Mastering Gap Trading: Strategies for Profiting From Market Gaps

Gaps are essential in technical analysis and play a significant role in a trading strategy. Experienced traders know that price gaps provide big clues about price movements and the market’s trend. Below, we’ll delve into what a gap is, as well as the markets in which gaps appear and the reasons behind gap formations, and then we’ll look at gap trading techniques.

Key Takeaways:

A gap is an area on a price chart in which the price rallies or falls quickly with little or no trading activity taking place at any price level.

Gaps occur regularly in all markets. Understanding their individual price patterns can help you spot trends.

A popular trading strategy is to assess where current gaps are and anticipate market trades to fill them.

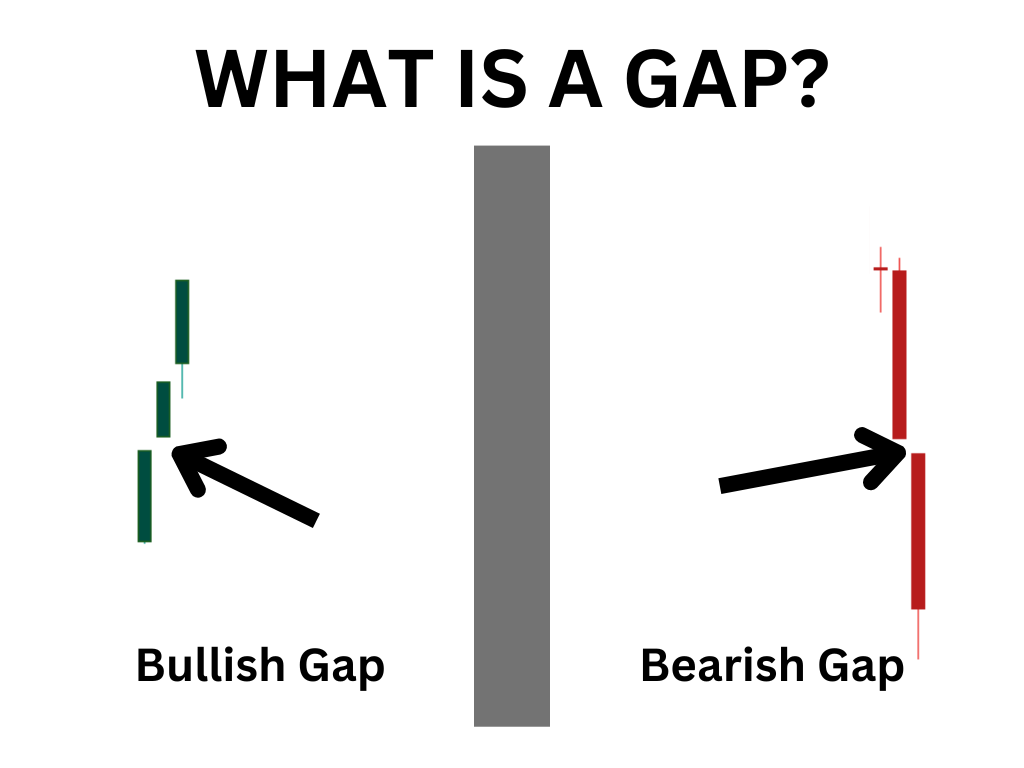

What Is a Gap?

A gap occurs when there’s an empty space or jump in price movement on a chart, indicating that little or no trading activity has taken place within a specific price range. Gaps typically occur overnight or during periods when the market is closed, resulting in a visible gap on the chart. They can appear on various time frame charts: Intraday, daily, weekly or even monthly.

Gaps are visual representations of significant shifts in supply and demand dynamics. They reflect imbalances between buyers and sellers, leading to abrupt price movements. The size and occurrence of gaps can vary, ranging from small gaps that span a few price levels to large gaps that cover several percentage points.

Which Markets Experience Price Gapping?

