How to Trade USDT Perpetual Futures on Bybit

Crypto perpetuals futures are a type of derivatives product that allows traders to gain exposure to cryptocurrencies with leverage. Traders have the flexibility to go long or short on crypto assets, and keep their positions open for indefinite periods.

With USDT perpetual futures on Bybit's intuitive and user-friendly trading platform, you can realize these benefits with futures contracts settled in USDT, a leading stablecoin.

This article will introduce you to USDT-settled crypto perpetuals, and explain how they work and how you can start trading them. No worries — we'll guide you through each step you need to take to get started with USDT perpetual futures trading on Bybit.

Key Takeaways:

Crypto perpetuals, a type of futures contract that doesn’t expire, uses a funding rate mechanism to track the underlying asset's spot price.

USDT perpetuals on Bybit are settled in the USDT stablecoin.

You can trade over 576 crypto perpetual pairs with Bybit while taking advantage of high liquidity, competitive fees and a user-friendly platform.

What Are USDT Perpetual Futures Contracts?

USDT perpetual futures contracts are crypto perpetuals settled in Tether USD (USDT), a stablecoin pegged to the U.S. dollar (USD). As derivatives, cryptocurrency perpetuals enable you to trade an underlying asset like Bitcoin (BTC) or Ethereum (ETH) without an expiration date. While you are obliged to buy or sell traditional futures at expiration, you can hold crypto perpetual contracts indefinitely.

Crypto perpetuals allow you to use leverage to amplify your potential returns and keep your positions open for indefinite periods. They also offer you the flexibility to profit from both upward and downward price movements with long and short trades. Perpetual futures trading can also help you hedge against market risks without owning the underlying asset.

On Bybit, all settlements, margin, and profit and loss (P&L) calculations are denominated in USDT for linear USDT perpetuals. On the other hand, inverse perpetual futures contracts, which you can use to generate returns when crypto prices fall, are settled in the underlying asset.

What Is USDT?

Tether USD (USDT) is the leading stablecoin by market capitalization. As of May 8, 2025, it features a $149.5 billion market cap, and a $27.54 billion trading volume in the past 24 hours. USDT is issued and managed by the British Virgin Islands–based Tether Limited. It's owned by iFinex Inc, the same company that operates the Bitfinex cryptocurrency exchange.

USDT is a fiat-pegged stablecoin that closely follows the price of the U.S. dollar. To ensure the stablecoin's price stability, Tether maintains physical reserves, of which nearly 84% is held in cash or cash equivalent instruments.

Check out this Bybit guide to learn more about USDT.

Top Bybit USDT Perpetual Futures by Trading Volume

Bybit has a wide selection of USDT perpetuals that you can trade to speculate on the prices of underlying assets.

As of May 8, 2025, the top five USDT perpetual contracts by 24-hour trading volume on Bybit are BTCUSDT, ETHUSDT, SOLUSDT, SUIUSDT and KAITOUUSDT.

How Do USDT-Settled Crypto Perpetuals Work?

In contrast to standard crypto futures, crypto perpetuals don't have an expiration date, and can be held indefinitely. Since they don't expire, no physical delivery of the underlying asset is necessary. Instead, perpetual contracts are settled in cash, and their primary purpose is to enable traders to speculate on crypto prices without owning the underlying asset. On Bybit, settlement takes place in the USDT stablecoin for USDT perpetuals, and USDC for USDC perpetuals.

Because they lack an expiration date, crypto perpetuals rely on the funding rate mechanism to track the underlying asset's price. The funding rate can be positive or negative, and can change based on how close the futures price is to the spot price.

A positive funding rate indicates an overall bullish market sentiment. When the futures price is trading at a higher level than the spot price, buyers (longs) are required to pay sellers (shorts) the funding amount. In contrast, a negative funding rate is generally a signal of bearish market sentiment. Here, longs pay shorts the funding amount (as the futures price is lower than the spot price).

Key Metrics for USDT Perpetual Futures Contracts

In addition to the funding rate, some of the key metrics of USDT perpetual futures contracts include the following.

Open Interest: This term refers to the total number of active contracts for a USDT perpetual futures pair. It’s an excellent tool for analyzing market sentiment.

Market Price: The market price represents the current market value of the underlying asset. As a derivation of the index price, it’s used to prevent price manipulation, calculate position margin and unrealized P&L, and trigger liquidations.

Index Price: The index price is the real-time price of the underlying asset across multiple cryptocurrency exchanges. It’s used as the primary component for calculating the market price.

