Macro this week: Tariffs, recession fear and the Fed’s next move ahead of May 6 FOMC meeting

It's a tricky time for global financial markets, with worries swirling around US trade policy and its potential economic effects. Big tariff hikes in the ongoing US-China trade war have made the future feel uncertain, shaking things up for traders and investors.

As everyone tries to make sense of it all, key economic reports are giving us clues. Meanwhile, all eyes are on the upcoming Federal Open Market Committee (FOMC) meeting on May 6-7, 2025, for hints about where interest rates might be headed. Let's break down the latest data and look ahead to what the Fed might say.

Key Takeaways:

Recent US economic numbers paint a mixed picture: the job market looks stable, but inflation shows signs of cooling right before new tariffs really kick in.

Stocks and crypto are still seeing plenty of volatility, due to trade war jitters, while gold prices are hitting record highs as investors seek safe havens.

The Fed is expected to keep interest rates steady on May 6–7, but what it says about tariffs and future rate cuts will be crucial for market direction.

Key macro data releases in April

Economic numbers released so far in April have significantly influenced market sentiment amid trade tensions and policy questions. These reports offer a snapshot of the US economy's health just before the newest tariffs start making their mark.

Job openings

The US job market is still holding up, though some details suggest caution. Initial jobless claims for the week ending April 12 actually fell by 9,000 to 215,000. That's the lowest since February, and better than the 225,000 applications economists predicted, suggesting companies didn't immediately cut jobs after US president Donald Trump's April 2 "Liberation Day" tariff announcements.

However, continuing claims — the number of people receiving unemployment benefits after the first week — edged up slightly to 1.89 million for the week ending April 5. While new claims are low, higher continuing claims compared to a year ago suggest it might be getting tougher for laid-off workers to find new jobs. A strong job market could mean the Fed feels less pressure to cut interest rates, potentially helping the US dollar but weighing on riskier assets like stocks and crypto.

Core CPI

Good news arrived with the Consumer Price Index (CPI) report released on April 10, showing inflation cooled more than expected in March. Headline CPI dipped 0.1% from the previous month, pulling the yearly rate down to 2.4% (from 2.8% in February), below the 2.6% Wall Street forecast.

More importantly for the Fed, core CPI (excluding food and energy) only nudged up 0.1% monthly. This brought the annual core rate down to 2.8%, its lowest since March 2021 and better than the 3% forecast. Lower energy costs — especially gas (−6.3% MoM) — played a big part. While softer inflation usually supports rate cuts, the looming impact of tariffs complicates things, as these duties are expected to push prices higher.

Core PPI

Following the encouraging CPI numbers, the Producer Price Index (PPI) on April 11 also pointed to easing costs for producers. Headline PPI surprisingly dropped 0.4% in March against forecasts of a 0.2% rise, slowing the annual rate sharply to 2.7% from 3.2%. Core PPI also fell 0.1% month-over-month, bringing its yearly rate to 3.3%.

Falling energy prices were again a major factor. But the report wasn't all positive — it showed early signs of tariffs hitting, with wholesale iron and steel mill prices jumping 7.1% in March, the biggest monthly leap since April 2021. If these input costs keep rising due to tariffs, it could squeeze company profits and push bond yields higher.

Equities and crypto market performance

Markets have been volatile, reacting to economic data and trade policy shifts. US stocks saw big swings, with the S&P 500 reacting to both tariff fears and inflation news. When Trump announced a 90-day pause on many reciprocal tariffs (excluding China) on April 9, it sparked a major relief rally. The S&P 500 had its best day since October 2008, gaining 9.5% following the news, but overall uncertainty still lingers.

Bitcoin's price certainly reflected this turbulence. Following the April 1 JOLTS report showing fewer job openings, BTC briefly surged 5.24% from $82,563 to hit a recent high of $86,891 on April 2. However, the gains didn't last, as the price subsequently fell to $74,830 by April 7 amid intensifying US-China trade war tension.

A recovery brought BTC back to $83,020 by April 10, but it dipped again before getting a boost from the better-than-expected core PPI report on April 11. This pushed the price up from $79,664 on April 11 to $84,074 by April 17. As of April 22, 2025, Bitcoin is trading at around $88,000.

As the US dollar weakened and recession worries grew, gold prices soared past $3,300 an ounce, hitting record highs as investors sought safety in the precious metal.

Fed FOMC on May 6–7: What are investors watching?

