How to Trade USDC Perpetual Futures on Bybit

Perpetual futures at Bybit enable traders to speculate on cryptocurrency prices without expiration dates, providing flexibility for a wide range of strategies. With the added stability of USDC, one of the leading USD-pegged stablecoins, alongside customizable leverage and robust risk management tools, USDC perpetual futures are an ideal choice for both novice and seasoned traders.

Key Takeaways:

No Expiration: Trade without expiration dates, providing more flexibility for holding positions.

Stable Collateral: Use USDC, a stablecoin backed by USD, for reduced volatility.

Leverage Options: Access customizable leverage to maximize position potential.

What Are USDC Perpetual Futures Contracts?

USDC perpetual futures contracts are a type of crypto derivative that lets traders speculate on asset prices without needing to worry about contract expiration dates. This allows traders to hold positions as long as they meet margin requirements.

Flexible Trading: USDC perpetuals allow traders to go long (betting on a price increase) or short (betting on a price drop). For example, if you anticipate a rise in Bitcoin’s price, you can hold a long position indefinitely.

Leverage Options: Traders can use leverage to gain exposure to a larger position with a smaller amount of capital, potentially increasing returns. For instance, with 10x leverage, a $100 margin position has exposure to $1,000 worth of Bitcoin.

Stability of USDC Margin: Using USDC, the second-largest stablecoin by market capitalization, as collateral reduces exposure to volatility, as compared to using other crypto assets as margin.

What Is USDC?

USD Coin (USDC) is a stablecoin pegged to the U.S. dollar (USD), designed to maintain a 1:1 value with it. It’s widely used as collateral in crypto trading for its stability and reliability.

Issued by Circle: USDC is backed by Circle, a financial technology firm focused on transparent, fully-backed digital currencies. Each USDC token is supported by equivalent USD assets held in reserve.

Trusted Stability: Regular audits ensure that each USDC token is fully backed, providing users confidence in its value and liquidity.

Bybit’s Support for USDC: Bybit enables traders to use USDC for perpetual contracts, leveraging a stable asset as collateral for a more consistent trading experience.

For more information, visit Bybit’s USDC guide.

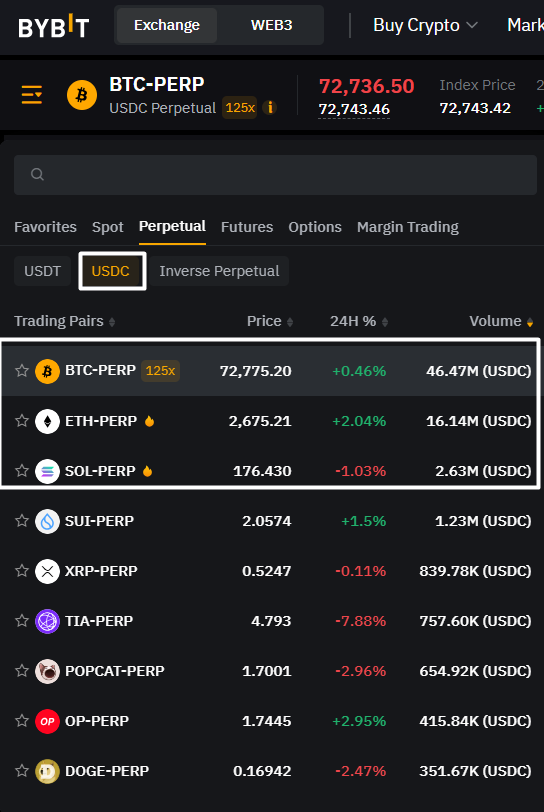

Top Bybit USDC Perpetual Futures by Trading Volume

Bybit offers several popular USDC perpetual futures contracts, with the highest trading volumes often seen in BTC-PERP, ETH-PERP and SOL-PERP.

These contracts allow traders to speculate on the price movements of major assets while using USDC as margin, providing stability and flexibility in volatile markets.

How Do USDC Perpetual Futures Contracts Work?

