mETH Protocol (cmETH): Effortless Cross-Chain ETH Restaking

Following Ethereum's move to a proof of stake (PoS) block validation model in September 2022, ETH staking and liquid staking solutions have been taking the market by storm. The Mantle Network (MNT) project — a popular Layer 2 chain for Ethereum — had also decided to leverage the popularity of ETH liquid staking by launching the mETH Protocol, then known as Mantle LSP, in late 2023. In a matter of months, mETH had grown to become Mantle's leading decentralized finance (DeFi) protocol and one of the largest liquid staking platforms in the industry.

Another development in this sphere that’s taken shape between the second half of 2023 and throughout 2024 has been the arrival and explosive growth of ETH liquid restaking. Introduced by the EigenLayer protocol, liquid restaking is notably different from liquid staking as it supports a wider range of yield generation opportunities. Having replaced liquid staking as the industry's new in-vogue “thing,” liquid restaking is gaining popularity at lightning speed. Observing the development, the mETH Protocol has decided to add liquid restaking to its arsenal with the introduction of the cmETH liquid restaking token.

Key Takeaways:

mETH Protocol is a liquid staking/liquid restaking service on the Mantle Layer 2 chain.

In late October 2024, the protocol entered the liquid restaking niche by introducing the cmETH token, an omnichain asset that creates liquid restaking opportunities via partner platforms, such as EigenLayer, Symbiotic and Karak.

cmETH can be bought on Bybit as a Spot pair (cmETH/USDT).

What Is mETH Protocol?

mETH Protocol (mETH) is an Ethereum liquid staking and liquid restaking solution launched in late 2023 on the Mantle Network Layer 2 blockchain. The protocol was launched under the name Mantle LSP and rebranded to mETH in August 2024. Originally, the protocol was purely dedicated to liquid staking, with the mETH liquid staking token (LST) as the backbone of its operations. Users can stake ETH via mETH Protocol and earn yields generated from the block validation process on the Ethereum (ETH) chain. mETH is an LST issued as confirmation of staking deposits that also accrues rewards generated from ETH staking.

mETH is a classic liquid staking solution that provides more flexible and affordable staking opportunities as compared to direct staking on Ethereum, where direct staking requires running a validator node and committing 32 ETH (slightly over $100,000) as collateral. mETH-based liquid staking, however, is possible with no hardware resources committed to the network and only a 0.02 ETH (less than $70) minimum investment.

In May 2024, the protocol's governance community passed a proposal to add liquid restaking (covered in the section below) to the platform's product line. The protocol subsequently launched the cmETH liquid restaking token (LRT) to support this new functionality. Introduced in late October 2024, cmETH acts as a deposit confirmation token that accrues rewards from ETH liquid restaking.

Along with the introduction of the cmETH LRT, the mETH Protocol also introduced its governance token, COOK.

What Is Liquid Restaking?

