Bitcoin Spot ETFs Approved — What’s Next?

January 2024 has a prominent position in the history of cryptocurrency. Despite the uncertainty in the impact of the recently approved Bitcoin Spot ETFs, one thing is for sure: the approval of BTC Spot ETFs in the US will bring more institutional influence to crypto valuation, adding to the complexity of crypto trading.

In this analysis, we’ll dive deep into the aftermath of Bitcoin Spot ETF approvals, their impact on Bitcoin’s price, updates on Bitcoin fundamentals and a preview of the upcoming Bitcoin halving.

Crypto in Focus — What’s Next for Bitcoin?

ETF Debut Performance

Note: If without clear indication, “Bitcoin Spot ETFs” refers to the 11 Bitcoin Spot ETFs approved to be listed in the US by the SEC.

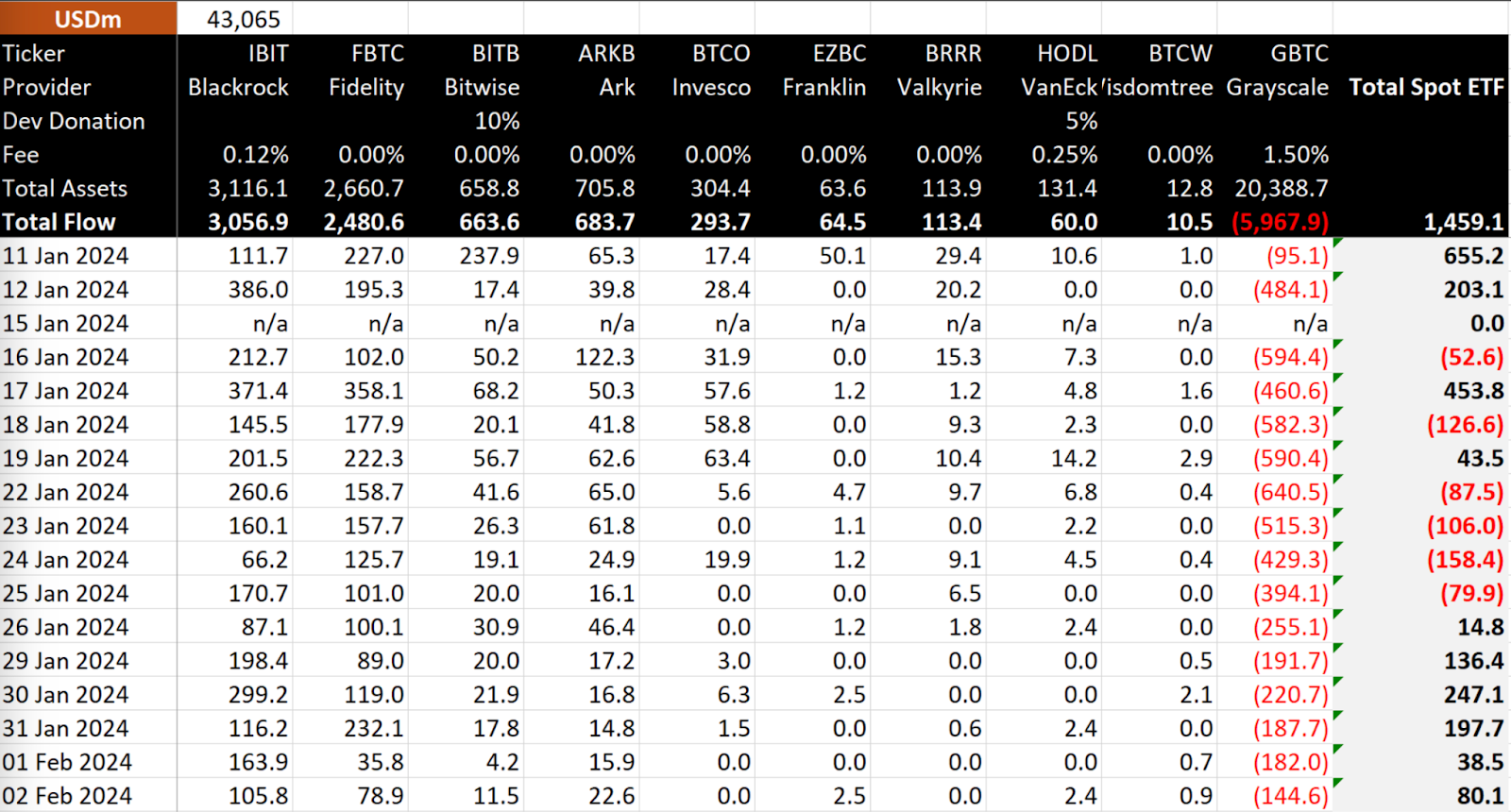

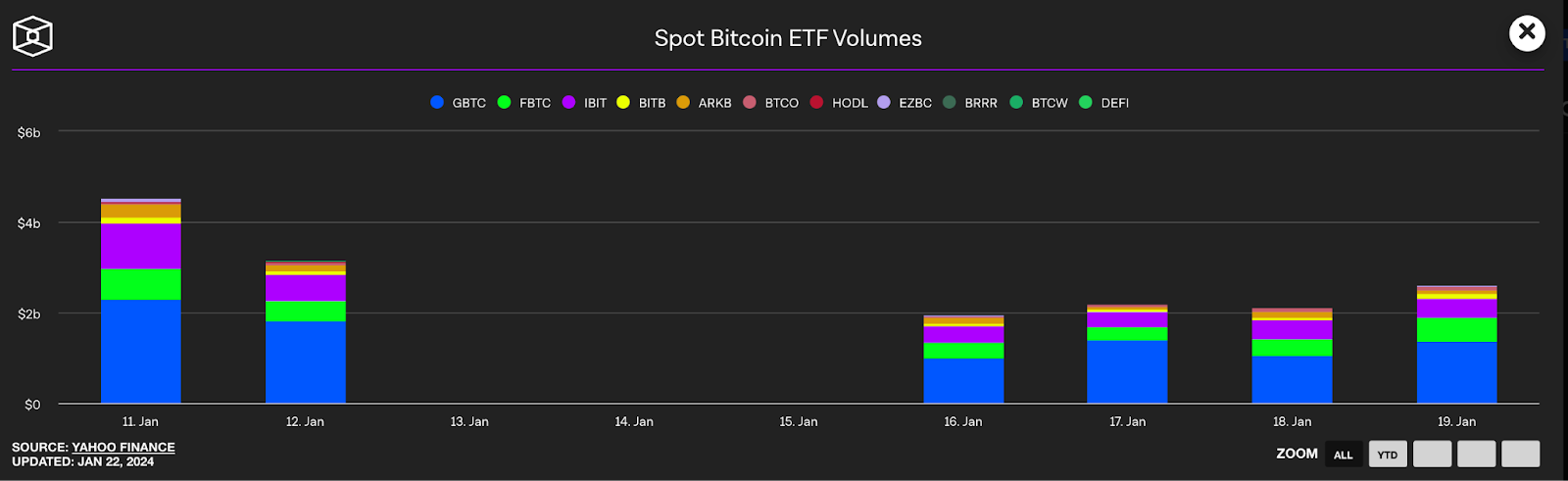

Bitcoin Spot ETFs were approved by the SEC on Jan 10, 2024, with the first 11 issuers open to trading on the following date. As a result, the market has been closely monitoring the performance of these 11 Bitcoin Spot ETFs, particularly regarding the capital flow, which measures how much Bitcoin is taken out of the circulating supply. The intended supply shock has been envisioned as the catalyst for the rally in Bitcoin’s price rally; this theory assumes that there would be huge capital inflows into Bitcoin Spot ETFs.

The debut of 11 Bitcoin Spot ETFs saw an initial $1.5 billion injected by traders in the first half month, falling short of Bloomberg’s expected $4 billion inflow on day one. In addition, the market projected $50 billion flowing into those Bitcoin Spot ETFs by the end of 2024. (As a comparison, the futures-based ProShares Bitcoin ETF (BITO) attracted $1 billion on its first trading day.)

However, there’s been a promising turnaround since Jan 26, 2024. Ever since capital outflows from the Grayscale Bitcoin Trust ETF (GBTC) decelerated, all 11 Bitcoin Spot ETFs have been seeing net positive inflows, and the industry still hopes to achieve the $50 billion capital inflow target in 2024 as GBTC’s impact fades. The remarkable outflow of GBTC is generally considered to be a one-off, due to realized profits from GBTC’s NAV discounts before its conversion to an ETF.

