How to Trade BTC, ETH and SOL Futures Derivatives Contracts on Bybit

Crypto futures contracts are a type of derivatives product used to buy or sell a crypto asset at a predetermined price on a specified future date. The buyer of a futures contract is obligated to buy and receive the underlying asset at the moment the futures contract expires, while a futures contract’s seller is obligated to sell and deliver the underlying asset when the contract expires.

While Bybit offers various derivatives products, such as USDT and USDC perpetual futures, inverse futures and options, this article covers crypto futures contracts with expiration dates. Bybit offers weekly, bi-weekly, tri-weekly, monthly, bi-monthly, quarterly and bi-quarterly futures contracts for Bitcoin (BTC), Ether (ETH) and Solana (SOL). We’ll discuss the ins and outs of Bitcoin, Ether and Solana futures derivatives trading on Bybit, including the different types of contracts and their initial and maintenance requirements.

Key Takeaways:

Crypto futures contracts are financial instruments that oblige the buyer to purchase the underlying cryptocurrency or digital asset at a predetermined future price and date.

They can be used by traders to hedge the price movement of the underlying cryptocurrencies to help prevent losses due to unfavorable price changes.

Crypto futures contracts allow traders to use leverage to speculate on the directions of cryptocurrency prices (either long or short).

What Are Crypto Futures Contracts?

Crypto futures contracts are financial derivatives contracts that obligate buyers and sellers of cryptocurrencies to transact them at a predetermined future date and price. The buyer must purchase the underlying asset from the seller, regardless of the current market price of the underlying cryptocurrency at the expiration date.

Traders use crypto futures contracts to hedge or speculate on the price movement of a cryptocurrencies without needing to own the underlying assets. Futures contracts also allow traders to use leverage, which may amplify gains or losses. Bitcoin and Ethereum futures contracts are traded on the Chicago Mercantile Exchange (CME) and on cryptocurrency exchanges such as Bybit.

What Are Bitcoin Futures Contracts?

Bitcoin futures contracts allow cryptocurrency traders to speculate on the price of Bitcoin without taking possession of the underlying asset (BTC). The contracts are agreements to buy or sell BTC at a predetermined price on a specified future date.

Traders and institutional investors use Bitcoin futures contracts to hedge against price fluctuations, or to speculate on Bitcoin’s price movements with greater capital efficiency through the use of leverage. Bitcoin futures contracts offer exposure to Bitcoin’s price without the complexities of managing the underlying asset itself. Bybit offers weekly, bi-weekly, tri-weekly, monthly, bi-monthly, quarterly and bi-quarterly Bitcoin futures contracts.