24-Hour Trading Volume: This metric measures the total volume of contracts traded in the previous 24 hours for a futures pair on Bybit. It’s denominated in the underlying asset, and provides valuable insights into market dynamics and liquidity.

How to Trade USDT Perpetuals on Bybit

Bybit is a user-friendly and intuitive trading platform with a wide selection of USDT perpetuals. Thus, it’s an excellent choice for both veteran traders and beginning traders seeking to dabble in perpetual futures trading.

In the following section, you'll find a comprehensive guide that guides you through each step to get started with crypto perpetual futures trading on Bybit.

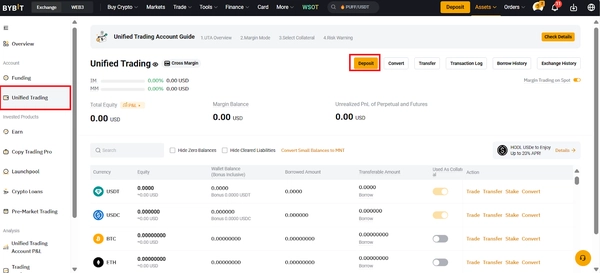

Step 1: Open a Unified Trading Account

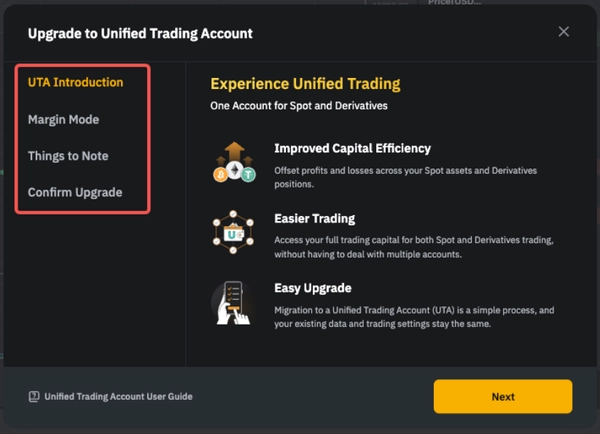

The first step to get started with USDT perpetual futures trading on Bybit is to open a Unified Trading Account (UTA). A UTA is mandatory in order to trade perpetuals on the platform. and will provide you with a tailored trading experience, account finances and risk management.

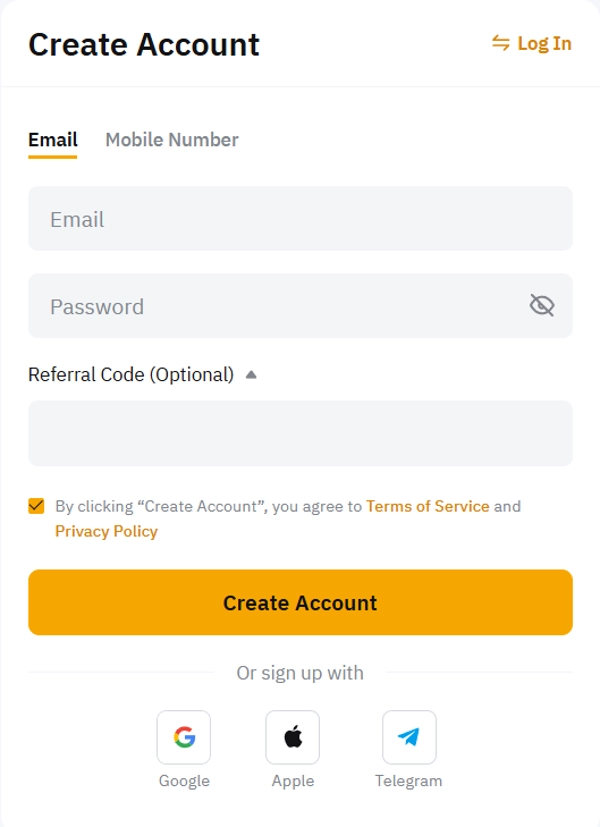

For new users, Bybit will automatically open a UTA. Simply follow this link to register and verify your identity.

If you have a Standard Account with Bybit, you can upgrade it to a UTA by clicking on Upgrade on the Trade page in the trading widget.