As a highlight, debut week performances are historically critical. It’s not uncommon for the market to try and estimate the entire year of capital inflows from the first few days of capital flow. For example, the Canadian Bitcoin Spot ETF eked out over $400 million in capital inflows in its first two days of trading and ended its debut year with around $700 million in capital inflows. Extrapolated from this estimate, the new Bitcoin Spot ETFs would only manage to earn $2 billion by the end of 2024. Nonetheless, the US market is quite different from the Canadian financial market.

All in all, despite a slower beginning, some analysts suggest that institutions known for their cautious approaches may take time to embrace this new investment instrument. Hedge funds, for instance, have restrictions in their offering documents that limit them to investing in only mature or time-tested instruments. This demand for a proven product aligns with a thoughtful investment strategy, indicating a potential gradual increase in capital inflows into BTC Spot ETFs as confidence builds.

Strong Trading Volume

| Bitcoin Spot ETFs in the US | Centralized and Decentralized Crypto Exchanges |

A = Daily Trading Volume (USD) | ~$1 billion | ~$10 billion |

B = Assets Under Management or Total Market Capitalization | ~$30 billion | ~$800 billion |

C = A/B | 0.033 | 0.01 |

The trading volume of Bitcoin Spot ETFs stands out significantly in comparison to the calculated capital inflows, showcasing an intriguing trend. This anomaly could be attributed to selling pressure from Grayscale’s Bitcoin Trust ETF, as investors are capitalizing on discounted profits and dealing with GBTC’s relatively high fees (compared to peers). Additionally, the uptick in trading volume might be a result of investors transitioning their holdings from Bitcoin Futures ETFs to BTC Spot ETFs, reflecting a dynamic shift in the market.