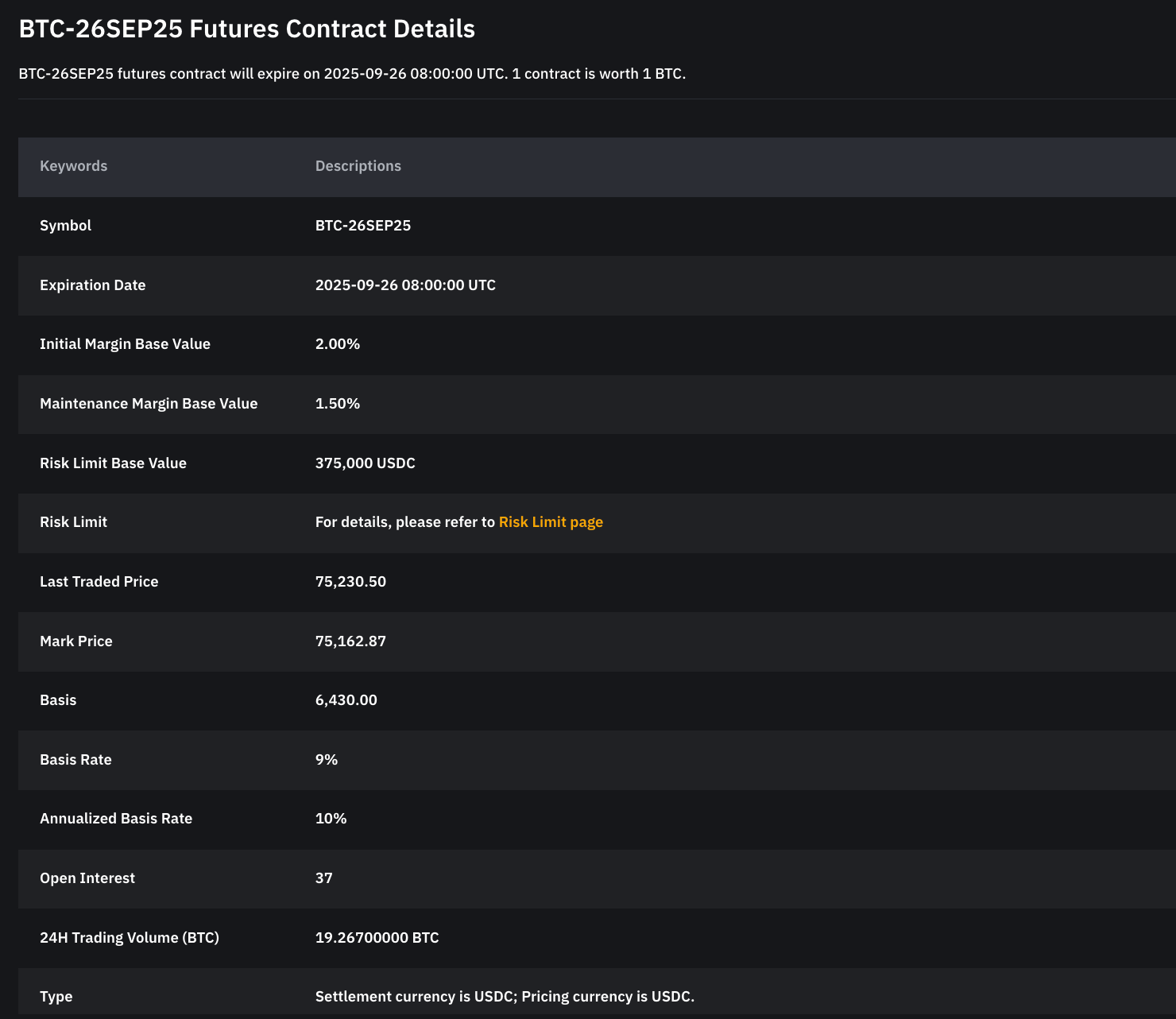

Looking at the contract details, each Bitcoin futures contract on Bybit comes with conditions and details, such as ticker symbol, expiration date, initial margin, maintenance margin, open interest and contract size.

The symbol includes the underlying asset and the expiration date. For example, for the BTC-26SEP25 futures contract, the underlying asset is BTC, and the expiration date is September 26, 2025.

Since the futures contract is settled in the USDC stablecoin, the term initial margin refers to the amount of USDC you’ll need in your Bybit account to open a futures position.

For the BTC-26SEP25 futures contract, the initial margin base value is 2.00%, meaning that crypto traders can trade Bitcoin with leverage of 50:1. Note that the regular Bitcoin futures contract size at Bybit is 1 BTC.

What Are Ethereum Futures Contracts?

Just as with Bitcoin futures contracts, Ethereum futures contracts allow traders to speculate on the price of Ether (ETH) without taking possession of it.

