Calendar Spread: Leveraging on Volatility For Maximum Gains

What is a Calendar Spread?

A calendar spread is a popular two-legged options strategy whereby an investor simultaneously sells (writes) and buys (holds) options with the same strike price, but with different expiration dates. Typically, this options strategy involves selling a near-dated (front-end) options contract while buying a longer-dated (back-end) contract.

How Does a Calendar Spread Work?

Considered a horizontal spread or a time spread, a calendar spread is a price-neutral strategy that benefits from time decay (A.K.A. theta) and rising levels of implied volatility (IV).

Shorter-dated options decay (lose value) faster than those with more days to expiration (DTE). For this reason, theta works in favor of the front-end short position, which decreases in price faster than the back-end long position.

Calendar spreads are long vega (volatility), meaning they perform best when volatility moves higher. Ideally, however, the underlying asset should not drift too far from the strike price. This is because longer-dated options are more sensitive to IV: An increase in IV should increase the value of the back-end long position more than its front-end counterpart.

The calendar spread is a low-risk options trading strategy with limited upside potential. Its maximum potential loss is the cost of opening the trade (Premium Paid − Premium Received = Total Debit).

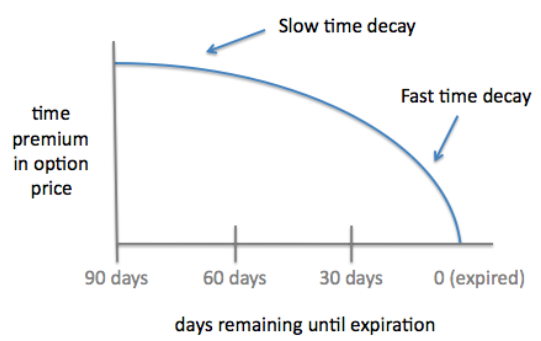

Theta Decay Impact

When trading calendar spreads, theta decay is your best friend. As the diagram below shows, the rate of theta decay increases as an option moves closer to the expiration date. By selling a near-dated option and buying a longer-dated option, you’re well-placed to reap the benefits of this relationship.

Source: Born To Sell Options, LLC

Implied Volatility Effect

Apart from time decay, IV is also a major factor in the calendar spread's profitability. The back-end option is more sensitive to IV than the front-end option. For this reason, rising volatility is a positive for calendar spread strategies. In contrast, falling volatility impacts the back-end option more than the front-end, countering the front-end’s positive relationship with time decay.

The Greeks

While theta and vega are key considerations when trading a calendar spread, delta doesn’t have much of an impact.

Delta measures how much an option premium will change for every $1.00 move in the underlying price. Call options have a positive delta ranging from 0 to 1, while put options carry a negative delta ranging from −1 to 0.

An ATM call option typically has a negative delta close to -0.50, meaning the premium will add or subtract $0.50 for every $1.00 move in the underlying crypto asset price. The call option delta increases as the market moves higher, and decreases as the price moves lower.

Similarly, an ATM put option has a delta close to −0.50, meaning the premium will +/−$0.50 for every $1.00 move in the underlying crypto asset. The negative put option delta increases as the market moves lower, and decreases as the price moves higher.

Because a call calendar spread combines a front-end ATM (short) call and a back-end ATM (long) call the contrasting positions mostly net off against each other. The same is true when trading a put calendar spread.

Breakeven Point

Because there are two different expiration dates in a calendar spread, it's impossible to calculate the exact point at which the trade is neither making nor losing money (the breakeven point) at expiration. This is because we can't predict the value of the back-end option at the time the front-end option expires.

Sweet Spot

The calendar spread options strategy profits the most (sweet spot) when the front-end option expires ATM. Here, the front-end option has zero value and the back-end option still holds time value.

Margin Requirements

By signing up for Bybit's Portfolio Margin mode, USDC derivatives account holders with a minimum net equity of 1,000 USDC are eligible for preferential margin requirements when trading USDC Perpetual futures and Options contracts.

Portfolio Margin mode uses a risk-based approach designed to reduce margin requirements. Similar to the Standard Portfolio Analysis of Risk (SPAN) model favored by clearing houses and traditional exchanges, Portfolio Margin mode combines active open positions to determine your overall portfolio risk. This method reduces the margin requirement for a calendar spread strategy by netting the exposure of the front-end short position against the back-end long position.