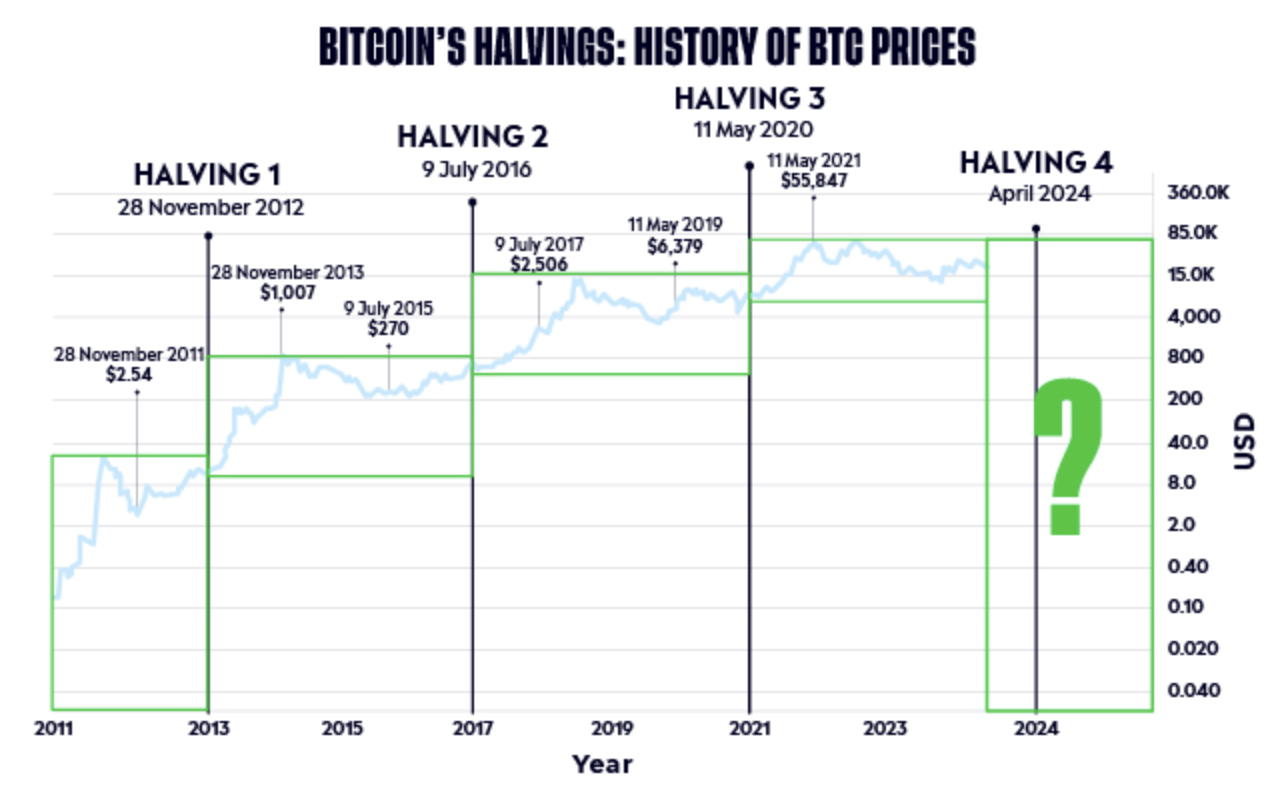

Halving

Bitcoin halving is an important event that occurs every 210,00 blocks, or approximately every four years. It’s a programmed mechanism that cuts in half the reward for Bitcoin mining, theoretically to control the issuance of new bitcoins and manage inflation.

Bitcoin’s network operates on a fixed supply schedule, with a total cap of 21 million bitcoins. The previous halving took place in May 2020, reducing the reward for each mined block of BTC transactions from 12.5 bitcoins to 6.25 bitcoins per block, and the upcoming halving will reduce the mining reward to 3.125 BTC.

Halving events have had significant implications for Bitcoin’s ecosystem, reducing the rate at which new bitcoins are created and effectively slowing the supply of new coins entering the market. Coupled with increasing demand for Bitcoin, this reduction in supply has historically led to upward pressure on BTC’s price. As visible in the graphic above, an upward price trend in the first year follows a new halving cycle.

