How to Get Started With Crypto Futures Trading on Bybit

Crypto futures enable traders to hedge against market risks, amplify their position sizes with leverage and execute different strategies without owning the underlying asset. On an intuitive and user-friendly trading platform like Bybit, you can access a wide range of futures contracts with top-tier liquidity.

In this article, we'll introduce crypto futures trading, show you how crypto futures contracts work and discuss the different futures contracts available on Bybit. We’ll also provide a comprehensive step-by-step guide that shows you how to get started with crypto futures trading on Bybit.

Key Takeaways:

Crypto futures contracts are a type of derivatives that let you buy or sell an underlying digital asset at a pre-agreed price at expiration.

The key components of a crypto futures trade include the symbol, underlying asset, contract size and maintenance margin.

By trading crypto futures on Bybit you can amplify your potential returns with up to 50x leverage, take advantage of top-tier liquidity and cost-efficient fees, and trade on an intuitive and user-friendly platform that’s tailored for both beginning and veteran traders.

What Are Crypto Futures Contracts?

Crypto futures are derivatives trading contracts that represent the right to buy or sell an underlying cryptocurrency at a set price at a future date. In a futures trade, the buyer is obliged to purchase the underlying asset at the expiration date.

These derivatives trading contracts originate from the traditional finance (TradFi) industry. That said, there are a few key differences between crypto futures and their conventional counterparts.

On the one hand, traditional futures are strictly regulated and can only be traded when the respective stock exchange is open. Also, they represent general market assets, such as stocks, forex and commodities. In contrast, crypto futures track digital asset prices that can be traded at any time, and their regulation varies by jurisdiction.

Crypto futures enable traders to gain exposure to cryptocurrencies without actually owning them. However, the primary benefit of these contracts is their ability to amplify your position size with leverage. By doing so, you take higher risks to trade with less capital and increase your potential returns.

Types of Crypto Futures Contracts on Bybit

Based on the underlying asset, you can trade three types of crypto futures contracts on Bybit:

Type | BTC Futures | ETH Futures | SOL Futures |

Symbol | e.g., BTC-29NOV24 | e.g., ETH-29NOV24 | e.g., SOL-29NOV24 |

Underlying Asset | BTC | ETH | SOL |

Quoted in | USDC | USDC | USDC |

Settled in | USDC | USDC | USDC |

Tick Size | 0.5 USDC | 0.05 USDC | 0.01 USDC |

Minimum Order Size | 0.001 BTC | 0.01 ETH | 0.01 SOL |

Supported Leverage | Up to 50x | Up to 50x | Up to 50x |

Settlement Interval | Every 8 Hours — 12AM (Midnight), 8AM and 4PM UTC | Every 8 Hours — 12AM (Midnight), 8AM and 4PM UTC | Every 8 Hours — 12AM (Midnight), 8AM and 4PM UTC |

Delivery Time | 8AM (UTC) on Delivery Date | 8AM (UTC) on Delivery Date | 8AM (UTC) on Delivery Date |

Delivery Price | Average of Index Prices 30 mins Before Delivery | Average of Index Prices 30 mins Before Delivery | Average of Index Prices 30 mins Before Delivery |

Delivery Fee | 0 | 0 | 0 |

Trading Hours | 24 Hours, 7 Days a Week | 24 Hours, 7 Days a Week | 24 Hours, 7 Days a Week |

Contract Variations | Weekly, Bi-Weekly, Tri-Weekly, Monthly, Bi-Monthly, Quarterly, Bi-Quarterly | Weekly, Bi-Weekly, Tri-Weekly, Monthly, Bi-Monthly, Quarterly, Bi-Quarterly | Weekly, Bi-Weekly, Tri-Weekly, Monthly, Bi-Monthly, Quarterly, Bi-Quarterly |

Eligible Account | Unified Trading Account | Unified Trading Account | Unified Trading Account |

Eligible API Version | Open API V5 | Open API V5 | Open API V5 |

In addition to standard crypto futures, you can also trade inverse futures contracts on Bybit. With inverse futures, you can generate returns when the underlying asset's price declines, without taking a short position. Examples include BTCUSD1227 and ETHUSD1227.

You can also trade perpetual crypto futures on Bybit. Unlike standard futures contracts, perpetuals don't have an expiration date, meaning you can hold them for virtually indefinite periods. These derivatives trading contracts use the funding rate as a mechanism to track the spot price. On Bybit, you can access a wide range of crypto perpetuals, such as BTCUSDT, ETHUSDT and SOL-PERP.

How Do Crypto Futures Contracts Work?

By trading a crypto futures contract, you agree to buy or sell the underlying asset at the expiration date. This allows you to set your price in advance. You can manage crypto futures on Bybit via your Unified Trading Account.