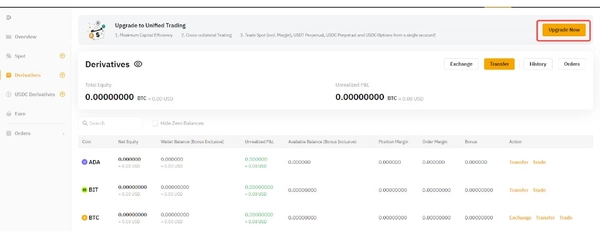

You can also upgrade your account by clicking on Upgrade Now on the Assets page in the Spot or Derivatives menu.

After reading the account's details, as well as acknowledging Bybit's Trading Rules and Terms of Service, click on Confirm Upgrade to finalize the process.

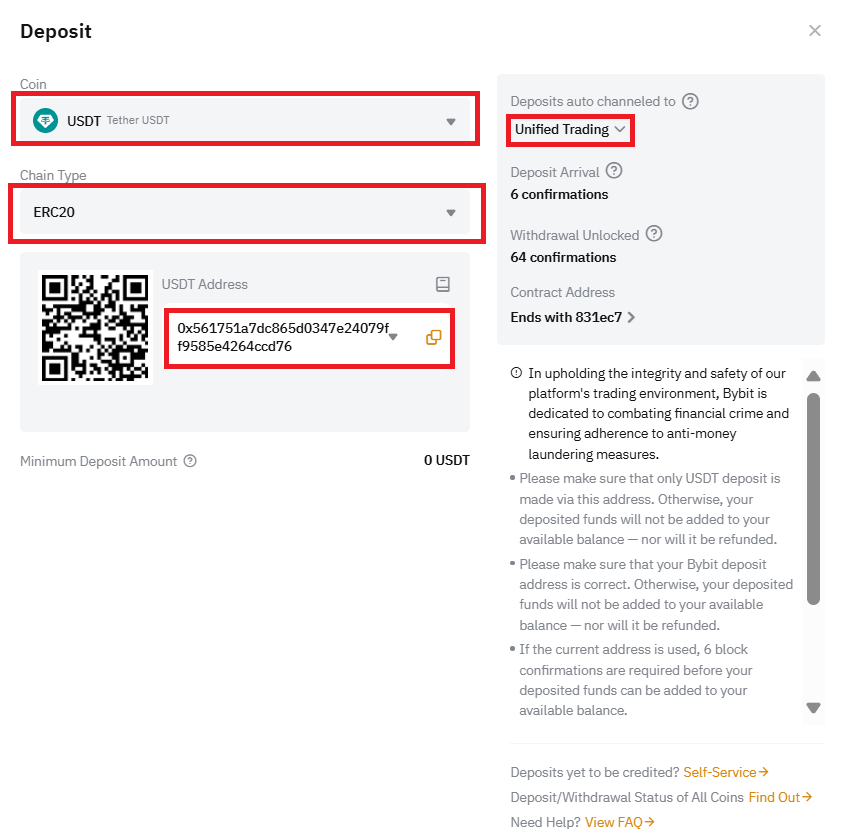

Step 2: Deposit Funds

Once your Unified Trading Account is ready, the next step is to fund it with crypto or fiat currency. Head to the Assets page, select the Unified Trading menu and click on Deposit.

Select your preferred cryptocurrency, the blockchain from which you’ll make the transaction, and Unified Trading for auto-channeling deposits. Always ensure that you’ve chosen the correct network in order to prevent a loss of funds. After doing so, copy/paste the wallet address or scan the QR code with your phone's camera to initiate the deposit from your wallet.

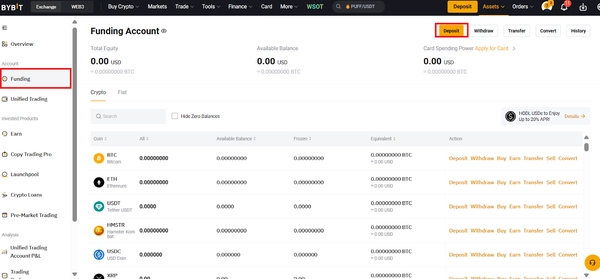

You can also fund your account with fiat currency via the Funding menu.

