10 Best Crypto Day Trading Strategies in 2023

Day trading cryptocurrencies can be an exhilarating activity for traders. However, it’s also one of the more difficult time frames to trade. Cryptocurrencies tend to exhibit higher intraday volatility than in many other financial markets, thereby requiring a greater level of skill to trade short time frames successfully.

As we navigate this dynamic landscape, we want to equip ourselves with the most effective strategies to maximize our gains and minimize risk. In this article, we’ll delve into the realm of crypto day trading and present a list of the top 10 strategies to consider. Whether you’re a seasoned trader or just beginning your trading journey, get ready to explore the fast-paced arena of crypto day trading.

Key Takeaways

Crypto day trading is riskier and requires a more robust skill set than trading for longer time frames.

There is no best strategy for everyone, but there may be a best strategy for you. The key is to find an approach that fits your personality, and focus on that.

No matter which day trading strategy you use, a strong risk management regime is critical to success. Losses must be kept to a minimum for positive trades to grow.

What Is Crypto Day Trading?

Crypto day trading is defined by a trader’s expectation of entering and exiting a trade within the same day (also referred to as intraday, or one-day time horizon). Therefore, being able to interact with intraday price dynamics is critical. How a trader engages the market during the time horizon will depend on the strategy deployed.

Nevertheless, in general, traders will be looking for smaller price movements based on intraday market behavior. By trading intraday, traders can use tighter risk parameters than for longer time frames and adjust their allocation size accordingly, since the average size of a trade is larger than that used for a longer time horizon, given the smaller expected movement. In addition, there are no overnight holds in day trading, so that risk is eliminated.

