How to Hedge with Crypto Options to Maximize Gains During BTC Uncertainty

Part 1: Crypto Options

Looking to expand your investment portfolio, or keen to start a rainy day fund? Right this way! In this article, you'll learn how to use Options to maximize your profits in uncertain markets. From basic to advanced strategies, there’s something here for everyone. But before we dive in, here are two things about Options we’ll bet you didn’t know:

Options trading as we know it today can be traced back to the philosopher Aristotle, who detailed the first-ever call Option (against an olive oil harvest) in the 6th century B.C.

Stock Options have become so popular that they’re expected to overtake stock trading in volume by 2023.

Now for the basics.

First and foremost: Options contracts are derivatives. Essentially, this means they're tied to an underlying asset such as a stock, a commodity or a cryptocurrency.

Options always have an agreed-upon price (known as the strike price) at which the buyer will gain long or short exposure to the underlying asset. They also have a predetermined date at which they expire (expiration date).

There are two types of Options: Call Options (calls) and Put Options (puts).

- → A call Option gives the buyer and seller long and short exposure above the strike price, respectively.

Read more: Call Options: A Cost-Efficient Way to Earn on Your Assets

- → A put Option gives the buyer and seller short and long exposure below the strike price, respectively.

Read more: Put Options: Effectively Manage Price Risk With This Tool

As they’re highly versatile, you can use puts and calls on their own or combine them to create complex Options strategies. Ultimately, the end goal for all strategies is the same — to profit from market conditions.

The Option buyer (sometimes called the holder) always pays a fee (Option premium) to the seller (or writer). This amount indicates the maximum amount of money the buyer can lose, and the most the seller can profit, from the particular trade.

When trading Options, there are three ways to describe a strike price:

- At-the-money (ATM): The underlying asset’s price is the same as the strike price.

- In-the-money (ITM): Describes a strike price in a favorable position to the underlying asset. A call Option is ITM when it's below the underlying, and a put Option is ITM when it's above the underlying.

- Out-of-the-money (OTM): When a strike is in an unfavorable position. A call Option is OTM above the underlying asset; a put Option, below the underlying.

What Is Crypto Options Trading?

Although they may sound complicated, Options are one of the most common investment strategies for traders to hedge their existing positions and bet on the market’s movement for returns. A crypto Option is a contract that gives you the right to buy or sell an asset at a specific price within a given time frame or a particular expiration date, depending on the chosen type of contract.

“Crypto Options trading” is a term used to describe Options contracts designed specifically for cryptocurrencies. Like stock Options, crypto Options are booming, as more retail traders turn to Options as a hedging instrument amidst the bear market. Fundamentally, crypto Options share the same characteristics as stock Options, but they come with many more advantages.

Unlike stock Options, crypto Options don’t require you to buy or sell the underlying asset if an Option expires ITM. Instead, your trading account will receive a credit or debit equal to the cash difference between the strike price and the Option's settlement price.

By removing the hassle of physical ownership, you can focus on what's truly important — making money.

Read more: Crypto Options: Why They Deserve a Place in Your Portfolio

Why Do Futures Traders Diversify Their Portfolios With Options to Amplify Returns?

In 2021, Options trading hit record levels of 62.58 billion contracts after numerous Option wins made headlines across the globe.

GME and AMC stock prices surged, and several Wall Street hedge funds opened sizable short positions in GME and AMC in anticipation of a drop in share prices.

Retail traders rightly guessed that if stocks moved higher, institutions would be forced to buy back shares, pushing prices even higher.

To take advantage of this, they bought far OTM call Options and paid small up-front premiums. Using leverage, retail traders multiplied their buying power to gain access to a much larger volume of stock than if they’d bought it outright. As predicted, stocks roared higher, with call Options increasing in value exponentially and generating huge profits for retail traders.

With this knowledge, futures traders now consider Options a key component of their investment portfolios.

Can Crypto Options Really Help to Maximize Gains?

Once you’ve learned to use them to your advantage, crypto Options really can help you maximize gains. Here are three ways to profit from Options:

Hedging to Reduce Market Risks

Options are ideal for protecting an underlying portfolio against market risks and uncertainties.

If you hold the underlying asset, a long put or a put spread are effective ways to hedge against a sell-off. If you're short of the underlying, a long call or call spread offers the same protection on the upside.

The great thing about Options is that you can choose an expiration date to protect your portfolio for one day, or weeks — or even months in the future.

Leverage Your Capital

With Options, all you need is a little capital to potentially gain significant profits.

When you buy an Option, you can gain access to a large amount of the underlying asset for a small initial deposit. By using leverage, you can multiply the buying power of your capital several times over.

Limited Risk, Unlimited Upside

Every trader dreams of their first “10-bagger” (+1,000% ROI). Options are the perfect way to achieve it.

All long Options have limited risk and significant (sometimes unlimited) profit potential. To illustrate this point, think back to the first crypto bull run of 2021. Some coins/tokens recorded growth of 10–20x, with a small number skyrocketing to over 100 times their original value within just a few months.

Now, just imagine leveraging on Options to take advantage of this price action, knowing the most you could lose is the premium … and the sky’s the limit when it comes to profit. Sounds good? That’s the beauty of Options for you.

Find out how bull markets can affect you: Bullish vs. Bearish Markets: How Are They Different?

How Do Crypto Options Work?

Although crypto Options behave like other Options, they’re more user-friendly. What do we mean by this? Hold your horses — we’ll explain.

As Bybit’s crypto Options are cash settled, you realize your profits as soon as the Option expires, allowing you to move on to the next opportunity without hesitation. This makes crypto Options the perfect choice for speculating and hedging.

Another benefit is that they don’t have a fixed contract size, so you can risk as much or as little as you want.

In addition, Bybit’s crypto Options are settled in USDC for security and flexibility. In the examples below, you’ll see how this works in practice.

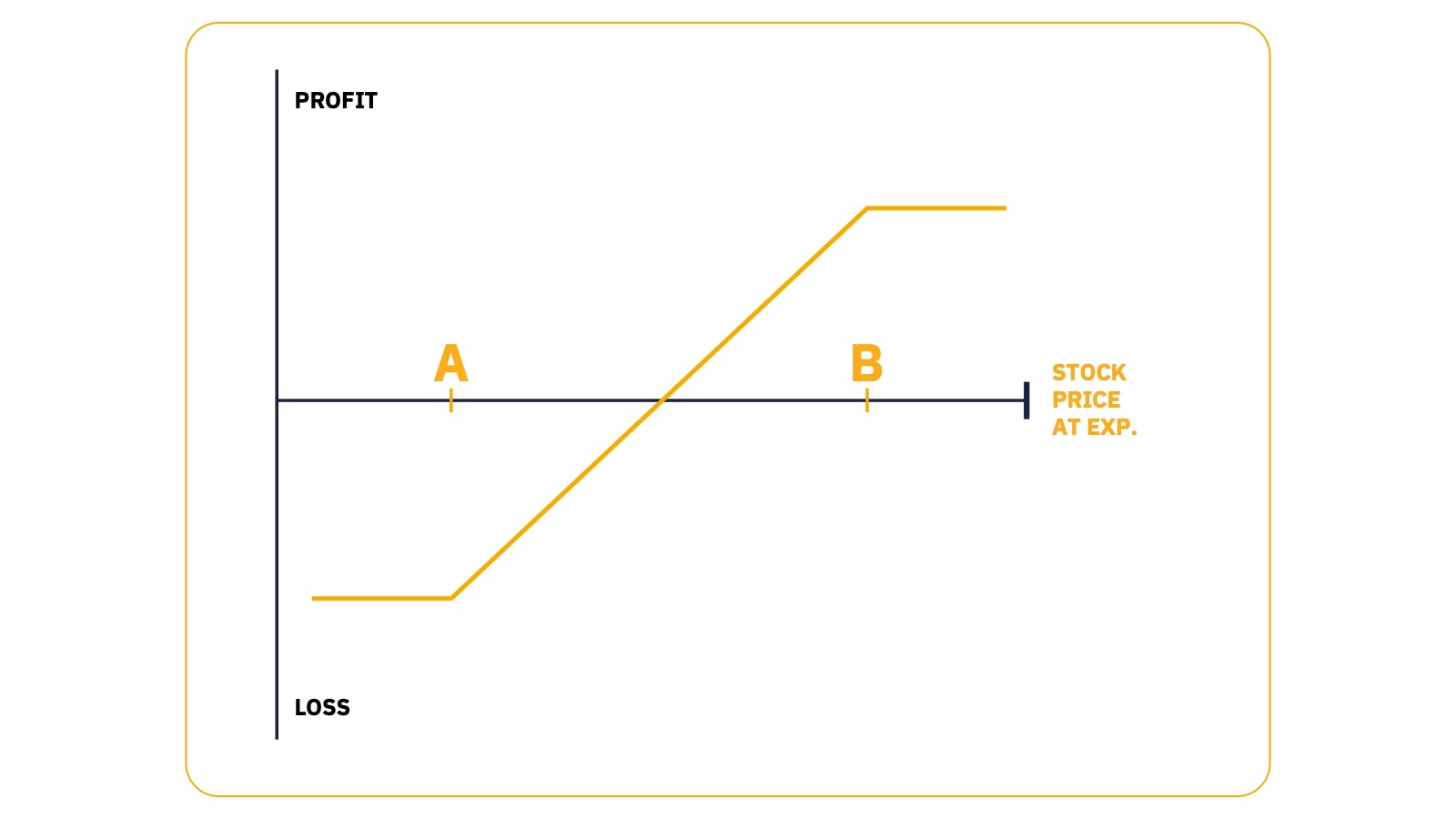

Bull Call Spread

A bull call spread is an effective way to profit in a bull market without breaking the bank.

The setup for the strategy involves buying a call Option (usually OTM) and selling a call at a higher strike price with the same expiration date.

Since you're buying the strike closest to the underlying, the trade costs a net debit, which is the most you can lose.

Here's an example of the bull call spread in action:

Underlying BTC price of $30,000:

- Buy one BTC $31,000 call, costing $600

- Sell one BTC $33,000 call, receiving a premium of $150

The trade costs a net debit of $450 (Premium paid of $600 − Premium received of $150)

The breakeven point is $31,450 (Lower strike + Net debit). The maximum potential profit of $1,550 occurs if the $33,000 call expires ITM ($33,000 − $31,000 − $450).

The worst-case scenario is when the settlement price is at or below $31,000. Here, both calls expire worthless, and you lose the $450 net premium paid.

