Resolv (RESOLV): A new architecture for crypto-native stablecoins

Stablecoins are meant to provide stability in the volatile world of crypto, but many have built-in issues. Take fiat-backed stablecoins — they promise a 1:1 peg to the dollar because they hold real-world assets (RWAs), actual cash or cash equivalents as collateral. The catch? You have to trust that those centralized companies really hold the money within the traditional financial infrastructure, and won't freeze or lose it. It's an off-chain risk that can cause problems, as has happened numerous times in the history of the crypto market.

Then there are algorithmic stablecoins, which try to keep their pegs without real collateral. Instead, they use complex algorithms to expand or shrink supply based on demand. But when the market crashes or becomes volatile, those algorithms sometimes fail, causing a stablecoin to lose its dollar peg — and its users’ trust. Perhaps the most high-profile of these cases involved the TerraUSD (UST) stablecoin crash in May 2022.

Resolv (RESOLV) is a stablecoin protocol that takes a different approach. It backs its stablecoin with transparent on-chain crypto assets, such as Ether (ETH), Lido Staked ETH (stETH) and Bitcoin (BTC). But holding volatile crypto alone isn't stable, so Resolv pairs each crypto holding with a short futures contract. This hedging strategy, known as delta-neutral, aims to balance out price moves so the stablecoin’s value remains steady near $1, irrespective of market developments.

In essence, Resolv combines real crypto reserves with smart hedging in order to offer a stablecoin that's transparent, backed by actual assets and designed to avoid the weaknesses of other stablecoins, both the algorithmic and fiat-backed varieties.

Key Takeaways:

Resolv (RESOLV) is a decentralized protocol that uses a unique mechanism based on delta-neutral strategies to offer a USD-pegged stablecoin, USR, and a yield-bearing asset, RLP.

The platform's native token, RESOLV, is used primarily for governance and staking.

- RESOLV can be bought on Bybit as a USDT Spot pair and Perpetual contract.

What is Resolv?

Resolv (RESOLV) is an Ethereum-based stablecoin protocol designed to maintain price stability through a delta-neutral strategy. Instead of using fiat reserves or algorithmic supply controls, it relies on staked on-chain crypto assets paired with short futures positions to hedge against market volatility. The goal is to offer a stablecoin that stays near $1 without depending upon centralized custodians or fragile algorithms.

Resolv issues two tokens in order to separate stability and risk. USR is the stablecoin that users hold for predictable, dollar-like value, and RLP is the risk token that absorbs market swings and costs involved in hedging. USR holders get a stable asset backed by real crypto without the usual price swings, while RLP holders take on the volatility but get rewarded through yields from staking and perpetual futures funding.

Resolv's approach addresses core problems with existing stablecoins. Fiat-backed stablecoins like Tether (USDT) or USDC depend upon third-party custodians to hold reserves in bank accounts. These reserves aren't always transparently audited, and users rely on trust rather than verifiable backing. For instance, Tether Inc., the issuer of USDT, has been accused of not maintaining the full reserves to back its stablecoin.

Algorithmic stablecoins, meanwhile, can collapse under stress. TerraUSD (UST) is the most well-known case, having lost its peg to the US dollar in 2022 after its mechanism failed during adverse market developments.

Resolv’s innovations

Resolv removes trust-based and algorithmic counterparty risks by keeping everything on-chain and pairing tangible assets with real hedges. Collateral and hedging positions are designed to avoid dependence on any centralized custodian or risky trading algorithm.

The design also introduces flexibility, as the protocol can adjust asset allocations and rebalance positions as needed to maintain the delta-neutral exposure. This means that USR can maintain its stability, even if the composition of the backing assets changes over time.

The Resolv protocol was developed by Resolv Labs, an Abu Dhabi–based startup founded in 2023 by Ivan Kozlov, Fedor Cmilev and Tim Shekikhachev. It was launched on the Ethereum Mainnet in September 2024. The USR and RLP Resolv tokens were also deployed at that time, while its native governance token, RESOLV, debuted in June 2025.

