Crypto Trading Fees: Comparing Crypto Fees Across Exchanges

Part 1: What Are Crypto Trading Fees & Why Do We Need to Pay Them?

Crypto trading fees are an intrinsic part of cryptocurrency exchanges. The fees are often paid to receive various kinds of trading and investment services on the exchange. The following guide will help you understand how these charges impact your bottom line.

What Are Crypto Trading Fees?

Crypto trading fees are collected by a crypto exchange when a user trades crypto, completes a transaction or invests in a crypto-related financial instrument.

Depending on the service, crypto platforms charge different kinds of fees. You can often view the fee structure on the Fee Schedule page published by the particular crypto exchange.

For instance, buying and selling a crypto coin incurs fees which can range between 0.05% and 0.25% of the transaction volume. Similarly, each time you withdraw a coin, you may need to pay a crypto withdrawal fee for transferring the coin to another online wallet. If you're an active investor who participates in different types of lucrative investment programs, you may be asked to pay investment fees.

To attract new customers, crypto exchanges typically run promotions so that new account holders can receive discounts on standard fees. For example, new users may receive a sign-up bonus when they trade a certain amount, which may offset their trading fees. Similarly, existing customers can enjoy attractive discounts by trading more, thus climbing up the various tiers reserved for loyal customers.

Retail vs. VIP Crypto Trading Fees

When you open an account on a crypto exchange, you're likely charged the standard retail fee, which is higher as compared to VIP tiers. Therefore, becoming a VIP member can save you a lot on typical crypto trading fees.

Almost every crypto exchange offers some kind of VIP program. Each one usually includes multiple VIP levels. However, the conditions to join can differ from platform to platform.

Generally, the most popular approach to becoming a VIP is to execute a minimum amount of crypto trading within 30 days. The more you trade, the higher the VIP level. For example, non-VIP members usually pay a 0.10% fee on spot crypto transactions compared to VIPs, who pay less than half that amount.

Trading a minimum amount of crypto is just one way to achieve VIP status. Depending on the crypto exchange, there are other methods as well. With Bybit, you can become a VIP in multiple ways. For instance, you can reach VIP 1 status by keeping more than $50,000 in your account. As soon as you meet this requirement, you’ll automatically be upgraded to VIP 1 or higher, based on your account balance or trading volume, in one to two business days.

Bybit is also one of the few crypto trading platforms that allow users to achieve VIP status without waiting for the 30-day transition period. If you're an active trader on another crypto exchange, you can either submit a request or talk to a Bybit customer support rep to bypass the 30-day rule.

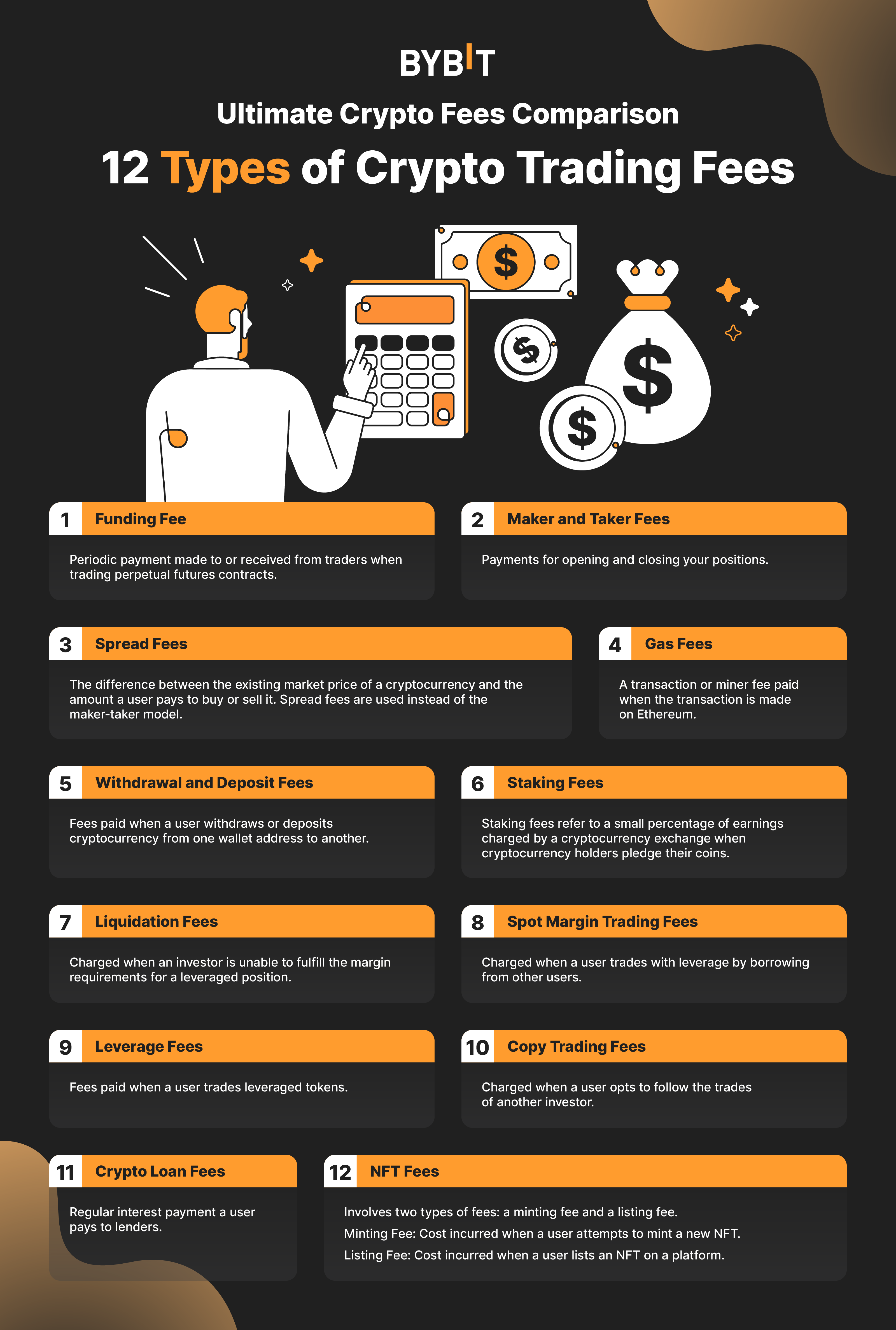

Types of Crypto Trading Fees

Recently, crypto exchanges have introduced several new investment products exclusive to the crypto ecosystem. This means that you’ll likely encounter plenty of DeFi projects with their own fee structures. To make things a little easier, we've compiled a brief guide to the types of crypto trading fees you're likely to come across.

Funding Fees

The funding fee is vital to perpetual contracts. If you trade perpetual contracts, you need to pay a funding fee to other traders, or receive it from them. In most cases, the funding fee is calculated every eight hours, which means that you can either pay or receive the fee three times during the entire day.

At the time of funding, if the perpetual future price is lower than the actual spot price (of the underlying asset), short position holders pay the funding fees to long position holders, and vice versa.

Just to give you some idea, the average funding rate for BTC is usually less than 0.01% per funding rate interval. This rate can differ across different crypto platforms. For example, the BTC funding rate on Bybit is generally a fraction of funding rates on other exchanges.

