5 Best Trading Strategies You Can Use to Trade Options on Bybit

Although cryptocurrencies are a niche in the finance realm, the crypto industry has made great strides in recent years. From IPO-esque Launchpad and Launchpool projects to structured products like Bybit’s Shark Fin, plenty of TradFi elements are being adopted for crypto investors and speculators to generate extra yield.

The latest innovation in this space is crypto derivatives. By employing crypto derivatives trading strategies, smart investors can stand to earn a tidy profit. Curious about finding out more? Scroll on as we cover everything you need to know about trading strategies for crypto derivatives.

What Is Crypto Derivatives Trading?

Before diving into specific strategies, it’s important to first understand the tools available in your arsenal. On Bybit, you’ll be able to trade all kinds of crypto derivatives. These range from Perpetual and Futures contracts that use stablecoins like USDT and USDC as collateral, to inverse Perpetual and Futures contracts that use the coin or token itself as collateral. For advanced strategies, you can trade crypto options as they offer more opportunities for hedging and enhanced gains.

Best Options Trading Strategies

The best thing about derivatives trading strategies is that they're varied to suit your trading style. Check out our list below for the best derivatives trading strategies tailored for you.

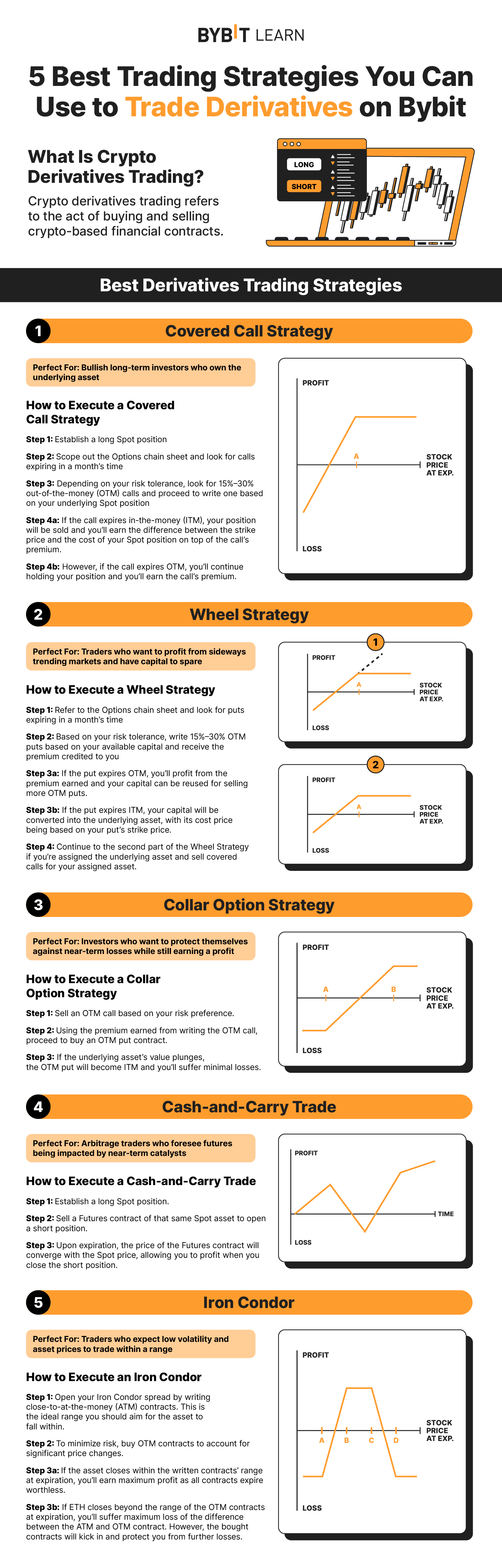

Covered Call Strategy

Perfect For: Bullish long-term investors who own the underlying asset.

