A Guide to Automated Trading Strategies in Bybit Copy Trading

Ready to elevate your copy trading experience as a Master Trader? Bybit Copy Trading now features a new upgrade, Automated Copy Trading, which allows Master Traders to implement automated trading strategies. This upgrade offers a seamless experience that will boost your trade success rates and earn you more followers.

Key Takeaways:

Bybit Copy Trading has a new upgrade, Automated Copy Trading, that enables Master Traders to execute automated trading strategies.

The Automated Copy Trading upgrade also offers other benefits such as USDT Perpetual Trading features including TradingView Alert, Trailing Stop and Conditional Orders.

Bybit-supported automated trading platforms such as 3Commas and Insilico Terminal can be easily accessed using the Bybit API key.

What Is Bybit Copy Trading?

Bybit Copy Trading brings together Master Traders and followers for a truly transparent win-win trading experience. As a Master Trader on the Bybit Copy Trading platform, you gain direct access to a vast global user base, significantly increasing your potential to attract followers. With Bybit Copy Trading, you can take advantage of a highly efficient and reliable platform thanks to its 99.9% system functionality with a rapid and high-performing matching engine.

With the introduction of the Automated Copy Trading upgrade designed specifically for Master Traders, you can benefit in several ways:

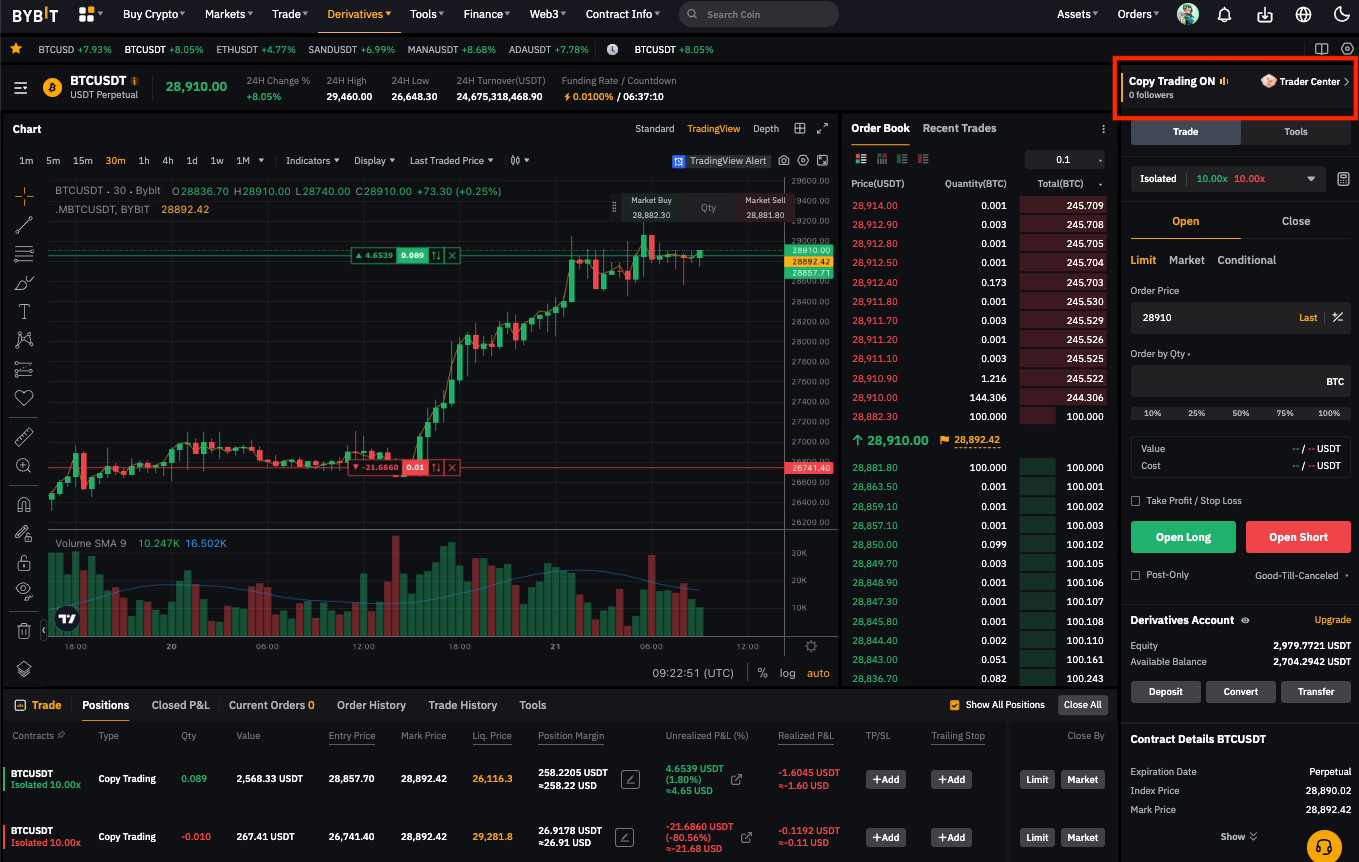

