Circle stock outlook in 2025: How to trade CRCL on Bybit

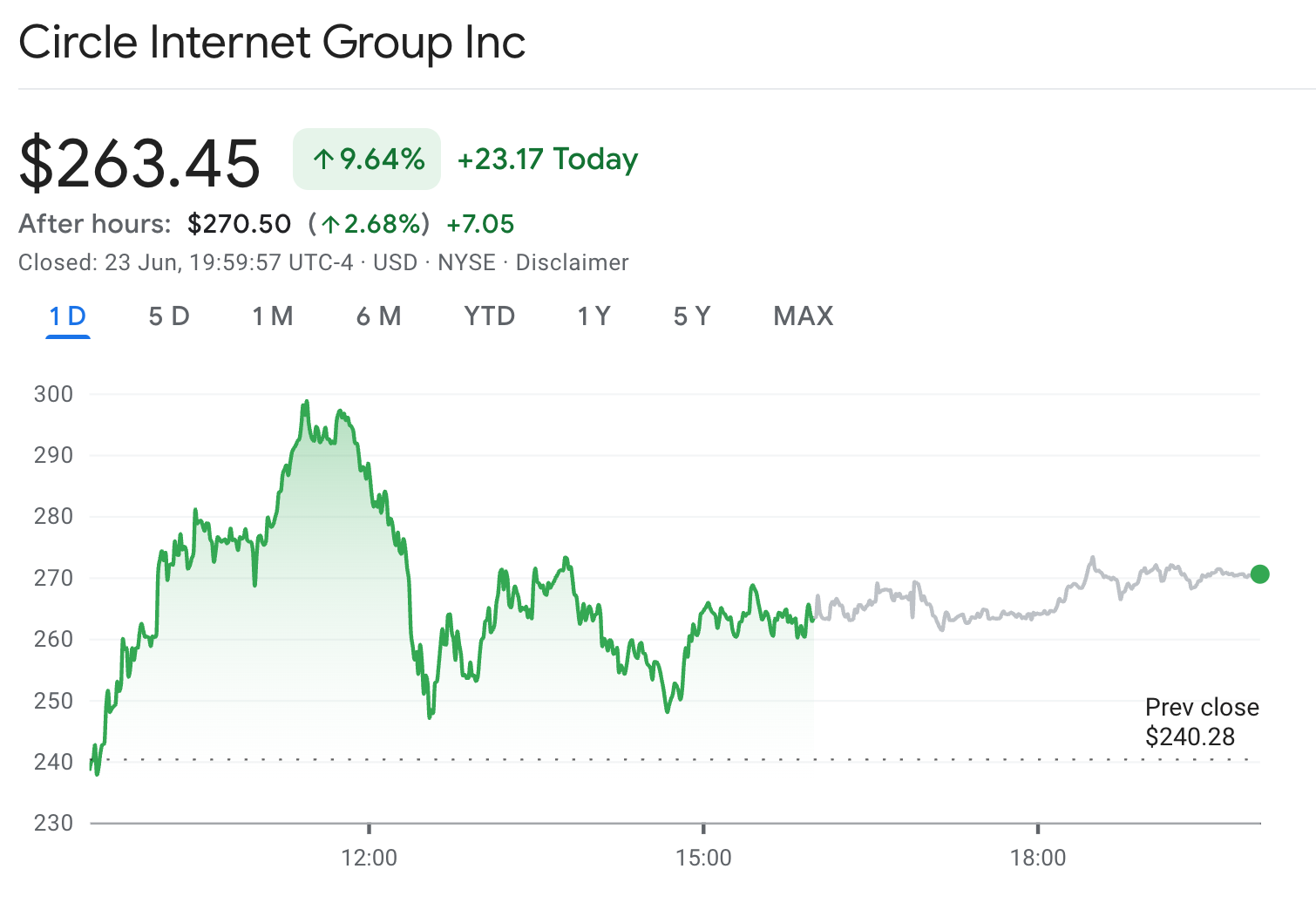

Since going public on Jun 5, 2025, Circle Internet Group, Inc. (CRCL) has emerged as one of the year’s top performers. After its IPO, Circle’s stock has surged over 749%, climbing from $31 to approximately $270.54 per share as of June 24. This explosive rally reflects growing investor confidence in both Circle’s stablecoin infrastructure and increasingly active US regulatory clarity.

