How to Get Started With Bybit Crypto Perpetual Derivatives Trading

Perpetual futures contracts have become a popular choice among cryptocurrency traders, offering flexibility and unique features as compared to traditional futures. Bybit provides the tools and resources necessary to get started with crypto perpetuals trading through its Unified Trading Account (UTA).

The UTA centralizes your trading experience by allowing you to manage spot, futures and options trading from a single account. Traders can easily select their desired trading pair on the platform to enhance their overall trading experience.

Key Takeaways:

Unlike traditional futures, perpetual contracts have no expiration date, allowing you to hold positions as long as you maintain sufficient margin requirements.

With the UTA, you can capitalize on market movements across different products without needing to close or settle contracts at set intervals, which optimizes capital efficiency.

Perpetual futures are gaining traction due to their flexibility, risk management options, and high leverage potential, attracting both new and experienced traders.

What are crypto perpetual futures contracts?

Crypto perpetual futures contracts are derivatives that allow you to speculate on the price movements of assets, such as Bitcoin or Ethereum, without a set expiration date. Unlike traditional futures contracts, which involve an agreement to buy or sell an asset at a predetermined price on a specific date, perpetual futures can be held indefinitely as long as you meet the necessary margin requirements within your Unified Trading Account (UTA).

Bybit offers linear perpetual contracts settled in USDT. With the UTA, you can open long or short positions, using USDT as your margin, and all calculations for profit, loss and margin are settled in that same currency. This centralized system allows your unrealized profits to be used as margin for other positions, significantly enhancing your capital efficiency.

Example: A 1 BTC contract in a BTCUSDT perpetual contract would yield a profit of 100 USDT if the price of Bitcoin rises by $100. This straightforward calculation and the ability to hold positions for any duration make perpetual contracts a preferred choice for many traders.

Key differences from traditional futures contracts

The main distinction between perpetual futures and traditional futures is the lack of a fixed settlement date. Traditional futures require periodic closures or rollovers, which can complicate long-term strategies. In contrast, perpetual futures allow you to hold positions indefinitely, maintaining greater flexibility.

Price convergence: While traditional futures align with the spot price as they near expiration, use periodic funding rates to keep prices close to the spot value. Funding payments are exchanged between long and short positions based on market conditions, helping to maintain price stability.

Popularity of crypto perpetual futures

Perpetual futures trading has become increasingly popular in crypto markets due to several key advantages:

Flexibility: You can hold positions without worrying about expiration dates.

Unified margin access: With Bybit’s UTA, you can leverage over 70 cryptocurrencies as collateral to help you optimize your capital efficiency across the Bybit platform.

Leverage Options: Access high leverage to maximize potential returns.

Accessibility: Platforms like Bybit offer real-time data, user-friendly interfaces, and robust risk management features.

Bybit's user-friendly trading interface allows traders to easily navigate and manage their positions, enhancing the overall trading experience.

The combination of these benefits makes perpetual futures appealing to both beginning and experienced traders, allowing them to enhance trading strategies or hedge risks effectively.

Perpetual futures vs. traditional futures: ‘Quick scenario’

Let’s take an example. John, a trader, expects Bitcoin’s price to rise from $30,000 to $35,000 over three months.

Traditional futures: John selects a three-month contract. Upon expiration, he faces the risk of price convergence or additional fees to roll the contract over.

Perpetual futures: On Bybit, John holds a BTCUSDT perpetual contract indefinitely within his UTA, avoiding expiration constraints. He maintains his position as long as his margin is sufficient, allowing him to profit from the price increase without the limitations of traditional contracts.

How perpetual futures trading works

No expiration date

Since perpetual futures lack an expiration date, you can hold long or short positions indefinitely. This provides greater flexibility to adapt to market changes without the need to close contracts or roll them over.

Within the UTA, you can maintain these positions across various instruments, such as BTCUSDT perpetuals, as long as your total account maintenance margin rate (MMR) remains below 100%. This account-level approach means your unrealized profits from one position can help support the margin requirements of another, preventing unnecessary liquidations during temporary market volatility.

Funding rate mechanism

The funding rate mechanism is the primary tool that keeps perpetual contract prices aligned with the spot price of the underlying asset. It involves periodic payments between traders, typically adjusted and exchanged every eight hours.

Positive funding rate: Long traders pay short traders

Negative funding rate: Short traders pay long traders

With the UTA, funding fees are automatically deducted from or credited to your available balance. If a trader holds a $10,000 long position in BTCUSDT and the funding rate is -0.0015% (as seen in the example above), the trader would actually receive a payment from short position holders.

If the rate were 0.0100%, the fee would be $1.00 (calculated as $10,000 × 0.0100%). Bybit’s platform displays real-time funding rates and countdowns to the next settlement, helping you plan your positions effectively.

