MilkyWay (MILK): Liquid staking and restaking for the modular era

Modular blockchain architectures are growing more popular in the industry as an alternative to monolithic designs. For instance, chains like Celestia (TIA) eloquently separate their consensus layers from other infrastructural components for more flexible and accessible validation services. At the same time, validator ecosystems on Celestia and similar modular networks can benefit immensely from attracting additional staking funds to provide more reliable services.

MilkyWay (MILK) is a decentralized protocol that aims to do just that — provide liquid staking and restaking services in order to support modular blockchains, as well as various Actively Validated Services (AVS). Having started as one of the first liquid staking providers for the Celestia blockchain back in December 2023, MilkyWay added the restaking functionality to its service line in late 2024. As of May 2025, it’s emerged as one of the few decentralized finance (DeFi) protocols to support both liquid staking and restaking, allowing you to earn yields on the same funds from up to three sources — native staking on the original chain, liquid staking, and restaking that supports a variety of bridges, oracles, rollups and other AVS-based platforms.

MilkyWay currently provides liquid staking services for three blockchains — Celestia, Initia (INIT) and Babylon (BABY). The platform’s restaking service is also flexible, allowing you to choose between three different modes — platform-managed, operator-specific or AVS-specific.

Key Takeaways:

MilkyWay is a Cosmos-based DeFi platform that provides liquid staking and restaking solutions to secure modular blockchains and AVS services, such as oracles, bridges and rollup sequencers.

Using its platform, you can utilize the same crypto funds to derive income simultaneously from three yield sources — native staking, liquid staking and restaking.

MilkyWay's native token, MILK, is used for governance, gas fee payments, transaction processing and liquidity provision. MILK can be bought on Bybit as a USDT Spot pair and a USDT Perpetual contract.

What is MilkyWay?

MilkyWay (MILK) is a decentralized platform that offers liquid staking and restaking services, focusing on three Cosmos-based blockchains: Celestia, Initia and Babylon. It’s one of the rare platforms that supports both liquid staking and restaking, allowing you to utilize your crypto funds to derive income simultaneously from up to three sources — native staking, liquid staking and restaking to support AVS.

Similar to the networks it supports, MilkyWay was built using the Cosmos SDK and is part of the wider Cosmos ecosystem. It positions itself as a Layer 1 chain, though some critical functions on the protocol — for example, Celestia liquid staking — are carried out by leveraging smart contracts on another Cosmos-based blockchain, Osmosis (OSMO).

MilkyWay’s origins

MilkyWay’s inception dates back to December 2023, when it was launched to support liquid staking on the Celestia chain. In late 2024, the platform added support for restaking, emerging as probably the leading solution within the Cosmos ecosystem supporting both of these yield-generating activities.

MilkyWay aims to provide support to modular blockchains, and all three chains it focuses on are based on architectural modularity. Celestia’s network offers outsourced data availability (DA) and consensus layers to blockchains. Initia (INIT) specializes in the integration between Layer 1 and Layer 2 technologies to help address the problem of multi-chain fragmentation. These two networks operate essentially as infrastructure providers. In turn, Babylon focuses on DeFi — specifically, supporting Bitcoin (BTC) staking. It operates as a modular plug-in solution to enable Bitcoin funds to secure various proof of stake (PoS) chains.

In order to support cross-chain communications and the transfer of liquid staking and restaking assets across different native environments, MilkyWay has implemented support for two bridging solutions: Hyperlane and IBC Eureka.

How does MilkyWay work?

For liquid stakers

The MilkyWay liquid staking protocol allows stakers of Celestia’s TIA, Initia’s INIT and Babylon’s BABY tokens to reuse their funds for additional yield throughout the DeFi ecosystem. For Celestia liquid staking, when you deposit your TIA funds on MilkyWay, you’re issued a liquid representation of your staked position in the form of the milkTIA liquid staking token, which can then be used on DeFi protocols for lending, borrowing, collateral and more.