This article covers the key drivers behind CRCL’s momentum and the upcoming catalysts shaping its outlook, and shares how you can trade CRCL on Bybit TradFi directly on the Bybit App.

Key Takeaways:

CRCL is up over 749% since its IPO, driven by strong investor demand and regulatory momentum.

The GENIUS Act, passed by the US Senate, is currently a major catalyst for stablecoin legitimacy.

CRCL is tradable on Bybit TradFi with USDT margin, up to 5x leverage and 50% off fees.

What is the Circle Internet Group?

Circle Internet Group, Inc. is the company behind USDC (USDC), the second-largest stablecoin in circulation, with a market cap of $61.4 billion and $61.2 billion in circulation.

USDC is a dollar-pegged stablecoin backed 1:1 by US dollar reserves. It’s widely used for payments, DeFi applications and cross-border remittances. Circle Internet Group, Inc. was co-founded by Jeremy Allaire and Sean Neville in October 2013.

Notably, Coinbase partnered with Circle in launching USDC through the Centre Consortium, boosting the coin’s credibility and adoption.

Circle’s oversubscribed IPO

On Jun 5, 2025, Circle launched its IPO under the ticker CRCL, raising $1.1 billion by selling 34 million shares of Class A common stock at $31 per share. The IPO, held on the New York Stock Exchange (NYSE) and led by underwriters J.P. Morgan, Citigroup and Goldman Sachs, valued the company at $6.9 billion.

The offering was 25x oversubscribed, with participation from notable institutional investors like ARK Investment Management and BlackRock, signaling strong institutional interest and confidence in Circle’s role as a regulated stablecoin leader. Circle’s trading day debut on the NYSE saw shares surge 168% to $83.23 on the first day and climb to $107.70 by the second day.

Why did CRCL surge post-IPO?

Since its IPO, CRCL has surged over 749%, boosting Circle’s valuation well above $63.89 billion. The rally was sparked by strong investor demand and the passage of the GENIUS Act in the US Senate shortly after the IPO.

The GENIUS Act establishes federal standards for stablecoins, requiring full reserve backing, regular audits and compliance checks. As the issuer of USDC, Circle is well-positioned to benefit from this regulatory clarity, which is seen as a major tailwind for its future growth.

CRCL stock outlook in 2025

Circle’s 2025 outlook is promising, but not without risks.

Bullish factors:

The GENIUS Act passed in the US Senate, advancing Circle toward federal licensing.

The Stablecoin market is projected to hit $400B by the end of 2025, with the potential to reach $2–3.5 trillion by 2030.

Circle holds a first-mover advantage as a compliant US stablecoin issuer

Bearish factors:

The bill still needs House and presidential approval to become law.

Tether remains the dominant stablecoin in terms of market share.

Federal Reserve rate cuts may reduce interest earned on USDC reserves.

How to trade CRCL on Bybit TradFi

Bybit has launched stock and CFD trading through its TradFi platform, allowing users to trade 78 US stock CFDs, including CRCL, directly using USDT, with no MT5 app required.

Step-by-step: How to trade CRCL

Log in or create a Bybit account, and complete KYC verification.

Navigate to Trade → TradFi in the Bybit App.

Tap on Apply to open your TradFi account, and agree to the terms.

Deposit USDT to your Funding Account, and transfer it to your TradFi Account.

Go to the Stocks tab, search for CRCL, and tap on CRCL to open.

Choose Buy (if bullish) or Sell (if bearish), then set your trade volume and confirm the trade.

Note that the maximum leverage is up to 5x, while every trade incur fees of $0.04 per share, and a $5 minimum commission per order. Learn more on how to trade global markets on the Bybit App.

Trade CRCL on Bybit and save 50% on fees

For a limited time, Bybit is offering 50% off trading fees on all stock CFD trades, including CRCL. Whether you're bullish on Circle or exploring broader stock opportunities, now is a great time to start. Start trading CRCL today with 50% off fees on Bybit TradFi.

#LearnWithBybit