How to Manage a Crypto Portfolio Successfully (5 Easy Ways)

Many new crypto traders focus on buying just one coin. However, their crypto performance is relegated to the sentiment, development, and community behind that one project.

Building a balanced crypto portfolio can help guard against excessive losses since some projects will outperform others. Over the next few minutes, we will discuss what a cryptocurrency portfolio is, the benefits of a crypto portfolio, and tools to help you manage one.

What Is a Cryptocurrency Portfolio?

A cryptocurrency portfolio is a basket of digital assets consisting of cryptocurrencies. Crypto investors aim to improve their risk-adjusted returns by mixing and diversifying their cryptocurrency and token investments.

For many beginners, investing in crypto means buying and holding Bitcoin. Did you know there are over 10,000 cryptocurrencies available? It is not feasible to buy all 10,000 for your portfolio, nor do you want to. The top five largest valued cryptocurrencies make up 76% of all cryptocurrency value.

The vast number of cryptocurrencies available speaks to the future potential of crypto. Therefore, including crypto as a portion of your overall investment portfolio makes sense.

Before we dig into methods to build your crypto portfolio, let’s tackle some benefits a crypto portfolio may deliver.

The Purpose of Having a Balanced Portfolio

Most beginning crypto investors believe buying crypto simply means holding Bitcoin in hopes its value moves up to $1 million per coin. Buying Bitcoin is a place to start. However, you can’t run until you first learn how to walk.

As we have seen in 2021, there are times when investors favor Bitcoin and other times that Bitcoin falls out of favor. Early in 2021, Bitcoin was accelerating higher in price behind speculation of its institutional adoption into corporate balance sheets. That favorable outlook was quickly reversed a couple of months later when debates about Bitcoin’s electricity usage and resultant carbon footprint began to swell.

An investor whose portfolio consists of just Bitcoin will experience volatile market swings.

Balance with Diversification

The first benefit of a balanced portfolio is diversity. Holding onto just one coin leaves you susceptible to the ups and downs of news that solely impacts that coin.

Another example of this dynamic is Ripple. Recently, U.S. governmental bodies were focused on whether Ripple was initially breaking their regulations. Ripple sold off on the news. Cryptocurrencies are largely unregulated, and the laws around them are still being created. Therefore, investment in just one coin pins the returns of your crypto investment to the performance of that one coin.

Better Chance of Picking an Outperformer

A secondary benefit of a balanced crypto portfolio is that when you spread your investments out, you have a better shot at picking a coin that outperforms. Indeed, the reason more than 10,000 cryptocurrencies exist is that each one is trying to improve on some real-world problem with cryptocurrency.

Bitcoin is the largest and oldest cryptocurrency and has stood the test of time. However, we don’t know if someday there will be another coin worth more than Bitcoin if that newer coin improves on a certain fundamental quality. As you research cryptocurrencies, look for those projects that have the potential to solve real-world problems. For example, Chainlink’s solution to the oracles problem could be a potential alternative that will take off one day.

Diversify to Rebalance

Lastly, having a diversified portfolio allows you to rebalance your portfolio so it doesn’t become overweight in certain coins.

