Solayer: Building Solana’s Native Restaking Network

The arrival of the EigenLayer (EIGEN) protocol in mid-2023 ushered in a new era for Ethereum (ETH) stakers— the birth of native ETH restaking. Using the protocol's restaking service, users can now reuse their staked Ether to secure additional blockchain protocols and services, earning crypto income from more than one source.

Besides native ETH restaking, EigenLayer also offers liquid restaking, which allows you to secure additional platforms within the wider Ethereum ecosystem via liquid staking tokens (LSTs). Ever since the launch of EigenLayer, Ethereum restaking and liquid restaking services have flourished, attracting decentralized finance (DeFi) users enticed by multiple yield sources and the noble goal of securing a multitude of blockchain services with their funds.

Until August 2024, Layer 1 blockchains beyond Ethereum lacked the kind of native restaking and liquid restaking functionality that EigenLayer provides. That’s when Solayer — a native restaking and liquid restaking service for the Solana (SOL) blockchain — arrived on the stage. You can lock your SOL or select LSTs on the Solayer platform and be issued sSOL, an asset that lets you earn additional yield by delegating your stake to secure additional services and protocols within the Solana ecosystem.

Key Takeaways:

Solayer is the first native restaking and liquid restaking protocol on Solana’s blockchain.

Its platform lets you reuse your staked SOL and some LSTs to earn additional yield by securing the operations of various Solana-based Actively Validated Services (AVS).

What Is Solayer?

Solayer is a native restaking and liquid restaking protocol on Solana that allows you to use your SOL funds or some Solana-based LSTs to earn yield by securing a variety of AVS and associated solutions on the blockchain.

Solayer users deposit SOL or LST assets — such as Marinade Staked SOL (mSOL), Jito Staked SOL (JitoSOL) and BlazeStake Staked SOL (bSOL) — on its platform and get issued the sSOL restaking token. Then, sSOL can be delegated to secure consensus on various Solana-based decentralized apps (DApps) that require a validation process beyond what’s provided by the blockchain's underlying consensus mechanism.

The functional model adopted by Solayer closely replicates that of EigenLayer, the leading native restaking and liquid restaking provider on Ethereum. Similar to the way EigenLayer allows users to reuse staked ETH or LSTs for additional yield, Solayer provides an opportunity for users to earn yield from reusing their staked SOL or some Solana LSTs.

Established by Solana co-founders Anatoly Yakovenko and Raj Gokal, Solayer was launched on the Solana mainnet in August 2024. As of early December 2024, the protocol has already achieved a total value locked (TVL) of $367 million. While this might be a relatively modest amount compared to the largest DeFi protocols on Solana, it should be mentioned that Solayer is the first (and so far, the only) native restaking and liquid restaking solution on the Solana blockchain, a pioneer of this niche of DeFi within the Solana ecosystem.

As of December 2024, Solayer operates without a designated native token, although there are reports of a potential airdrop campaign planned by the platform. However, it's unknown if such an airdrop would be followed by the introduction of a native token. Moreover, the Solayer team hasn’t provided official confirmation of an airdrop.

How Does Liquid Restaking Work?

Native restaking and liquid restaking — the core services offered by Solayer — have been popularized by Ethereum's EigenLayer protocol. Native restaking allows users who contribute funds to staking on a Layer 1 chain to reuse the same funds to secure the validation mechanism on additional blockchain platforms and services. Liquid restaking is a derivative of native restaking, whereby you can reuse LST assets issued by liquid staking protocols to provide support to the validation process on blockchains and associated services.

Both native restaking and liquid restaking are great ways for DeFi users to earn additional yield while securing the functionality of more than one blockchain. Blockchain services that use AVS protocols to restake and utilize funds normally require validation and network resources beyond those provided by the Layer 1 chain where the original staked funds are locked. These AVS protocols can be external or internal to the core Layer 1 chain. As we detail in a section below, Solayer focuses on internal, or endogenous, AVS.

How Does Solayer Work?

