Bybit x FXStreet TradFi Report: Why this week’s CPI and PPI data is a make-or-break event

Key Highlights:

It’s a critical week for inflation ahead of the Fed’s rate decision on Sep 17, 2025

PPI on Wednesday and CPI on Thursday will powerfully shape expectations

Markets are pricing in an 88% chance of a rate cut, with crypto, gold and stocks on alert

Bitcoin faces a major breakout or breakdown, based on the CPI outcome

The S&P 500 is eyeing 7,000, as lower inflation could extend the equity rally

Trade stock tokens with Bybit here.

Inflation week could decide the Fed’s next moves

This week is set to deliver one of the most impactful sequences of macroeconomic data in months, with the Producer Price Index (PPI) on Wednesday and Consumer Price Index (CPI) on Thursday. Both inflation reports will directly influence the Federal Reserve's interest rate decision on Wednesday, September 17, and could trigger powerful moves in equities, cryptocurrencies and precious metals.

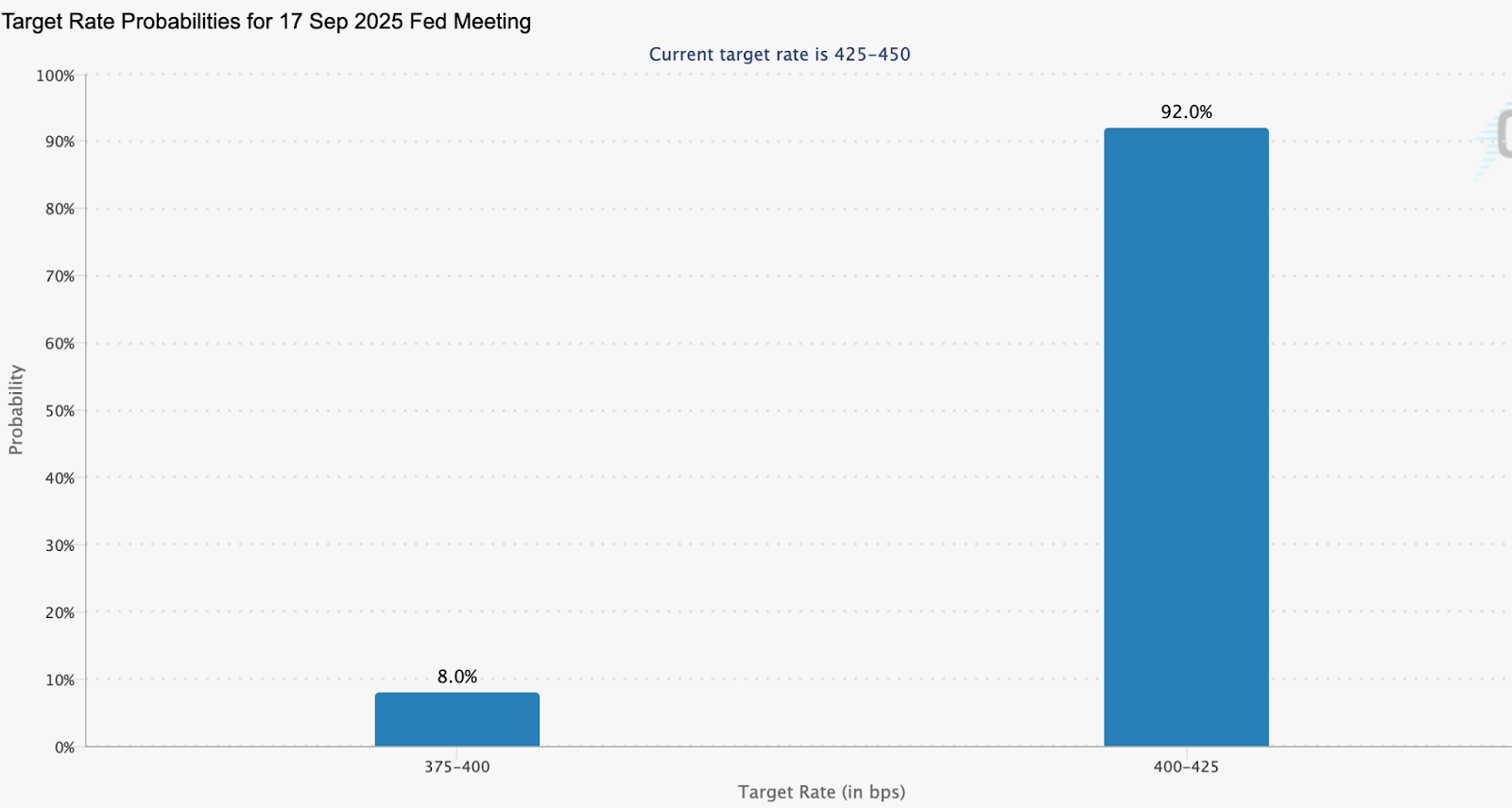

Source: CME FedWatch

According to CME FedWatch data, markets are currently pricing in a 92% probability that the Fed will cut rates next week from 4.5% to 4.25%, and an 8% chance of a deeper cut to 4.0%. If this week’s inflation readings come in softer than expected, that could solidify expectations and increase the likelihood of further reductions in November and December.