Calendar Spread Setup

Let’s assume that the market price of BTC is $20,000, and that you have a neutral price outlook on it. You may choose to set up the calendar spread as follows:

Calendar Call Spread

- Sell one at-the-money (ATM, which means the strike price is the same as the underlying asset’s current price) BTC call option with 20 DTE, with a strike price of $20,000; receive a $500 premium from the buyer.

At the same time:

- Buy one ATM Bitcoin call option with 50 DTE, with a strike price of $20,000; pay a $1,500 premium to the seller.

The total cost is a net debit of $500 − $1,500 = −$1,000 (Premium Received − Premium Paid).

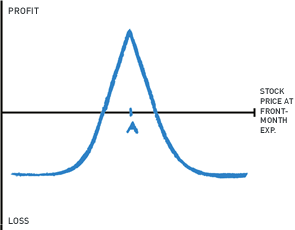

The payoff diagram below shows the calendar spread strategy achieving maximum profit potential when the underlying security is trading at the same level as the strike price (when the front-end option expires).

Source: The Options Playbook

To maximize your chances of success when using the call calendar spread strategy, consider these two factors:

Whether volatility is likely to increase between the time of trade and the time the front-end option expires (the same time the back-end call is closed).

The number of DTE that will work best for each of the different-dated strike prices.

The long call calendar performs well when volatility increases. For maximum potential profit, use this trading strategy when you expect volatility to move higher in the immediate future.

It’s crucial to choose the optimal expiration date for the front-end option (short call). Ideally, an option with 20–30 DTE works best — here, the premium is high enough to offset part of the back-end option’s cost.

For the back-end (long call), an option with 40–50 DTE is far enough to benefit from higher IV, while being close enough to make the strategy cost-effective.

Converting to a Bullish Call Option:

The call calendar spread can be changed from a price-neutral strategy to a near-term neutral — but longer-term bullish — play by leaving the back end open (“lifting a leg”) when the nearby contract expires.

In this scenario, when the front-end call expires (either worthless or in-the-money), the back-end long call remains open and acts as a standalone bullish call.

This trade benefits if the underlying crypto asset experiences minimal movement in the near term, but rises in price, experiencing higher IV after the front-end option expires — allowing the standalone long call to profit.

Although lifting a leg increases the maximum potential profit, it changes the strategy from low-risk to high-risk. If the front end expires ITM and the back end OTM, both legs will lose money.

Calendar Put Spread Setup

As with a calendar call spread, the best time to trade a calendar put spread is when you expect volatility to increase before the front-end option expires.

The calendar put spread is a price-neutral strategy, using ATM strike prices for both legs. In this strategy, the back-end option is closed at the same time the front-end option expires.

Converting to a Bearish Put Option:

Similar to the call calendar spread, the put calendar can be changed from a price-neutral strategy to a near-term neutral, but longer-term bearish strategy.

Here, when the front-end contract expires (either worthless or in-the-money), the back-end long put option remains open, acting as a standalone bearish put option.

Again, lifting a leg increases both the maximum potential profit and the maximum potential loss.

Double Calendar Spread Setup

The double calendar spread is a relatively complex trading strategy combining a calendar call spread and a calendar put spread. You may ask: Why should I use a double calendar spread? Well, using both put and call calendars widens the trading range at which the strategy is profitable.

Assuming BTC is trading at $20,000, a double calendar spread may look like this:

- Sell one out-of-the-money BTC call option with 20 DTE, with a strike price of $22,000, receiving a $250 premium from the buyer.

- Buy one out-of-the-money BTC call option with 50 DTE, with a strike price of $22,000, paying a $750 premium to the seller.

In the above example, the cost of the trade is a net debit of −$500 (Premium Received − Premium Paid).

At the same time:

- Sell one out-of-the-money BTC put option, expiring in 14 days' time, with a strike price of $18,000 — receiving a $250 premium from the buyer.

- Buy one out-of-the-money BTC put option, expiring in 40 days' time, with a strike price of $18,000 — paying a $750 premium to the seller.

Similar to the call calendar spread above, the initial cost of the trade is a net debit of −$500 (Premium Received − Premium Paid).