Gaps can appear in price charts of any financial instrument, including stocks, commodities, currencies, cryptos and indices. They aren’t limited to a specific market or asset class, though certain asset prices are more prone to gaps. Any markets that open and close at specific times are the most common financial markets for price gaps. This is because the price moves during after-hours trading and then appears to "jump" when the market opens.

In stock markets, a gap is commonly observed due to a break in trading sessions between a market’s open price as compared to the previous day's close. After the close of one trading session, new information can emerge, such as earnings reports, economic data or news events that impact trader sentiment. When the market reopens, it can result in a price gap, indicating a significant change in market expectations.

Similarly, in commodity markets, price gapping may appear during a break in trading on an exchange. Price gaps can occur due to factors such as supply and demand imbalances, geopolitical events, weather conditions or economic data releases. These gaps can lead to significant price movements among commodities like gold, oil or agricultural products when a market reopens after a period of closure.

The foreign exchange market (or forex) is continuously traded 24 hours a day, five days a week. Gaps in the forex market primarily occur during weekends or major holidays (such as Christmas and New Year’s), when trading is closed. Economic or political events that take place over a weekend could result in a price gap as trading resumes on Monday.

Crypto markets are generally traded continuously (24/7) on most exchanges. Therefore, overnight and weekend gaps on price charts are rare. However, it’s crucial to note that price gaps still occur on crypto charts, but they aren’t visible on Spot price charts. One trading strategy experienced crypto traders use is to look for gaps on Bitcoin and Ethereum futures charts, as there are no overnight or weekend trading sessions.

Reasons Gaps Appear

Several factors contribute to the formation of gaps in price charts. The following are some common reasons why gaps occur.

News Releases: Significant news announcements during earnings season, economic data releases, mergers and acquisitions or regulatory changes can lead to gaps in stock prices. Positive or negative news can create a sudden shift in market sentiment, causing prices to gap up or down when the market reopens.

Overnight Developments: Events that occur when market trading is closed — i.e., geopolitical news, global economic developments or corporate actions — can impact investor sentiment and create gaps. These can cause a significant change in market expectations, resulting in gaps when trading resumes. Back in September 2001, the U.S. stock market was closed for one week due to terrorist attacks. When trading resumed, prices gapped down significantly.

Limit Up/Limit Down: In some markets, circuit breaker mechanisms halt trading when price movements exceed a predefined threshold. When trading resumes after such a halt, it can lead to gaps in price as the market adjusts to the new information. For example, there are three levels of market-wide circuit breaks when the S&P 500 moves 7%, 13% and 20% in one day, leading to a temporary halt in trading.

Illiquid or Volatile Markets: Thinly traded or highly volatile markets are more susceptible to gaps, even during the same trading day. Lower liquidity levels or rapid price movements can cause gaps as the market struggles to match buy and sell orders at specific price points. This can be exacerbated when major news is released. These price gaps happen all the time, and are visible on a 15-second or shorter chart.

What Happens When a Gap Is Filled?