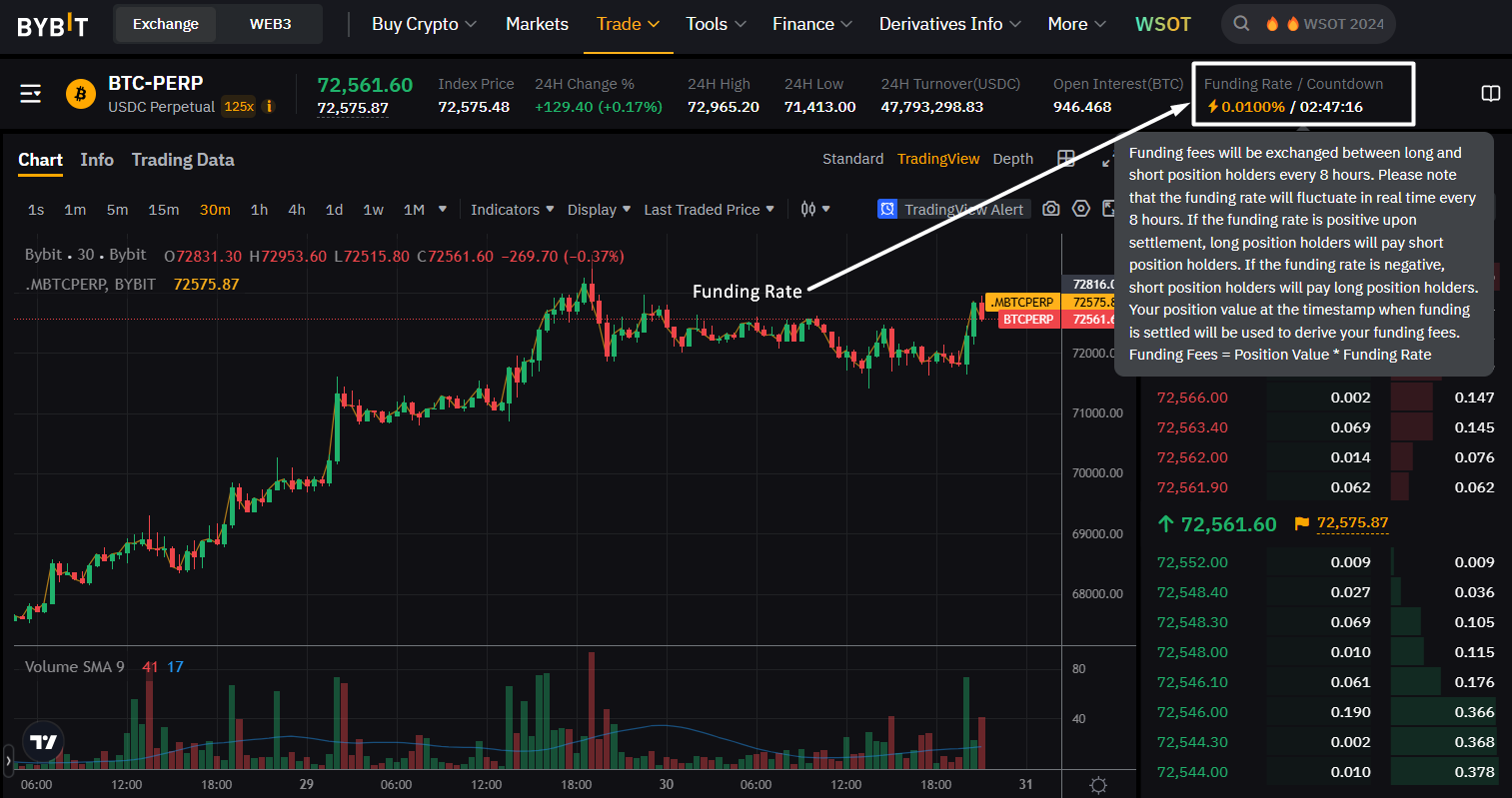

USDC perpetual futures contracts on Bybit allow traders to use USDC as collateral to speculate on price changes of major crypto assets. A key feature of perpetual futures trading is the funding rate mechanism, a periodic payment exchanged between long and short traders to keep contract prices close to the asset's spot price.

