Bybit TradFi Report: Will the market decline after an upcoming Fed rate cut?

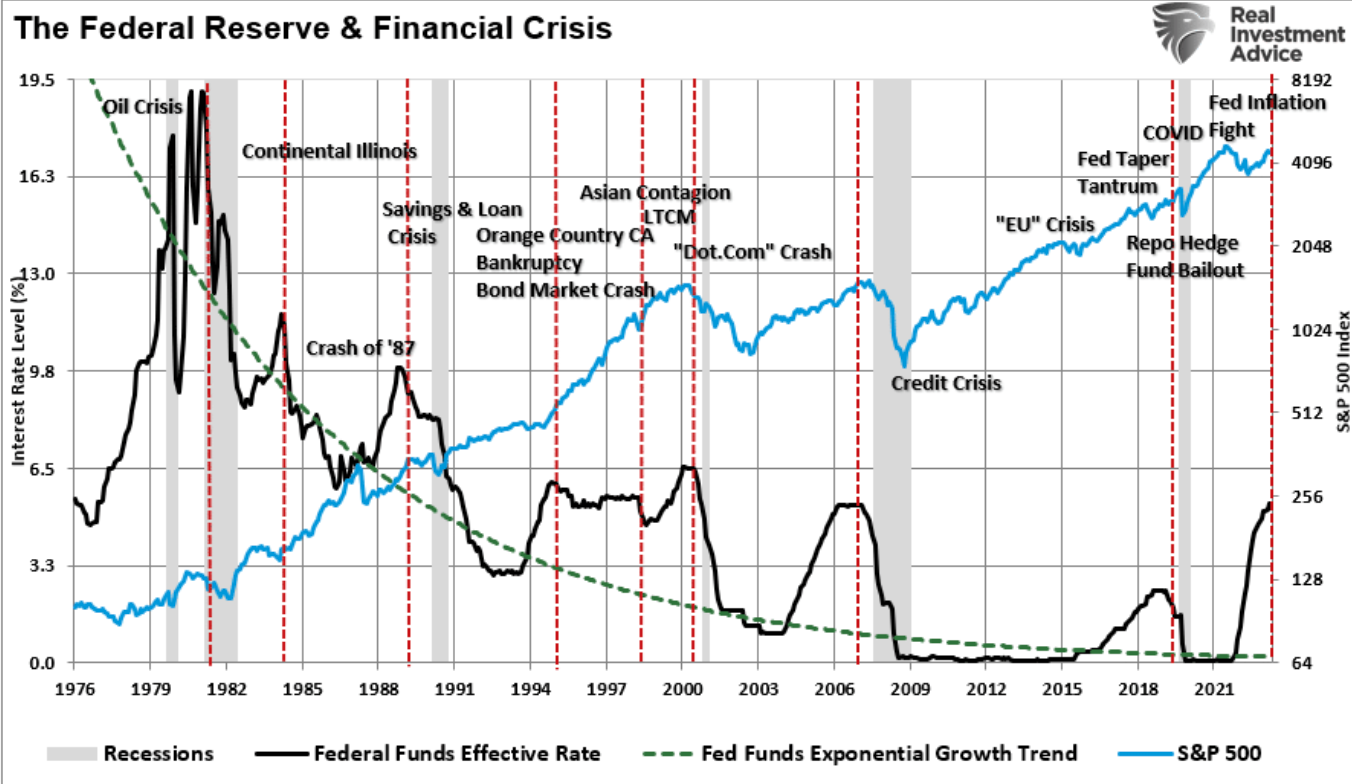

Federal Reserve rate cuts are typically viewed as stimulative, producing lower borrowing costs, increased liquidity and a boost to risk assets. Yet history shows that markets often decline following the initial rate cut in a monetary easing cycle. With a weakening job market from the recent September 2025 job data, how will the market react to a much-anticipated Fed rate cut?

The context behind rate cuts

The Federal Reserve rarely cuts rates in a vacuum. Rate reductions generally fall into one of three categories:

Normalization cuts: These occur when inflation is under control, and the Fed is seeking to support growth after a period of tightening. In these cases, markets tend to respond positively.

Recession cuts: These are implemented when the economy is already contracting or at risk of doing so. Historically, these cuts coincide with falling corporate earnings and rising unemployment — conditions that weigh on equity valuations.

Panic cuts: Triggered by financial crises or geopolitical shocks, panic cuts aim to restore confidence. While markets may rebound over the long term, the immediate aftermath is often marked by heightened volatility and drawdowns.

Key takeaway: The reason behind the rate cut matters more than the cut itself.

Historical performance post-cut

Source: Real Investment Advice

Data from Evercore ISI and Capital Economics shows that when the Fed has cut rates during or ahead of a recession, the S&P 500 has historically declined by an average of 4% over the following six months. This contrasts with a 14% gain when cuts occur in a non-recessionary environment. For example:

Dot-com bust (2001): The Fed began cutting rates aggressively, but the S&P 500 fell nearly 13% over the next six months.

