can place a limit order so they won’t be matched with an order immediately even when the terms are met.

Differences Between Spot Trading & Margin Trading

In spot trading, traders purchase cryptocurrencies with the capital they have available, fully possessing the asset once the trade has been executed.

In margin trading, traders borrow capital from a third party to complete the purchase of cryptocurrencies. This allows margin traders to purchase larger quantities of cryptocurrencies or enter larger trading positions, resulting in the potential for more significant profits. However, this is considered riskier as a losing margin trade could potentially amplify the losses and cost margin traders more than their initial capital.

In addition, margin traders are required to consistently meet their margin requirements to avoid receiving a margin call, which could cause the trader’s assets to be sold off. Margin traders are thus required to constantly keep an eye on their trades. In addition, the costs of a margin loan can pile up, rendering the need for margin traders to trade in shorter time frames more often as compared to spot trading.

Differences Between Spot Trading & Futures Trading

With spot trading, cryptocurrencies are purchased with immediate delivery and spot traders will own the underlying asset. Afterward, spot traders generally wait for the price of the cryptocurrency to increase before taking profit.

Futures traders, on the other hand, don’t own the underlying asset; they merely own a contract which represents the cryptocurrency’s value. In futures trading, both the buyer and seller agree to trade a certain quantity of cryptocurrency at a specific price in the future, which is then locked in the contract until the transaction is completed at a later date. When the contract matures on the predetermined date, the buyer and seller come to a settlement.

The main difference between spot trading and futures trading lies in the use of leverage. Futures trading allows for the use of leverage, so that futures traders can enter a larger position even if they have a lower account balance.

Cryptocurrency Spot Markets

Spot markets, also known as cash markets since traders make payments up-front, are available for a wide range of asset classes. These include stocks, bonds and the foreign exchange (forex) market. NASDAQ and NYSE (New York Stock Exchange) are two of the most popular spot markets.

To understand how the spot market works for cryptocurrency spot trading, let’s take a look at a BTC/USDT spot trading pair.

Buyer A, with 1,000 USDT, puts in a buy order for an equivalent amount of BTC at the unit price of $42,000. Buyer A will be matched with Seller B, who offers BTC in exchange for USDT at Buyer A’s desired price. Once Buyer A and Seller B have agreed on the price, the order will be executed and filled immediately.

Spot markets are commonly affected by market sentiment, and spot prices for nearly all cryptocurrencies fluctuate wildly. Therefore, understanding market sentiment is a useful skill for spot traders.

There are different types of spot markets for cryptocurrencies, which we’ll discuss in the next section.

Type of Cryptocurrency Spot Markets

Spot trading occurs in two major types of spot market: Exchanges and over-the-counter (OTC) trading.

Exchanges

Exchanges are platforms where market demand and supply are aggregated, allowing spot traders to buy or sell cryptocurrencies quickly at market price. In cryptocurrency spot markets, there are two distinct exchanges: centralized exchanges (CEXs) and decentralized exchanges (DEXs).

Centralized Exchange

A CEX acts as an intermediary between spot traders and cryptocurrencies, functioning as a custodian and managing the traded cryptocurrencies. CEXs provide an order book, which will provide spot traders information with regard to the amount of cryptocurrency available for sale, and also the market demand for a cryptocurrency. This is useful for gauging the market liquidity available for trading.

CEXs grant spot traders access to fiat-crypto trading pairs. To begin spot trading, users simply have to deposit either fiat or crypto into their account.

There are certain responsibilities specific to CEXs:

Ensuring Smooth Transactions

Platform Security

Customer Protection

Regulatory Compliance

Fair Pricing

Know Your Customer (KYC)

Anti-Money Laundering (AML)

Since CEXs offer the above functionalities and services for users, spot trading on CEXs often involves transaction fees. Fees are also charged for listing and other trading activities. Thus, CEXs can profit regardless of the market state as long as they have sufficient trading volume and users.

Decentralized Exchange

This type of exchange is most commonly used for cryptocurrency trading. DEXs have similar functionalities and services as CEXs. However, the greatest difference lies in that there are no intermediaries involved in DEXs. The matching of buyers and sellers is achieved through blockchain technology, where smart contracts with predetermined rules are used to execute trades directly from a trader’s wallet. With self-executing codes, traders are able to transact without needing to trust an intermediary to complete the trade for them. Similarly, the traded cryptocurrency doesn’t need to be held in custody by the CEX, giving traders full ownership of the cryptocurrency.

When using DEXs, traders aren’t required to create an account, and can bypass the KYC process. This provides users with a lot more privacy and freedom, allowing them to trade directly with others. However, the tradeoff is that should there be any technical issues, the lack of KYC and customer support leave the trader largely stranded.

Some DEXs use an order book model, similar to that of CEXs. A more recent development within the space is the automated market maker (AMM) model, such as that of Uniswap and PancakeSwap. AMMs use a formula to determine prices and make use of liquidity pools.