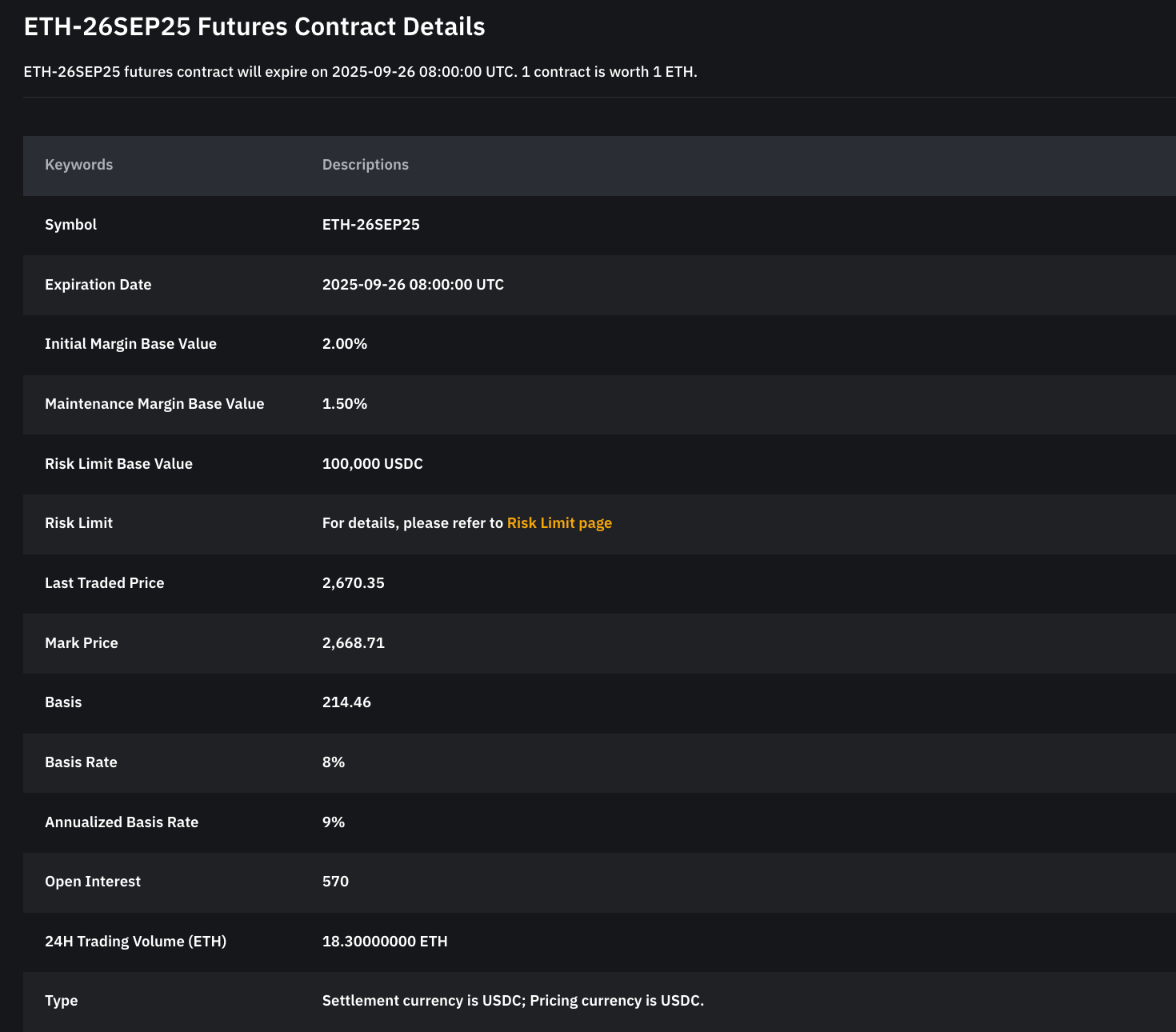

On Bybit, users can trade Ethereum futures contracts, which are settled in USDC. Looking at the ETH-26SEP25 futures contract details, the expiration date is September 26, 2025.

A standard ETH futures contract on Bybit has a size of 1 ETH, and comes with a 2.00% initial margin base value and a 1.50% maintenance margin base value.

Just as with Bitcoin, users can trade Ethereum futures contracts on Bybit with up to 50:1 leverage. However, with ETH futures contracts, the annualized basis interest rate is higher (9%), and the settlement cryptocurrency of the contracts is in either USDT or USDC.

What Are Solana Futures Contracts?