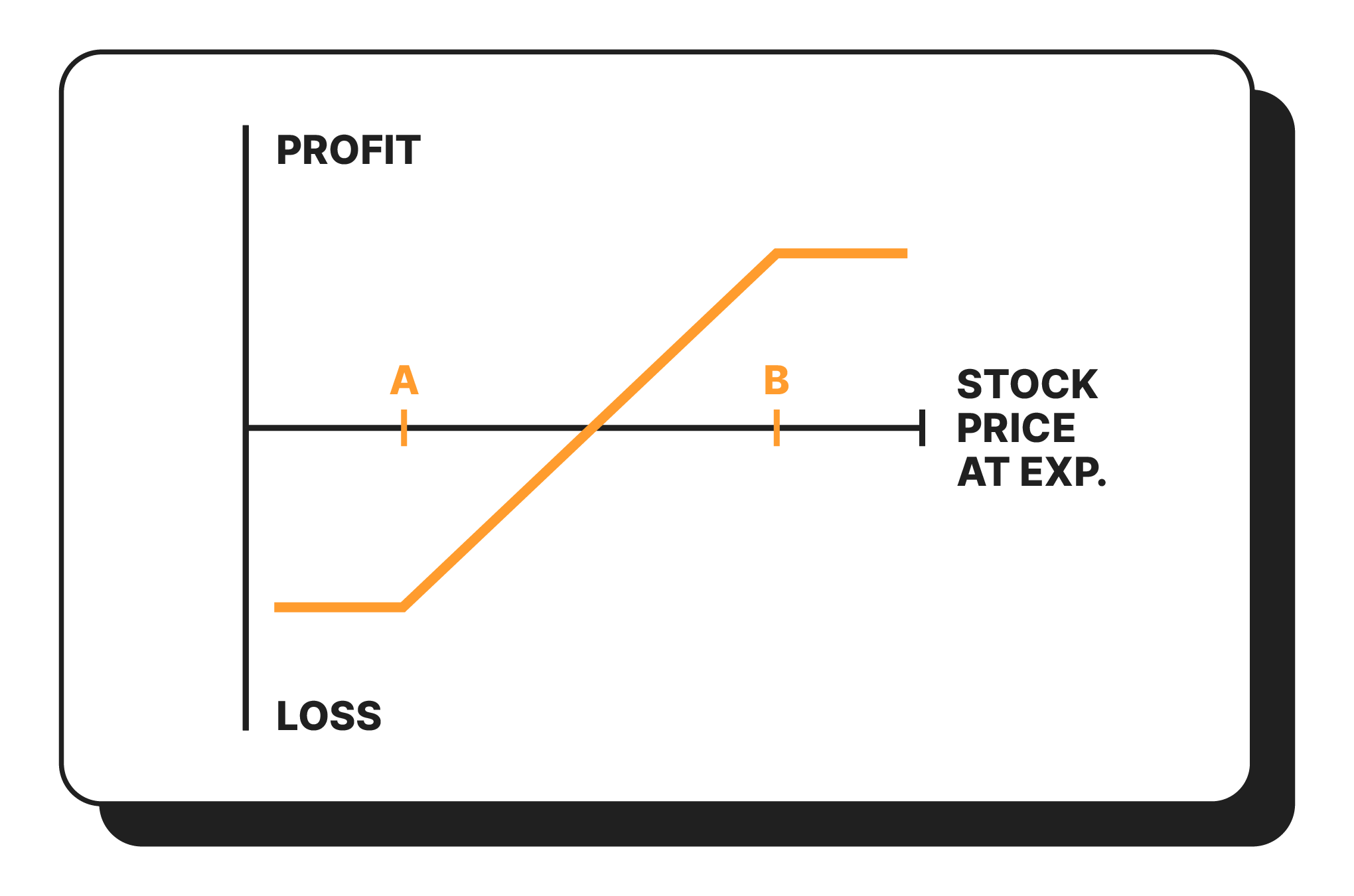

The Covered Call strategy comes in two parts: owning the asset and writing an out-of-the-money (OTM) call on said asset. While this neutral strategy might limit your upside, it allows investors to generate a steady flow of income in the form of call premiums. This allows long-term hodlers to benefit, even when the asset's price moves sideways or drops.

How To Execute This Options Strategy:

Step 1: Establish a long Spot position.

Step 2: Scope out the options chain sheet and look out for calls that are expiring in a month’s time.

Step 3: Depending on your risk tolerance, look out for 15% – 30% OTM calls and proceed to write one based on your underlying Spot position.

Step 4a: If the call expires in-the-money (ITM), your position gets sold and you’ll earn the difference between the strike price and cost of your Spot position on top of the call’s premium.

Step 4b: However, if the call expires OTM, you’ll continue holding your position and you’ll earn the call’s premium.