Over-the-Counter (OTC) Trading

Spot trading can be carried out through OTC trading or P2P trading, with each carrying its own benefits.

OTC trading is considered to be off-exchange, as the buyer and seller transact directly, without any third party or trading platform overseeing their trade. The buyer and seller aren’t using an order book, and instead can choose to transact any cryptocurrency at any price that they both deem fit, even if it's below or above market price.

OTC trading is popular among spot traders for the following benefits:

Reduced Slippage

Using an order book can result in slippage, particularly for cryptocurrencies with lower liquidity such as small-cap cryptocurrencies. This results in spot traders being unable to fill their order at the price desired. OTC trading bypasses the order book, letting spot traders fill their trade positions without experiencing high slippage.

Reduced Market Volatility

Since OTC traders are transacting off-the-market, they can trade a large amount without worrying about causing volatility that would result from trading in an open market.

How to Profit From Spot Trading

Spot trading allows users to hold tokens for up to multiple years. It’s thus used by many traders to dollar-cost average (DCA) their favorite cryptocurrencies. Note that profits only become “real” when cryptocurrencies are “moved,” meaning converted to fiat currency or stablecoins. It’s also at this point that cryptocurrencies become taxable, but they can be held indefinitely before they’re taxed.

How to Trade on Bybit Spot

If you’re interested in trading the spot market with Bybit, the following is a step-by-step guide to help you get through the process.

1. Create an account on Bybit. Register on Bybit web or Bybit App, and do the KYC verifications to unlock a higher trading volume, higher deposit and withdrawal limits.

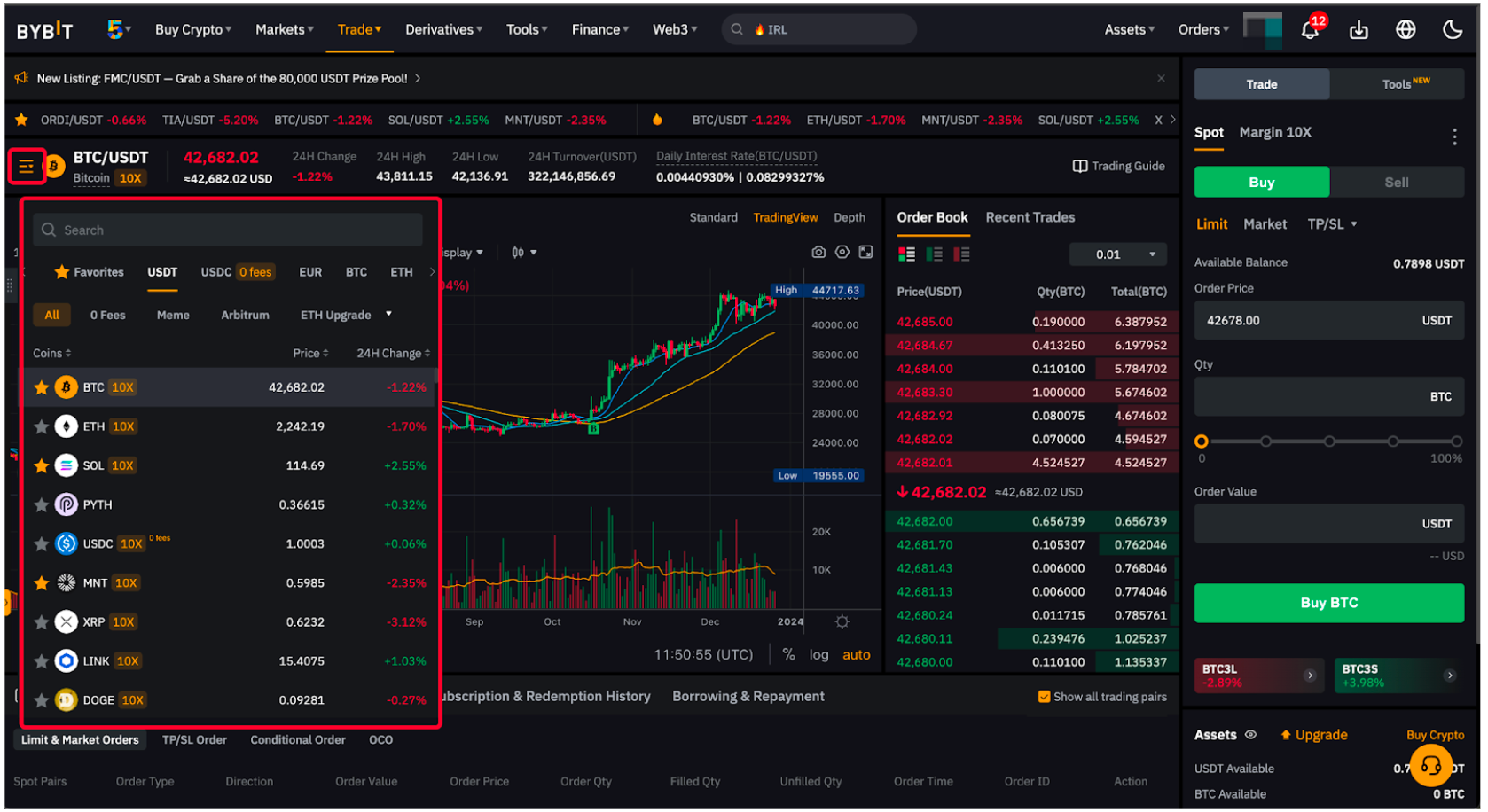

2. On the left dropdown icon, hover your cursor and you will see all supported Spot trading pairs, along with the Last Traded Price and the 24-hour change percentage of the corresponding trading pair.