Since its launch, Resolv has focused on scaling its collateral base and expanding perpetual futures coverage across centralized exchanges (CEXs) and decentralized finance (DeFi) derivatives platforms. As of the time of this writing on Jun 20, 2025, Resolv has a total value locked (TVL) of $372 million.

How does Resolv work?

Resolv issues two tokens — USR and RLP. USR is a stablecoin backed by a mix of ETH, BTC, stETH and other crypto collateral held in the protocol’s Collateral Pool. These holdings are paired with short positions in the perpetual futures market to offset price changes. This setup is what keeps USR stable: when the value of the underlying crypto moves, short futures are expected to move in the opposite direction, neutralizing the effect. This dynamic is known as a delta-neutral position.

USR

Resolv maintains the value of its stablecoin, USR, by building a delta-neutral portfolio, so that every crypto asset in the system — such as ETH, stETH or BTC — is paired with a short futures position. The two sides of the trade are meant to cancel out price movements in order to keep the portfolio's overall value stable even when markets swing. This setup allows Resolv to mint USR using USDT and USDC, and to keep it close to its dollar peg without depending upon fiat reserves or supply manipulation.

RLP

RLP, the protocol's risk token, is also minted using USDT and USDC. It absorbs the volatility and funding risks that USR avoids. When the system earns yield — from staking ETH, funding rates on perpetual futures, or other sources — that value flows primarily to RLP holders. But RLP holders also absorb losses as the result of futures funding turning negative, slippage in execution or other adverse market developments. In essence, RLP acts as the backstop of the system and as a risk management tool for USR.

This structure separates risk and stability, as USR holders get a stable asset with minimal exposure to crypto price movements and RLP holders take on the market exposure and, in return, get the upside when yields exceed costs.

Three key components power this system — the Resolv Liquidity Pool, the Collateral Pool and the Resolv Points mechanism.

Resolv Liquidity Pool (RLP)

The Resolv Liquidity Pool acts as the counterparty to the short futures that hedge the protocol's crypto holdings. Users who deposit assets into the RLP vault receive RLP tokens in return. These deposits take on the market and funding risks that USR holders avoid. In return, RLP holders receive most of the system's yield from Resolv's Collateral Pool profits — including staking rewards and positive funding rates — but also absorb losses if those sources underperform or if hedging costs rise.

RLP is self-balancing in that its yield increases when there are fewer liquidity providers, and decreases as the number of liquidity providers increases.

This protection layer allows USR to remain stable and absorbs protocol risks. The risk is offloaded from USR to RLP, creating a clear line between stablecoin holders and risk participants. In this way, the value of RLP can fluctuate, but USR remains pegged — as long as the protocol manages the hedges effectively.

Resolv Collateral Pool

The Collateral Pool is where the protocol’s core assets are held. These include ETH, BTC, stETH and any other supported tokens of the Resolv ecosystem. The pool forms the reserve backing for USR. When someone wants to mint USR, they deposit supported collateral into this pool. The protocol then opens short futures to hedge the price exposure, creating the delta-neutral position.

Collateral in this pool is held mostly on-chain. However, a small portion is also kept off-chain in institutional collateral as margin for perpetual futures. The pool is also isolated from the RLP side of the system, so users minting USR don’t directly take on market risk — the protocol does it on their behalf, using RLP as the counterbalance.

Resolv Points

Resolv Points are the protocol’s reward mechanism. Users earn points by interacting with the system — for example, by holding RLP or USR, staking USR or using ecosystem integrations. These points are non-transferable and non-tradable. They’re expected to contribute to future token distributions and other on-platform incentives.

The points system is meant to reward early and active users without introducing new crypto tokens or prematurely diluting existing ones.

Resolv key features

Resolv’s system is defined by two core features that make its stability model functional in practice: active delta-neutral asset management, and strict economic segregation between risk and safety. These features aren’t marketing terms: they’re enforceable by protocol design, and critical to keeping the system solvent, transparent and operational in different market conditions.