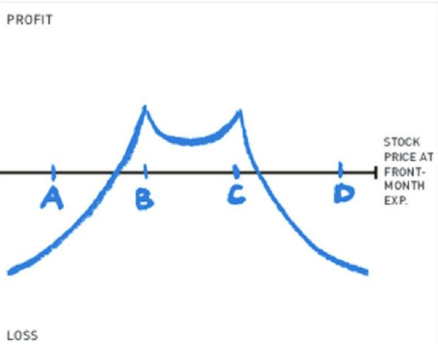

You can change the dynamics of the trade by using a combination of OTM puts and OTM calls. Although the double calendar spread shown previously benefits from rising volatility and time decay, the payoff diagram below shows two key differences from a traditional calendar spread.

The strategy achieves the maximum profit potential when either of the front-end options expires ATM ($18,000 or $22,000), doubling the chance of achieving the maximum payout … but wait, because there's a catch:

The strategy profits less than a typical calendar spread if the underlying asset price has little or no movement, and expires close to the price the trade was opened at ($20,000 in this example).

Source: The Options Playbook

Who is the Calendar Spread For?

When used as a price-neutral strategy, a calendar spread is suitable for both beginner and experienced traders alike — here, the spread has clearly defined risk parameters, offering a great way to benefit from rising volatility and time decay with limited risk.

When to Use the Calendar Spread

Calendar spreads work best when IV moves higher. Therefore, always take into consideration where IV is in relation to historical volatility.

For instance, a crypto asset experiencing extremely high volatility by historic standards may not be the best choice if you’re hoping to benefit from even higher volatility. A better approach would be to structure a calendar spread around potentially market-moving events, such as an approaching economic data release.

Calendar Spread Example

Here's a step-by-step guide to executing a calendar spread on Bybit.