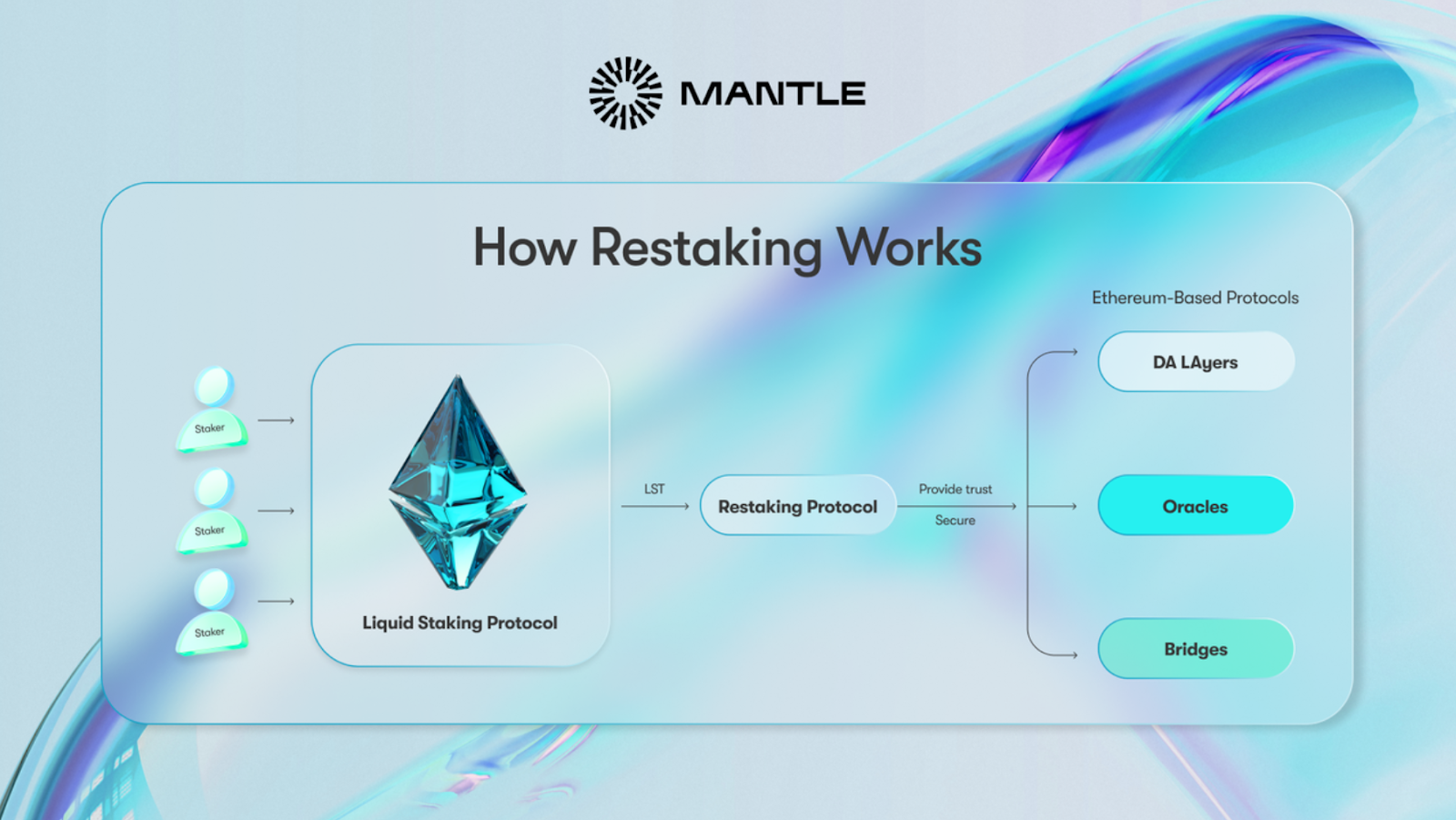

Liquid restaking represents an evolution of liquid staking, which became popular after Ethereum's move to PoS block validation in September 2022. Liquid staking protocols let users stake ETH funds and earn yield without the need to meet Ethereum's quite nontrivial financial and technical minimum requirements for running a validator node.

When users stake funds with liquid restaking protocols, they’re issued LSTs as confirmation of their deposits. These LST assets can be further used within the DeFi ecosystem on various protocols to earn additional yield. For instance, Lido (LDO) — the most popular liquid staking protocol deployed on Ethereum — provides users with the stETH LST, which represents the underlying principal-staked ETH. While your original ETH earns staking yield through Lido, you’re free to use stETH on various DeFi lending and borrowing protocols or swap pools to generate additional yield.

In June 2023, the EigenLayer protocol first introduced the concept of liquid restaking. With liquid restaking, you’re issued an LRT asset as a receipt for your original staked ETH funds. The LRT can then be reused for staking and other yield-generating DeFi activities on other platforms to secure their operations. At first glance, liquid staking using LSTs and liquid restaking using LRTs look similar, as both allow you to use an asset issued as your ETH deposit receipt on other platforms for additional yield.