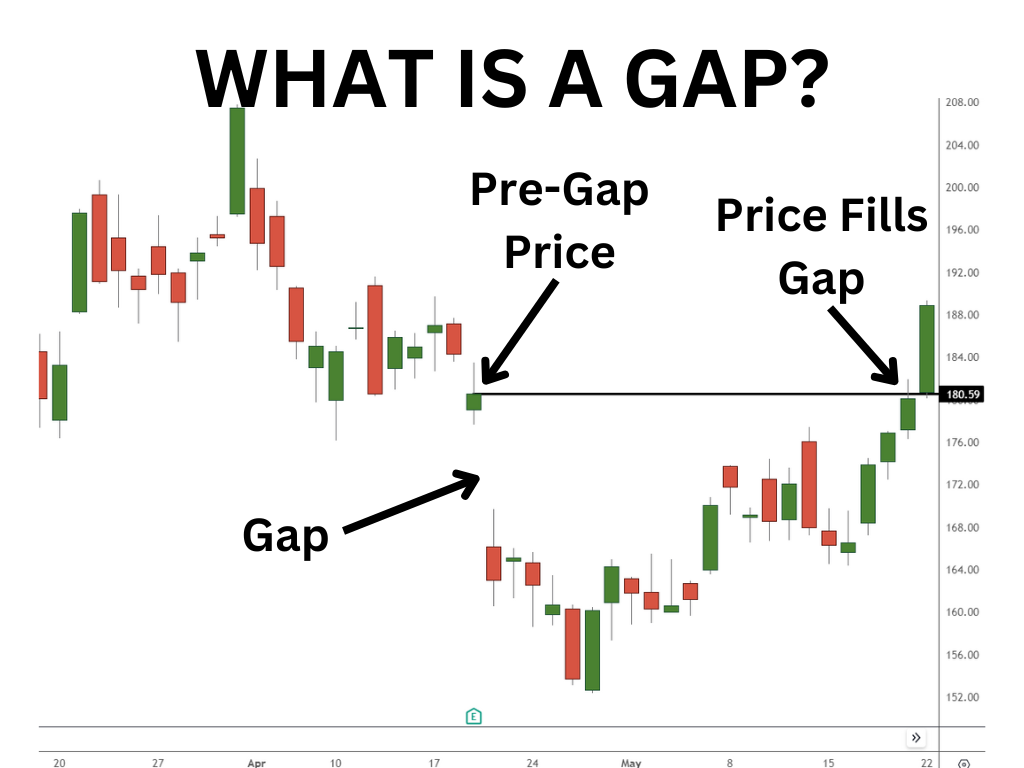

As previously noted, a price gap is a visible empty space on a price chart. After a gap is created, prices may reverse and fill the gap. In essence, the market’s price trades back to the pre-gap price level.

There is no expectation of when a price gap will fill. It can be completed within hours, days, weeks or months.

In the illustration above, the price gap begins at $180.59. After gapping down, the correction stops, and a price rally trends higher to fill the gap and return to $180.59 after a period.

Most price gaps fill within a relatively short amount of time, but the market doesn’t have to. You can anticipate where the price gap will fill or not, depending on the gap type.

Types of Gaps

We can determine the type of gap, depending on the pattern and where it appears within a trend. In this section, we’ll explore four types of gaps: Common gaps, continuation gaps, breakaway gaps and exhaustion gaps.

Common Gaps

Common gaps, also known as trading gaps or area gaps, are the most frequently occurring type. They often emerge due to regular market fluctuations, and can be found in any market environment. Common gaps typically hold little predictive value, as they tend to get filled relatively quickly.

Common gaps can occur in both uptrends and downtrends, and are characterized by a lack of major news or events driving the price movement. They represent a temporary pause in the ongoing trend, and indicate a minor shift in market sentiment. The price often retraces to fill the gap and resumes its previous trend.

Over a weekend, if prices gap in forex, traders will benefit on Monday, anticipating the gaps to fill. Generally speaking, these gaps are often considered less significant for making decisions, and traders may choose to focus on other types of gaps that offer stronger trading signals.