Great Financial Crisis (2007–2008): Despite multiple cuts, markets plunged as systemic risks overwhelmed monetary support.

COVID-19 panic (2020): The Fed slashed rates to zero, yet markets experienced a sharp sell-off before recovering.

These episodes underscore the reality that rate cuts often lag behind economic deterioration. By the time the Fed acts, investor sentiment may already be fragile, and earnings expectations are under pressure.

Why markets react bearishly

Several factors explain the bearish reaction to rate cuts:

Signal of economic weakness: A rate cut is often interpreted as confirmation that growth is faltering. Investors may reassess risk premiums and reduce their exposure to cyclical assets.

Earnings compression: Lower rates don’t immediately offset declining corporate profits. If rate cuts coincide with falling demand, margins and earnings estimates are revised downward.

Lagging impact: Monetary policy operates with a delay. It can take months for lower rates to stimulate investment, hiring and consumption — leaving a window of vulnerability.

During uncertain periods, investors rotate into bonds and defensive sectors, reducing equity demand even as rates fall.

Weakening job market in 2025

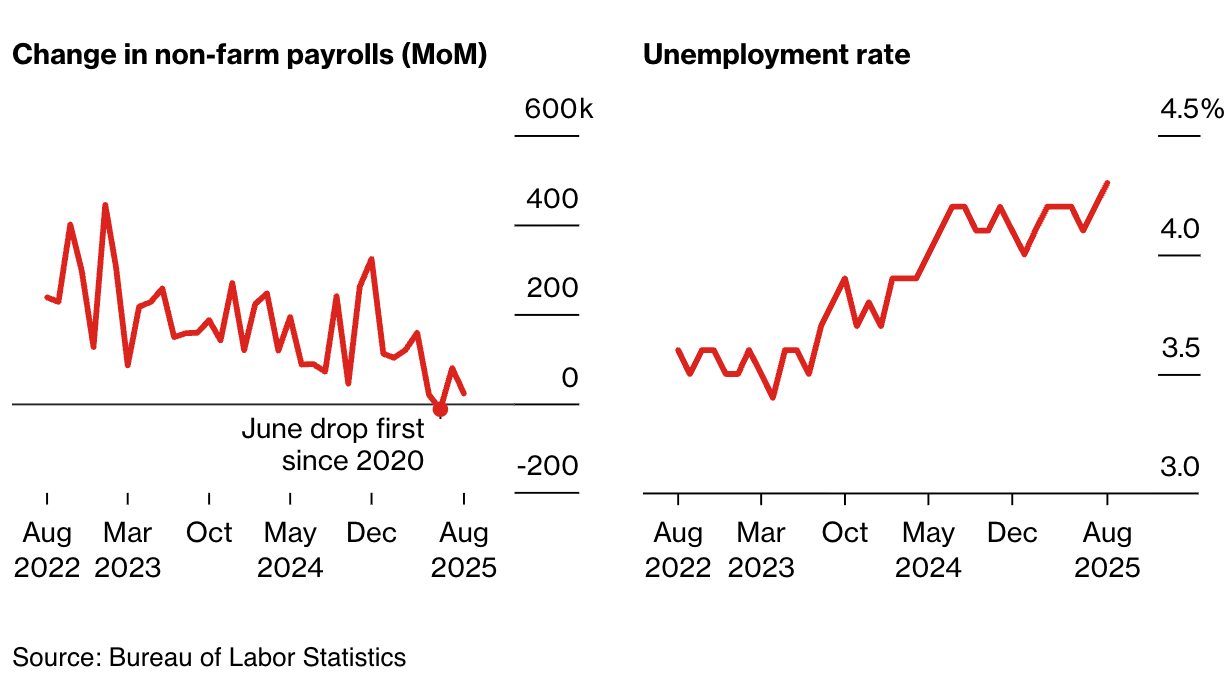

Following Chair Powell’s dovish remarks at Jackson Hole on August 22, markets rallied on expectations of a rate cut in September. However, underlying data — slowing job growth, sticky inflation and rising fiscal concerns — suggest the Fed is responding to deteriorating conditions, rather than proactively supporting expansion. If this cut marks the start of a recessionary easing cycle, historical precedent warns of potential downside in equities.

Moreover, while tech and crypto assets have shown resilience, their sensitivity to liquidity conditions means they could face renewed volatility if rate cuts fail to stabilize macro sentiment. Investors should consider the broader economic backdrop and exercise caution when interpreting easing as a bullish signal.

The most recent job report (September 2025) indicates that the US job market is weakening with plunging new payrolls and a rising unemployment rate. A Fed rate cut in mid-September, followed by a weakening job market before that, might concern investors and push the market lower.

Final words

Rate cuts aren’t inherently bullish. When they occur in response to economic weakness or financial stress, they often coincide with falling equity markets. Investors should focus less on the rate decision itself and more on the context — labor market trends, earnings revisions and fiscal dynamics. In 2025, as the Fed pivots toward easing, the risk is not that rates are too high, but that they’re falling for the wrong reasons.