Gold moves: Trade the momentum with Bybit TradFi

Gold isn’t just a hedge anymore — it’s a momentum asset moving in sync with the world’s shifting macro trends. In October 2025, gold reached an all-time high above $4,380 per ounce, marking an impressive 60% year-to-date gain as inflation stayed sticky, the Federal Reserve signaled rate cuts, and the US dollar softened.

As global uncertainty deepens, gold’s role has evolved from a passive store of value into a dynamic, tradeable macro instrument. Central banks are buying at record levels, while investors are positioning for volatility as yields and policy expectations shift.

According to the World Gold Council and The Future Laboratory’s 2025 report, the total market value of gold-backed tokens reached $1.79 billion in August 2025, the highest amount on record. Tokenized assets, such as Tether Gold (XAUT) and PAX Gold (PAXG), have gained popularity among investors seeking verified on-chain exposure with transparent custody. The report also introduced the Standard Gold Unit (SGU), a proposed framework linking physical gold with digital finance.

Bybit TradFi helps traders turn these macro forces into opportunity. With instant access to gold CFDs and futures, one-click execution and real-time analysis tools, Bybit bridges the gap between traditional and digital markets, making it easier than ever to trade gold like a pro.

Key Takeaways:

Gold hit a record high above $4,380 per ounce in 2025, gaining nearly 60% year-to-date.

Sticky inflation, Fed interest rate cut signals and a weaker dollar are driving renewed demand.

Central banks continue to expand reserves, pushing total global holdings above 36,000 tonnes.

Bybit TradFi lets you trade gold CFDs and futures (XAUUSD+) with real-time data, analysis tools and one-click execution.

Why gold is moving now

Gold’s 2025 rally is being driven by a rare combination of monetary shifts, dollar weakness and geopolitical tension. Inflation across major economies remains above central bank targets, while global markets are positioning for multiple rate cuts in 2026. Meanwhile, lower real yields have boosted demand for non-yielding assets such as gold.

In addition, the US Dollar Index (DXY) has dropped from a January high of 110.17 to below 99.60, an 8% decline year-to-date. The weaker dollar has directly supported gold’s rise as investors rotate into tangible assets amid declining yields and slower growth expectations.