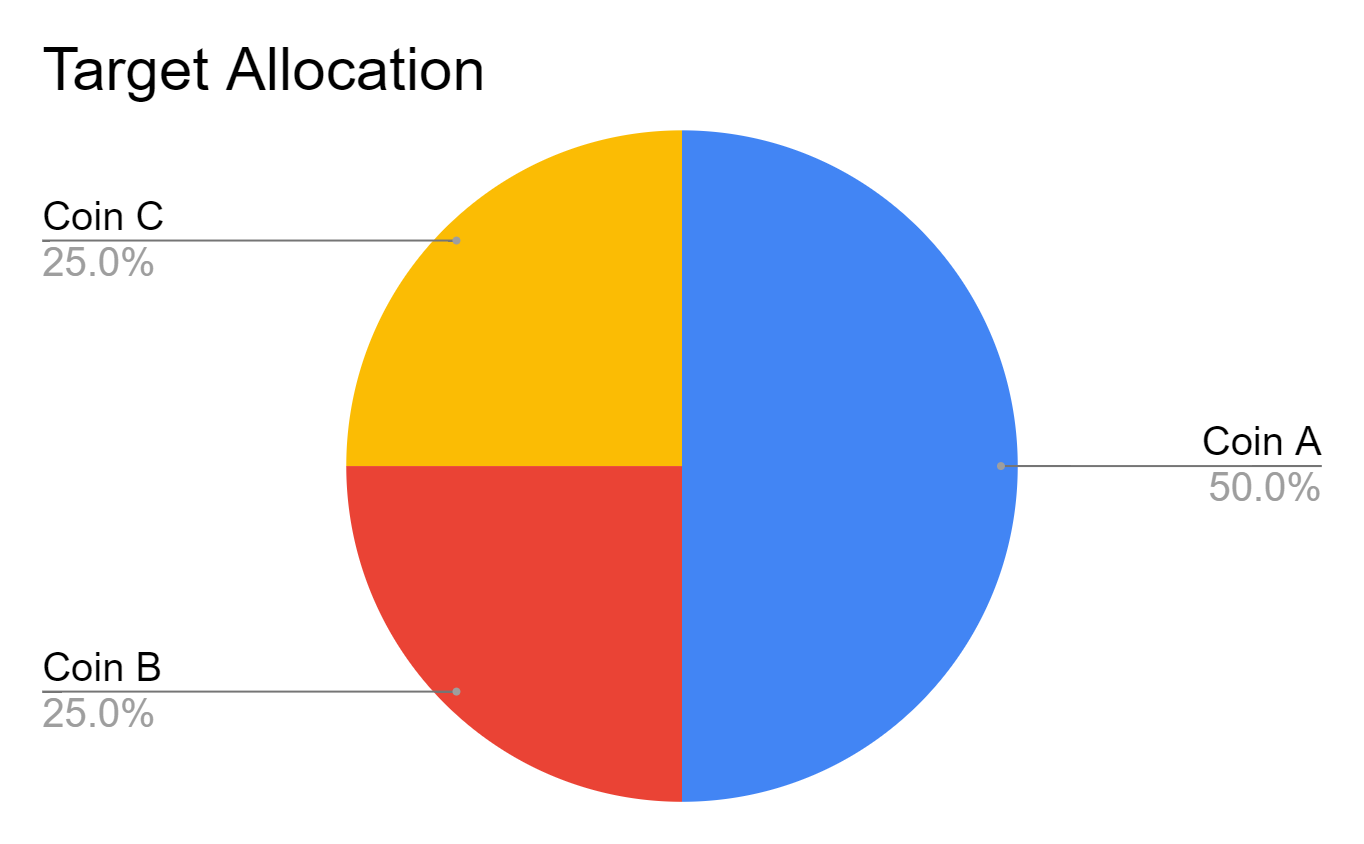

For example, let’s assume you’ve invested in three coins: coin A, coin B and coin C.

You decide to allocate 50% to coin A, 25% to coin B, and 25% to coin C. You further decide to allow the percentages to deviate by 10%. Coin A rockets higher and, as a result, is now 60% of your crypto portfolio. Therefore, you decide to sell off a portion of coin A and buy coins B and C to rebalance back to the 50-25-25 split. This way, you are using the gains from your outperforming crypto to fund the rest of your portfolio.

5 Ways to Help Manage Your Portfolio

Having a balanced crypto portfolio means you’re halfway to creating a sustainable portfolio. Investing in digital assets is relatively new, with a lot of intimidating terminologies.

Take the time to learn and analyze them fundamentally before diving headfirst into the water. If you are ready to build, here are five foundational pillars to help you strive toward that balance and to manage your crypto portfolio.

Dollar-Cost Averaging

Many investors might not have a large lump sum that they can transfer from traditional investments into a crypto portfolio. Therefore, making regular small investments from your income cash flow, regardless of crypto prices, is a great way to build up your portfolio. As a result, dollar-cost averaging is one of the best trading strategies to build your portfolio that works in both up and down markets.