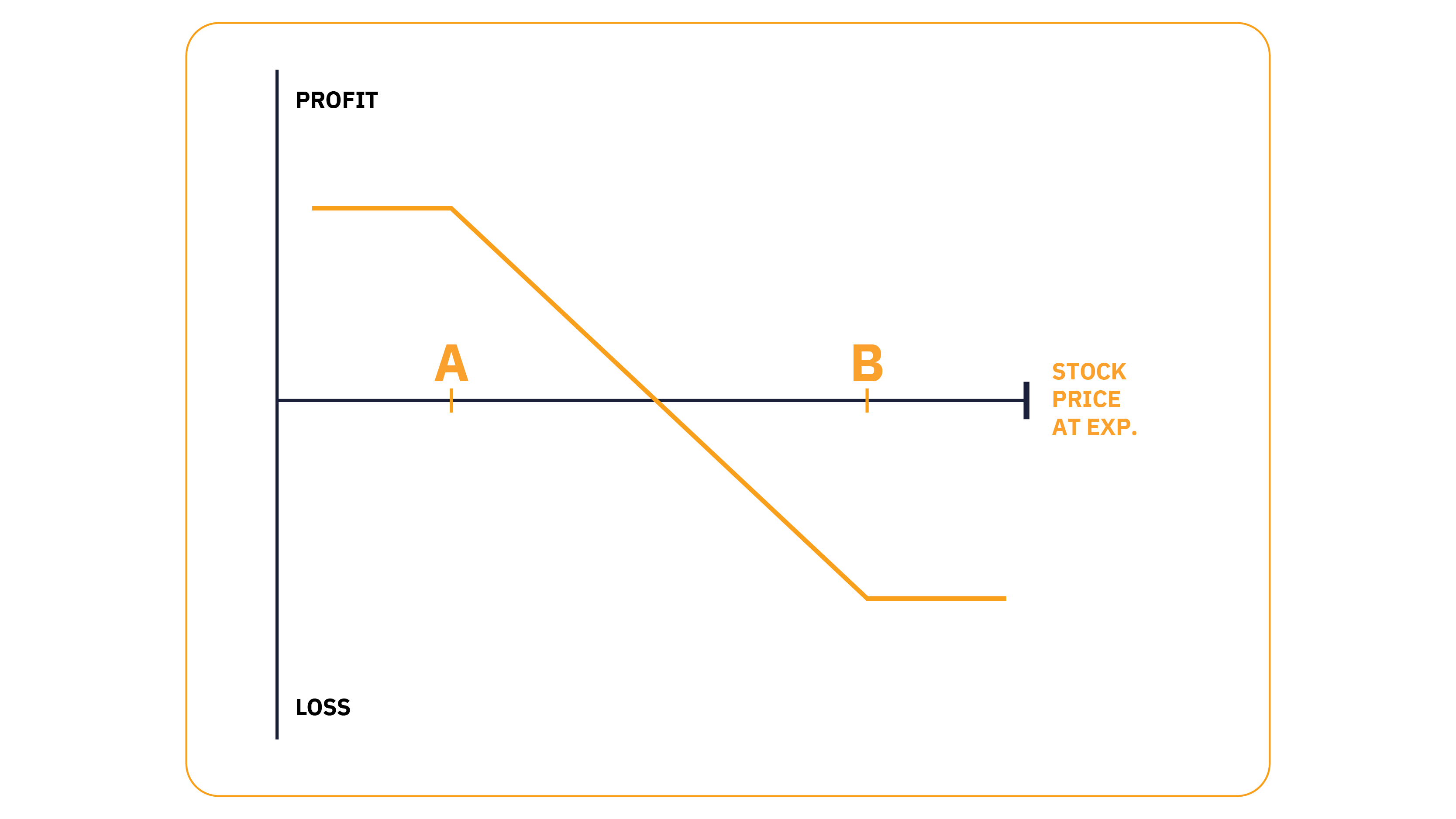

Bear Put Spread

The bear put spread is the mirror image of the bull call spread, offering a low-risk play for bear market profits.

To set up the bear put spread, you buy a put Option (usually OTM) and sell a put at a lower strike with the same expiration date.

Like the bull call spread, you're buying the strike closest to the underlying, so the trade costs a net debit.

For example:

Underlying BTC price of $30,000:

- Buy one BTC $29,000 put, costing $600

- Sell one BTC $27,000 put, receiving a premium of $150

The cost is a net debit of $450 (Premium paid of $600 − Premium received of $150), which is also your maximum potential loss.

The breakeven point is $28,550 (Higher strike − $450 Net debit). The max profit of $1,550 occurs if both strikes expire ITM ($29,000 -$27,000 − $450).

The maximum potential loss occurs when both strikes expire OTM with zero value. Here, you lose your $450 investment.

Read more: Bull Put Spread: An Excellent Way to Profit From Time Decay

Call Options

Call Options are contracts that confer upon their owner the right (but not the obligation) to buy a specific amount of an underlying asset at a preset price, on or before a certain date (known as the expiration date).

Put Options

Put Options are contracts that confer upon the Options buyer the right (but not the obligation) to sell a specific amount of an underlying asset at a preset price within a particular time frame.

What Are European Options?

A stock or crypto European put and call Option is a contract that gives investors a right to buy or sell an asset at a specific price on the day the contract expires.

What Are American Options?

A stock or crypto American put and call Option gives investors the right to exercise the contract to buy or sell an asset at any time within a given time frame before the contract expires.

How Do Crypto Options Differ From Stock Options?

Though they have similar characteristics, Bybit’s crypto Options are different from traditional Options in several ways.

All Options are cash-settled, meaning no physical transfer of ownership takes place at expiration. Instead, when an Option expires ITM, the holder’s account receives a credit equal to the difference between the strike price and the underlying asset’s settlement price.

Bybit also offers European-style contracts, which can only be exercised at the time of expiration.

Options expiring ITM are exercised automatically.

How Is Hedging Futures Different From Hedging Options?

There are a few ways in which hedging with Options — as opposed to futures — can deliver better results.

With futures, you benefit only from a single-directional (up or down) move. But with Options, you can profit when the market moves up, down, sideways, up then down, down then up, a little or a lot … you get the point. In short, Options are much more versatile than futures.

With futures, you take on the same risk level whether you buy or sell. However, you can never lose more than your initial investment when you purchase an Option. Additionally, depending on the strategy, a long Option could have unlimited upside potential.

Another advantage of using Options over futures is that the risk of liquidation is minimal for long Options. Because you pay an up-front premium, the maximum potential loss is known, making it easier for you to manage your capital.

Read more: Futures vs. Options: Which One Suits You Best?

Part 2: Start Your Journey: Choosing the Ideal Trading Platforms for Crypto Options

The first step in your crypto trading journey is choosing the ideal exchange.

When deciding which exchange best suits your needs, there are various factors to consider, including security, liquidity, trading fees and the number of assets available for trading. Before you begin, also consider these two questions:

- Is the exchange’s interface easy for beginners to navigate?

- Is help available around the clock, should you require it?

There's a lot to unpack, but don’t worry. Here’s a summary of four popular crypto exchanges.

Bybit

Established in 2018, Bybit cryptocurrency exchange offers a highly advanced, no-frills interface. It’s powered by an ultra-fast matching engine that’s capable of handling up to 100,000 transactions per second (TPS).

You can fund Bybit trading accounts with a wide range of crypto and fiat currencies. Bybit users enjoy access to over 100 spot assets, over 100 perpetual and quarterly contracts, and live 24/7 multilingual support. Additionally, thanks to Bybit’s 99.99% system functionality, you’ll never need to worry about downtime.

On the downside, Bybit is not currently available for trading in some countries, including the United States.

Deribit

Panama-based Deribit is an institutional-grade platform offering access to BTC, ETH and SOL derivatives and Options. Deribit is highly liquid and commands a considerable market share of open-interest Options. The exchange offers advanced functionality that caters to the needs of both professional and institutional clients. However, Deribit has a lengthy KYC process, no live customer support and a limited offering of products.

Delta Exchange

Next on the list is Delta Exchange, which caters to retail and institutional clients. Delta currently supports trading for BTC and over 50 top altcoins. It uses an advanced, high-speed matching engine to execute orders. Clients have access to live multilingual support around the clock. It’s important to note, however, that Delta only accepts BTC/USDT and ETH for account funding, and isn’t the most liquid of exchanges, due to low trading volumes.

OKX

Popular crypto Options exchange OKX offers retail clients access to a wide range of digital assets. The exchange has millions of users, is highly liquid and uses advanced matching techniques to reduce execution slippage. Funding Options include fiat and digital currencies, and customers can access live support 24/7. Unfortunately, OKX is hampered by one critical flaw: A complicated fee structure.

Comparison Table of Different Crypto Exchanges

Criteria | Bybit | Deribit | Delta Exchange | OKX |

PM-enabled/ Bar | Yes/1,000 USDC | Yes/No Bar | Yes/Only For BTC | Yes/100k |

Full Cross Margin | No | No | No | No |

Settlement/ Pricing | USDC | BTC for BTC, ETH for ETH, SOL for SOL | USDT | BTC for BTC, ETH for ETH, SOL for SOL |

Multi-collateral | Yes | No | No | Yes |

Burst Capacity | Up to 500 batch requests, 20 orders per batch, 10k TPS | 200 TPS | N/A | Up to 1,000 (250 x 4) TPS |

Liquidity | < 10 bps1 spread/$500k size on BBO2 | ~ 10 bps/$500k size on BBO | < 10 bps/$10k size on BBO | > 20 bps/$100k size on BBO |

Block Trade | Yes | Yes | No | No |

Fee Rate | As low as 1 bps maker3/taker4 | 3 bps for both taker and maker | 5 bps for taker/maker | 2 bps maker, 3 bps taker |

Margin Calculation | Based on calibrated volatility model, impervious to manipulation | Based on calibrated volatility model | N/A | Based on calibrated volatility model |

Liquidation | Partial, will only reduce position | Partial, but will increase position | N/A | Partial, but will increase position |

1 BPS: Basic points — a unit of measure commonly used in interest rates and other percentages in finance.

2 BBO: Best-bid-offer — the best bid and ask price on the order book at any given time.

3 Maker: A “maker” refers to a market maker. Makers provide liquidity to the market.

4 Taker: A “taker” places orders which immediately remove liquidity from the market.

Part 3: Top 4 Crypto Options Hedging Strategies With Which Even Rookies Can Make Consistent Profits

