How to Trade Inverse Perpetual Futures on Bybit

Inverse perpetual contracts offer crypto traders a unique way to speculate on the price movements of cryptocurrencies without holding the underlying asset in stablecoins, such as USDT and USDC. These contracts are denominated in the base currency (for example, BTC) and allow traders to engage in futures markets with leveraged positions.

Currently, perpetual futures dominate the crypto derivatives market. According to CoinGlass, on October 31, 2024, Bitcoin’s perpetual trading volume was $18.2 billion, far exceeding the spot trading volume of over $2 billion.

Key Takeaways:

Inverse perpetual contracts are denominated in a base cryptocurrency, such as BTC.

Crypto traders often use inverse perpetuals to hedge or profit from price movements.

Risk management strategies, such as stop-loss orders and position sizing, are essential tools for trading inverse perpetual contracts.

What Are Inverse Perpetual Contracts?

Inverse perpetual contracts are a type of futures contract used in crypto derivatives markets. They differ from traditional futures contracts, which often require fiat or stablecoin collateral. Inverse perpetual contracts are denominated and settled in a base cryptocurrency, such as Bitcoin (BTC) or Ether ETH). This unique structure allows crypto traders to speculate on the price of a cryptocurrency without using a stablecoin such as USDT as collateral.

For instance, a trader using an inverse BTCUSD perpetual contract can speculate on Bitcoin’s price in USD (U.S. dollars) while collateralizing their position in BTC. If the trade is profitable, the gains are paid out in Bitcoin, meaning traders can increase their Bitcoin holdings directly. Bybit offers inverse perpetual contracts, and allows traders to use Bitcoin and altcoins as the base currency.

Why Crypto Traders Use Inverse Perpetual Futures Contracts

Crypto traders prefer inverse perpetual contracts for several reasons:

Hedging Potential: Traders holding a cryptocurrency can hedge against price drops by shorting the asset.

Leveraged Trading: Inverse perpetual contracts offer leverage, allowing traders to take larger positions with less initial capital.

Crypto-Denominated Payouts: Profits are paid out in the underlying cryptocurrency, ideal for traders looking to increase their crypto holdings.

How Do Inverse Perpetual Contracts Work?

Inverse perpetual contracts function as a type of futures contract without an expiration date. Unlike linear futures, inverse perpetuals don’t need to be rolled over, allowing traders to hold positions indefinitely. Below, the key elements in the operation of these contracts are defined.

Key Components of Inverse Perpetual Contracts

Base Currency: The contract’s currency, typically the asset traded (such as BTC).

Underlying Asset: The asset tracked by the contract, such as Bitcoin (BTC) in a BTCUSD contract.

Market Price: Real-time market price of the underlying asset, used to determine gains or losses.

Leverage: Allows traders to take larger positions with smaller amounts of collateral.

Fees: In addition to trading fees, funding fees balance long and short positions by incentivizing traders based on market conditions.

Order Size: Typically, there is a minimum order size for inverse contracts. Make sure you check these minimums before placing trades. For example, Bybit has a minimum order size of $1 per contract.

No Expiration Date: Inverse perpetuals have no expiration date, giving traders flexibility on when to close a position.

Inverse perpetual contracts also feature an inverse pricing mechanism. For example, in a BTCUSD inverse contract, as the BTC price rises in terms of USD, fewer BTC are required to meet the contract's notional value, impacting profit-and-loss dynamics.

