Obol Collective (OBOL): Coordinating trust through collective staking

"The Ethereum blockchain has crashed!" — This is a news piece that has never been reported and will, hopefully, never see the light of day. Although several other blockchain networks have experienced significant outages or total breakdowns, a network failure of any appreciable proportions has never occurred in the history of Ethereum (ETH). A large part of the blockchain's stellar security record is due to its global and well-decentralized network of validator nodes.

However, despite boasting excellent decentralization properties, Ethereum does have areas to improve upon in its validation and staking mechanisms. First, running a full validator node on the network is financially prohibitive for smaller individuals and entities, as the blockchain requires a stake of 32 ETH (around $84,500 as of May 14, 2025) per each full validator. Secondly, there’s always a risk of individual validators, even the largest ones, being hacked. Finally, technical failures may lead to slashing penalties for validators, and too many instances of such slashing can undermine trust in the blockchain’s security model.

Obol Collective (OBOL) is a decentralized platform based on distributed validator technology (DVT), which aims to solve the vulnerabilities of Ethereum validation and staking. Leveraging DVT, Obol lets multiple nodes run as a single validator, splitting both the processing load and slashing risks. By distributing responsibility across numerous participants, Obol effectively eliminates single points of failure and enhances the overall resilience of Ethereum’s staking infrastructure. Importantly, Obol’s use of DVT reduces entry barriers to Ethereum staking for smaller entities — individuals or small organizations — as they can team up and pool their resources to act as a single validator.

Key Takeaways:

Obol Collective (OBOL), a provider of distributed validator infrastructure, lets multiple nodes act as a single Ethereum validator.

By splitting a validator's processing responsibilities, risks and collateral requirements between different nodes, Obol makes Ethereum staking more affordable for smaller entities and improves the overall security of the Ethereum blockchain.

Obol's native token, OBOL, is used for governance and staking and in various DeFi applications. OBOL can be bought on Bybit as a USDT Spot pair or a USDT Perpetual contract.

What is Obol Collective?

Obol Collective (OBOL), a provider of decentralized infrastructure, enables multiple parties to jointly run Ethereum validators in a secure and fault-tolerant fashion. At the core of Obol’s product offering is DVT — a technology that splits all the functionalities of a single validator on a proof of stake (PoS) network between multiple (potentially many) individual nodes. These nodes share not only processing responsibilities, but also risks and rewards.

Support for liquid staking

Obol’s infrastructure project is most typically used by liquid staking platforms, such as Lido (LDO) and Rocket Pool (RPL), to support their operations. While these protocols handle user funds and front-end functionality, Obol provides its DVT-based validator set to help support their Ethereum-based liquid staking.

Obol offers numerous benefits to liquid staking protocols and validator entities. It creates access to Ethereum staking for smaller, aspiring validators. Such entities often struggle with the financial requirement of staking no fewer than 32 ETH to run a validator. By joining an Obol cluster, which lets multiple nodes act as a single validator, these smaller players can participate in Ethereum staking by splitting the 32 ETH requirement between them.

Protection against slashing

Additionally, Obol’s DVT-based node splitting for validators provides better protection against the risk of slashing, which results in financial penalties or even suspension for the offending node. Slashing occurs on Ethereum and other PoS chains when a validator fails to fulfill their responsibilities on the network. It may happen due to willful misbehavior, or it could often be the result of honest mistakes or misconfigurations. For instance, a failed internet connection may keep a validator node offline for too long, resulting in slashing. Thanks to Obol's DVT, the other nodes can still keep the cluster functioning if one node fails.

Obol Collective’s origins

The Obol project was conceptualized and developed by Obol Labs, an Illinois (US)–based company founded in 2021 by Oisín Kyne and Collin Myers, and the platform is supported by the nonprofit Obol Association. The first distributed validator on Ethereum was launched by the project in late 2022. As of this writing in May 2025, Obol Collective has established itself as the largest provider of DVT services in the blockchain industry.

How does Obol Collective work?

