How to Use Scaled Orders to Trade Derivatives on Bybit

In trading, derivatives are financial instruments that derive their value from underlying assets, such as cryptocurrencies, allowing traders to profit from price movements without direct ownership. Scaled orders, a popular tool among derivatives traders, break large trades into smaller orders across a price range, providing enhanced execution control and reduced market impact. This article explores how Bybit scaled orders work, their strategic advantages and how to use them effectively.

Key Takeaways:

Scaled orders enhance trade execution, enabling precise management of trades.

They also minimize market impact, which is ideal for large trades.

With a scaled order, you can place a trade across different price levels for consistent entry/exit execution.

What Are Scaled Orders?

Scaled orders are a trading strategy that divides a large order into multiple smaller orders, placed across a specified price range. This approach allows traders to enter or exit positions gradually in order to gain better control over trade execution and minimize impact on market prices.

Commonly used in derivatives trading, scaled orders help manage large trades with precision. This makes them popular among traders who want diversified entry or exit points.

Bybit’s platform offers detailed tools for setting up scaled orders, which allows traders to customize each aspect of their strategies.

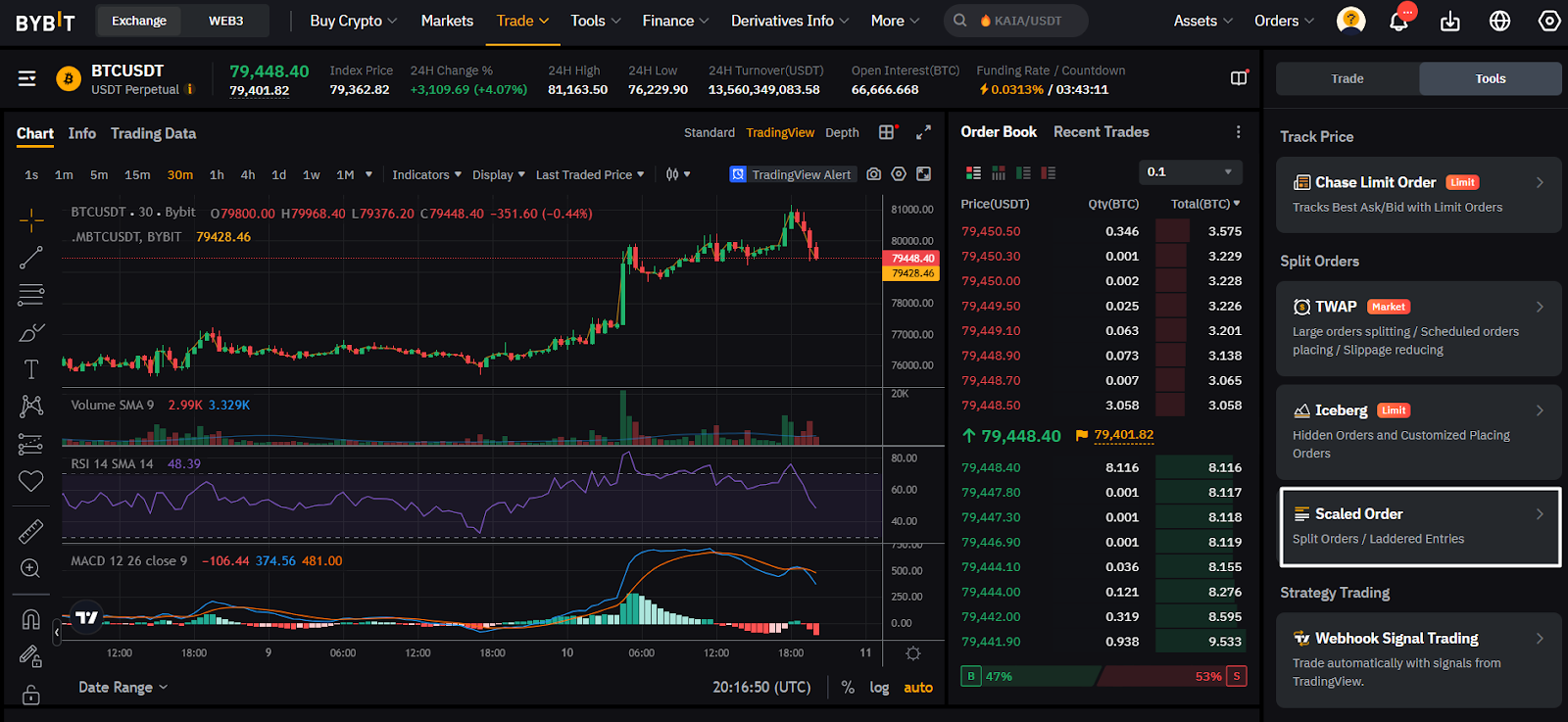

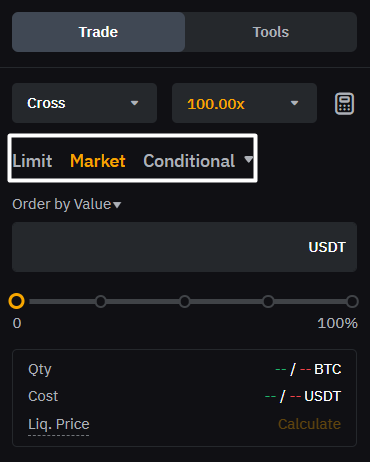

Order Types on Bybit

Bybit offers several order types to meet diverse trading needs.

Market Orders: Execute your order instantly at the current market price, which is ideal for quick entry or exit when prioritizing immediate action over price precision.

Limit Orders: Execute only at a specified price or better, giving you control over entry and exit points (especially in less volatile markets).

Conditional Orders: These orders trigger once predefined conditions, such as price levels, are met. This is useful for planned entries or exits based on specific market moves.

The different order types described above allow traders to choose a method that aligns with their trading strategies and goals.

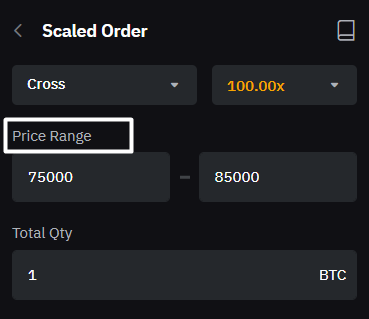

How Do Scaled Orders Work?

Scaled orders divide a large trade into smaller, incremental orders placed at various price levels within a specified range. This approach allows traders to execute large trades with less impact on the market price. Below, we illustrate how it works, using the Bybit platform interface as an example.