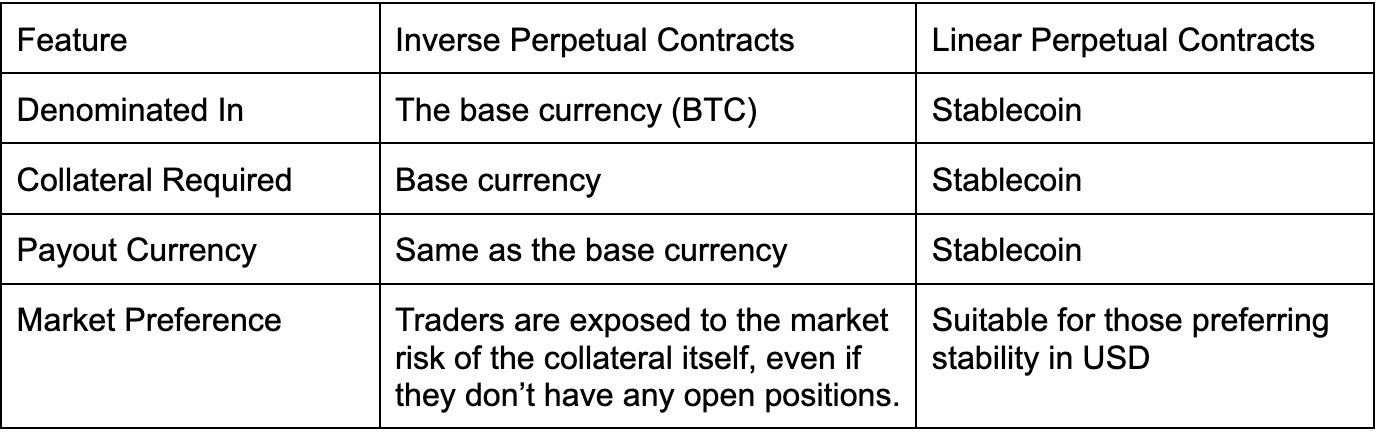

Key Differences Between Inverse Perpetual and Linear Perpetual Contracts

Inverse perpetual contracts differ from linear perpetual contracts in both their structure and settlement mechanisms. Below is a quick comparison:

How to Trade Inverse Perpetual Contracts on Bybit

Bybit currently supports nine (9) inverse perpetual contracts, and boasts a daily trading volume of almost $1 billion. Its exchange offers competitive fees starting at 0.0200% for makers, and 0.0550% for takers.

Bybit provides an easy-to-navigate platform for trading inverse perpetual contracts. Here’s a step-by-step guide to get started:

Sign Up or Log In: Start by creating a Bybit account (or log in if you already have one).

Deposit Funds: Ensure you have the base currency (e.g., BTC or ETH) in your account. Transfer BTC or ETH from your wallet, or from another platform if necessary.