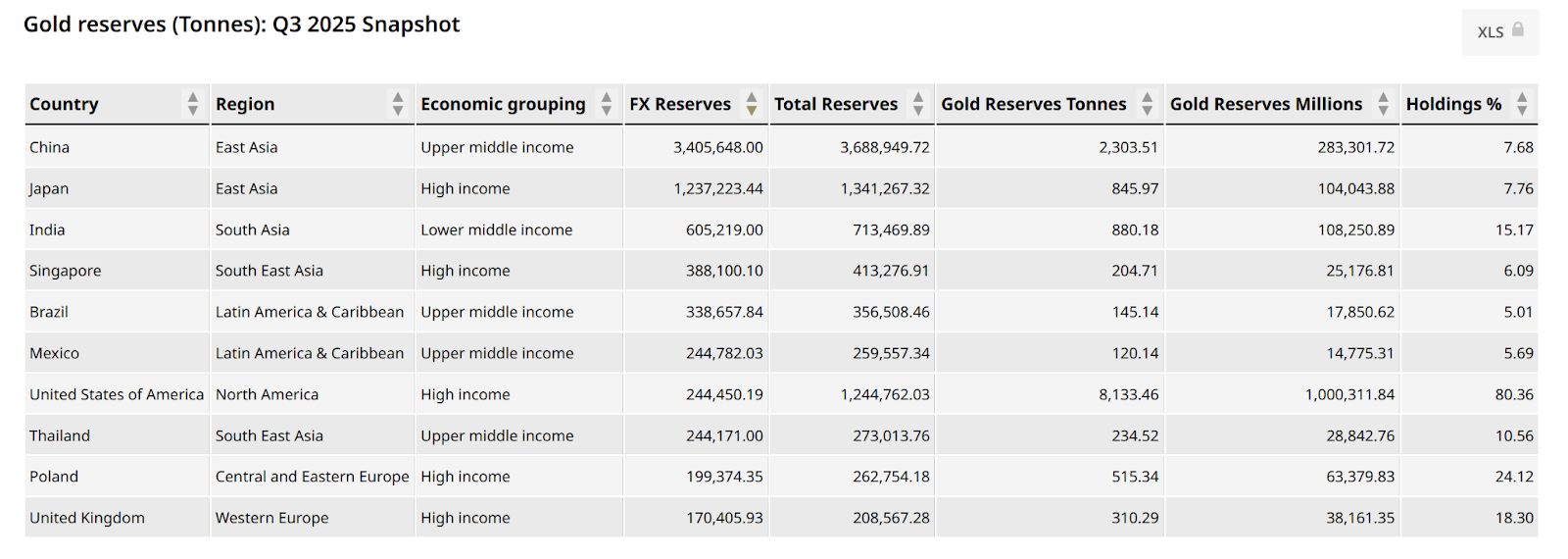

Source: gold.org

According to Q3 2025 data at gold.org, global reserves remain strong: the US leads with 8,133 tonnes, followed by China (2,303 tonnes) and India (880 tonnes). Smaller economies, such as Singapore, Poland and Thailand, have also expanded holdings, pushing global reserves beyond 36,000 tonnes.

At the same time, renewed tariff escalations, the US–China trade war and conflicts in Eastern Europe and the Middle East continue to amplify safe-haven flows. Each new flashpoint sends volatility higher — and, with it, gold, making the world’s foremost precious metal one of 2025’s most traded and profitable macro assets.

Geopolitical and market uncertainty

The VIX, a key measure of market volatility, is now hovering near 17.5, up from 2024 lows, signaling persistent caution in global risk assets.

Each geopolitical flashpoint tends to send volatility — and gold — higher, reinforcing the metal’s role as a reliable hedge during uncertain times. For active traders, tracking the VIX and macro headlines remains essential to catching gold’s next momentum surge.