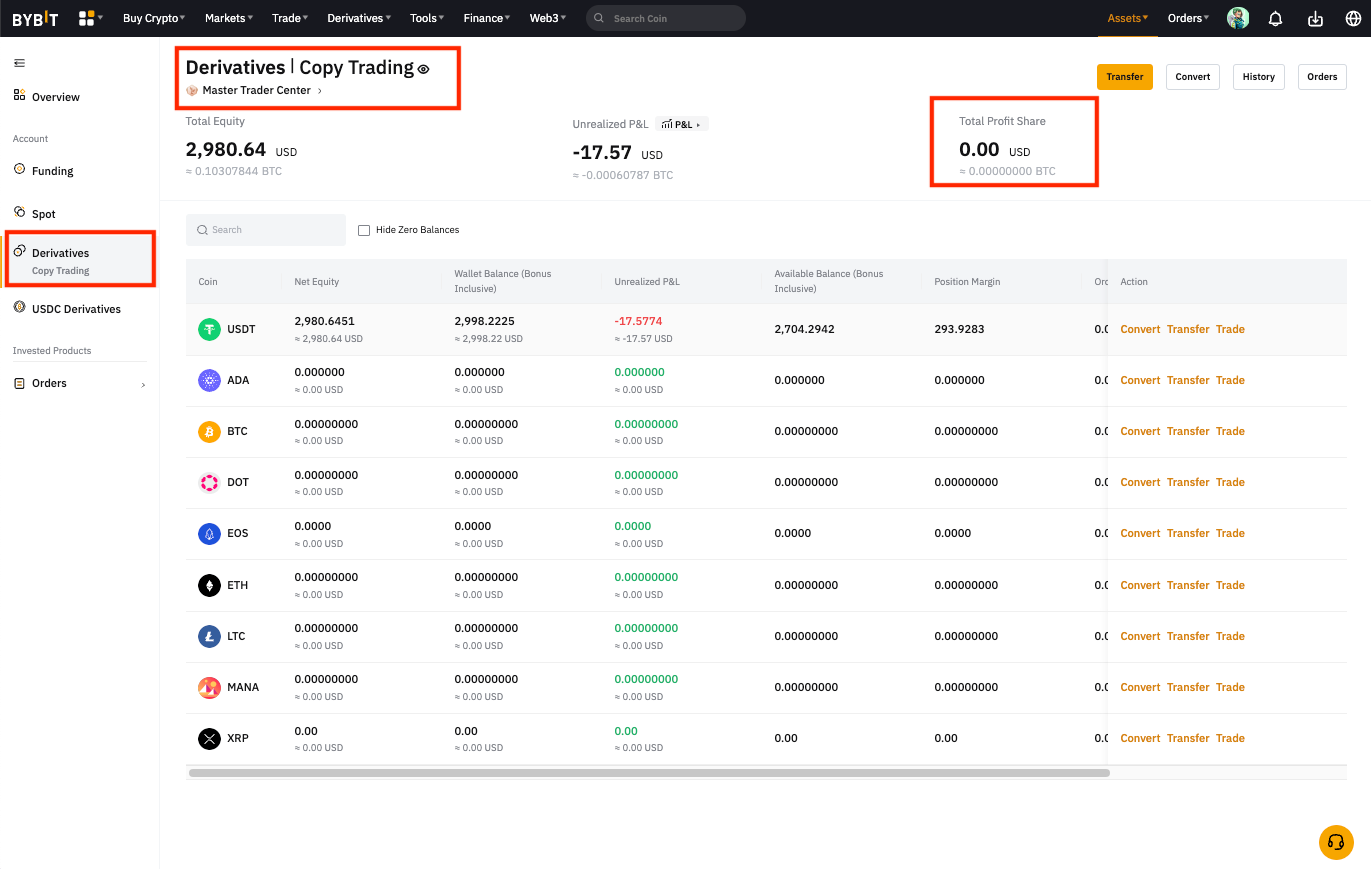

Improved Integration with Derivatives Trading Terminal: Previously, Master Traders could only engage in copy trading separately from the main Derivatives Trading terminal. With the Automated Copy Trading upgrade, the platform has integrated copy trading into the main Derivatives Trading terminal. As a result, the Copy Trading tab disappears, and all trading activities, including copy trading, can now be accessed within a single tab. Hence, when you trade in your Master Trader Subaccount, all of the USDT Perpetual Trading pairs supported on Bybit Copy Trading will be automatically copied by your followers. This streamlined approach simplifies the entire copy trading process for everyone involved.

Old Terminal

Upgraded Terminal

Full Suite of Derivatives Trading Functions: You can unlock all the trading features available in the USDT perpetual market. This includes previously unavailable features before the upgrade, such as TradingView Alert, Trailing Stop, Conditional Orders and more. These advanced tools empower you to fine-tune your trading strategies and maximize your potential for success.

Copy Trading via API: You get the advantage of utilizing the V3/V5 Linear USDT Perpetual OpenAPI for copy trading. This API provides a powerful and efficient framework for executing copy trades, enhancing the overall performance and reliability of your trading activities. By leveraging this advanced OpenAPI, you can experience smoother and more efficient copy trading operations.