In the screenshot above, a trader sets up a scaled sell order on the BTCUSDT Perpetual contract. The parameters are as follows:

Price Range: $75,000 to $85,000

This is the range within which the sell orders will be placed. Orders will be executed progressively, as the price moves up through this range.

Total Quantity: 1 BTC

This is the entire position size, which will be split across multiple sub-orders.

Order Quantity Distribution: Five (5) orders

The total BTC quantity is divided into five parts. Each sub-order is 0.2 BTC.

Order Prices: Each order is set at a $2,500 increment within the range, as follows:

$75,000, $77,500, $80,000, $82,500 and $85,000.

The benefits of using scaled orders are as follows.

Enhanced Execution Control: By setting orders at specific price levels, the trader has greater control over the timing and price at which each sub-order is executed, allowing them to better manage risk.

Steady Entry and Exit Points: By placing orders at multiple levels, the trader achieves a balanced average entry or exit price, thus reducing exposure to sudden market shifts.

Diversified Order Placement: Placing orders across a range allows for smoother entry/exit, without drastically affecting the market price.

Using scaled orders allows traders to sell (or buy) gradually over a defined range, making it easier to handle larger orders while minimizing their effect on the overall market.

Advanced Trading Strategies Using Scaled Orders

Scaled orders can be paired with other strategies on Bybit to create a robust trading approach. By using the example setup above for BTCUSDT, additional strategies can enhance control and profitability.

Take Profit/Stop Loss: By setting take-profit or stop-loss levels, traders can automatically secure gains or limit potential losses for each scaled sub-order. For instance, if the price reaches the top of the $75,000–$85,000 range, take-profit orders will lock in profits.

Trailing-Stop Orders: Trailing stops adjust as prices move, protecting profits by shifting the stop level closer to the market price. In the example above, a trailing stop could be set to follow upward momentum, locking in gains if the price reverses.

Combining these strategies with scaled orders provides consistent control, ensuring efficient trade execution even in volatile markets.