Depending on how you intend to use the funding fee, you can receive regular funding fees from other traders, use the funding rate for arbitrage, or treat it as just another fee you need to pay to trade perpetual futures contracts.

| Average Funding Rate for BTCUSDT Perpetual Contract* |

Bybit | 0.0000448% |

Binance | 0.00538% |

Gate.io | 0.0000704% |

KuCoin | 0.000417% |

OKX | 0.00391% |

Huobi | 0.00000569% |

Coinbase | N/A |

MEXC | 0.0000705% |

*Average historical funding rate for BTCUSDT Perpetual Contract from Oct 1, 2022 to Oct 31, 2022

Maker and Taker Fees

If you’re wondering what transaction fees are in crypto, remember that most crypto exchanges use the maker-taker fee model, instead of charging fixed transaction fees. These maker and taker fees are the fees that you pay for opening and closing your positions.

In simpler terms, you're charged a maker fee for every limit order and a taker fee for every market order. Usually, the maker fee is less than the taker fee, because when you place a limit order on the crypto exchange, you automatically become a liquidity provider. Since limit orders aren’t executed immediately, they sit in the order book, which improves liquidity.

In contrast, the taker fee is usually higher than the maker fee. Generally, you pay a taker fee on all market orders. Since trade execution on the market order is instant, your order doesn't sit in the order book, which takes away liquidity. In this case, therefore, you're charged a taker fee because you're removing liquidity from the exchange.

Bybit ran a zero fees campaign on all spot trading pairs, valid until Jan. 3, 2023. Users can enjoy trading with some of the newest tools on our Spot platform for free instead of paying the usual 0.10% maker and taker fees.

To promote perpetual and futures trading activities, Bybit offers large discounts on both maker and taker fees. The maker fee on futures trading is only 0.02% on standard accounts. Bybit VIP members pay 0.018% fees or less for trading perpetual and futures.

Spread Fees

Some exchanges use spread fees instead of the maker-taker fee model. The spread fee is determined by calculating the difference between the existing market price of a cryptocurrency and the amount the user pays to buy or sell it.

In most cases, spread fees are much higher than typical maker-taker fees. For instance, the average spread fee on cryptocurrency sales and purchases can be 0.5% on some exchanges, which is five times the fees charged by a typical crypto exchange using the maker-taker model.

Gas Fees

The term "gas fee" is associated with transactions on the Ethereum blockchain network. While other blockchain networks simply call this a "transaction fee" or "miner fee," every such transaction on Ethereum is known as a “gas fee.”

Almost all actions on the Ethereum blockchain require gas. If you transfer ETH, or Ether, to another wallet, you need to pay a gas fee because the Ethereum blockchain is involved in the process.

Transferring ETH isn't expensive, and you don't need to pay a high gas fee unless the network is congested. However, creating NFTs and executing smart contracts on the Ethereum blockchain can be quite expensive. In this case, the gas fee is much higher as compared to rival networks.

So, why do people pay a high gas fee to Ethereum? The answer is that it's easier to create smart contracts and build DApps on Ethereum than it is on most other blockchain networks.

Withdrawal and Deposit Fees

Crypto users need to pay withdrawal and deposit fees when moving cryptocurrency from one wallet address to another. The terms “withdrawal and deposit” may seem self-explanatory, but be sure never to ignore these fees. Exchanges may have different fees, and not every exchange offers the cheapest protocol to transfer assets between different wallets. In addition, there may be limitations regarding the minimum amount that you can transfer to take advantage of the lowest rates.

If you're an active trader who has multiple cryptos in your portfolio, your choice of transfer protocol (as well as potential limitations on withdrawals) can substantially impact the final price.

Staking Fees

Many exchanges offer staking as a way for users to earn passive income. Just as with a traditional savings account, you can stake your crypto or withdraw it at any time, although in some cases, you may need to pledge your coin for a certain duration before you can unlock it.

The staking reward for crypto coins is normally calculated via APR or APY, depending upon the platform. Staking is popular among crypto traders because it tends to offer a much higher yield than investors can find at traditional financial institutions. For instance, staking USDT and other stablecoins on a crypto exchange is a great way to earn passive income without the risk of price fluctuations associated with volatile crypto markets. Oftentimes, the exchange will take a small percentage of your staking rewards, which is referred to as a staking fee.

Liquidation Fees

A liquidation fee is charged when an investor is unable to fulfill the margin requirements for a leveraged position. In this case, the system automatically closes the open position and charges a liquidation fee.

Spot Margin Trading Fees

When trading spots, you can't go short. However, certain crypto exchanges will let you trade with leverage by borrowing from other users. If you use this strategy, the system will automatically borrow from those lenders, place a trade and charge you spot margin trading fees.

Leverage Fees

You’ll encounter leverage fees when trading leveraged tokens, instruments that don't have a typical settlement date. This also means that there’s no need to worry about margins and liquidation risks. Here are some crypto transaction fees associated with leveraged tokens:

- Subscription Fees: Charged when traders choose to purchase leveraged tokens.

- Redemption Fees: Charged when you wish to redeem a leveraged token.

- Management Fees: Charged daily to manage leveraged positions.

| Subscription Fees | Redemption Fees | Management Fees |

Bybit | 0.05% | 0.05% | 0.005% |

Binance | 0.1% | 0.1% | 0.01% |

Gate.io | N/A | N/A | 0.1% |

KuCoin | 0.1% | 0.1% | N/A |

OKX | N/A | N/A | N/A |

Huobi | Based on subscription quantity | Based on redemption quantity | Based on ETP holding share |

Coinbase | N/A | N/A | N/A |

MEXC | N/A | N/A | 0.001% |

Copy Trading Fees

You’re assessed copy trading fees when you opt to follow the trades of another investor. Most crypto platforms have some sort of copy trading program, which lets users automatically mirror and execute the trades of veteran traders. Some exchanges don't charge a copy trading fee because the lead trader is paid a percentage of the follower’s profits.

| Copy Trading Fees | Profit Sharing |

Bybit | Free | 10% |

Binance | N/A | N/A |

Gate.io | Free | 5% |

KuCoin | N/A | N/A |

OKX | N/A | N/A |

Huobi | Free | Up to 25% |

Coinbase | N/A | N/A |

MEXC | Free | Up to 15% |

Crypto Loan Fees

A crypto loan fee is the regular interest payment that you pay to lenders. This is usually much lower than the fee for a traditional loan. Most crypto exchanges facilitate the borrowing and lending of crypto loans. Depending on the type of loan, this can be borrowing coins, cash or a physical asset, such as real estate.

NFT Fees

NFT fees often involve a minting fee and a listing fee. A minting fee is usually incurred when you attempt to mint a new NFT. Since this requires miners to carry out resource-intensive computations, you’re required to pay a small fee to compensate them for helping you to record the transaction on the blockchain and complete the minting process.

As its name suggests, a listing fee is incurred when you list an NFT on a platform. You may sometimes also be charged a fixed platform fee upon the sale of your NFT.

Why Do We Need to Pay These Crypto Trading Fees?

First, it's important to understand that every financial institution, including banks, charges some sort of fee. More importantly, many of these fees are paid to cryptocurrency miners, whose vital work helps process transactions and secure blockchain networks.

Part 2: How to Choose the Best Crypto Exchange With the Lowest Crypto Trading Fees

If you're an active trader, keep an eye on crypto trading fees. They can quickly derail your profitable strategy. This topic is particularly important to swing traders and speculators, who love to ride market trends.

The following crypto fees comparison guide analyzes the trading fees charged by some of the largest crypto exchanges around the world. After reading it, you can easily skim through the trading fee schedule of most crypto exchanges.