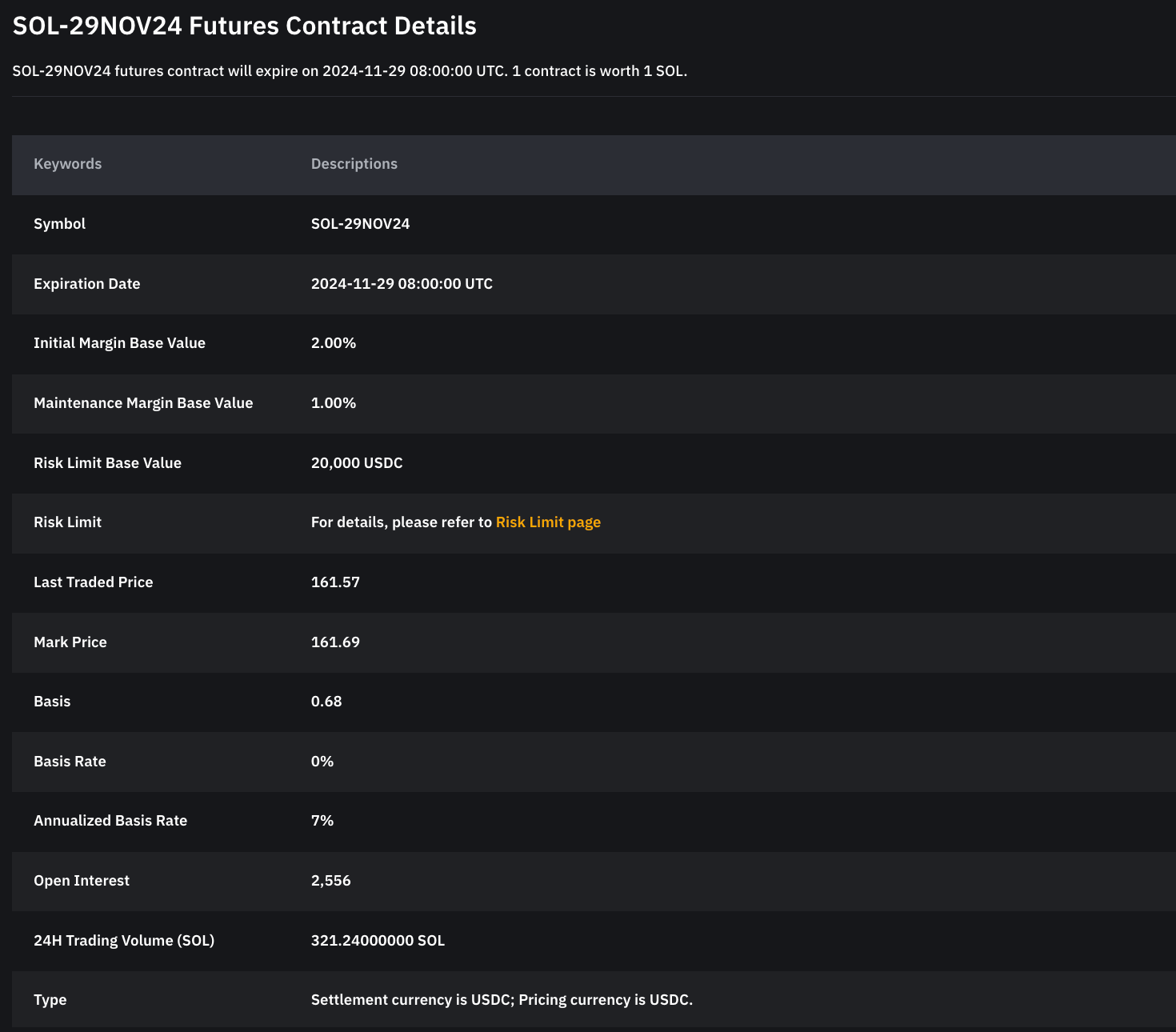

Bybit also offers Solana futures contracts, giving traders exposure to Solana without owning SOL. Each futures contract is worth 1 SOL, and comes with a 2.00% initial margin base value and an annualized base interest rate of 9%.

As you can see from the contract details for SOL-29NOV24, the expiration date is November 29, 2024, at 8AM UTC.

Please note that only weekly, bi-weekly, tri-weekly and monthly Solana futures contracts are offered.

How to Trade BTC, ETH and SOL Futures on Bybit

To trade BTC, ETH and SOL futures, you’ll first need to have a Bybit account. Luckily, this is an easy process that only takes a few minutes of your time. Follow the steps below to get started trading futures contracts on Bybit.

1. Register for a Bybit account (or log in if you already have one).

2. Verify your identity. Click on Get Verified Now’ and follow the on-screen instructions.

3. Deposit funds into your Bybit account using any of the following methods.

Crypto Deposit: Transfer BTC or other supported cryptocurrencies directly to your Bybit account.

One-Click Buy: Instantly purchase crypto using a debit or credit card.

Fiat Deposit: Deposit funds using local fiat options.

P2P Trading: Buy BTC from other users on Bybit’s peer-to-peer platform, often with zero fees.