Funding Rate Mechanism: When the funding rate is positive, long positions pay short positions; when negative, short positions pay long positions. This helps align contract prices with the broader market.

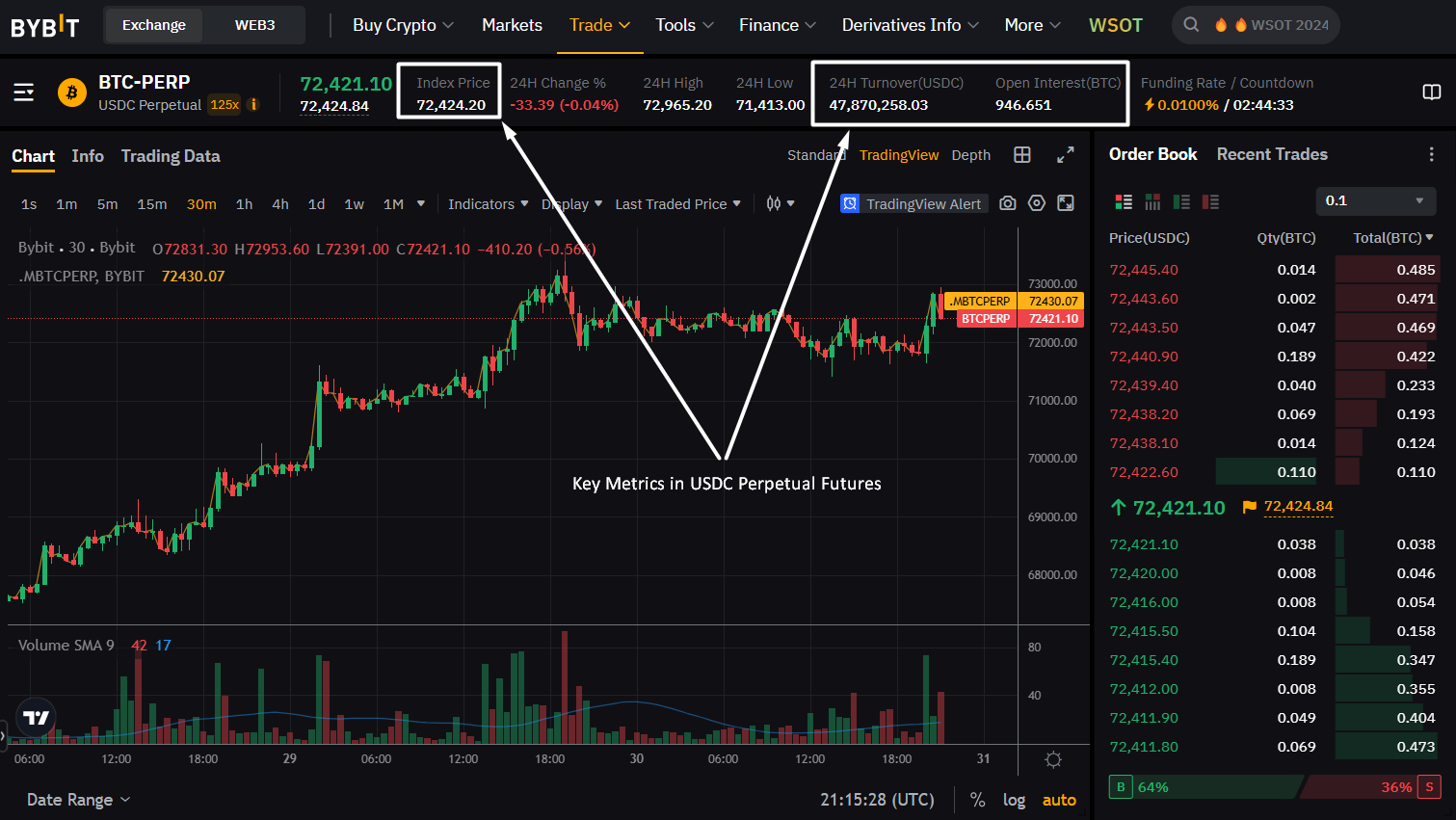

Key Metrics in USDC Perpetual Futures

Open Interest: Total number of active contracts, signaling market engagement.