However, there are significant underlying differences between the two concepts. LSTs cannot be reused on additional platforms beyond Ethereum for staking to secure their consensus mechanisms. Instead, these assets can only be utilized in liquidity pools, lending solutions and other DeFi apps that are detached from the underlying validation/staking process on a given chain or protocol.

In contrast, LRTs are assets that can be reused beyond Ethereum’s Layer 1 to secure through staking the operations of Layer 2 chains, bridges, oracles, data availability (DA) layers and other solutions servicing the broader Ethereum ecosystem. Additionally, similar to LSTs, LRTs can typically be reused in liquidity pools, lending protocols and other DeFi solutions not responsible for the underlying security of a blockchain platform or service. In other words, liquid restaking/LRTs offer a significantly wider choice of platforms and reuse modes than liquid staking/LSTs.

What Is mETH Protocol’s Liquid Restaking Token (cmETH)?

cmETH is mETH Protocol's value-accumulating receipt token for liquid restaking. It's a composable liquid restaking token designed to support the new restaking function on the platform. Thanks to its use of the LayerZero OFT (Omnichain Fungible Token) standard, it has native-level multi-chain functionality. By committing your ETH funds to restaking via mETH Protocol, you can be issued the cmETH LRT. Similar to mETH, which is used for liquid staking, cmETH roughly tracks the price of ETH, and typically trades at a slightly higher rate than Ether, due to accumulating yields.

