What is Strategy (formerly MicroStrategy)?

Few stocks can outperform Bitcoin (BTC) over an extended period of time. Yet, one company has provided more return over the past five years. Between Jun 18, 2020 and Jun 18, 2025, Strategy (MSTR) has returned 2,960%, while BTC has returned 1,006%. Previously MicroStrategy, Strategy was once a business intelligence firm that transformed itself into the largest corporate holder of Bitcoin, with 529,000 BTC in its treasury.

In this article, we’ll look at Strategy to see how its founder, Michael Saylor, turned the company into the largest institutional Bitcoin holder — and how it’s inspired numerous global firms to adopt the corporate Bitcoin treasury strategy.

Key Takeaways:

Strategy has transformed itself into a Bitcoin-focused company with over 529,000 BTC on its balance sheet.

It raises capital through innovative financing tools, such as STRK and STRD, to expand its Bitcoin holdings without diluting common equity.

While its Bitcoin-centric strategy has delivered major gains, this design also exposes the company to downside risk during Bitcoin bear markets.

What is Strategy?

Strategy was founded in 1989 as a business intelligence company by Michael Saylor. Originally named Microstrategy, the company rebranded in early 2025, simplifying its name to Strategy. Initially, the company’s core business model was designed to help organizations analyze their data, and to provide them with the information necessary to make informed decisions.

In August 2020, Strategy announced the adoption of Bitcoin as its primary treasury asset. Since there was no Bitcoin ETF available at that time, Strategy’s stock, MSTR, became a proxy-ETF instrument that allowed Wall Street institutions to obtain exposure to Bitcoin. This event triggered a significant repricing of the stock, driving its value up nearly 60% in the following months. Capitalizing on this success, Saylor pivoted the company’s core mission from business intelligence to Bitcoin treasury management.

Strategy’s Bitcoin purchases

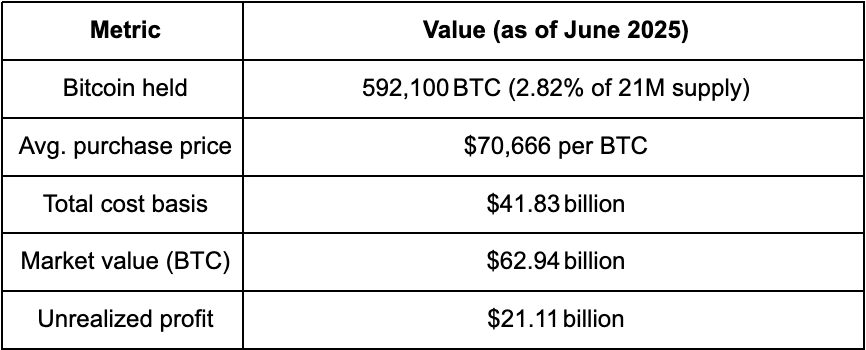

Over the past five years, Strategy has amassed a large Bitcoin balance sheet through regular purchases. As of June 2025, it holds about 529,100 BTC, which accounts for roughly 2.8% of Bitcoin’s 21 million supply. Strategy has used a dollar-cost-averaging (DCA) approach, bringing its average acquisition price to around $70,666 per BTC. The table below summarizes Strategy’s Bitcoin treasury:

Michael Saylor’s Bitcoin price prediction

Michael Saylor has been a vocal Bitcoin evangelist for several years. He firmly believes Bitcoin is in a multi-year bull market, and expects BTC’s price to eventually reach $1 million. Saylor argues that Bitcoin’s fixed supply and growing institutional acceptance justify this prediction. Beyond price calls, Saylor has pioneered the idea of “Bitcoin-backed” corporate financing, and under his guidance, Strategy claims to be the world’s largest issuer of Bitcoin-linked credit instruments.

Strategy’s Bitcoin treasury approach

Strategy uses a mix of the following methods to pay for Bitcoin.

Convertible debt: Strategy issues convertible bonds (debt that can convert into stock) to raise cash for BTC. For example, in recent years Strategy has sold zero-coupon convertible notes.

Equity offerings: The company also sells new shares of various types. In early 2025, it launched a $21 billion at-the-market program for its 8% Series A “STRK” preferred stock, and in June 2025, it sold about $980 million of 10% Series A “STRD” preferred shares.

Operating income: Strategy continues to earn several hundred million dollars per year from its business intelligence software enterprise. These cash flows are partly used for buying bitcoins.

Once purchased, Strategy’s bitcoins are kept in cold storage custody. All of Strategy’s Bitcoin is held through Coinbase Prime, providing an additional layer of security. On the accounting side, Strategy has adopted fair value accounting to reflect Bitcoin’s market value on its balance sheet.

What is Strike (STRK)?

STRK is the ticker for Strategy’s 8.00% Series A Perpetual Strike Preferred Stock (nicknamed “Strike”). Announced on Mar 10, 2025, Strategy filed an at-the-market program to issue up to $21 billion of these shares. STRK pays an 8% dividend, and is convertible into common stock at $1,000 per share. The stock is a high-yield funding vehicle that Strategy can use to raise additional capital to buy more Bitcoin without touching its common equity.

