When to Trade Options and Why Trade Options?

Key Takeaways:

Traders can use options to hedge against volatility and for profit amplification without owning the underlying assets.

Options are great for traders to amplify profits in both bull or bear markets, with minimal entry barriers.

- Advantage of Bybit Options: Portfolio Margin mode reduces margin requirements and offers increased buying power, helping traders optimize their margin and potentially take larger positions with less capital.

Why Trade Crypto Options?

Crypto options and traditional crypto trading offer traders an opportunity to maximize profits using different strategies. However, options trading offers several distinct advantages from traditional trading products. The following are some examples.

Hedging Instrument

For traders looking to manage risk and capitalize on market movement, options are a popular investment strategy. Crypto options, for example, are contracts that allow the trader to buy or sell an asset at a specified price within a given time frame or by a specific expiration date.

Suppose the option expires in the money (ITM). In that case, the trader's account will receive a credit or debit based on the cash difference between the strike price and the settlement price, without requiring them to actually buy or sell the underlying asset.

Learn more: How to Hedge With Crypto Options

Profit Amplification

Options provide a gateway for retail traders to get started in crypto trading with minimal capital. When trading options, you’re buying a contract with a minimal entry price at a calculated risk to gain access to a large number of underlying assets. With leverage, options traders can multiply their buying power with minimal invested capital. In other words, the trader is leveraging the value of the underlying security for a maximum return on investment.

What Sets Bybit Options Apart From the Rest?

Optimized Capital Efficiency

Bybit users who upgrade to the Unified Trading Account (UTA) enjoy enhanced capital efficiency by offsetting their unrealized profits and losses on all derivatives positions on Bybit, including Bybit Options.

With the UTA, Bybit Options traders can better hedge their positions without separating their accounts for different derivatives products, so margins won’t require additional capital for offsetting risks. Since margin trading with a UTA is at the account level instead of the position level, margin requirements could be significantly lower. Thus, traders have more protection for their hedged positions.

Highly Competitive Options Fees and Best-in-Class Liquidity

Bybit Options trading involves three major fees: trading fees, delivery fees and liquidation fees.

Trading fees: These are charged in USDC in the form of maker and taker fees when opening or closing a trading USDC Options position on the platform.

Delivery fees: Based on the predetermined agreement, these are charged when an options contract is exercised.

Liquidation fees: If a position is liquidated, the trader will be charged based on the option’s traded size, index price and the current liquidation fee rate.