Best Overall Crypto Exchanges With Low Trading Fees

The lack of universal guidelines often makes it difficult for traders to understand and compare trading fees across different crypto platforms. Fortunately, the overall structure of crypto trading fees is quite similar. Learning a few basic concepts will help you compare crypto exchanges without using advanced tools and filters.

When viewing an exchange’s Fee Schedule, you'll notice that it mainly displays spot trading and futures trading fees. Under most circumstances, spot trading fees are higher than futures trading fees. These charges are always listed as maker fees and taker fees. For the sake of simplicity, the maker fee is charged to all limit orders and the taker fee is charged to all market orders, irrespective of whether you're opening a trade or closing your position.

The fee that you pay is also determined by your level on a trading exchange. Almost everyone starts at the standard level unless you hold a certain number of cryptos in your wallet.

Pay attention to the first level, because this is probably where you’ll begin. As you climb up the ladder, the fee changes accordingly. Here is how it's normally displayed:

- Level 1 — Conditions to achieve that level — Maker/Taker Fee

- Level 2 — Conditions to achieve that level — Maker/Taker Fee

- Level 3 — Conditions to achieve that level — Maker/Taker Fee

It's easy to climb up the levels and pay less. You can do this by:

- Trading a specific volume during the 30 days

- Holding a certain amount of equity in your wallet

- Owning a token native to the platform

- Any combination of the above

Depending on the crypto exchange, the system will automatically upgrade your account to a particular level. On most platforms, VIP status starts from Level 2, which means that you can enjoy privileged services in addition to the lower trading fee.

Now that you have some idea of the basic fee structure, here's how to interpret a typical crypto trading fees table:

- Level 1 — Trade Volume

- Level 2 — Trade Volume

- Level 3 — Trade Volume

For the convenience of readers, we've displayed only the standard account and first three levels of the VIP account in the charts below, making it easier to understand and compare the fees.

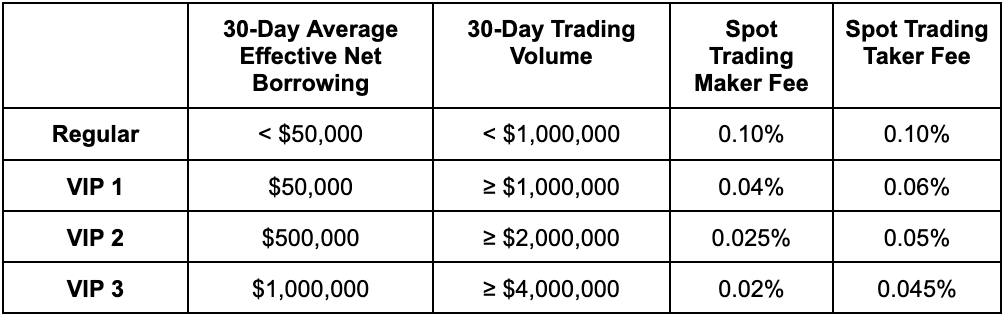

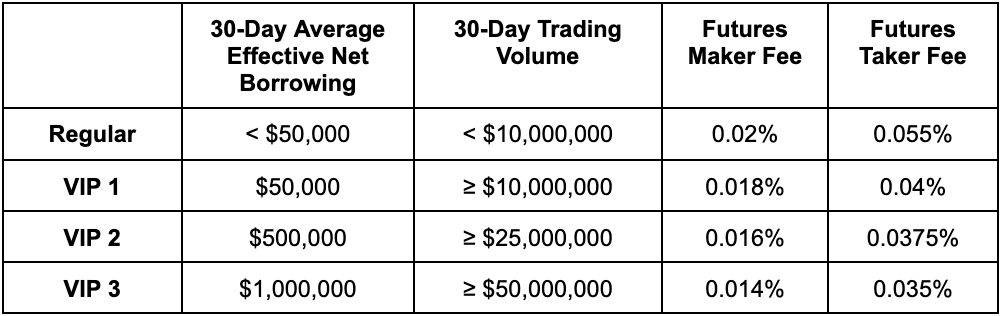

Bybit

Among the largest crypto exchanges, Bybit offers one of the lowest crypto trading fees. The platform is particularly known for its variety of futures and derivatives instruments. When trading futures, the maker fee and taker fee are only 0.02% and 0.055%, respectively.

Keep in mind that the original fee page on the Bybit exchange displays the taker fee, followed by the maker fee. Below, we've displayed it as the maker/taker model as shown on most crypto exchanges.

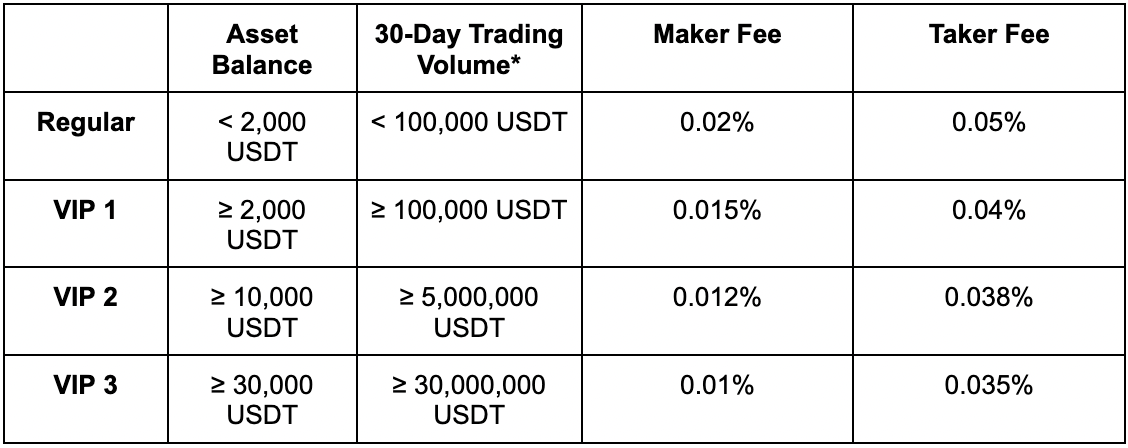

Bybit Fees (Spot)

Bybit Fees (Futures)