Seamless Account Management: You can streamline your trading operations and conveniently handle multiple Subaccounts. You will get a comprehensive view of each Subaccount and coordinate your trading activities across the accounts, thereby optimizing your trading efficiency. You can also be assured of secure and swift asset transfers across your accounts.

Effortless Management of Trades: You can manage your profit and loss (PnL) and export your Order and Trade History with ease, allowing for efficient monitoring of trading activities and facilitating informed decision-making as you review your past trades and assess the success of your current trades.

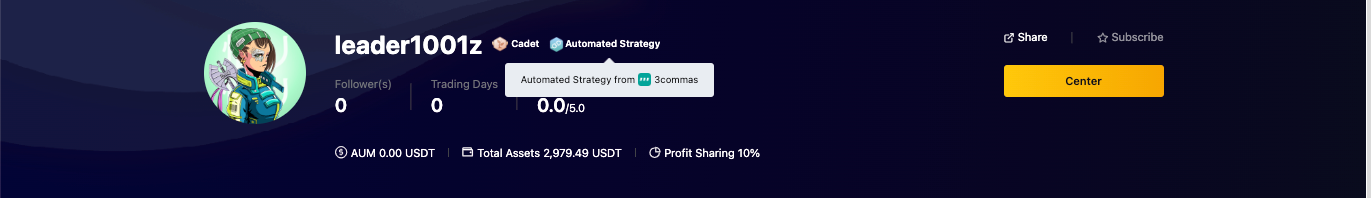

Automated Strategies Badge: You will receive a badge on your profile page when you use automated strategies. This badge acts as a testament to your dedication to staying ahead of the curve and utilizing cutting-edge tools to achieve your trading goals. It positions you as an authority in the realm of algorithmic trading and adds credibility to your profile as it helps you attract followers seeking experienced Master Traders who are adept at incorporating automation into their trading practices. Note:The badge will be reflected for Master Traders using 3Commas and Insilico during the beta phase, and it will progressively extend to other partners.

What Is Automated Trading?

Automated trading, or algorithmic trading, is a trading method that leverages computer programs using algorithms to automatically set parameters on placing a trade to execute trades at a precise timing.

Automated trading not only enables traders to implement many more trades within a short time span, but also empowers them to carry out predetermined trading strategies. In fact, strategies are crucial in algorithmic trading due to their pre-planned nature in order to make successful trades. This makes automated trading a favorite among many professional traders who aim to fine-tune their strategies for consistently great results.