Fundamental

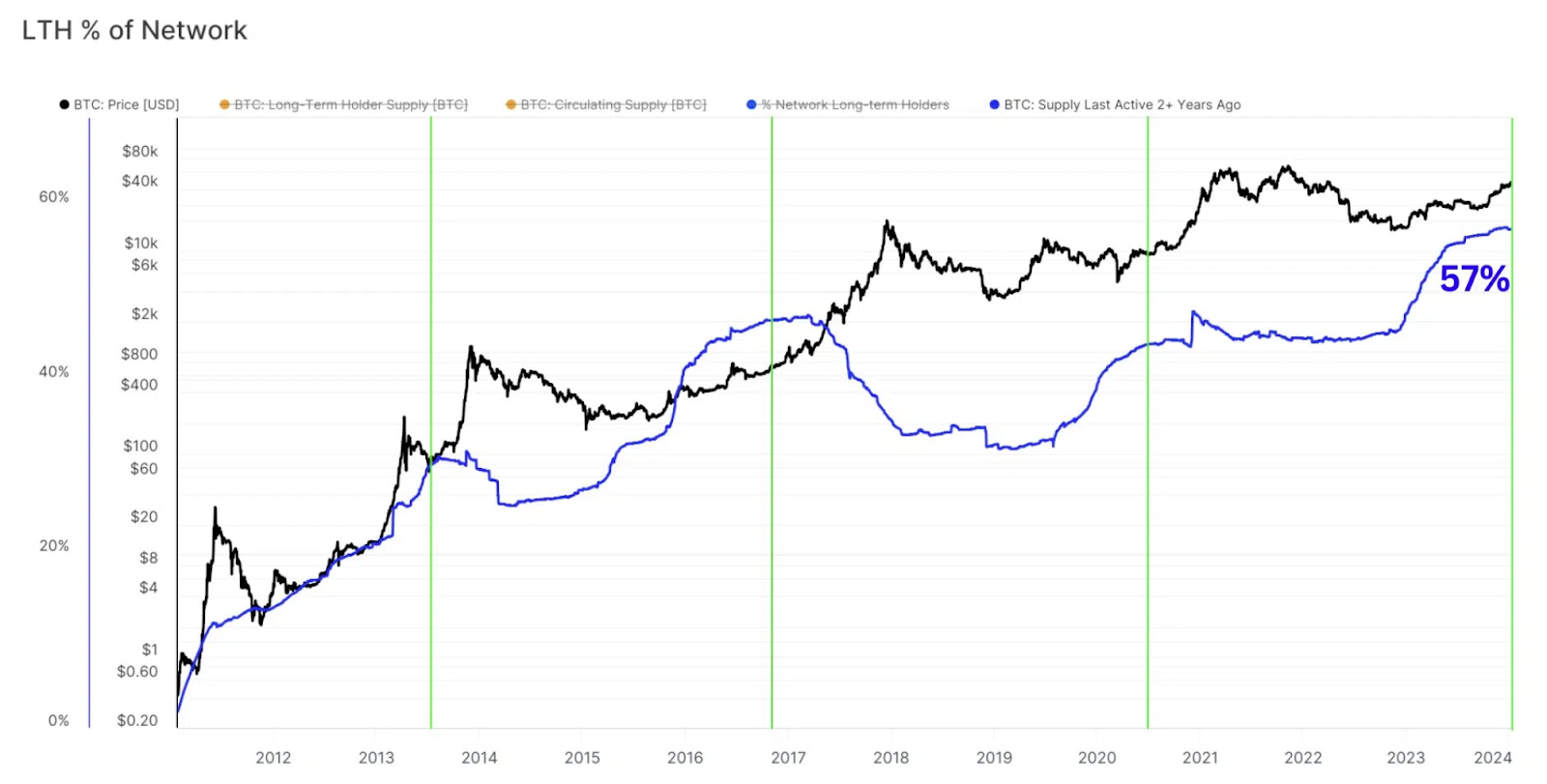

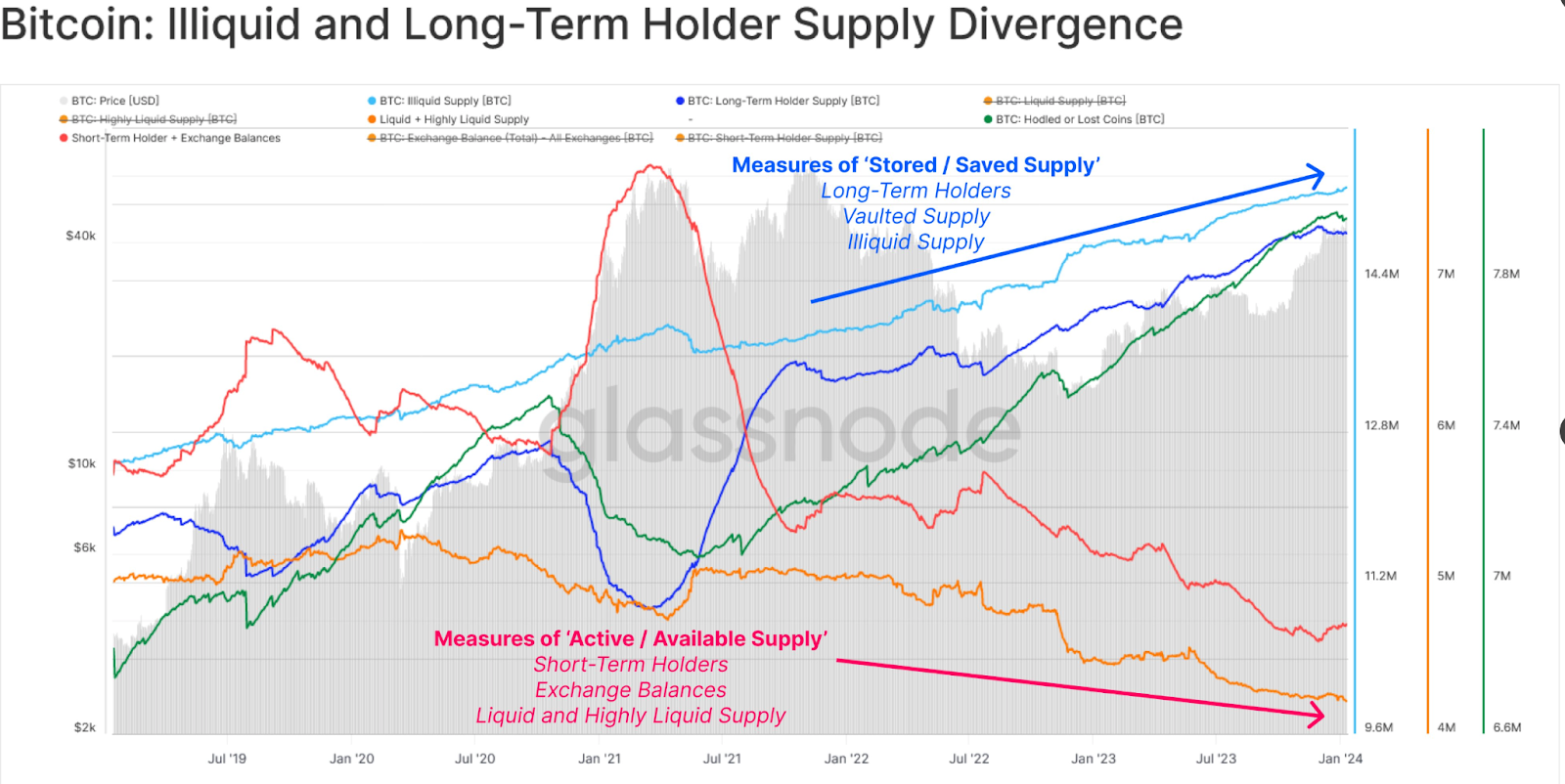

HODLing Behavior

Long-term holders of Bitcoin have surged to 57%, while liquid supply and the number of short-term holders have continued to drop. The approval of Bitcoin Spot ETFs will speed up this trend, since they require the storage of spot Bitcoin by ETF issuers/participants, siphoning liquidity away from the spot BTC market. While assets under management (AUM) and trading volume may fail to live up to expectations, Bitcoin Spot ETFs might continue to see flows from previous Bitcoin Futures ETFs and Bitcoin-related derivatives.

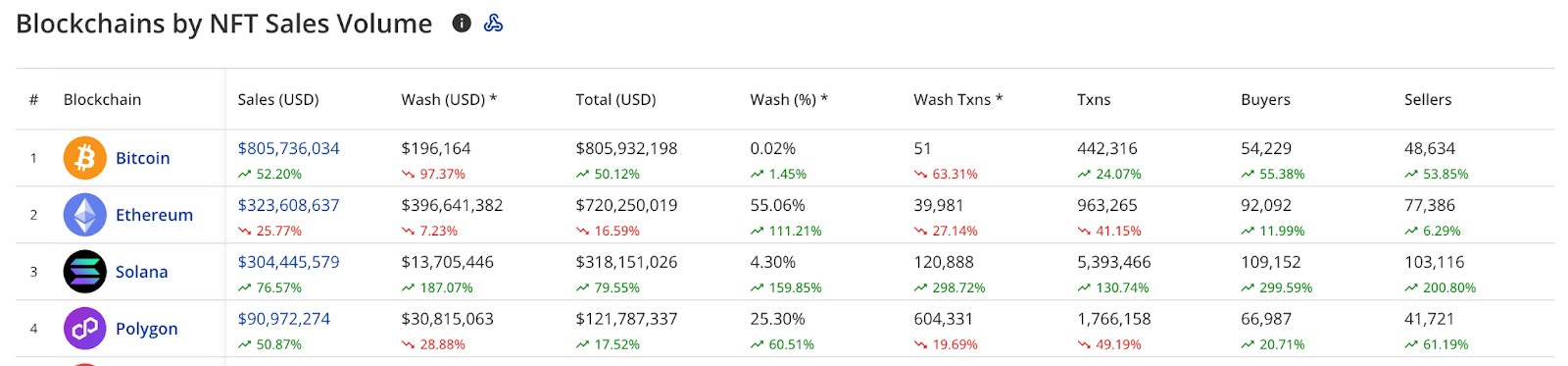

Other than trading, fundamental Bitcoin has been enhancing its utility with the help of active community developers and Web 2.0 players, particularly in relation to NFTs.

NFT Sales

In December 2023, Bitcoin saw higher NFT sales than Ethereum did, due to the popularity of Bitcoin inscriptions, as we’ve seen projects announcing their intentions to inscribe their new collections on the network.

In summary, we have a fundamentally strong thesis concerning Bitcoin.

Overall on Bitcoin

In sum, strong Bitcoin HODLing, the upcoming halving and a growing developer community for Bitcoin will continue to support BTC’s bullish price action. In particular, the US will likely kick off its loosening economic cycle soon, benefiting high-beta risky assets. In addition, we believe that the surprisingly low capital inflows of Bitcoin Spot ETFs are due to the intense selling pressures from GBTC and the “sell the news” narrative. Once Bitcoin adjusts to a price that sounds attractive, institutions will likely pour in their capital. Web 2.0 institutions are experts in trading, and they wouldn’t inject big money on day one if the market were overbought, especially considering that Bitcoin is still ~40% below its ATH.

Macro in Focus

What Drove January’s Price Actions?

Undoubtedly, the most significant influence on the pricing of risky assets was the timing of the expected Fed rate cuts. As a highlight, the Fed meeting on January 31 dampened the expectation of an earlier rate cut.