Covered Call

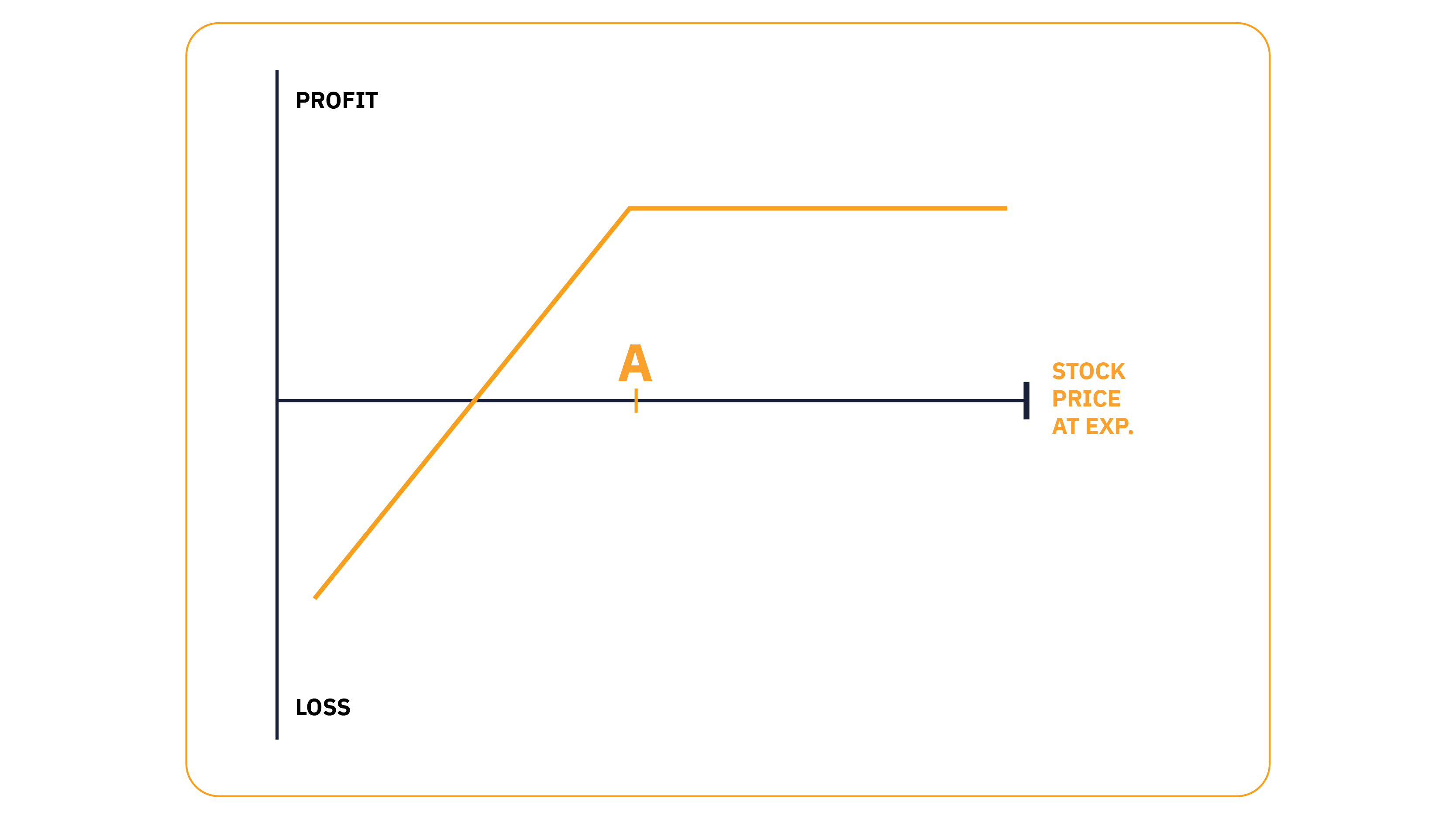

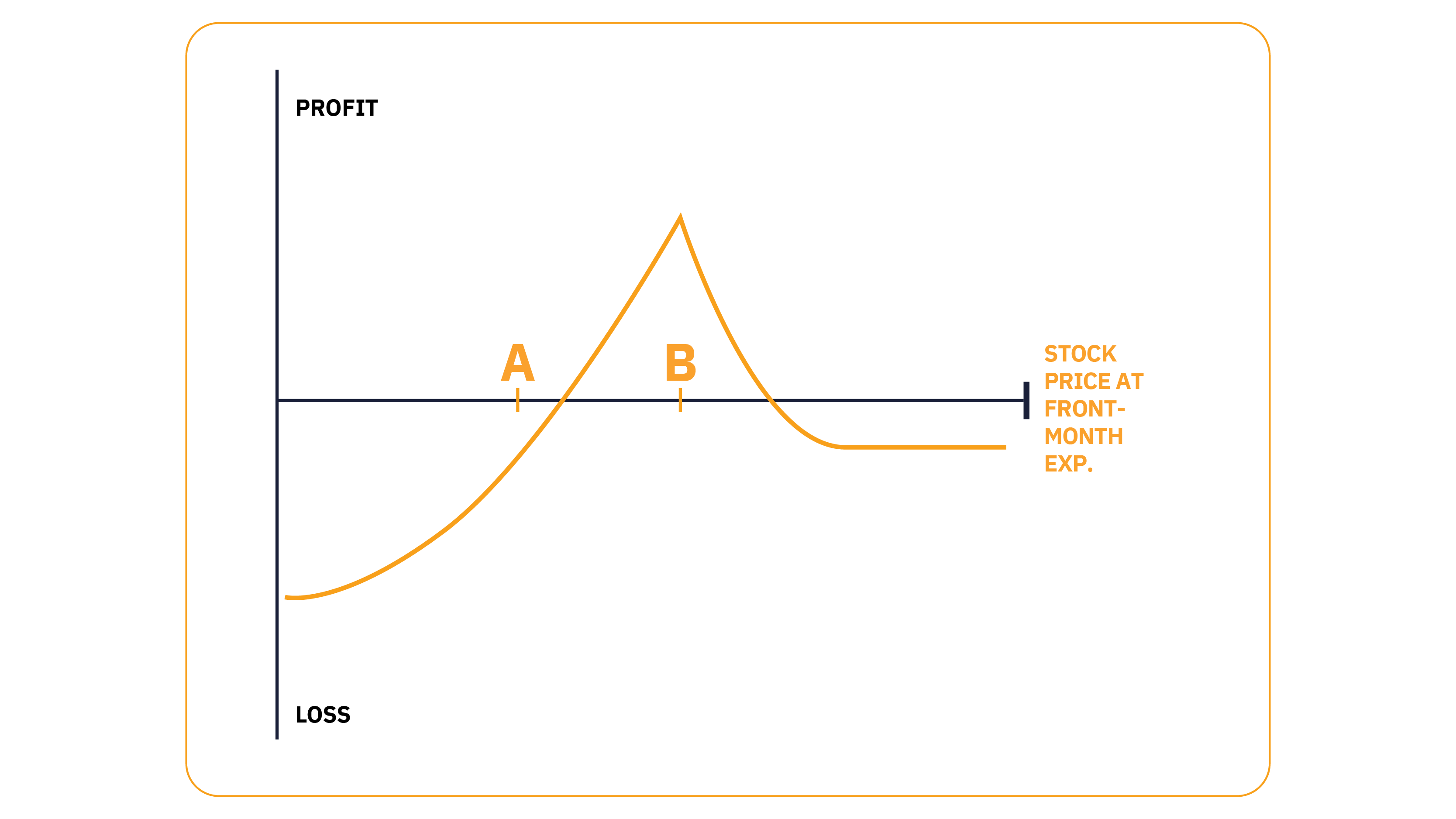

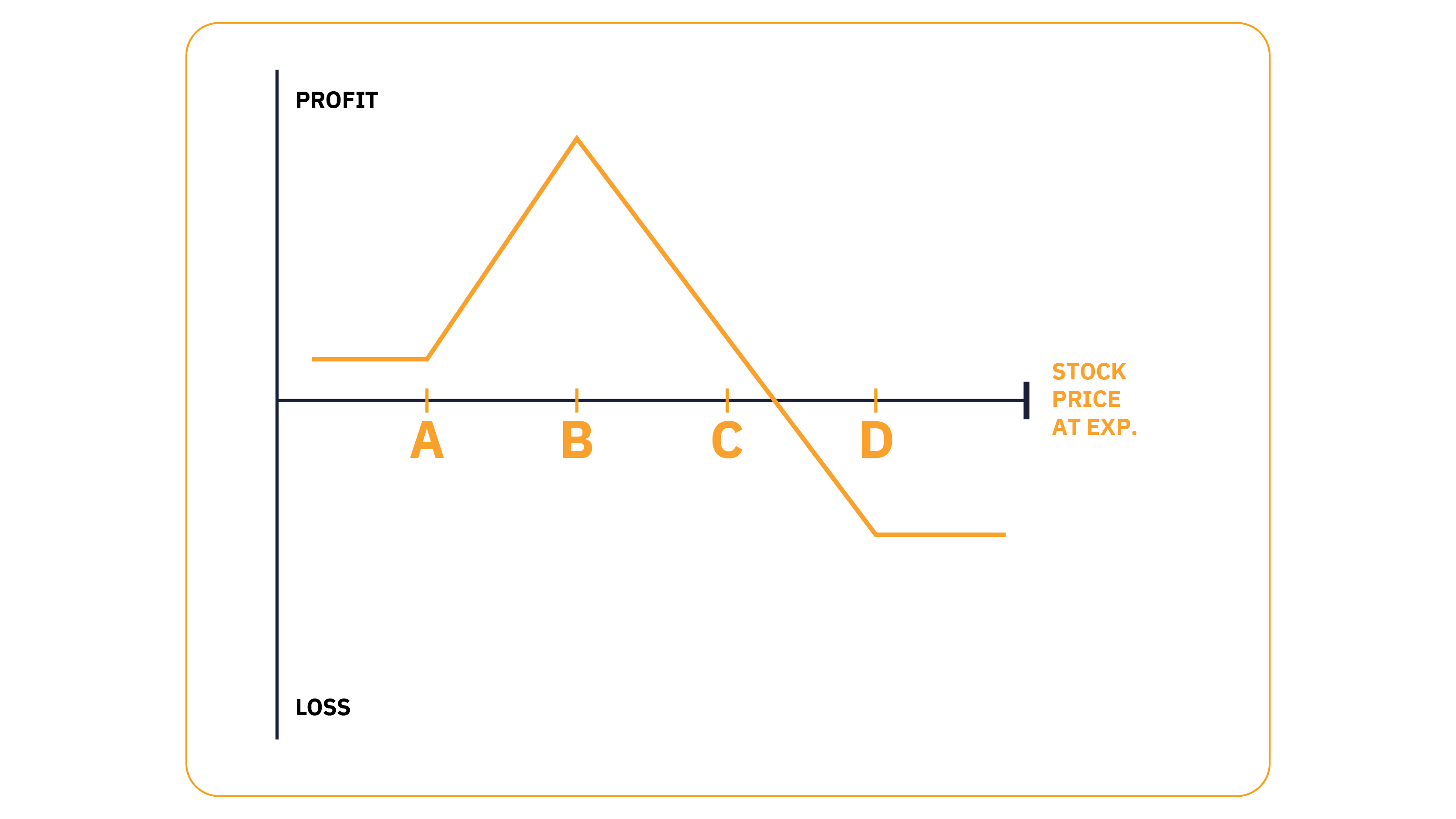

Covered Call Payoff Diagram

Let's see how you can use the covered call strategy to generate consistent passive income against an underlying crypto portfolio.

A covered call has two clear benefits: It protects your underlying asset against a small drop in price, and it profits when the market moves sideways or slightly higher.

By selling a call Option against your portfolio, you’re hedging against downside price risk and reducing your overall exposure to loss. The best time to use this strategy is when you aren’t expecting the price to move much higher.

The first step in this strategy is to own the underlying asset. For this example, we'll use BTC.

Here's how the covered call is set up:

- You own an asset, such as Bitcoin

- You sell an out-of-the-money call Option and receive a premium. Ideally, you choose a strike price close enough to pay a decent amount, but OTM enough to expire worthless. The goal is to keep all of the premium.