Example:

After buying 1 ETH at $1,200, you can write a covered call by selling a 1400C contract that's expiring a month out. Based on the ask-bid spread, a premium of about 1% of the ETH’s cost is credited to you. Upon expiring, if the ETH-1400C contract expires OTM, you’ll profit from the call’s premium and continue to hold the shares. If the call expires ITM, you’ll sell 1 ETH at $1,400 and pocket $200 and the call’s premium.

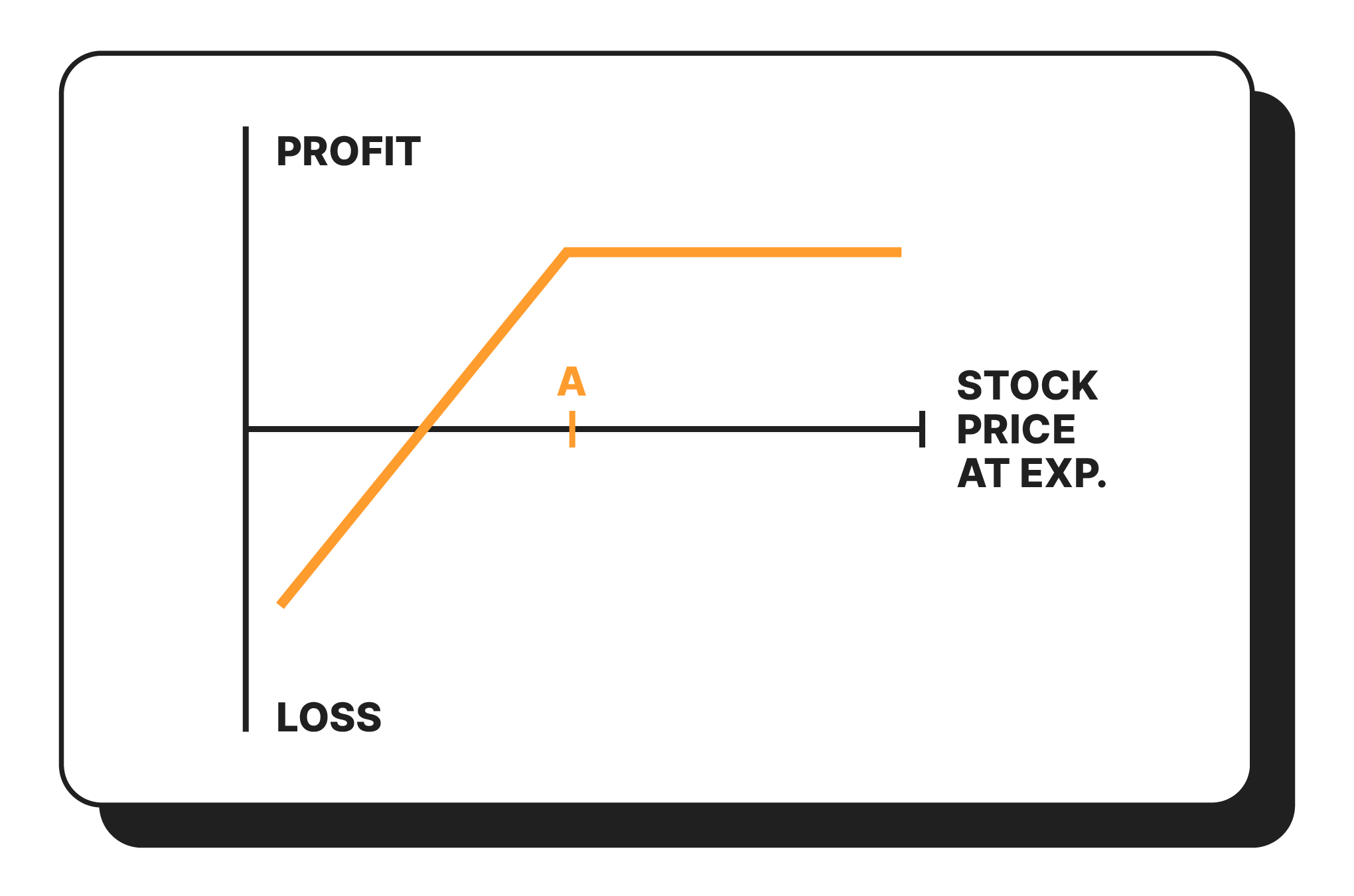

Wheel Strategy

Perfect For: Traders who want to profit from sideways trending markets and have capital to spare.