Using Obol, developers and operators can create distributed validator (DV) clusters, each one acting as a single full validator on Ethereum. There are two options for creating clusters within Obol Collective:

In solo mode, one operator creates and controls all the nodes that comprise that cluster. Technically speaking, this mode doesn't fully align with the ethos of DVT, since one entity is in charge of all the nodes. However, solo mode may be preferable for testing purposes, although there are no restrictions on using it in a production environment.

When one operator creates a cluster, they can assign multiple nodes to it, creating a distributed setup that avoids a single point of failure. It's recommended that the cluster nodes be hosted on different machines, although it's also permissible to use a single machine for all of the nodes. Using one machine for all cluster nodes creates a significant vulnerability, due to centralization of resources.

The second mode allows multiple node operators to create a cluster. This is an ideal setup for ensuring maximum decentralization and independence of the cluster from a single entity. As long as two-thirds of the nodes are active, the cluster remains operational. The larger the cluster size, the greater the ability of the cluster to operate, even when some nodes are faulty.

To automate and manage proper splitting of validator rewards and staking allocations, Obol uses a set of smart contracts called Obol Splits. These are noncustodial and normally immutable, meaning that the share allocations rewarded to nodes within a DV cannot be changed after the cluster’s deployment. However, one specific type of Splits contract, a controllable splitter contract, does have the functionality to update split percentages at a post-deployment stage.

Obol Splits technology has been integrated into some of the leading liquid staking and restaking protocols — Lido and EigenLayer (EIGEN) — to help DV operators service these platforms.

Obol Collective key features

Charon (DV middleware)

Charon is middleware developed by Obol to allow any Ethereum validator to operate as part of a DV. It acts as the main layer, allowing the platform to offer DVT-based services. Using Charon, operators can create a Byzantine fault tolerant (BFT) cluster and coordinate their work on the network as a single entity. Byzantine fault tolerance allows Obol clusters to operate and process Ethereum blocks even if some of the nodes within the cluster behave maliciously, or fail due to technical issues.

DV-based staking product

Obol also offers a staking-as-a-service (StaaS) product that lets users access staking opportunities without having to run the actual node hardware, further reducing barriers to end users for entry to Ethereum staking.

DV Launchpad

Obol’s DV Launchpad lets users configure and launch their clusters. Step by step, the launchpad walks users through all of the procedures required to create their own DV together with their peers. For less technically minded users, the launchpad is an ideal way to set up clusters using its graphical interface.

What is the OBOL crypto token?

The platform's native token, OBOL, is an ERC-20 asset issued on the Ethereum blockchain. OBOL was launched in January 2025, more than two years after Obol began offering its DV services. Upon launch, OBOL tokens remained locked, i.e., non-transferable. On May 7, 2025, this restriction was removed, making OBOL publicly available and freely tradable. Due to the lockup period, many online sources report May 7 as the token's actual launch date.

The OBOL token has several key functions on Obol Collective. One of these is governance, as OBOL token holders can delegate their voting power to designated delegates who participate in votes in the Token House, a governance platform where proposals regarding Obol Collective's direction and rules are introduced, considered and voted on.

Delegates also vote on funding allocations to support ecosystem growth under Obol’s Retroactive Funding (RAF) program. As such, OBOL holders may participate in funding decisions through their chosen delegates.

Another utility function of the token is that of staking. You can earn OBOL rewards through OBOL Incentives, a community incentives program that lets you stake your ETH on DVs. In 2025, 12.5 million OBOL are being distributed as staking rewards under this program.

The OBOL token may also be used for various DeFi use cases, e.g., within lending protocols and restaking platforms, as well as for increasing liquidity on DeFi protocols by contributing to their liquidity pools.