Delta-neutral portfolio management

Every USR minted is backed by a position that combines long spot crypto with a short perpetual futures hedge. The spot side — with assets such as ETH, BTC or stETH — is held in the Collateral Pool. Meanwhile, the futures short is executed on external markets, including CEXs andDeFi derivatives platforms. The notional exposure of these perpetual futures is calibrated to match the value of the spot side, so the protocol doesn’t care if the market moves up or down, as the net result should remain stable.

This isn't a passive setup. The protocol uses external oracles and internal logic to monitor PnL drift, slippage and funding costs in real time. It can rebalance positions by adjusting futures sizes or rotating assets within the Collateral Pool. If, for example, ETH increases in price and the hedge underperforms due to delayed execution, the imbalance is absorbed by RLP — not USR.

Position sizing is managed algorithmically and built to respond to leverage caps and liquidity depth on supported futures markets. This ensures Resolv doesn't break delta neutrality by overleveraging or trading into illiquid order books.

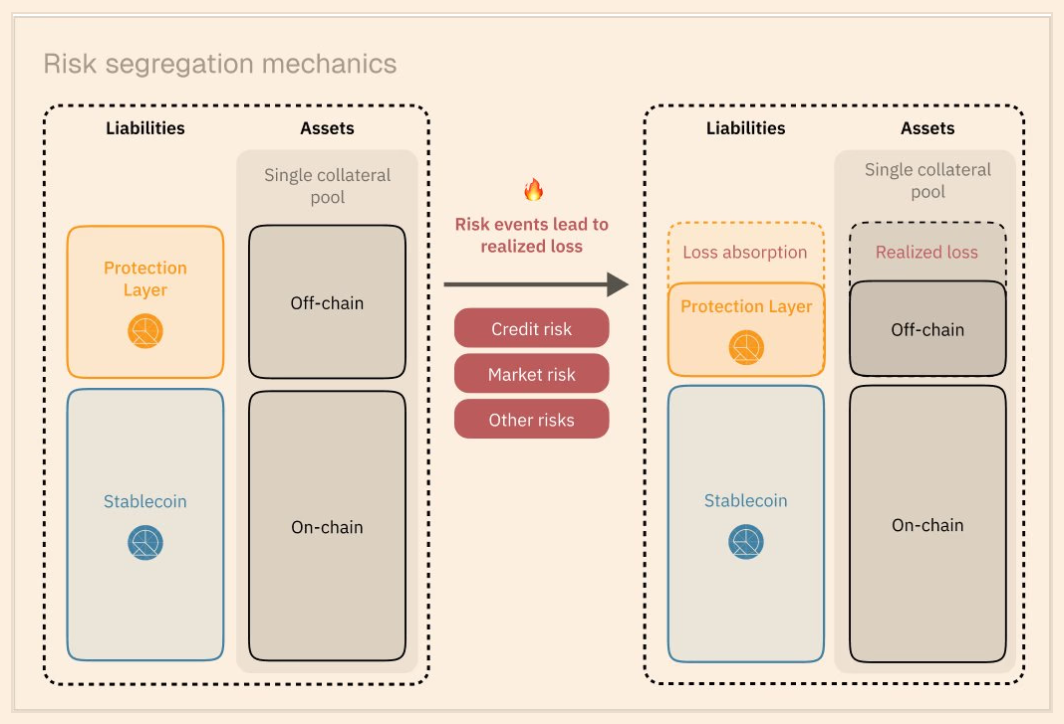

Risk segregation via dual-token economics

Resolv’s architecture is explicitly designed to prevent risk leakage and to ensure sustainable yields. USR is backed by delta-neutral positions, but that hedge isn’t perfect — funding rates can swing, trades can slip and positions can become temporarily unbalanced. These risks don’t hit USR holders. Instead, they’re absorbed entirely by the Resolv Liquidity Pool, which is why RLP exists.

RLP depositors act as the economic counterparty to the protocol’s short futures. This isn’t abstract — when a short position has a negative funding rate, RLP pays it. When a rebalance loses money due to price movement between execution and hedge placement, RLP covers it. Conversely, when futures funding is positive or staking yields are high, RLP earns that value. This is direct exposure — not just token speculation.