What is Stride (STRD)?

STRD is Strategy’s newer preferred offering. In June 2025, the company announced an IPO of 10.00% Series A Perpetual Stride Preferred Stock (ticker: STRD). It planned to sell 11.76 million STRD shares at $85 each to raise about $979.7 million. Like STRK, STRD is aimed at long-term, yield-seeking investors. At 10% annual dividend, STRD offers the highest yield among Strategy’s capital products, though it’s also riskier, as it sits below STRK in the capital structure.

MSTR stock performance

Source: Google Finance

Before the Bitcoin treasury announcement in August 2020, MSTR stock was trading at around $12. Four years later, in November 2024, the stock reached a peak price of $543, an increase of 4,525%. The stock performance largely tracks with BTC’s price movement. When Bitcoin retraced to $75,000 in April 2025, MSTR fell to $240. Currently, the stock is trading at $376, and is up 23.01% year-to-date.

Strategy’s broader market impact

Strategy’s aggressive Bitcoin treasury strategy and the subsequent price movement of MSTR have attracted the attention of several other publicly listed companies.

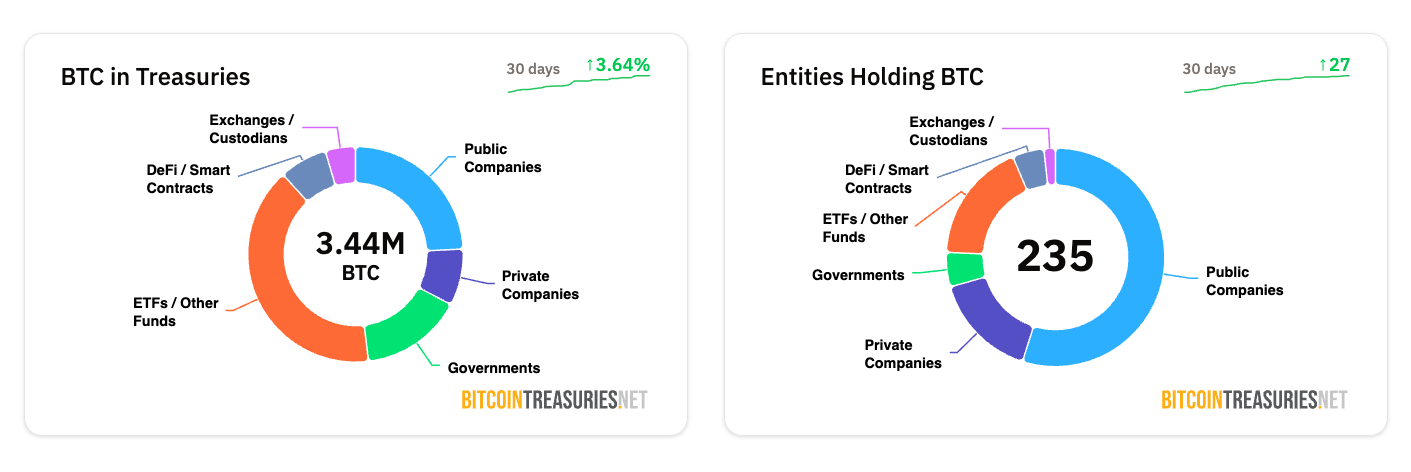

As of June 2025, 235 companies worldwide have Bitcoin on their books, including 130 public firms. Public companies alone hold 832,136 BTC, which accounts for almost 4% of the entire Bitcoin supply.

Risks of Strategy’s approach

While Strategy’s approach has been termed as an “infinite money glitch” by some in the market, it isn’t without risks, the largest one being the impact of Bitcoin’s volatility on the company's balance sheet and valuation. For example, during the 2022 Bitcoin crash, Strategy’s stock lost nearly 90% of its value. A similar collapse now could create a vicious cycle, whereby a falling BTC price would cause Strategy to sell its Bitcoin — which, in turn, would drive Bitcoin’s price even lower, forcing the company to sell even more Bitcoin.

Trade MSTR on Bybit TradFi

Strategy has pioneered the use of Bitcoin as a corporate treasury asset, demonstrating that a public company can use creative financing (such as STRK and STRD) to scale into Bitcoin. The company’s moves have helped drive corporate Bitcoin adoption globally, with companies not only accumulating Bitcoin, but other leading digital assets, such as Ether and Solana, into their corporate treasuries.

Bybit users can trade MSTR stock contracts for differences (CFDs) on Bybit TradFi using the Bybit App now. To trade MSTR on Bybit:

- Log in or create a Bybit account, and complete KYC verification.

- Navigate to Trade → TradFi in the Bybit App.

- Tap on Apply to open your TradFi account, and agree to the terms.

- Deposit USDT to your Funding Account, and transfer it to your TradFi Account.

- Go to the Stocks tab, search for MSTR, and tap on MSTR to open.

- Click on Buy or Sell, then set your trade volume and confirm the trade.

Learn more here about how to create your TradFi account and trade with the Bybit App.

#LearnWithBybit