Why inflation matters so much this week

Inflation and interest rates often move together. Lower inflation gives central banks room to ease, while higher inflation requires tightening. That's why this week’s data is vital.

PPI (Wednesday) is forecasted to have risen 0.3% month-over-month. In July, the number shocked markets with a 0.9% gain, which triggered a pullback in Bitcoin, gold and equities.

CPI (Thursday) is forecasted to have risen from 2.7% to 2.9% year-over-year. A result below expectations could be fuel for a rally across assets.

Traders are watching these releases as key directional triggers, especially since there are no other major economic releases (aside from retail sales on September 16) before the Fed’s interest rate decision.

What does this mean for crypto, stocks and metals?

Lower inflation increases the chances of multiple interest rate cuts, which typically push money away from low-yielding instruments (such as bank deposits and bonds) and into assets like the following:

Cryptocurrencies, such as Bitcoin and Ether

Precious metals like gold and silver

Growth equities, especially in the tech sector

Markets are already pricing in a 75% probability that the Fed funds rate could fall to 3.75% or lower by year end. This week's inflation figures could be pivotal in pushing that probability even higher.

Market strategy: Two critical trading windows

Traders are preparing for two waves of opportunity:

Wednesday — PPI release

If the number is below expectations, expect a moderate rally in crypto, metals and equities.

A higher-than-expected figure could prompt defensive selling, especially in crypto markets.

Thursday — CPI release

A softer CPI reading could lead to a stronger second leg of the rally of the broader risk assets.

A CPI reading above 2.9% would reduce the chance of a rate cut, leading to a market correction.

This setup is amplified by the lack of additional Fed-relevant data before the September 17 decision, making these inflation numbers uniquely decisive.

Why do falling interest rates benefit crypto?

When interest rates fall:

Consumers and investors pull money out of bank deposits, as yields become less attractive.

This money often flows into spending and investing, both of which support higher prices and asset valuations.

Cryptocurrencies, in particular, benefit from this dynamic, seen as alternatives to fiat currency and increasingly viewed as inflation hedges or high-growth bets.

If inflation remains subdued, the Fed has room to ease further, which could power a late-year rally across assets, especially Bitcoin.

Technical analysis

Bitcoin (BTC)

Bitcoin hit its all-time high (ATH) of $124,500 on August 14, the same day July’s PPI data came in unexpectedly hot. Since then, BTC has been in a controlled profit-taking decline, forming a classic lower highs/lower lows pattern.

Initial resistance is at $117,300, the high from August 22.

If inflation reports are soft, BTC could quickly climb to $120,000 before the Fed decision.

A weak CPI could be the trigger to break Bitcoin’s ATH and launch it toward $135,000 by year end.

Conversely:

A hot inflation reading could drive BTC toward its September 1 low of $107,200.

A break below $105,000 would likely trigger strong downside momentum.

MACD and RSI on the two-hour chart confirm that BTC is approaching short-term resistance, but soft CPI/PPI results could make those resistance levels irrelevant.

Source: TradingView

S&P 500

The S&P 500 is holding above its pivot level of 6,500 points, with investor sentiment supported by expectations of rate cuts.

Lower rates reduce the relative appeal of cash and bonds, making equities more attractive.

A softer inflation reading could open the door to a move toward 6,600, and potentially the psychological 7,000 level by year end.

Technically:

MACD and RSI on the two-hour chart show no significant resistance.

The short-term target is a new ATH above 6,600, depending upon CPI confirmation.

Source: TradingView

Crypto/macro crosswinds intensify

With Ether (ETH) also rebounding, and XRP hovering near breakout levels, crypto traders are monitoring inflation data and Fed policy simultaneously. The timing of these themes makes this week a perfect storm for volatility.

Watch for the following potential events:

A soft CPI result to trigger broad-based buying

A hot CPI or higher-than-expected PPI to weaken crypto’s momentum, at least in the short term

Conclusion: Thursday’s CPI is the make-or-break event

The Producer Price Index on Wednesday will serve as the first spark, but Thursday’s CPI will determine whether the Fed accelerates its path to rate cuts.

If inflation comes in cooler than expected, the S&P 500 could target 7,000, while Bitcoin could reclaim $120,000 and potentially surpass its ATH.

If inflation surprises to the upside, traders should prepare for pullbacks and heightened volatility. The Fed’s decision on September 17 hinges on this week’s data — and so does the path of markets heading into Q4 2025.