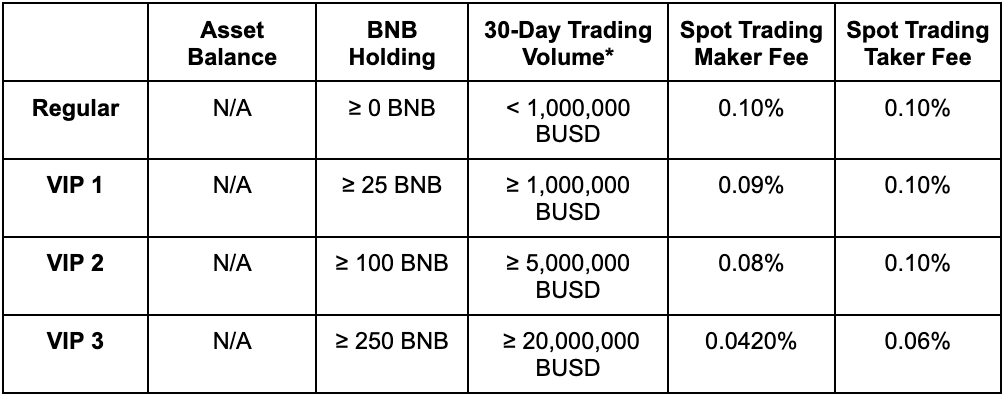

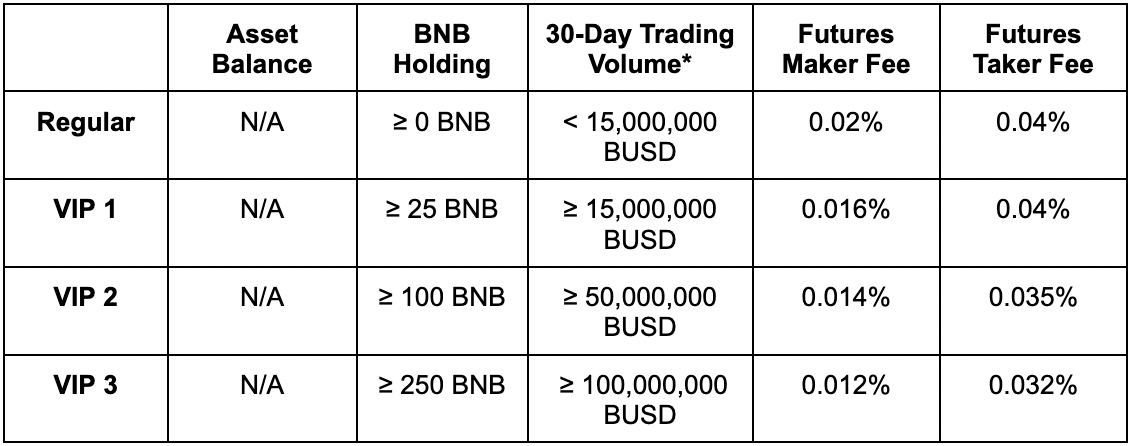

Binance

Binance is the gold standard for most traders. Despite the platform’s publicity, the trading fee isn’t highly competitive. In addition, you need to trade a minimum volume and also hold a certain amount before graduating to VIP status.

Binance Fees (Spot)

*1 BUSD to 1 USD

Binance Fees (Futures)

*1 BUSD to 1 USD

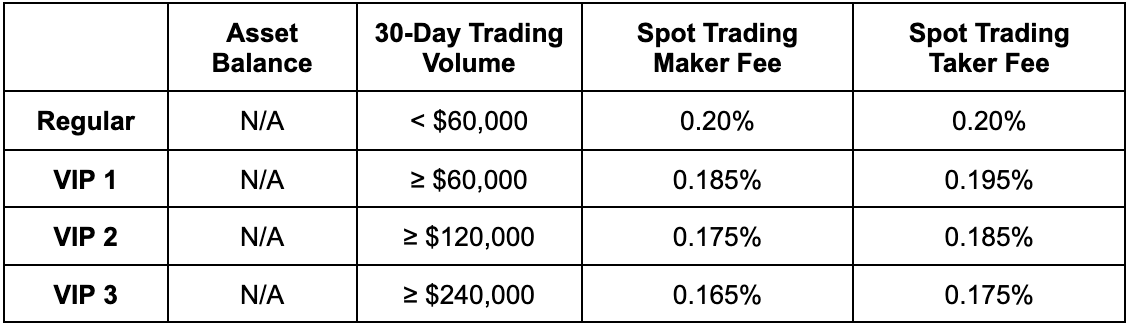

Gate.io

Compared to the other crypto exchanges on this list, Gate.io doesn’t offer very competitive fees for spot trading, which makes it a better platform for those looking to trade futures instead.

Gate.io Fees (Spot)

Gate.io Fees (Futures)

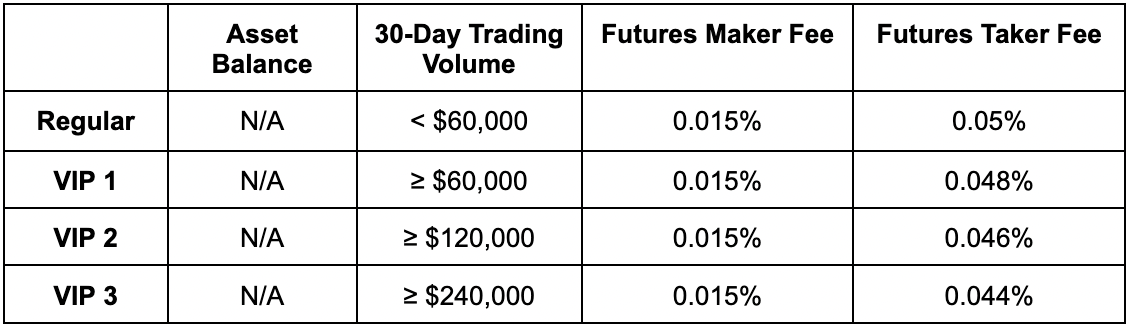

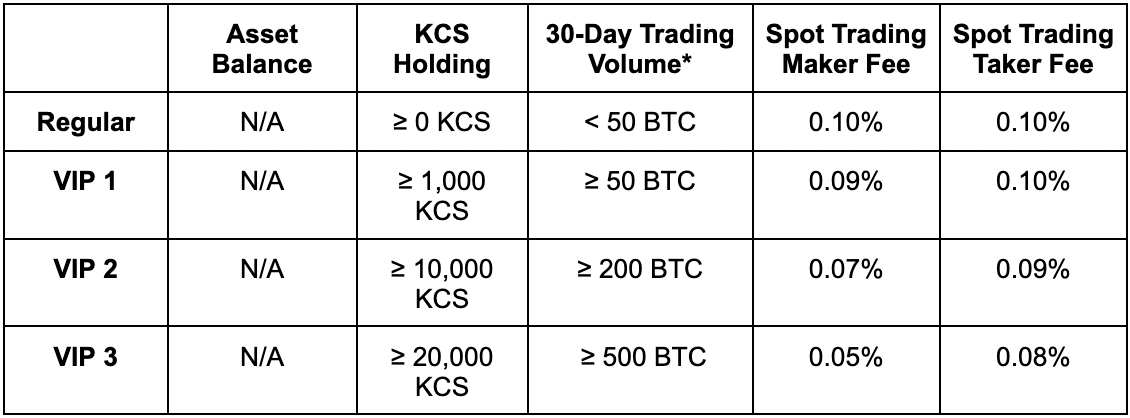

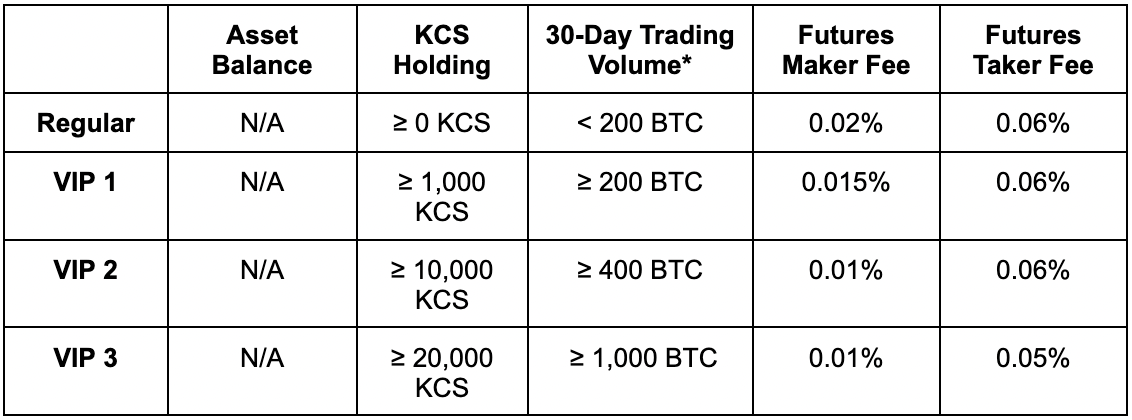

KuCoin

The fee structure on the KuCoin platform is divided into three subcategories: Class A coins, Class B coins and Class C coins. While KuCoin provides a competitive fee for popular coins and quick access to VIP status, the fee for Class B and Class C coins is more than double that of the Class A digital assets.