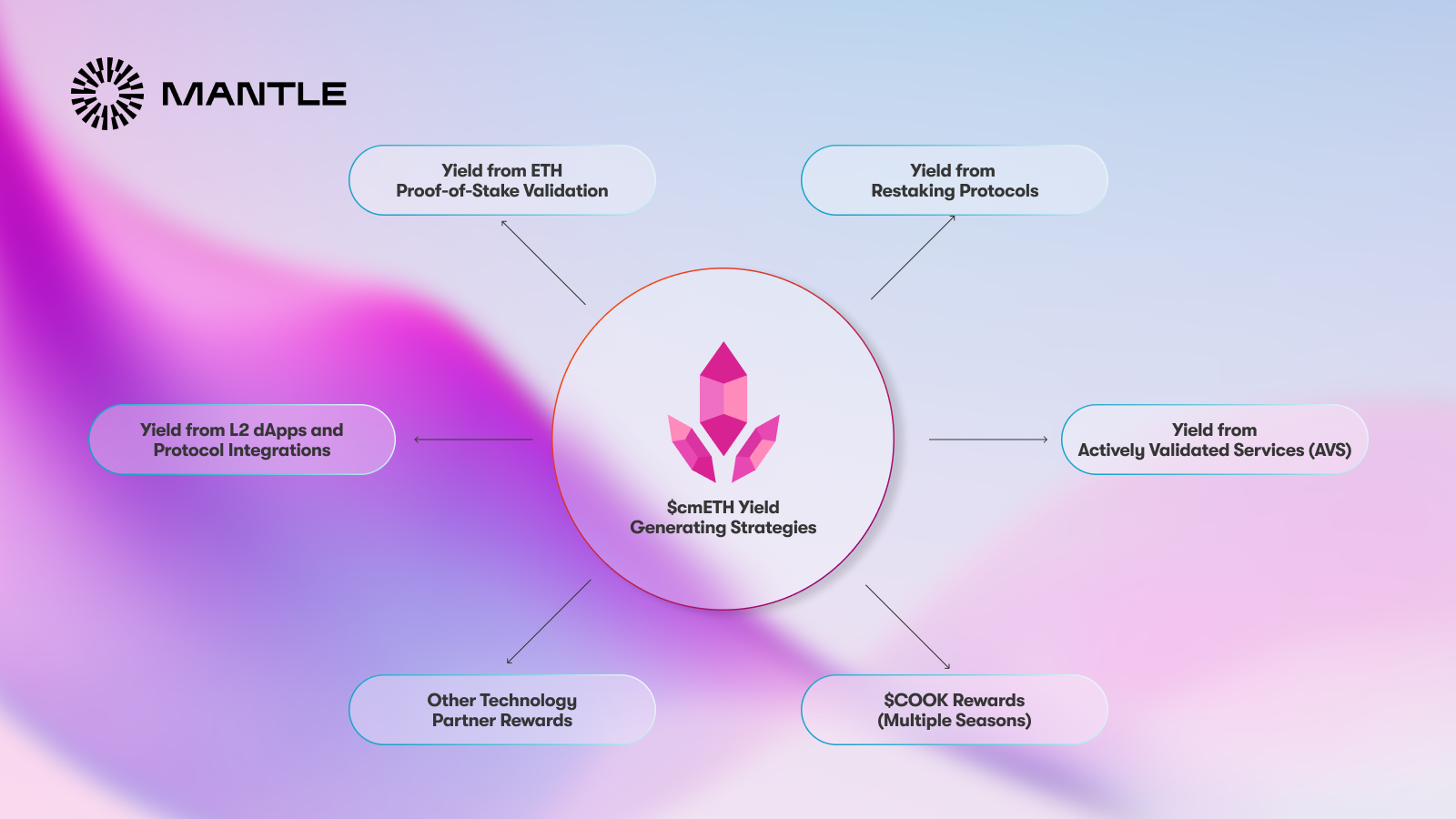

The protocol uses several liquid restaking providers — EigenLayer, Symbiotic and Karak — as well as associated Actively Validated Services (AVS) to put your ETH funds to use, secure a variety of chains and protocols, and deliver you competitive APY rates from liquid restaking. As solutions and services on blockchain platforms that are being actively monitored and adjusted to ensure their efficiency and security, AVSs contrast with fully automated blockchain services, which are based more on a "set and forget" premise.

cmETH has no maximum supply limitation. As a typical LRT asset, its total supply in circulation will fluctuate based on the amount of ETH committed to liquid restaking via the protocol. As of Nov 25, 2024, the token's total circulating supply stands at 232,299 cmETH.

cmETH vs. mETH

cmETH and mETH represent mETH Protocol's liquid restaking and liquid staking tokens, respectively. To enjoy liquid restaking opportunities, you can convert your mETH to cmETH at a ratio of 1:1. An advantage of cmETH over mETH is the wider choice of yield-bearing options. mETH is typically used to access staking yields from supporting Ethereum's block validation mechanism. It can also be used on a variety of liquidity pools on Mantle Network, decentralized money markets and the Mantle Network decentralized exchange (DEX).

cmETH creates opportunities to secure a variety of chains, protocols and solutions within the Ethereum ecosystem via EigenLayer, Symbiotic, Karak and various AVSs, something that’s not possible with mETH and liquid staking. As such, cmETH provides a wider array of options and potentially better yields than with mETH, due to the variety of available choices.

Where to Buy cmETH

cmETH is available on the Bybit Spot market as a swap pair with USDT. Until Nov 29, 2024, you can also take advantage of Bybit's cmETH Token Splash campaign to grab a share of the 10 million COOK prize pool. To be eligible for the rewards, new users who sign up on Bybit and complete identity verification need to accumulate a deposit volume of at least 0.1 cmETH, or deposit 100 USDT and trade 100 USDT worth of cmETH via their first trade with their Bybit account. Existing users can also qualify for COOK rewards by trading at least 500 USDT worth of cmETH, with the chance to earn more by higher trading volume.

Closing Thoughts

By introducing the cmETH token, mETH Protocol has entered the game of liquid restaking. Using this new service, mETH users can now generate yield rates and achieve capital efficiency that the standard liquid staking service may not be able to match. If you’re a DeFi user interested in new liquid restaking options, the cmETH token from mETH Protocol may deserve your serious consideration.

#LearnWithBybit