High leverage, risks and benefits

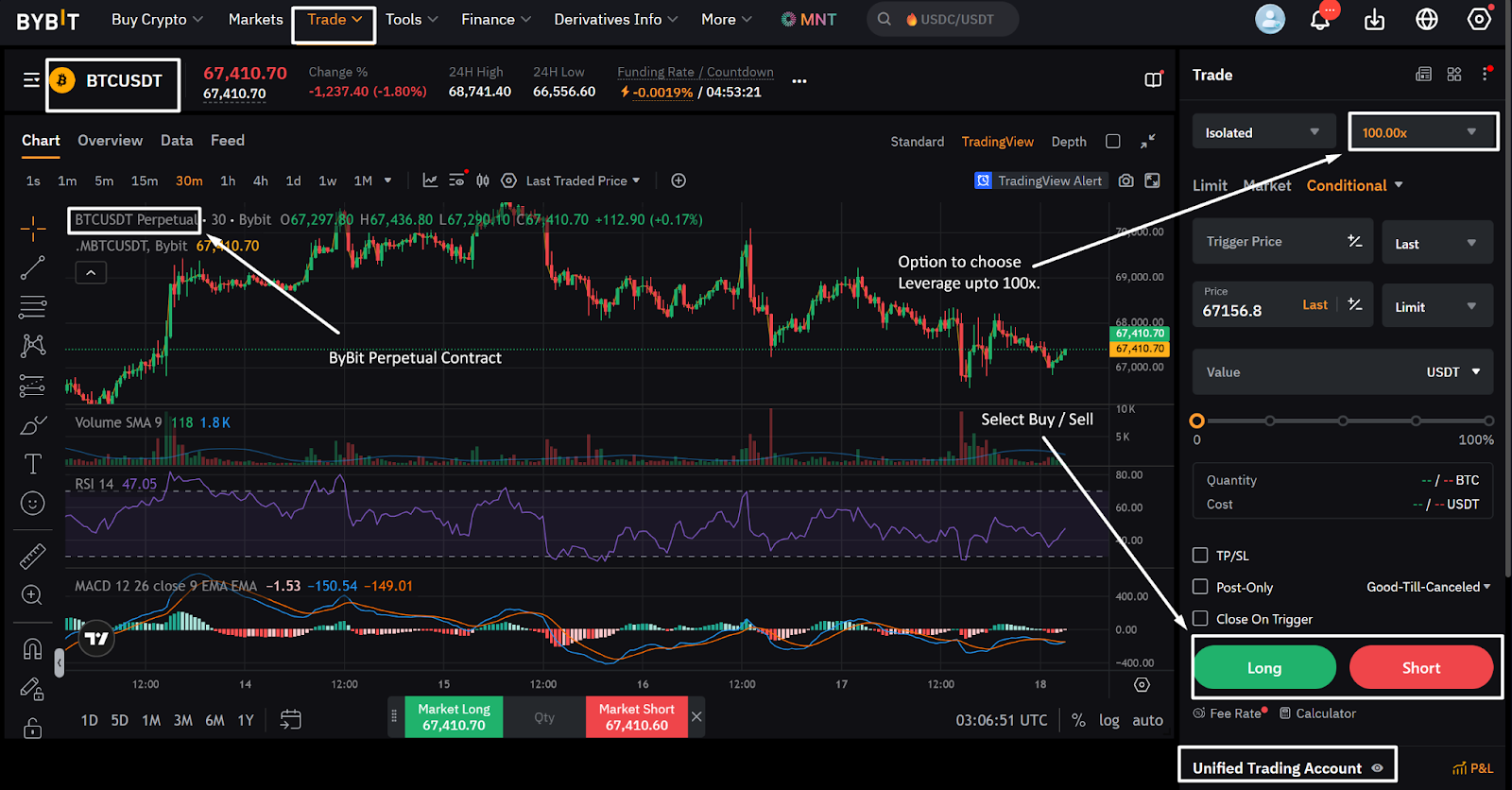

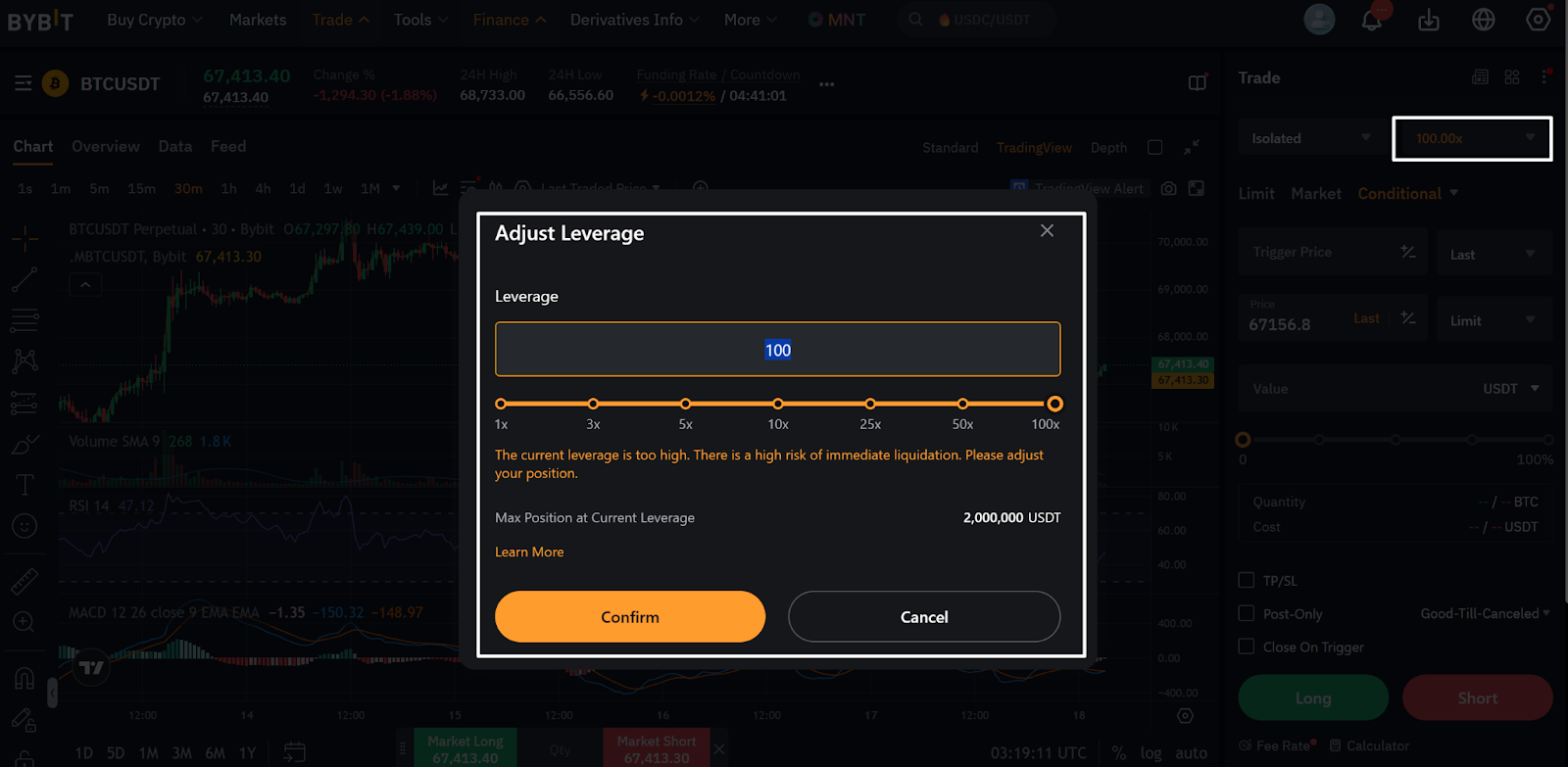

Perpetual futures contracts on Bybit offer you the opportunity to use high leverage, sometimes up to 100x. This means that with a relatively small margin, you can control a much larger position.

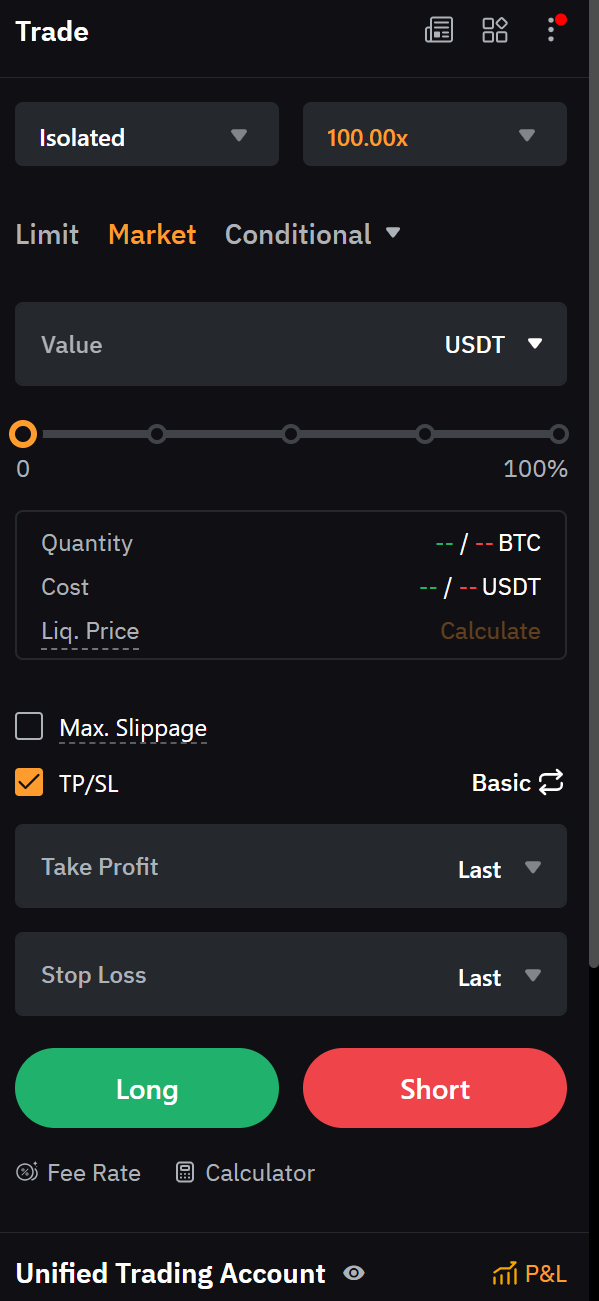

Within the UTA, leverage is applied to the total adjusted equity of your account when using Cross Margin or Portfolio Margin modes. This allows for greater capital efficiency, as the UTA leverages your entire asset value, including unrealized profits, to maintain and initiate derivative positions. As shown in the platform interface, Bybit allows you to select your preferred leverage level, ranging from 1x to 100x, depending upon your risk tolerance and trading strategy.

Benefits of high leverage

Amplified returns: High leverage enables you to potentially multiply your profits. For instance, with 100x leverage, you can open a $10,000 position with just $100 in margin.

Flexible leverage settings: You can adjust leverage based on your strategy or market conditions. With the UTA, you can easily switch between Isolated, Cross and Portfolio Margin modes to optimize the way your leverage and collateral are utilized.

Risks of high leverage

Increased risk of liquidation: Higher leverage increases the risk of rapid margin depletion. With the UTA, liquidation is triggered when the account's MMR reaches or exceeds 100%. High leverage settings significantly narrow the gap between your entry price and liquidation price.

Need for risk management: You must employ robust risk management strategies, such as setting stop-loss orders, monitoring market conditions, and choosing leverage levels responsibly.

Margin requirements for perpetual positions

To maintain an open position in perpetual futures, you must keep your margin balance above a required minimum, known as the maintenance margin. On Bybit, this requirement depends upon the size of your position and the leverage used.

Under the UTA, margin is managed at the account level, rather than per position. This means that your total account equity is used to support all open positions, allowing for greater flexibility.

Leverage impact: Higher leverage lowers the Initial Margin needed to open a position but increases your liquidation risk.

Automatic liquidation: With the UTA, liquidation is triggered if your account's MMR reaches 100%. At this point, Bybit automatically liquidates positions in order to prevent a negative balance.

Key calculations

Understanding these figures is essential for making informed trading decisions, and anticipating how price changes will impact your account.

Average entry price (AEP)

This reflects the average price paid for a position.

Formula: AEP = Total contract value ÷ Total quantity of contracts

For example, if you hold 0.5 BTC at $5,000 and buy another 0.3 BTC at $6,000, your new AEP is $5,375.

Profit & loss (P&L) calculations

Unrealized P&L: This shows your current profit or loss on an open position.

Long formula: Qty × (last price − entry price)

Short formula: Qty × (entry price − last price)

Example: With an entry price of $7,000 and a last price of $7,500, a 0.2 BTC long position yields an unrealized profit of 100 USDT.

Closed P&L: This accounts for all trading fees when a position is finalized.

Formula: Position P&L − fees = Closed P&L

Last traded price: The last traded price is crucial for calculating realized profits and losses, as it reflects the most recent price at which a contract was executed.

Bybit’s platform provides real-time data for P&L, margin balance and leverage, allowing you to track your performance accurately.

For details on P&L calculation, refer to the section on Margin Requirements and P&L Calculations.

Bybit’s platform shows real-time data for P&L, margin balance and leverage. Understanding how these figures are calculated helps traders make informed decisions. For example, knowing the unrealized P&L formula lets traders anticipate how price changes impact their positions.