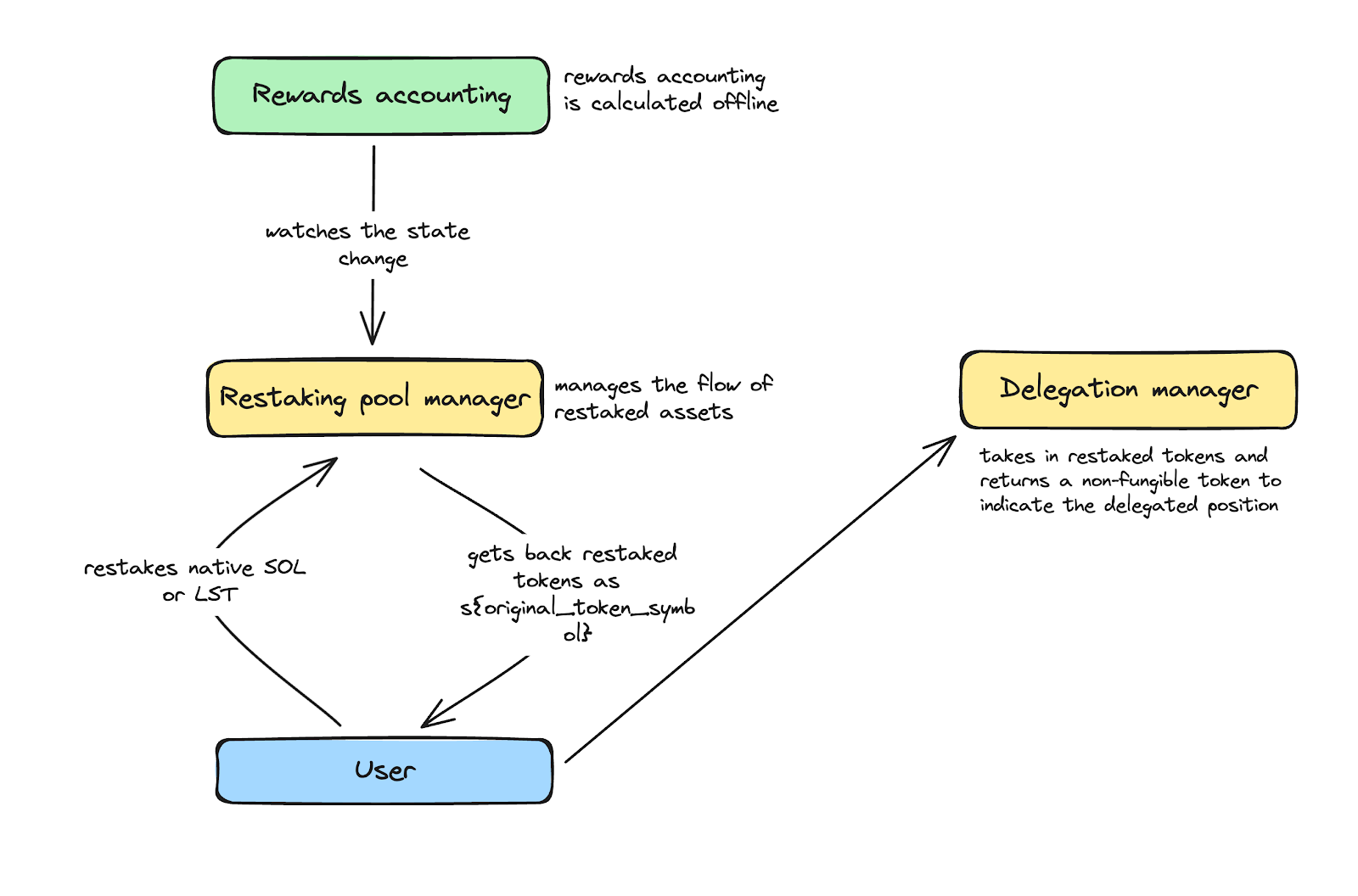

The Solayer platform is made up of three key components that enable its operations:

Restaking pool manager

Delegation manager

Rewards accounting unit

The restaking pool manager is a component that accepts users’ initial deposits in SOL (or LSTs) and converts them to restaked assets, i.e., sSOL.

Users receive their sSOL, which can be further utilized to secure a variety of Solana-based AVS. This is done by delegating sSOL to participating DApps. The job of the delegation manager is to enable this process. Examples of DApps in which sSOL can be restaked include the Sonic (SONIC) Layer 2 chain, HashKey Cloud web3 infrastructure provider and Bonk (BONK) meme coin ecosystem. When users delegate to these services, they’re issued wrapped SPL tokens that serve as confirmation of their restaking positions. (SPL is Solana's main fungible token standard, analogous to Ethereum's ERC-20.)

