Usual (USUAL): A New Model of Collateralized Stablecoin Ownership

More than a decade ago, in mid-2014, the first stablecoins arrived on the stage of the crypto market. These cryptocurrencies were designed to provide stability in the typically volatile world of crypto, and to serve as a bridge between the traditional finance (TradFi) and decentralized finance (DeFi) ecosystems. At the core of their functionality is a mechanism that maintains a close peg to some traditionally valued asset, be it the U.S. dollar, euro or Bitcoin (BTC).

Stablecoins have proved to be tremendously popular, with the leading asset in this niche, Tether (USDT), routinely attracting higher trading volumes than any other cryptocurrency — including the mighty Bitcoin. The second most popular stablecoin in the market, USDC (USDC), also enjoys multibillion-dollar daily trading volumes, and ranks among the top 10 cryptocurrencies by market cap.

Despite their popularity, many leading stablecoins — including the dominant USDT and USDC pair — have opaque collateral management mechanisms, are lacking in transparency, don't distribute revenues to the wider user community and are highly centralized in terms of control.

Usual (USUAL) is a DeFi solution launched on the Ethereum (ETH) blockchain that aims to tackle these deficiencies of traditional stablecoins by offering a real-world asset (RWA)–backed stablecoin and redistributing protocol revenues among its users. The platform's primary stablecoin — USD0 — is backed by collateral invested mainly in short-term U.S. Treasury Bills; maintains a tight peg to the greenback via these secure investments; has a fully transparent reserve verification system; and opens up additional yield opportunities across a variety of external DeFi protocols via a liquid staking token (LST) derived from it.

Key Takeaways:

Usual (USUAL) is a decentralized fiat stablecoin issuer that distributes protocol revenues among holders of its governance token, USUAL, and offers an RWA-backed stablecoin, USD0.

Usual's USD0 is collateralized using short-term U.S. Treasury Bills, thereby providing some of the safest and most stable reserves for a stablecoin in the world of finance.

The protocol's USUAL token is used for governance and reward distributions, and is currently available on Bybit's Pre-Market Perpetuals trading platform via a USDT-based perp futures contract.

What Is the Usual Crypto Protocol?

Usual (USUAL) is an Ethereum-based DeFi platform that offers an RWA-backed, USD-pegged transparent stablecoin, USD0, and distributes protocol revenues among its user community. USD0 is backed by collateral invested in RWAs, primarily in short-term U.S. Treasury Bills. The short-term, highly liquid and secure nature of these government-issued assets ensures that USD0's peg to the U.S. dollar isn't likely to be compromised.

Usual has partnered with Hashnote, a Florida-based regulated provider of digital and tokenized fund products, to facilitate secure investment in U.S. Treasury Bills and associated products.

Usual's USD0 is a unique stablecoin product, distinct from the dominant assets in this niche, USDT and USDC. While these cryptocurrencies also maintain fiat reserves to back their value, they’re controlled by centralized corporate entities, and their USD reserves are exposed to the traditional banking system, with poorly known levels of risk associated with them.

USD0 is also distinct from so-called algorithmic stablecoins, whose values aren’t backed by fiat assets, and which are highly dependent upon underlying protocols’ activity to maintain their pegs. In many cases, these algorithmic coins lose their pegs and stability when the underlying lending or borrowing activities on their protocols are manipulated by whales or become subject to panic-driven runs. The most notorious example was the 2022 crash of TerraUSD (UST).

Usual’s platform also offers a liquid staking version of USD0, USD0++, which can be used throughout the DeFi ecosystem for additional yields. It has partnered with several Ethereum DeFi protocols to expand the universe of platforms where USD0++ can be utilized, including Morpho (MORPHO), Pendle Finance (PENDLE), ether.fi (ETHFI) and more.

Usual also has another distinct feature: the protocol aims to distribute future revenue among its users, specifically among holders of its upcoming USUAL governance token.

The platform was developed by the France-based Usual Labs, a blockchain development outfit co-founded by Adli Takkal Bataille, Hugo Sallé de Chou and former French parliament member Pierre Person. Usual launched the USD0 stablecoin in mid-2024. In late November 2024, the platform introduced the USUAL governance token, set to be launched sometime in mid-December 2024.