On Desktop

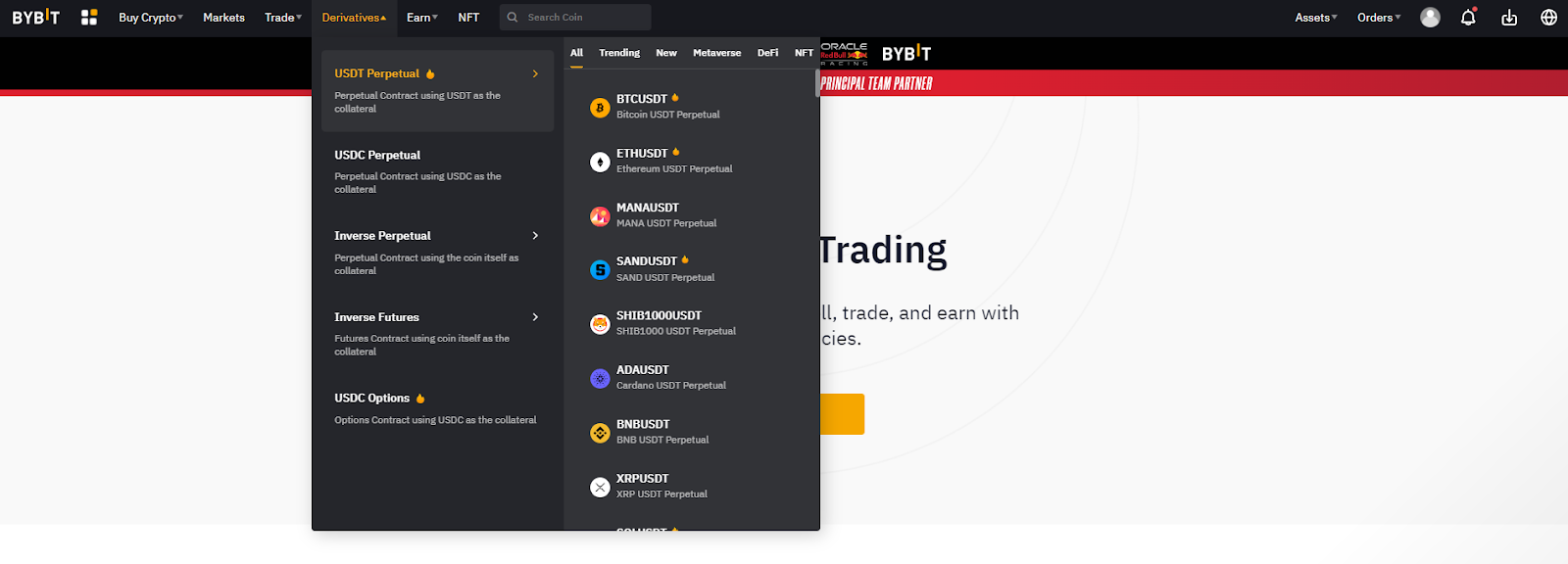

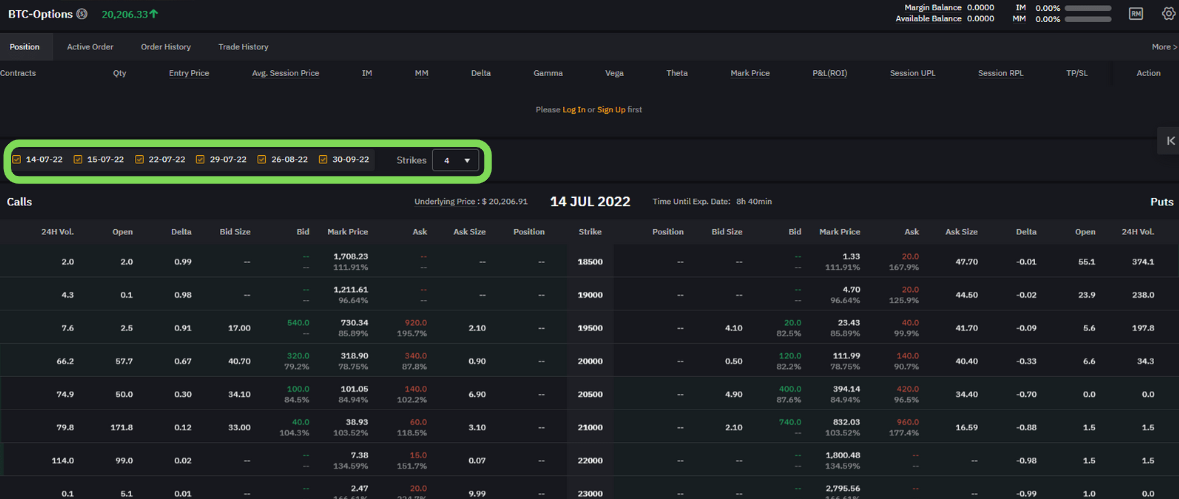

Step 1: Click on the Derivatives tab and select USDC Options.

Source: Bybit

Step 2: Deselect the expiration dates you don’t want to view. For a calendar spread, you can choose to display several expiration dates at the same time.

Step 3: Next to the expiration dates, select the number of available strike prices you wish to view from the drop-down list.

Source: Bybit

Step 4: Select option type: Calls or Puts

Call options are displayed on the left-hand side of the options chain, and Put options on the right. All expiration dates available are displayed at the top of the option chain.

Here, you can see the option’s bid-ask spread, volume, delta calculation and your current position (assuming you have one).

Source: Bybit

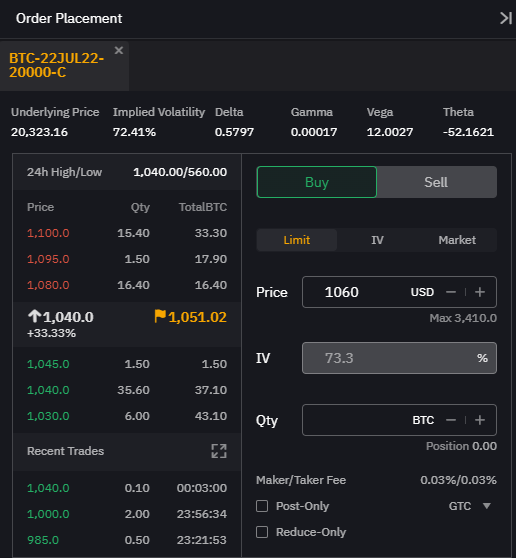

Step 5: Once you’ve clicked on the strike you wish to view, an order placement window will pop up on the right side of the page. Here, you’ll find the IV, delta, theta, gamma and vega calculations for the selected strike, along with the order book depth.