- To give yourself the best chance of success, sell a call expiring in 30–45 days. The premium loses its time value quickest within this range.

Example:

- Long 0.20 BTC, purchased at $20,000 (current market price of $30,000).

- Sell 0.20 of the BTC $35,000 call, with 35 days to expiration, receiving a premium of $250.

As long as BTC is below $35,000 at expiration, the $250 premium is yours to keep, essentially reducing the price of your long BTC position to $19,750 ($20,000 − $250).

The breakeven point is when BTC drops $250 to $29,750 (current price − premium). You lose money below the $29,750 mark.

The best outcome is if BTC is higher at expiration (but not above $35,000), and the call expires worthless. In this scenario, not only do you get to keep the premium, but you also have paper profits on the underlying.

Once the call Option expires, you sell a new call, expiring in 30–45 days, repeating the process for as long as you hold the underlying asset.

The worst possible outcome at expiration is when the market is above the strike price. You then miss out on potential profit above $35,250.

- Potential Profits: The underlying asset price trades sideways, or increases close to (but not above) the strike price at the time of expiration.

- Potential Losses: The premium from selling a covered call is unlikely to offset a larger drawdown in the value of the underlying crypto asset.

Read more: Covered Call: How to Generate Passive Income With It

If you're still unsure how to profit from the covered call, why not paper-trade first using a Bybit demo account? This way, you can master the strategy before moving on to the real thing.