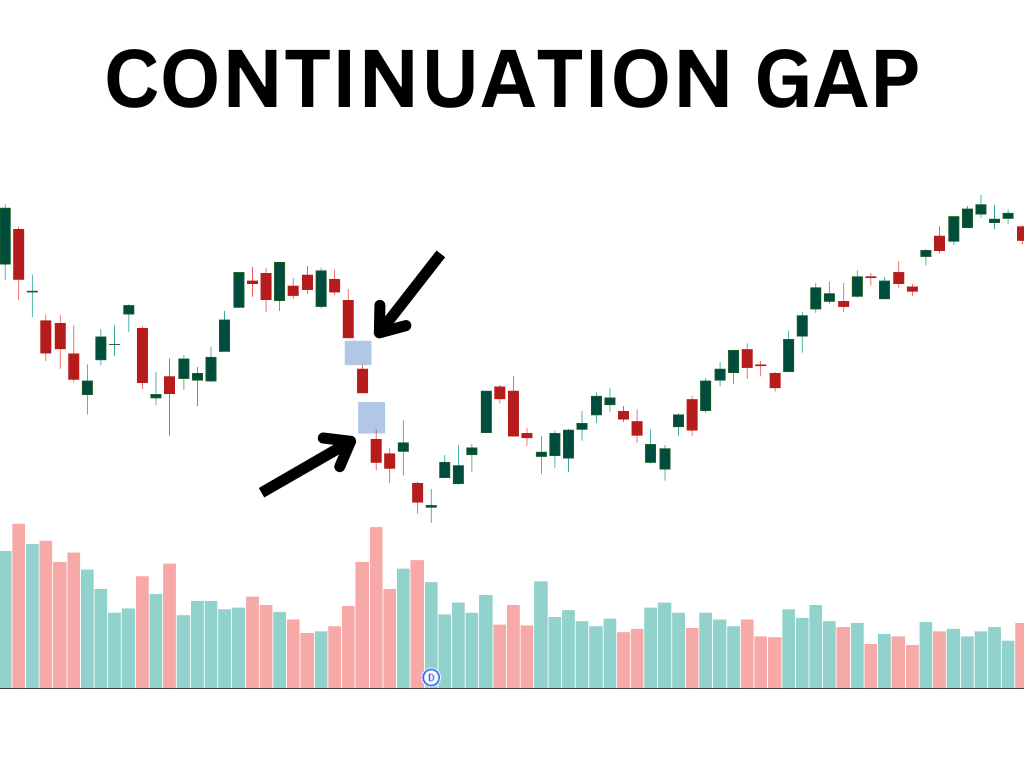

Continuation Gaps

Continuation gaps (also known as runaway gaps) reinforce the prevailing trend in the market. They occur within an ongoing trend, and are a sign of solid market momentum accompanied by high volume, which supports the price spike. Continuation gaps usually suggest that the existing trend is likely to persist, and multiple gaps may appear sequentially. Traders can use the initial gap as a signal to enter, or to add to positions in line with the existing trend.