Dollar-cost averaging (DCA) is an automatic system of making fixed dollar amount investments, regardless of a token’s price. By entering the investment in regular increments, you are smoothing out the anxiety resulting from imperfect timing. If the price of the cryptocurrency moves higher, you can add more shares in a strong bull market. If the price of the cryptocurrency moves lower, you will be able to add even more shares as your investment amount in fiat terms remains fixed.

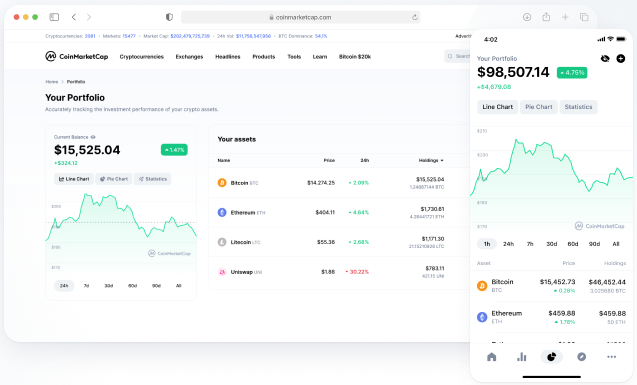

Use a Crypto Portfolio Tracker

One of the biggest advantages of the crypto economy is the decentralized nature of many coins. As you build your portfolio, you may have to deal with several different wallets, exchanges, and platforms, allowing you to take advantage of promotions. As a result, it can be cumbersome to manage your crypto portfolio across these wallets and trying to remember which cryptocurrency is where.

Crypto portfolio trackers are a way to solve this problem. A crypto portfolio tracker is a software that reads your wallets’ data and displays the aggregate information into a dashboard for you. Portfolio trackers make it easy for you to keep up with how much you have invested in each cryptocurrency. If one cryptocurrency is outperforming another, you’ll see it gaining a larger percentage of your overall portfolio.

Also, most portfolio trackers allow you to trade across many crypto exchanges, including Bybit, from their service. These trackers provide an additional convenience in that you do not have to log into each exchange account to make your trades. However, that convenience typically comes with a fee.

Another important benefit that crypto portfolio trackers provide is in tax planning and preparation. For example, in the United States, cryptocurrency holdings are treated as property. Therefore, a taxable event is triggered on the sale of crypto. A cost basis for the crypto holding is needed to accurately assess the tax implication. Even situations such as interest gained from staking alter the coin’s cost basis. As a result, an active crypto trader will generate a lot of transactions that need analyzing for tax purposes. A crypto portfolio tracker can help organize these transactions for record-keeping.

Selecting a Crypto Portfolio Tracker

Crypto portfolio trackers come with a variety of features, but choosing one doesn’t have to be difficult.

Step 1: Determine what convenience the tracker provides and what problems it will solve for you. Don’t forget about the time spent organizing your trades for determining your tax liability.

Step 2: Look into the app’s safety and security. Many crypto portfolio trackers link to crypto exchanges, and it is crucial to protect your coins.

Step 3: Practice makes perfect. Many trackers offer free trials so you can play around with them for a while.

Step 4: Look for a simple, clean, and clear layout. You don’t want to spend a lot of time trying to figure out how to use your portfolio tracker. An intuitive design will help make it easier for you to manage your crypto portfolio.

Now that you know what to look for, here are several portfolio trackers that may be of interest to you.

Be Rational

Crypto prices can be extremely volatile, with wild swings to both the upside and downside. Additionally, blockchain technology — which cryptocurrency fuels — is a relatively new technology and truly exciting. However, don’t let all of the hype put your emotions into overdrive.

Fear of missing out (FOMO) is a major reason why traders fail at portfolio management. Emotions usually lead to buying an asset at high prices, only to see a large correction take hold. Also, we can become anxious when the market drops 30% — because we are uncertain if that correction will dig deeper and become a 70% correction.

