Market Chatter: Are We Overleveraged?

Welcome to Market Chatter, your guide to on-the-ground conversations among Bybit communities in different regions.

We want to take advantage of Bybit’s global network and our regional partners to share market colors based on what our traders and users have been chatting about — and what draws their attention. This week, we look into BTC.

There’s certainly a lot of hype in the crypto community as the price of BTC reached over $90,000 for the first time. As the bullish sentiment in the market can be seen across the board, our desk shows that the BTC derivatives markets could already be overleveraged at this point without significant changes in the fundamentals.

Crypto has become a major issue during the recent U.S. elections, and president-elect Donald Trump’s campaign has made big promises about crypto, including setting up a strategic Bitcoin reserve. Although BTC has the potential to become a treasury asset held by central banks, corporations and institutions, some traders believe that we’re still far away from turning that possibility into a reality. The recent price actions suggest that the market could be moving away from fundamentals and showing a bit of FOMO.

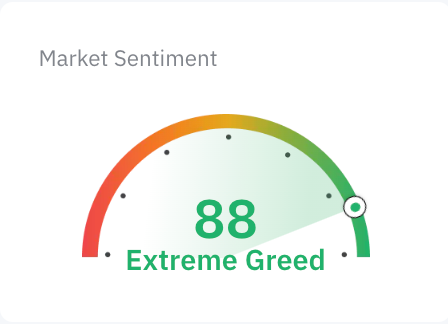

In fact, the Crypto Fear & Greed Index on Bybit Learn has already reached the “Extreme Greed” zone, indicating an increased risk of irrational behavior in the market.

The Crypto Fear & Greed Index has entered the “Extreme Greed” zone. Source: Bybit

In a recent Bloomberg interview, Michael Novogratz, the head of digital investment firm Galaxy Digital, said the odds of a Bitcoin strategic reserve under the Trump administration are low, mostly because the Republicans don’t have majority control in the Senate, which could create friction in the legislative procedure. However, as a result of the 2024 U.S. elections, after January 20, 2024 there will be a Republican majority in the U.S. Senate and, most likely, in the House of Representatives as well.

Some traders have also highlighted that it could be dangerous for retail investors without much crypto experience to enter the market now, as it could be painful if the current leverage unwinds. That’s why we recommend investorsdo their own research before investing in any crypto.

What We’re Reading on Bybit Learn

Department of Government Efficiency (D.O.G.E.): Meme Coin Inspired by New Trump-Musk Initiative

Learn From Smart Money: Derivatives Data Shows Divided Views on ETH as ETF Recorded Strong Inflows