Market Price: Real-time price of the asset on Bybit.

Index Price: Weighted average across exchanges to avoid price distortions.

24-Hour Trading Volume: Reflects transaction activity, providing insights into liquidity and market dynamics.

How to Trade USDC Perpetual Futures on Bybit

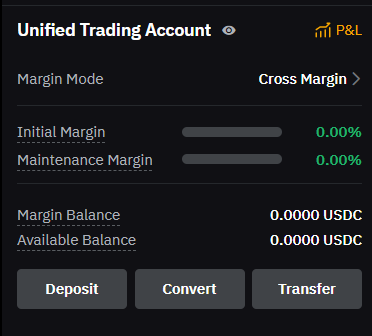

1. To trade USDC perpetual futures on Bybit, start with depositing USDC into your Unified Trading Account by selecting your preferred deposit method in the Assets section.

3. S

Crypto Deposit: Deposit USDC or other supported cryptocurrencies directly into your Bybit account.

One-Click Buy: Buy crypto instantly using a debit or credit card.

Fiat Deposit: Add funds using local fiat currency through bank transfers or other supported payment methods.

P2P Trading: Purchase USDC from other users directly via Bybit’s peer-to-peer marketplace, often with zero fees.

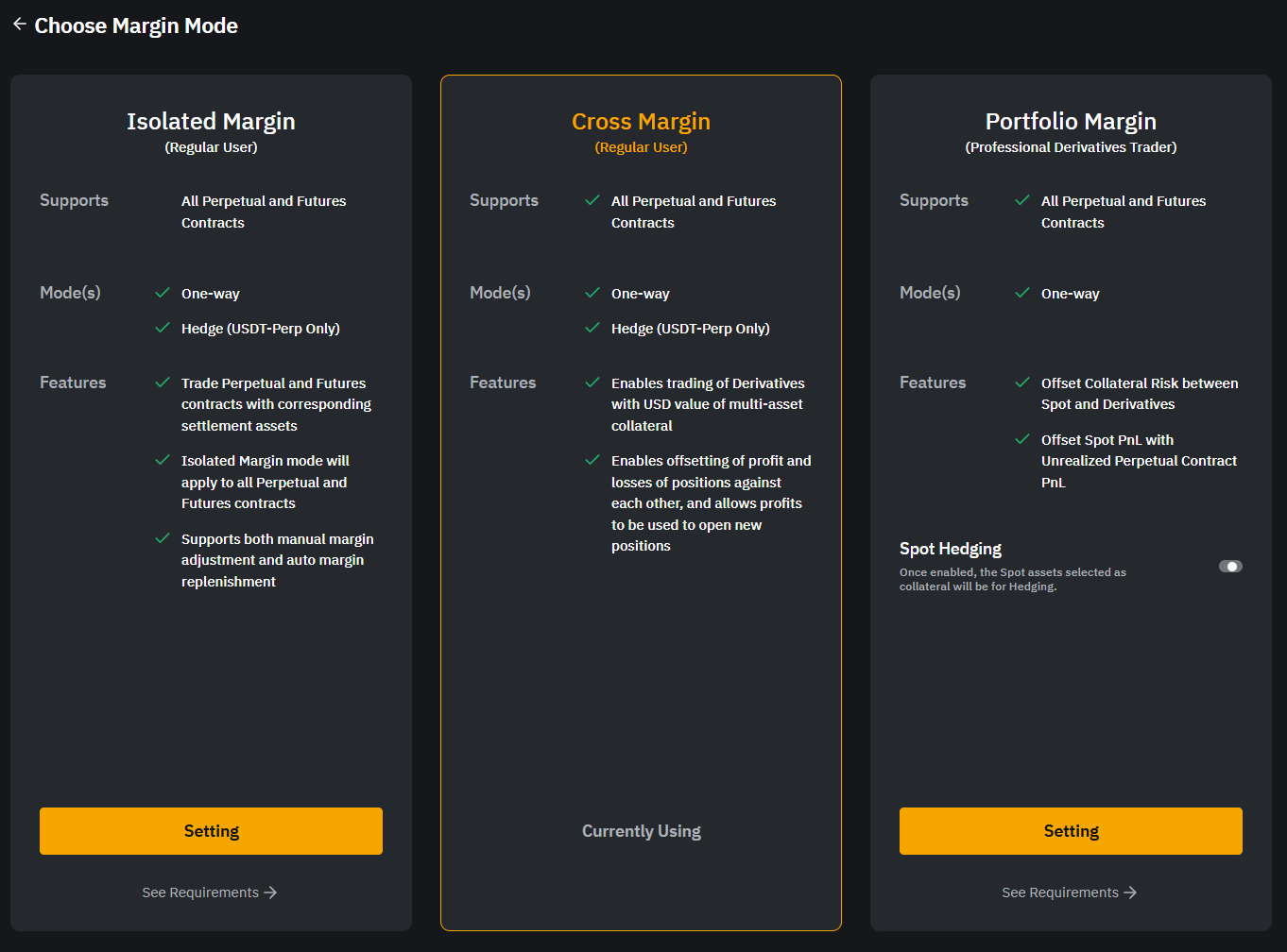

2. Select the Margin Mode

Isolated Margin: Contains risk to a single position, limiting potential losses to that trade.

Cross Margin: Shares margin across all positions, offsetting gains and losses but potentially impacting your entire balance.

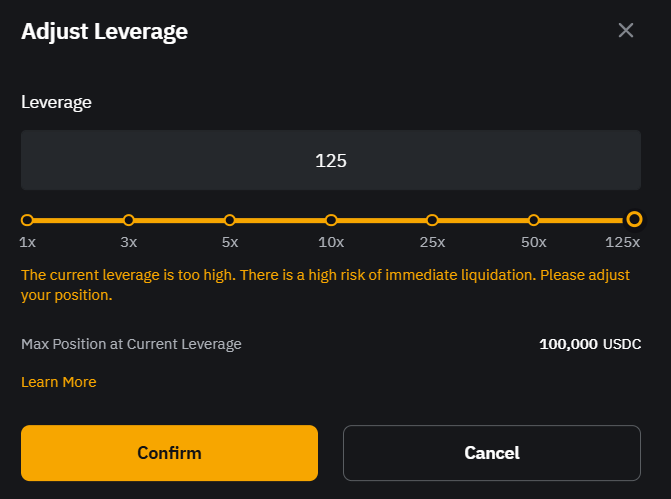

3. Set Your Leverage

Bybit offers leverage of up to 125x, allowing you to amplify gains or losses. Adjust leverage according to your risk tolerance.

4. Execute Your Trade(s)

Order Types: Use Market Orders for instant trades, Limit Orders for specific price targets and Trigger Price to activate orders at desired levels.