Keen on taking the Covered Call strategy one step further? Make sure to give the Wheel Strategy a try. Instead of simply opening a long spot position by buying your preferred crypto underlying asset, the Wheel Strategy involves two parts: selling cash-secured puts and covered calls.

After ensuring you have enough capital to fulfill contracts you’re assigned to, select a strike price to sell your put at. Should the put expire ITM, you can then proceed to sell covered calls for the underlying asset that’s assigned to you.

How To Execute This Options Strategy:

Step 1: Refer to the Options chain sheet and look for puts that are expiring in a month’s time.

Step 2: Based on your risk tolerance, write 15%–30% OTM puts based on your available capital and receive the premium credited to you.

Step 3a: If the put expires OTM, you’ll profit from the premium earned and your capital can be reused for selling more OTM puts.

Step 3b: If the put expires ITM, your capital gets converted into the underlying asset, with its cost price being based on your put’s strike price.

Step 4: Continue to the second part of the Wheel Strategy if you’re assigned the underlying asset and sell covered calls for your assigned asset.

Example:

Sell a BTC-15000P cash-secured put that’s expiring in a month. Then, if you’re assigned BTC because the put contract expires ITM, continue to run the wheel strategy by selling a BTC-17000C covered call. If the covered call expires ITM, you’ll earn a tidy profit and have capital to now sell more cash-secured puts.

