Bybit TradFi Report: Without US government data to look for, private data shows the market is stabilizing

With the official labor data suspended due to the ongoing US government shutdown, market participants are turning to alternative sources to gauge the health of the US labor market. Bloomberg News has reconstructed weekly unemployment claims, using unadjusted state-level filings and seasonal adjustment factors from the Bureau of Labor Statistics. This workaround provides a provisional snapshot of labor market conditions, though it lacks the full fidelity of the US Department of Labor’s standard releases.

Private compiled data

According to Bloomberg’s analysis, initial jobless claims fell to approximately 218,000 for the week ending October 25, down from a revised 231,000 the previous week. This decline suggests a modest improvement in labor market conditions, though the absence of data from Massachusetts, Arizona, the District of Columbia and the Virgin Islands introduces some uncertainty. For these jurisdictions, Bloomberg substituted the average of the prior four weeks in order to maintain continuity. While this method closely mirrors official seasonal adjustments when all states are included, the missing data points underscore the limitations of relying on partial inputs.

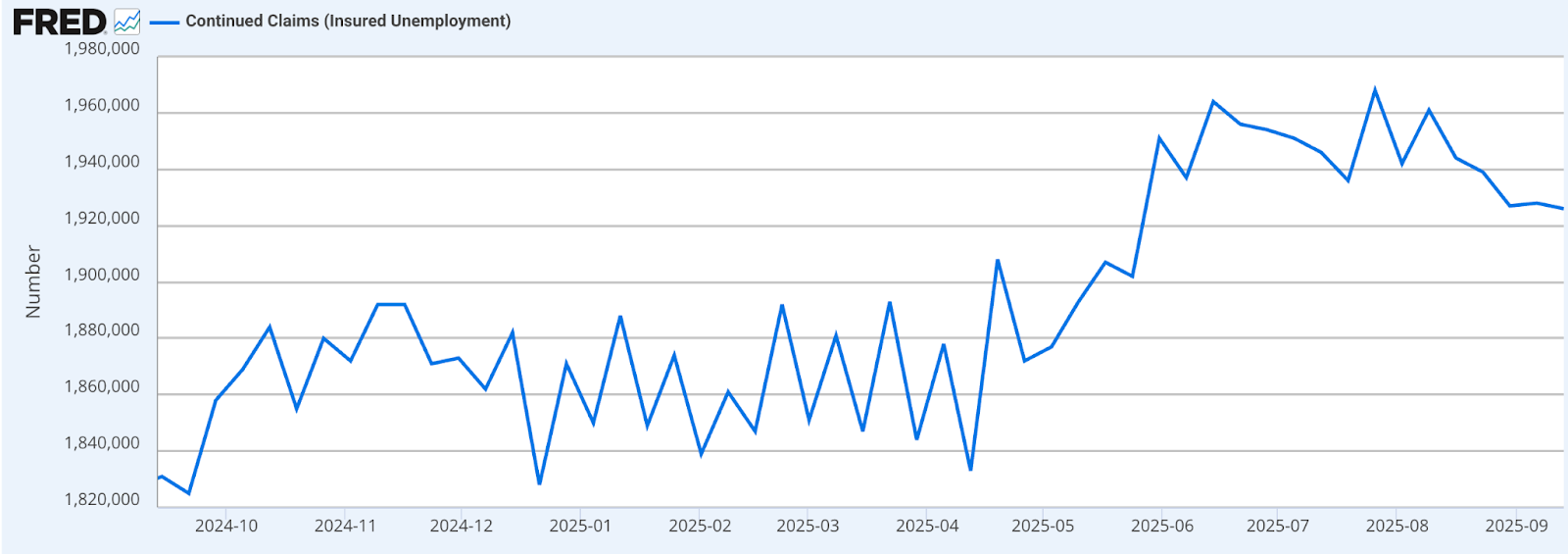

Continuing claims

Source: FRED

Continuing claims, which serve as a proxy for the number of individuals receiving unemployment benefits, edged up slightly to 1.95 million in the week ending October 18 from 1.94 million. This marginal increase may reflect slower re-entry into the workforce or a plateau in hiring momentum, both of which warrant close monitoring in the absence of broader employment metrics.

Federal workers remain disproportionately affected by the shutdown. Initial claims under the Unemployment Compensation for Federal Employees (UCFE) program declined to 8,865 for the week ending October 25, but the figure remains historically elevated. Continuing claims among federal employees rose to 20,594, marking the highest level since the conclusion of the previous government shutdown. These figures highlight the direct labor market impact of suspended federal operations, and suggest that the shutdown’s ripple effects are beginning to manifest more broadly.

ADP, job postings and wage trends

In the absence of key labor reports, such as Nonfarm Payrolls and JOLTS, investors and analysts should pivot to high-frequency private sector data and alternative indicators. ADP employment figures, online job postings and wage trends can offer directional insight into hiring activity. Consumer sentiment and spending patterns may also serve as indirect gauges of labor market confidence.

Source: ADP Research

Preliminary data from ADP shows that private sector employers added an average of 14,250 jobs per week over the past four weeks, marking a clear rebound from the job losses recorded in September.

It should be noted that ADP Research will now release US payroll data on a weekly basis — in addition to its monthly report — in order to provide high-frequency insights into the labor market. Additionally, market pricing — particularly in safe-haven assets and rate-sensitive instruments — can reveal how investors are recalibrating expectations around growth and monetary policy.

In short, the market may be stabilizing, based on private data

The modest decline in initial jobless claims, coupled with elevated continuing claims and federal worker filings, paints a mixed picture. While layoffs may be stabilizing, persistent benefit claims and shutdown-related disruptions suggest underlying fragility. With one interest rate cut already priced in, further signs of labor market deterioration could accelerate expectations for a more dovish Federal Reserve stance. In any event, until official data resumes, the focus will remain on triangulating labor conditions through alternative metrics and market signals.