Eigenpie (EGP): ETH Liquid Restaking Powered by EigenLayer

To secure the Ethereum network, token holders are required to lock away their tokens for a long time through the native staking process that powers the proof of stake (PoS) consensus mechanism on the platform. While this structure helps keep the network liquid and secure, it’s a bit rigid regarding capital efficiency.

To counter this limitation, liquid staking protocols such as Rocket Pool and Lido introduced the concept of liquid staking, which allows staked ETH to be used for other decentralized finance (DeFi) activities, earning token holders extra rewards by issuing liquid staking tokens (LSTs).

However, liquid staking only allows assets to be staked in a single PoS blockchain. This limitation has led to the development of liquid restaking on platforms such as EigenLayer. It allows you to use staked assets to secure and earn rewards from multiple protocols through the use of liquid restaking tokens (LRTs).

One of the liquid restaking protocols operating on EigenLayer is Eigenpie, which lets you stake your staked assets to node operators in exchange for LRTs so you can earn rewards.

Let's examine Eigenpie more closely to see how it’s shaping the liquid restacking narrative in the DeFi ecosystem.

Key Takeaways:

Eigenpie is a restaking platform on EigenLayer that lets ETH and ETH LST holders earn additional rewards through restaking their staked ETH assets to receive liquid LRTs.

With features such as isolated liquid restaking, native restaking and Eigenpie Enterprise, the platform provides an innovative approach to restaking in the EigenLayer ecosystem.

Its governance and reward-earning token, EGP, is available on Bybit's Spot trading platform (EGP1/USDT).

What Is Eigenpie?

Eigenpie is a liquid restaking protocol within the EigenLayer ecosystem that allows you to earn passive income from both Ethereum staking and EigenLayer restaking while maintaining your assets’ liquidity through the use of LRTs. As an innovative SubDAO created within the Magpie ecosystem, Eigenpie aims to provide more utility for ETH holders in line with the broader vision of EigenLayer via liquid restaking.

As a native ETH holder or liquid staking participant, you can deposit your assets on Eigenpie, which then restakes them to node validators on EigenLayer. The node validators will then use these assets to power new Actively Validated Services (AVS) on EigenLayer, allowing you as a token holder to earn extra rewards while maintaining liquid positions. Eigenpie has integrated with various DeFi platforms that let you use your LRTs to explore other yield-earning DeFi opportunities while accumulating Eigenpie points that qualify you for the EGP airdrop and EGP IDO allocation.

What Is EigenLayer?

EigenLayer is an Ethereum restaking protocol designed to enhance the capital efficiency of your staked ETH by restaking it across different protocols. As a support layer for the Ethereum network, EigenLayer has a set of node validators who temporarily stake assets and verify transactions securely. Users who delegate their tokens to these node validators receive LRTs, which earn them rewards without unlocking their staked positions.

EigenLayer operates a system of AVS that allows projects such as sidechains, oracles and bridges to connect to its liquid restaking token protocols in order to secure their platforms without running full nodes.

Eigenpie Key Features

As a novel isolated liquid restaking platform of EigenLayer, Eigenpie’s distinctive features include the following.