What Does Usual Aim to Achieve?

The introduction of the USD0 stablecoin is a potentially paradigm-changing event for the crypto market. This innovative asset adopts many of the advantages of fiat-backed stablecoins, but also resolves many associated issues. Usual Labs has targeted several goals with the advent of USD0 and its unique working mechanism.

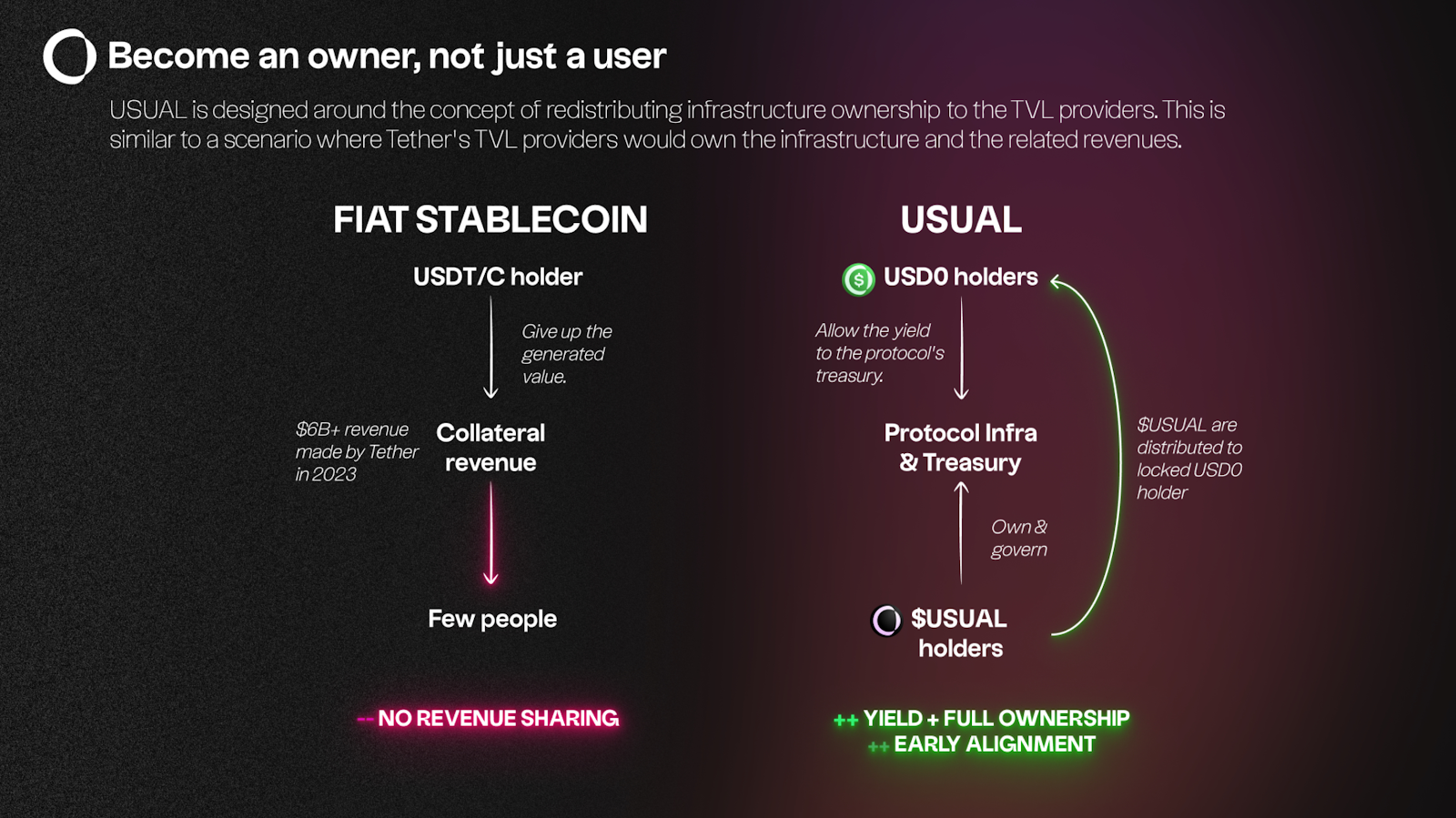

One key aim is to change the way that profits from decentralized stablecoin operations are shared. Usual's revenue is to be shared with the user community — namely, the holders of the USUAL token. All the revenue generated from the platform's operations flows to its treasury. USUAL holders are in charge of this revenue, making them eligible to decide on the actual distribution. In essence, owning USUAL entitles you to a share of potentially 100% of revenue generated by the platform.