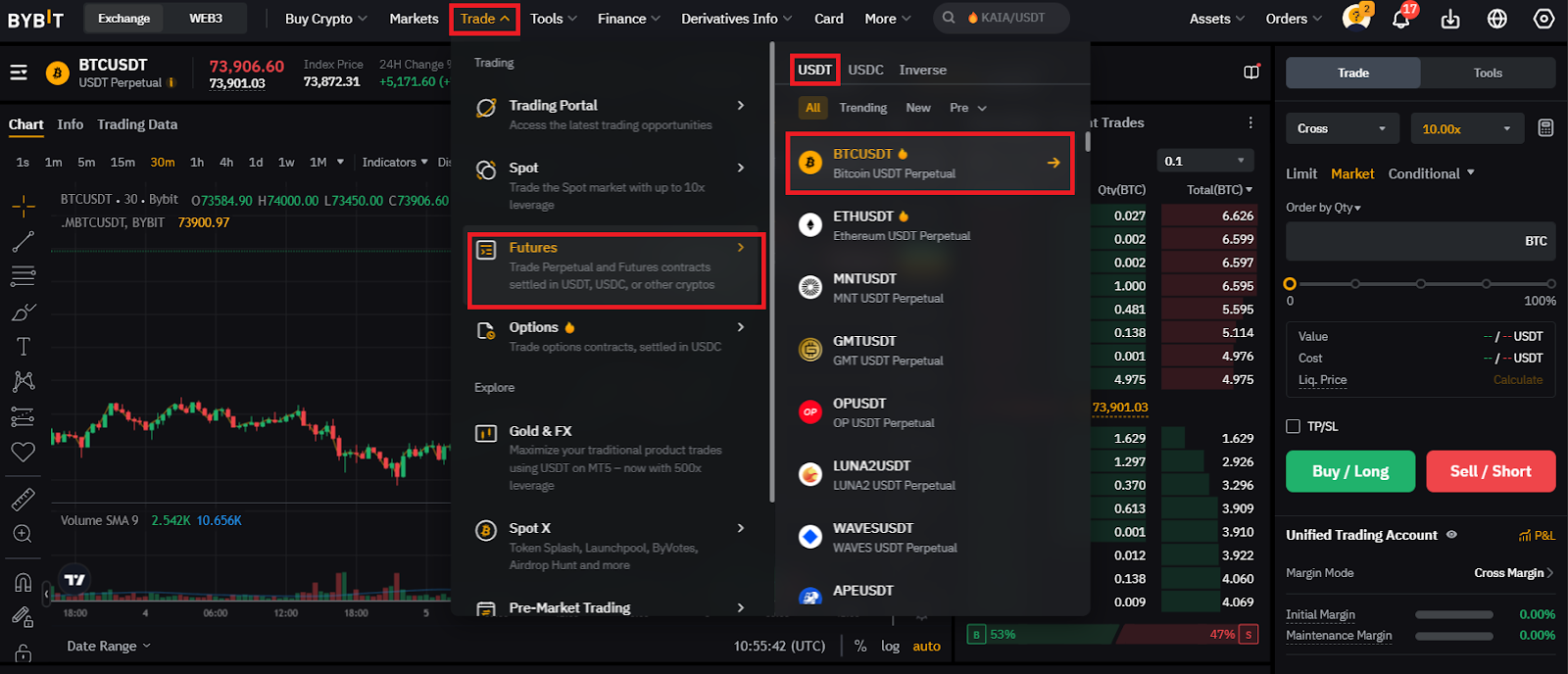

Step 3: Execute the Trade

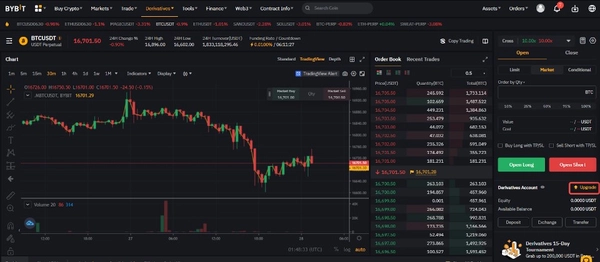

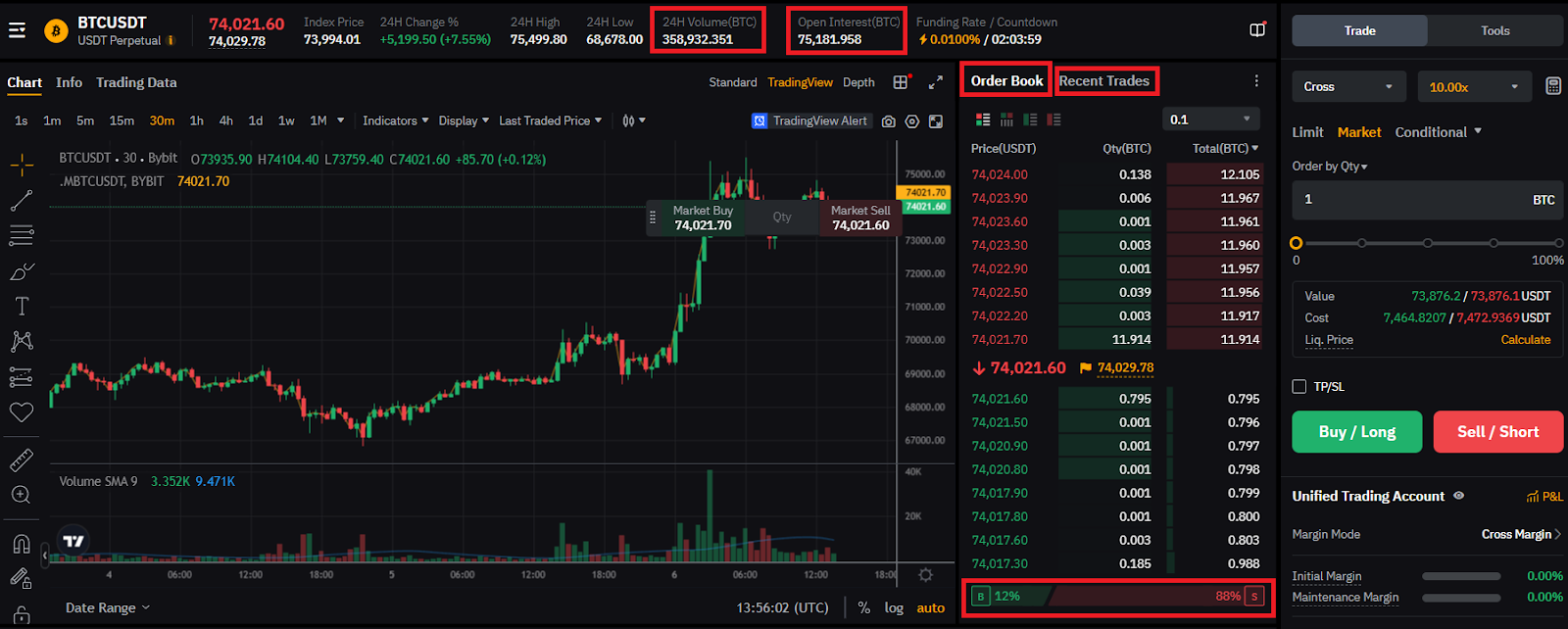

With a funded Unified Trading Account, it's time to open a new USDT perpetuals position on Bybit. To do that, click on Trade, select Futures and your preferred symbol from the USDT tab. In this guide, we’ll open a position in the BTCUSDT perpetual futures contract.

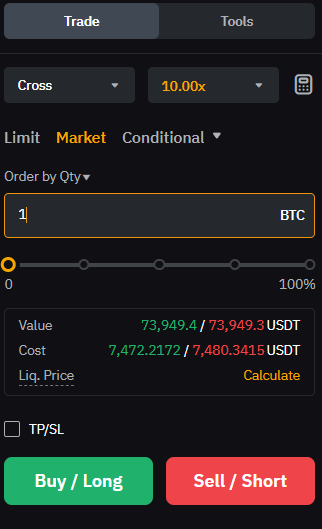

After analyzing the chart and determining an entry point, use the trading widget on the right to open your position.