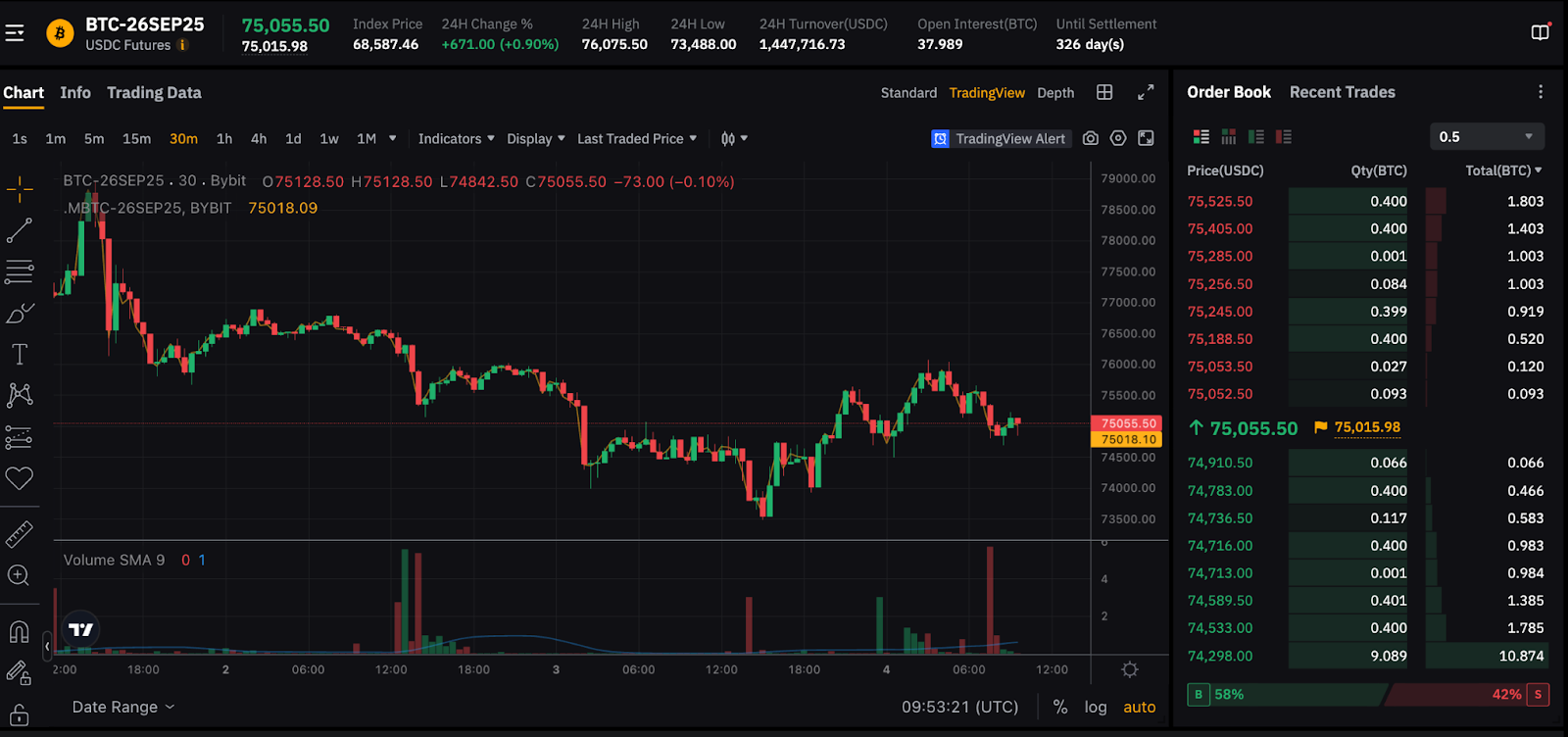

4. Once your account is funded, you can start trading. For Bitcoin futures contracts, head to the Bitcoin futures page of the desired contract. For this guide, we’ll use BTC-26SEP25.