When you buy a contract on Bybit, you generate returns on the trade when the future price (which tracks the underlying asset's price) rises. On the other hand, shorting crypto futures allows you to profit when the contract's price falls.

For example, suppose you take a long position in BTC-27DEC24 with a 1 BTC position size. Here you agree to purchase 1 BTC on December 27, 2024 for 72,000 USDC. (The latter is the current Bitcoin price as of the time of this writing on Nov 4, 2024.) Let's say BTC's price increases to 100,000 USDC by the expiration date. In that case, you’ll earn 28,000 USDC, minus trading fees. However, if Bitcoin’s price falls to 50,000 USDC by December 27, you’ll have a loss of 22,000 USDC.

Crypto futures have multiple important components, such as the contract symbol, expiration date, underlying asset, contract size and maintenance margin.

Futures Contract Symbol

Every futures pair has a symbol — for example, BTC-27DEC24. On Bybit, this symbol has four components for standard contracts:

A root identifying the asset (BTC)

A day code (27)

A month code (DEC)

A year code (24)

Combining the day, month and year codes (e.g., 27DEC24) gives you the contract's expiration date.

Expiration Date

The expiration date (e.g., December 27, 2024 for the BTC-27DEC24 contract) refers to the date at which your crypto futures contract will be settled. This is also the last day you can trade the contract.

At expiration, your crypto futures contract is settled in cash, or via the underlying asset's (e.g., BTC) physical delivery. On Bybit, the BTC-27DEC24 derivatives contract settles in USDC, with delivery taking place on December 27, 2024 at 8AM UTC. The contract's delivery price is determined by the average index price in the final 30 minutes before expiration. Bybit charges no delivery fees for crypto futures traders.

Underlying Asset and Contract Size

The underlying asset is the cryptocurrency you buy or sell with a crypto futures contract. Besides the underlying asset, it's also important to learn which token the contract is settled in at the expiration date. In the BTC-27DEC24 contract, these are as follows:

Underlying asset: BTC

Settled in: USDC

Each crypto futures pair has a contract size (the amount of the underlying asset delivered for a single contract). With Bybit, the contract size equals one unit of the underlying cryptocurrency (e.g., 1 BTC for BTC-27DEC24).

Maintenance Margin for Futures Positions

Maintenance margin refers to the minimum amount of margin you must have to maintain your position or account. If your position margin falls below this level, a liquidation will occur to prevent you from falling into negative equity. Thus, the maintenance margin is a critical component to consider if you use leverage to amplify your potential gains with crypto futures.

At Bybit, the maintenance margin level for crypto futures contracts is based on various risk tiers. Each tier has its own risk limit (maximum position size in USDC) and maximum leverage. Greater risk limits come with higher tiers and maintenance margin rates, as well as lower leverage.

For example, for the BTC-27DEC24 contract, the maintenance margin rates would be set as follows:

Tier 1:1.5%, with a 375,000 USDC risk limit

Tier 20: 11%, with a 2.75 million USDC risk limit

How to Get Started With Crypto Futures Trading on Bybit

As a user-friendly and intuitive exchange, Bybit offers a futures trading platform that’s an excellent choice for both beginning and experienced traders.

The following is a step-by-step guide to help you get started with crypto futures trading on Bybit.

Step 1: Open a Unified Trading Account

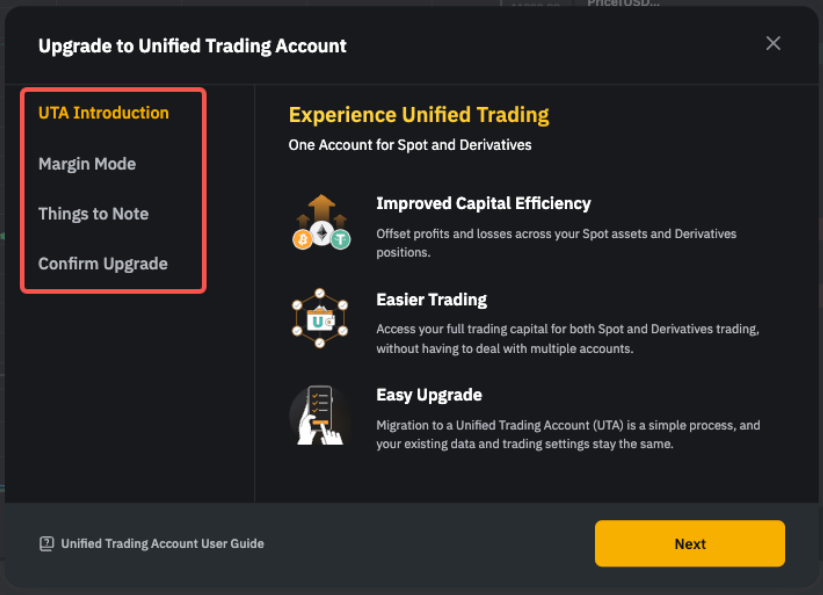

With a Unified Trading Account, you don't have to switch from one instrument account to another to tailor your trading experience, risk management and account finances. Most importantly, a UTA is mandatory for trading crypto futures contracts on Bybit.