Top Crypto Day Trading Strategies

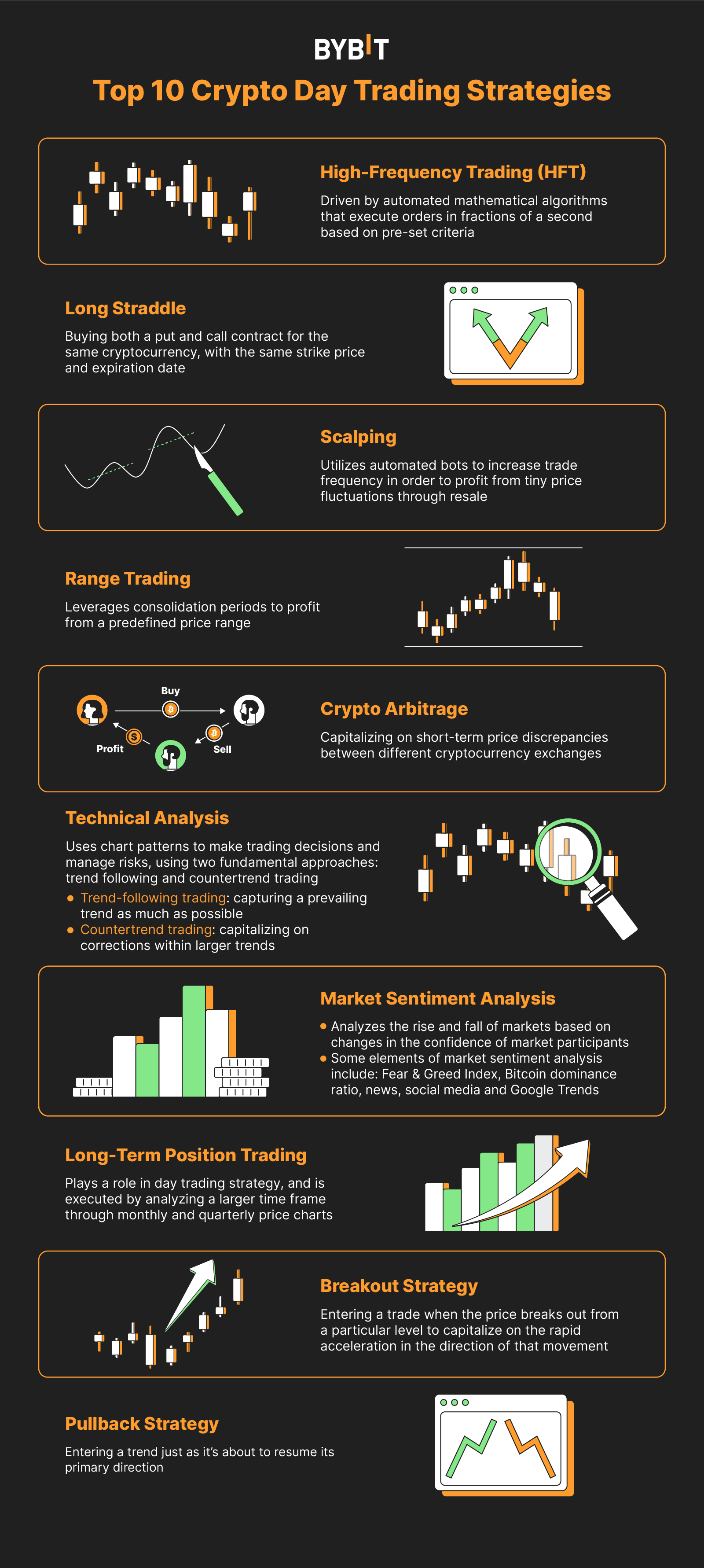

1. High-Frequency Trading (HFT)

High-frequency trading (HFT) is driven by automated mathematical algorithms that execute orders in fractions of a second based on pre-set criteria. These algorithms manage a high volume of orders, aiming to capitalize on minute price movements over extremely short time frames (often mere seconds or fractions of a second). The lightning-fast speed of HFT necessitates the use of trading bots. By handling substantial order sizes, HF traders contribute to the liquidity of the cryptocurrency market. The primary objective of a high-frequency trader is to optimize speed and minimize transaction costs, prioritizing efficient execution and cost-effective transactions.

2. Long Straddle

The long straddle is a day trading options strategy that looks to profit from market volatility. It involves buying both a put and call contract for the same cryptocurrency, with the same strike price and expiration date. This strategy may also be referred to as a straddle or option straddle. In a long straddle, it’s expected that while one side of the trade may result in losses, the profit gained from the winning position will outweigh those losses, leading to an overall net gain.

3. Scalping

Scalpers capitalize on short and rapid price movements, often utilizing automated bots to increase trade frequency in order to profit from tiny price fluctuations through resale. Compared to longer time frames, scalping involves higher frequency, larger trading volumes and bigger positions, as the targeted price changes are relatively smaller. Consequently, it’s essential to consider trading costs, as they can consume a significant portion of the trader’s revenue.

Scalping can be risky, as reliable patterns become more difficult to identify and exploit within a shorter time frame. Therefore, scalpers need to adhere to a strict exit strategy, ensuring that a single substantial loss does not negate the multiple small gains achieved.

Scalping can be approached in two ways. The first approach involves executing many trades at high volume to capitalize on concise and fast price movements. The second approach adopts a slower trading process, relative to high-frequency scalping, and focuses on slightly larger but still relatively small price movements, a lower number of trades, smaller position sizing and slightly longer holding periods.