How to trade perpetual futures on Bybit: Step-by-step guide

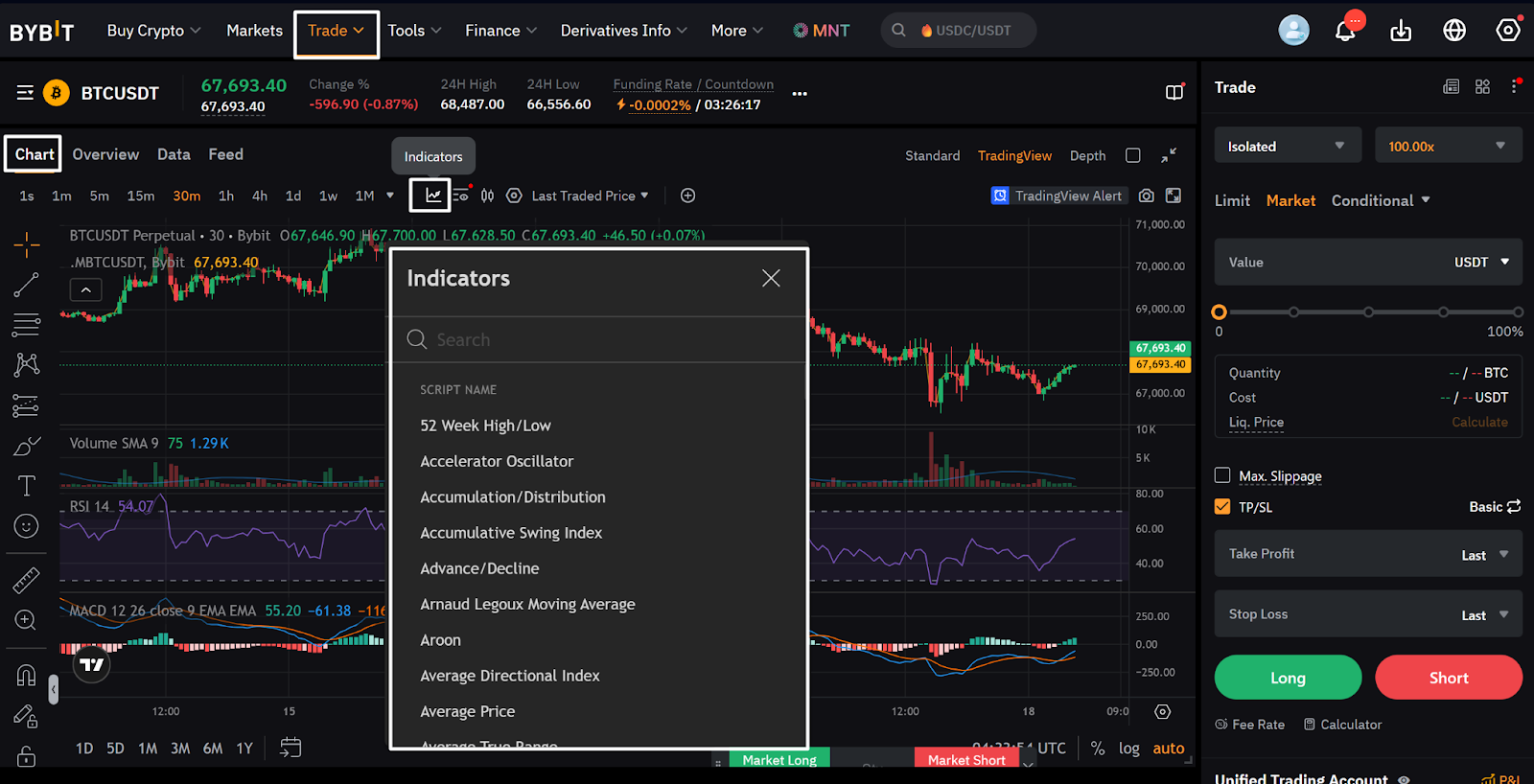

Bybit offers a user-friendly and feature-rich trading platform designed for both beginning and experienced traders. It provides real-time market data, advanced charting tools, and a range of order types, enabling you to make informed decisions. All derivatives trading is now centralized within the UTA, which simplifies the process by managing multiple positions and collateral types from a single interface.

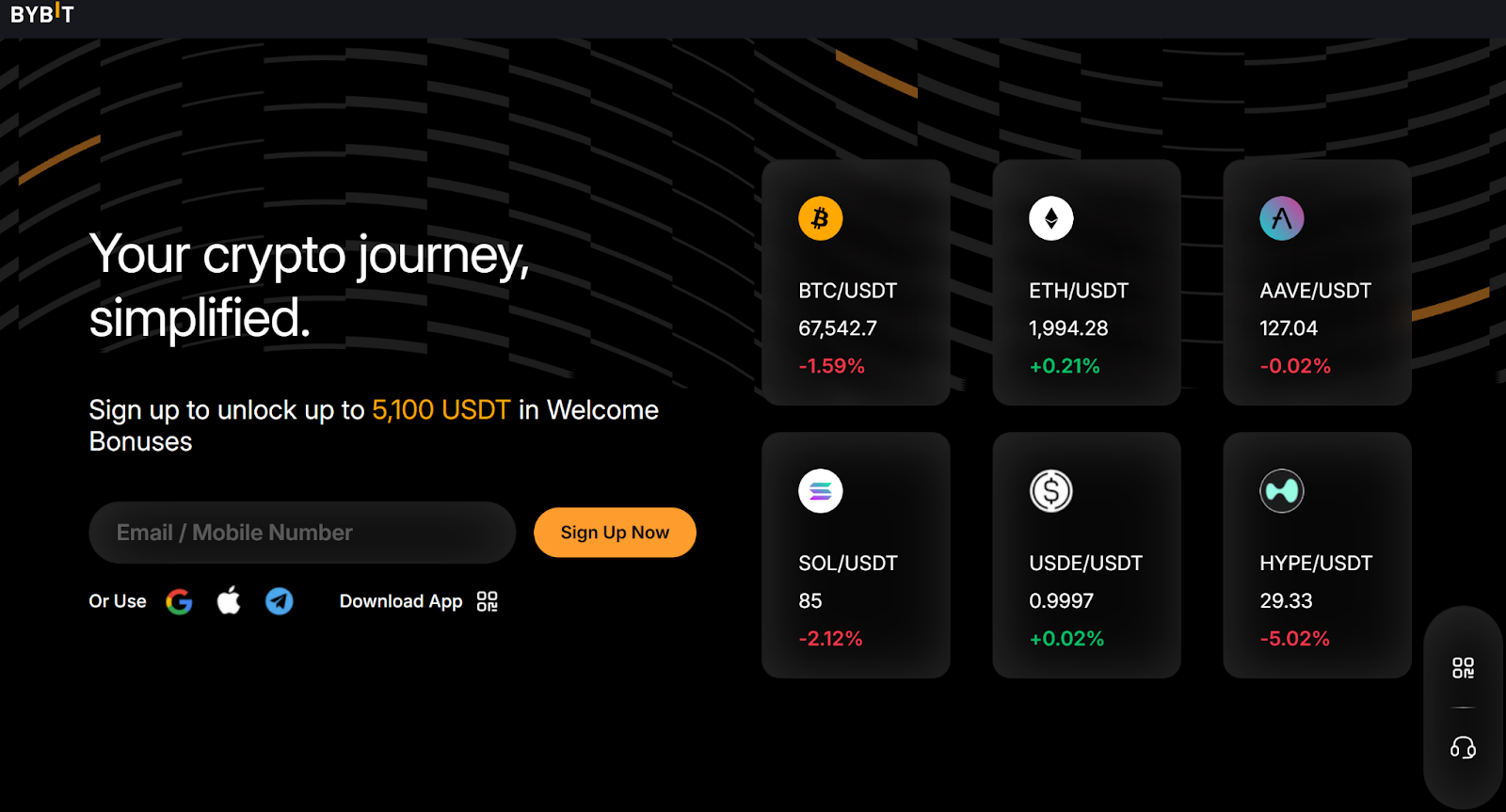

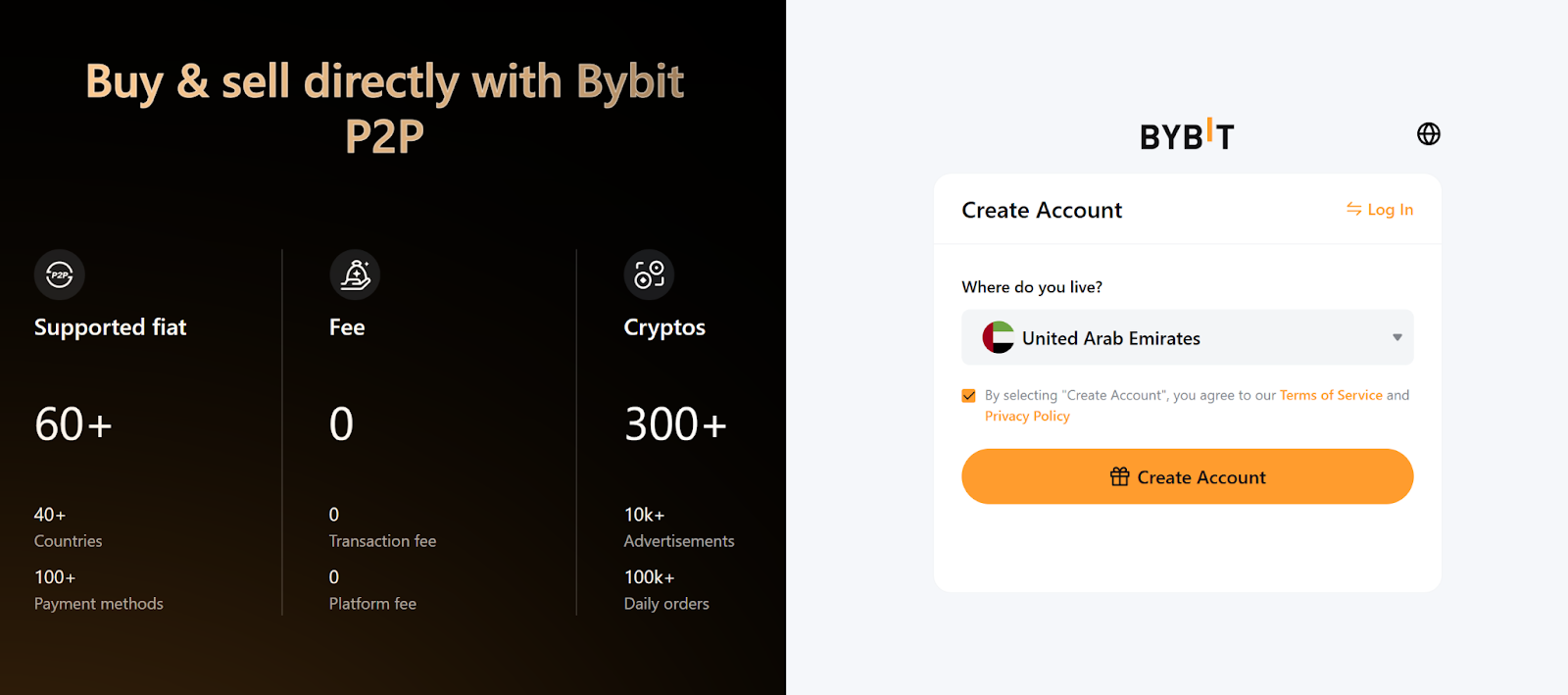

Sign up on Bybit and complete the KYC verification

Signing up on PC/desktop

To sign up on a PC or desktop, follow the steps below:

Visit Bybit’s website: Go to the official website and click on the Sign Up button located at the top right corner of the page.

Choose your method: Select whether you want to sign up with your email address or mobile number.

Enter your details: Input the necessary details, such as your email address and password, or your mobile number and password.

Create your account: Click on the Create Account button after reading and agreeing to Bybit’s Terms of Service and Privacy Policy.

Verification: Complete the reCAPTCHA verification and enter the verification code received via email or SMS.

Signing up on mobile

To sign up on a mobile device, follow the steps below:

Download the App: Download the official Bybit App from the Apple App Store or Google Play Store.

Launch the App: Open the Bybit App and tap on the Sign Up button located at the top right corner of the screen.