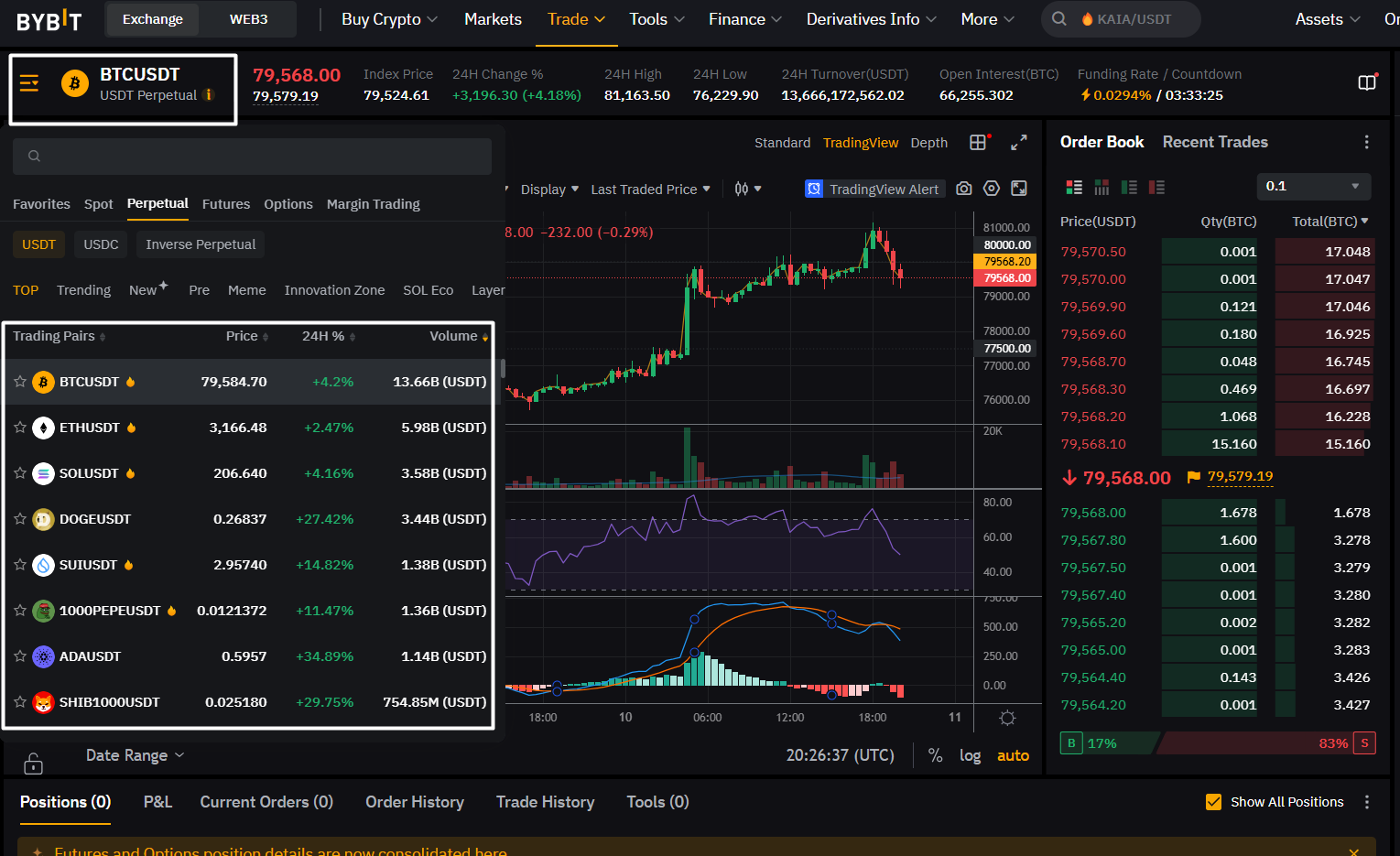

How to Use Scaled Orders on Bybit

To execute a scaled order on Bybit, follow the steps below.

1. Navigate to Bybit’s Trading Terminal: Log in to your Bybit account (or register for an account if you don’t have one) and go to the derivatives trading page.

2. Select a Trading Pair: Choose the asset you want to trade, such as BTCUSDT.

3. Choose Scaled Order: Under the order types, select Scaled Order.

4. Set Parameters: Define key settings, including the price range (e.g., $75,000–$85,000), total quantity and the number of orders (e.g., five orders of 0.2 BTC each). Adjust distribution options (such as Flat, Increasing or Decreasing) as needed.

5. Review and Submit: Confirm all details, then submit the scaled order. Bybit will automatically place limit orders across the specified price range.

6. Monitor Orders: Use Bybit’s order management tools to track and adjust active orders under the Current Orders tab.

Risk Management and Position Sizing

Effective risk management is essential when using scaled orders. Position sizing helps limit exposure by ensuring trades align with your risk tolerance. Bybit’s platform includes tools to manage both position size and risk, supporting traders in setting realistic order sizes relative to account balance and market conditions.

Conclusion

Bybit’s scaled orders enable precise large-volume trades that minimize market impact, offering traders enhanced control, diversified entry points and steady execution. Explore Bybit’s advanced trading tools to optimize your derivatives trading strategy.

Explore Bybit’s demo account for a risk-free start to help build effective habits before diving into live markets.

Ready to start? Create your Bybit account today and explore flexible futures contracts.

#LearnWithBybit