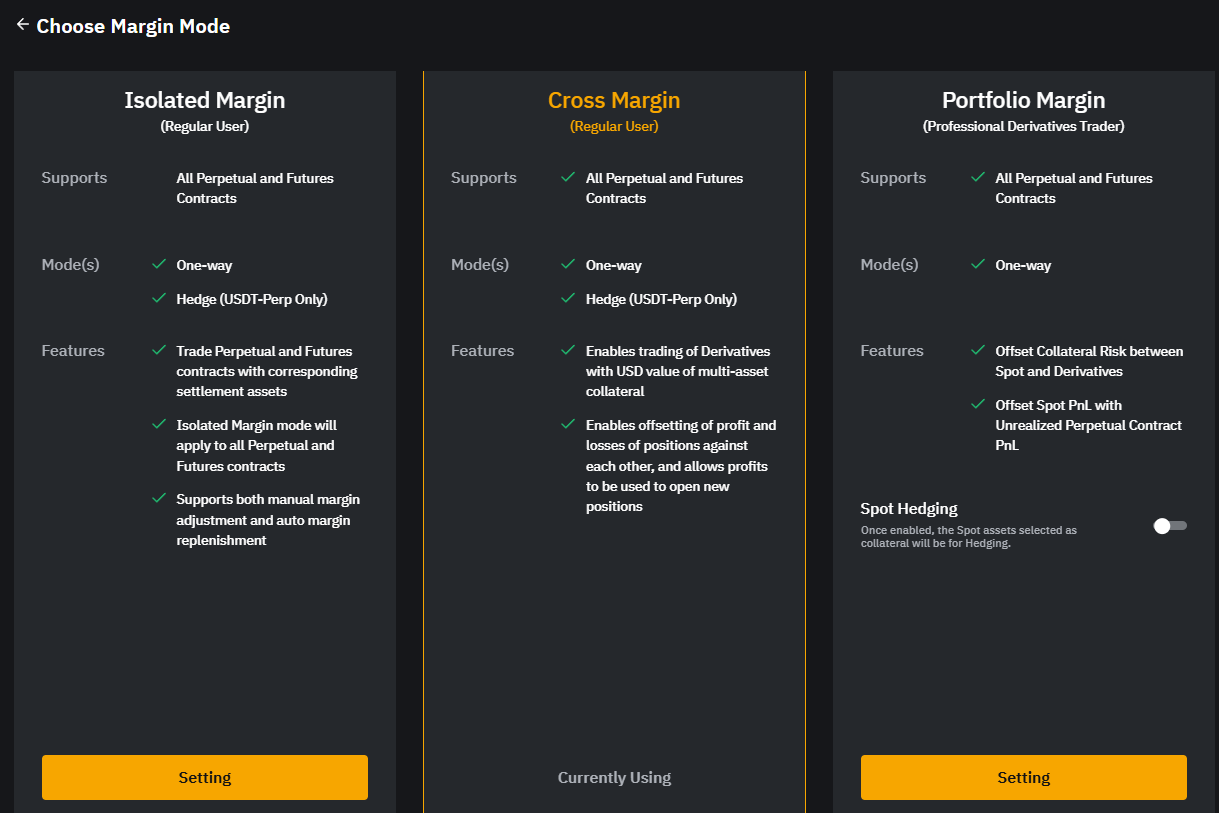

First, select your preferred margin mode, which will apply to your account. You can choose between the following options.

Isolated Margin: Isolated margin calculates margin requirements, and triggers liquidations based on each individual position.

Cross Margin: The default option for regular users, cross margin will take the USD value of all collateralized assets in your account and trigger liquidations when the account Maintenance Margin rate (MMR) reaches 100%.

Portfolio Margin: Available exclusively to professional derivatives traders, portfolio margin considers the overall risk of a portfolio rather than each isolated position.

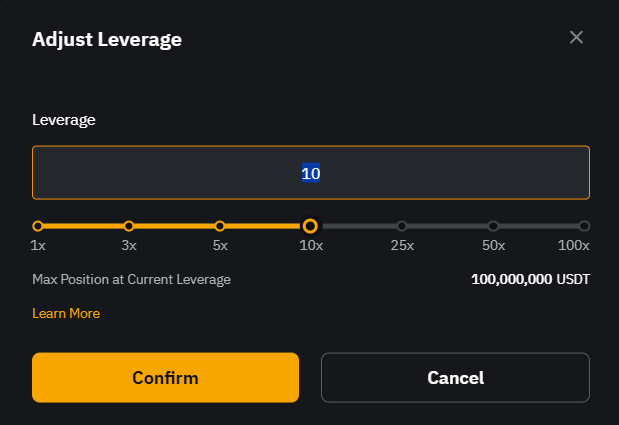

Once you’ve chosen your margin mode, the next step is to set the leverage for the trade. Use the slide to select a value between 1x and 100x, and click on Confirm.

Next, select an order type for your trade from the following choices.

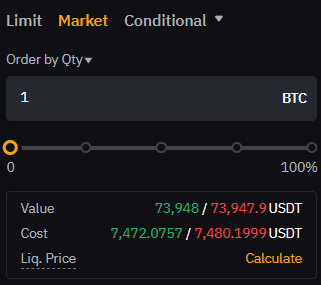

Market Order: Fill your order immediately at the best available price.

Limit Order: Set a specific price (Order Price) at which to buy or sell USDT perpetuals.

Conditional Order: Set a Trigger Price at which the conditional order is to be activated. This is useful for stop losses, take profits and breakout trading.