Isolated Liquid Restaking

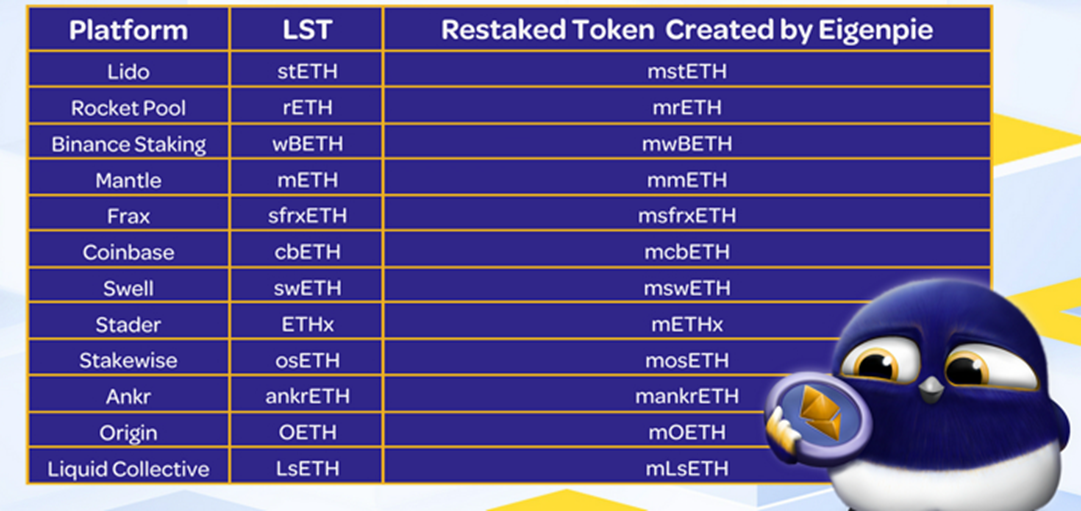

Eigenpie offers an innovative approach to liquid restaking by offering isolated liquid restaking tokens exclusive to a particular ETH LST. This isolates the risk to only the specific token staked on Eigenpie, and not any other ETH LST’s performance. This feature not only ensures that liquid restaking on Eigenpie is security-focused, but also offers an optimal restaking experience, especially to risk-averse LST holders. Below is a chart with the isolated liquid restaking tokens available on Eigenpie.

Isolated Native Restaking

Eigenpie also offers isolated native restaking in collaboration with SSV Network, an open-source ETH staking network that uses Secret Shared Validator (SSV) technology to create a decentralized and secure environment for ETH staking by splitting a validator key into several keyshares, which are distributed to multiple nodes. The isolated native restaking feature on Eigenpie allows ETH holders to connect their ETH to the website and restake it through a simple user interface. Once it’s restaked, ETH holders receive egETH tokens that earn them 2x Eigenpie points, resulting in better yields over time.

Eigenpie Enterprise

Eigenpie Enterprise, a restaking feature on Eigenpie designed for institutional grade investors, comes in two versions that are designed to accommodate different enterprises, depending upon their needs.

The first version allows enterprises to participate in native restaking, liquid restaking and DeFi protocols only within the Eigenpie ecosystem in order to reduce their risk of bad debt. Meanwhile, the second version enables institutions to expand their positions from their existing EigenLayer holdings into the Eigenpie Institution Node Delegator, which opens them to more DeFi opportunities since they can deposit their LRTs in their preferred DeFi platform.

What Is the Eigenpie Token (EGP)?

Eigenpie Token (EGP) is the governance and reward-earning ERC-20 token on Eigenpie. It's designed to ensure the sustainability and long-term success of Eigenpie as a restaking platform. As an EGP holder, you can lock your tokens to receive vlEGP tokens (at a 1:1 ratio) that can then be used to participate in Eigenpie's governance, and to earn rewards for active participation in the ecosystem.