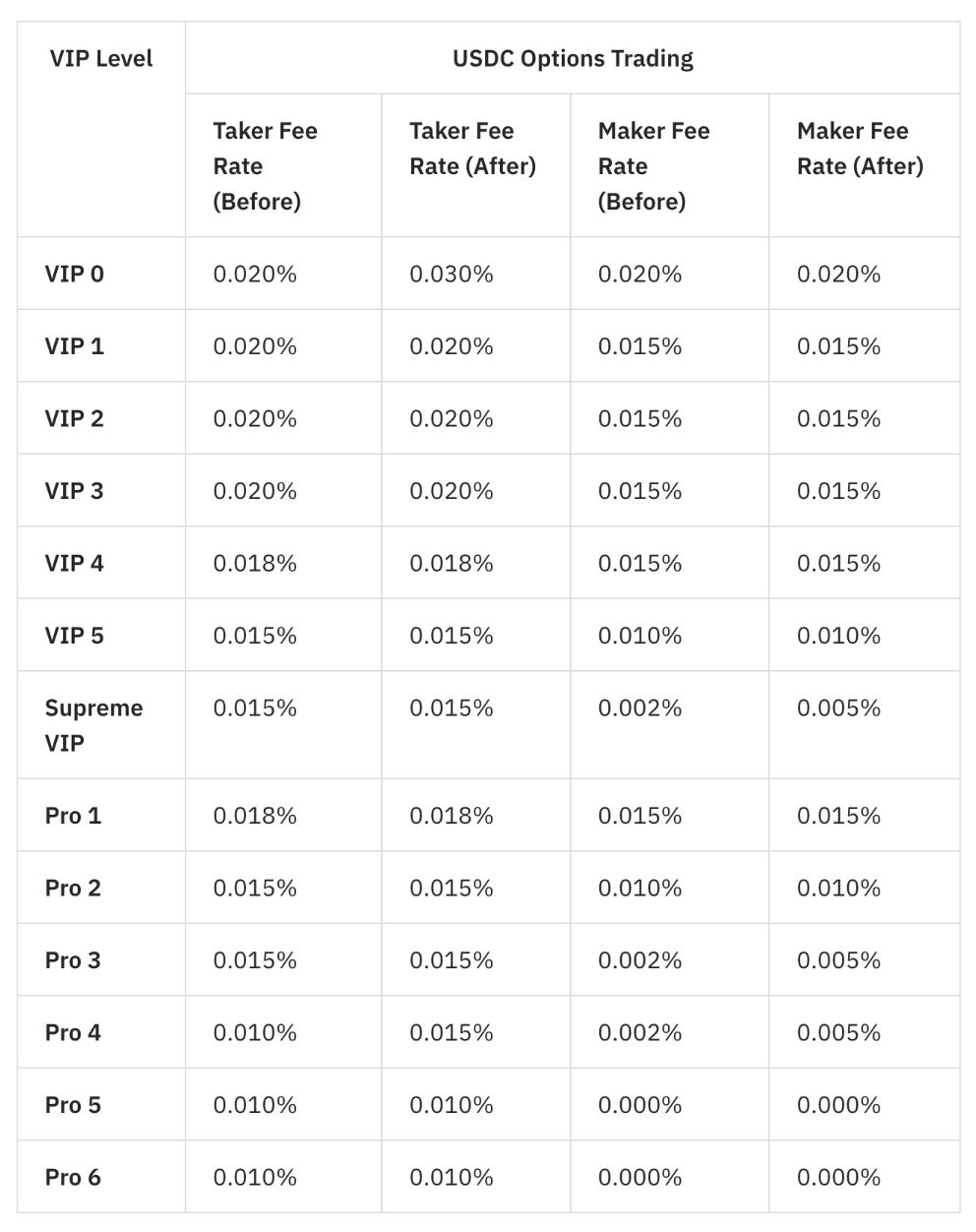

Bybit recently revamped its options fees across all users' VIP tiers, featuring some of the lowest trading fees in the industry — including zero settlement fees for short-term contract expiration. Below is an overview of Bybit Options fee revisions.

Pioneer in the Stablecoin-Settled Options Market

Bybit is a proud partner with Circle Internet Financial — most widely known for being the issuer of USD Coin (USDC). This partnership paves the way for the rapid growth of all things USDC, including the USDC Options offered on Bybit’s platform, allowing our traders to leverage the strength and stability of the leading digital dollar-based currency.

Traders can mitigate the risk of volatile price swings without hedging their underlying collateral exposure, since the USDC stablecoin is less volatile than any other cryptocurrency. The ease of calculating profit and loss (P&L) in USD equivalents makes it easier for traders to benchmark and calculate returns.

Bybit’s Innovative Portfolio Margin Boosts Profitability

Portfolio Margin mode helps traders optimize the margin requirements for their trading positions. It considers the overall risk of a portfolio rather than each position in isolation. By reviewing portfolio-level risk, traders can potentially reduce their margin requirements and trade larger positions. This translates into increased buying power, capital efficiency and trading flexibility, potentially opening the door to more trading opportunities.

Bybit Options is one of several trading platforms in the industry to feature ETH and BTC options. Users benefit by lowering their margin requirements on hedge positions that are aligned with the overall risks of the entire portfolio. At the same time, Portfolio Margin mode offers traders increased access to leverage, which can help them increase their exposure to the market while maintaining a balanced portfolio.

With increased leverage, traders can hold larger positions with less capital for a higher return potential with calculated risks.

Trade With Safety and Fairness: Industry-Leading Risk Control

Bybit is committed to protecting users from financial and security risks. We deploy multi-layered liquidation protocols in a safe and fair environment to ensure all Bybit traders can manage risk and safeguard themselves from excessive loss. In addition, users on the platform are free to customize their personal settings based on their preference for additional protection and enhanced security.

Summary

Bybit encourages traders to take control of their investments, manage their risks effectively and capitalize on the volatile crypto market. Whether you're a seasoned trader or a beginner, Bybit Options provides a powerful avenue for you to enhance your trading portfolios. While options can help to amplify profits, they can be risky for traders who aren’t familiar with the trading mechanics involved.

Learn more: