How to Trade Inverse Crypto Futures Contracts on Bybit

Futures contracts allow traders to lock in the future price of an asset, enabling potential profit from market movements without direct ownership. Bybit’s inverse futures offer a unique edge: they use Bitcoin (BTC) or Ether (ETH) as both collateral and settlement currencies, providing an opportunity to grow crypto holdings directly, instead of holding stablecoins in standard crypto futures contracts.

This article explains the workings of inverse futures contracts on Bybit, including key features, trading steps and essential risk management techniques.

Key Takeaways:

Inverse futures use BTC or ETH as collateral, allowing traders to increase their crypto exposure and avoid USD conversions.

Inverse futures contracts are ideal for long-term strategies, as they can protect value in BTC and USD terms.

Trading inverse futures doesn’t incur funding fees, making it cost-effective for extended holdings without recurring costs.

What Are Inverse Futures Contracts?

Inverse futures contracts are a type of trading contract in which a cryptocurrency (such as BTC or ETH), rather than a stablecoin, is used as both the collateral and settlement currency. On Bybit, each inverse contract is valued at 1 USD in BTC or ETH terms, allowing traders to speculate on crypto prices without relying on stablecoins like USDT or USDC.

These contracts are ideal for traders focused on growing their BTC or ETH holdings, as profits are directly realized in BTC or ETH.

For those seeking direct crypto exposure and flexibility in BTC and ETH holdings, inverse futures offer a distinct approach. (For more information, visit the Bybit Help Center.)

How Do Inverse Futures Contracts Work?

Inverse futures contracts on Bybit allow you to trade crypto prices using BTC or ETH as both collateral and settlement currency. Unlike perpetual contracts, these contracts have a fixed expiration date, meaning all positions must be settled by that date.

Inverse futures contracts are ideal for traders looking for crypto-based settlement and cost-effective long-term positions, as they don’t incur funding fees.

Fixed Expiration: Positions automatically settle on the contract’s expiration date, unlike perpetual contracts, which have no expiration.

Leverage Options: BTCUSD contracts support up to 100x leverage, allowing traders to control larger positions with smaller collateral.

Long and Short Positions: Traders can take advantage of both rising and falling markets by going long or short on these contracts.

No Funding Fees: Bybit’s inverse futures don’t have recurring funding fees, making them suitable for extended holding periods.

For further details, please see Bybit Inverse Futures Contracts and Bybit Inverse Futures FAQ.

Key Difference Between Linear Futures and Inverse Futures

The main difference between linear and inverse futures contracts lies in their settlement currencies.

Linear Futures: Settled in USDT or USDC, offering a stable value. This is ideal for traders seeking to minimize exposure to crypto volatility while trading cryptocurrency assets.

Inverse Futures: Settled in cryptocurrency (e.g., BTC or ETH), making them suitable for traders aiming to build crypto holdings. Profits and losses are realized in the underlying crypto, allowing traders to grow their crypto stack.

Linear futures are preferable for stability, while inverse futures suit traders focused on accumulating crypto.

How to Read Contract Details for Inverse Futures

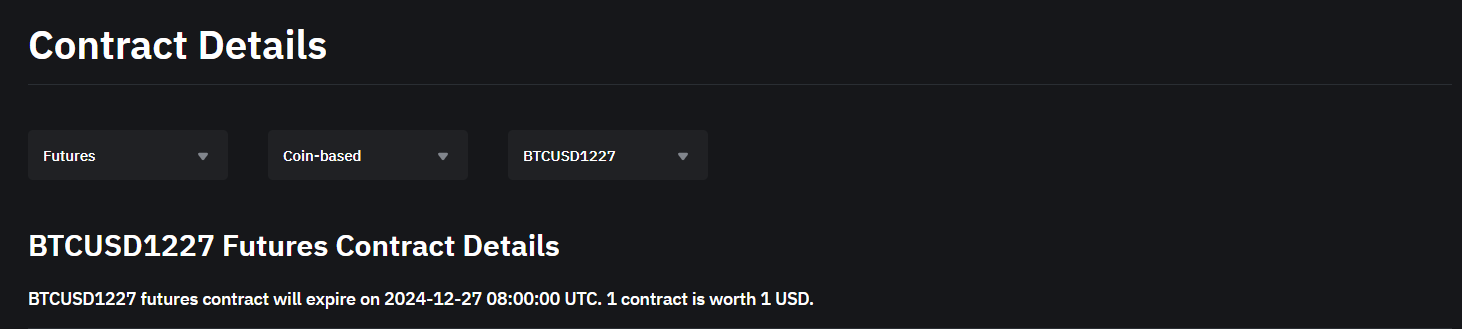

Each inverse futures contract on Bybit has a unique symbol that provides information on the asset and expiration date. For example, BTCUSD1227 is a Bitcoin (BTC) futures contract quoted in USD and settled in BTC. The contract is set to expire on December 27, 2024, at 8AM UTC.

The symbol format follows [Asset][USD][MMDD], where MMDD indicates the month and day of settlement.

Why Do Traders Use Bybit Inverse Futures?

Bybit’s inverse futures provide unique benefits for traders.

Shared Margin: Flexibly manage BTC by using a single BTC account across both perpetual and futures contracts. For example, profits from a BTC perpetual contract can support an inverse futures position.

Shared Insurance Fund: Offers added security by sharing the insurance fund with BTC perpetual contracts, helping cover potential losses.

No Funding Fees: Unlike perpetual contracts, inverse futures have no funding fees, allowing traders to hold long-term BTC positions without recurring costs.

The above features make Bybit inverse futures appealing for traders with BTC-focused strategies.

How to Trade Inverse Futures on Bybit

To trade inverse futures on Bybit, follow the steps below:

Fund Your Account Deposit BTC or other supported cryptocurrencies into your Bybit account to start trading inverse futures. You can use several methods to fund your account:

Crypto Deposit: Transfer BTC or other supported cryptocurrencies directly to your Bybit account.

One-Click Buy: Instantly purchase crypto using a debit or credit card.

Fiat Deposit: Deposit funds using local fiat options.

P2P Trading: Buy BTC from other users on Bybit’s peer-to-peer platform, often with zero fees.

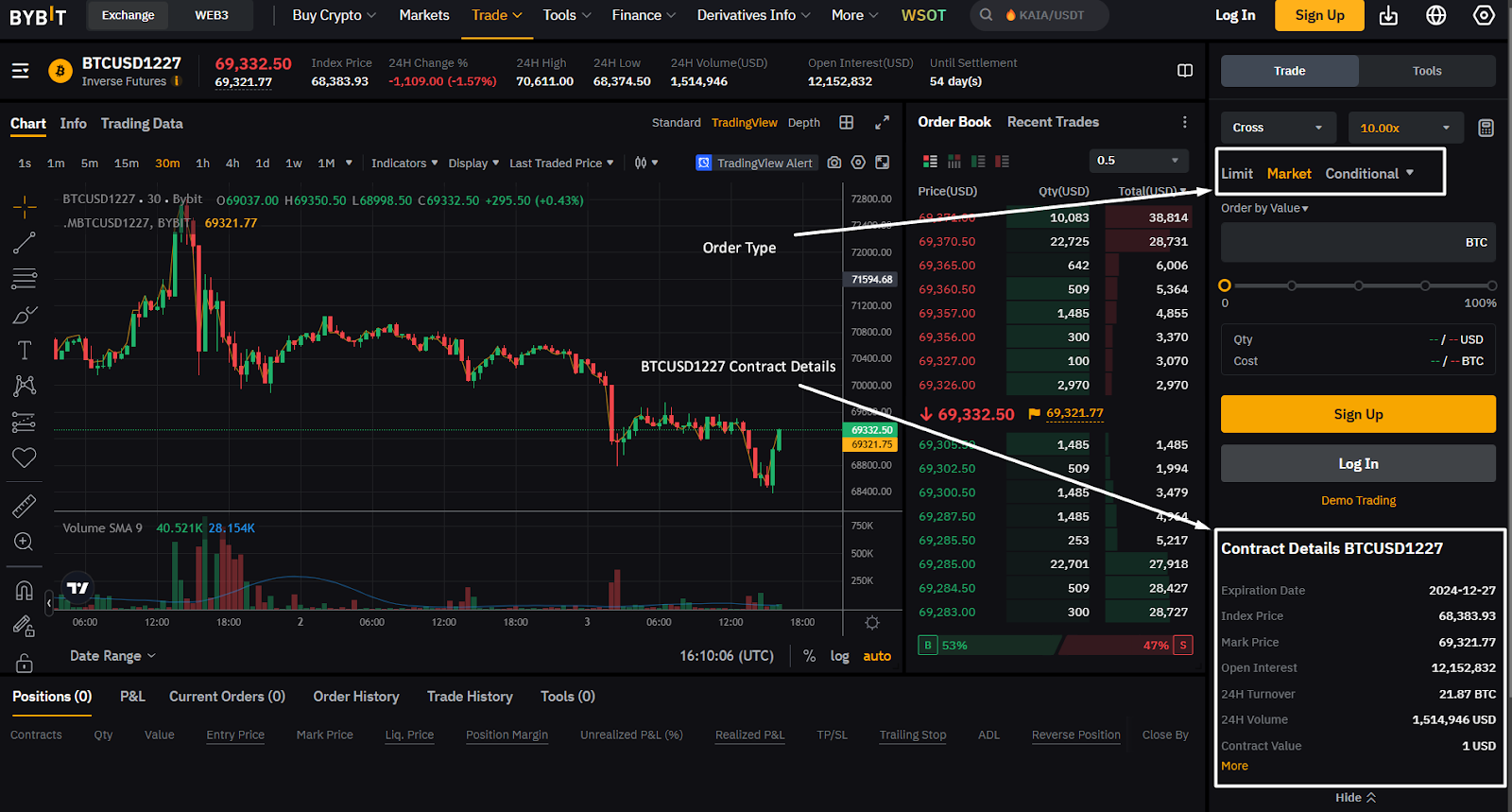

Choose Order Type

Select Market or Limit order, based on your trading strategy. Market orders execute immediately at the current price, while limit orders let you set a preferred entry price.

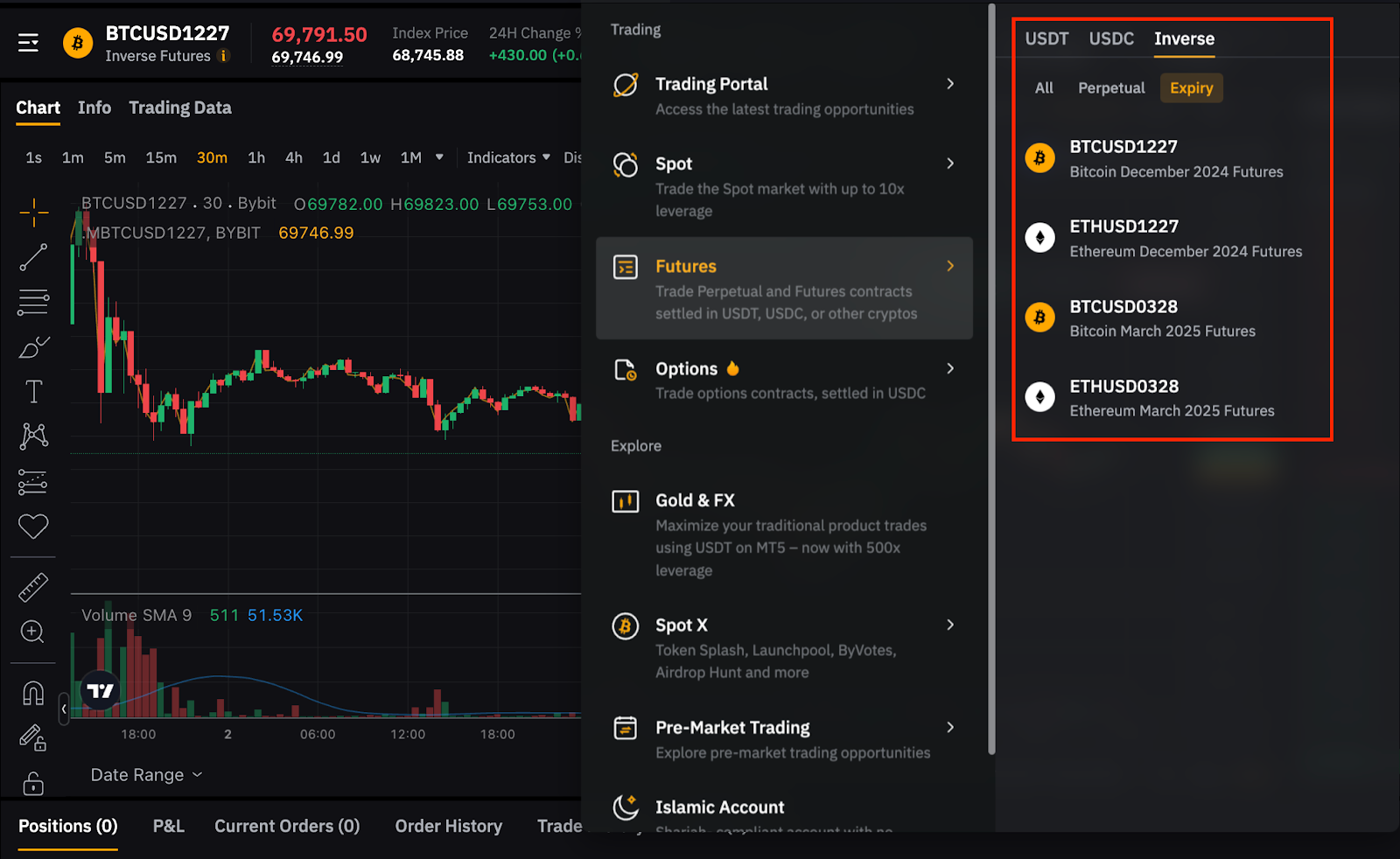

3. Select Contract and Leverage

For example: BTCUSD1227 is an inverse futures contract with BTC settlement, ideal for stacking, leveraging in bullish markets and for hedging strategies. Bybit allows you to set leverage up to 100x for BTC contracts.

Use Bybit's chart and order book to monitor real-time data, including open interest, volume and contract details for BTCUSD1227.

How to Calculate Profit & Loss for Inverse Futures Contracts

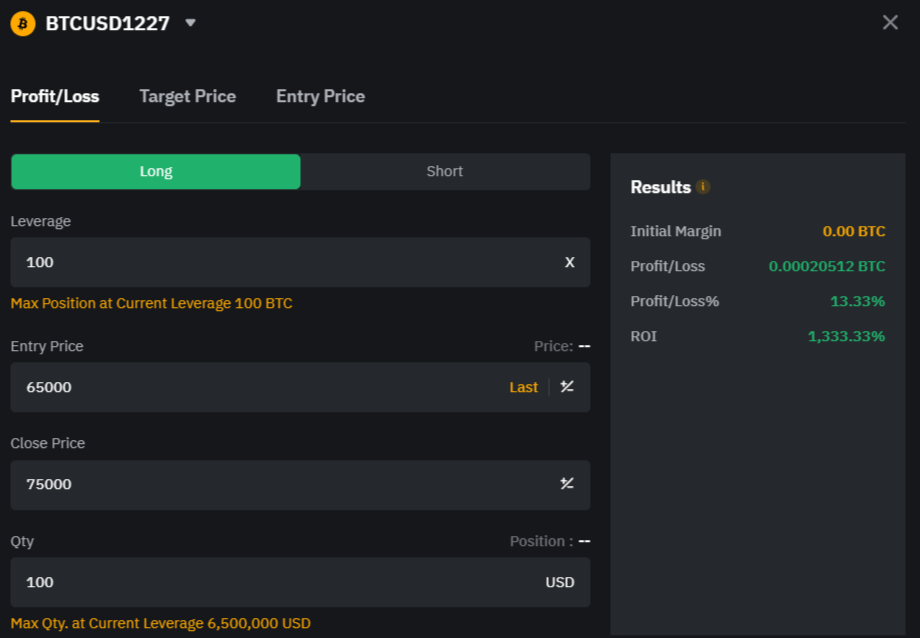

To calculate Profit & Loss (P&L) for an inverse futures contract on Bybit, use the following formula:

P&L = (1/Entry Price − 1/Exit Price) × Contract Quantity

Example Calculation (BTCUSD1227):

Entry Price = $65,000, Exit Price = $75,000, Contract Quantity = 100

Calculate (1/Entry Price) − (1/Exit Price): 0.00001538 − 0.00001333 = 0.00000205

Multiply by Contract Quantity: 0.00000205 × 100 = 0.00020512 BTC

In this example, the P&L is 0.00020512 BTC. This represents the profit in BTC for the trade, based on the entry and exit prices. Bybit uses the last traded price (LTP) to calculate P&L for positions closed before the settlement date.

Margin Requirement and Maximum Position Size for Inverse Futures Contracts

Bybit’s inverse futures contracts have specific margin requirements and position limits.

For BTCUSD, traders can use up to 100x leverage, with the smallest order size set at 1 USD and the maximum single order capped at 1,000,000 USD (up to 100 BTC).

The total position limit for BTCUSD is 1,000 BTC, while ETHUSD offers leverage up to 50x with a 30,000 ETH position limit.

For more detailed margin requirements, please see Bybit Margin FAQ.

How to Hedge Positions Using Inverse Futures

Using a 1x leverage sell/short position for Bybit’s inverse futures contracts can help protect the USD value of your BTC in a volatile market. This method, known as synthetic hedging, keeps the dollar value of your BTC stable, even if BTC’s price changes.

Example:

Starting Point: Trader A buys 1 BTC at $40,000 and opens a 1x leverage sell short position.

If BTC Falls: BTC drops to $20,000. The short position gains 1 BTC, totaling 2 BTC worth $40,000.

If BTC Rises: BTC rises to $80,000. The short position incurs a 0.5 BTC loss, leaving 0.5 BTC, still valued at $40,000.

Summary: By holding a 1x sell/short position equal to the value of their BTC, Trader A can keep the USD value of their holdings steady, even as BTC’s price rises or falls. This strategy is ideal for those seeking stability in a volatile market.

Conclusion: Getting Started With Inverse Futures Contract Trading

Bybit’s inverse futures contracts provide unique benefits, such as BTC-based settlement, hedging flexibility and zero funding fees, making them a top choice for traders with crypto-focused strategies. New traders can explore Bybit’s demo account for a risk-free start, building effective habits before diving into live markets.

Ready to start? Create your Bybit account today and explore flexible futures contracts.

#LearnWithBybit