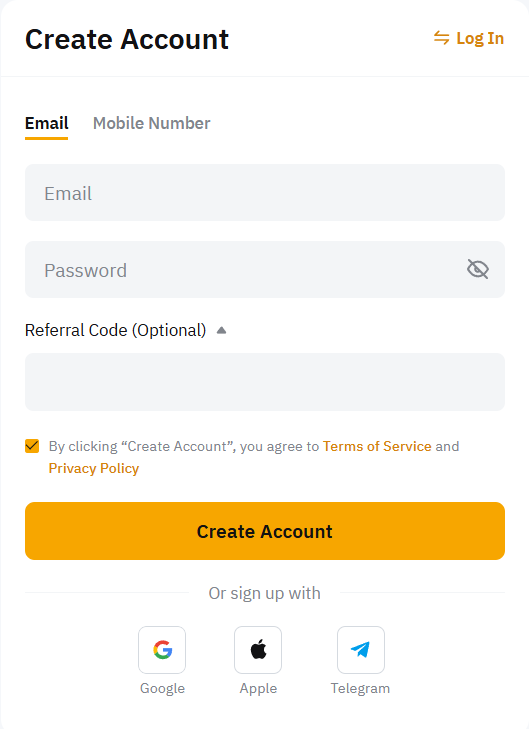

To open a UTA, you need to already have an account with Bybit. If you don't have one, use this link to register (and for ID verification). For new registrations, Bybit will automatically provide users with a UTA.

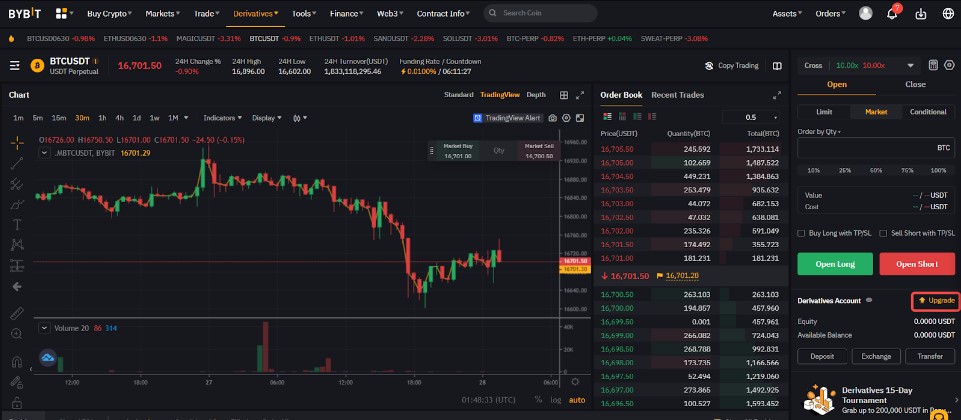

If you have a Standard Account, you can upgrade it to a Unified Trading Account by clicking on Upgrade on the Trade page in the trading widget next to your account.

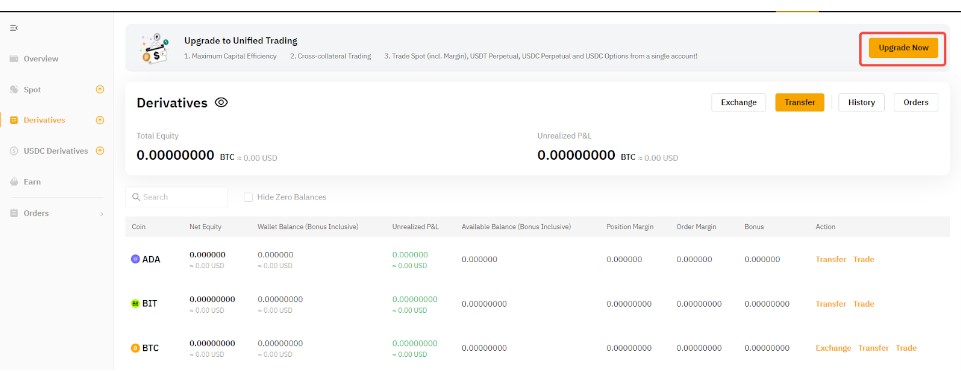

Alternatively, you can head to the Assets page and click on Upgrade Now in the Spot or Derivatives menu.