This starkly contrasts with the way that other fiat-backed stablecoins, notably USDT and USDC, operate. All the revenues generated from these stablecoins are appropriated by their respective founding companies — Tether Limited for USDT, and Circle Internet Financial Limited for USDC. While the risks from the operations of these assets are externalized and shared with holders of the stablecoins, the revenues are internalized and scooped up by Tether and Circle.

Another aim of the Usual project is to bring transparency to the management of collateral that backs the USD0 stablecoin. As a decentralized protocol, Usual provides the transparency of collateral funds' allocation. Again, this contrasts with the opaque nature of the way that USD collateral for some stablecoins is managed. Tether's USDT has particularly raised concerns in the crypto investor community, as the company has never conducted a full-scale audit for its vast claimed dollar reserves.

Another aim of Usual is to provide a stablecoin that’s completely secure from exposure to the traditional, fractional reserve-based banking system. Some crypto investors have derided the fractional reserve system, whereby only a small proportion of client liabilities are actually held at any given time by banks. Projects like USDT and USDC rely heavily on the traditional banking system, which backs their U.S. dollar reserves. These banks naturally rely on fractional reserves that, at least in the opinion of the most risk-averse investors, exposes them to potential failures.

In contrast, USD0 is backed by short-term U.S. Treasury Bills, an asset class that’s fully backed by the U.S. government's pledge. These are considered among the safest assets in the world of finance, as the U.S. government has never yet defaulted on its payment obligations. Unlike USD deposits in banks, USD0's Treasury Bill–based collateral isn't exposed to the risks of the fractional reserve system. As such, the coin's collateral is based on a government-backed asset, providing a level of security that most fiat-based stablecoins in the market are unlikely to match.

How Does Usual Work?