KuCoin Fees (Spot) — Class A Coins Only

*1 BTC to 20,000 USD

KuCoin Fees (Futures) — Class A Coins Only

*1 BTC to 20,000 USD

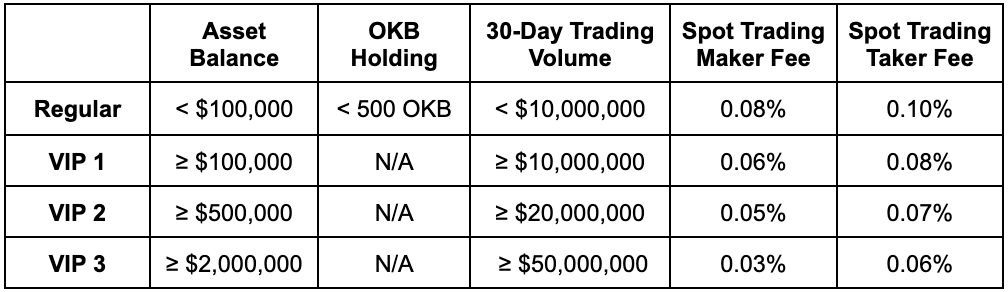

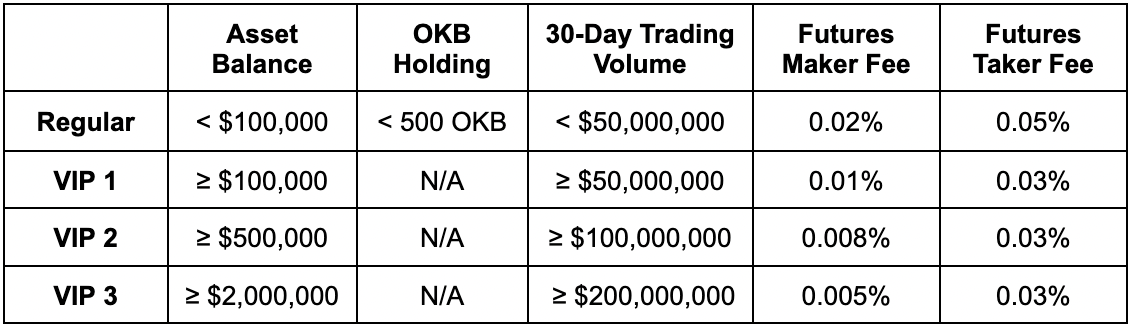

OKX

OKX (formerly OKEx) uses separate fee structures for its regular users and VIP users. For comparison purposes, the following table combines the first tier of standard and first three tiers of VIP levels.

OKX Fees (Spot)

OKX Fees (Futures)

Huobi

Huobi is another crypto exchange that offers rather competitive rates for trading spot and futures. Users can also receive discounts if they hold a certain amount of HT tokens.

Huobi Fees (Spot)

Huobi Fees (Futures)

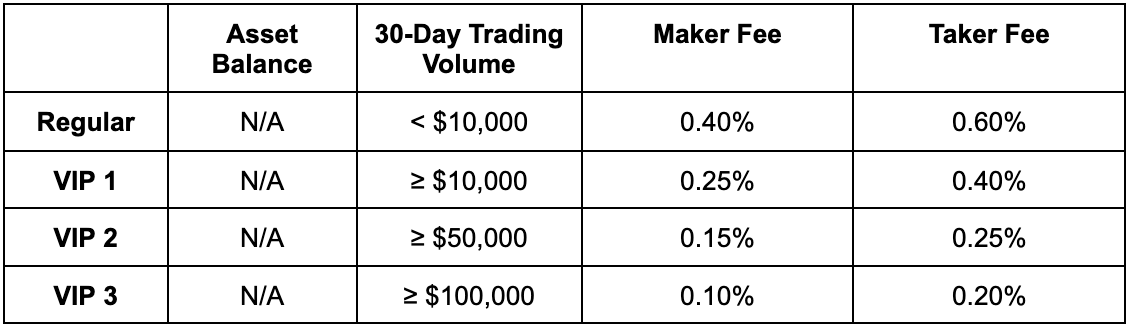

Coinbase

Coinbase is a bit different from the rest of the crypto exchanges on this list. If you want to trade with leverage, try Coinbase Pro. Due to certain restrictions and local regulations, crypto trading fees are much higher than on comparable exchanges.

Coinbase Fees (Spot & Futures)

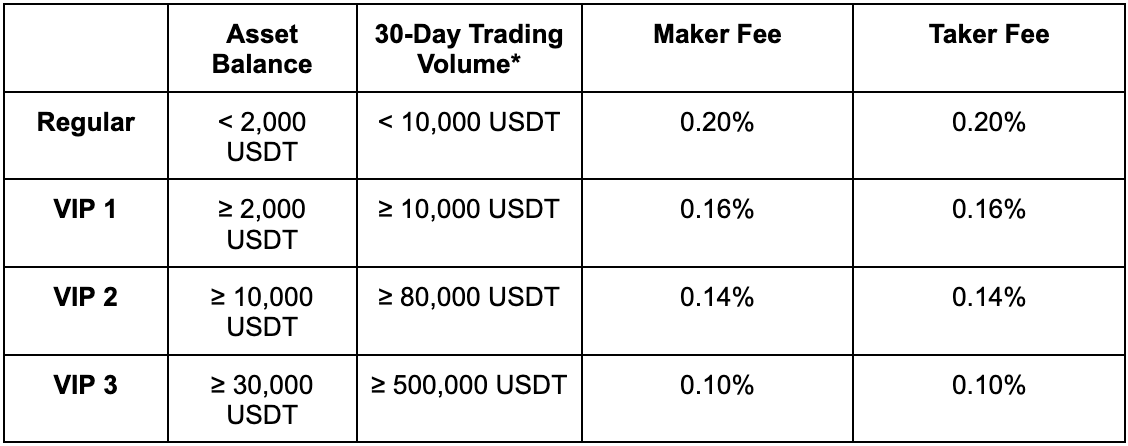

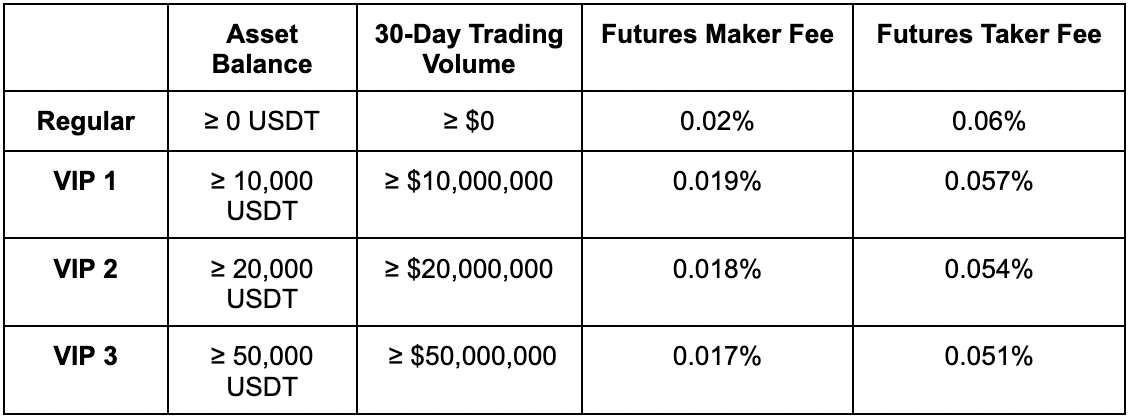

MEXC

MEXC has no fee tiers for spot trading. Instead, it charges a fixed spot maker and taker fee of 0.20%, which is high compared to other platforms on this list. The platform doesn’t offer much information on VIP rebates.