Next, read the details shown in the pop-up, acknowledge Bybit's Trading Rules and Terms of Service for the UTA and click on Confirm Upgrade. Now that your Unified Trading Account is ready, you can start trading crypto futures contracts.

Step 2: Fund Your Unified Trading Account

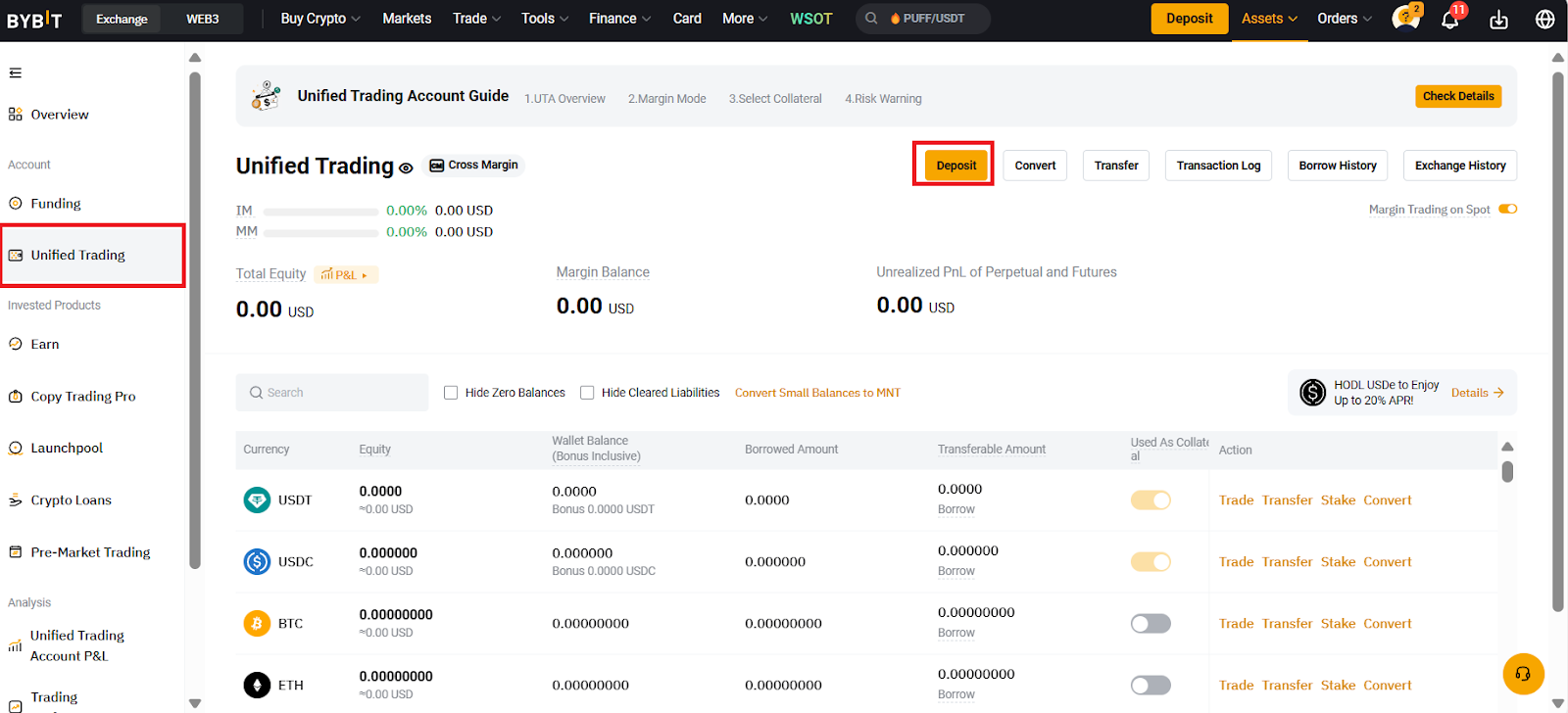

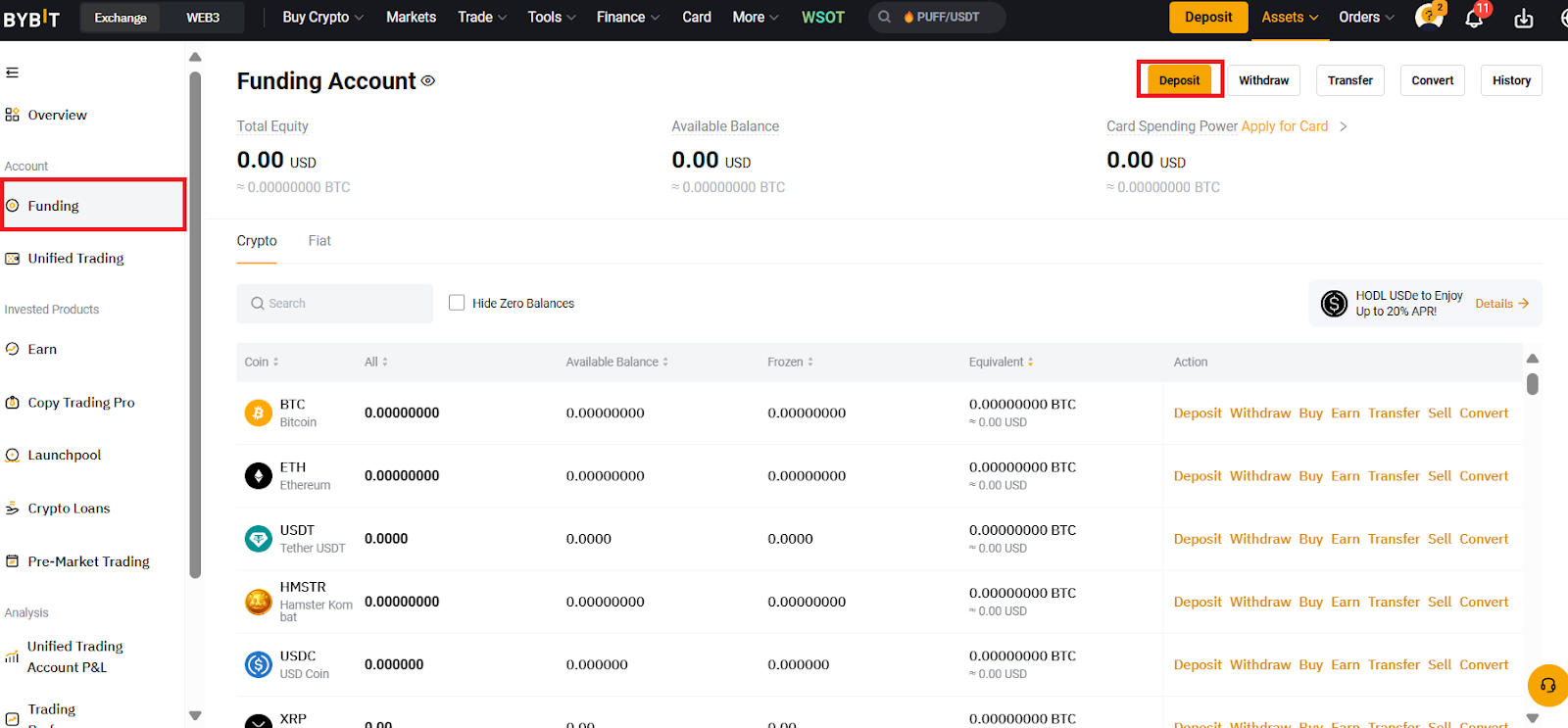