Protective Put

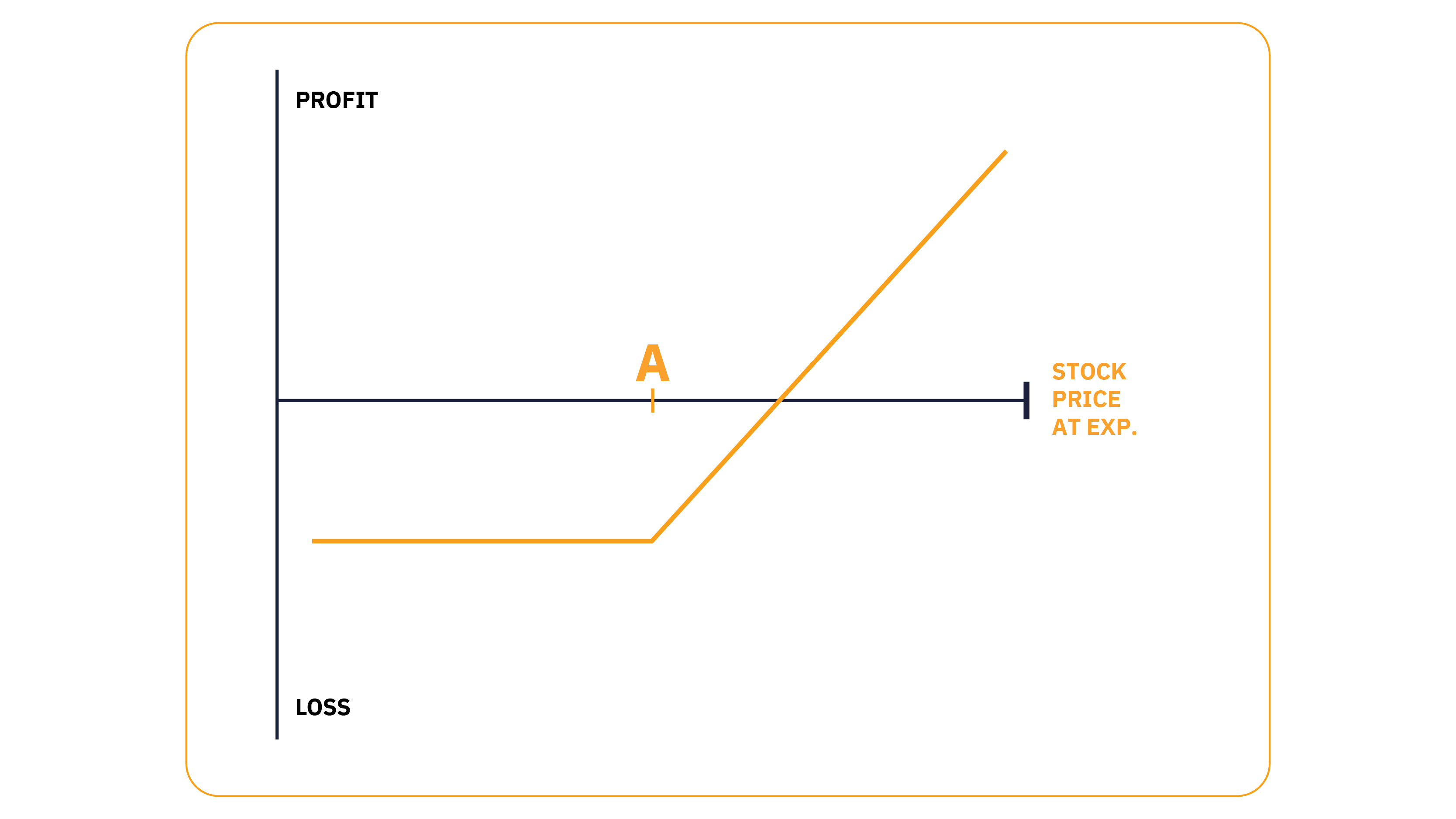

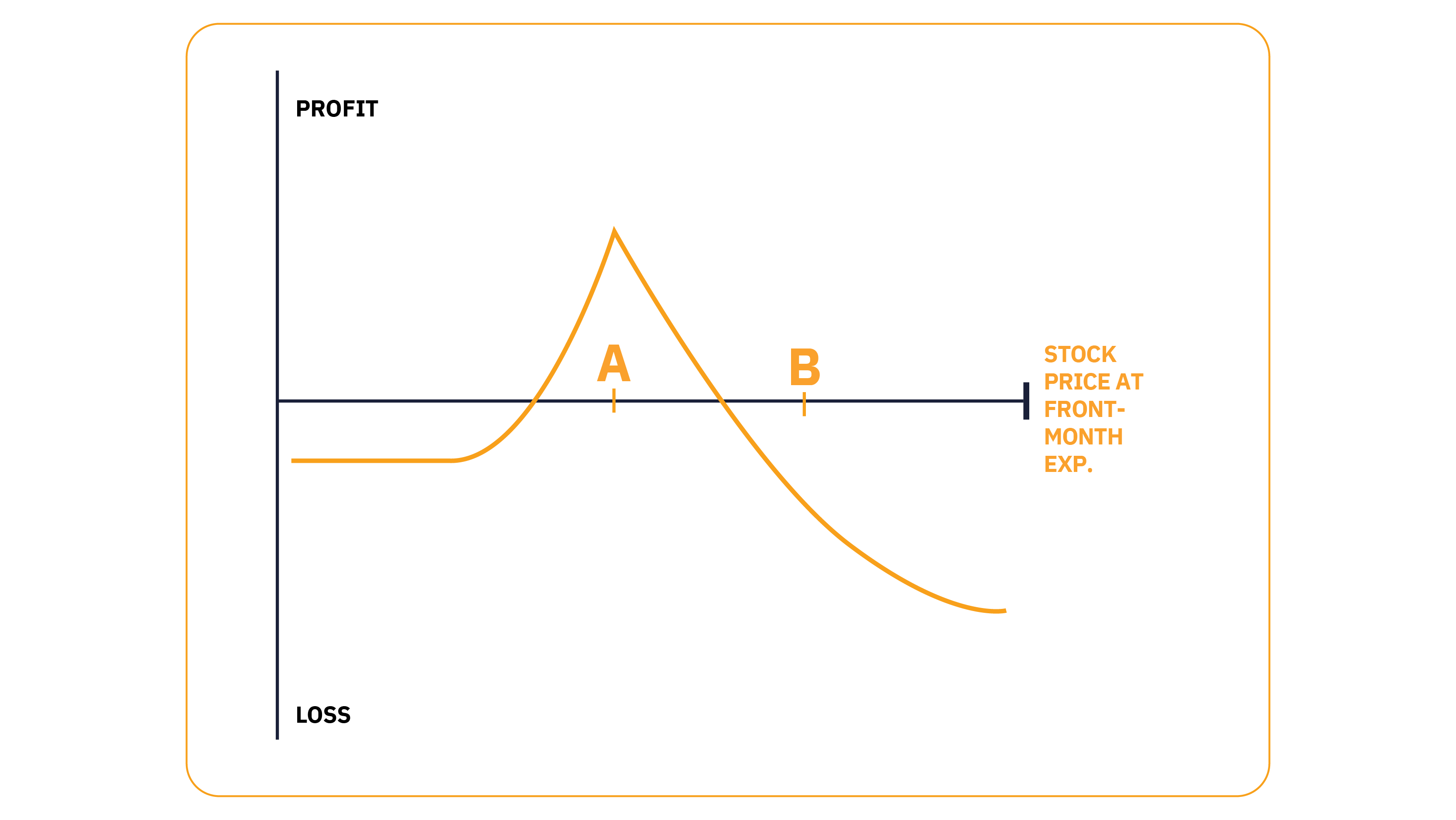

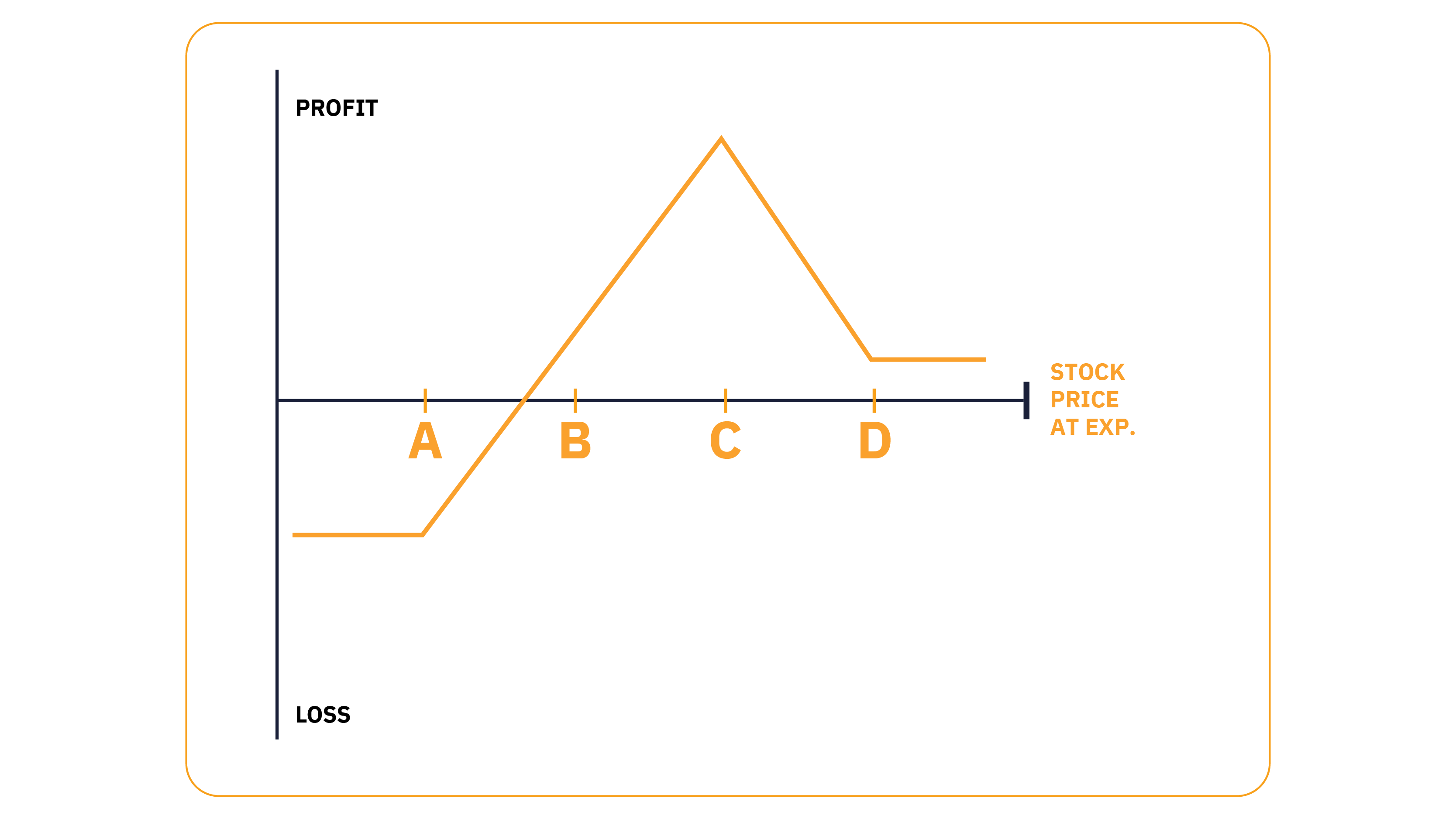

Protective Put Payoff Diagram

A simple way to hedge against market uncertainty is through buying a protective put.

Like the covered call, you use a protective put when you have an underlying long crypto position. The protective put is a low-risk strategy which never loses more than the amount of premium you’ve paid for the Option.

Here's an example of using a protective put to hedge against market uncertainty,

- Long 0.20 BTC, purchased at $20,000 (current market price of $30,000).

- Your long position shows a healthy profit of $2,000 ($10,000 × 0.20 BTC). While you believe BTC will move higher, you want to protect your profit from near-term weakness.

- Buy 0.20 of a BTC $27,000 put, expiring in 60 days, costing $500.

Ideally, choose a put with at least 60 days to expiration to benefit from slow time decay in the early stages.

The beauty of the protective put is that it covers you if BTC falls below $26,500 (strike price − premium), but leaves the upside open for you to profit if the market moves higher.

Although buying a put costs money, it's a small price to protect yourself from extreme volatility.

- Potential Profits: You make money when the underlying goes up more than the premium paid. This strategy helps to protect your underlying long position if the price falls below strike price A while the Option contract is active.

- Potential Losses: In terms of loss, you could potentially lose the amount of premium you’ve paid for the Option.

Married Put

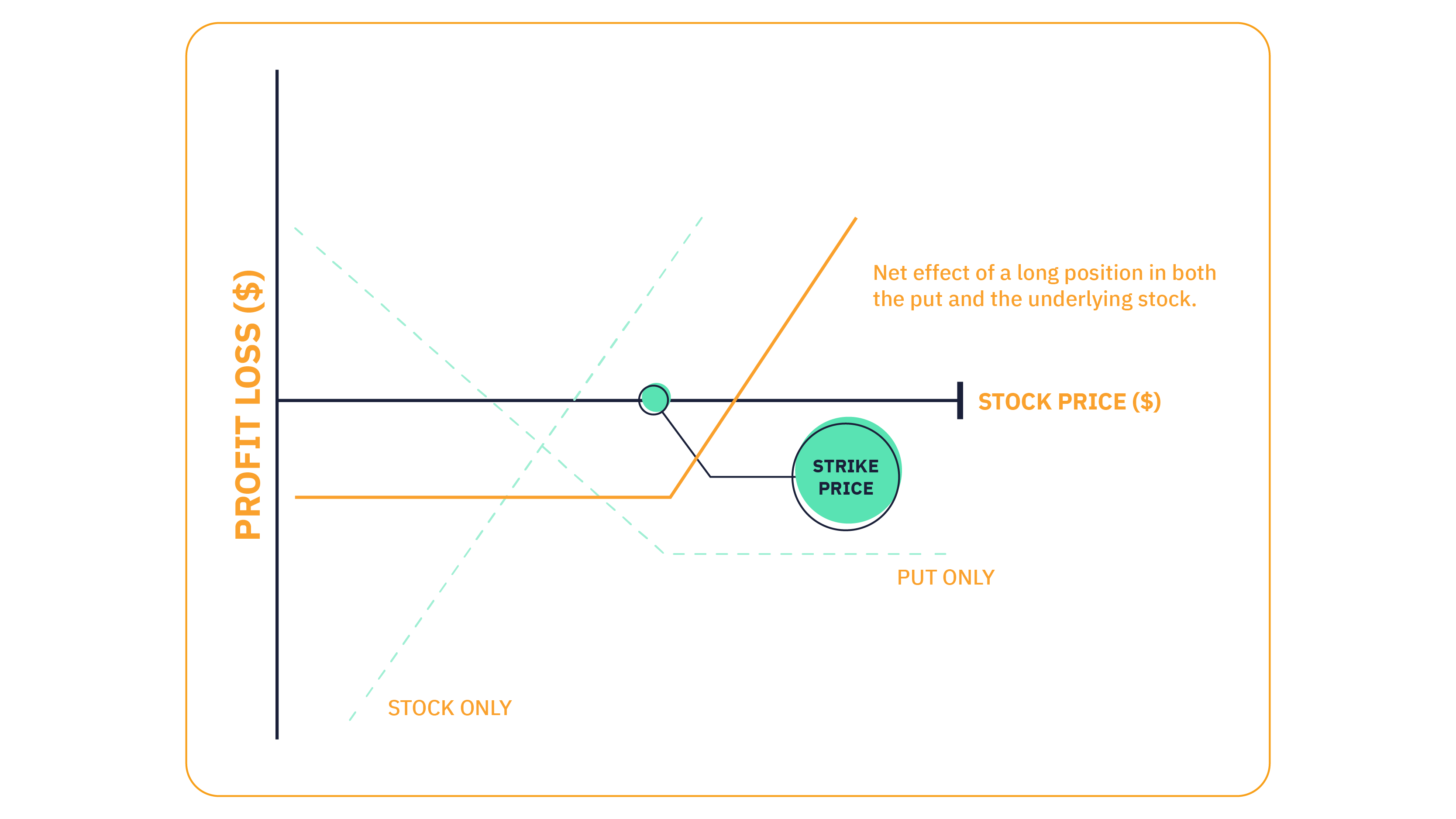

Married Put Payoff Diagram

If you want lower risk when buying crypto, use the married put strategy.

The married put works just like the protective put. The only difference is you use the protective put against an asset you already own. With the married put, you buy the Option at the same time you purchase the underlying crypto.

For a married put, you usually select a strike price as close to the asset's purchase price as possible (ATM). Of course, there's no law saying it can't be an OTM strike; that's totally up to you.

The risk profile of a married put mirrors the protective put.

- Potential Profits: Figuring out if the trade will profit is easy. You make money if the price of your crypto rises by more than the premium.

- Potential Losses: You lose money if your crypto falls by more than the premium.

We've learned how to use covered calls for passive income, and puts to protect against volatility. But what happens when you combine them?