Choose your method: Select whether you want to sign up with your email address or mobile number.

Enter your details: Input the necessary details, such as your email address and password, or your mobile number and password.

Create your account: Tap on the Sign Up button after reading and agreeing to Bybit’s Terms of Service and Privacy Policy.

Verification: Complete the reCAPTCHA verification and enter the verification code received via email or SMS.

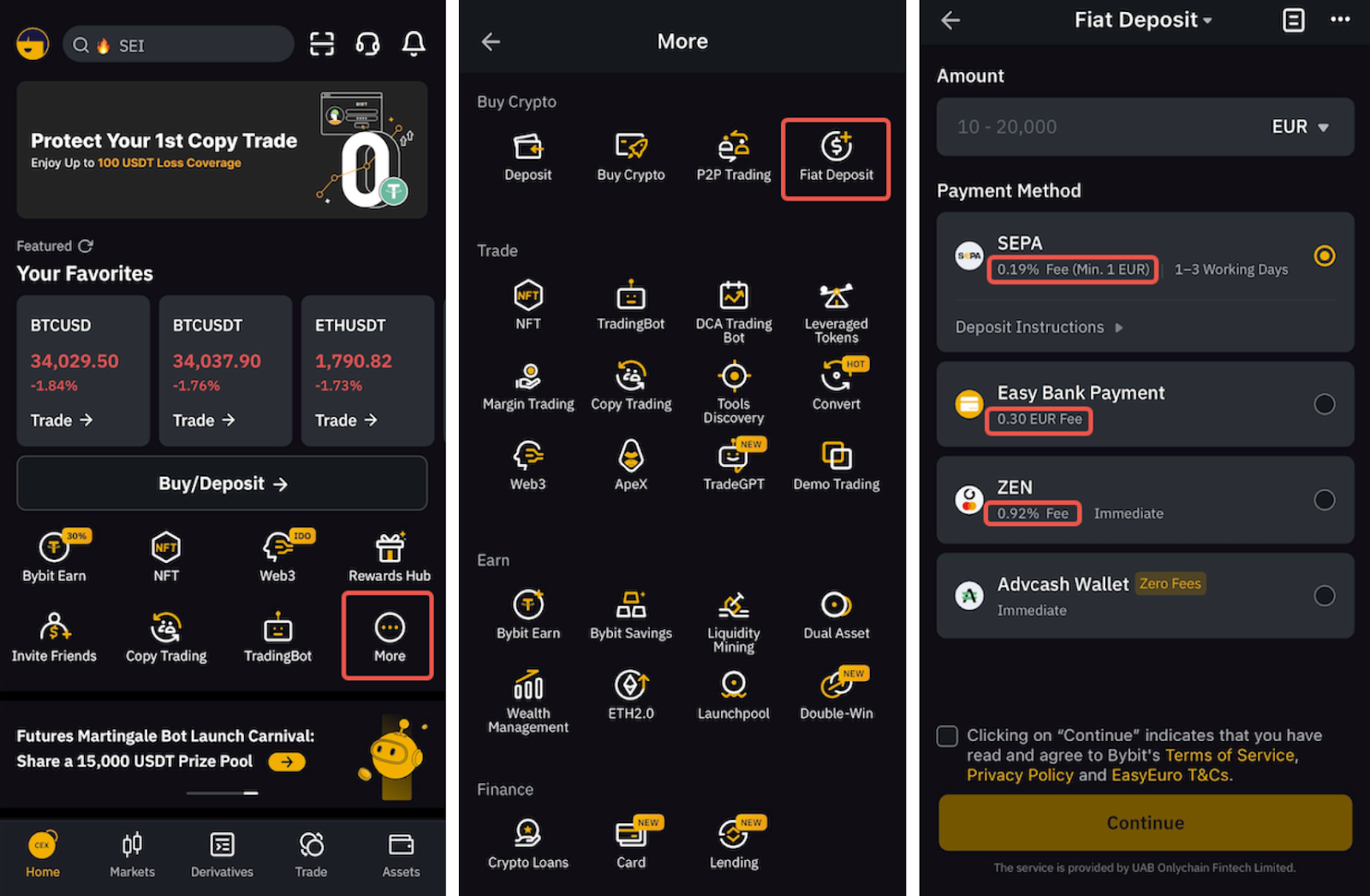

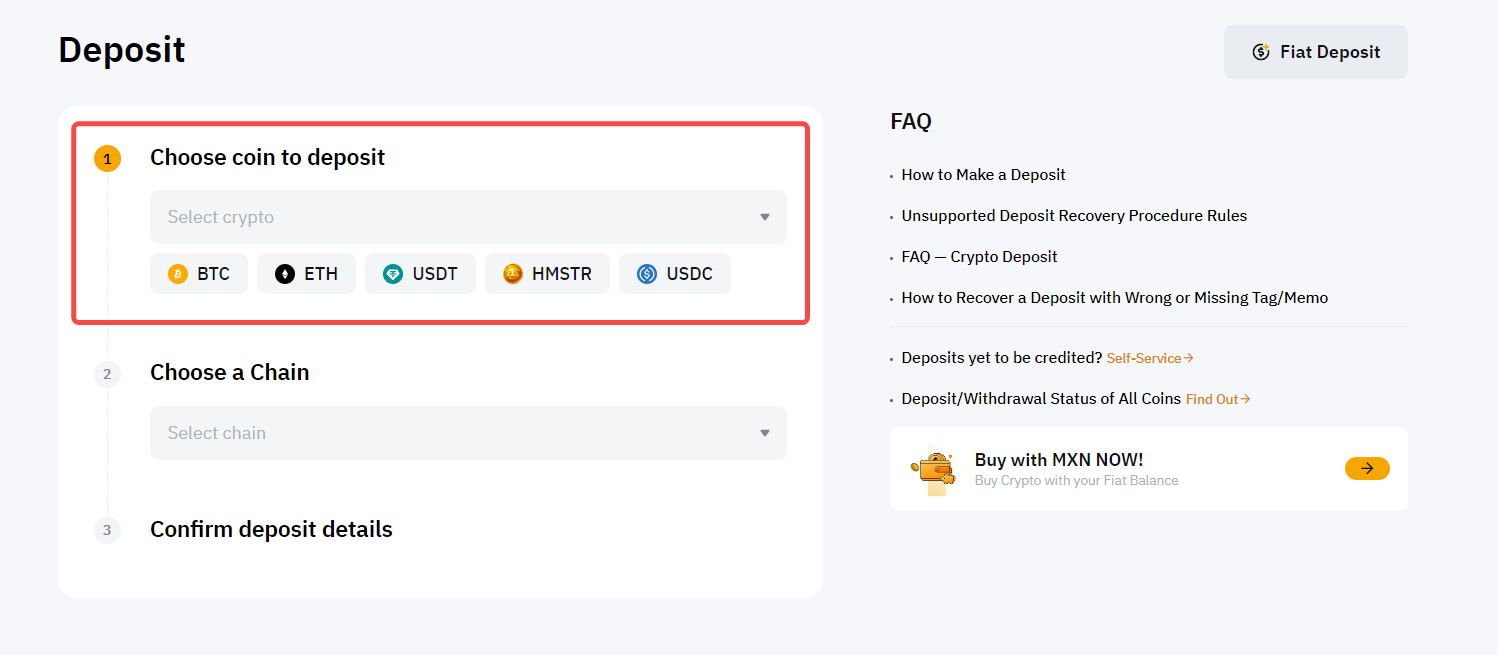

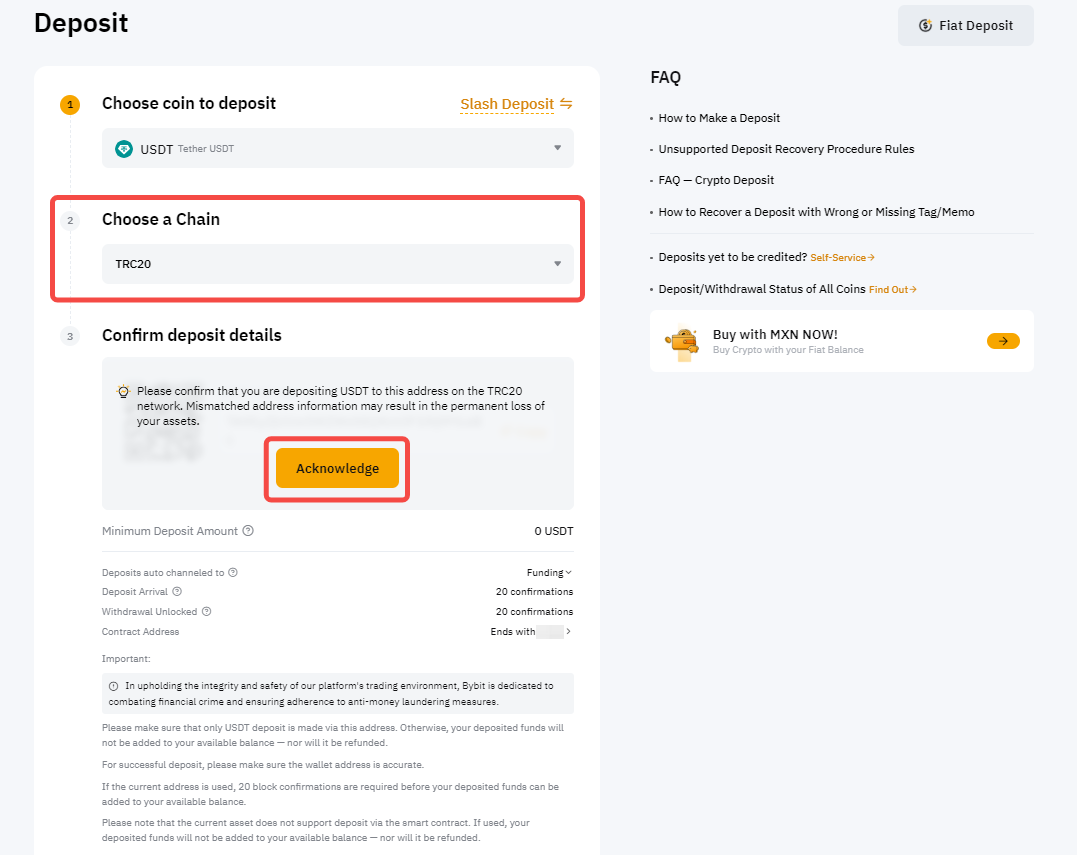

Deposit funds easily with fiat or crypto options

To trade perpetuals, you must first fund your UTA. Because the UTA supports over 70 cryptocurrencies as collateral, you have significant flexibility in how you capitalize your account. You can use the following two methods to deposit funds:

Fiat deposit: Transfer fiat currency directly to your Bybit account via Fiat Deposit. Once the deposit is completed, the funds are credited to your Funding Account. You can then purchase crypto using your fiat balance, or transfer the funds to your UTA to serve as margin. Supported methods include SEPA, Easy Bank Payment or other regional providers, depending upon your place of residence.