Head to the Assets page, select Unified Trading and click on Deposit.

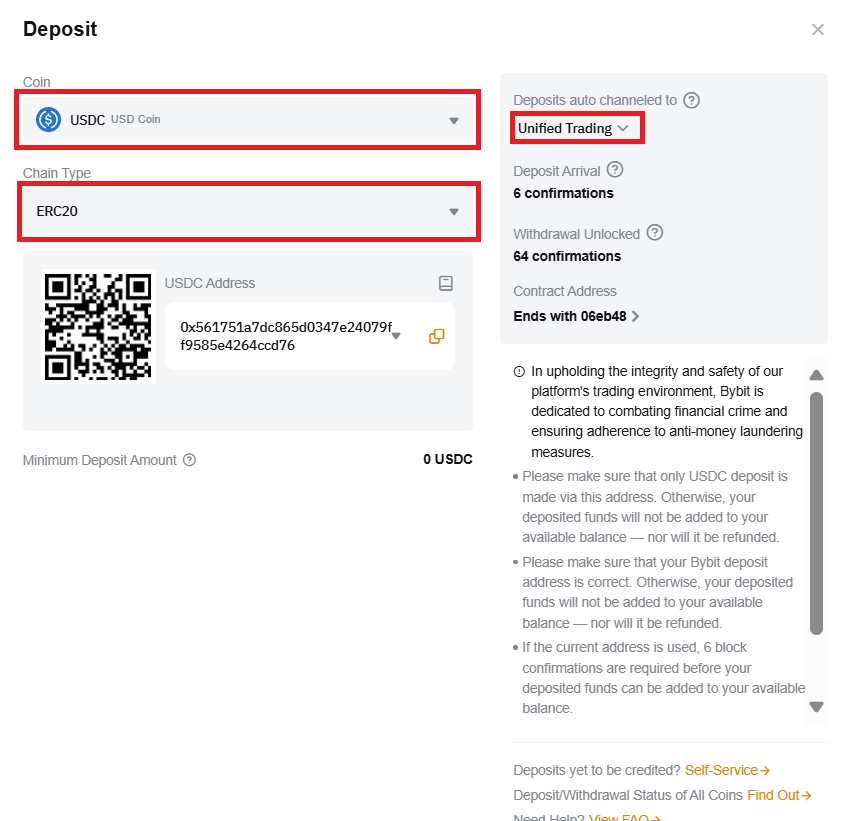

In the pop-up window, choose your desired cryptocurrency and blockchain. To avoid any losses, please always ensure that the selected network corresponds to the chain on which it resides. For example, choose ERC-20 if you’re transferring USDC to your Bybit account from Ethereum.