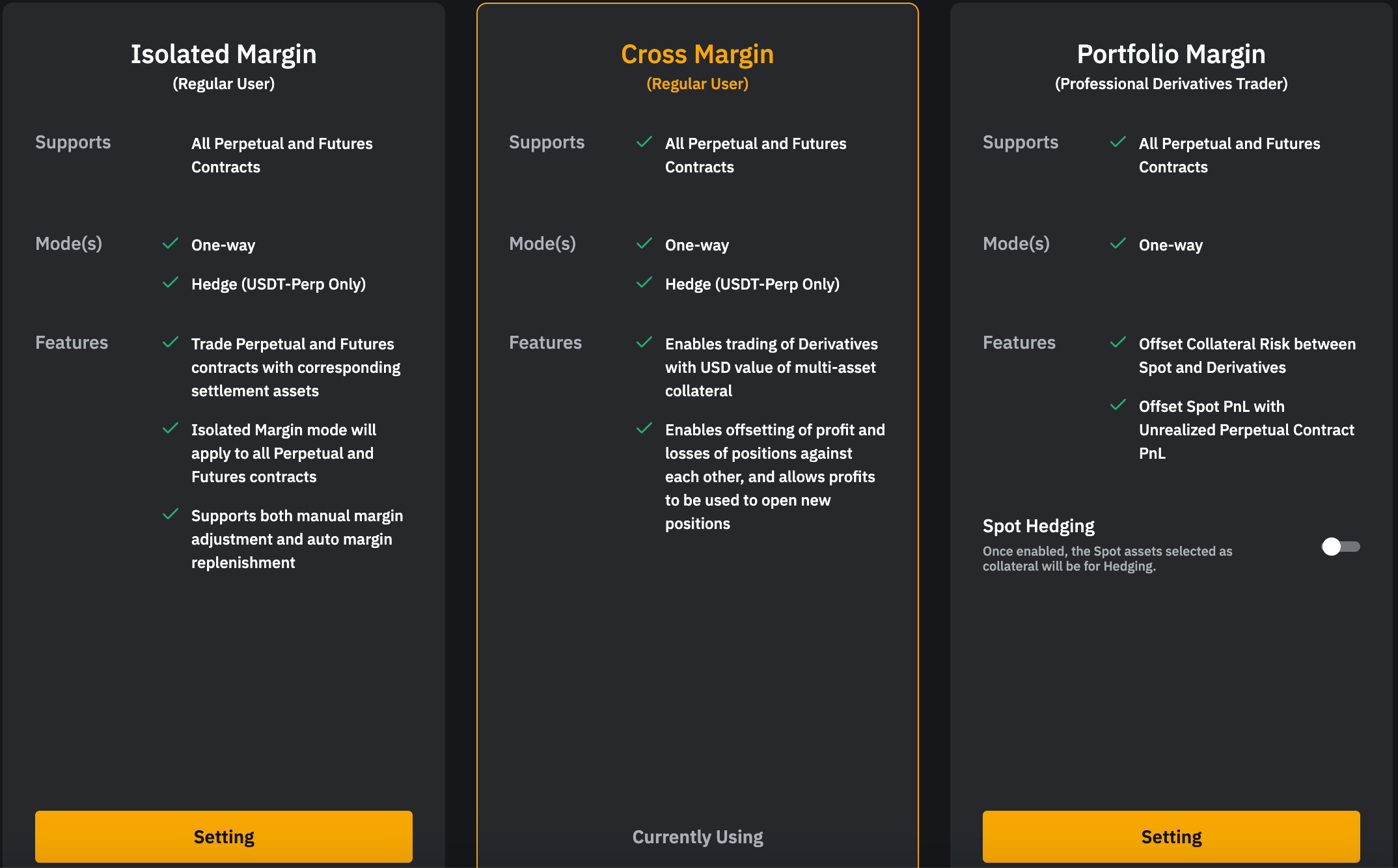

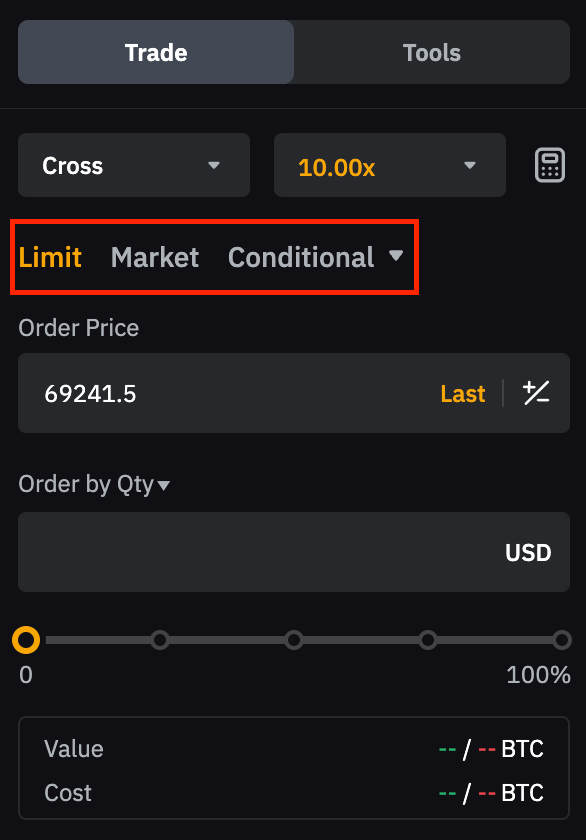

Select Margin Mode: Regular users can select between Isolated Margin or Cross Margin, while professional traders can select Portfolio Margin.