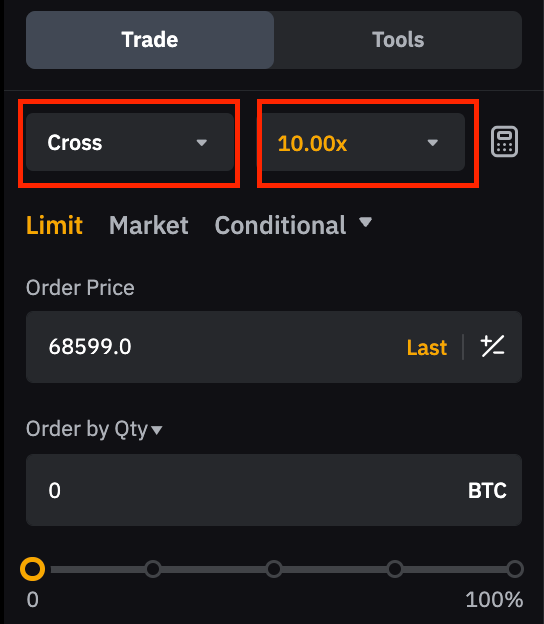

5. Select the margin mode (regular users can select between isolated margin and cross margin) and leverage (up to 50x).

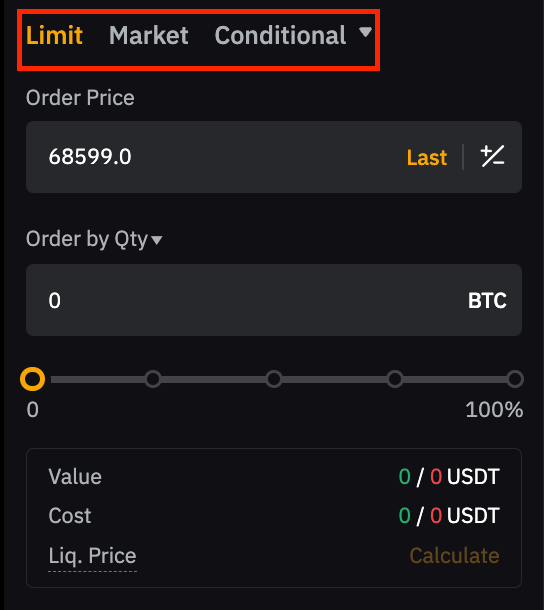

6. Select the order type. Learn about the difference between limit, market and conditional orders here.

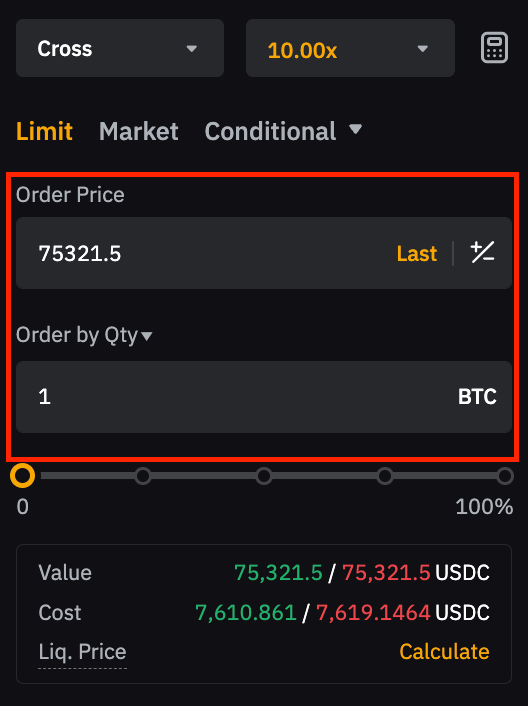

7. In this case, we’ll use a limit order. Enter the Order Price, which is the price you’d like the order to be executed at. Enter the order quantity (denominated in BTC, with 1 contract worth 1 BTC). The value and cost will be automatically calculated.