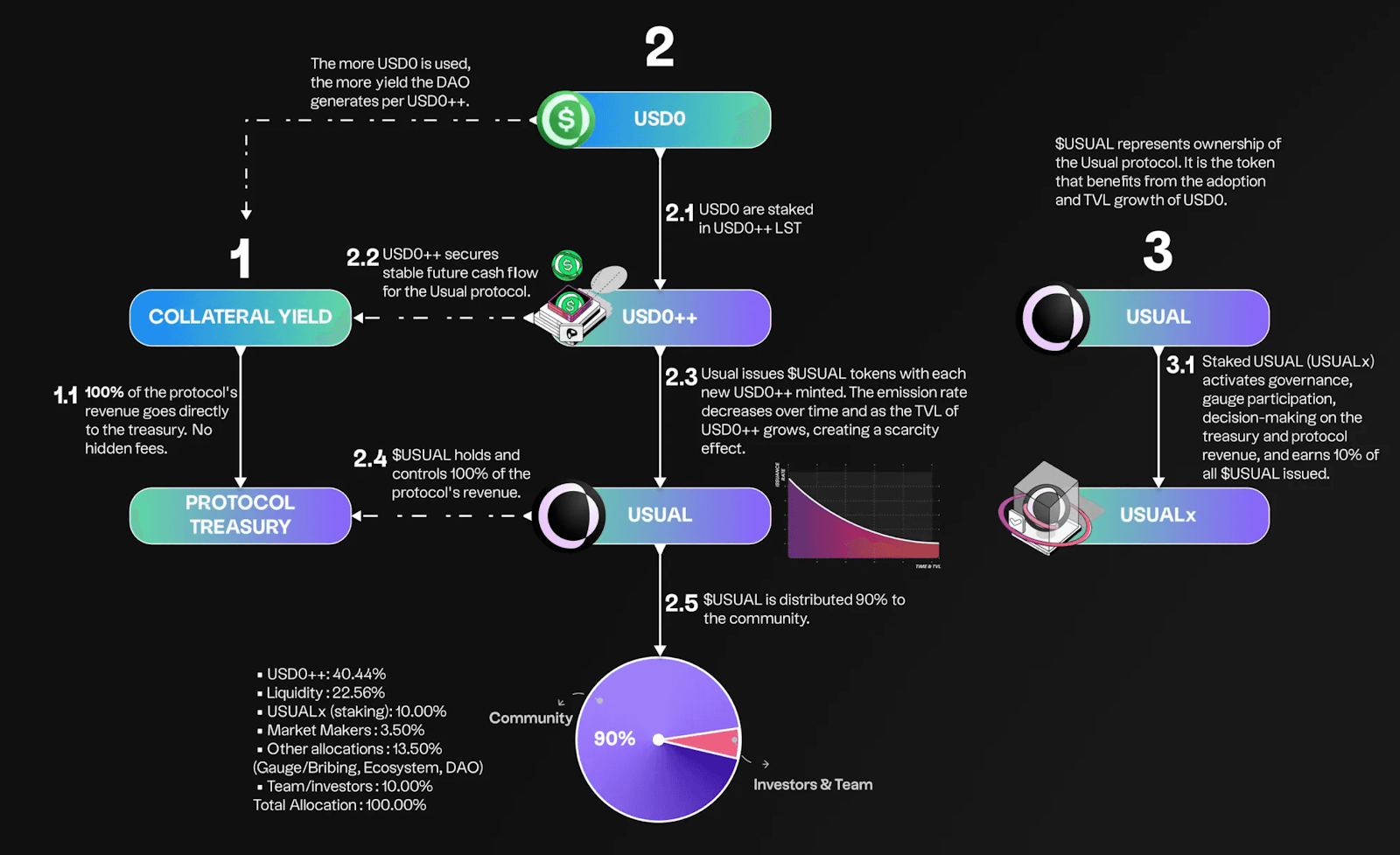

Usual uses a three-token model to power its operations and services. There's the fiat-backed USD0 stablecoin, which is protected by Treasury Bill collateral. The second asset is the USD0++ LST, a derivative of USD0 issued upon staking the latter. And there’s the USUAL governance token that grants holders the right to participate in decision-making on the protocol's rules and future direction.

USD0 (Fiat USD Stablecoin)

The Usual protocol provides two ways to mint the USD0 stablecoin:

1) Direct minting using real-world assets:This is normally done by investing in the USYC fund and using it as collateral, then depositing it into the mint engine to mint USD0. USYC is an on-chain representation of the Short Duration Yield Fund (SDYF) provided by Hashnote, a regulated provider of tokenized fund products. USYC/SDYF is based mainly on U.S. Treasury Bills with short-term maturity.

2) Indirect minting:You can also mint USD0 indirectly on a 1:1 basis by supplying the USDC stablecoin as collateral.

Redeeming the stablecoin is also possible in two ways — directly through the protocol, or via the secondary market. When using direct redeeming, you simply withdraw your RWA collateral using the protocol's interface. Alternatively, you can sell USD0 for USDC or USDT via a secondary market platform, such as Curve Finance (CRV), a popular DeFi protocol that specializes in stablecoin assets.

USD0++ (USD0 Liquid Bond)

USD0++ is an LST representation of USD0. When you stake USD0 on the platform, you’re issued USD0++, which is fully composable and can be used on various Ethereum-linked protocols to earn additional yield. You can lock USD0 to get issued USD0++ for four years. However, you’re also free to unstake at any time.

Staking rewards from locking USD0 to get USD0++ are paid in USUAL tokens. Usual's model rewards long-term staking commitments, as users are encouraged to stake for at least six months — this is the minimum period of staking required to qualify for what the protocol calls the Base Interest Guarantee (BIG). BIG essentially refers to a guaranteed yield from native staking of the underlying RWAs on the Usual protocol. When the period concludes, the staker can choose to collect the yield in either USUAL or USD0.