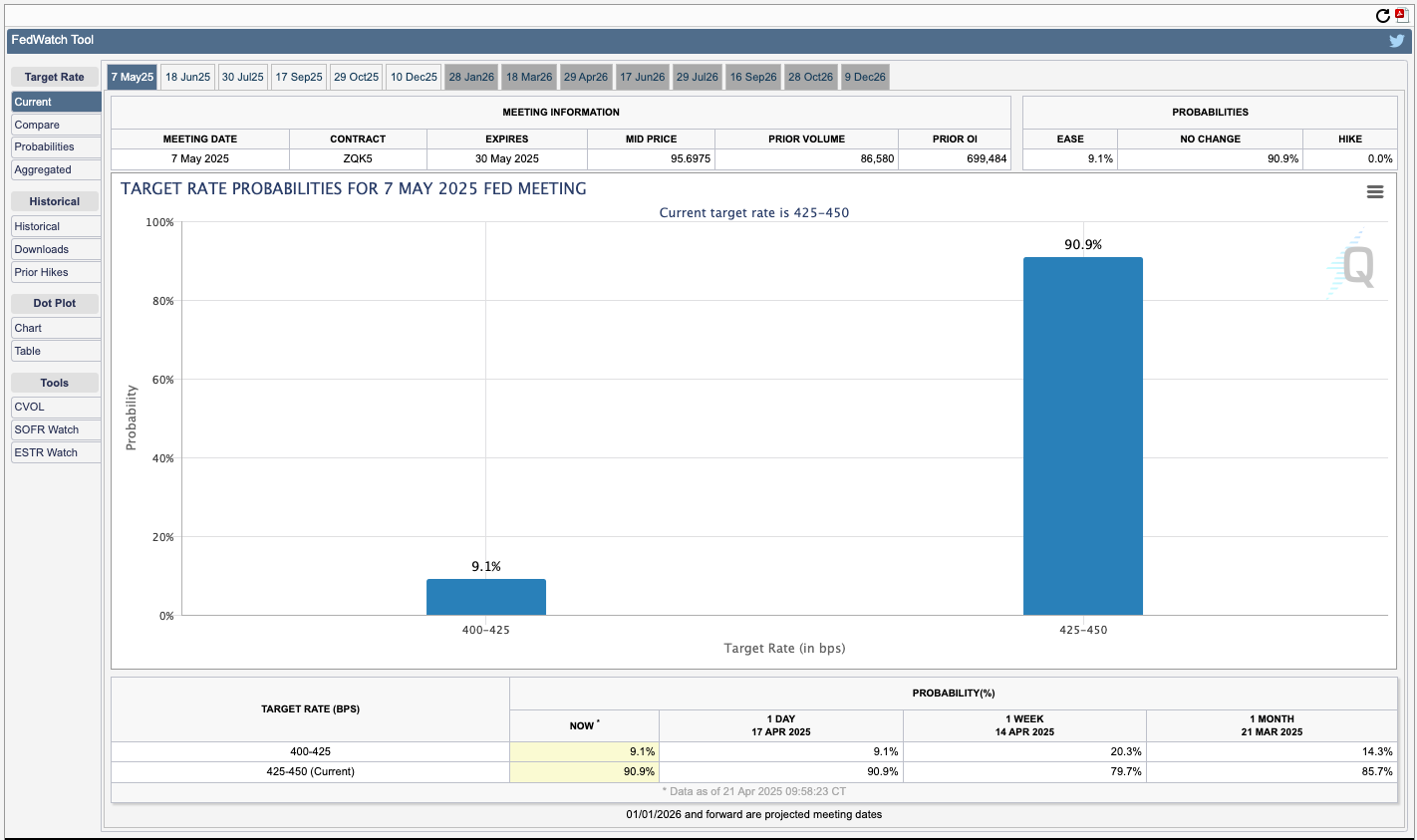

The upcoming FOMC meeting on May 6–7 is a key focus for traders seeking clarity on interest rates. Markets widely expect the Fed to keep the federal funds rate steady at 4.25%–4.50%. Although March's inflation cooled somewhat, it's still above the Fed's 2% target. Officials have signaled patience, especially with the job market looking stable — something Fed Chair Jerome Powell recently described as being in solid condition.

Most investors will watch the FOMC's statement and Powell's press conference for changes in tone, especially regarding tariffs. Fed officials like New York Fed President John Williams have acknowledged tariffs will likely boost inflation and slow growth.

Williams even projected GDP growth could fall below 1% and inflation could rise to between 3.5% and 4% this year, due to tariffs and less immigration, stating it's "simply too early to know the answers" because of the uncertainty. Powell himself also noted signs the economy might have slowed in the first quarter.

While a May rate cut looks highly unlikely — the CME FedWatch Tool shows slim odds — investors will listen for hints about when future cuts might occur. Market analysis suggests a cut at the June 18 meeting is more likely than not. Further out, markets might be pricing in about three cuts by year end, but predictions vary (from one cut to five). Any sign that cuts could be delayed beyond June, or that the Fed is more worried about inflation, could negatively impact risk assets such as crypto.