Conversion delays and slippage deter the adoption of LSTs (due to the fragmented nature of liquidity pools), which contributes to insufficient liquidity. To tackle this issue, Solayer has consolidated liquidity in a single sSOL/SOL pool design. This efficient design allows all AVS LST tokens to be immediately unwrapped back to the underlying representation, sSOL, significantly reducing price impact and fees while boosting the overall user experience.

The third key component, rewards accounting, is an offline module used to calculate rewards for users by accessing data in the restaking pool manager. These rewards will likely be used in the future to run specific loyalty campaigns and airdrops. The image below demonstrates the holistic interaction between the three components and the user.

Solayer Key Features

sSOL

sSOL is the platform's restaking token issued upon depositing SOL or LSTs. So far, we've explained how sSOL is used for restaking by delegating to participating DApps. However, Solayer's documentation also mentions that sSOL might be used in various DeFi strategies. This is a reference to various liquidity pools and vaults — yield-bearing DeFi opportunities that might not necessarily be focused on securing consensus on an AVS system. This makes sSOL liquid and versatile, with applications beyond just AVS.

Some of the platforms on which sSOL might be used in this capacity include the Orca (ORCA), Jupiter (JUP) and Raydium (RAY) decentralized exchanges (DEXs), vault strategies on the Kamino (KMNO) finance protocol and more.

Endogenous AVS

We noted above that the key application of sSOL is that of restaking on various AVS. In general, “AVS” in the blockchain industry refers to a diverse range of protocols and services that require validation processes beyond those provided by the underlying Layer 1 chain. These might include oracles and oracle networks, cross-chain bridges and messaging layers, Layer 2 chains, decentralized modular services, data availability (DA) layers and more. Many of these platforms have cross-chain functionality.

However, in the case of Solayer, the AVS involved are all internal to the Solana network. These are called endogenous AVS, as opposed to exogenous AVS, which may have cross-chain functionality and access networks beyond Solana. Examples of these endogenous AVS include decentralized cloud infrastructure on Solana providers, Solana Layer 2 blockchains and native Solana DApps.

sUSD

Besides its core native restaking and liquid restaking services, Solayer has also ventured into the stablecoin niche with the introduction of sUSD — a real-world asset (RWA)–backed synthetic stablecoin. sUSD is a yield-bearing and secure stablecoin backed by U.S. Treasury Bills and pegged to the U.S. dollar. It's the first RWA-backed synthetic stablecoin asset that provides yield-bearing opportunities on Solana.

By simply holding sUSD, you can earn yield tied to U.S. Treasury Bills, currently at a rate of around 4%.

Using Solayer With Bybit

Bybit has partnered with Solayer to offer its LST asset, Bybit Staked SOL (bbSOL), for restaking opportunities on the Solana-based platform. Backed by Bybit, bbSOL provides a way for Bybit users to expand their choice of liquidity provision and yield-earning options.

To use bbSOL on Bybit, first visit the Solayer app's homepage. From there, click on the Connect Wallet link in the top right corner and link your Bybit Wallet. After connecting your wallet, you’ll see a list of options for restaking that includes the bbSOL token. Choose the bbSOL token and then click on the Deposit link next to it. You can then enter the amount of bbSOL you'd like to commit to Solayer restaking.

Closing Thoughts

By offering its innovative restaking and liquid restaking services, Solayer secures Solana and provides unique yield-generation opportunities on the Solana blockchain. Given how unique the platform's service is within the Solana ecosystem, it's likely that a wide range of interested parties — from individual restaking enthusiasts and partnering DeFi protocols to institutions and industry leaders — will take a keen interest in Solayer.

Besides championing restaking services on Solana, the project has also ventured into the stablecoin market by introducing the sUSD yield-bearing token. The first RWA-backed stablecoin of its kind, sUSD will also likely play a key role in supporting Solayer’s early growth.

With the first native restaking and liquid restaking services and the first RWA-backed, yield-bearing liquid stablecoin for Solana, the team at Solayer sure do like being trailblazers!

#LearnWithBybit