Following is an overview of MEXC’s futures trading fees:

MEXC Fees (Futures)

A Comparison of Crypto Trading Fees Across Crypto Exchanges

Since most crypto enthusiasts trade both spot and derivatives, it's logical to compare the fee across these formats. Here's a comparison of spot and derivatives trading fees, from lowest to highest:

Spot Trading

Crypto Spot Trading Fees on CEXs

| Spot Trading Maker Fee | Spot Trading Taker Fee |

Bybit | 0.10% | 0.10% |

Binance | 0.10% | 0.10% |

Gate.io | 0.20% | 0.20% |

KuCoin | 0.10% | 0.10% |

OKX | 0.08% | 0.10% |

Huobi | 0.20% | 0.20% |

Coinbase | 0.40% | 0.60% |

MEXC | 0.20% | 0.20% |

VIP Program Crypto Spot Trading Fees on Bybit

VIP Level | Spot Trading Maker Fee | Spot Trading Taker Fee |

Regular | 0.10% | 0.10% |

VIP 1 | 0.04% | 0.06% |

VIP 2 | 0.025% | 0.05% |

VIP 3 | 0.02% | 0.045% |

VIP 4 | 0.015% | 0.04% |

VIP 5 | 0.0125% | 0.035% |

Supreme VIP | 0.005% | 0.02% |

PRO 1 | 0.015% | 0.04% |

PRO 2 | 0.0125% | 0.035% |

PRO 3 | 0.01% | 0.03% |

PRO 4 | 0.0075% | 0.025% |

PRO 5 | 0.005% | 0.02% |

Derivatives Trading

Crypto Futures Trading Fees on CEXs

| Futures Maker Fee | Futures Taker Fee |

Bybit | 0.02% | 0.055% |

Binance | 0.02% | 0.04% |

Gate.io | 0.015% | 0.05% |

KuCoin | 0.02% | 0.06% |

OKX | 0.02% | 0.05% |

Huobi | 0.02% | 0.05% |

Coinbase | 0.40% | 0.60% |

MEXC | 0.02% | 0.06% |

VIP Program Crypto Futures Trading Fees on Bybit

VIP Level | Futures Maker Fee | Futures Taker Fee |

Regular | 0.02% | 0.055% |

VIP 1 | 0.018% | 0.04% |

VIP 2 | 0.016% | 0.0375% |

VIP 3 | 0.014% | 0.035% |

VIP 4 | 0.012% | 0.032% |

VIP 5 | 0.01% | 0.032% |

Supreme VIP | 0% | 0.03% |

PRO 1 | 0.01% | 0.032% |

PRO 2 | 0.005% | 0.032% |

PRO 3 | 0% | 0.03% |

PRO 4 | 0% | 0.0275% |

PRO 5 | 0% | 0.025% |

Crypto Options Trading Fees on CEXs

| Options Maker Fee | Options Taker Fee |

Bybit | 0.02% | 0.02% |

Binance | 0.02% | 0.02% |

Deribit | 0.03% | 0.03% |

OKX | 0.02% | 0.03% |

VIP Program Crypto Options Trading Fees on Bybit

VIP Level | Options Maker Fee | Options Taker Fee |

Regular | 0.02% | 0.02% |

VIP 1 | 0.015% | 0.02% |

VIP 2 | 0.015% | 0.02% |

VIP 3 | 0.015% | 0.02% |

VIP 4 | 0.015% | 0.018% |

VIP 5 | 0.01% | 0.015% |

Supreme VIP | 0.002% | 0.015% |

PRO 1 | 0.015% | 0.018% |

PRO 2 | 0.01% | 0.015% |

PRO 3 | 0.002% | 0.015% |

PRO 4 | 0.002% | 0.01% |

PRO 5 | 0% | 0.01% |

If you're looking for a crypto exchange with the lowest fees, Bybit has all the answers. Simply register for a Bybit account to get started.

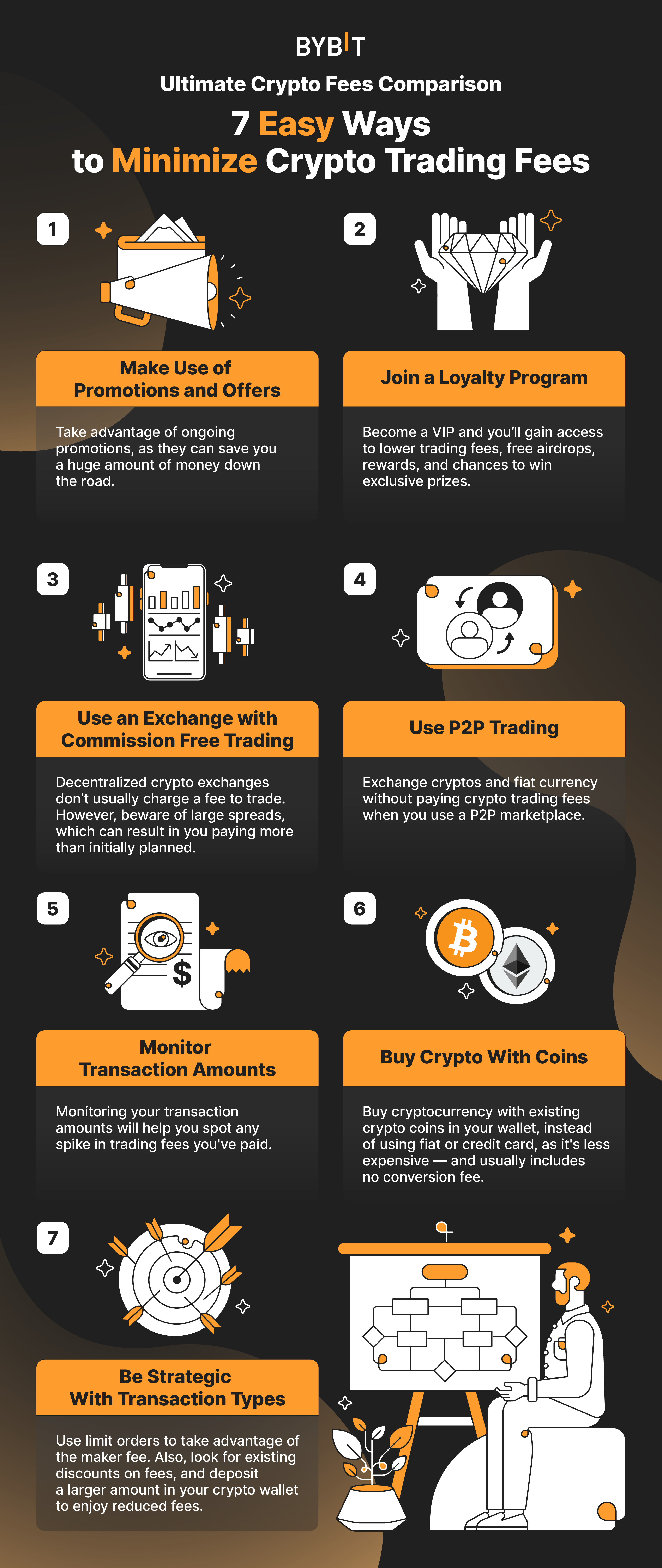

Part 3: How to Minimize Crypto Trading Fees to Maximize Gains

The following section outlines intuitive ways to reduce your crypto trading fees. In some cases, you can save up to 100%, similar to receiving free crypto trading rewards.