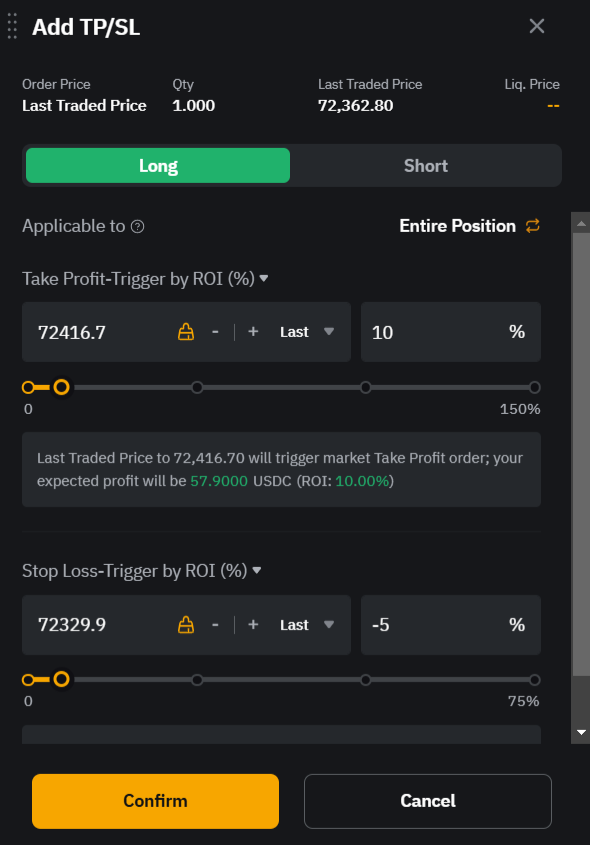

Take Profit/Stop Loss (TP/SL): Automatically close positions at preset profit or loss levels, such as a 10% TP or 5% SL.

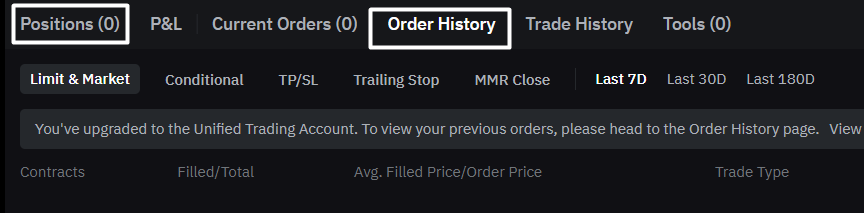

5. Track active trades in Positions and review history in Order History or Trade History for transparency.

Margin Requirements for USDC Perpetual Positions

Margin Requirements: Bybit’s USDC perpetual futures require you to maintain a margin balance in order to keep your positions active.

Isolated Margin vs. Cross Margin

Isolated Margin: Limits risk to a specific position, so only that position’s funds are at risk if liquidation occurs.

Cross Margin: Uses the entire account balance as margin, helping prevent liquidation across multiple positions but potentially impacting all trades.

USDC Perpetuals vs. USDT Perpetuals: USDC perpetual contracts are settled in USDC, while USDT perpetuals are settled in USDT.

For more details, visit Bybit’sHelp Center.