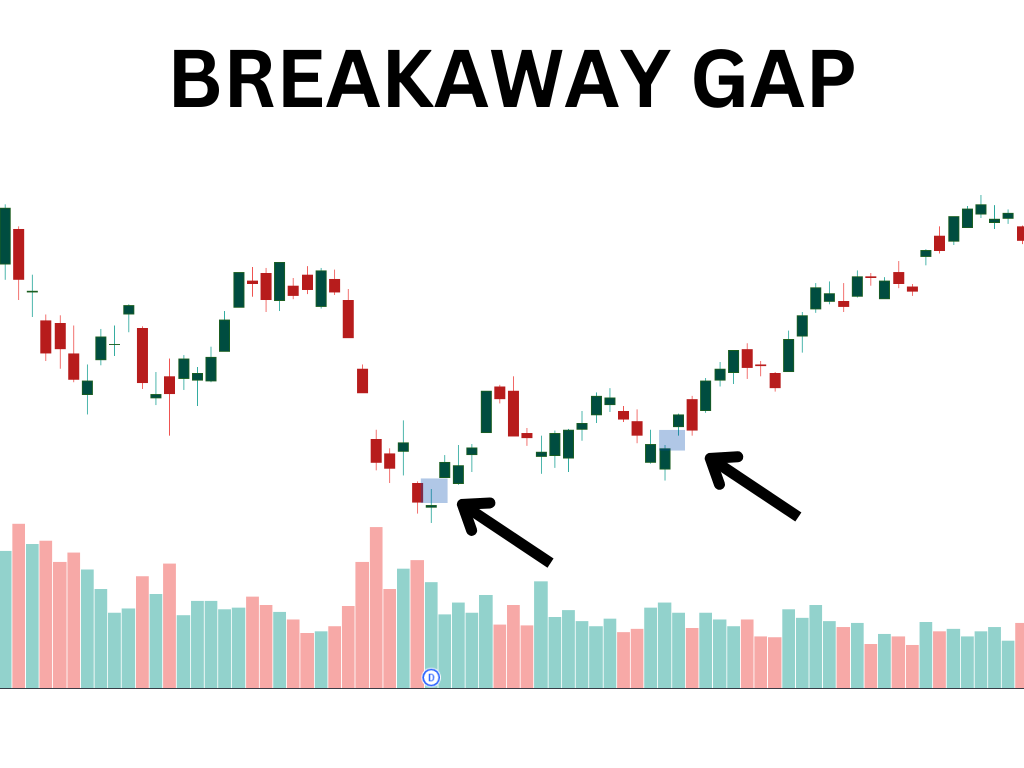

Breakaway Gaps

Breakaway gaps occur when price breaks through a significant level of support or resistance, resulting in a substantial price movement. These gaps often accompany important news, earnings releases or other market-moving events. Breakaway gaps are considered more significant than common gaps, as they indicate a potential shift in the market's sentiment and can lead to the formation of new trends.

In an uptrend, a breakaway gap occurs when the price gaps up, crossing above a key resistance level. This signals a decisive move from buyers, suggesting the potential for a strong bullish trend. Conversely, in a downtrend, a breakaway gap occurs when the price gaps down, breaking below a critical support level and indicating significant selling pressure and the potential for a strong bearish trend.

Higher trading volumes often accompany breakaway gaps, as increased market participation validates the significance of the gap. Traders look for breakaway gaps as an opportunity to enter positions in the direction of the gap, anticipating a continuation of the new trend.

Exhaustion Gaps

Exhaustion gaps signal a possible depletion of the current trend, indicating a potential trend reversal or a temporary pause in the prevailing trend’s direction. These gaps typically occur near the end of a significant price move, and suggest that market sentiment is changing.

In an uptrend, an exhaustion gap appears as an upward gap, indicating a final surge in buying pressure. This gap often reflects a last-minute buying frenzy before the trend reverses or enters a consolidation phase. Conversely, in a downtrend, an exhaustion gap appears as a downward gap, signifying a final bout of selling pressure before the trend potentially reverses or pauses.

Exhaustion gaps are characterized by high volume, as traders and investors rush to take advantage of the last remaining opportunities in the current trend. Technical analysts often use additional confirmation signals — such as trend line breaks, support/resistance breaches or the formation of reversal chart patterns — before considering a potential trend reversal based on an exhaustion gap.