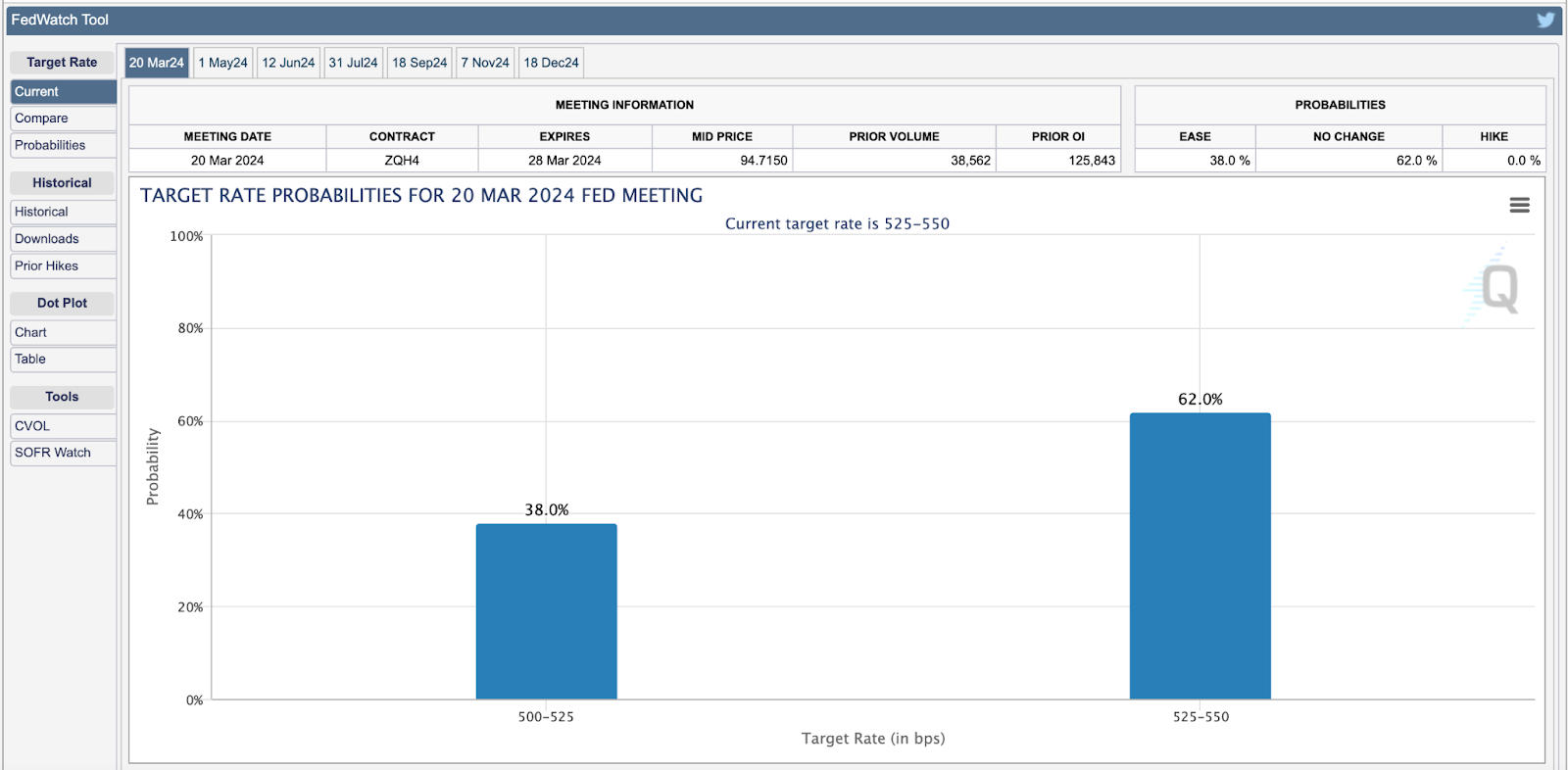

CME FedWatch Tool

Let’s look at what’s turned out differently in the market’s bet on the interest rate path. Last month, over 70% of market participants thought there would be a 25 basis point (bps) cut in March’s Fed decision. As of the time of this writing (Feb 7, 2024), the probability has dropped to 38%. The market has reacted to the robust US economic data and employment reports, and has tuned down its previous aggressive estimates.

Let's dive into the economic data.