You can place orders by price or by selecting your desired IV level.

To place the order:

- Select a direction: Buy or Sell

- Enter the order price, or the amount of IV

- Enter the order quantity

- Select Post-Only (optional)

- After completing these steps, click on the Place Order button.

Source: Bybit

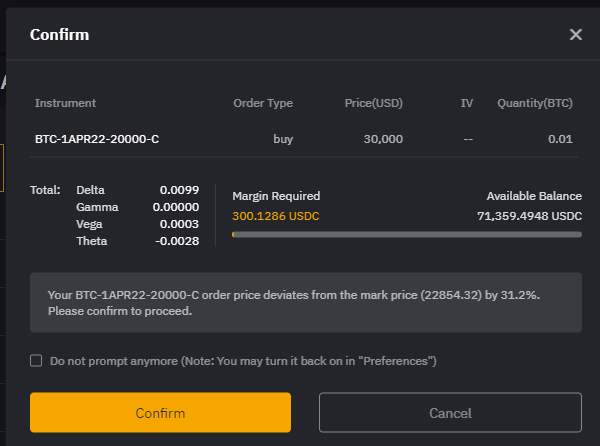

Step 6: After you’ve placed your order, a confirmation window will appear.

Once you’ve checked that all the information you've entered is correct, click on Confirm to submit your order.

Source: Bybit

Pros

- Benefits from rising volatility.

- Theta decay works in the strategy's favor.

- Maximum potential loss can be determined.

- Flexible — an options calendar spread can be profitable, no matter which direction the underlying crypto asset moves.

Cons

- Limits potential upside gains.

- Breakeven point can’t be calculated.

- Investors must remember to close the back-end option when the front-end option expires.

- A drop in volatility works against this strategy.

Risks

Before opening a calendar spread position, here are three questions to ask yourself:

- Have you chosen the best possible strike price and/or expiration dates?

- Have you assessed the level of IV in relation to historical volatility?

- Are you comfortable with all potential outcomes of this strategy?

If your answer to any of the above questions is “no,” you may need to reassess your setup or forgo this strategy entirely.

Calendar Spread Returns

Because we can't know in advance 1) the value of the back-end option at the time, and 2) when the front-end option expires, it's impossible to calculate the exact returns from a calendar spread. What we do know, thankfully, is that this strategy works best when volatility goes up. Therefore, to maximize potential returns, implement a calendar spread when you expect a crypto asset to become more volatile.

Maximum Take-Profit Potential

Similar to the sweet spot, the maximum take-profit potential for a calendar spread is when the front-end option expires ATM. In this case, the near-dated contracts expire worthless, but the back-end call option contains time value.

Maximum Incurred Loss Potential

Calendar spreads are low-risk strategies, limiting the maximum incurred loss to the difference between the lower premium received when writing the front-end option and the premium paid for the back-end option (Premium Received − Premium Paid − Transaction Costs).

Calendar Spread Tips

Here are some ways to enhance the potential profit of a calendar spread strategy:

- Sell front-end options with 20–30 days to expiration.

- Look for signs that volatility will increase in the immediate future.

- Always close the back-end contract at the same time as the front-end: Either at or before expiration.

Adjustments to Make in Bearish Markets

Unlike with directional options strategies, such as a bear put spread (bearish) or call options (bullish), the movement of the market doesn’t really matter for calendar spreads. Rather, IV will dictate if a calendar spread strategy achieves its maximum potential profit or loses money.

So far, we've learned that rising volatility works in this strategy's favor. However, a sudden drop in volatility could cause the back-end option to lose more value than the near-dated option gains. If this happens, the investor may choose to close the position early, rather than let it expire worthless. However, time decay speeds up as an option moves closer to expiration, working in the front-end option's favor as expiration draws near.

Alternative Strategies

A calendar spread is one of several options strategies designed to benefit from time decay.

Here are some other strategies to consider:

In a Nutshell

The wide selection of options strategies available means traders of all experience levels and risk appetites can potentially benefit. Though calendar spreads may not be suitable for every investor, they’re definitely a great way to profit from rising market volatility without taking on unnecessary risks. For those willing to learn, you can start trading the wide array of options listed on Bybit anytime you're ready.