Successful crypto traders or investors are always rational about their plans and goals. There will still be good investment opportunities to grow your total portfolio balance. Using technical analysis eradicates emotions and helps you foster more discipline trading strategies. All you need is just stick to the plan.

Develop a Strategic Exit Strategy

Every good plan must include an exit strategy. Science tells us that whenever our trades are winning, dopamine is released from our brain, making us feel good about our decisions.

Absent an exit plan, that good feeling will cause us to stick with the position as a feedback loop kicks off. More gains lead to more dopamine, and more dopamine causes us to hold on to the trade. Then, if the market collapses, we hope it will bounce back. In a best-case scenario, the crypto market rallies again. But there’s also a worst-case scenario: the correction keeps going further and further.

Every great trend eventually ends. Sure, strong trends can last a lot longer than people anticipate. But eventually, the trend becomes oversaturated, and it changes.

A good trader is going to think about their exit plan BEFORE they enter a trade. This way, it is clear at what price they’ll close out the trade for a profit, and at what price they’ll close out for a loss. Again: stick to your plan.

Diversifying Your Portfolio

A good portfolio management strategy includes diversifying your investments. You’ve heard the saying about not placing all of your eggs in one basket. In case the basket was to fall, you don’t want to lose all of your eggs.

A lot of hype surrounds fast-moving, high-performing cryptocurrencies. Some of the hype is warranted, as certain cryptos do have a promising future and solve real-world problems. Other cryptos solve real-world problems as well, but our world is still dominated by traditional business and finance.

Two highly volatile and uncorrelated crypto assets can smooth each other out, providing outstanding risk-adjusted returns. The bad news is that a lot of cryptocurrencies are correlated to each other. Therefore, while diversifying your crypto portfolio can be challenging, it is still possible.

First, plan out a base for your portfolio. Which cryptocurrencies have large market capitalizations, leading to strong future potential? Second, consider investing a portion of your portfolio into stablecoins that you can lend out for a high-interest rate. Adopting a portion of your portfolio to act as a high-yield savings account means that a portion of your portfolio will always be gaining — even in a down market.

Third, consider small amounts invested into small high-growth projects. These projects may still be correlated to the gains and losses of the broader crypto market, but if one of them takes off, the additional growth may bump your portfolio’s overall value higher.

Do your research by reading up on the fundamentals of a cryptocurrency’s native token. Sometimes, the current price does not reflect the true value the token brings to the crypto economy.

How Much Should You Invest in Bitcoin?

If you are going to invest, how much is too much? Here are some of the suggestions from financial coaches:

1. Dan Wagner: Invest less than 10% of your portfolio in crypto.

Dan Wagner, the founder of Exponential Growth Financial, says that “investors should have no more than 10% of their overall portfolio invested in crypto.”

Dan also notes that you can’t use crypto to pull you out of huge debt piles. If your cash flow isn’t stretching to the end of the month, cryptocurrency isn’t the solution to that problem.

2. Salah-Eddine Bouhmidi: 1–5% is useful for crypto.

Salah-Eddine Bouhmidi, Head of Markets at IG, says “a classically oriented investor should keep the risk of highly speculative assets small. Depending on the risk profile, 1–5% of the portfolio is useful for physical exposure to cryptos.”

Salah-Eddine also notes that risky investors may use up to 20%, but that risk becomes extremely large and the portfolio is exposed to great volatility.

3. Vrishin Subramaniam: 2–5% of your net worth

A recent Time article revealed Vrishin Subramaniam, founder, and financial planner at CapitalWe, adds, “Two to 3% is usually what we see for most clients who are not tracking crypto markets more than once a week.”

Subramaniam recommends these conservative numbers as part of a wait-and-see strategy until we know more about the long-term performance of crypto.

Final Thoughts

Building your crypto portfolio doesn’t have to be complicated. However, it does require a plan and perhaps some help like a portfolio tracker. Even if you don’t have the excess cash to invest now, you can use dollar-cost averaging to build up a balanced portfolio. As with any investment, you will want to research the fundamentals behind an asset before buying. Your portfolio value often derived from how well you manage your crypto assets.