2. Crypto deposit: Transfer supported digital assets, such as USDT, BTC, or ETH, from an external wallet or another exchange. When making a crypto deposit, you can route the funds directly to your UTA, or to your Funding Account for later transfer.

This provides flexibility for users to fund their accounts easily.

Manage orders: Place, adjust, or close trades

Once your UTA is funded, you can begin managing your positions. The UTA utilizes an account-level margin system, meaning that your total adjusted equity across all supported collateral assets is used to maintain your derivative positions.

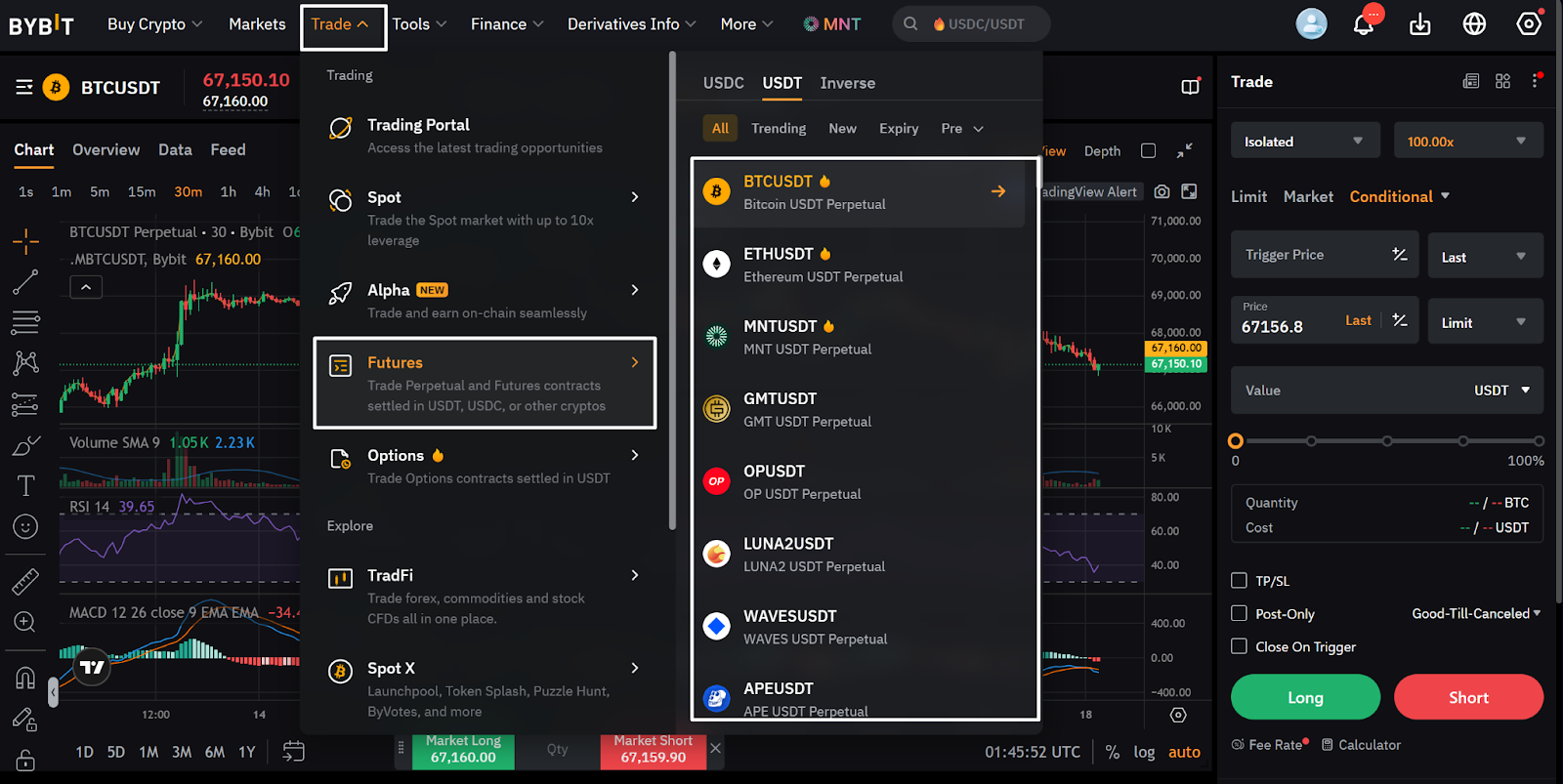

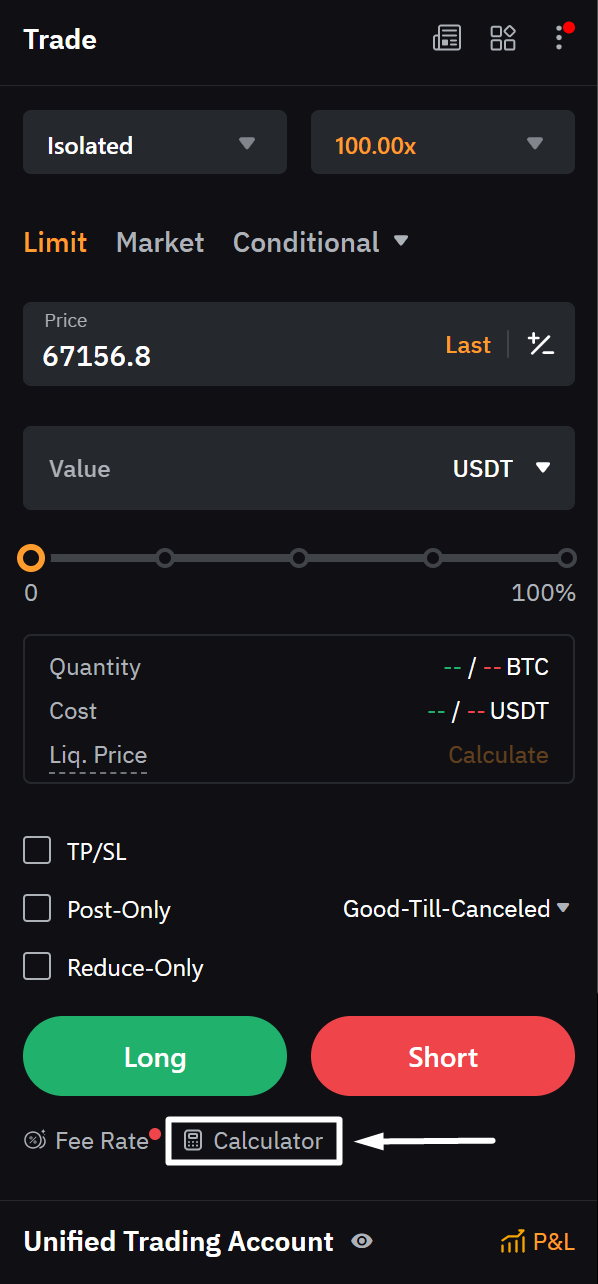

Place an order

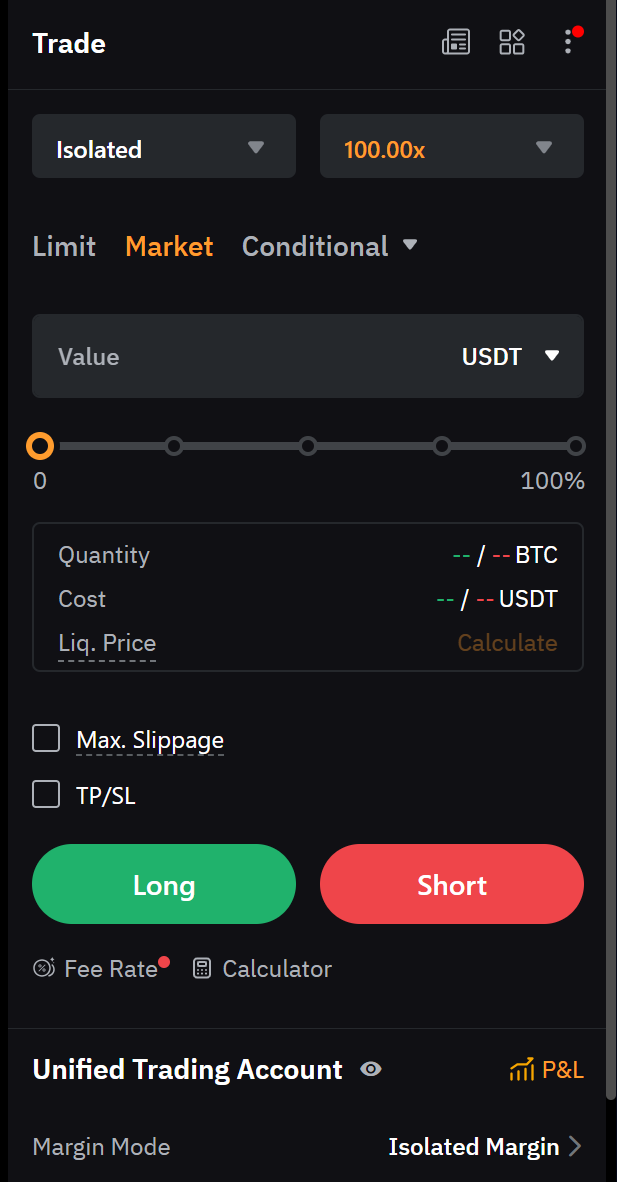

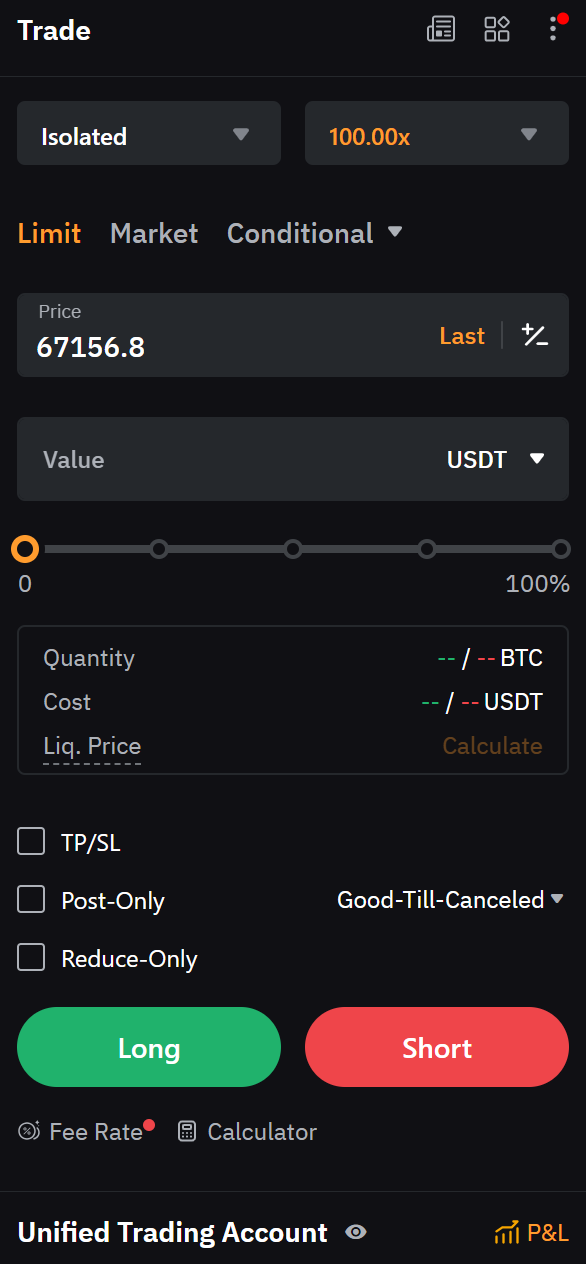

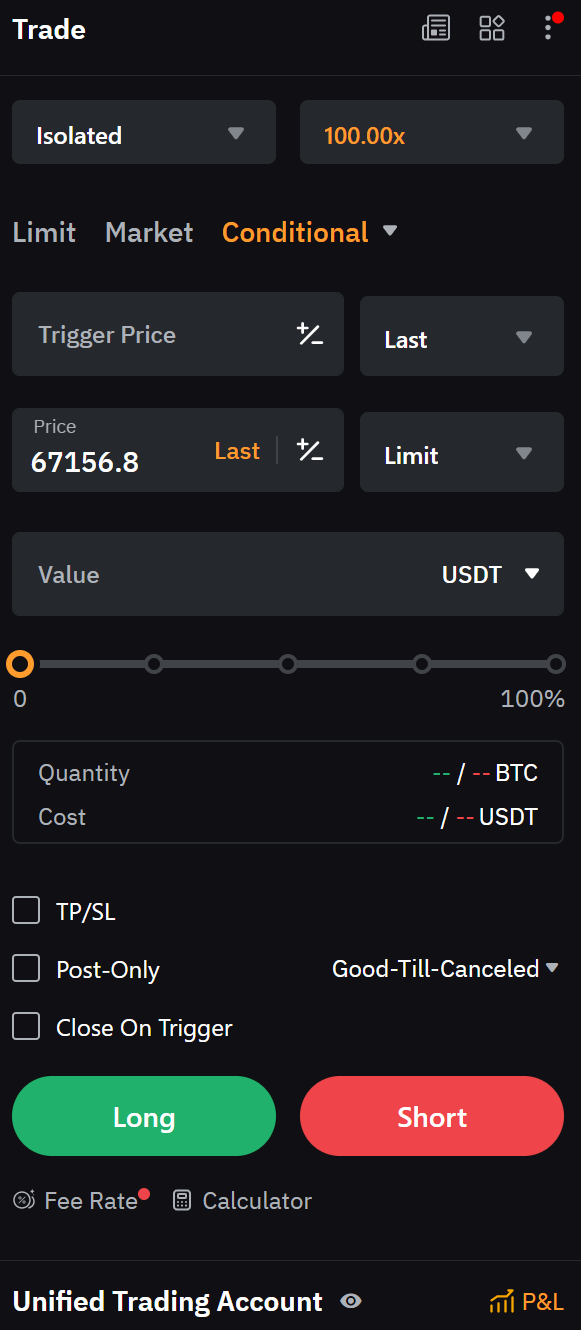

Select a trading pair on the derivatives page (e.g., BTCUSDT) and choose your preferred order type:

Market order: Executes immediately at the best available current market price.

Limit order: Executes only at your specified price or better.

Conditional order: Executes automatically once specific market conditions or trigger prices are met.

Manage your positions