Can Traders Minimize Crypto Trading Fees?

The answer is Yes. There are various ways to save on crypto fees. For example, using a limit order for all your trades is one of the easiest ways to save more than 50% on trading fees. Whenever you place a limit order, it adds to the exchange’s liquidity, and you become a market maker. Similarly, investing in the native currency of the platform is a useful method. The rules may differ, but most crypto exchanges give some sort of benefit to holders of their native coin.

7 Easy Ways to Minimize Crypto Trading Fees

If you're a high-frequency trader, minimizing crypto trading fees can decide the eventual outcome of a trade — whether it’s an overall profit or loss. Here are more ways to receive discounts on crypto trading fees:

Make Use of Promotions and Offers

Crypto platforms are well-known for providing a variety of incentives. One of the most popular campaigns at Bybit is a classic example, as their previous "zero fees" campaign let users trade commission-free on all spot pairs for a limited time period. If you’re looking to spot trade, be sure you take advantage of such opportunities.

It may not seem like much at first glance — but these ongoing promotions can save you a huge amount of money down the road.

Join a Loyalty Program

Joining a loyalty program can often save you more than half the trading fees. Once you’re a VIP, you’ll have access to free airdrops, rewards, and chances to win exclusive prizes. Each year, crypto companies also hold private events for their loyal members.

Use an Exchange with Commission-Free Trading

You can join a decentralized crypto exchange to enjoy commission-free cryptocurrency trading. These exchanges don’t charge a fee. However, keep an eye on the spread because larger spreads on decentralized exchanges (DEXs) can backfire. Ultimately, you may pay much more than you initially planned.

Use P2P Trading

For currency conversions, use a peer-to-peer (P2P) marketplace instead of buying crypto using traditional methods. Most crypto platforms offer P2P platforms where you can exchange cryptos and fiat currency without paying crypto trading fees.

Monitor Transaction Amounts

Before trading, read the fee schedule of your preferred crypto exchange. You can easily access the document by Googling it. Use keywords such as “[the name of your preferred crypto exchange]" + "fees." Once you're satisfied, monitor your transaction amounts carefully, because it's easy to miss out on the fine print.

Buy Crypto With Coins

If you hold crypto coins in your wallet, buy a new crypto with these coins instead of using fiat or credit card, because it’s less expensive. In addition, there’s often no conversion fee. In contrast, buying crypto or stablecoins using a credit card or other traditional methods will always incur a hefty charge.

Be Strategic With Transaction Types

It's always a good idea to use limit orders so that you can take advantage of the maker fee. Also, look out for existing discounts on crypto trading fees. If possible, deposit a larger amount in your crypto wallet in order to climb up a tier, which should automatically reduce your fees.

Part 4: How You Can Save on Crypto Taxes With Crypto Trading Fees

Did you know that crypto trading fees are tax deductible? Whenever you buy, sell or exchange a cryptocurrency, you can claim it as an expense when you file your taxes. Hopefully, the following section will help you understand your potential tax liabilities.

What Are Crypto Taxes?

Crypto taxes are paid when you hold cryptos and profit from them. Depending on your local jurisdiction, you may need to pay tax if you trade cryptos, make a transaction using them, or mine cryptos. Therefore, if you’ve conducted any transactions using crypto, it's better to consult a tax professional before filing your tax returns.

How Do Crypto Taxes Work?

In many countries, cryptocurrency is classified as an asset. Cryptos are taxable, just like stocks. If you profit from the crypto trade, you need to report such gains and pay tax. If you end up with a loss, you can deduct it from your tax.

It's important to understand that buying and owning cryptos isn’t taxable until you sell them — i.e., close your position. For instance, if you bought crypto in 2021 and you're still holding it, you don't need to report anything on your 2022 tax return, because the position isn’t closed yet.

Do You Have to Pay Crypto Taxes?

The crypto space is still evolving and it has many gray areas. If you live in a country whose regulators require you to report such transactions, you must pay tax. Any lapse on your part can result in potentially severe penalties.

Residents of the U.S., Canada, the U.K. and Australia must report such transactions. In contrast, Germany, Portugal, Singapore and Malaysia don't tax their citizens’ crypto transactions.

How Do Crypto Trading Fees Lower Your Crypto Taxes?

The trading fees you pay when buying and selling crypto are tax-deductible. These fees can be added to your cost basis, because they directly reduce your capital gains and increase your capital loss. You can also deduct the gas fee paid to a blockchain.

Keep in mind that the fee for transfer between two wallets is non–tax-deductible, because it doesn't contribute to your net income. However, businesses may be able to write off transfer fees as an expense if wallet-to-wallet transfers are a necessary part of their business.