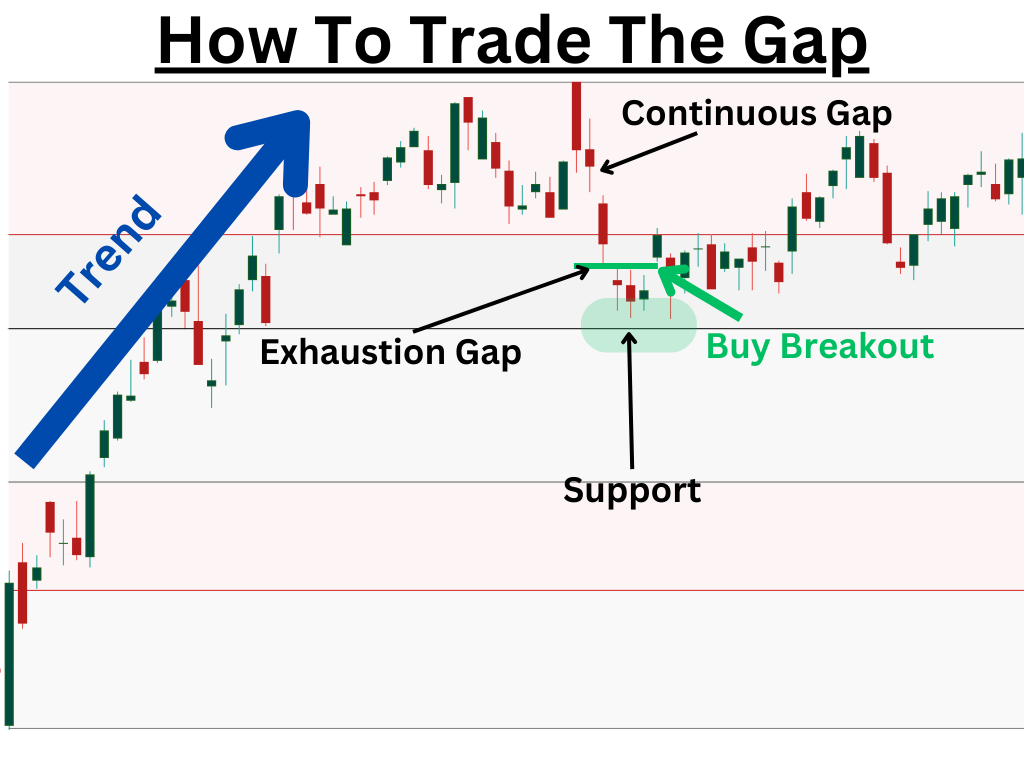

How to Trade the Gap

Each type of gap provides unique insights into market behavior and potential trading opportunities. By recognizing the characteristics of common gaps, continuation gaps, breakaway gaps and exhaustion gaps, traders can make more informed decisions and enhance their trading performance.

Following are some key considerations when trading the gap.

Identify the Type of Gap: Before initiating a trade, it's important to identify the gap you're dealing with. Consider whether it's a common, continuation, breakaway or exhaustion gap, as each type may require different trading strategies.

Assess the Market's Trend: Analyze the broader market context and sentiment to determine whether the gap aligns with the prevailing trend or represents a potential reversal or continuation. For example, a runaway (or continuation) gap will generally move in the same direction as the prevailing trend. On the other hand, an exhaustion gap suggests prices may soon move in the opposite direction.

Confirm With Technical Indicators: Utilize technical indicators to confirm the trading signals provided by the gap. Support and resistance levels, trend lines and other price patterns can help validate the gap's significance and corroborate potential trading opportunities.

Define Entry and Exit Points: Establish clear entry and exit points for your trades based on your analysis. Consider using stop-loss orders to protect your position in case the trade goes against you. Then, set profit targets based on the potential price movement following the gap.

Gap Trading Strategies and Tips

When considering a gap trading strategy, here are the two most common gap patterns to consider adding to your trading repertoire.

Gap And Go: This strategy involves trading in the direction of the gap and anticipating that the price trend will continue, leaving the gap exposed. Continuation and breakout gaps are the best types to implement for this strategy.

If a stock gaps up, traders might enter long positions, expecting the price to rise further. If a stock gaps down, traders might short the stock, anticipating further downward movement. In neither scenario are traders expecting the price gap to be filled anytime soon.

In the example above, notice how the long green candle (point 1) indicates heavy buying and a strong trend to the upside. A trader could buy on the open of the next session and place a stop loss just below yesterday’s close. The target would be twice the distance to the stop loss.

Then, several weeks later, price gaps lower after a long red candle (point 2). A trader noticing this trend to the downside could sell short on the next open, and place a stop loss just above the pre-gap price.

Fade Gaps, Fill Gaps: This gap-fill strategy involves trading against the direction of a gap, expecting a reversion of price to fill or backfill the full gap. This strategy gauges the momentum of the current trend and uses gaps as price targets.

Above, we see on the left a decline that includes a continuation gap. Price continues lower, then trades sideways for a while.

Then, one last exhaustion gap lower suckers the shorts in and opens the door for a price rally.

A trader noticing this setup could target the pre-gap price of the continuation gap. Prices often revert to fill old gaps. Several days later, in fact, the price does rally and fills that gap.

One essential trading tip to remember: When the price begins to fill the first portion of the gap, it usually completes the job and fills the entire gap. Therefore, you can target pre-gap price levels when trading this strategy.

The Bottom Line

Prices gap due to an imbalance of buyers and sellers. Gaps provide a significant clue to traders regarding both price action and price patterns on trading charts. Gap trading is a popular strategy experienced traders use as they anticipate a gap fill or a gap-and-go.

#Bybit #TheCryptoArk