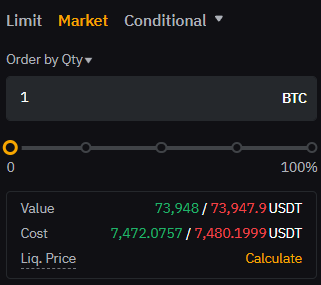

After selecting your order type, set the order amount for the trade. You can order either by quantity, denominated in the underlying asset, or by value, denominated in USDT.

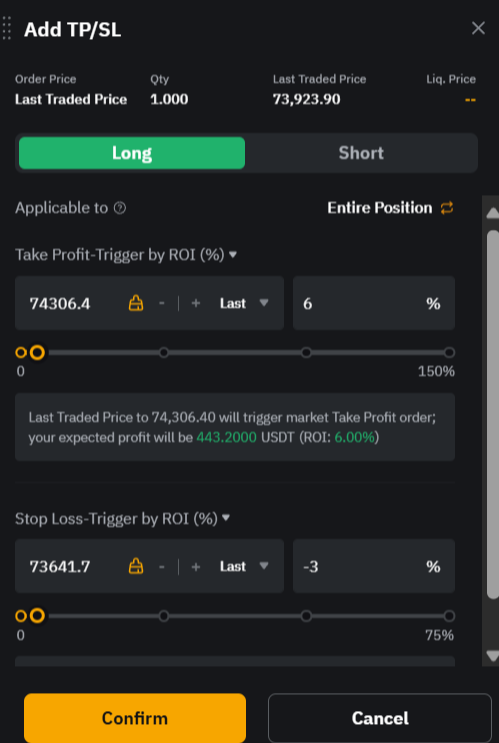

It’s advised that you set both a Stop Loss and Take Profit order to manage your risks efficiently. You can do that by ticking the box next to TP/SL, providing a Stop Loss and a Take Profit trigger price, and clicking on Confirm.

Finally, review your order and click on Buy/Long to open a long position or Sell/Short to open a short USDT perpetual position. Your order will automatically be executed by Bybit's robust matching engine, based on the provided parameters.

Step 4: Manage Your Crypto Perpetuals Positions

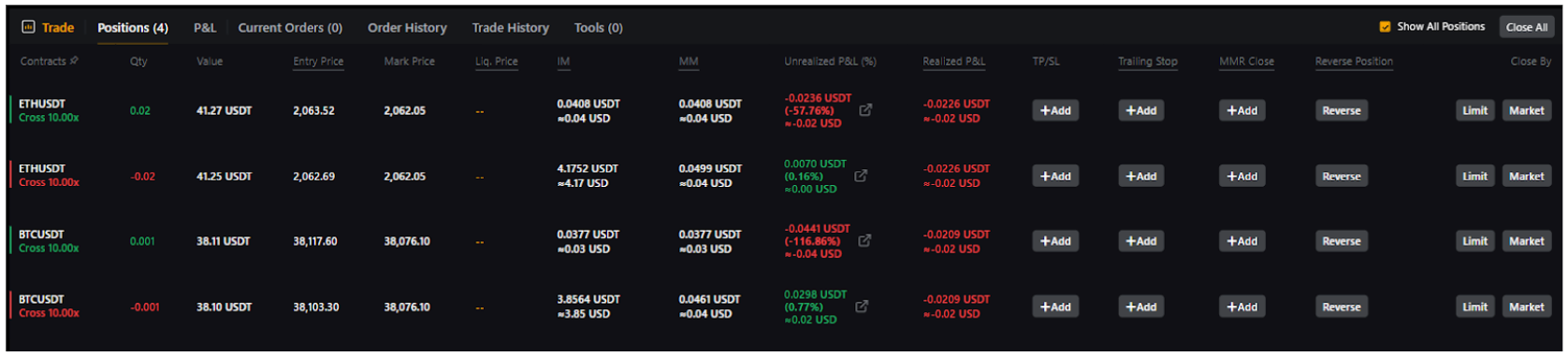

You can track your positions under Positions at the bottom of the trading page. In this menu, you can view and manage all your past and current orders and their P&L.

[Bonus] Protect Your First Futures Trade With Bybit

Interested in trying out futures trading but too wary of the risks? You can now protect your first USDT perpetuals trade with 50 USDT loss coverage. Simply claim your voucher, make your first Futures trade anytime from now through Jun 30, 2025 and you'll be able to get compensation of up to 50 USDT if your first Futures trade results in a loss. Click here to learn more.

Maintenance Margin Requirements for Leveraged USDT Perpetual Positions

A margin balance is necessary to keep your USDT perpetuals positions open on Bybit. Margin is calculated based on individual positions for both isolated margin and cross margin accounts.