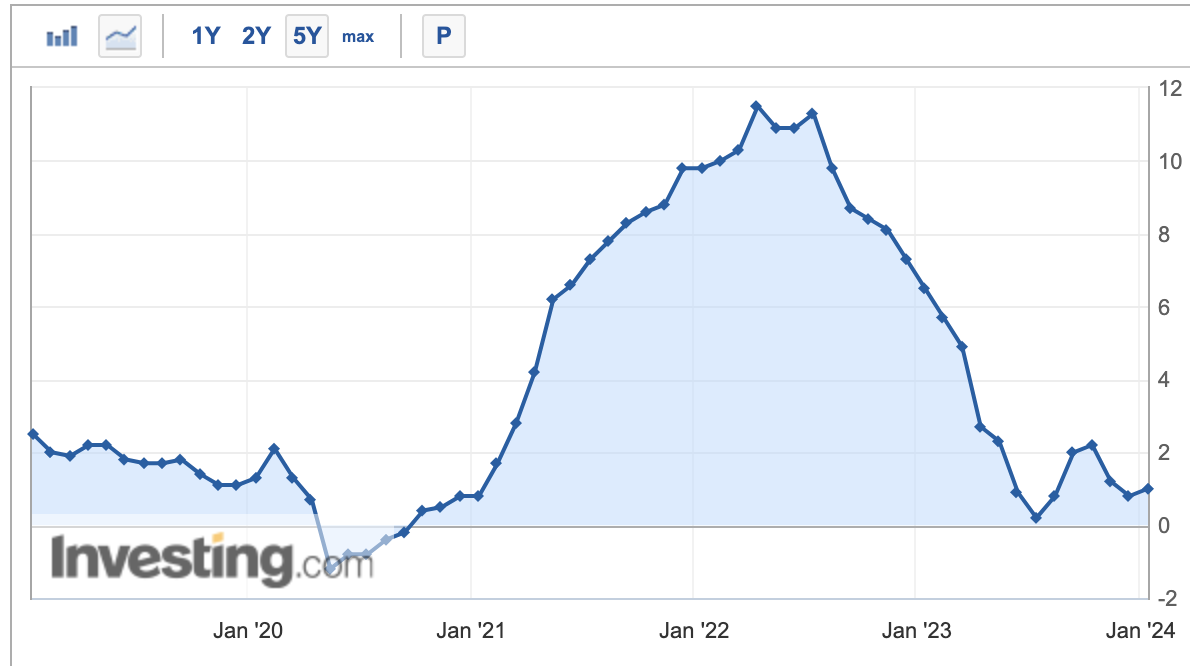

US PPI YoY Growth (up to December 2023)

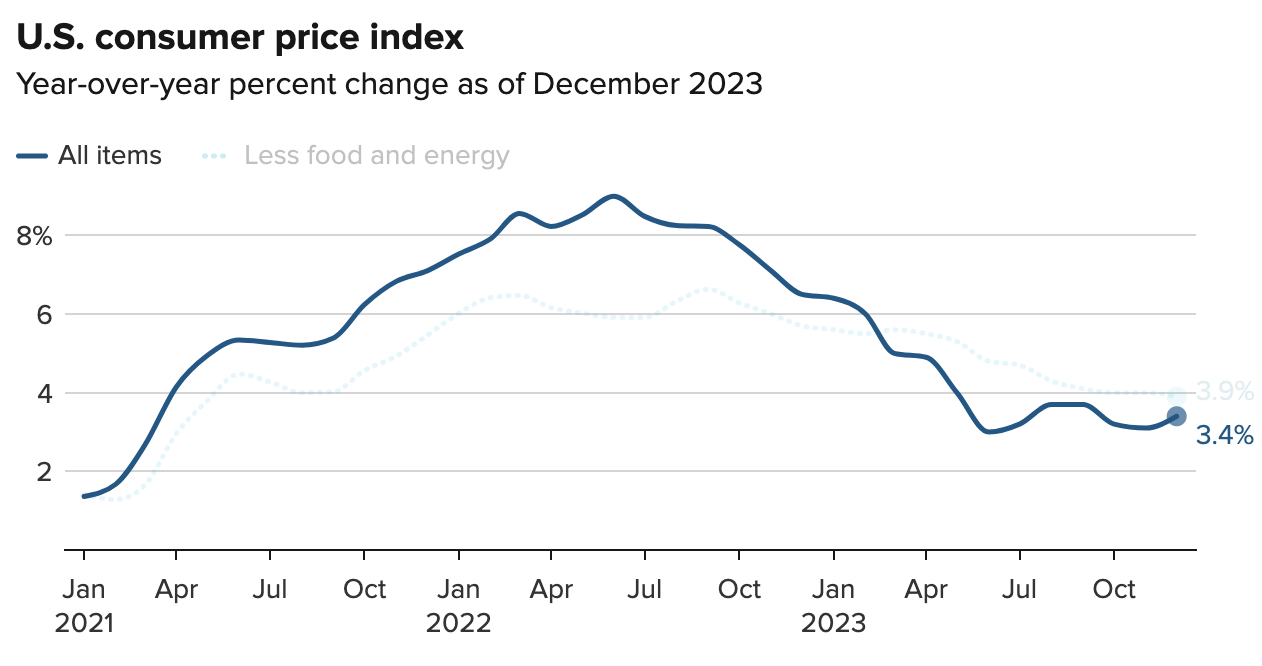

The Producer Price Index (PPI) and Consumer Price Index (CPI) that formed in early 2022 have halted. In particular, the CPI print shows signs of stabilizing above the 3% range. This is undesirable for most Fed officials, who tend to tame the interest rate down to the 2% range before considering a rate cut.

