9 Pro Tips To Win A Crypto Trading Competition

Cryptocurrency trading competition is happening more frequently than ever on exchanges to incentivize traders with lucrative prizes based on their skills and strategies. Trading competitions are a win-win situation for crypto exchanges and traders alike, but how can you leverage these events to make a bang for your buck?

We listed some tips to help you better strategize and accelerate trading results.

Key Takeaways:

- Crypto trading competitions incentivize traders with lucrative prizes based on their skills and strategies.

- Some of the pro tips to win a crypto trading competition include analyzing your strategies, staying informed of world events , and making sure you cut your losses in time.

1. Observe and Apply Strategies You've Learned.

Observation is everything. When competing, you should be keen to filter out some of the good and bad strategies some contestants made to refine your overall trading plan. Avoid focusing too much on your trades and becoming oblivious to your competitors' moves.

An obstinate mistake is when experienced traders set their heads only on their trading strategies, which they overlook what others are doing and fall into the traps of their detrimental move. Likewise, a classic mistake from a novice trader with "textbook" trading basics might blindly apply these strategies without analyzing other competitors' actions. Neither of these approaches will yield anything worthwhile if you want to win the contest.

2. Analyze Your Strategies.

Trading competitions usually last from a few days to normally a maximum of a month. It is not uncommon for participants to lose track of their past moves and analysis if it's not properly tracked or documented. The short-term nature of these competitions makes traders believe that it is redundant to analyze their trading history. And often, participants might get too caught up in the competitive spirit and pay less attention to record-keeping.

3. Always Stay Informed of World Events.

Stay updated with the latest competition announcements, trading policies, regulations, international financial and political forums, and overall market performance that has the potential to affect one's competition performance.

For example, the Wormhole bridge exploit on Solana that made a headline in the crypto realm in February 2022 may indicate turbulence in the market while you're competing. Concentrating on technical analysis of the crypto asset and its price charts is good. Still, fundamental analysis plays a big part in determining the coming up or downtrend. Any trader with a solid grounding in fundamental analysis knows that significant world events can have a massive effect on crypto price charts. Thus, it pays to stay informed about the crypto buzz to maximize your chances of winning a crypto trading contest.

4. Have Proper Time Management.

5. Be Willing to Take on Some Risks.

In the world of trading, everything hinges on the general rule of risk vs. return. Typically, the greater the risks, the higher the expected returns.

More risk-averse traders will limit their risks by adopting more conservative trading strategies. For many long-term-oriented traders, high-risk approaches are susceptible to failure.

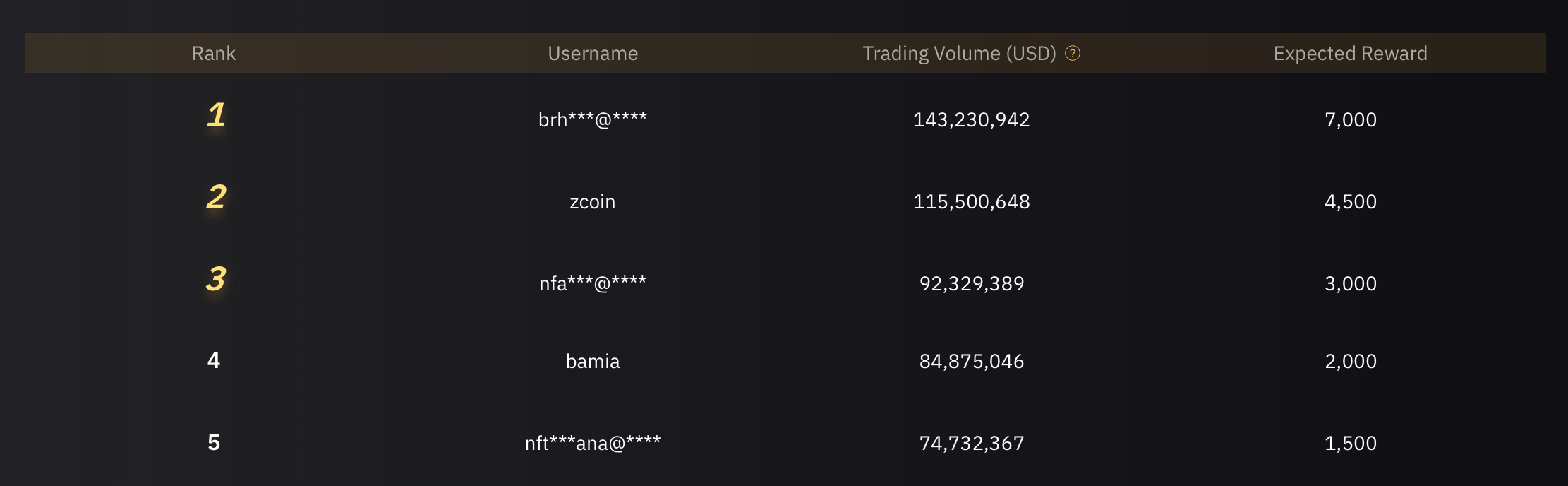

There are subtle differences when comparing trading in an actual environment to a competition. Participants can easily afford to take higher risks when trading in a demo environment. The demo mimics the actual trading, using a mock cryptocurrency funded on your account without an actual deposit. Hence, participants are evaluated purely based on their skills and strategies. It is common for more risk-tolerant participants to use riskier strategies to secure their rankings based on the profit and loss ratio. While, undoubtedly, many will fail and raze their accounts, some will arrive at the finish line with very high return ratios. Comparably, a low-risk, long-term strategy will still leave you little chance of matching these participants' achievements. The image below shows the returns of the top 5 participants in Bybit’s 2023 Trading Competition. Still think you could match these returns with a conservative trading strategy?

Learn how to join a Bybit Trading Competition

6. Make Sure You Cut Loss in Time.

Remember that you must achieve high returns relatively quickly to maximize your chances of winning. A drawn-out strategy where you take losses and hope for a turnaround is not ideal for a trading competition environment.

7. Understand the Competition Rules.

Knowing the essential qualification and registration rules is also crucial. Read the competition terms and conditions carefully to understand the game's rules. You would want to avoid spending a month participating in a contest only to find out at the end that you are eventually disqualified due to some minor rule infringement.

8. Come Up With a Game Plan.

Competition trading is not exactly the same as actual trading, but many of the same rules apply. Just as you would only start actual trading with carefully drawn short-term and long-term plans, you shouldn't do so in competition trading. Always start with a plan and execute it in a disciplined way.

9. Stick To Your Plan and Don't Get Emotional.

We have mentioned being disciplined with your plan, haven't we? This is paramount in any crypto trading competition you decide to join. The competitive spirit of many crypto contests often leads to traders abandoning their game plans on a whim.

Stay rational and don't get caught up in the emotional spirals. Always stick to your game plan and adjust it only when truly necessary.

#LearnWithBybit