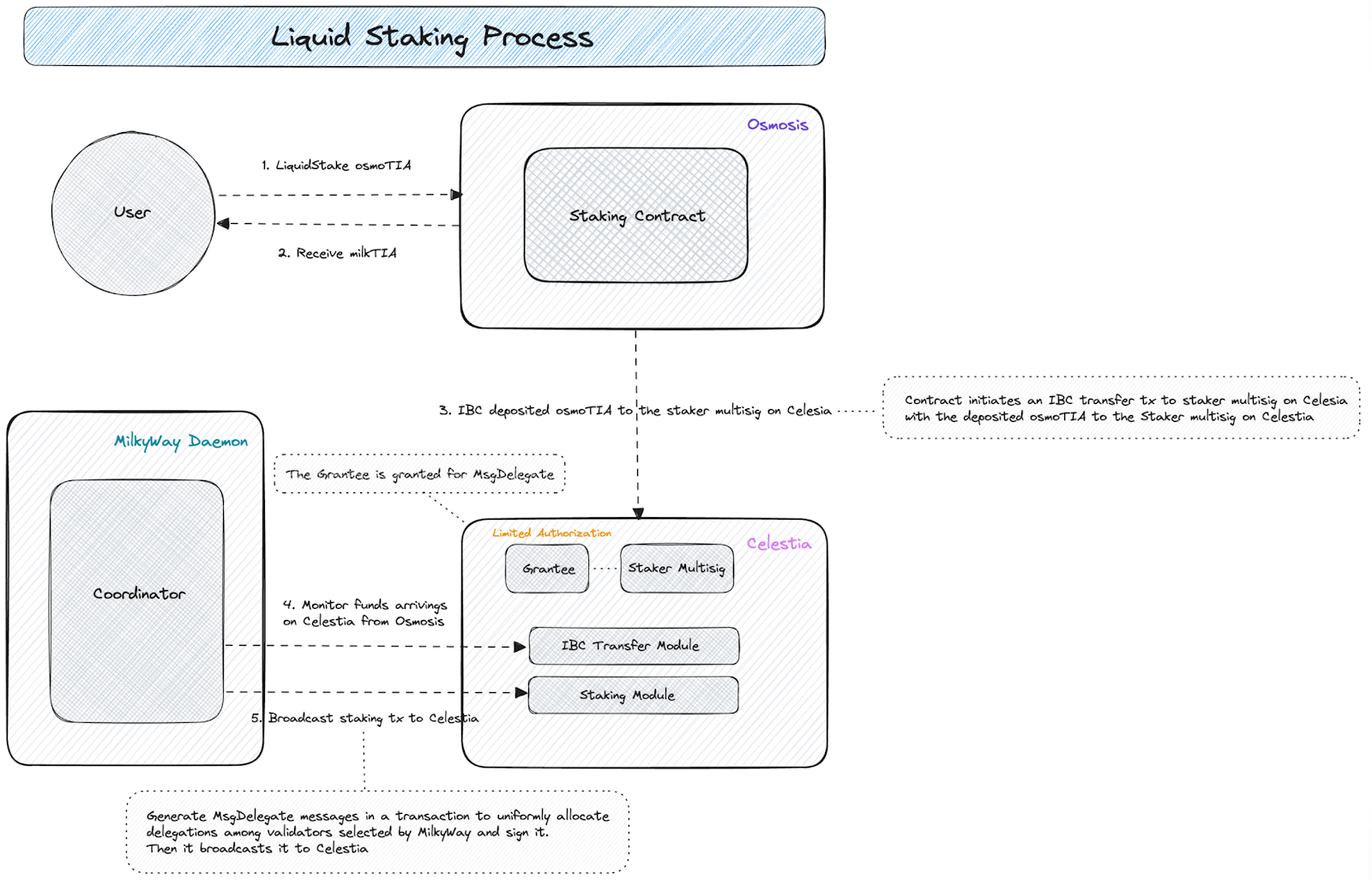

When you stake TIA via MilkyWay, your funds are delegated to established validators on the Celestia network. In the future, this delegation process will be governed by the MilkyWay decentralized autonomous organization (DAO). Your staked TIA is first transferred from Celestia to the Osmosis chain, where MilkyWay maintains smart contracts governing the process. The smart contracts are used to calculate the proper amount of milkTIA, which is then minted and sent to your Osmosis wallet.