Set Unified Trading to auto-channel deposits to your UTA, and initiate a transaction from your wallet to the address displayed on the page.

Besides crypto, you can also deposit fiat currency via the Funding menu.

Step 3: Open a Crypto Futures Position

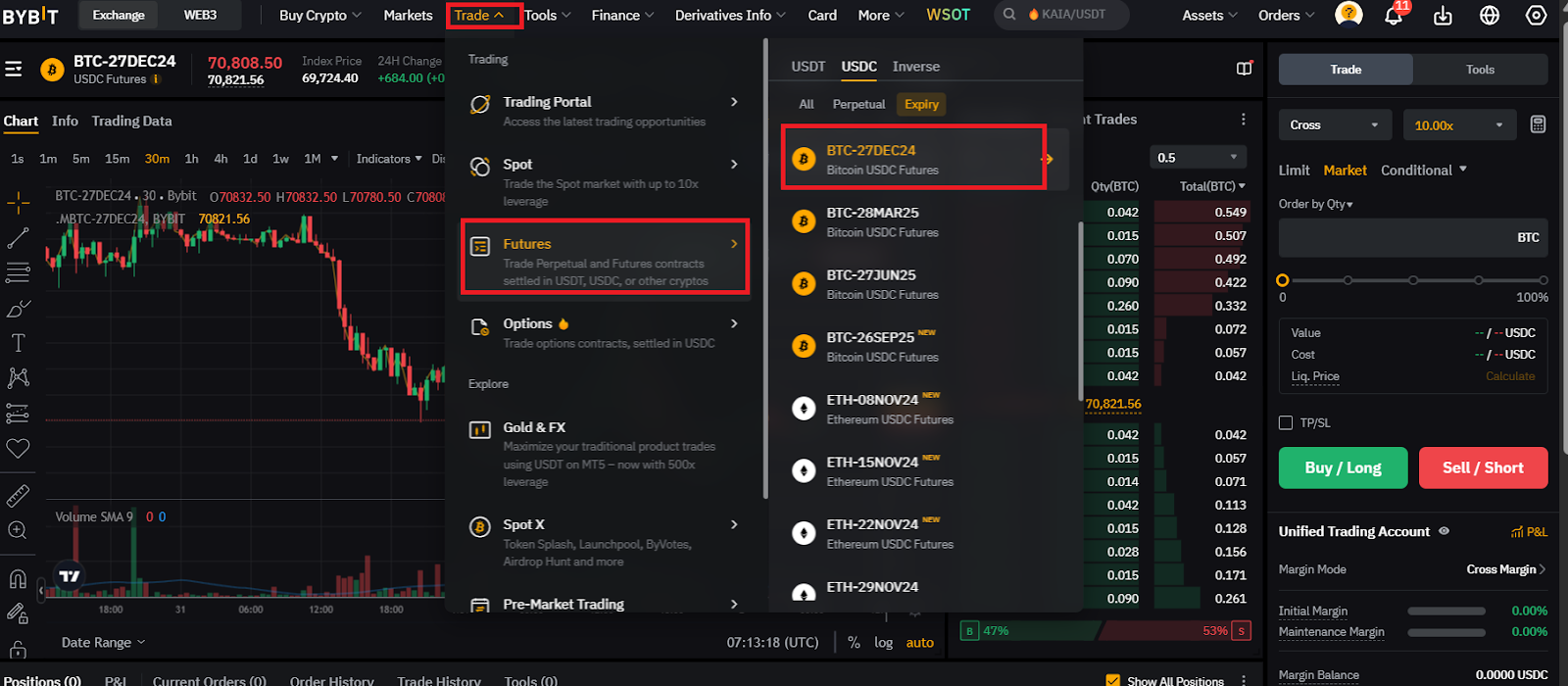

After funding your UTA, the next step is to open a crypto futures position on Bybit. To do that, click on Trade, choose Futures and tap on the symbol of your preferred contract. For this guide, we have selected BTC-27DEC24.