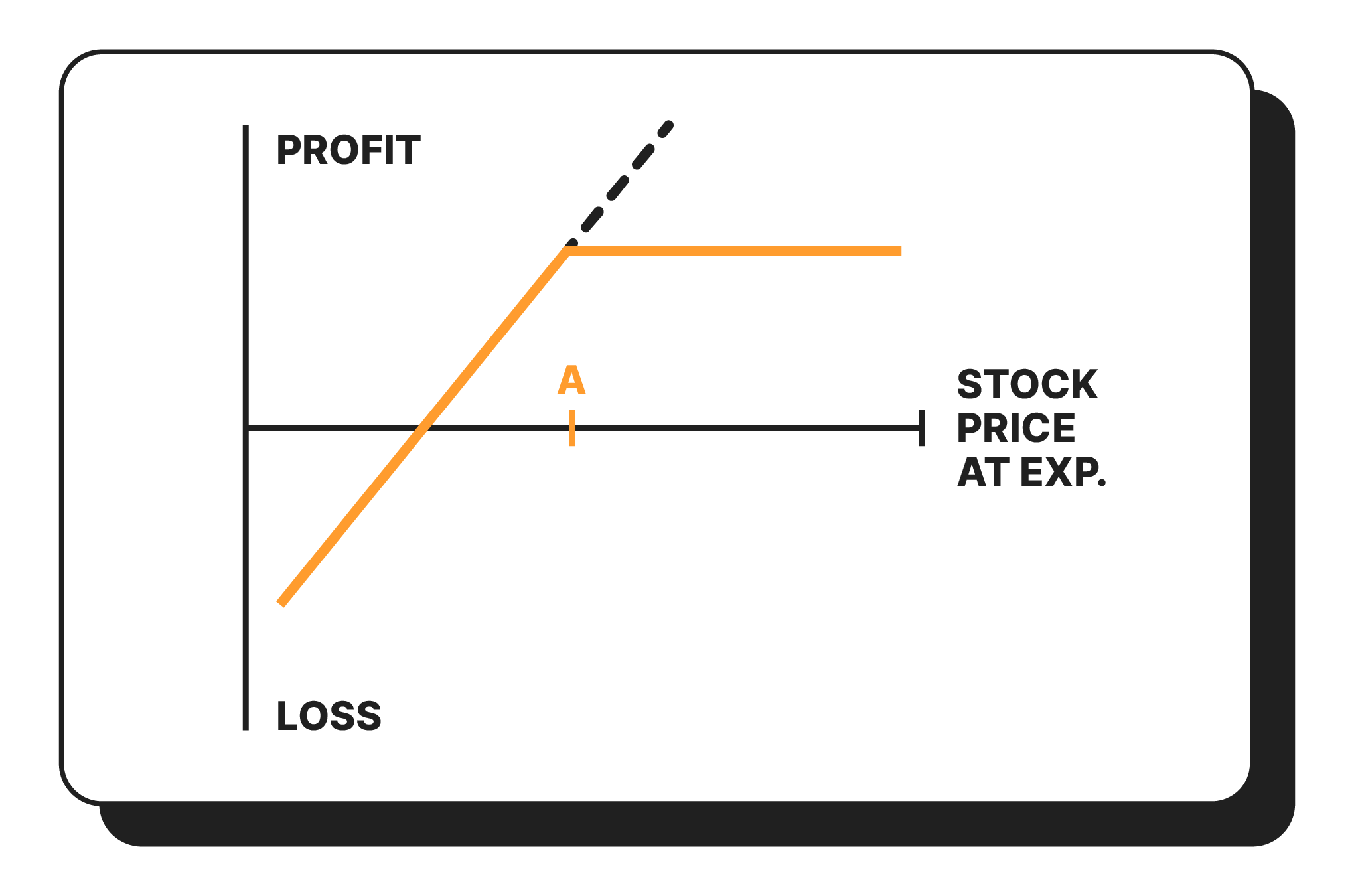

Collar Option Strategy

Perfect For: Investors who want to protect themselves against near-term losses while still earning a profit.

A final variation that we’d like to cover is the Collar Option strategy. Like the Covered Call strategy, this best derivatives trading strategy excels at limiting your risk while allowing investors to stay bullish in the grand scheme of things. What’s different is that Collar Option strategies involve an extra protective put that traders buy to guard against black swan events that cause the asset to massively plunge in value.

How To Execute This Options Strategy:

Step 1: Like the Covered Call strategy mentioned above, sell an OTM call based on your risk preference.

Step 2: Using the premium earned from writing the OTM call, proceed to buy an OTM put contract.

Step 3: If the underlying asset’s value plunges, the OTM put will become ITM and you’ll be able to suffer minimal losses.

Example:

After buying 1 ETH and writing an OTM call, utilize the Collar Option strategy by buying an OTM ETH put. This protects you from any short-term downside while allowing you to stay bullish in the long run. Should ETH suddenly crash in value, you can then proceed to rely on this hedge to minimize your portfolio losses.