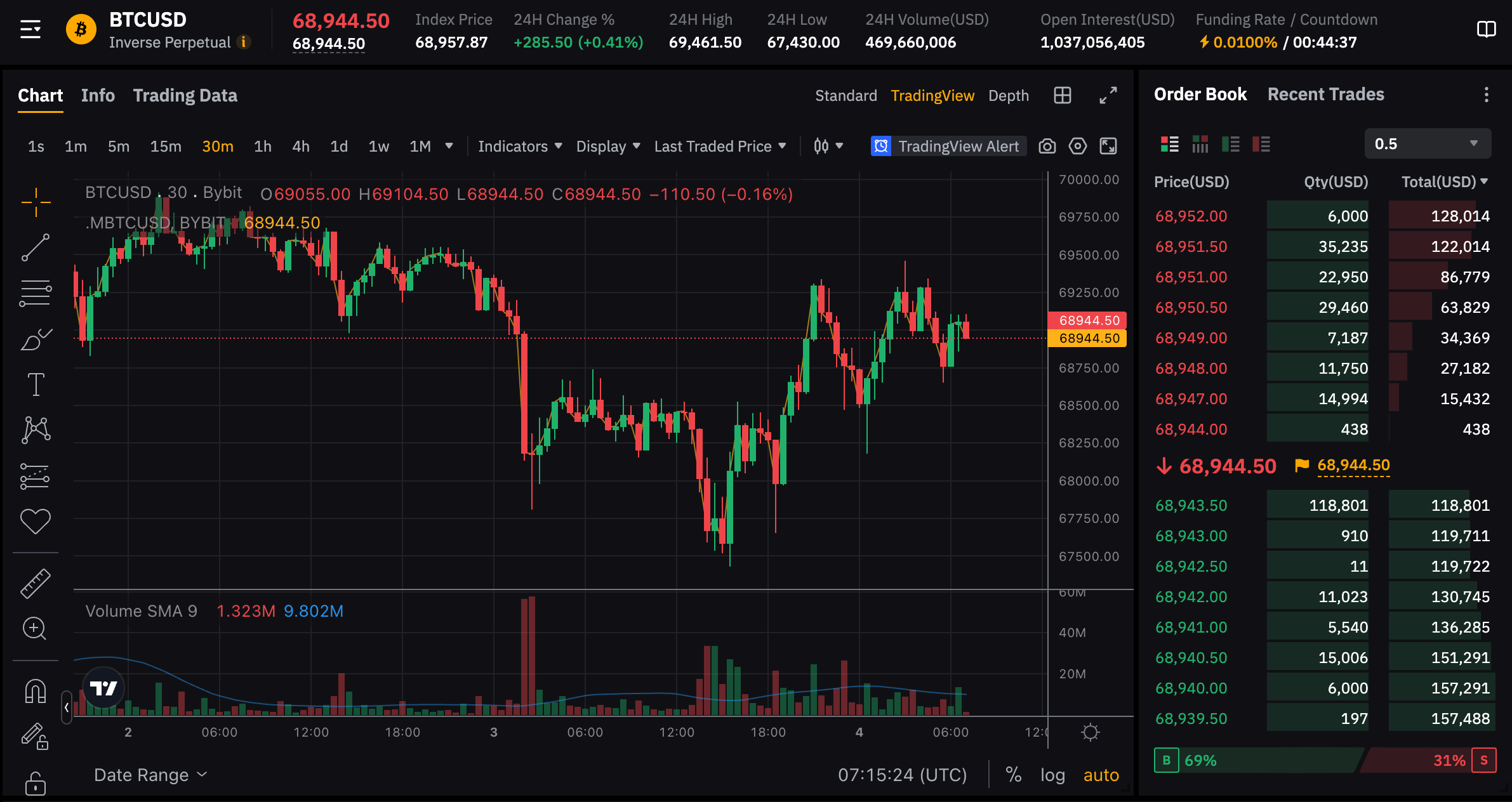

Select the Inverse Perpetual Contract: Navigate to the Derivatives section and choose an inverse perpetual contract, such as BTCUSD