Adjust margin: In Isolated Margin mode, the UTA allows you to segregate margin for individual positions in order to limit potential losses. In Cross Margin mode, you can monitor your account's total MMR to manage overall risk.

Check the mark price: Always monitor the Mark Price, as it’s the key indicator used to calculate unrealized P&L and determine if a position reaches its liquidation price.

Cancel an order: Navigate to the 'Orders' tab to cancel any open, unfilled orders at any time.

Close a position: When you are ready to realize your gains or limit losses, select 'Close' on your active position and confirm the transaction.

Use TP/SL: Set take profit (TP) and stop loss (SL) orders to automatically trigger, based on your desired return on investment (ROI), to manage your trades more proactively.

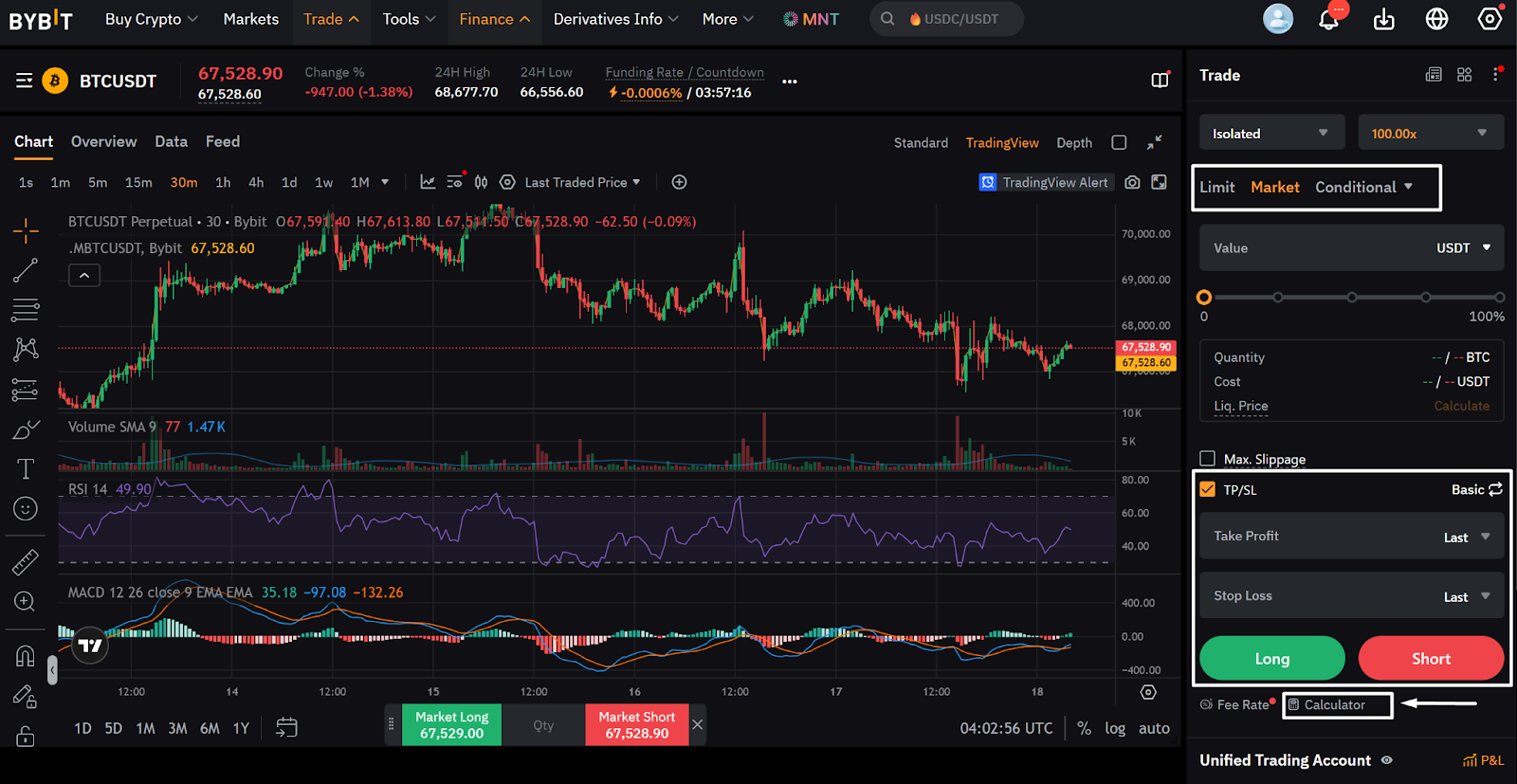

How to use Bybit’s position calculator to open perp positions

Bybit’s Position Calculator is a vital tool for planning your trades, allowing you to estimate profit and loss (P&L), target prices, and liquidation prices before you ever commit capital. Within the UTA, using this calculator is especially important because your risk is managed at the account level across all your open positions.

To access the tool, simply click on the calculator icon located in the upper-right corner of the order placement panel on the trading page.