Collar Option Strategy

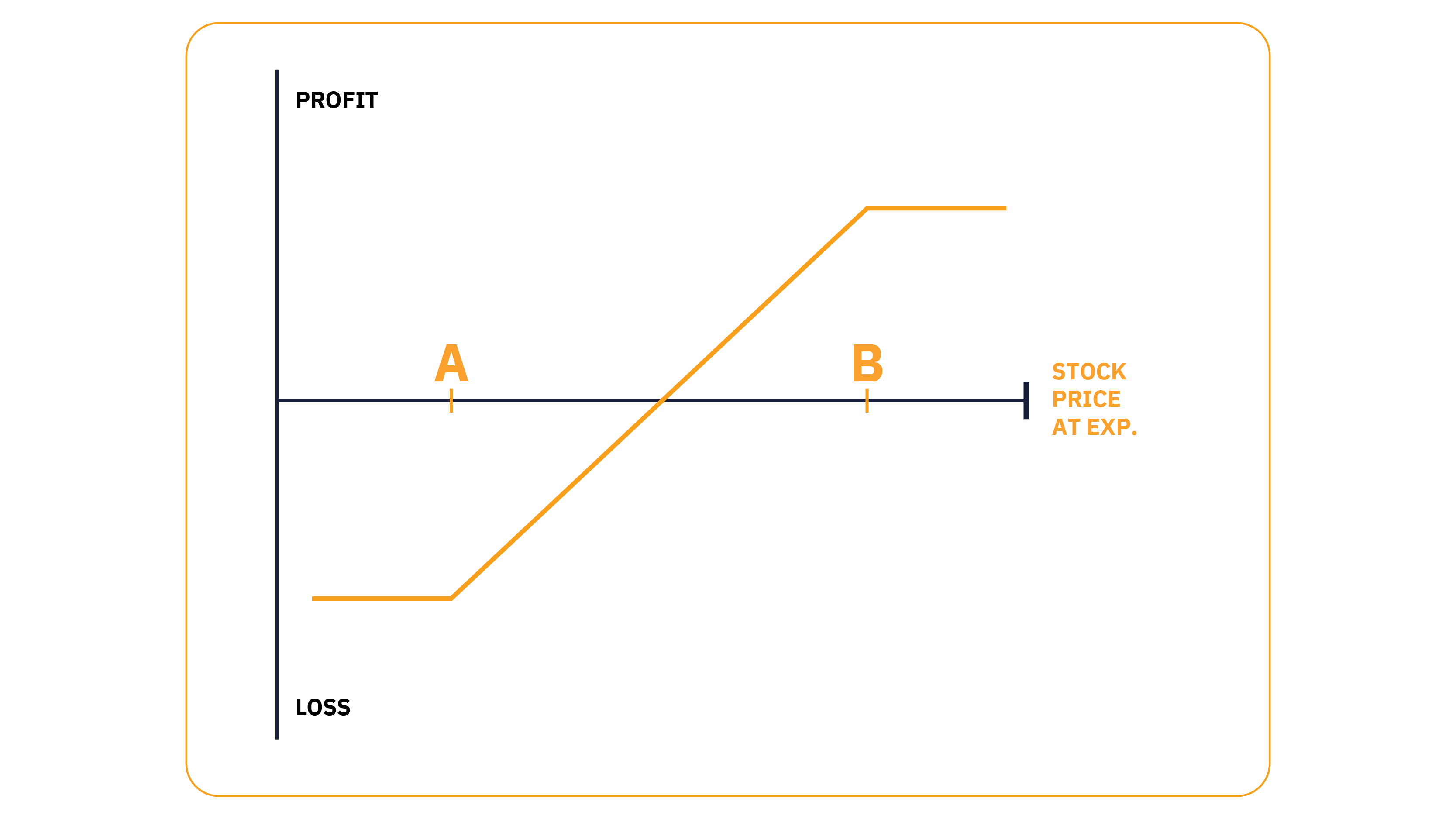

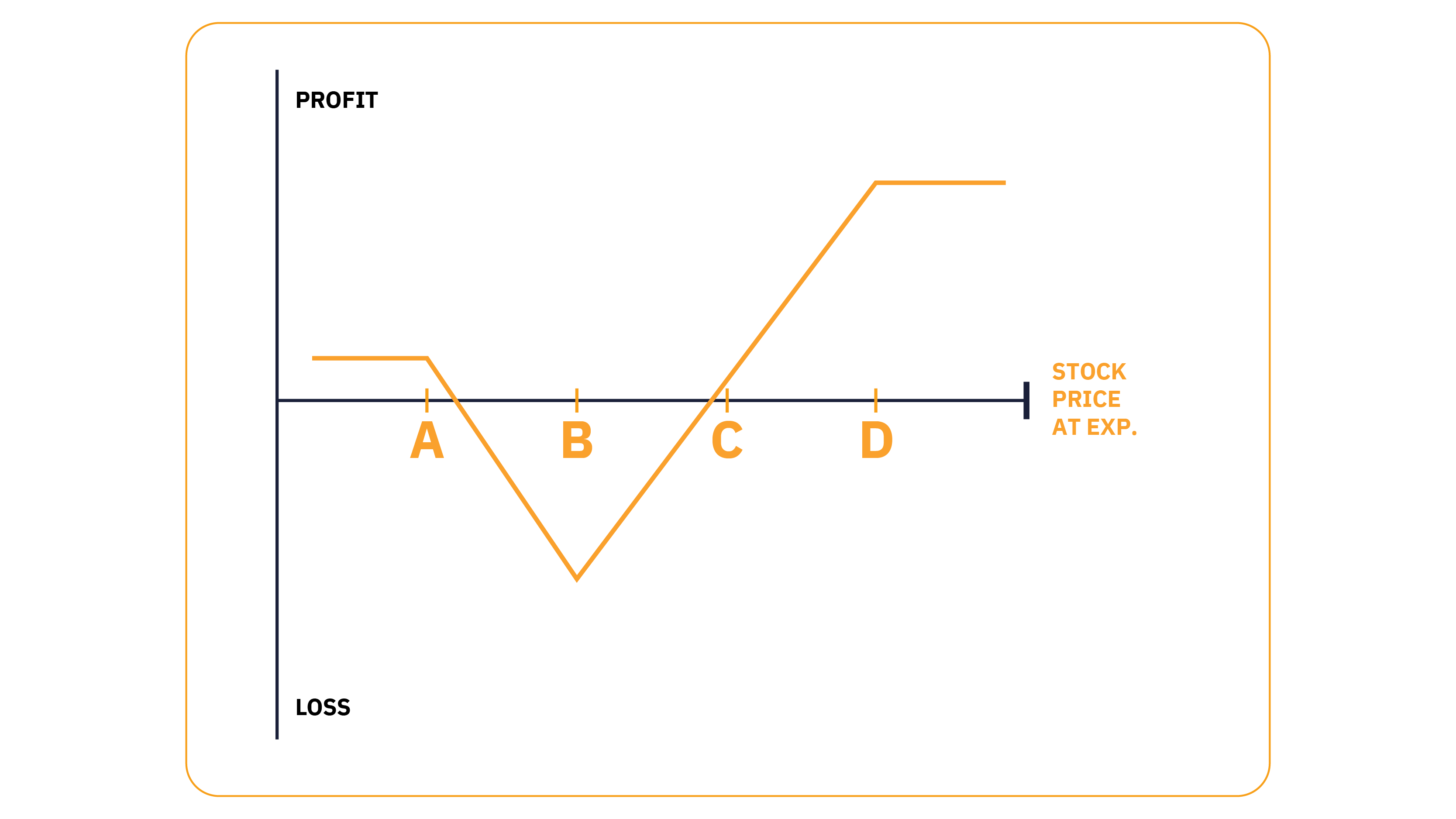

Option Collar Payoff Diagram

The Option collar provides the same security as the protective put for a fraction of the price.

The Option collar combines a covered call and a long put Option to provide a fixed trading range for your crypto asset.

The put Option protects your portfolio against downside volatility, and the premium from the short call helps cover the cost.

This strategy works best when you have a moderately bullish view of the market, but want to protect against large losses.

The cost of the trade varies, depending on the location of the strike prices. For instance, the strategy is cheaper when both strikes are the same distance from the underlying market than if the long put is closer than the call.

Example:

- Buy 0.20 of a BTC $28,000 put, costing $300.

- Sell 0.20 of a BTC $32,000 call, receiving a $250 premium.

- Long 0.20 BTC (current market price of $30,000).

Even though the strikes are the same distance from the underlying asset price, the trade costs $50 (net debit) due to the opposing bid-ask spreads.

In a low-risk, low-reward situation, the collar protects your position if the price drops below $27,950 (put strike − net debit of $50), while limiting your upside potential to $31,950 (call strike − net debit of $50).

You profit from this trade when the underlying asset is higher by more than $50, but below the call strike when it expires.

- Potential Profits: When the underlying asset is equal to the short call strike price at expiry.

- Potential Losses: If the underlying asset is below the long put strike price at the expiration date.

Now that we've covered the basics, it’s time to move on to more advanced strategies.

Before we do, however, it's crucial to know that the following five strategies are considerably complex, and are best suited to traders with at least an intermediate knowledge of Options trading.

Part 4: Elevate Your Profits with 5 Veteran Options Trading Strategies

Diagonal Spread

Diagonal Put Spread Diagram — Setup

Diagonal Call Spread Diagram — Setup

A two-step strategy that profits from time decay, the diagonal spread is similar to the calendar spread with one major difference: While a calendar spread usually combines call or put Options sharing the same strike, but different expiration dates, a diagonal spread uses call or put Options of different strikes.

The diagonal spread has many variations, including the call diagonal, the short diagonal and the long put diagonal.

Typically, you use the diagonal spread when you’re bullish or neutral on a crypto or any given asset class. Depending on your view, you can use either puts or calls. In this example, we'll look at an advanced variation: A diagonal spread with calls.

First, you sell an OTM call Option (Strike A) with about 30 days to expiration (front-end strike).

Then, you buy a further OTM call Option (Strike B), with 60 days to expiration (back-end).

Now you have a calendar spread position. The aim is to end up with a short call spread.

Here's where it gets complicated: When the front-month contract expires, you sell the same strike price (A) with the same expiration date as the back-end long call Option.

The aim is to collect enough premium on the short strike (A) to exceed the cost of the long back-end call.

The trade profits from time decay, and works best when the market trades sideways for the first 30 days and falls in the next 30 days.

Ideally, you want the price to stay close to the front-end strike until it expires. Then, you’ll profit most if both the back-end Options expire OTM.

- Potential Profits:

- True Profit = Total Profit − Premium Paid for the Put/Call Option − Strike Price A

- Potential Losses:

- Net Credit Maximum Risk = Strike Price A − Strike Price B − Total Net Credit Received