3. To find a specific Spot trading pair, use the search box. If you see a 10x label beside a certain trading pair, it indicates that the trading pair is supported in Spot Margin Trading.

4. Place your order in the right trade tab. Bybit Spot Trading offers various order types, such as market and limit orders. To learn more about the differences between each order type, please refer to Types of Orders Available on Bybit.

5. To open a Market Order as an example, ensure you are currently in the Spot tab. Then, choose to Buy or Sell an asset. Enter your order value or quantity. If you place your order through other order types, such as Limit Order and Conditional Order, you will need to enter your order price or trigger price.

6. A confirmation window will pop up. Ensure your order details are correct then click on Buy or Sell.Calculating Bybit Spot Trading Fees

Let’s take the BTC/USDT spot trading pair as an example. If BTC is trading at a current price of $96,000, traders can buy or sell 1 BTC at 96,000 USDT. The formula is as follows:

Trading Fee = Filled Order Quantity × Trading Fee Rate

Alice buys 1 BTC using a Market Order with USDT. The taker’s fee for Alice would be 1 × 0.1% = 0.001 BTC

Jack buys 96,000 USDT using a Limit Order with BTC. The maker’s fee for Jack would be: 96,000 × 0.1% = 96 USDT

Once the order is filled:

Alice needs to pay a taker fee of 0.001 BTC for 1 BTC with the created Market Order. After the auto deduction of trading fees, Alice will receive a total of 0.999 BTC.

Jack buys 96,000 USDT with a Limit Order, and will pay a maker fee of 96 USDT. He’ll receive a total of 95,904 USDT after the deduction of maker fees.

However, if the orders are canceled or unfulfilled, Jack and Alice won’t be charged any trading fees.

Advantages of Spot Trading

Transparent Prices

Spot market prices are completely transparent, and can be viewed on the order book. The prices are based solely on market supply and demand. This is unlike other trading instruments, such as derivatives (futures, options, etc.), where prices are dependent on multiple factors, including time, funding rate, interest rates and others.

Straightforward Process

Spot traders can easily calculate their risk and reward based on their entry price and the current market price. This is because spot traders own the cryptocurrencies outright, and therefore don’t need to worry about other factors such as maintenance margins and interest payments.

Simple

As mentioned above, spot traders won’t be liquidated or get a margin call, unlike with margin trading. Spot traders can thus “set and forget,” only checking in when they’d like to take profit. On the other hand, given the volatility of cryptocurrencies, derivative traders who utilize leverage and margin have to constantly monitor their positions to protect themselves against liquidation.

Spot traders can also enter and exit a trade any time they want, without needing to constantly check on their trade positions.

Relatively Low Risk

Spot trading carries lower risk as compared to derivatives trading. Without the use of margin, spot traders are protected from losing more than their initial capital investment.

Holding Power

As spot trading doesn’t utilize any form of leverage or margin, spot traders aren’t required to pay interest or maintain a margin. Hence, if a spot trader has a lot of confidence in a particular cryptocurrency, they can choose to hold onto it even if the token has taken a huge beating in terms of price.

Disadvantages of Spot Trading

Limited Profit Potential

As mentioned earlier, spot trading doesn’t utilize leverage and margin, and only taps on the amount of capital a spot trader has. Thus, the positions involved in spot trading are capped, and spot traders can’t enter larger positions such as those in futures and margin trading. The profit potential that a spot trader stands to earn is thus limited.

Slippage Due to Lack of Market Liquidity

Over time, spot market liquidity can dry up. Particularly during bear markets, smaller altcoins tend to lose a substantial amount of their liquidity, given the reduced market trading volume.

When this occurs, spot traders will have difficulty buying or selling their cryptocurrencies for a fair market price because of the slippage that results from insufficient liquidity. They’ll either have to sell their crypto for a lower-than-fair-market price, buy a cryptocurrency for a higher-than-fair-market value, or hold onto their investments in the hopes of receiving a better price in the future.

The Bottom Line

Overall, using the spot market for crypto trading can be a great way to own cryptocurrencies at your desired prices. The immediacy that comes with a spot market trade can be invaluable when you want to obtain instant returns. In comparison, you’ll need to wait for your returns with futures trading, and must contend with the risk that you could lose your initial margin.

.jpeg)

.jpeg)

.jpeg)

.jpeg)