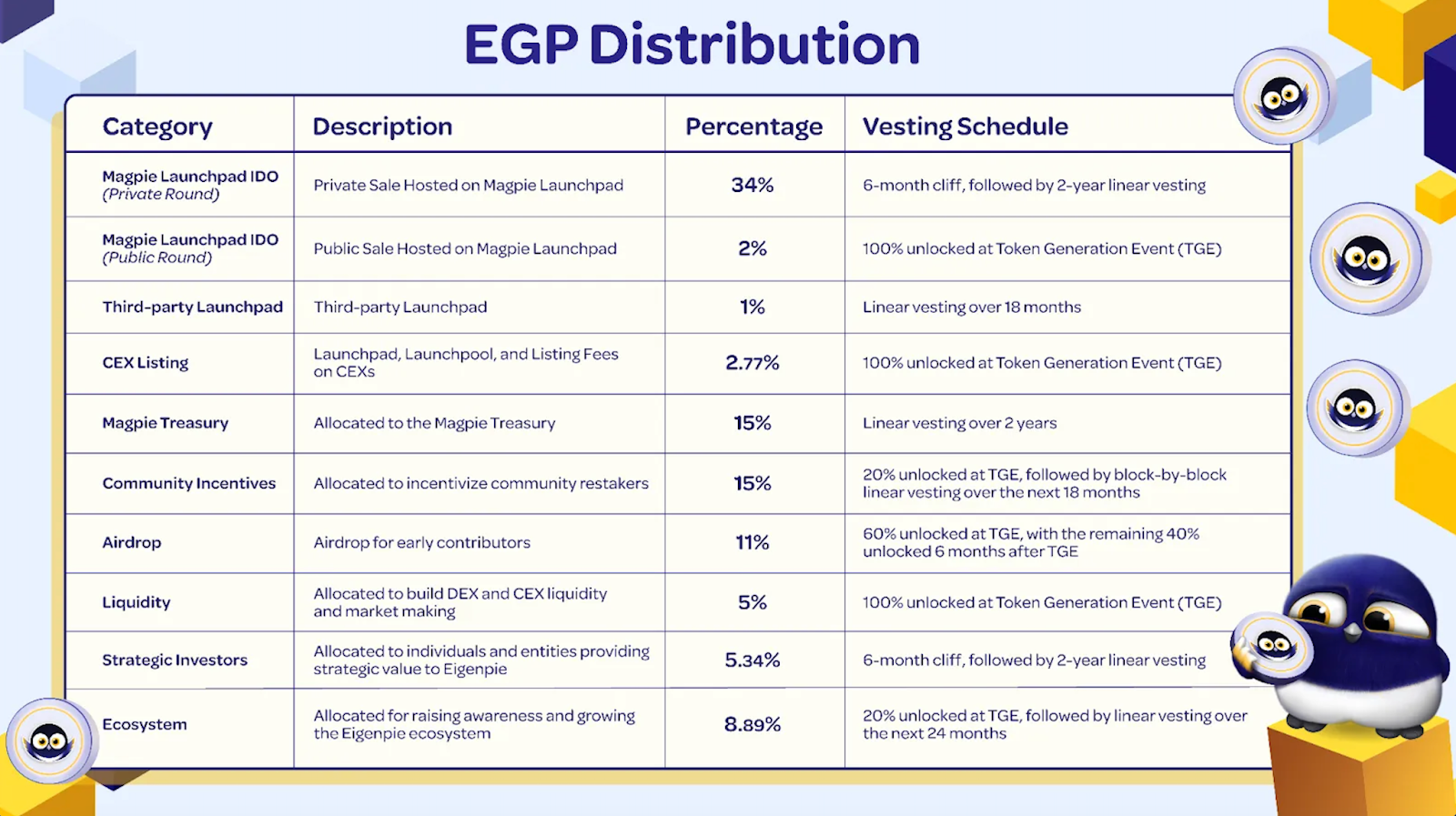

EGP has a total supply of 10 million tokens, distributed as shown below:

EGP Airdrop

Eigenpie's airdrop is reserved for holders who accumulate Eigenpie points through user engagement, and for web3 users from Binance and OKX. To accumulate Eigenpie points, users need to remain active on the platform by depositing LSTs. In short, 1 ETH worth of LST deposits on the platform earns you one point per hour. You can also earn points through referral, whereby your additional points are proportionate to the points earned by your referee.

Where to Buy Eigenpie (EGP)

You can buy EGP on Bybit's Spot trading platform. The token is listed as the EGP1/USDT trading pair. Trading EGP on Bybit's user-friendly terminal is fast and efficient, and comes with 24-hour multilingual customer support.

Closing Thoughts

The liquid restaking concept in cryptocurrency continues to proliferate, since it provides capital-efficient utility for ETH holders. Since Eigenpie is a top protocol on EigenLayer, ETH and LST holders can leverage its features, such as isolated liquid restaking and native restaking, to earn additional passive income from their staked assets.

Furthermore, institutional enterprises can leverage Eigenpie’s platform to access a wide range of DeFi opportunities by using their staked assets. The protocol offers liquid restaking services, and is thus timely as investors continue to explore DeFi opportunities in the crypto market.

#LearnWithBybit