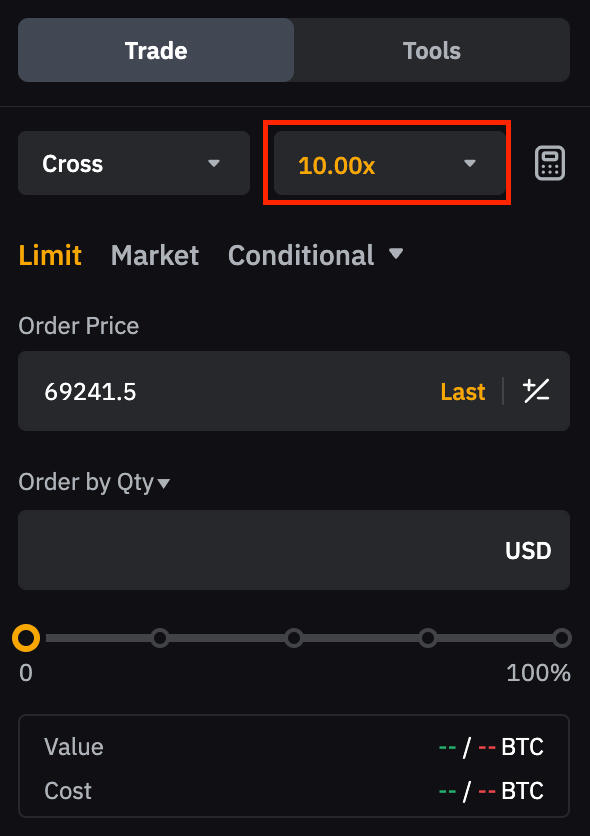

Choose Leverage: Adjust the leverage you’re comfortable with. Bybit allows flexible leverage settings for inverse contracts, so you can decide the level of risk.

Place an Order: Use the Bybit trading interface to choose a market or limit order. Input the contract size and select either Buy or Sell.

Monitor the Position: Once your position is open, monitor it from the Open Positions section. Bybit offers real-time P&L tracking, which helps you adjust your position as needed.

Close the Position: When ready, close the position from the trading panel. Your profit or loss will be realized in BTC.

Refer to Bybit’s BTCUSD trading page for specific contract details and trading tools.

How to Calculate Profit & Loss for Inverse Perpetual Contracts

Calculating profit and loss in an inverse perpetual contract is straightforward, but differs from the method for linear contracts. Take note of the following variables:

Contract quantity = Q

Average entry price = E

Last traded price = L

For long positions, P&L is calculated as follows:

P&L = Q × [(1/E) − (1/L)]

For example, you buy 100 Q (for the BTCUSD pair) at an average price (E) of $10,000, and sell at $12,000 (L).

Profit = 100 × [(1/10,000) − (1/12,000)]

=100 × (0.0001 − 0.000083333)

=100 × 0.000016666

=0.001667 BTC

For short positions, P&L is calculated as follows:

P&L = Q × [(1/L) − (1/E)]

If you buy 100 Q (for the BTCUSD pair) at an average price (E) of $10,000 and sell at $8,000 (L), the P&L is calculated as follows:

P&L = 100 × [(1/8,000) − (1/10,000)]

= 100 × (0.000125 − 0.000125)

= 100 × 0.000025

= 0.0025 BTC

Risk Exposure of Inverse Perpetual Contracts

Following are some risks associated with trading inverse crypto perpetual contracts.

Price volatility: The crypto market experiences wild swings that can potentially wipe out leveraged traders.

Funding rate mechanisms: Regular funding rate payments can unexpectedly increase trading costs. Therefore, traders must continuously monitor and manage these funding rate structures.

Leverage: This represents a double-edged sword that can either make or break traders. High leverage multiplies both potential gains and losses exponentially

Liquidation: Leverage and volatility can cause traders to lose their entire margin.

Risk Management Strategies

Position Sizing: Avoid taking positions that are oversized relative to your account balance.

Stop-Loss Orders: Place stop-loss orders to prevent excess losses that can result from sudden price swings.

Constant Monitoring: Crypto markets operate 24/7, and price movements need to be watched closely. Use alerts and tracking tools.

Conclusion: Getting Started with Inverse Perpetual Futures

Bybit's inverse perpetual futures platform offers high liquidity and advanced trading tools for cryptocurrency derivatives. Our user-friendly interface supports efficient position management and competitive fees. However, traders must understand that these instruments carry substantial risks, including potential loss of capital through liquidation and market volatility.

Proper risk management is crucial. Use stop losses and avoid over-leveraging positions. Start with small position sizes, and maintain adequate margin buffers. Never risk more than you can afford to lose. You can practice your strategies on Bybit's demo account without financial risk, giving you a hands-on way to learn the platform’s features and market dynamics.

#LearnWithBybit