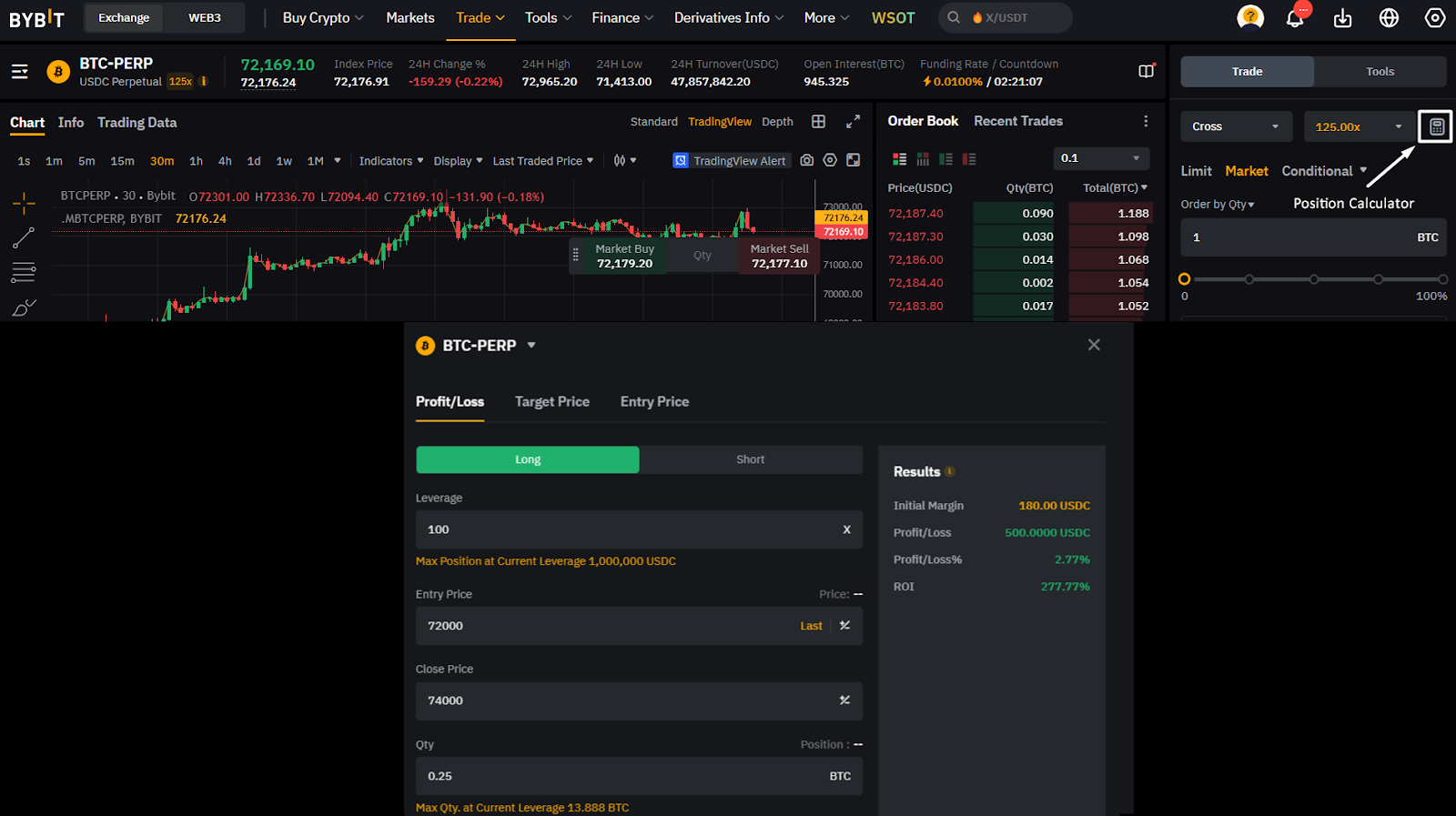

How to Calculate Position Sizing for Perpetual Positions

Position sizing is essential in perpetual futures trading, because it determines the capital at risk and supports effective risk management.

Calculation Method: Traders can use Bybit’s Position Size Calculator to estimate appropriate sizing based on risk tolerance and account balance.

For instance, in the example shown above, a trader opens a long position on BTC-PERP:

Leverage: 100x

Entry Price: $72,000

Close Price: $74,000

Quantity: 0.25 BTC

With an initial margin of 180 USDC, the trade yields a profit of 500 USDC, resulting in a return on investment (ROI) of 277.77%. Bybit’s Position Size Calculator helps traders determine the optimal position size, based on leverage and risk.