Upgrading to Automated Copy Trading

For New Master Traders

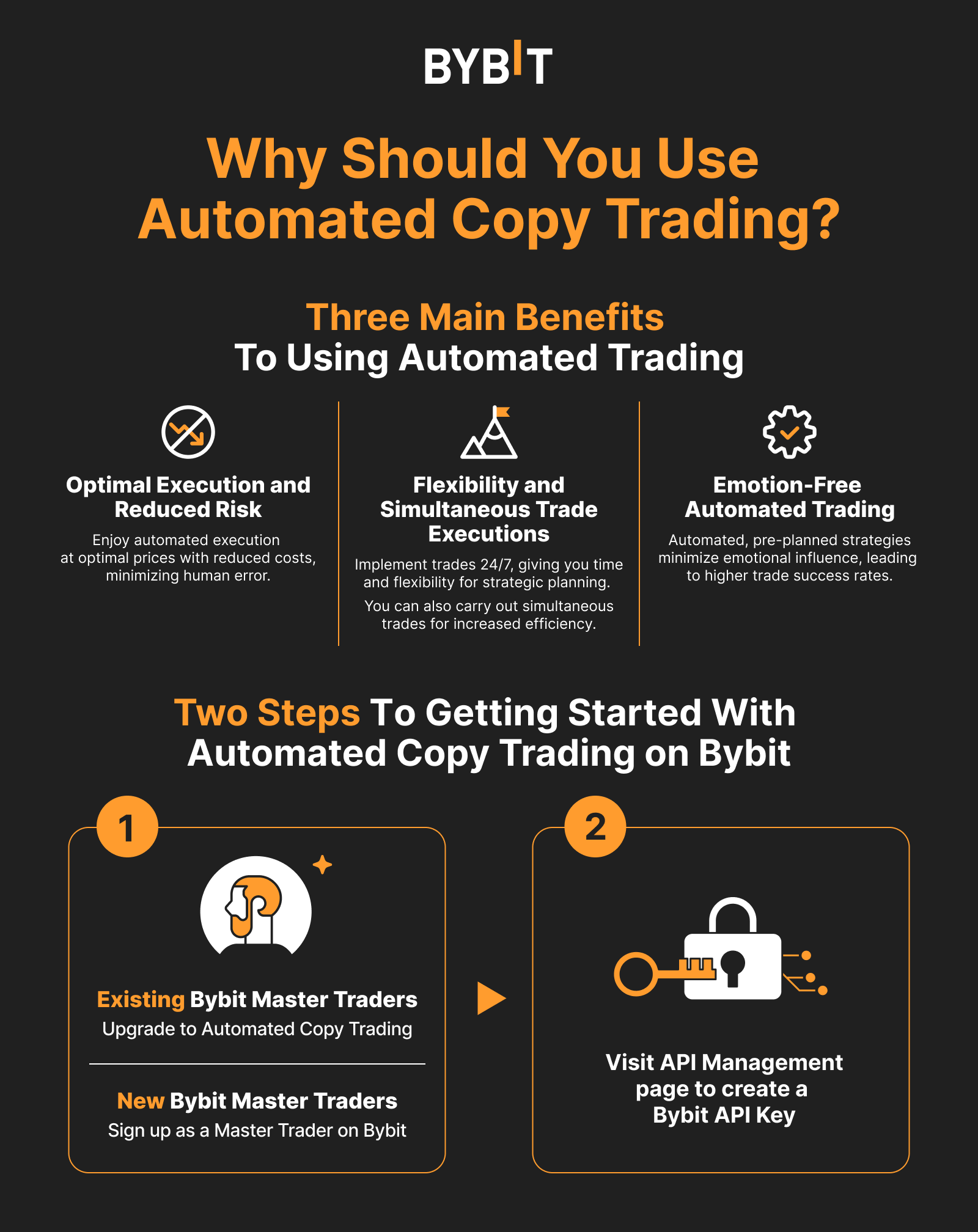

If you join Bybit as a new Master Trader, you will automatically be granted the Automated Copy Trading upgrade. All you have to do is sign up with Bybit and set up your Master Trader account.

For Existing Master Traders

For existing Master Traders, a simple upgrade to Automated Copy Trading is needed before creating the Bybit API key to establish a seamless connection with your preferred automated trading platforms. The upgrade process is simple and only requires a few easy steps. Once upgraded, you'll be all set to dive into the world of automated trading and unleash its potential for your trading success.