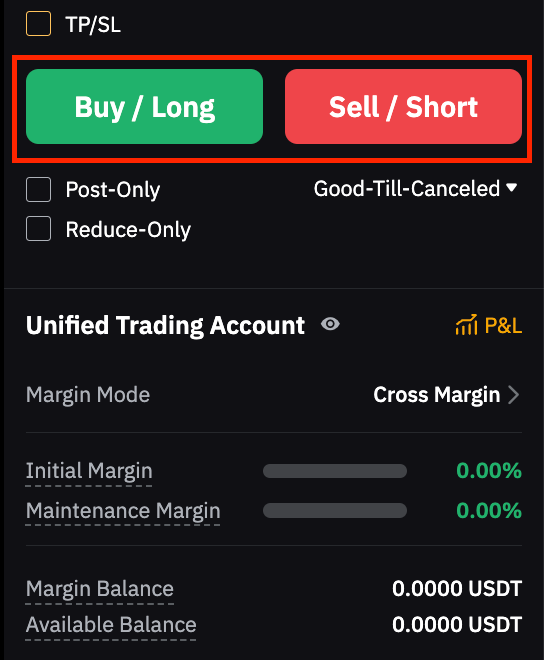

8. Finally, select Long/Buy to purchase the futures contract, or Sell/Short to sell the futures contract.

9. Once the position is open, please ensure that your margin meets the maintenance margin threshold to prevent liquidation. (Learn more about maintenance margin here.)

10. For Ethereum futures, select the desired contract, such as ETH-26SEP25, and carry out the same steps.

11. For Solana futures, select the desired contract, such as SOL-29NOV24, and carry out the same steps. Please note that Solana futures only offer weekly, bi-weekly, tri-weekly and monthly contracts.

Initial and Maintenance Margin Requirements

With BTC, ETH and SOL futures derivatives trading, the initial margin is the minimum margin required to open a position. The lower the leverage ratio used by traders, the higher the initial margin required.

Initial margin is calculated using the following formula:

Initial Margin = Position Size × Position Average Entry Price/Leverage

For example, a 1.0 BTC/USDT contract with a price of $60,000 per BTC with 10x leverage will require 1.0 × 60,000/10 = 6,000 USDT.

Maintenance margin refers to the minimum amount of margin that traders must maintain within their positions or trading accounts to continue holding their positions. When unrealized losses fall below the maintenance margin requirement, a liquidation of the position will be triggered.

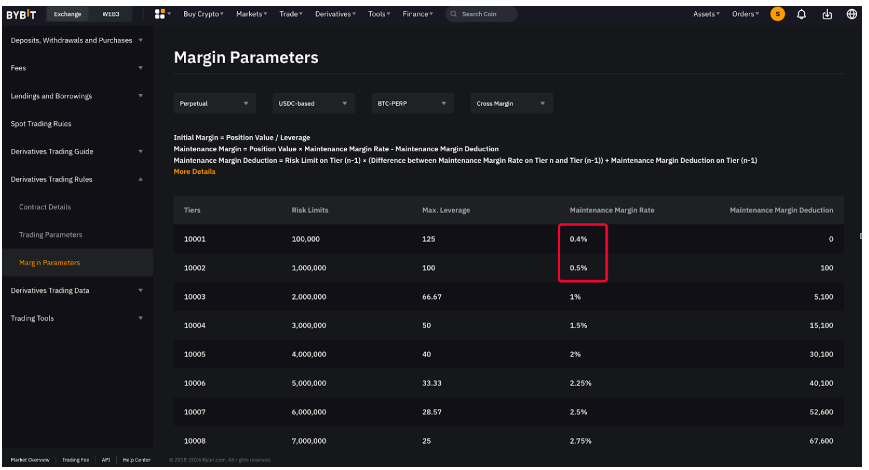

For example, if you open a Bitcoin futures contract position with a value of 100,000 USDC, the maintenance margin rate (MMR) required for the position is 0.4%, meaning that at least 4,00 USDC must be kept in the position or your Bybit account to avoid triggering a liquidation.

Conclusion

In this article, we’ve discussed how to trade futures derivatives contracts on Bybit; how to read contract details for BTC, ETH and SOL futures contracts; and the importance of initial and maintenance margin fees.

Now that you know how to trade Bitcoin, Ethereum and Solana futures contracts on Bybit’s cryptocurrency trading platform, it’s time to put your knowledge to the test by signing up for an account, depositing funds into it and trading futures contracts. Additionally, you can sign up for a Bybit demo account, which provides a risk-free simulated trading environment that replicates real-world market conditions so you can practice futures trading without risking any real money.

Please note that futures derivatives contracts are complex financial instruments. As such, they come with a high risk of losing money due to the use of leverage. It’s important to consider whether you understand how futures derivatives contracts and other products offered on the Bybit platform work before depositing any funds and opening positions.

#LearnWithBybit