The original TIA funds are then sent from Osmosis to the Celestia chain. These transfers are executed using the IBC bridge, a major bridging protocol within the Cosmos ecosystem. A MilkyWay coordinator node is then responsible for allocating the TIA to validators used by the platform. As your staked tokens accumulate rewards on Celestia, you’re free to use your milkTIA on other platforms for additional yield.

INIT and BABY liquid staking

Similar processes, though with some technical differences, are used for INIT and BABY liquid staking. For INIT, when you deposit your funds on MilkyWay, they’re sent from the Initia Layer 1 chain to an Initia-linked Layer 2, where the protocol maintains another set of smart contracts. These smart contracts calculate the requisite amount of milkINIT (the liquid staking representation of the original INIT) and send it to your wallet, at which point you’re free to use your milkINIT LST in DeFi protocols. The original INIT is transferred back to the Initia mainnet and allocated to select validators to earn staking rewards.

BABY liquid staking works quite similarly — your BABY staked assets will be allocated to MilkyWay’s validators on the Babylon chain to earn native staking rewards, and you’ll also be issued milkBABY as an LST to use for additional yield on DeFi solutions.

For restakers

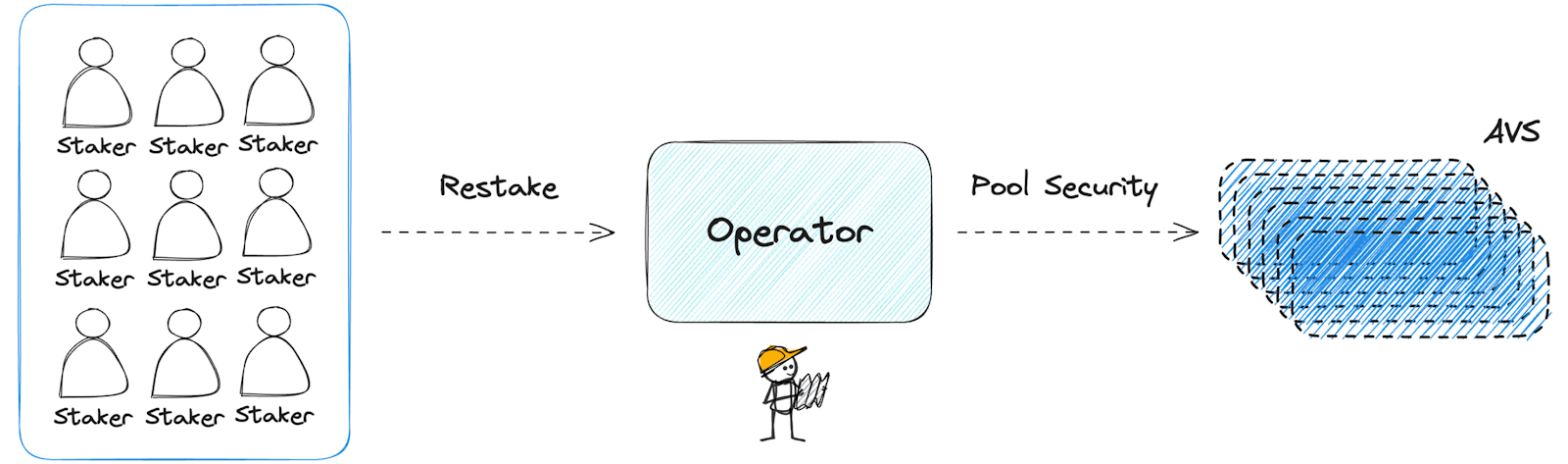

MilkyWay’s restaking service allows you to further reuse your staked funds to secure a variety of decentralized platforms and services. Major blockchain networks typically have no shortage of validators to secure their consensus layers. However, there are additional services and applications that service the blockchain networks, but experience a lack of necessary validator ecosystems of their own. These may include blockchain price oracles, bridges or rollup sequencers — services collectively known as AVS.