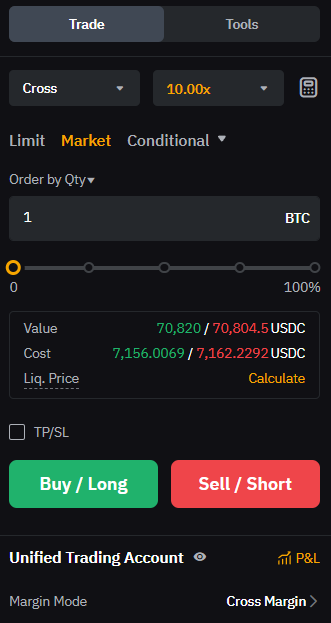

Once you’ve analyzed the crypto futures market via fundamental and/or technical analysis to determine an entry point, use the trading widget on the right to open a position.

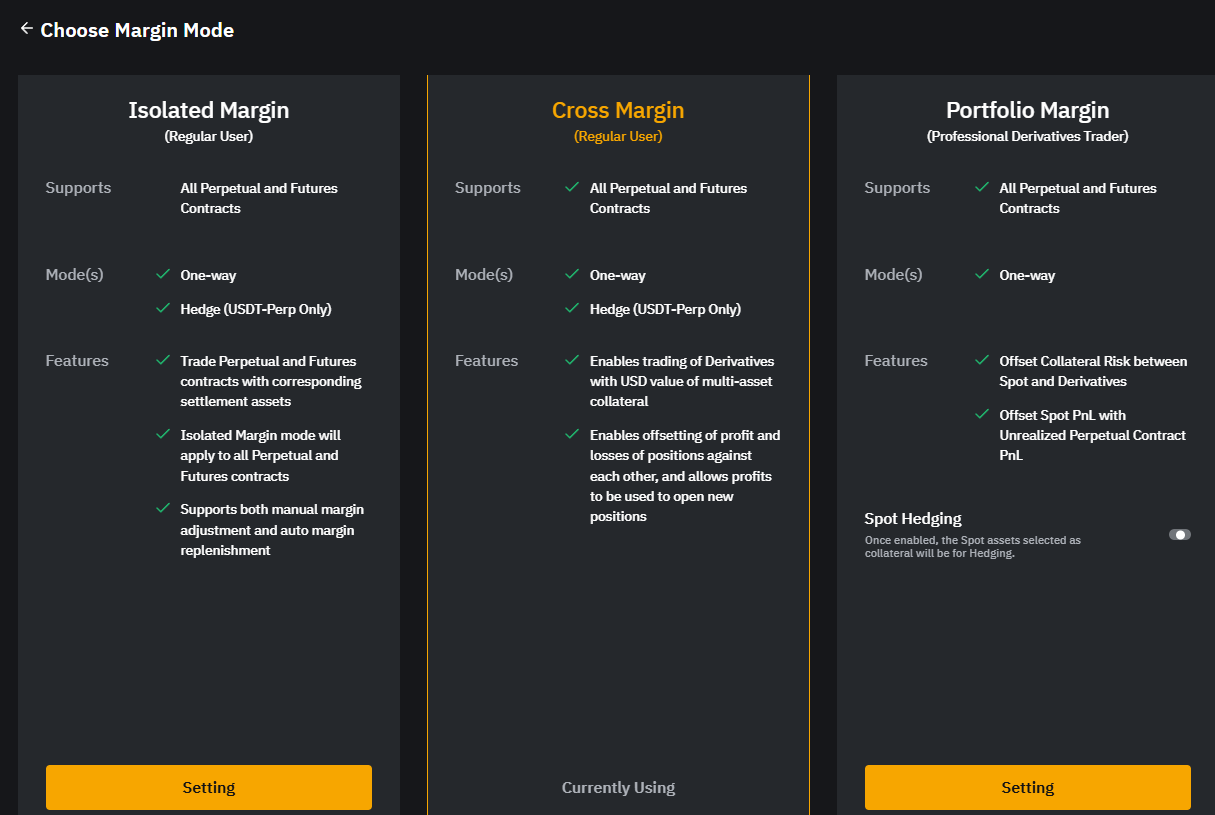

First, choose your desired margin mode: Isolated Margin, Cross Margin or Portfolio Margin (learn more about these here).

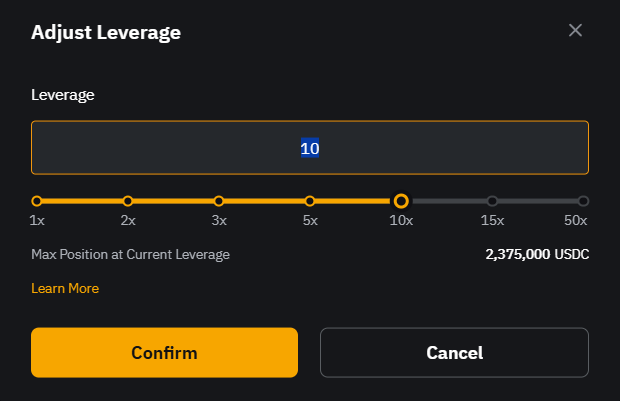

Next, adjust the leverage for your position. Remember, higher leverage means greater risks and more potential returns for the trade. When you’re ready, click on Confirm.