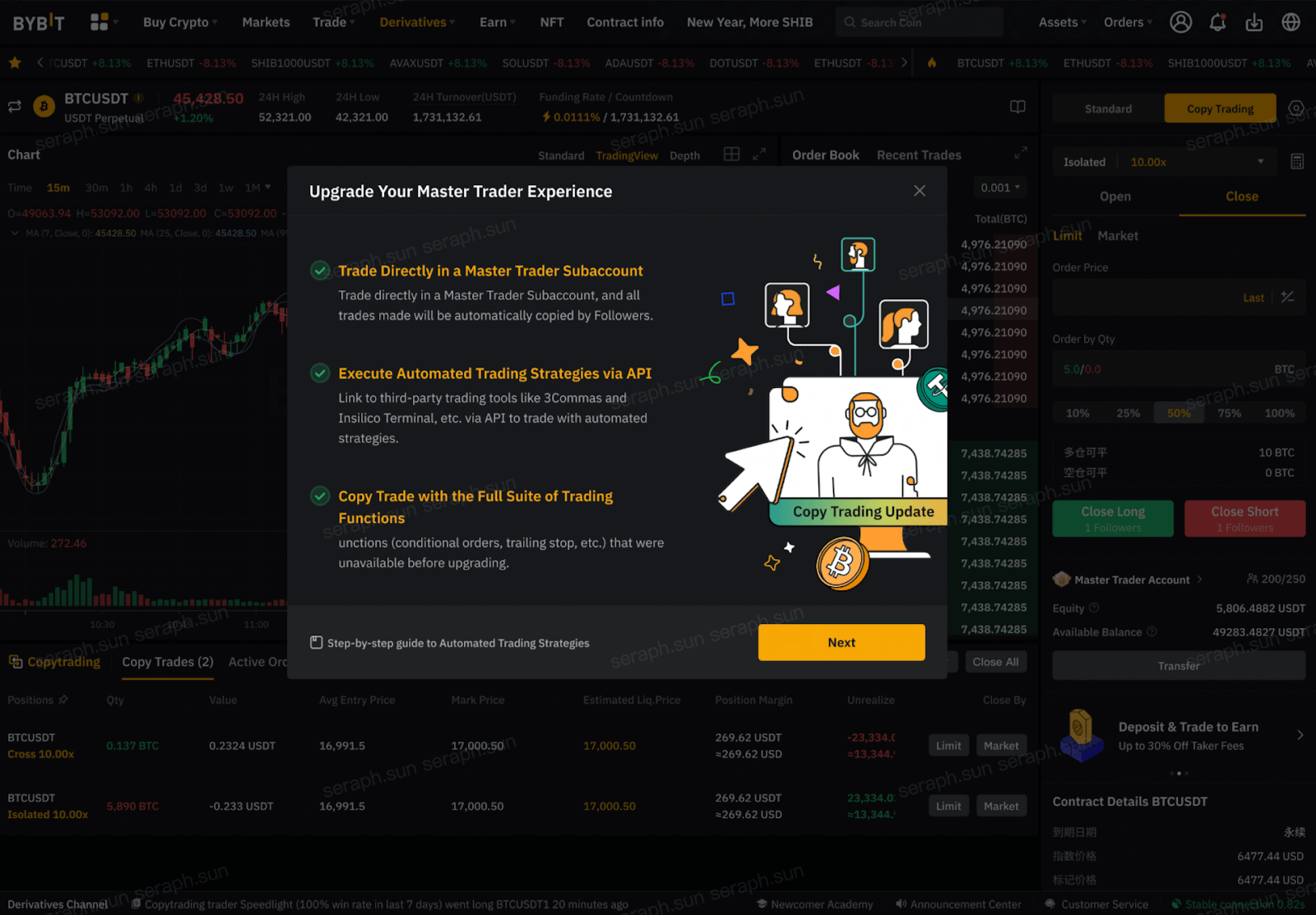

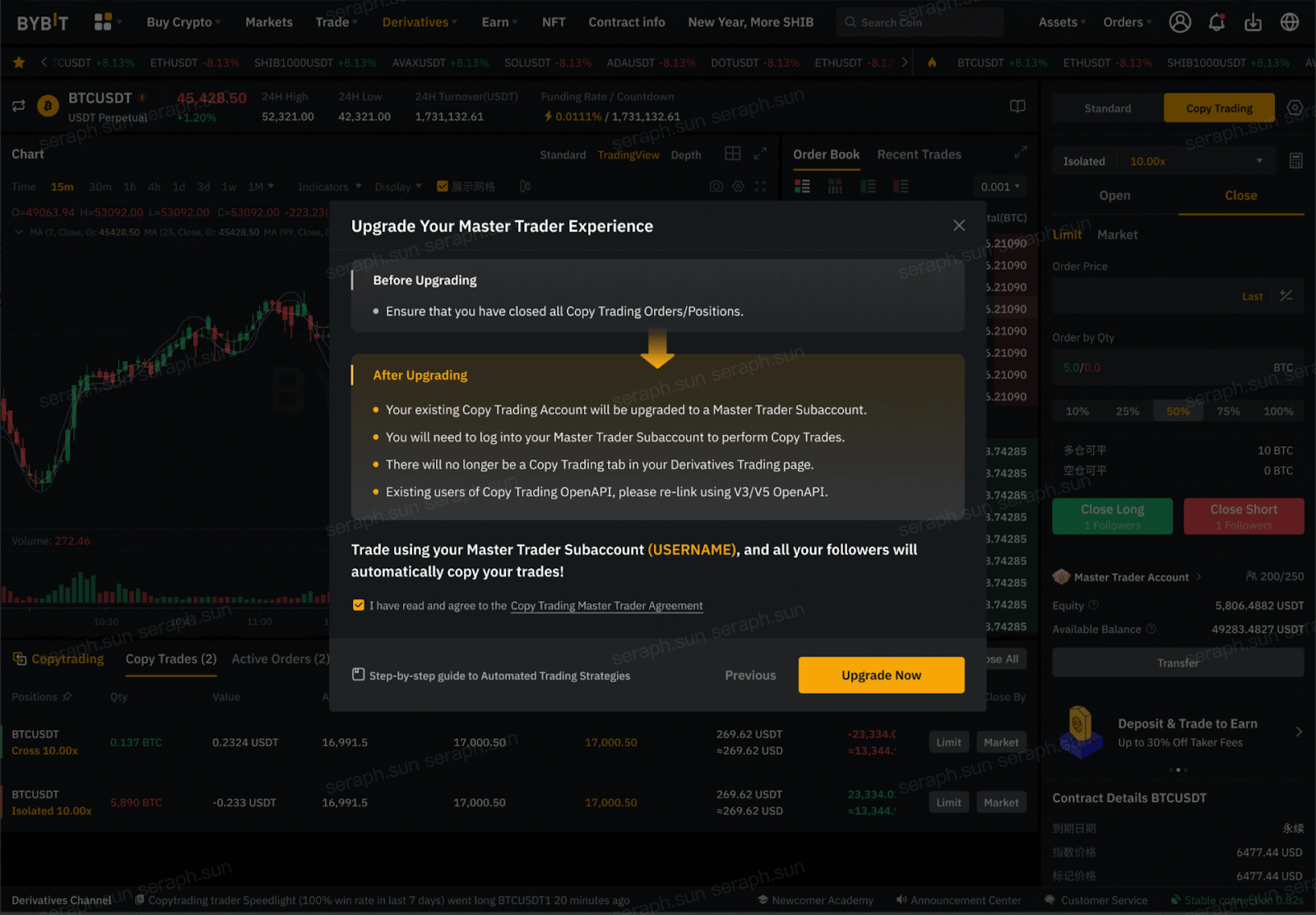

- There are two ways to access the upgrade. You can either enter via the Copy Trading tab on the Derivatives Trading terminal, or access through your Master Trader Center. Either way will lead to a pop-up notice for you to upgrade your Master Trader experience. Click Next to proceed with upgrading.

2. On the next screen, read the Copy Trading Master Agreement and tick the box to indicate that you have read and agreed to the agreement. Then, click Upgrade Now.