Navigating the macro crosscurrents

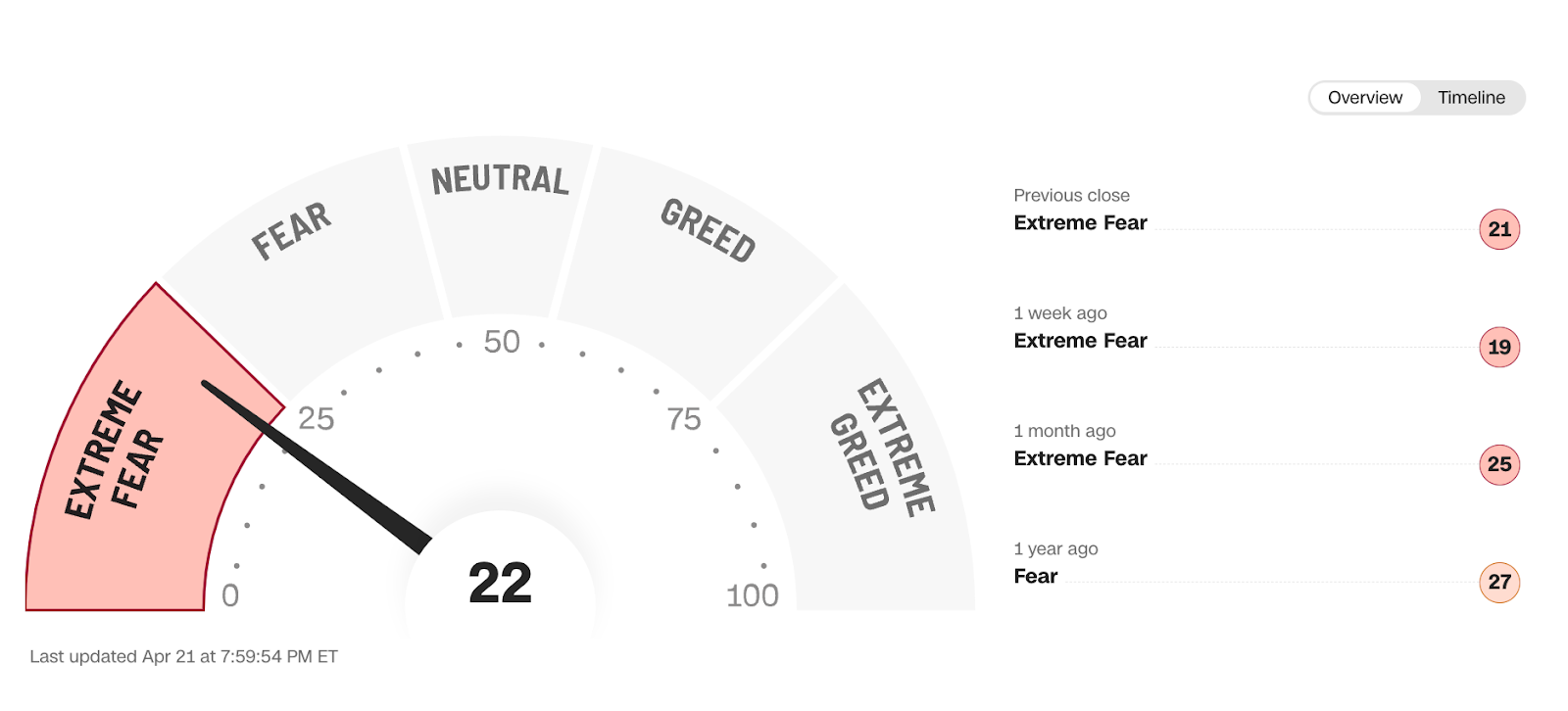

Current market sentiment has sunk to extreme fear territory for the past month. Tariffs and recession fears drove a sharp sell-off in global markets and crypto, while economic data is sending mixed signals — a strong job market alongside cooling March inflation right before new tariffs hit.

The upcoming FOMC meeting is pivotal. A rate hold is expected, but the Fed's view on tariff impacts and future rate cuts will be critical. Crypto and equity traders should pay close attention to Fed communications and economic data in order to navigate the uncertainty and adjust their strategies.

If you're looking to diversify or manage risk across different assets, Bybit makes it easy to trade gold, forex and other traditional finance markets alongside crypto via our MT5 platform. You can trade over 100 pairs with features like tight spreads, tailored fees, top-tier liquidity and up to 500x leverage. Create an account now to get started!

#LearnWithBybit