Select whether to place a limit, market or conditional order (learn more about these order types here), and set the desired order amount.

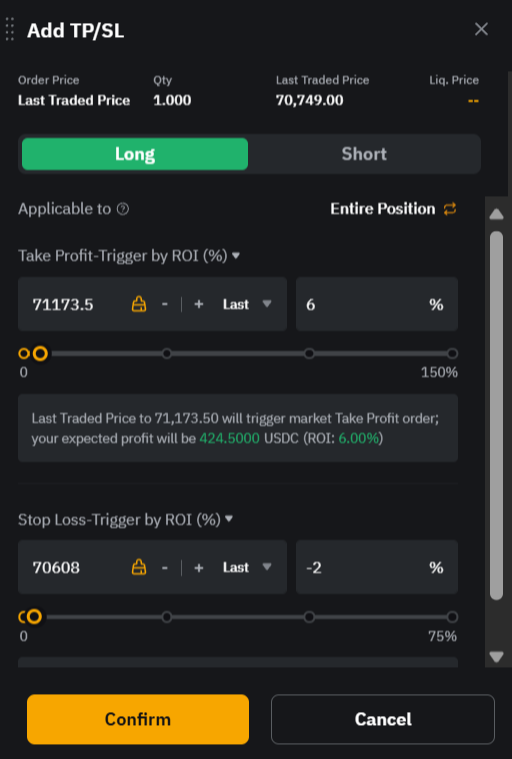

By ticking the box next to TP/SL, you can set a stop-loss order and/or a take-profit order for your trade to help manage your risks efficiently. Click on Confirm to proceed.

Finally, after reviewing your order, click on Buy/Long to open a long position or Sell/Short to open a short futures position. Bybit's robust matching engine will automatically execute your order. Market orders are executed at the current market price, limit orders at the set order price and conditional orders at the set order and trigger prices.

[Bonus] Start Trading With Zero-Risk Futures

From now through Jun 30, 2025, users interested in trying out crypto futures on Bybit can enjoy up to 50 USDT of losses from their very first trade. Click here to learn more about this exclusive event and claim your zero-loss voucher today!

Trading Strategies for Crypto Futures

To maximize your profits and minimize your risks in the crypto futures market, you need to follow sound trading strategies. Diligently following predefined rules and conditions helps you make informed, data-backed decisions and minimize the impact of your emotions on your trades. Below, we’ve collected some of the best trading strategies for the crypto futures market (you canfind more strategies for futures in this article):

Hedging: Open a futures position in the opposite direction of an existing trade to minimize the risk of potential losses.

Day trading: Use same-day futures trades to profit from short-term crypto price movements.

Scalping: Generate returns on small price movements with this short-term futures trading strategy.

Swing trading: Open crypto futures positions to take advantage of short- to medium-term price movements.

Position trading: Profit from long-term digital asset price movements.

Effective crypto futures trading strategies incorporate multiple tools and practices to manage risks. Examples include stop-loss and take-profit orders, diversified portfolios, hedging, and never risking more capital that you can afford to lose.

Benefits of Trading Crypto Futures on Bybit

Trading crypto futures on Bybit provides traders multiple benefits:

No delivery fees

Cost-efficient trading fees

Access to top-tier liquidity

Up to 50x leverage via Bybit’s Unified Trading Account

Enhanced capital management and leverage opportunities with Portfolio Margin

The ability to hedge against market risks

Risks of Crypto Futures Trading

Crypto futures are risky financial products. Some of the potential risks to traders are as follows:

Leverage increases the risk of liquidations and financial losses

High market volatility

Regulatory uncertainty

Not suitable for traders without the knowledge or experience to manage risks efficiently

Conclusion

Crypto futures trading enables you to amplify your potential returns, and to hedge against market volatility and other risks.

However, crypto futures are risky financial products, and traders must be aware of the potential risks. Examples include high volatility, potentially leading to rapid and significant losses; leverage risks, which could amplify losses or lead to a margin call; liquidation risk when margin falls below the maintenance margin level; and liquidity risks for smaller crypto assets.

With Bybit's user-friendly and intuitive trading platform, you can take advantage of top-tier liquidity and cost-efficient fees to maximize your profits. In addition, you can access multiple tools for efficient risk management.

Are you ready to get started? Sign up today to trade crypto futures on Bybit!

#LearnWithBybit