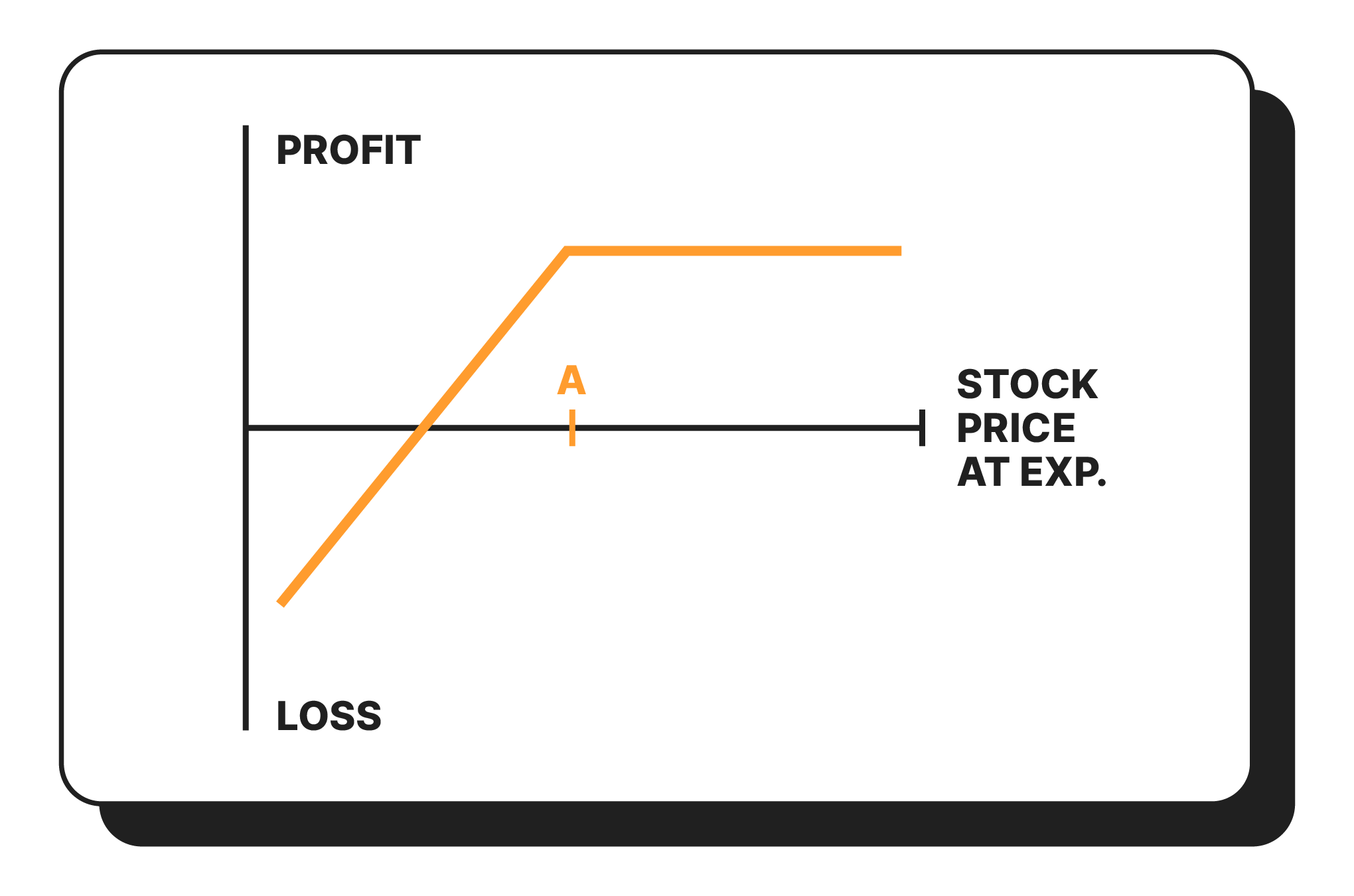

Cash-and-Carry Trade

Perfect For: Arbitrage traders who foresee futures being impacted by near-term catalysts.

Is a short-term catalyst weighing on the sentiment of crypto futures? Cash-and-Carry Trades are the best way to profit from this. Unlike the other best derivatives trading strategies on this list, Cash-and-Carry Trades offer a market neutral approach that minimizes volatility and guarantees risk-free profits. As an arbitrage strategy, this trade will only be viable if the short futures position exceeds the cost of the long Spot position.

How To Execute This Options Strategy:

Step 1: Establish a long Spot position.

Step 2: Sell a Futures contract of that same Spot asset to open a short position.

Step 3: Upon expiry, the price of the Futures contract will converge with the Spot price, allowing traders to profit when they close the short position.

Example:

Begin by buying 1 BTC and selling a BTC-JUN contract. For each position, you’d profit from the difference between the BTC Spot and Futures contract. In doing so, you’ll be exploiting the existing sentiment and profiting without exposure to any directional risk.

Iron Condor

Perfect For: Traders who expect low volatility and asset prices to trade within a range.