4. Range Trading

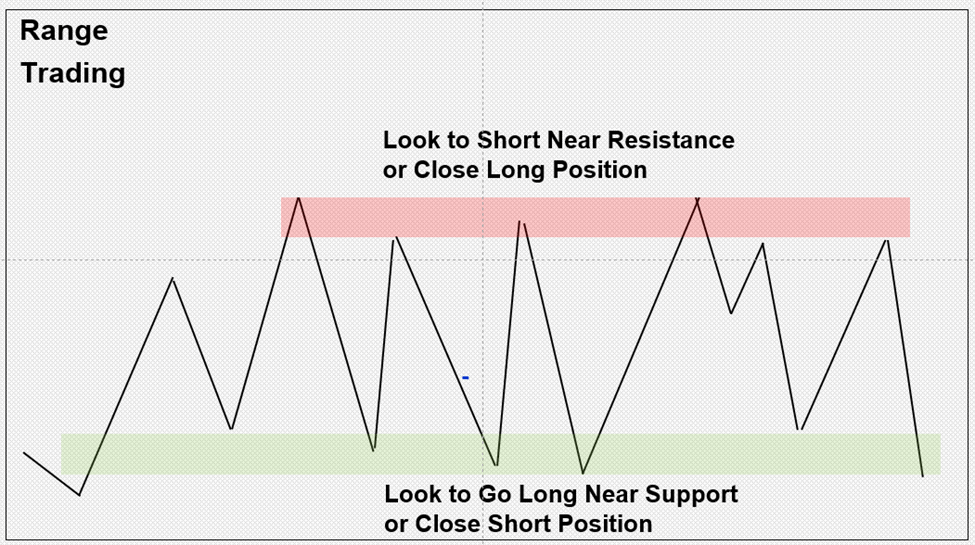

Cryptocurrency markets are constantly oscillating between trending and consolidation environments. Range trading involves leveraging consolidation periods to profit from a predefined price range. The range is defined by key levels of support and resistance, often represented by classic consolidation patterns such as rectangles or symmetrical triangles.

In range trading, traders seek to enter a short position or close a long one at resistance near the top of the range where resistance is encountered. Conversely, they may also aim to initiate a long position or close a short one near the bottom of the range around support. Stop-loss orders are placed beyond the extremes of the range to mitigate risk from adverse price movements.

5. Crypto Arbitrage

Crypto arbitrage traders aim to capitalize on short-term price discrepancies between different cryptocurrency exchanges. They look to buy crypto on one exchange and swiftly sell it on another at a higher price. Alternatively, for shorts, they‘ll sell on one exchange and buy on another to close the position. Speed is crucial in crypto arbitrage trading, so automated tools are frequently used to swiftly seize arbitrage opportunities across exchanges. To fully optimize returns, keeping trading costs low is vital given the large volume of transactions.

6. Technical Analysis

Technical analysis primarily uses chart patterns for trading strategies and risk management protocols. It operates on three principles: 1) The market discounts everything. 2) Prices move in trends and countertrends. 3) History repeats itself.

The idea is that price action is repetitive, with certain recurring patterns that can then be used as a tool to navigate markets.

There are many ways to deploy a strategy based on technical analysis, including the use of technical indicators or studies, which are usually based on price and/or volume. The key lies in identifying specific price patterns that can give a trader an edge. There are two fundamental approaches to using technical analysis: trend following and countertrend trading.