However, you can only use the settlement asset (USDT) to trade USDT perpetuals in isolated margin mode. If the market price reaches the liquidation price, liquidation is triggered

On the other hand, Bybit converts all the collateralized assets in your account into USD value in cross margin mode. Unlike for isolated accounts, a liquidation is only triggered when the account MMR reaches 100%.

Visit the Bybit Help Center to learn more.

How to Calculate Position Sizing Using Position Calculator

In perpetual futures trading, position sizing determines the amount of capital you put at risk. It’s a critical aspect of risk management that helps you decide the optimal size for your trades.

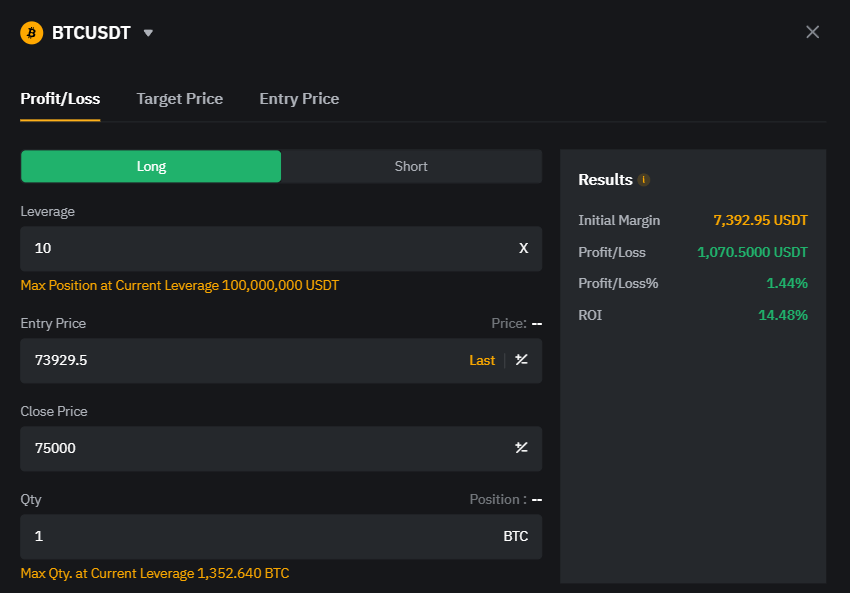

You can use Bybit's Calculator by clicking on the Calculator icon next to the leverage settings in the trading widget to estimate the right sizing, based on your risk appetite and account balance.

For example, suppose you go long on the BTCUSDT crypto perpetuals contract. With a 1 BTC order quantity and 10x leverage, you can generate a 14.48% return on investment (ROI) with 1,070.5 USDT in profits by opening your position at the price of 73,929.5 USDT and closing it at 75,000 USDT.

You can learn more about the Calculator here.

Advanced Tools for USDT Perpetuals Trading

You can also take advantage of the following advanced tools to trade USDT perpetuals.

Open Interest: Shows the active number of contracts in BTC, which is 75,181 for the BTCUSDT pair.

Trading Volume: Measures the volume of contracts traded in the past 24 hours (358,932 BTC).

Long/Short Ratio: Reflects trader sentiment by comparing the number of active long and short positions (12% vs. 88%).

Order Book: Displaying current buy and sell orders, the order book indicates present demand for the underlying asset (e.g., a buy order at a price of 74,021 USDT).

Recent Trades: Track real-time market activity by clicking on Recent Trades next to the order book on the trading page (e.g., a sell order at a price of 73,900 USDT).

Post-Only and Reduce-Only Orders: If you tick the box next to Post-Only in the trading widget, Bybit will only execute your Limit or Conditional order as a maker order. At the same time, selecting Reduce-Only will only reduce your position size, while canceling or adjusting orders that might increase your position size.

Getting Started With USDT Perpetual Futures on Bybit

Crypto perpetuals allow you to amplify your position size with leverage, and open both long and short positions without an expiration date.With Bybit's user-friendly and intuitive trading platform,you can trade a wide selection of USDT futures with competitive fees, up to 100x leverage and access to top-tier liquidity.

However, understanding the risks involved and efficiently managing them are critical for traders' long-term success in the perpetual futures market. Tools such as Stop Loss and Take Profit orders can help reduce your potential losses and maximize profits.

Ready to trade USDT perpetuals? Create a Bybit account to get started!

#LearnWithBybit