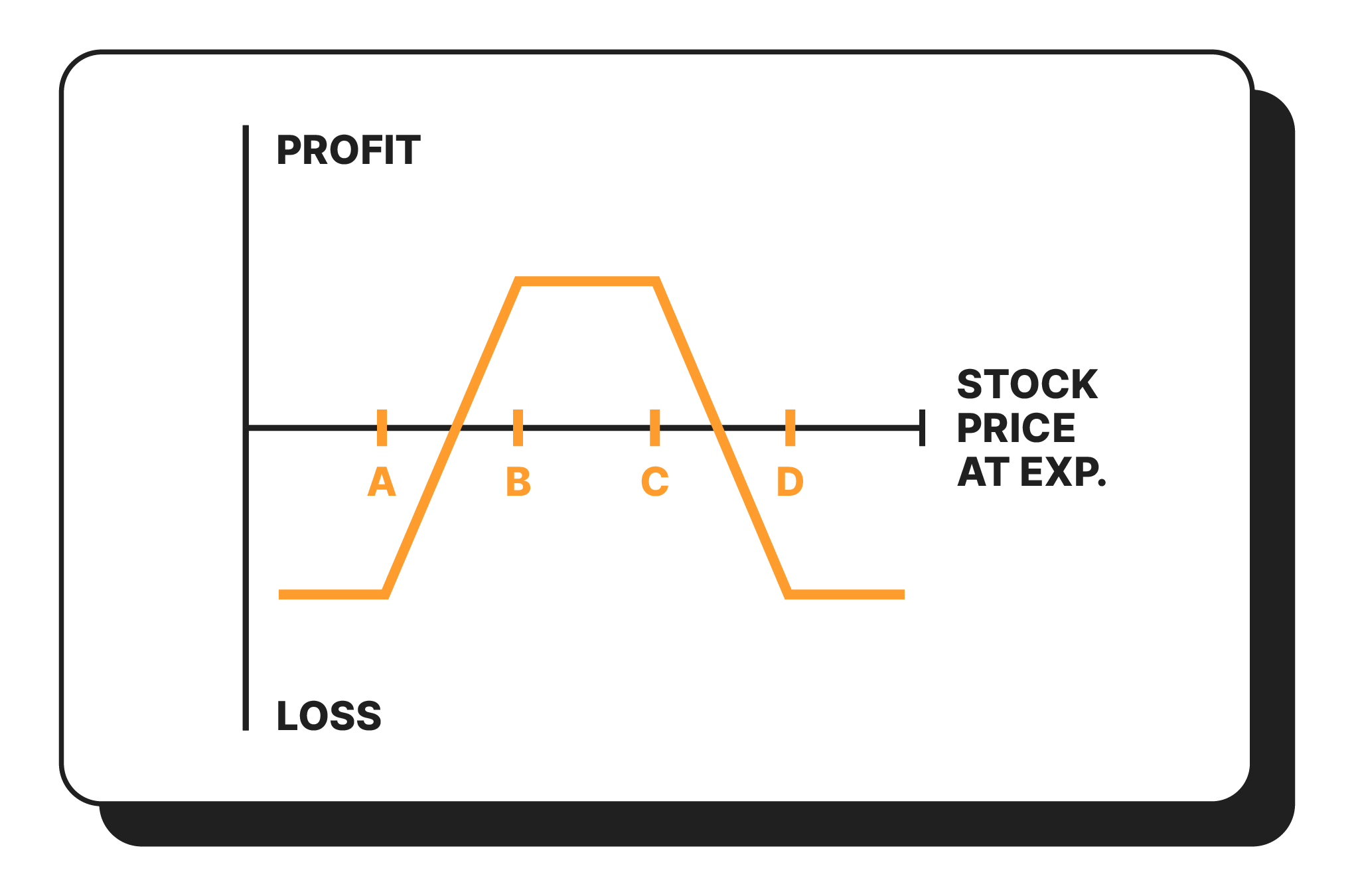

Option spread strategies like the Iron Condor combine calls and puts to ensure fixed losses and profits. Essentially, traders will buy and write an equal amount of OTM calls and puts to ensure volatility risks are accounted for while earning a guaranteed profit with each spread trade. During times of low volatility, Iron Condors excel because their multi-legged strategy guarantees high odds of profit.

How To Execute This Options Strategy:

Step 1: Open your Iron Condor spread by writing close to at-the-money (ATM) contracts. This is the ideal range you should aim for the asset to fall within.

Step 2: To minimize risk, buy OTM contracts to account for significant price changes.

Step 3a: If the asset closes within the written contracts’ range at expiry, traders will earn maximum profit as all contracts expire worthless.

Step 3b: If ETH closes beyond the range of the OTM contracts at expiry, traders will suffer maximum loss of the difference between the ATM and OTM contract. However, the bought contracts will kick in and protect traders from further losses.

Example:

Start by selling ETH-1150P and ETH-1250C, and buying ETH-1100P and ETH-1300C contracts. This will count as one Iron Condor spread. Maximum profit will be secured if ETH expires at $1,150-$1,250. On the flipside, traders will experience maximum loss when ETH expires below $1,100 or above $1,300.

The Bottom Line

We hope that this article has been helpful in educating you about the best crypto derivative trading strategies you can employ on Bybit. From the Wheel Strategy to Cash-and-Carry arbitrage trades, the sheer variety of derivatives for trade with us allows informed traders to protect their capital while maximizing opportunities for growth, regardless of market conditions and sentiment.

Interested in learning more about how options are priced? Our definitive guide to option greeks will be right up your alley. Alternatively, if you want to protect your portfolio during the bear market downturn, check out our guide to trading options and hedging.