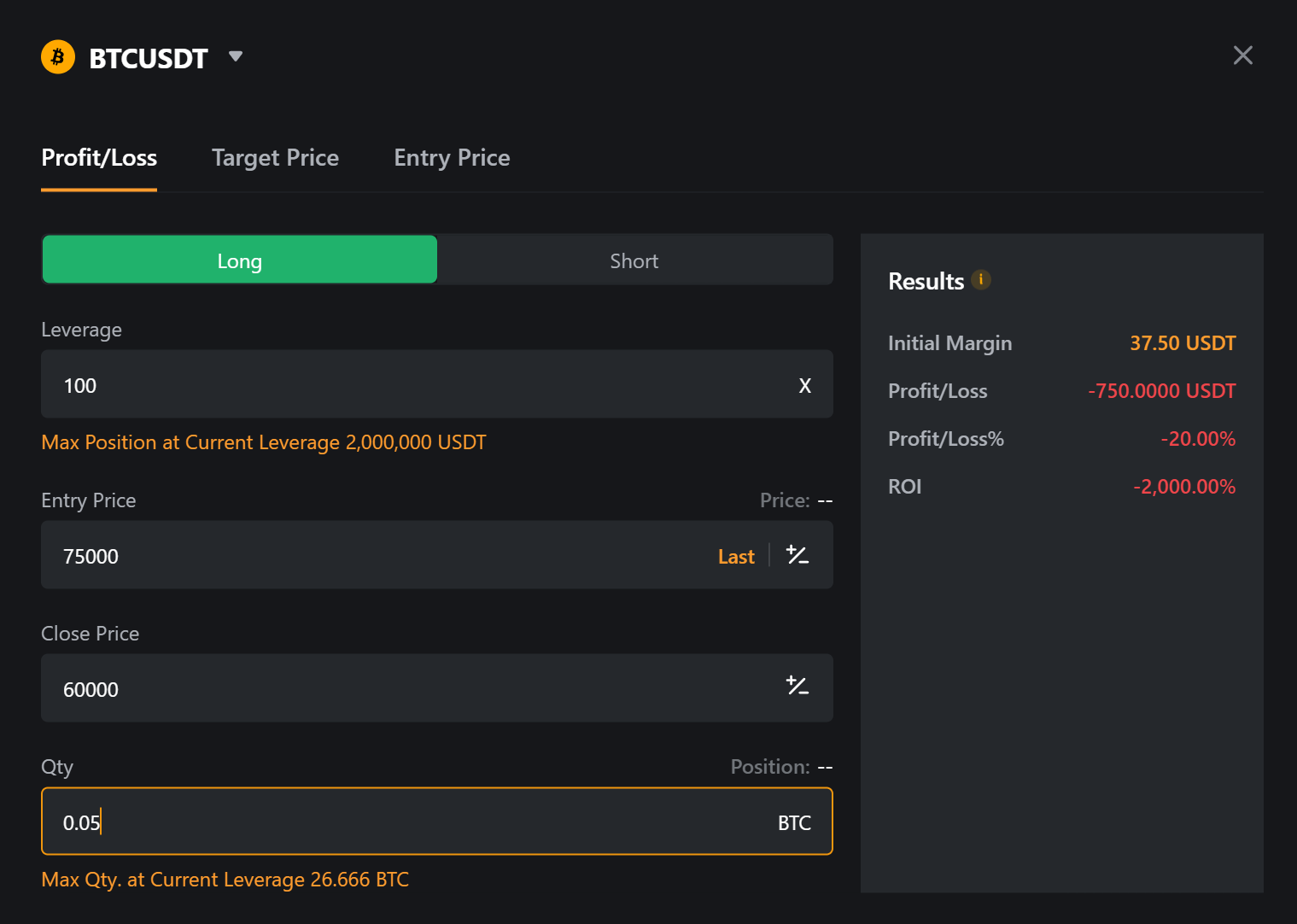

1. Calculate profit/loss

This tab allows you to visualize your potential returns based on specific market movements. You will need to enter your entry price, closing price, quantity, and leverage.

Example: With an entry price of $60,000, a closing price of $75,000, and 0.5 BTC at 100x leverage, your estimated profit would be $7,500.

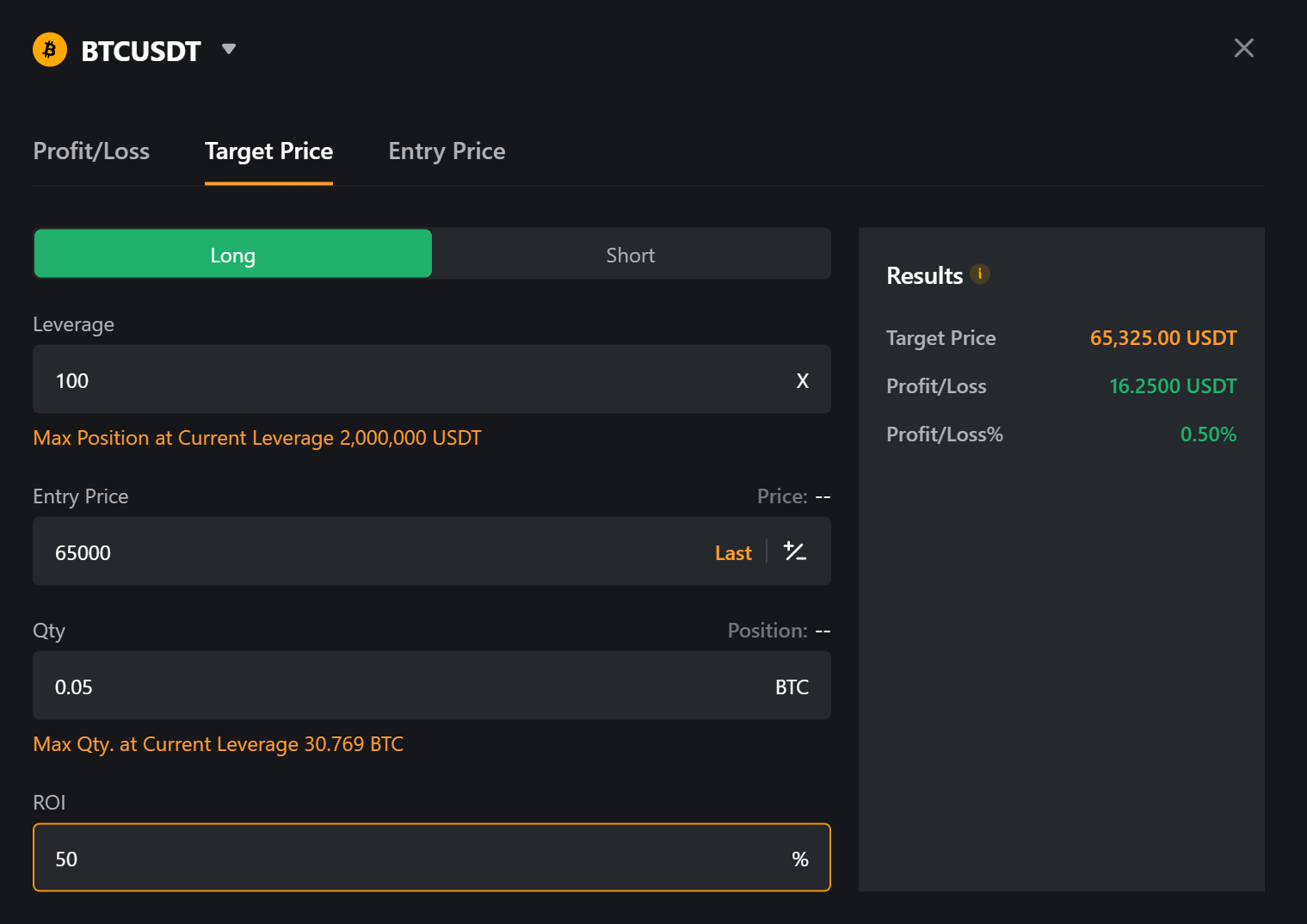

2. Determine target price

Use this function to set a clear exit strategy based on your desired return on investment (ROI). Input your entry price, quantity, and target ROI percentage.

Example: An entry price of $60,000 with a 50% ROI would give you a target price of $60,300.