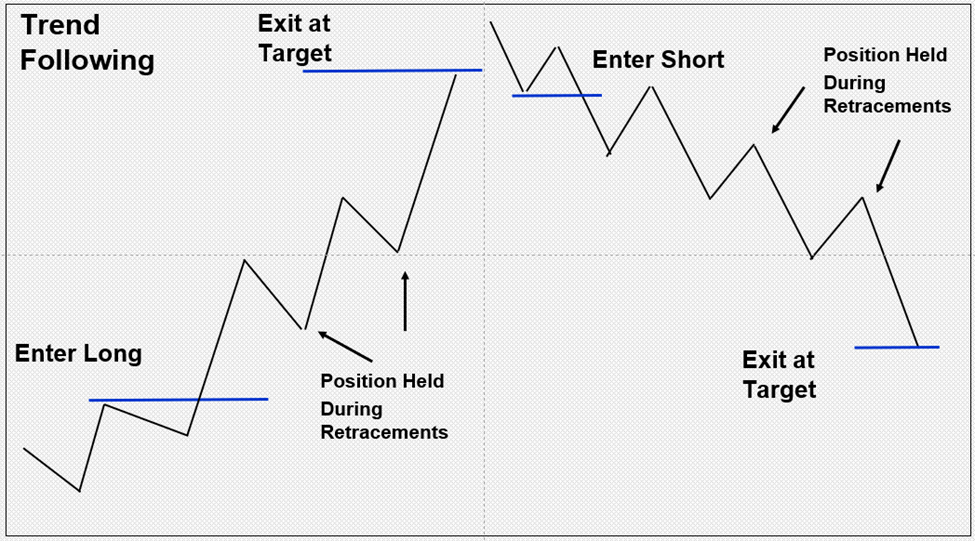

Trend Following

Trend-following traders look to capture a prevailing trend as much as possible. The type of trend they focus on depends on their primary time horizon, which can be short, intermediate or long-term. Trends can be traded on any time frame chart, and traders frequently rely on trend indicators such as trend lines and moving averages to guide their decisions.

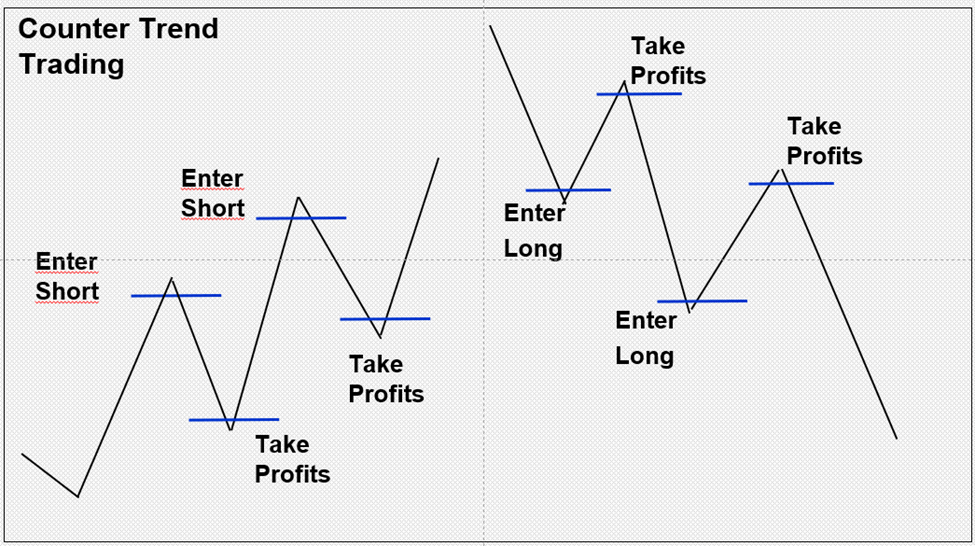

Countertrend Trading

Price movements occur in trends, consisting of price advances in one direction (up or down) followed by retracements or countertrend moves. Countertrend traders seek to capitalize on these corrections within larger trends. This is considered a somewhat riskier strategy than trend trading, and requires greater skill. By trading against the larger trend, countertrend traders take on more risk, as they’re going against the dominant force (up or down) at the time.

7. Market Sentiment Analysis

Understanding market sentiment is crucial. It drives the rise and fall of markets based on changes in the confidence of market participants. Market sentiment represents the collective attitude of investors and traders toward a specific financial asset, or the overall market. By analyzing market sentiment, traders can identify changes in attitudes and confidence that can influence changes in supply and demand, and, consequently, prices. Some elements of market sentiment analysis include the Fear & Greed Index, Bitcoin dominance ratio, news, social media and Google Trends.

Fear & Greed Index

The Fear & Greed Index acts like an emotional meter, measuring market sentiment on a scale from fear to greed, and everything in between. Traders closely monitor it for extreme readings in order to predict price movements. Excessive fear can lead to buying opportunities, as the sentiment may be on the verge of reversing. On the other hand, extreme greed indicates an overly bullish sentiment that may be due for a correction.

The index uses a variety of inputs, including coin dominance, momentum and volume, social media, Google Trends and measuring volatility.