Other Advanced Tools for USDC Perpetual Trading

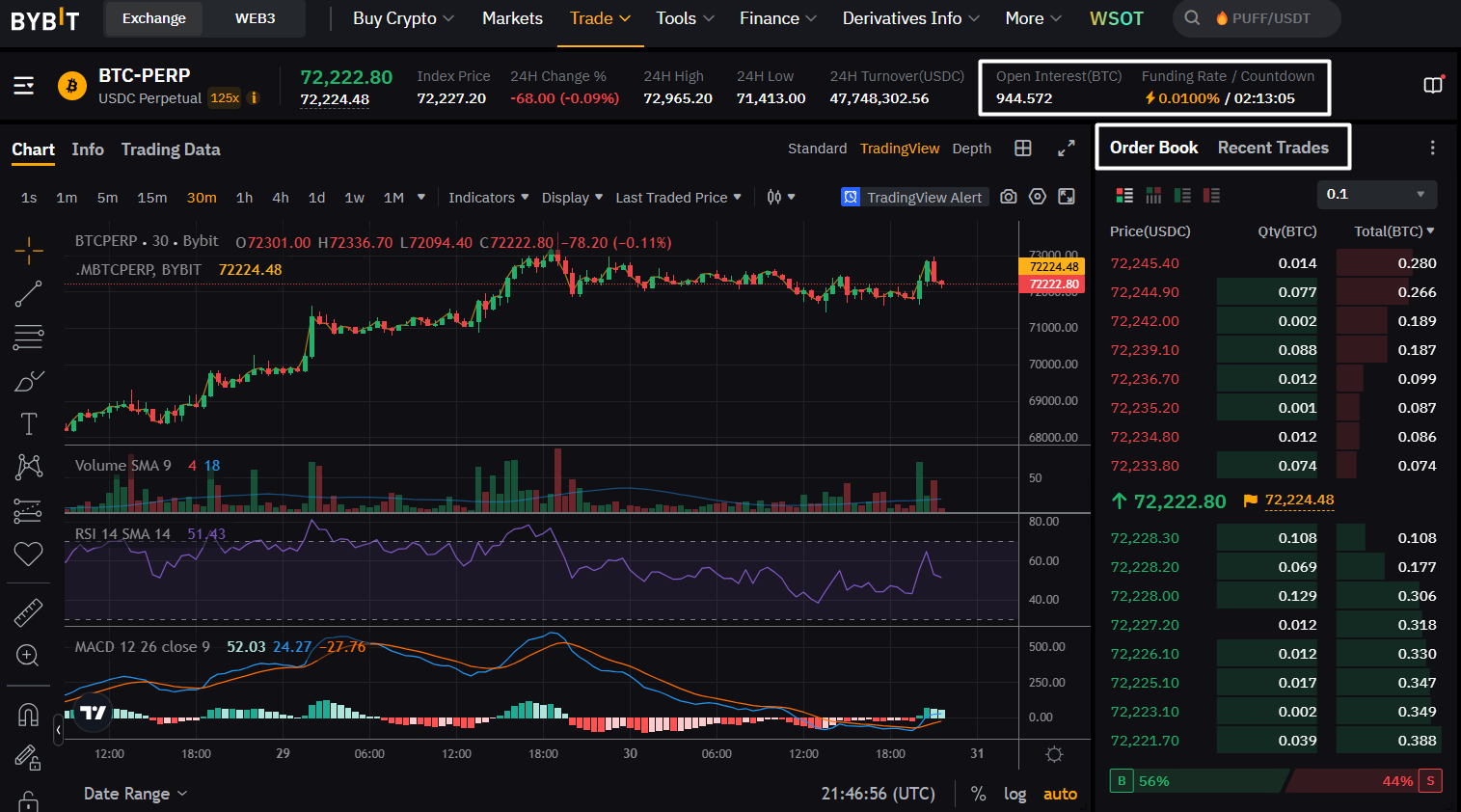

Open Interest: Indicates active BTC-PERP contracts, shown as 944.572 on the chart above, which helps gauge market participation.

Trading Volume: Measures transaction flow. Above, 24-hour turnover is 47,748,302.56 USDC.

Long/Short Ratio: Located at the bottom right. Shows 56% long vs. 44% short, reflecting trader sentiment.

Order Book: Displays current buy/sell orders, such as a buy order at 72,222.80 USDC.

Recent Trades: Logs executed orders, helping to track real-time market activity.

Conclusion: Getting Started With USDC Perpetuals Futures

Trading USDC perpetual futures on Bybit offers unique advantages, such as using USDC, one of the leading stablecoins, as collateral. This makes USDC perpetuals a reliable choice for those who are wary of market volatility. Bybit’s platform provides additional features, such as flexible leverage, advanced trading tools and access to in-depth market data, which together enhance trading precision and control.

However, it’s essential to grasp the risks involved. Leveraged positions amplify both gains and losses, so understanding risk management tools — such as setting stop-loss orders — is crucial for preserving capital. New traders can explore Bybit’s demo account, a valuable tool for practicing strategies without risking real funds that lets you build confidence and develop effective trading habits before diving into live markets.

Ready to start trading on Bybit? Create your account now and explore our flexible perpetual futures contracts.

#LearnWithBybit