To help provide network security and support the operations of these AVS-based solutions, MilkyWay offers you the ability to use your original staked funds for restaking. The key difference between liquid staking and restaking is that the former only lets you reuse your staked funds on DeFi protocols, while the latter is designed for supporting validation mechanisms of various AVS solutions.

In essence, restaking provides a third way to utilize your original crypto funds by securing AVS via liquid restaking tokens (LRTs).

To get issued a liquid restaking token on MilkyWay, you can deposit Layer 1 native tokens — TIA, INIT and BABY — or LSTs — milkTIA, milkINIT and milkBABY. Additionally, MilkyWay also accepts the USDC stablecoin for restaking.

Restaking methods

After depositing an accepted crypto token, you’ll be issued your LRT and can choose from various AVS services on which to restake. MilkyWay offers three options for restakers:

Pooled restaking: In this mode, you simply contribute your funds to a pool from which the protocol will choose an AVS on your behalf. The pooled mode lets you enjoy restaking rewards without having to choose your own AVS or validator.

Operator restaking: Choose a specific operator, typically a validator node, to whom you allocate your funds.

Service restaking: Pick a specific AVS, such as a bridge, oracle or rollup.

The operator and service restaking modes are optimal for experienced stakers and restakers, who can objectively evaluate the reward potential of each validator or AVS they pick.

For infrastructure operators

Developers, validators and AVS operators also benefit from MilkyWay's services. An infrastructure provider — such as an institutional validator node or AVS operator — may partner with the platform to have MilkyWay user funds directed to them for staking or restaking. This can serve as a significant income stream for these individuals or entities.

As of May 2025, the MilkyWay network uses the services of 11 validator nodes. MilkyWay validators enjoy numerous benefits, the most obvious one being the ability to attract staking funds from users. They may also participate in restaking by reusing their stakes to secure the various AVS available through the platform.

MilkyWay key features

Cross-chain communication

MilkyWay's cross-chain communications are supported by two key bridging solutions: IBC Eureka and Hyperlane. These platforms allow users to transfer tokens across different blockchain environments in order to access a variety of DeFi protocols, networks and AVS.

IBC Eureka’s cross-chain communication protocol extends Cosmos's original IBC bridge.

Hyperlane’s cross-platform messaging protocol boasts some of the industry's widest coverage, and supports both Ethereum virtual machine (EVM) and non-EVM networks.

Programmable rules

MilkyWay’s programmable rules are logic conditions that control how, where and under what conditions restaked assets are used (e.g., only restake to certain services or limit the slashing risk). There are two types of rules:

Delegation rules define which assets can be delegated to specific AVS operators and validators.

Slashing rules let developers determine the course of action to take when validators and operators are slashed for poor performance.

Hybrid opt-in model

A key difference between MilkyWay and other restaking providers is its hybrid opt-in model that allows you to choose exactly how your restaked funds are used — through a pooled allocation by the platform itself, or by your delegation to a specific operator or service. In contrast, many other restaking platforms simply handle your funds on your behalf, giving you only limited control over the selection of the restaking target.

Risk management

MilkyWay also protects your overall funds by allowing you to apportion your restaked funds over multiple operators or AVS. In this way, if one operator or AVS fails or gets slashed, your total investment isn’t entirely impacted.

What is the MilkyWay crypto token (MILK)?