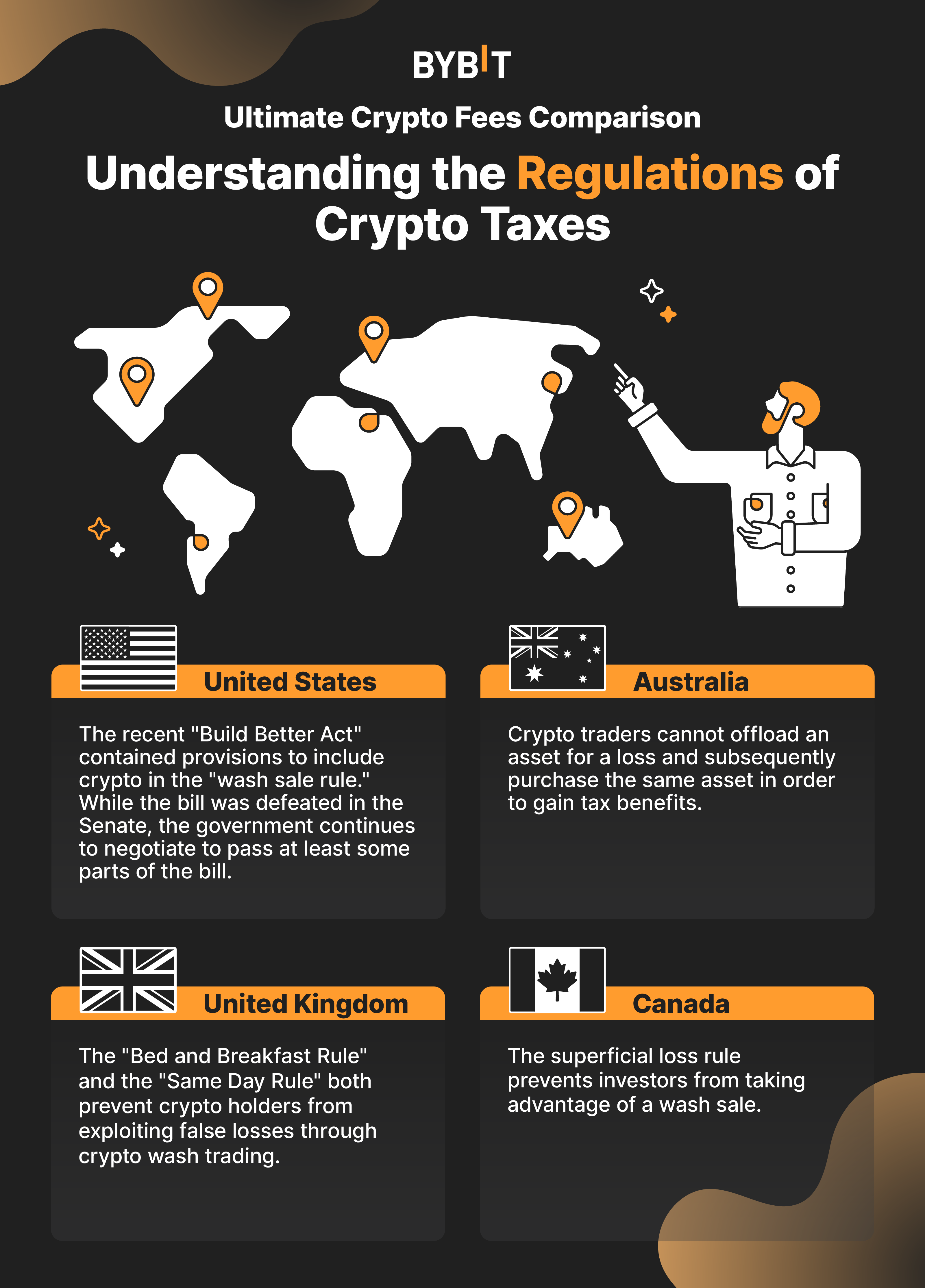

Understanding the Regulations of Crypto Taxes

In the past, investors have often tried to lower their taxes by selling and repurchasing the same digital asset that lost its value. A wash sale occurs when the investor closes a position at a loss, and then buys the same security within 30 days. To prevent investors from taking advantage of loopholes, the U.S. and other countries have introduced the "wash sale rule."

United States

The "wash sale rule" doesn't specifically apply to crypto, but efforts are underway to include crypto in the legislation. The recent Build Better Act contained such provisions. While the bill was defeated in the Senate, the government continues to this day to negotiate for at least some parts of the bill to be passed.

United Kingdom

HM Revenue & Customs (HMRC) has two similar rules that prevent crypto holders from exploiting false losses through crypto wash trading. Guidelines in the Bed and Breakfast Rule and the Same Day Rule apply to cryptocurrencies.

Australia

Australian law clearly states that you can't offload an asset for a loss, and then follow this up by purchasing the same asset to gain tax benefits. Since there’s no specific legislation, the intent of the investor determines the outcome.

Canada

The Canada Revenue Agency has implemented a superficial loss rule that prevents investors from taking advantage of a wash sale.

How to Calculate Crypto Taxes

Virtual currencies in the U.S., the U.K. and many other jurisdictions are treated as capital assets. This means that you need to pay your crypto tax. The amount of tax depends on various factors, such as your income bracket, the type of trading transaction and the length of the investment.

You can use crypto tax software to calculate your tax. Any reliable software will automatically sync with your crypto exchange to extract relevant information. It can also arrange information and fill in relevant forms, according to your local tax regulations. In most cases, customer support is readily available via chat, email and phone.

If you're interested in reading more about this subject, click on the following link for a detailed explanation of 17 of the best crypto tax software solutions.

Part 5: Choosing the Best Overall Crypto Exchange

Selecting a good crypto exchange isn't difficult if you know what to look for. This section provides an overview of important factors to consider when selecting a crypto platform. If your desired exchange has most of the attributes listed here, you're good to go.

What to Look for in a Crypto Exchange

Crypto Pairs

Sometimes, the most sought-after cryptos are newer coins that have yet to take off. In this case, it's better to look for an exchange that offers an extensive variety of new coins so that you don't miss out on potential gains.

Bybit offers an immense breadth of crypto pairs across both the spot and derivatives markets.

Liquidity

Not all crypto exchanges offer the liquidity required for trading lesser-known cryptos. Less liquidity leads to larger spreads, a shallow order book and significant slippage when placing large orders.

Bybit is one of the top crypto exchanges for supporting low slippage and deep liquidity.

Security

Make sure that your crypto exchange offers basic security features, such as phone validation, Google authenticator and two-factor authentication (2FA). In addition, some exchanges feature offline cold storage services, while others provide fund protection insurance. It's never too late to talk to customer service about the security of your funds.

With Bybit, you can be sure your crypto funds will be kept safe, thanks to its industrial-grade security.

Regulations

Is your crypto exchange regulated? It's important not to trust a broker that isn’t licensed in its jurisdiction. You can often view the licensing details at the bottom of the main web page, or in the About Us section.

Trading Fee

If you're an active trader, never ignore the trading fee. High-frequency traders, swing traders and day traders need to pay attention to the trading fee because it will likely take a good chunk of your profits.

Bybit currently offers competitive fees for both spot and futures trading pairs. You can also enjoy lower fees by activating your Bybit VIP tiers.

Trading Options

Most traders only look at spot pairs when trading crypto. They forget that they can often get better results from trading derivatives, perpetual contracts, crypto options or a combination of these.

Bybit offers various trading options to meet every trader's needs, in addition to trading bots that facilitate a more reliable trading experience.

Wallet

Almost every crypto exchange offers some kind of wallet to store crypto. If you're using the native wallet on the platform, you can receive returns on crypto savings. For enhanced security, some platforms offer a built-in wallet at an external location. Some even partner with third-party providers to help safeguard digital assets.

Bybit has recently launched the Bybit Wallet, a custodial web3 wallet that acts as a gateway to the web3 ecosystem.

Rewards

Reputable crypto exchanges provide regular rewards and incentives. Such freebies include virtual trading events where you can win thousands of dollars without risking the “real” cash. VIP members can also gain access to exclusive and attractive incentives.

Customer Service

Top-notch customer service isn’t the sole criterion to gauge reputation. However, when you need answers, you need them quickly. Therefore, make sure that your preferred crypto exchange offers instant, 24/7 access to support.

With Bybit's live 24/7 customer support, you can rest assured that you'll receive guidance every step of the way of your trading journey.

Frequently Asked Questions

Why Are Crypto Exchange Fees So High?

This mainly depends on your perception and the service you wish to use. Because each crypto exchange is different and transactions are processed differently on each blockchain, multiple factors can add to the fee. Nevertheless, transaction costs on good crypto exchanges are less than those for on-chain transactions on stock exchanges and other financial platforms.

What’s the Best Way to Minimize Crypto Trading Fees?

There are lots of ways to reduce crypto trading fees. You can use limit orders to place trades, or use the exchange’s native coin to pay the transaction cost. Exchanges like Bybit offer additional opportunities, which include the use of P2P services to buy and sell cryptos cost-effectively. Joining the Bybit loyalty program is another great option.

Are There Zero-Fee Crypto Trading Options?

While there isn't any free lunch, you can certainly trade crypto without fees by enrolling in the ongoing zero fees promotions on crypto exchanges. Bybit did offer a zero-fee campaign for all spot trading pairs. However, the campaign ended on Jan 3, 2023. The futures trading fee on Bybit is negligible, considering that you only pay 0.02% on limit orders.

#Bybit #TheCryptoArk