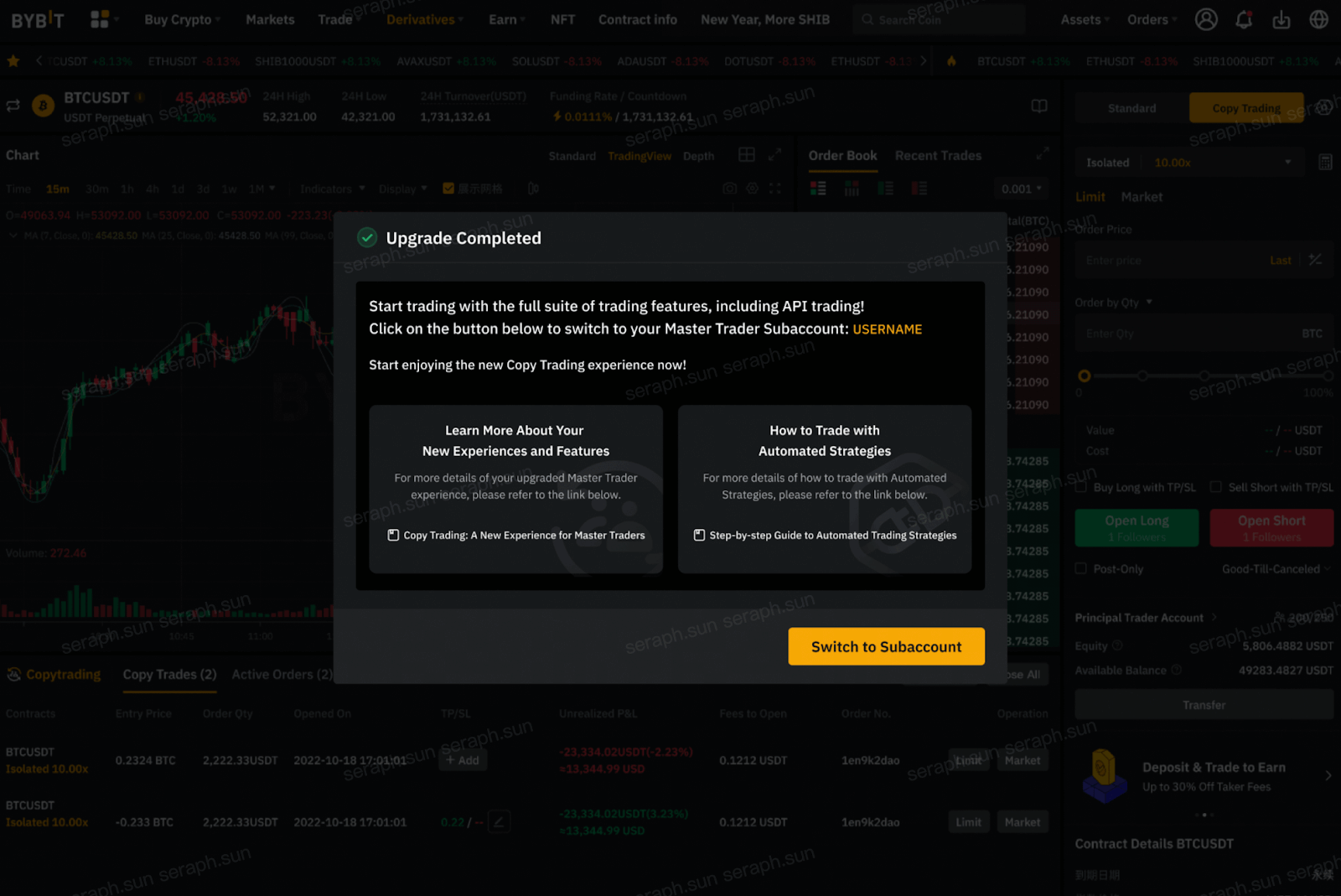

3. Once your upgrade is complete, click Switch to Subaccount.

Please note that you’ll have to close all your copy trading positions before you can proceed with the upgrade. During the upgrade, you will not be able to trade or transfer assets.

After you’ve upgraded to Automated Copy Trading, your copy trading account will be transformed to a Subaccount, and you can start to open trades in your Master Trader Subaccount with these new features for copy trading.

How to Get Started with Automated Trading on Bybit

After the Automated Copy Trading upgrade, you can create an API key for free by simply visiting the API Management page, which can be accessed from your Account page or Personal Setting page.

On the API Management page, click Create New Key. Then choose System-generated API Keys for Bybit-supported platforms like 3Commas and Insilico Terminal. Otherwise, select Self-generated API Keys. Make sure to copy or download your API key and secret key and keep them safe.

Once you have connected your Bybit API to the various trading platforms, you can unlock the full potential of automated trading strategies for your trading success.

Why Should You Use Automated Trading as a Master Trader?

Utilizing automated trading as a Master Trader offers a multitude of benefits.

Optimal Execution and Reduced Risk

Firstly, one of the advantages of algorithmic trading is that Master Traders no longer have to rely solely on their skills and experience to time their trades. Instead, trades are automatically executed at optimal prices and with reduced costs. This also means a lower risk of human error during trade executions.