- Net Debit Maximum Risk = Strike Price A − Strike Price B + Net Debit Paid

Read more: Diagonal Spread: A Hybrid Strategy That Nets You Profit

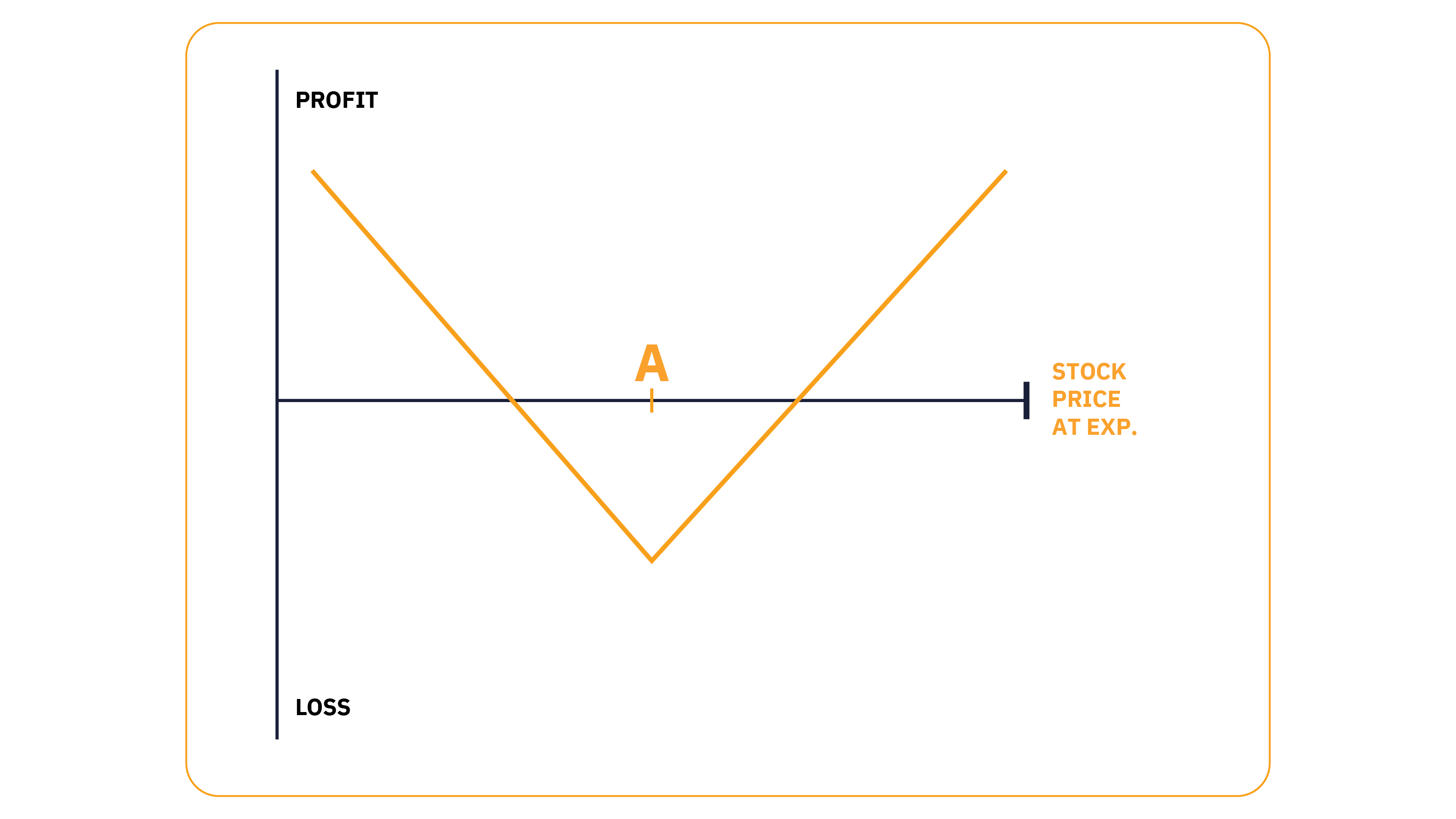

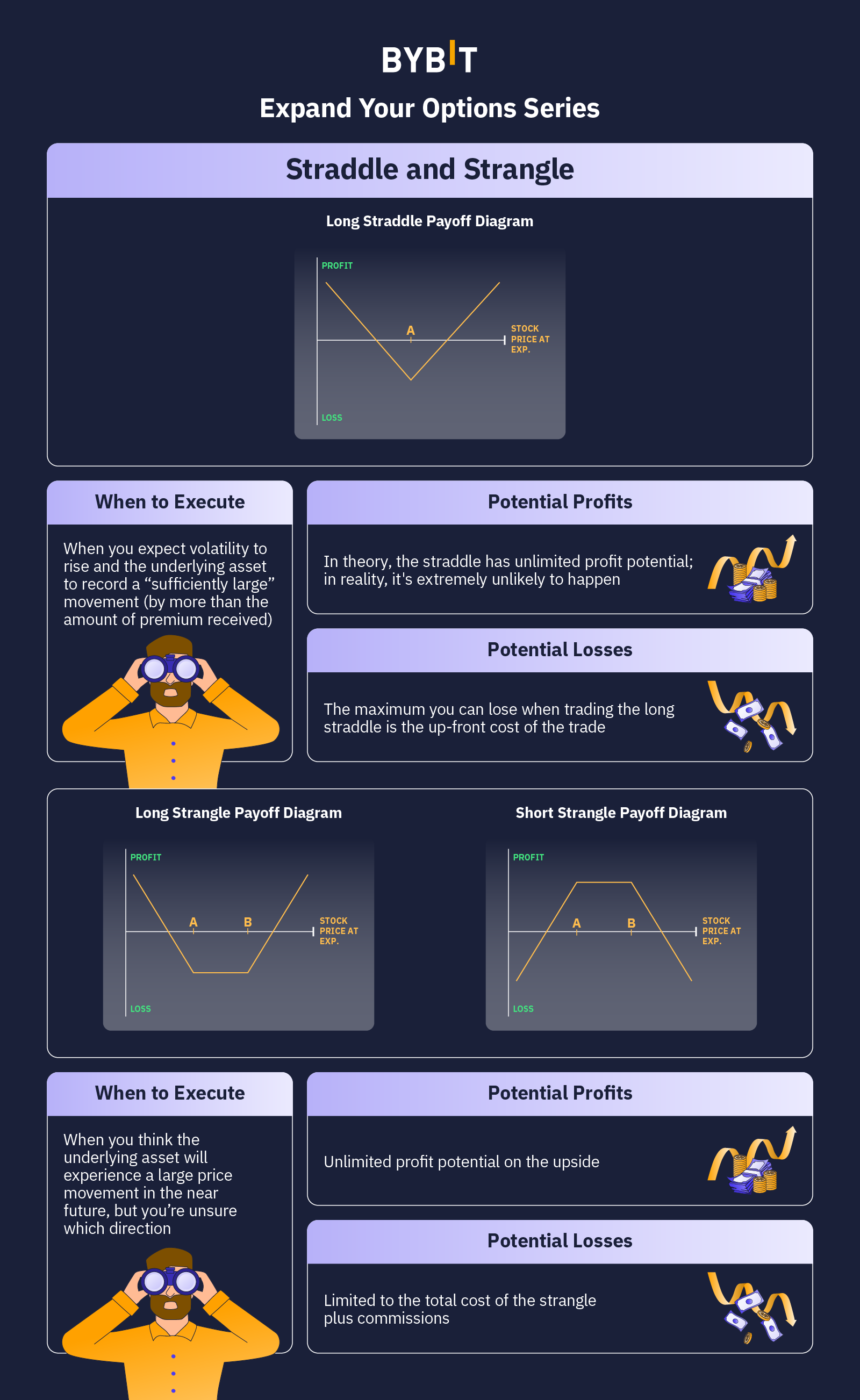

Straddle and Strangle

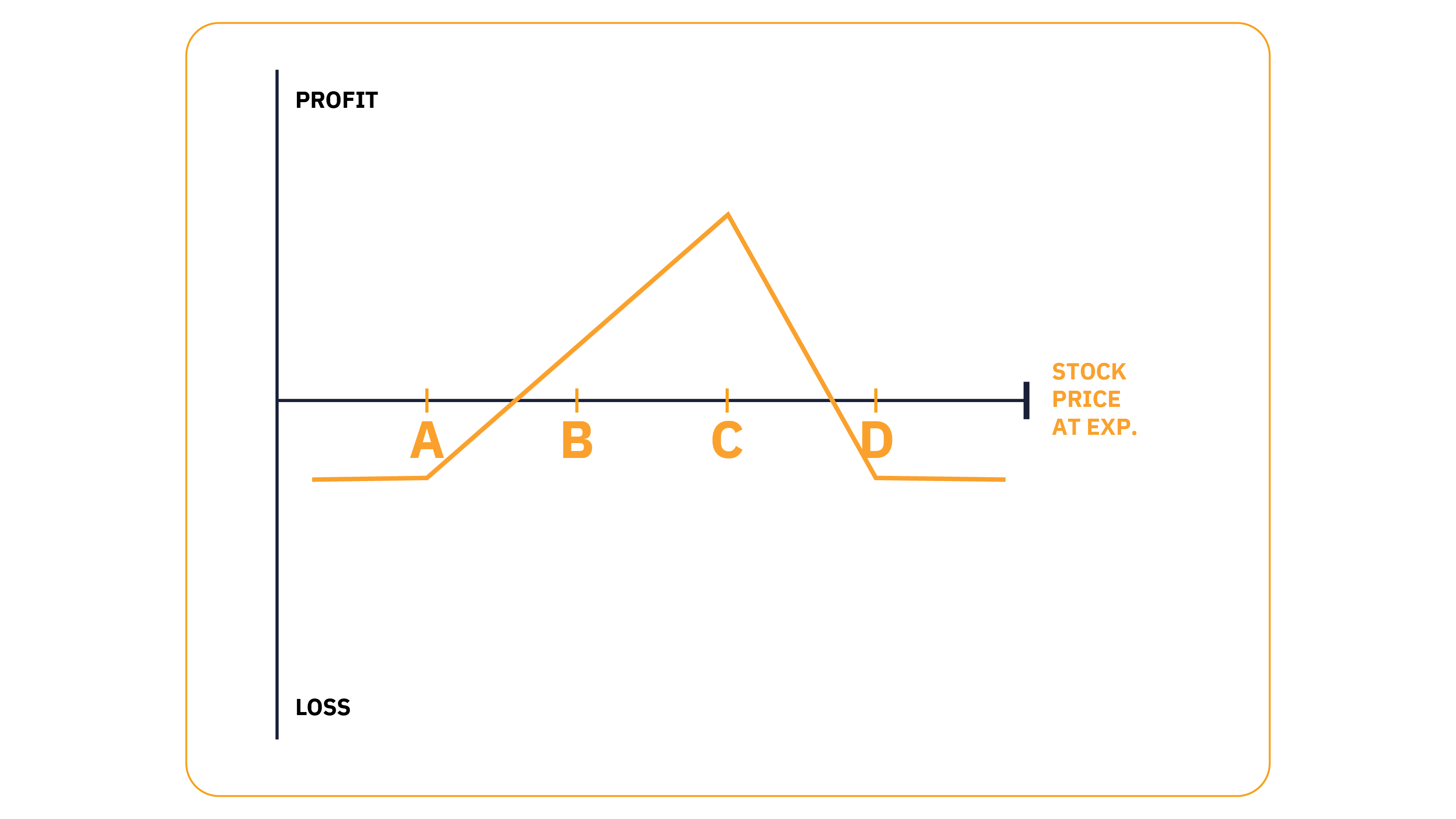

Long Straddle Payoff Diagram

Straddles and strangles are ideal for generating large returns with little risk.

If you think a big move is coming, but are unsure of the direction, buying straddles or strangles could be the way to profit. When you expect IV to fall, you could sell a straddle or strangle to benefit from time decay.

Although you can use either to express the same view, they differ in cost and profit potential.

To open a long straddle, you buy a put Option and a call Option with the same strike price and expiration date.

Because you buy both Options, the cost of the trade is a net debit (put premium + call premium).

For the trade to make money at expiration, either strike must expire in-the-money by more than the total cost of the premiums.

An example of a long straddle:

- Buy one ATM call costing $100

- Buy one ATM put costing $100

The cost of the trade is a net debit of $200 ($100 + $100).

For this trade to pay out at expiration, you need the market to be higher or lower by more than $200.

Anything less than that results in a loss. The worst possible outcome occurs when both strikes expire ATM.

On a positive note, a straddle has considerable profit potential, especially with crypto. Considering cryptocurrencies can be highly volatile, either option could expire ITM by a great distance, generating a return many times the size of your initial investment.

- Potential Profits: In theory, the strangle has unlimited profit potential; in reality, it's extremely unlikely to happen.

- Potential Losses: The maximum you can lose when trading the long straddle is the up-front cost of the trade.