Yields start accumulating from day one of staking. Although users are free to unstake at any time, those who do so before the six-month minimum period will forfeit accumulated rewards.

What Is the USUAL Governance Token?

USUAL is the Usual protocol's governance crypto token. It was unveiled on Nov 19, 2024, and is currently in pre-market mode only. It's expected that USUAL's public launch will occur in the near future. As USUAL is a community-first token, 90% of the tokens are distributed to the community with only 10% allocated to insiders (team and investors).

Usual feeds its revenues into its protocol's treasury, which is controlled by the USUAL holder community. As such, USUAL holders own 100% of the platform, a significant departure from the system used by many other stablecoin issuers, whereby a corporate entity earns all or the majority of the profits.

Additionally, Usual is designed such that its protocol will incentivize early adopters and long-term holders. As the TVL of USD0 increases, Usual will generate more revenue. The emission rate of USUAL is also disinflationary, gradually reducing as the TVL of USD0 rises and enhancing the scarcity of the token, which will subsequently lead to a boost in its value.

At the initial stages of the platform's market presence, Usual Labs is largely responsible for governance decision-making. However, this function will be taken over by USUAL holders, likely in the form of a decentralized autonomous organization (DAO).

Although called a governance token, USUAL has additional functionalities beyond supporting the protocol's governance processes. It’s also used to distribute yields from staking ( as discussed in the section above on USD0++). Rewards from the protocol's loyalty point campaigns are also airdropped in USUAL.

In addition, USUAL can be staked for additional governance rights and rewards. USUAL stakers will receive USUALx tokens, from which they can earn a portion of USUAL emissions and 50% of the fees generated from people unstaking their Usual assets (USUAL or USD0++).

USUAL's maximum and total token supply are specified at 4 billion. The initial circulating supply during the early days of the token's pre-market trading is close to 500 million as of Dec 2, 2024.

How to Earn USUAL Airdrop

The Usual protocol ran a points-based reward program from July through the last week of November 2024. Called the Pills Campaign, it let early users accumulate points by acting as liquidity providers before the protocol's full public launch phase. The accumulated Pills points will determine users' eligibility for a USUAL airdrop, slated for mid-December.

The airdrop will allocate 8.5% of the token's supply to eligible users — the more Pills points you've earned, the more USUAL tokens you’ll receive.

Where to Buy USUAL

During the token's pre-market trading stage, Bybit is one of the rare platforms that’s allowing you to access it. As of Dec 2, 2024, USUAL is available on Bybit's Pre-Market Perpetuals Trading platform as a Perpetuals futures contract with USDT.

Bybit Pre-Market Perpetuals lets you invest in a variety of upcoming cryptocurrencies via USDT-based perpetual futures contracts before these assets are listed on the main spot or derivatives markets. Using this platform, you can access a range of promising new crypto assets before they become publicly available. There are two main limits enforced by Perpetual Pre-Market — the position size cannot exceed $250,000, and leverage is permitted up to 5x.

Closing Thoughts

Stablecoins are one of the oldest asset types in the crypto industry, while RWAs are a much newer trend that’s growing increasingly popular among investors. The Usual project has decided to marry these two areas, providing an RWA-backed, USD-pegged stablecoin — USD0. The concept of using an RWA for stablecoin collateral may not be totally unique. However, using a highly secure asset such as U.S. Treasury Bills with short-term maturity is something that truly distinguishes the Usual protocol.

Distributing revenue among the governance token holder community is also a refreshing innovation in a niche dominated by providers who largely internalize protocol incomes. Currently, the stablecoin market is heavily dominated by USDT and USDC, with First Digital USD (FDUSD) also recently posting impressive, multibillion-dollar daily trading volumes. All three of these stablecoin issuers lack a mechanism to share revenue with their users. A major stablecoin provider that utilizes a democratized way of sharing protocol revenues with the user community is a deserted area, one that the Usual platform is keen to claim.

With all these merits of the Usual protocol, the upcoming USUAL token is a promising and potentially rewarding asset. Investors interested in stablecoins grounded in highly secure TradFi collateral might want to take a closer look at these new arrivals on the block — the USD0 stablecoin and the USUAL governance token.

#LearnWithBybit