Flexibility and Simultaneous Trade Executions

With automated trading, you’ll be able to execute trades 24/7, even when you’re not actively monitoring the market. This flexibility lets you plan your trading strategies around your schedule, ensuring that opportunities are not missed. Moreover, you can even carry out multiple trades simultaneously, maximizing your efficiency and allowing you to complete more trades within a given timeframe. As a result, your time will be freed up for you to determine new opportunities and analyze market trends.

Emotion-free Automated Trading

Even the most experienced Master Trader is susceptible to emotions, which may negatively impact their trades. By implementing pre-planned strategies through automation, you can significantly reduce the influence of emotions and increase the likelihood of successful trades.

Types of Automated Trading Strategies

Automated trading strategies have revolutionized the way traders approach financial markets. By harnessing the power of algorithms and technology, these strategies offer a systematic and efficient approach to trading, saving you time and headaches.

Whether it's capitalizing on price trends, mitigating market impact or managing risk, automated trading strategies provide traders with a competitive edge by offering consistent and disciplined trading approaches. In this article, we will explore various automated trading strategies that Master Traders might consider to help eliminate human emotions and biases from the decision-making process.

Time-Weighted Average Price (TWAP)

The time-weighted average price (TWAP) is an automated trading strategy used to transact large orders in a manner that minimizes market impact. It achieves this by splitting the order into smaller chunks and executing them at regular intervals over a specified duration, such as minutes, hours or even days.

By spreading out the order execution, TWAP aims to achieve an average execution price that closely mirrors the market average during that time. This strategy benefits institutional investors or traders dealing with large order sizes, as it helps the market absorb the order over time rather than executing the entire order at once.

Limit Chase

The limit chase automated trading strategy involves placing limit orders above or below the current market price to capture quick price movements at a discount. The limit orders are placed at a specified distance of N or fewer levels from the best price. When the market reaches the specified limit price, the strategy triggers the execution of the trade.

Since N levels of pricing were penetrated, large order blocks hitting the market will cause significant price movements in the market and trigger this strategy. The strategy aims to capitalize on the price swings as the limit orders will chase the best price available above or below the market price. By strategically positioning the limit orders, the strategy seeks to capture the last portion of a large order at a discounted price. This approach is grounded in taking advantage of temporary price discrepancies resulting from the influx of large orders.

Futures Grid Bot

The Futures Grid Bot is an automated trading strategy specifically designed for futures markets. It employs a grid-based approach to take advantage of price fluctuations within a predefined range. The strategy places a grid of buy and sell orders at predetermined price levels above and below the current market price.

As the market moves, the strategy aims to profit from the price oscillations of buying low and selling high (or vice versa) within the predefined grid range. By systematically entering and exiting positions based on price levels, the Futures Grid Bot strategy seeks to capitalize on short-term price movements while managing risk through its predefined grid structure.

Momentum/Trend-Following

Momentum and trend-following strategies aim to capitalize on the persistence of price trends in the market. They are arguably the most popular strategies as they identify trends with potential for strong moves and trade them. These strategies typically involve buying assets that are gaining momentum and selling assets that are losing momentum.

Trend-following strategies seek to identify and ride sustained price trends, either upward or downward. These strategies employ technical analysis tools and indicators to determine the direction and strength of trends. Lastly, these strategies aim to capture profits from the continuation of price movements.

Mean Reversion

Mean reversion strategies aim to exploit the tendency of prices to revert back to their average value after experiencing temporary deviations. These strategies identify assets that have moved significantly away from their average price and predict that they will eventually return to their mean.

Mean reversion strategies involve selling assets that have experienced a price increase and may be considered overbought while buying assets that have declined in price and are considered oversold. They rely on statistical analysis and indicators to identify overbought or oversold conditions in the market. These strategies leverage on the expectation that the overbought assets will experience a price decline and oversold assets will rebound, and seek to generate profits as prices revert back to their average levels.

Time-Series Momentum

Time-series momentum automated trading strategies seek to capture trends and momentum in asset prices over a given time period. These strategies analyze historical price data and identify assets that have exhibited consistent upward or downward price movements.

By measuring the strength and persistence of these trends, time-series momentum strategies aim to enter long positions in assets with positive price momentum and short positions in assets with negative price momentum. The strategy assumes that assets with recent positive performance will continue to outperform, while those with negative performance will continue to underperform. This approach allows traders to align their positions with prevailing market trends, potentially capturing profits from continued price movements.

Cross-Sectional Momentum

The cross-sectional momentum automated trading strategy is based on identifying assets with strong relative performance compared to their peers. It involves measuring the relative strength of different assets and selecting those that are outperforming the market. The strategy aims to ride the momentum of these assets by buying them and potentially selling the underperforming assets.

For example, Pepsi and Coca-cola are two stocks within the same group (beverages). A cross-sectional momentum strategy would buy the stronger-performing stock while simultaneously selling the weaker one. A similar strategy can be used in crypto and forex where the stronger asset is bought while the weaker market is sold. This strategy seeks to generate profits by assuming the assets that have shown strong performance in the recent past are more likely to continue their upward trajectory.