Bitcoin Dominance Ratio

The Bitcoin dominance ratio measures the market capitalization (market value) of Bitcoin to the total market cap of the entire cryptocurrency market. This ratio wields an influence over the overall market, as many smaller capitalization coins follow Bitcoin’s trend or have some connection to it. A declining ratio suggests that altcoins are doing better relative to Bitcoin.

News

Monitoring news that might impact cryptocurrencies is another way to assess sentiment by looking at the ideas and points of view expressed. This can give traders a feel for attitudes in the market, and can be used as a complement to other analyses. Keeping track of news feeds in an RSS aggregator (like Feedly) can expedite the review process. There are also subscription-based, event-driven news services that use sophisticated computer algorithms to identify news activity that might move a crypto token.

Social Media

Observing social channels can provide insight into market sentiment. One way to do this is to use monitoring software, such as TweetDeck for Twitter. You can categorize and organize feeds to keep track of activity by sources you’ve deemed to be credible. This can help reduce the “noise” so that you mostly see posts and comments from your selected sources.

Social media sentiment indicators aggregate data from various social media sites, and then they analyze it to identify trends or increased activity related to a specific cryptocurrency, industry, region(s) or countries.

Google Trends

Google Trends can be used to see how crypto-related topics or tokens are trending in Google Search. Analyzing whether certain searches — such as “bullish on Bitcoin” — are trending higher or lower may provide useful insight into the expectations and outlook for Bitcoin.

8. Long-Term Position Trading

While long-term position trading may not be the main focus for all active day traders, it can still play a role in their approach. To execute this strategy, the larger time frame is analyzed by including monthly and quarterly price charts. If a trade setup triggers on a monthly chart, it’s expected to be held for a longer period of time than with many other strategies. The longer time horizon is necessary in order to exploit the potential price movement and fully maximize gains.

9. Breakout Strategy

Breakout traders look to enter a trade when the price breaks out from a particular level, aiming to capitalize on the rapid acceleration in the direction of that movement. Breakouts can occur in either an upward or downward direction (breakdowns). The setups may include breakouts of trend reversal, or continuation patterns; price breaking out through a moving average; or prices establishing a new high or low trend.

10. Pullback Strategy

A pullback strategy incorporates trend and pattern identification in its analysis. The objective is to enter a trend just as it’s about to resume its primary direction. This strategy can be used in both uptrends and downtrends. It relies on proficient analysis of key support levels and a technique to determine when the pullback is complete, signaling a potential reversal setup.

Three Tips to Successful Crypto Day Trading

Set clear goals and define your risk tolerance before starting, as day trading volatile cryptocurrencies can be highly unpredictable.

Prices can move fast in day trading, so focus your efforts on a limited number of cryptocurrencies, around three to five. Dedicating your time and effort to this limited quantity helps you gain insights into how these cryptocurrencies behave during the day.

Implement proper risk management techniques, such as setting stop-loss orders to limit potential losses and taking profits at predetermined levels.

Crypto Day Trading FAQs

1. Is crypto day trading profitable?

This depends on the individual trader, though in general, trading over a shorter time frame is considered more complex than over a longer time frame. Therefore, day trading is more involved than holding assets for more than a day.

2. What’s the best crypto day trading strategy?

There is no universally superior day-trading strategy, as each trader is unique and needs to select a strategy that aligns with their understanding and comfort level. Some of the strategies more widely used by independent traders include technical analysis, scalping and range trading.

3. Which crypto coins are the best for day trading?

This depends on various factors, such as a trader’s experience level, skill and account size. Generally, it’s advisable to start trading in a lower-risk environment by choosing larger-cap coins with relatively high levels of volume. A good starting point to consider is the list of top 30 cryptocurrencies (based on market cap). You can then further narrow it down to your preferred choices from this list. If you seek more intraday volatility, then expand the list to include the next 30 cryptos by market cap.

#Bybit #TheCryptoArk