How to Use Chase Limit Orders on Bybit’s Derivatives Platform

Crypto derivatives are financial contracts that derive their value from underlying assets like Bitcoin. Traders rely on powerful tools for derivatives trading. One such tool is the Chase Limit Order, which allows traders to adjust their entry price automatically to match changing market conditions. This eliminates the need for traders to keep up with price fluctuations manually. In this article, we’ll discuss the key benefits and best practices for using Chase Limit Orders on Bybit.

Key Takeaways:

Chase Limit Orders allow traders to adjust their entry price dynamically to match changing market conditions.

Using Chase Limit Orders can help traders capitalize on market opportunities.

Proper risk management is important when using Chase Limit Orders.

What Are Chase Limit Orders?

A Chase Limit Order is a conditional limit order that automatically adjusts the bid or ask price to “chase” the best available market price, up to a specified maximum chase distance. This allows traders to enter a position close to the current market price, rather than setting a static limit price that may not be filled.

In short, Chase Limit Orders provide a bit more flexibility and automation, helping traders pursue the price as it moves — but with controlled limits to minimize overpaying or underselling.

The Chase Limit Order tool is available on the Bybit derivatives platform, giving crypto perpetuals and crypto futures traders flexibility to adapt to changing market conditions.

Advanced Trading Tools for Derivatives

In addition to Chase Limit Orders, Bybit's derivatives platform offers a range of other advanced trading tools, such as the following.

Scaled orders: These allow traders to place multiple limit orders at different price levels with a single click.

Trailing stop-loss: Automatically adjusts the stop-loss price to follow the market price, helping to protect traders’ profits.

Conditional orders: Trigger orders based on specific market conditions, such as price or time-based events.

These professional trading tools, combined with traditional order types like market orders and limit orders, provide Bybit traders with a wide range of options to tailor their trading strategies.

How Do Chase Limit Orders Work?

Here’s how a Chase Limit Order typically works.

Automatic price adjustment: The trader sets a starting price, along with the maximum price they’re willing to pay (for a buy order) or the minimum they’re willing to accept (for a sell order).

Trailing mechanism: The order will “chase” the price up or down within a preset range or “increment,” adjusting itself as the market price moves, but only within the set price limits.

Execution limits: If the stock’s price falls outside the specified limits (either rising above or below the set thresholds), the order won’t execute. This prevents the trader from paying too much or selling too low.

Expiration: Like other limit orders, Chase Limit Orders usually come with a time condition, such as day-only or good ‘til canceled (GTC).

When Do Derivatives Traders Use Chase Limit Orders?

Derivative traders find chase orders useful in fast-moving market conditions where static limit orders may not be a viable option. The following are some key scenarios in which Chase Limit Orders are used:

Scalping: Entering and closing positions quickly to profit from small price changes.

Swing trading: Positioning for larger price swings by using Chase Limit Orders to enter at favorable levels.

Trend following: Entering positions as the market trend develops.