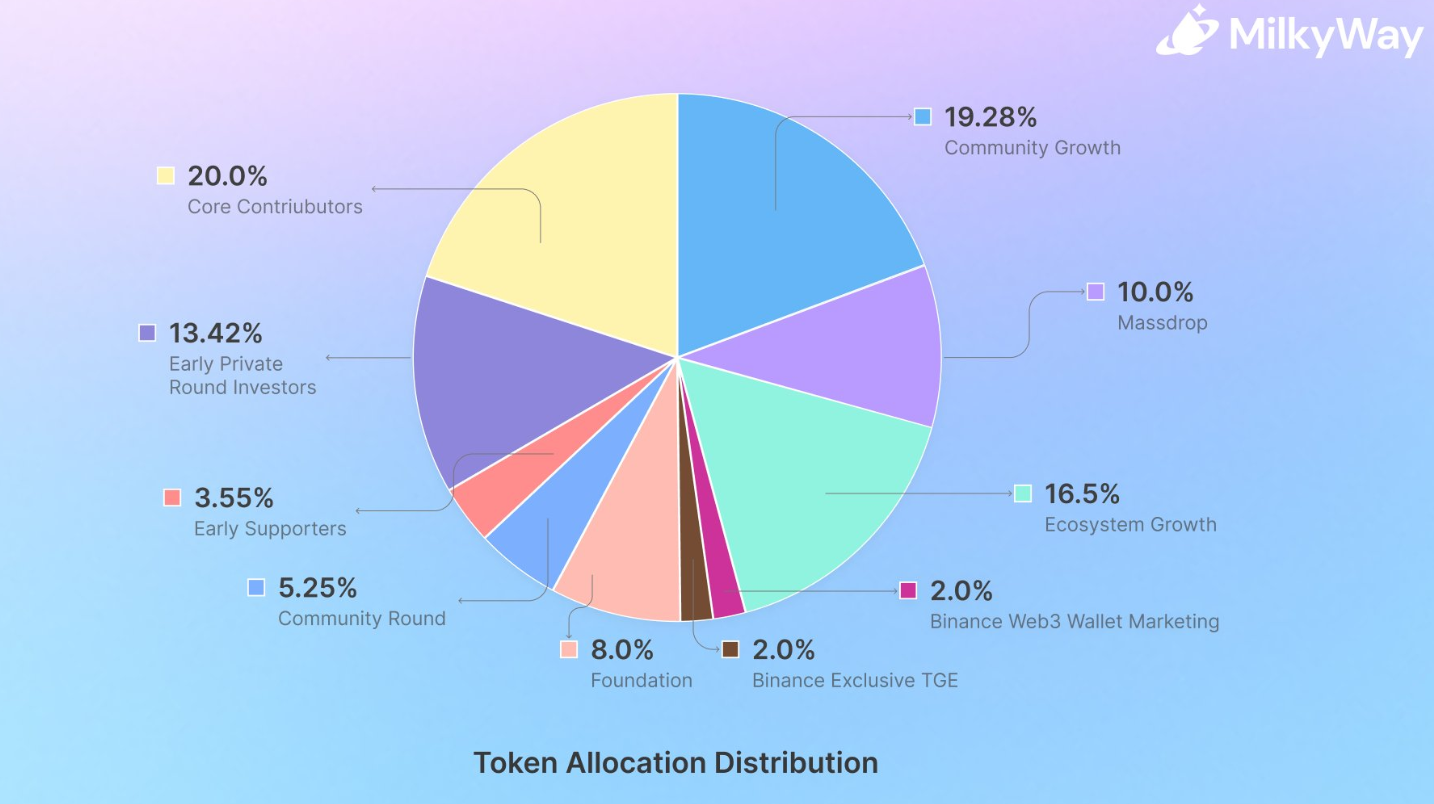

MilkyWay’s native token, MILK, is used for governance, gas fee payments, transaction processing and the provision of on-chain liquidity. Although MilkyWay was launched in 2023, MILK wasn’t launched until late April 2025. With a total supply of 1 billion, the MILK token’s supply allocation shares are per the chart below:

The MilkyWay project has announced an airdrop campaign, the Massdrop, the first phase of which began along with MILK's token generation event (TGE) on Apr 29, 2025. During phase 1 of the airdrop, you can claim MILK tokens via a dedicated portal until May 29, 2025, or through participating crypto exchanges.

Where to buy the MilkyWay crypto token (MILK)

You can buy the MILK token on Bybit's Spot market as a swap pair with USDT (MILK/USDT) or as a USDT Perpetual contract (MILKUSDT).

Closing thoughts

MilkyWay has challenged traditional staking models by offering an extremely versatile set of liquid staking and restaking services. With MilkyWay, savvy DeFi users can simultaneously earn yield on the same funds from up to three sources. In addition to featuring an unparalleled variety of avenues for yield, MilkyWay lets you do the noble thing — provide support to various modular blockchains and AVS operations with your crypto staking and restaking.

#LearnWithBybit