Dollar Cost Averaging (DCA)

The dollar cost averaging (DCA) strategy involves regularly purchasing a fixed dollar amount of an asset at predetermined intervals, regardless of its price. This strategy aims to mitigate the impact of short-term market volatility by spreading out the investment over time. During periods of lower prices, more units of the asset are acquired, and during periods of higher prices, fewer units are purchased.

Over time, this strategy can potentially reduce the average cost per unit and minimize the impact of market timing decisions. DCA is particularly popular among long-term investors seeking a consistent and gradual approach to building their investment positions.

Day Trading Automation

Day trading automation is a strategy that utilizes algorithms and automated systems to execute multiple short-term trades within a single trading day. These algorithms analyze various market price patterns, volume and volatility in real-time to identify and capitalize on short-term trading opportunities.

The strategy aims to profit from small price differentials and intraday price movements. By automating the trading process, day trading automation eliminates emotional biases and allows for rapid trade execution based on predetermined rules.

Arbitrage

Arbitrage is an automated trading strategy that seeks to exploit price discrepancies between different markets, instruments or exchanges. The strategy involves buying an asset at a lower price in one market and simultaneously selling it at a higher price in another market, profiting from the price differential.

This automated strategy will scan multiple markets in real time, identifying instances where prices diverge beyond normal market inefficiencies. For example, the price of Bitcoin might be lower on exchange A versus exchange B. Once an arbitrage opportunity is detected, a trade is executed to buy Bitcoin on exchange A while simultaneously selling Bitcoin on exchange B to take advantage of the price disparity. Arbitrage strategies aim to capture risk-free profits, as the price difference ensures a positive return regardless of the market's overall direction.

Risk-On/Risk-Off

The risk-on/risk-off strategy is designed to adjust trading positions based on the prevailing risk sentiment in the market. During risk-on periods, when investors are more optimistic about the market, the strategy favors higher-risk assets such as altcoins, stocks or high-yield bonds. It seeks to maximize the potential for higher returns during favorable market conditions.

Conversely, during risk-off periods characterized by increased uncertainty or market turmoil, the strategy shifts towards safer assets such as government bonds or defensive stocks. Within crypto, those “safer” coins would be blue-chip crypto like Bitcoin and Ethereum. By dynamically adjusting the portfolio allocation based on risk sentiment, the strategy aims to optimize returns in different market environments.

Market Timing

Market timing trading strategies aim to predict future price movements by analyzing various indicators used in technical analysis, price action, fundamental analysis or sentiment analysis. These strategies attempt to identify key moments to enter or exit positions in the market based on predicted price movements.

Market timing algorithms analyze historical data, patterns and market signals to generate buy or sell signals. However, it's crucial to note that market timing can be challenging, as accurate predictions are difficult to make consistently, and trading decisions are influenced by unpredictable factors.

Percentage of Volume

The Percentage of Volume (POV) automated strategy aims to execute trades based on a predetermined percentage of the total trading volume in a particular asset during a given time frame. This strategy is advantageous when dealing with large order sizes that could otherwise have a significant impact on the market.

By executing trades in proportion to the overall trading volume, the strategy attempts to minimize market impact and price distortions caused by the large order. It ensures that the trading activity aligns with the market's liquidity and helps traders avoid adverse effects on the asset's price while efficiently executing larger orders.

Implementation Shortfall

The Implementation Shortfall strategy aims to minimize the difference between the expected price and the actual execution price of a trade. It takes into account market impact and transaction costs when determining the optimal execution strategy. This strategy typically involves breaking down a large order into smaller parts and executing them over a specific period.

By balancing the desire for quick execution and minimizing slippage, the strategy seeks to achieve the best overall trade performance. Implementation Shortfall strategies utilize real-time market data and advanced algorithms to make informed trading decisions, optimizing trade execution while reducing the overall impact on the market.

Platforms For Automated Trading

In the past, coding knowledge was required to execute automated trading strategies. With the advancement in technology, you can easily find platforms that help you create algorithmic trading strategies without the need to code algorithms. The two platforms below can be easily accessed using the Bybit API key.

3Commas GRID Bot

3Commas GRID Bot is a trailing grid bot that trades at the most optimal prices in a sideways market, depending on whether the prices are above or below the medium line. It helps you make faster and longer profits as you can increase order sizes and place more Buy orders to continue trading when the price drops substantially. 3Commas GRID Bot also comes with many bot preset templates you can leverage to trade more efficiently, and can be stopped whenever you feel the market is unprofitable.

Insilico Terminal TWAP

The Insilico Terminal TWAP enables you to execute large orders at regular intervals and can be canceled at any time. It too gives you the option of placing stealth orders at randomized intervals and lot sizes, making it difficult to be detected by public market trackers.

The Bottom Line

With the upgrade in Bybit Copy Trading, Master Traders can easily execute automated trading strategies that give them a competitive edge to earn consistent returns in their trading, thereby attracting more followers and expanding their follower base. So, what are you waiting for? Sign up as a Master Trader on Bybit now to enjoy all the benefits of the Automated Copy Trading upgrade!

Disclaimer: All trading carries risk. Only risk capital you can afford to lose.

#LearnWithBybit