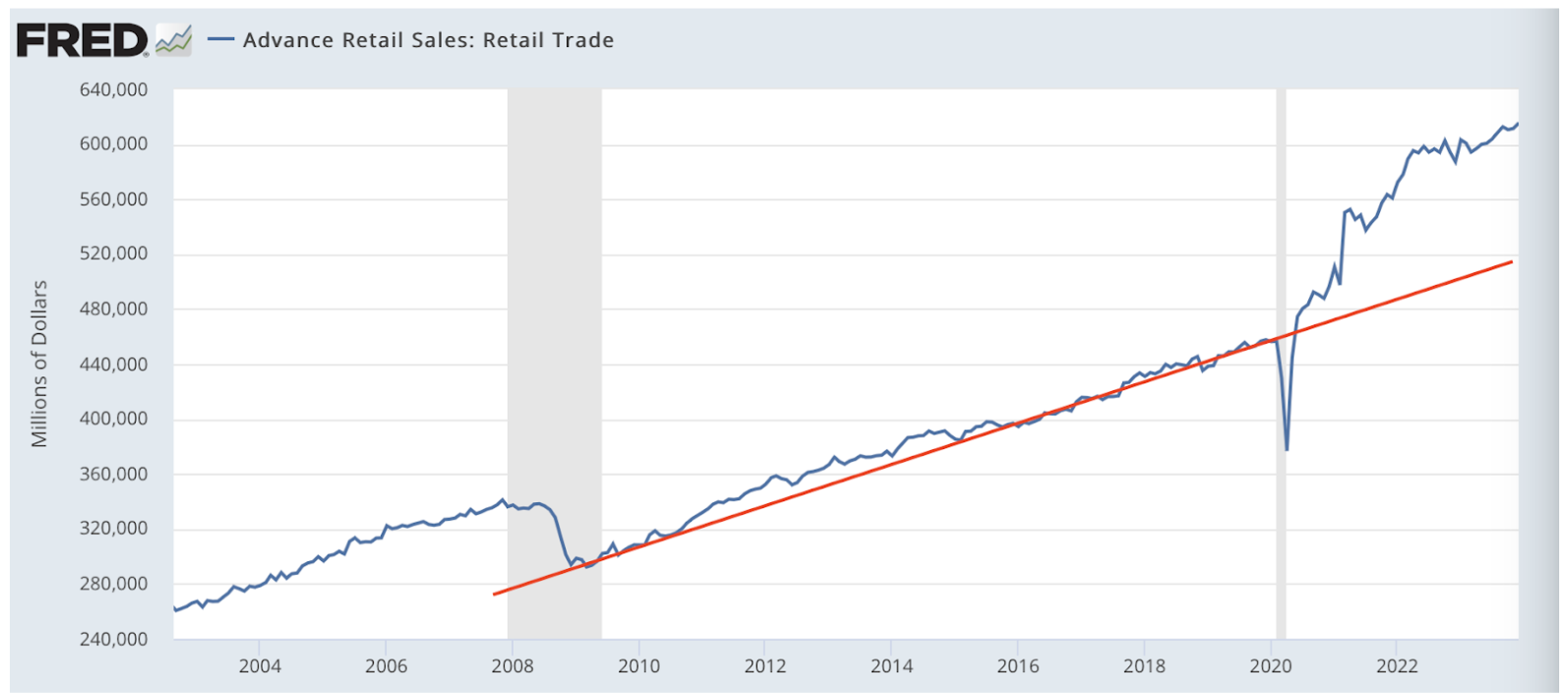

The economy has continued to grow, with the model now indicating 2.4% growth in nominal GDP in the fourth quarter of 2023. Meanwhile, retail sales have been firmly above the trend since the beginning of Covid-19. A desirable “soft landing” is seemingly materializing, further supporting the Fed’s hawkish policy tilt.

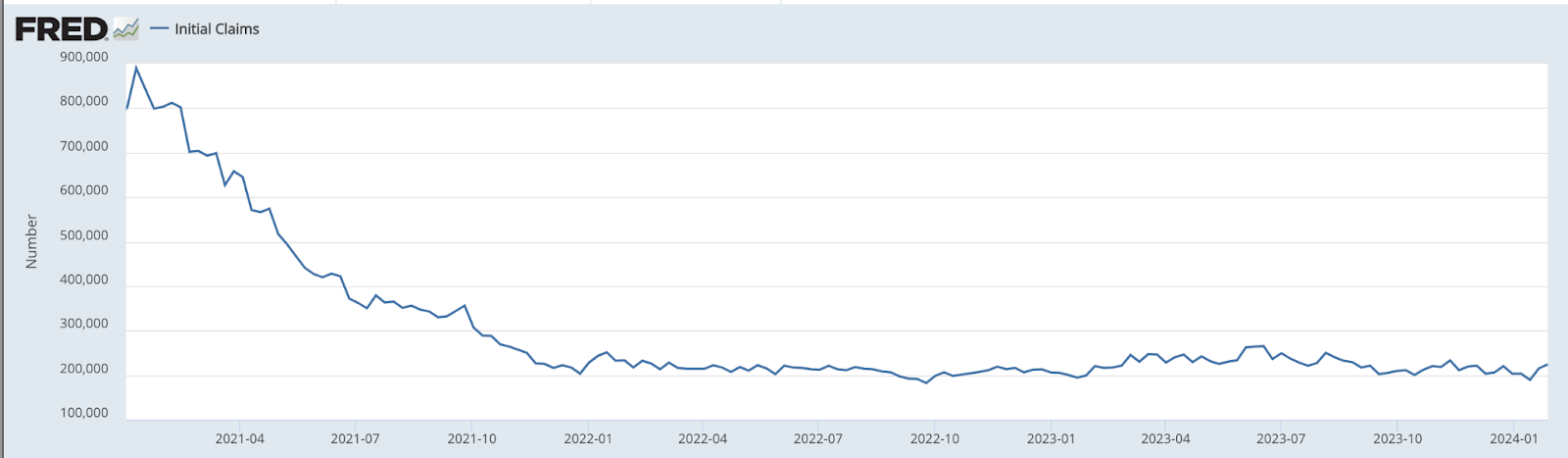

We also see resilience in the employment market, as the above graph shows no sign of rebounds in initial jobless claims. Pricing stability and full employment are the Fed’s two main pillars. The absence of a hiking unemployment rate likely won't lead to a significant shift in restrictive monetary policy.

In summary, the economy has been in good shape, a fact which doesn’t warrant an aggressive rate cut. In addition, Big Tech's corporate earnings have been solid. The highlight is that chip companies are coping well despite falling orders for smartphones and gaming, thanks to strong demand for AI chips and data centers.

#LearnWithBybit