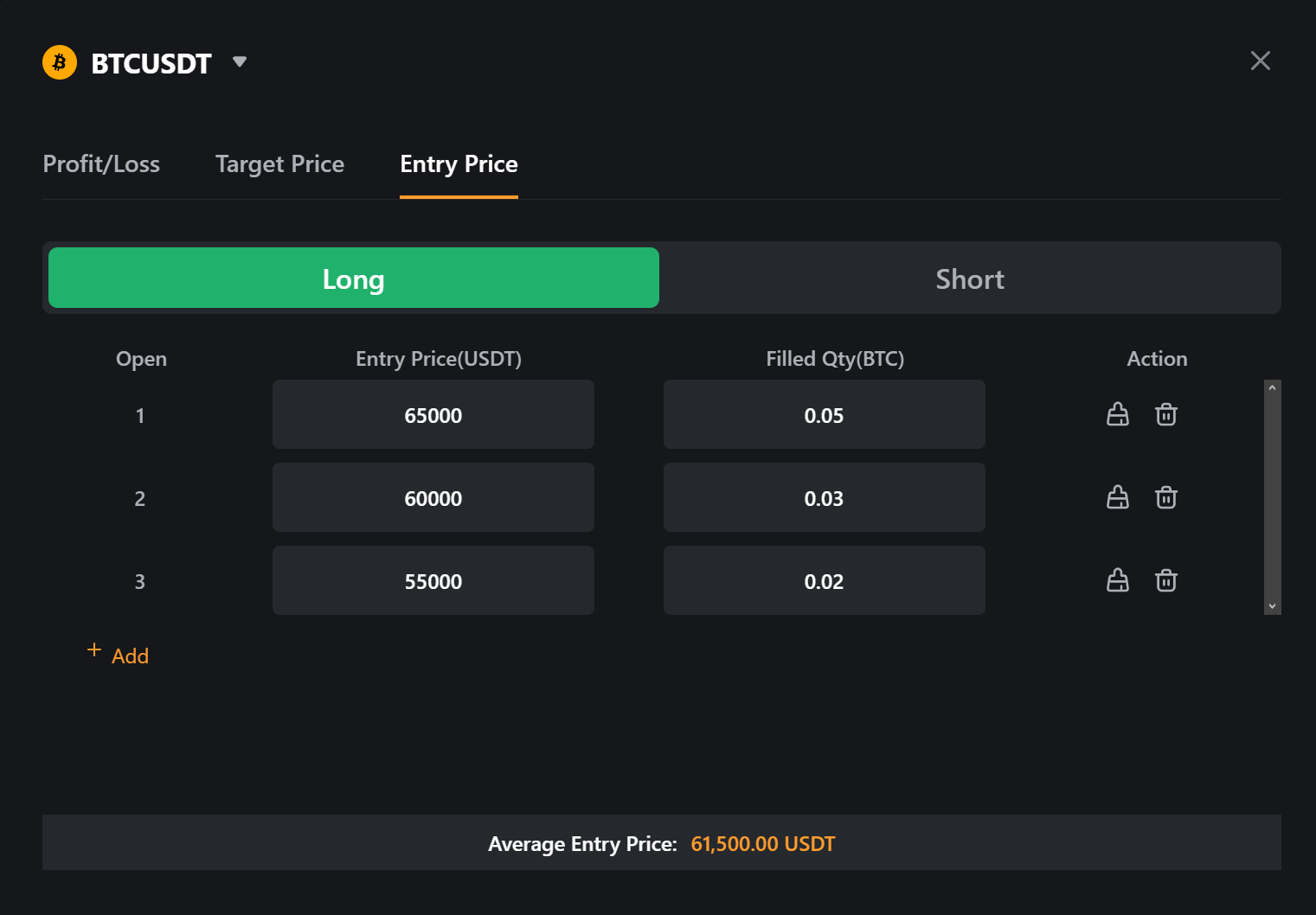

3. Calculate entry price

This is useful for position building or averaging down. Input multiple entry prices and quantities to find your Average Entry Price (AEP).

Example: If you enter prices of $60,000, $64,000, and $56,000 with varying quantities, the calculator might show an AEP of $59,000 USDT.

Pro tip: Use the calculator regularly to refine your strategy, and to ensure that your trades align with your risk tolerance within the UTA framework.

Key features and benefits of trading on Bybit

Bybit offers a suite of advanced features designed to provide a competitive edge while ensuring a stable and secure trading environment. Whether you’re a high-volume institutional trader or just beginning your derivatives journey, the platform provides institutional-grade tools within the UTA framework.

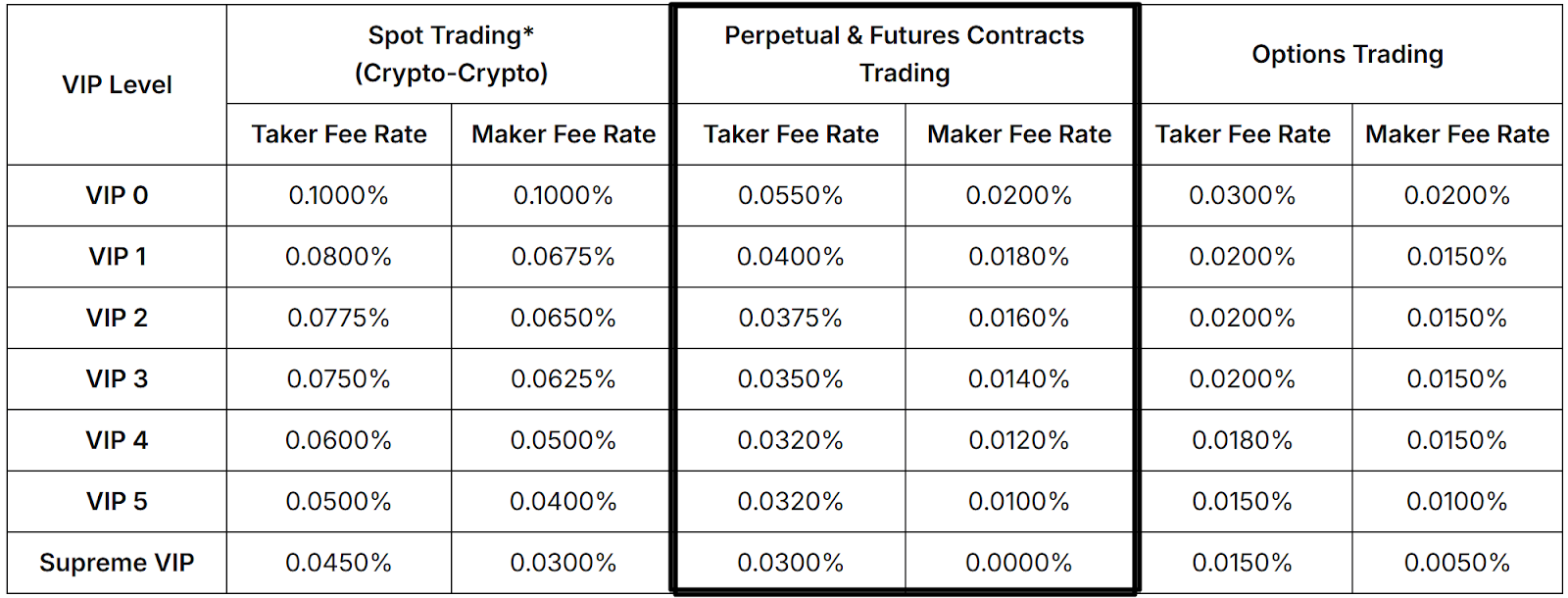

Competitive fees and high liquidity

Bybit is renowned for its deep liquidity, which ensures that even large orders can be executed with minimal slippage. Its platform uses a transparent maker/taker fee model, with rates that decrease as your trading volume increases through Bybit’s VIP and Pro programs.

Standard fees: For perpetual contracts, VIP 0 users enjoy competitive taker fees of 0.055% and maker fees of 0.02%.

Tiered rewards: High-volume traders can unlock significantly lower rates, with Supreme VIP members reaching 0.03% taker fees and 0.00% maker fees.

Efficiency: Deep order books mean faster execution and better price discovery, which is crucial for high-leverage trading.

Advanced risk management

Managing exposure is critical in volatile crypto markets. Bybit’s platform provides robust tools that allow you to automate your exit strategies and protect your capital.

TP/SL orders: Built-in Take Profit (TP) and Stop Loss (SL) functions allow you to set specific exit points at the moment of order placement.

Custom order types: Beyond standard orders, you can utilize Iceberg orders to hide large position sizes, or Post-Only orders to ensure you always act as a market maker and earn maker fees.

Account-level protection: The UTA supports Portfolio Margin mode, which uses a risk-based model to calculate margin requirements based on the overall risk of your entire portfolio.

Secure environment

Security is the foundation of the Bybit ecosystem. The platform employs industry-leading protocols to safeguard user assets and data.

Cold storage: The majority of user funds are stored in multi-signature wallets, which require multiple authorized signers to approve any outgoing transaction, providing a high level of protection against unauthorized access.

System integrity: Bybit features rigorous security standards, including two-factor authentication (2FA), advanced encryption, and regular security audits to ensure a resilient infrastructure.

Trading strategies for crypto perpetual futures

Technical and fundamental analysis

Technical analysis: Traders analyze price charts to spot patterns or indicators suggesting potential market movements. Popular tools include:

Moving averages: Identify trends by smoothing price data over a set period.

Relative strength index (RSI): Gauge market momentum and overbought/oversold conditions.

Moving average convergence divergence (MACD): Signal possible trend reversals or continuations.

Fundamental analysis: This approach involves assessing market trends, news, and economic events to anticipate future price changes. Traders monitor developments such as regulations, technological upgrades, and macroeconomic shifts.

Trading futures involves speculating on the price movements of underlying assets, allowing traders to leverage their positions and potentially maximize returns.

Hedging: Traders open an opposite position in perpetual futures to protect their existing crypto assets from price volatility. For instance, holding Bitcoin but anticipating a short-term drop can be hedged by opening a short position in BTC perpetual futures. With the UTA, your hedge positions can benefit from offset margin requirements, potentially reducing the total margin needed to maintain both positions simultaneously.

Arbitrage: This strategy exploits price differences between different markets. Traders can buy the asset in one market and simultaneously sell it in another to capture the price gap. The UTA streamlines this by providing a single point of access to various markets, allowing for faster execution and better capital management.

Understanding margin requirements and risk management

Initial margin is the minimum amount needed to open a leveraged position. For example, to open a $10,000 BTCUSDT position with 10x leverage, you need an initial margin of $1,000 USDT. This acts as collateral and allows you to control larger positions with smaller capital.

Position margin is the amount required to keep a position open. It changes with market conditions and leverage. For instance, if your leverage is 20x for a $10,000 trade, your position margin is 5% of the trade size, or $500 in USDT.

Maintenance margin is the minimum balance needed to keep the position active. In the UTA, if your account's MMR reaches 100%, liquidation is triggered. Falling below this level will result in your positions being closed automatically to prevent further losses.

Liquidation price is the price at which your position automatically closes. For example, if you open a BTCUSDT long position at $60,000 with 20x leverage, your liquidation price will be around $57,300, depending upon market volatility and funding fees.

Bybit’s risk management tools

Bybit provides essential tools, such as stop-loss orders and the UTA position calculator, to help you plan effectively. The UTA interface provides real-time alerts and detailed risk metrics such as the account-level MMR to help you avoid liquidations during market swings.

Conclusion

Perpetual futures allow you to speculate on asset prices without the limitations of fixed expiration dates. They provide flexibility and liquidity needed to navigate the 24/7 crypto market. However, these benefits come with significant risks, particularly when utilizing high leverage.

Bybit’s Unified Trading Account enhances this experience by centralizing your assets and providing a sophisticated, account-level margin system. This architecture empowers you to use unrealized profits as margin, manage diverse product types from a single interface and utilize robust risk management tools, such as the UTA Position Calculator and TP/SL orders.

By combining these essential features with clear maintenance margin rate requirements, Bybit ensures that you have the resources to strategically manage your positions and navigate market volatility with confidence.

Ready to start trading on Bybit? Create your account now and explore our flexible perpetual futures contracts within the Unified Trading Account.

#LearnWithBybit