The team intentionally modeled this structure after real-world capital stack design. USR functions like a senior tranche — protected, low-risk, low-return. RLP is a junior tranche — high-risk, variable-return, but essential to shielding the system. There's no crossover. This rigid firewall between USR and RLP ensures stable users don't get rugged by systemic volatility.

What is the RESOLV crypto token?

RESOLV is the native governance and staking token of the Resolv protocol. It was launched in June 2025 on Ethereum and BNB Chain (BNB).

The token serves two key roles in the ecosystem. First, RESOLV is stakeable. When staked, it converts into stRESOLV and begins earning rewards distributed every epoch (14 days). The reward multiplier increases with the average staking duration, up to 2x for long-term holders. Staking also boosts Resolv Points earnings, giving active participants greater exposure in future seasons. Secondly, it acts as a protocol governance asset, as holders of stRESOLV can vote on protocol changes, new integrations, treasury decisions and future incentive programs.

RESOLV’s tokenomics are also designed to incentivize long-term alignment. While RESOLV tokens are freely transferable once unstaked, stRESOLV tokens are non-transferable and subject to a 14-day cooldown period when unstaking.

The total and max supply of RESOLV is capped at 1 billion tokens. Allocation includes 10% for the Season 1 airdrop, 40.9% for the community and ecosystem, 26.7% for the team and contributors and 22.4% for investors — each category with its own vesting schedule to ensure gradual release.

RESOLV airdrop

The first RESOLV airdrop is held during May–June 2025, with registration from May 9–25 and claiming open until June 27. Eligible users receive stRESOLV tokens, which can be unstaked into tradable RESOLV tokens after a 14-day cooldown.

Users who participate in Resolv activities and point campaigns can check eligibility at claim.resolv.xyz. Only registered users can claim tokens. Distribution in staked form ensures that early holders are active governance participants, rather than just airdrop hunters.

Where to buy the RESOLV crypto token

You can trade RESOLV on Bybit both as a Spot pair with USDT and as a USDT-based perp contract. In addition, take advantage of the Bybit event dedicated to the token to earn RESOLV rewards. The campaign allows new users to earn RESOLV tokens by accumulating a deposit volume of at least 800 RESOLV, or by depositing 100 USDT and trading 100 USDT worth of RESOLV via their first trade. New and existing users can earn rewards by trading at least 500 USDT worth of RESOLV on the Spot market. The campaign is valid through Jun 24, 2025, 10AM UTC.

RESOLV crypto price prediction

As of Jun 20, 2025, the RESOLV token has been on the market for just 10 days. It currently trades at $0.1961, a 52.2% drop from its all-time high of $0.4085 on Jun 11, 2025, and a 6.4% increase from its all-time low of $0.1835 on Jun 10, 2025.

RESOLV’s long-term price outlook is bullish.CoinCodex expects the token to trade at $0.247 in 2027 and $0.50 in 2030, whileDigitalCoinPrice is forecasting average prices of $0.67 in 2027 and $1.03 in 2030.

RESOLV’s price performance will likely depend upon protocol adoption, ecosystem growth and sustained yields, but risks remain — including regulatory shifts and potential stress on the delta-neutral mechanism during extreme market conditions. As always, it’s recommended you do your own research before investing in RESOLV or any other crypto token.

Closing thoughts

Resolv sets out to solve a long-standing problem in crypto — building a stablecoin that's actually stable, transparent and decentralized. It avoids the usual pitfalls of fiat-backed and algorithmic stablecoins by combining real crypto collateral with short futures and introducing a clear separation of risk through its USR–RLP structure. The addition of the RESOLV token brings governance and incentive alignment into the mix, rewarding users who commit to the long term.

While this model isn’t without risks — especially during periods of high volatility or liquidity crunches — Resolv’s on-chain design and hedging logic provide a potential solution for two common types of DeFi users — those seeking low-risk decentralized stablecoins, via USR, and traders who are after sustainable yields with RLP.

#LearnWithBybit