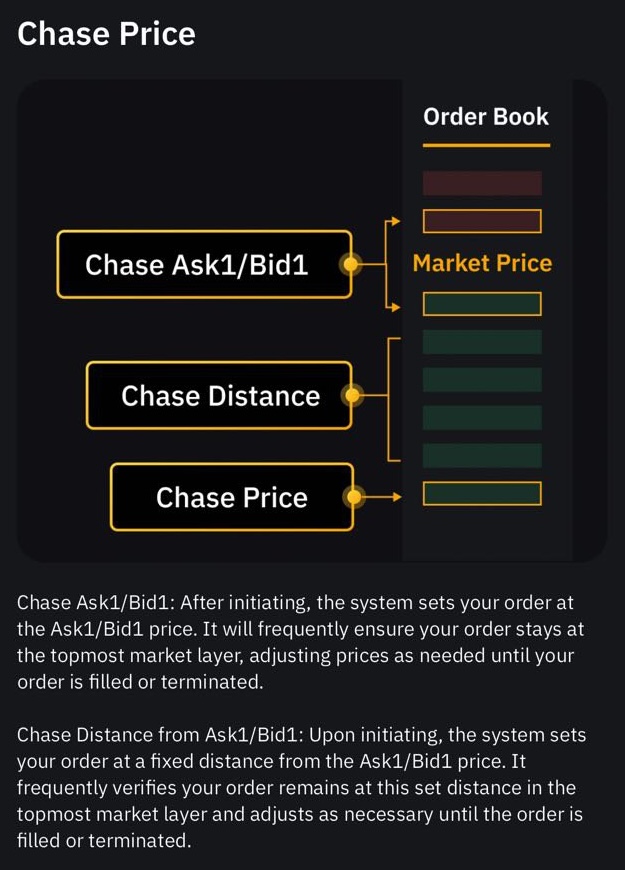

Momentum following, breakout trading and dollar cost averaging are common trading strategies that benefit from using chase orders. Traders are able to place a Chase Limit Order either at a fixed distance in price, or in percentage terms from Ask1/Bid1, which we will explain below.

How to Place a Chase Limit Order on Bybit

Follow the steps below to open a Chase Limit Order on Bybit:.

1. Log in to your Bybit account (or register for one) and navigate to the trading page.

2. Select the trading pair you want to trade, such as the BTCUSDT trading pair.

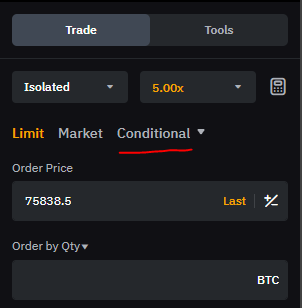

3. In the Order panel (under Conditional), select Chase Limit as the order type.

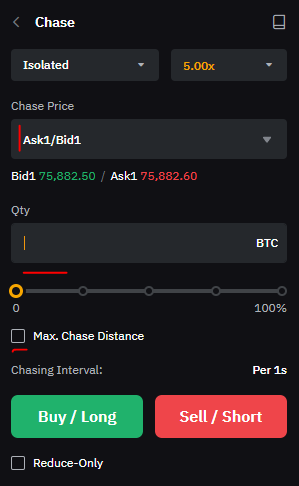

4. Under Chase Price, select the Ask1/Bid/ or Distance from Bid1/Ask1 option. The first option allows you to start the chase order at the ask1/bid1 price, while the second option sets the order at the specified distance from the ask/bid price.

5. Check the Max. Chase Distance box, and enter the maximum distance in terms of price or percentage, if you want the order to be terminated at a specific point.

6. Enter the order size under Qty and adjust the leverage as needed.

7. Review the order details, and click on Buy/Long or Sell/Short to submit the Chase Limit Order.

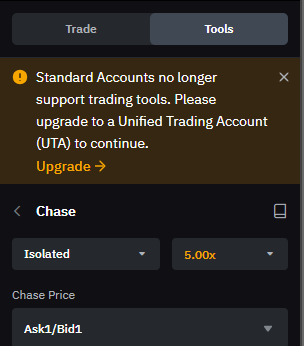

Bybit no longer supports trading tools such as Chase Limit tools on standard accounts. Traders need to upgrade to a Unified Trading Account (UTA).

Managing Risk With Chase Limit Orders

Set price alerts to notify you when your Chase Limit Order approaches your maximum chase distance parameter.

Implement trailing stops that move with the market price to protect profits while letting winning trades run.

Use time-based exit rules to automatically cancel Chase Limit Orders that haven't been filled within your specified time frame.

Calculate position sizing based on your account's risk tolerance before setting Chase Limit Order quantities.

Place hedge orders in correlated assets to offset potential losses if your Chase Limit Order moves against you.

Create a risk checklist to verify all order parameters align with your trading plan before you submit a chase order.

Conclusion

Chase Limit Orders help traders manage risk through automated price tracking and flexible execution parameters. Traders can use other risk management tools, such as stop loss, profit-taking and trailing stops to protect orders, minimize losses and maximize gains. The benefits of using chase orders on Bybit’s derivative platform include automated price hunting, risk control, smarter execution and time efficiency.

#LearnWithBybit