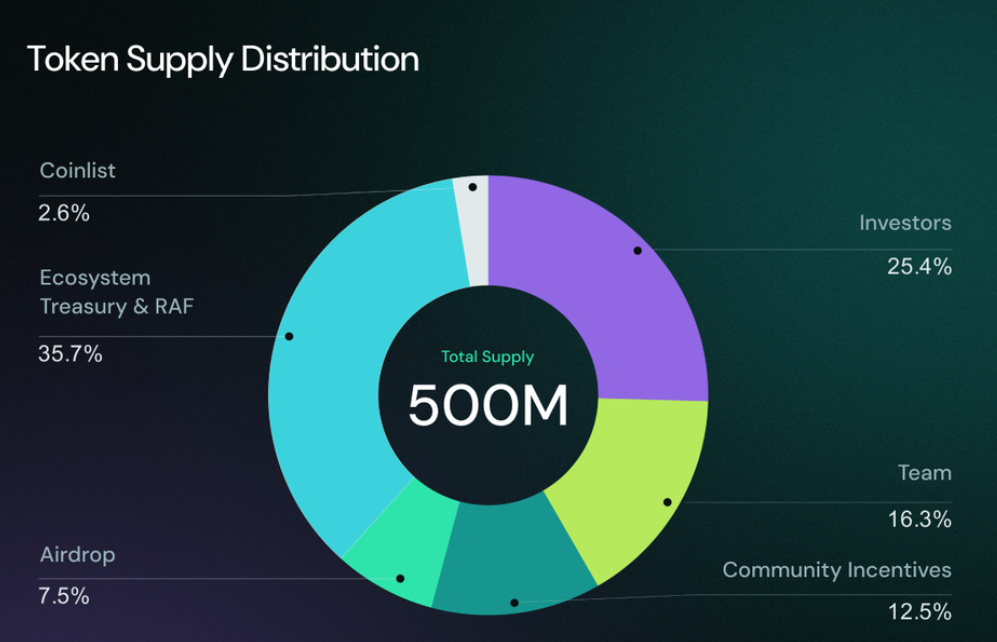

OBOL's total and maximum supply is 500 million, with just over 98.7 million tokens in circulation. Of the total supply amount, 7.5% was distributed via a retroactive airdrop that rewarded certain ecosystem community members, such as developers and users who contributed to testnet and Alpha and Beta Mainnet operations.

The chart below shows the allocation shares of the token’s total supply.

Where to buy OBOL

The OBOL token is available on Bybit both as a Spot pair with USDT and as a USDT-based Perpetual contract. You can also take advantage of the Bybit event dedicated to the OBOL token to grab a share of the 200,000 OBOL prize pool and earn a staking APR of up to 200%.

To join the event, deposit or trade OBOL on Bybit's Spot market, and stake between 200 and 1,000 OBOL using Bybit’s 15-day Fixed Savings plan to earn a 25% APR. Also, VIP users can enjoy staking limits of 2,000 OBOL and an exclusive 50% APR, while new users can access up to 200% APR via a booster voucher. The event is valid till Jun 7, 2025, 12PM UTC.

OBOL crypto price prediction

As of May 14, 2025, the OBOL token has been on the market only for a week. It’s currently trading at $0.2347, 38.3% lower than its ATH of $0.3801 on May 7, 2025, and 2.1% higher than its ATL of $0.2298, registered on May 13, 2025.

Long-term price forecasts for OBOL are mostly bullish. DigitalCoinPrice predicts average rates of $0.79 in 2027 and $1.17 in 2030, while CoinCodex expects the token to trade at around $ 0.25 in 2027 and rise to $0.86 in 2030.

Given the token's minimal market history, future price determination for OBOL is a tentative exercise at the moment. Various market forces and industry developments can influence the token's price in the future, so always conduct your own comprehensive research before deciding to invest in OBOL or any other crypto token.

Closing thoughts

As the leading provider of a decentralized operator ecosystem, Obol stands out as one of the most essential decentralized infrastructure networks in the Ethereum ecosystem, offering a truly next-gen staking and validation system and contributing to better blockchain security. Obol's DVT-based model offers slashing-resistant nodes, and helps further decentralize Ethereum’s validator system.

Distributed validators are crucial not just for decentralization, but also for better performance and security. Unlike traditional validators, they democratize access to Ethereum staking by supporting restaking-based finance applications and smaller players in the niche. Among Layer 1 blockchains, Ethereum features some of the most onerous financial requirements in order to run a full validator node. Obol Collective solves this problem using its DV model, a true innovation within the world of Ethereum.

#LearnWithBybit