Trade gold on Bybit TradFi

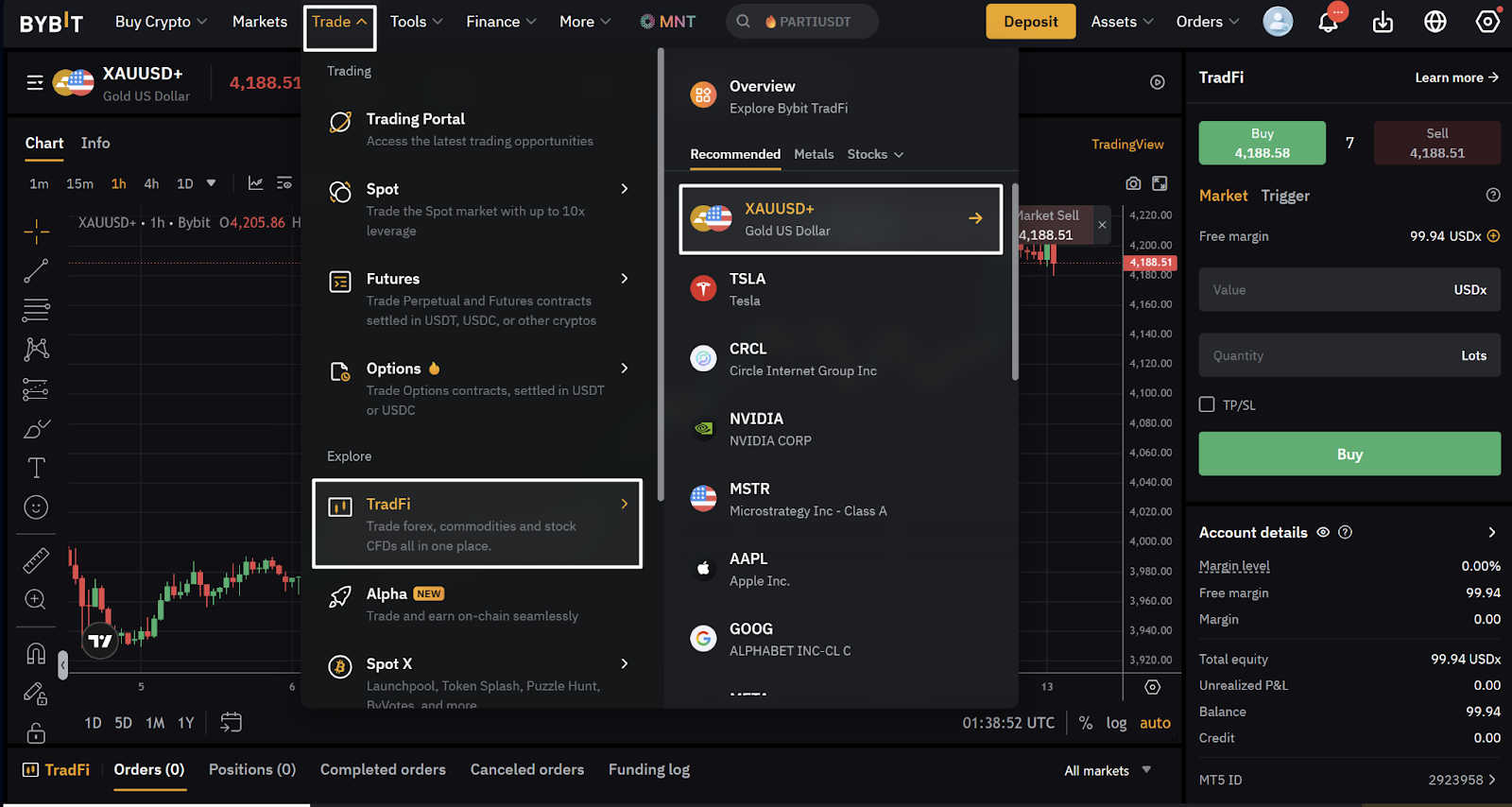

Bybit TradFi makes gold trading simple, fast and familiar. You can trade Gold CFDs and futures (XAUUSD+) directly from the same interface you use for trading crypto.

From the Trade menu, select TradFi → XAUUSD+ (Gold/US Dollar) to open the Gold Trade Dashboard. Here, you’ll find real-time charts, live commentary and instant order execution. You can buy or sell gold with just one click, no separate account or currency conversion needed.

Bybit’s unified account structure lets you trade gold, forex, indices and stocks all in USDT, with access to advanced charting tools, price alerts and technical overlays. The platform also tracks margin, free balance and equity on the same screen for better risk control.

For traders familiar with crypto volatility, gold on Bybit TradFi offers a similar high-liquidity environment with institutional-grade precision. The platform is available 24 hours a day, five days a week, in line with global forex trading hours.

Macro-driven trading strategies

Gold’s volatility makes it ideal for traders who thrive on macro momentum. The following are three popular strategies used by professionals:

Momentum trades around breakouts: When gold breaks major resistance or support, traders use tools such as RSI or moving averages to confirm direction.

Range trading during consolidation: In calmer phases, gold’s price often oscillates between $4,000–$4,200, offering short-term opportunities near support and resistance levels.

Event-based setups tied to macro data: Gold reacts instantly to events such as CPI releases, Fed meetings and jobs reports, making it an ideal asset for event-driven traders tracking volatility spikes.

These strategies highlight gold’s dual identity as both a hedge against macro shocks and a high-volatility asset for active traders.

Conclusion

Gold’s resurgence in 2025 proves how macro forces, rising inflation, shifting rate cycles and global uncertainty can transform a traditional hedge into a powerful trading asset. As central banks expand reserves and volatility returns, gold remains one of the most responsive markets to global change.

With Bybit TradFi, you can capture these moves in real time. The Gold Trade Dashboard offers everything you need, from live price data to one-click execution, so you can trade confidently through every macro cycle.

Sign in to Bybit TradFi today to trade gold with precision, speed and confidence.

#LearnWithBybit