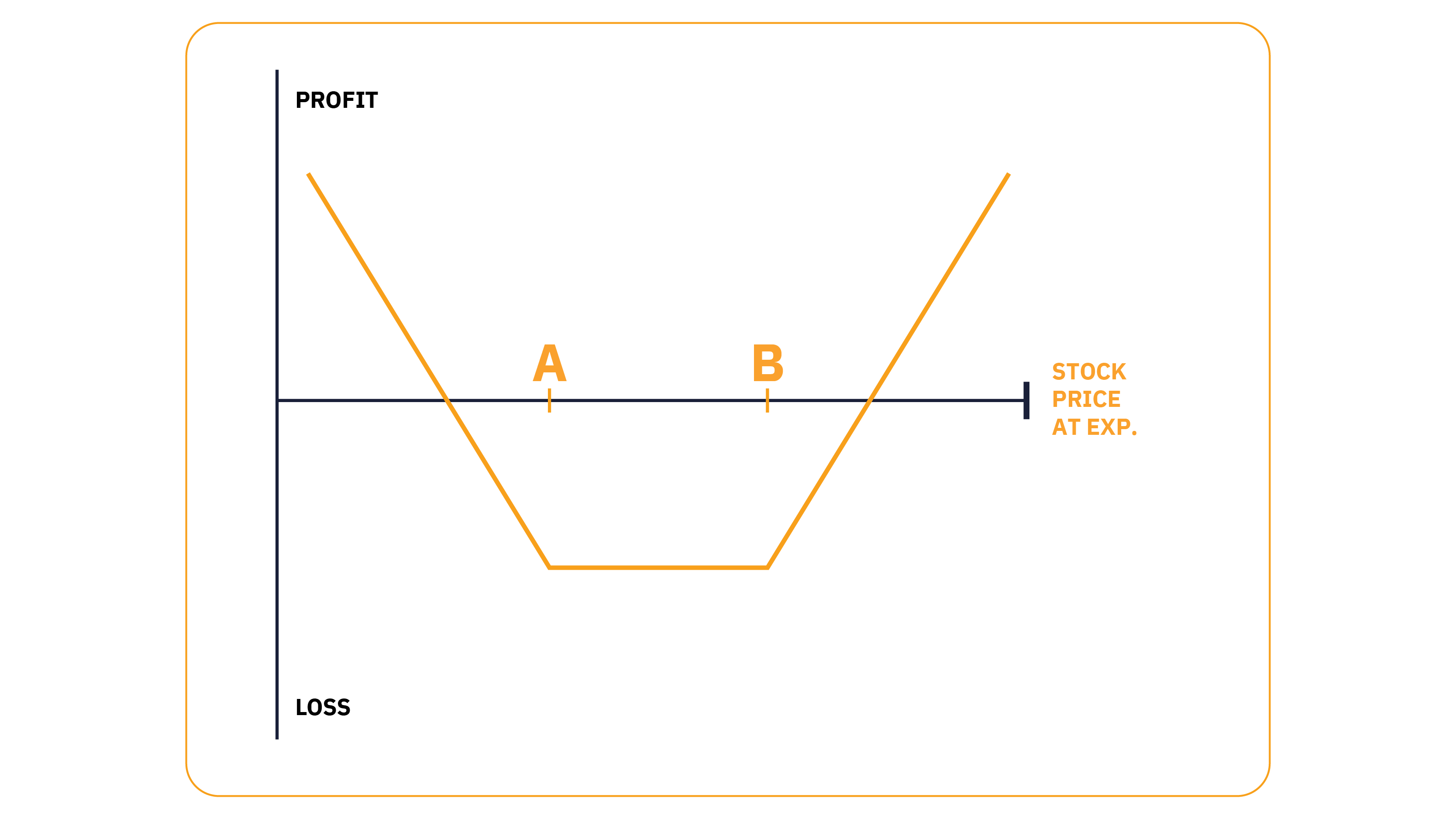

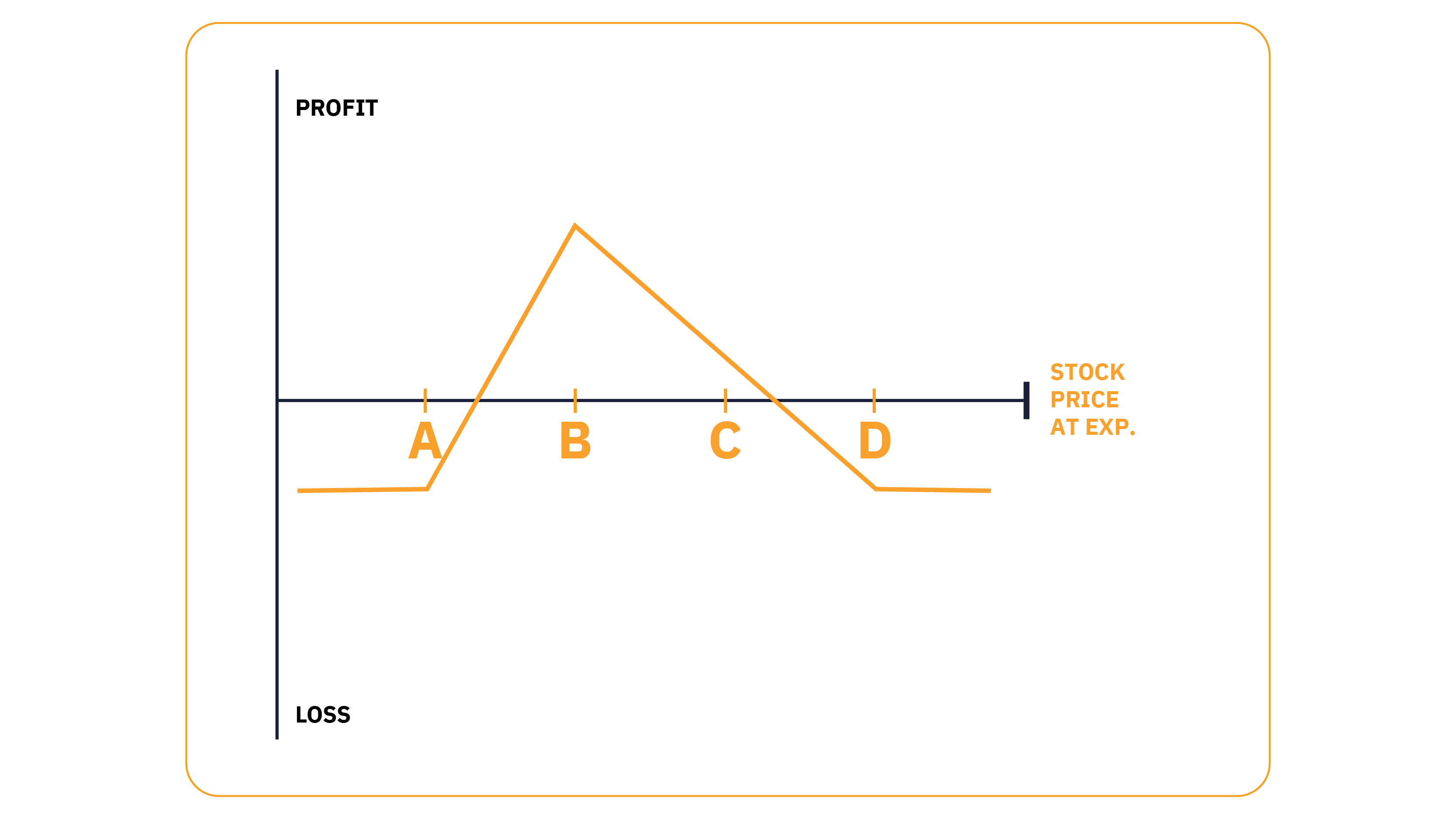

Long Strangle Payoff Diagram

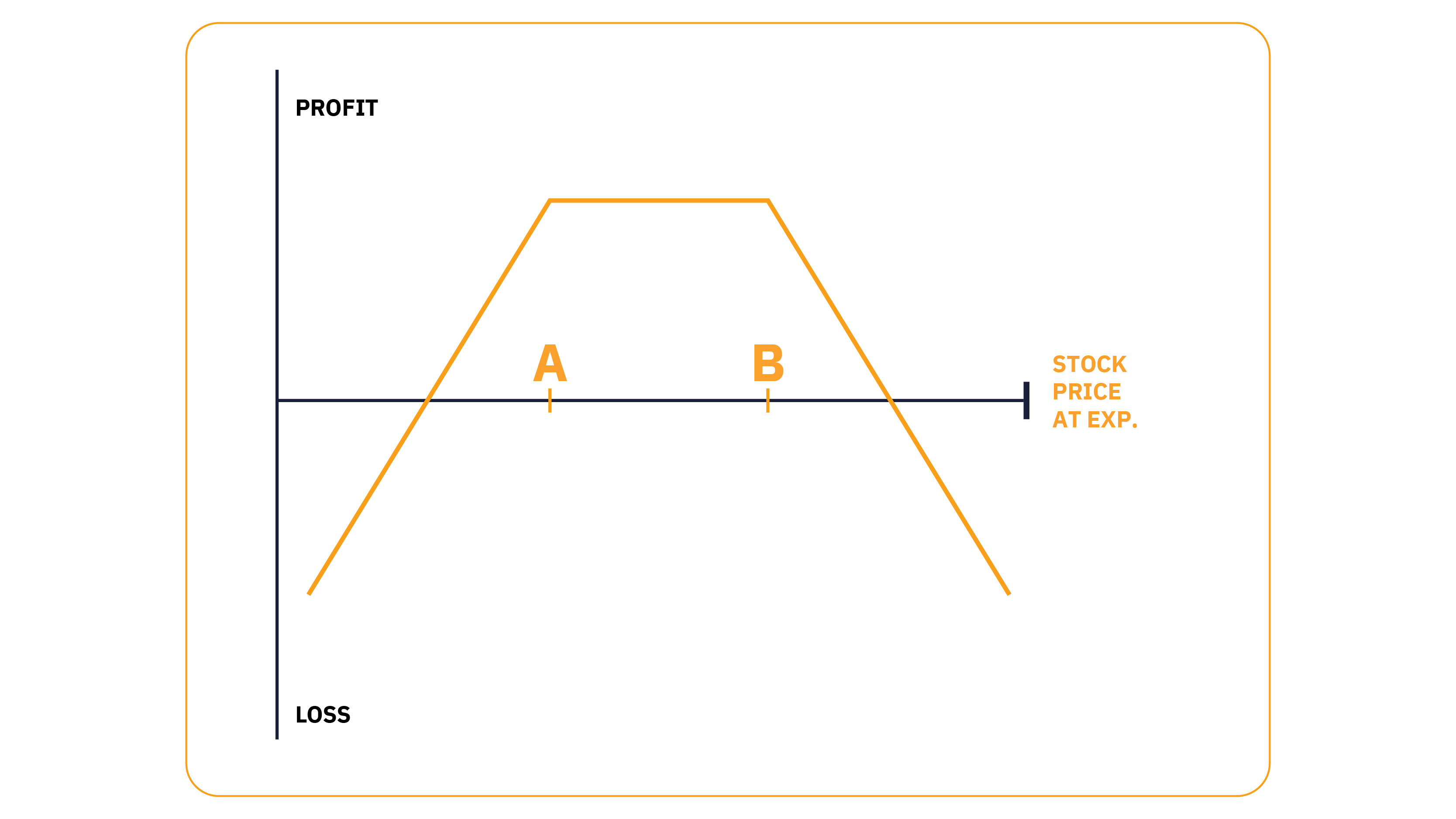

Short Strangle Payoff Diagram

If you're looking for a cheaper alternative to the straddle with the same upside potential, try a strangle.

The strangle uses OTM strikes with the same expiration date — usually the same distance from the current market price.

A long strangle could look something like this:

- Buy one OTM call costing $50

- Buy one OTM put costing $50

Meanwhile, a short strangle could look like this:

- Sell one OTM call costing $50

- Sell one OTM put costing $50

A strangle is always cheaper than a straddle because it takes more movement to profit.

To profit, you need the market to be above the call, or below the put, by more than $100.

The strangle, like the straddle, has tremendous upside potential. The drawback is that using OTM strikes means there's less chance either will expire in a profit.

- Potential Profits: Unlimited profit potential on the upside

- Potential Losses: Limited to the total cost of the strangle plus commissions

Read more: Straddle Options Strategy: How to Consistently Make Profits

Butterfly

Long Put/Call/Iron Butterfly Spread

Short Put/Call/Reverse Iron Butterfly Spread

Skip Strike Butterfly (With Calls) Payoff

Skip Strike Butterfly (With Puts) Payoff

Inverse Skip Strike Butterfly (With Calls)

Inverse Skip Strike Butterfly (With Puts)

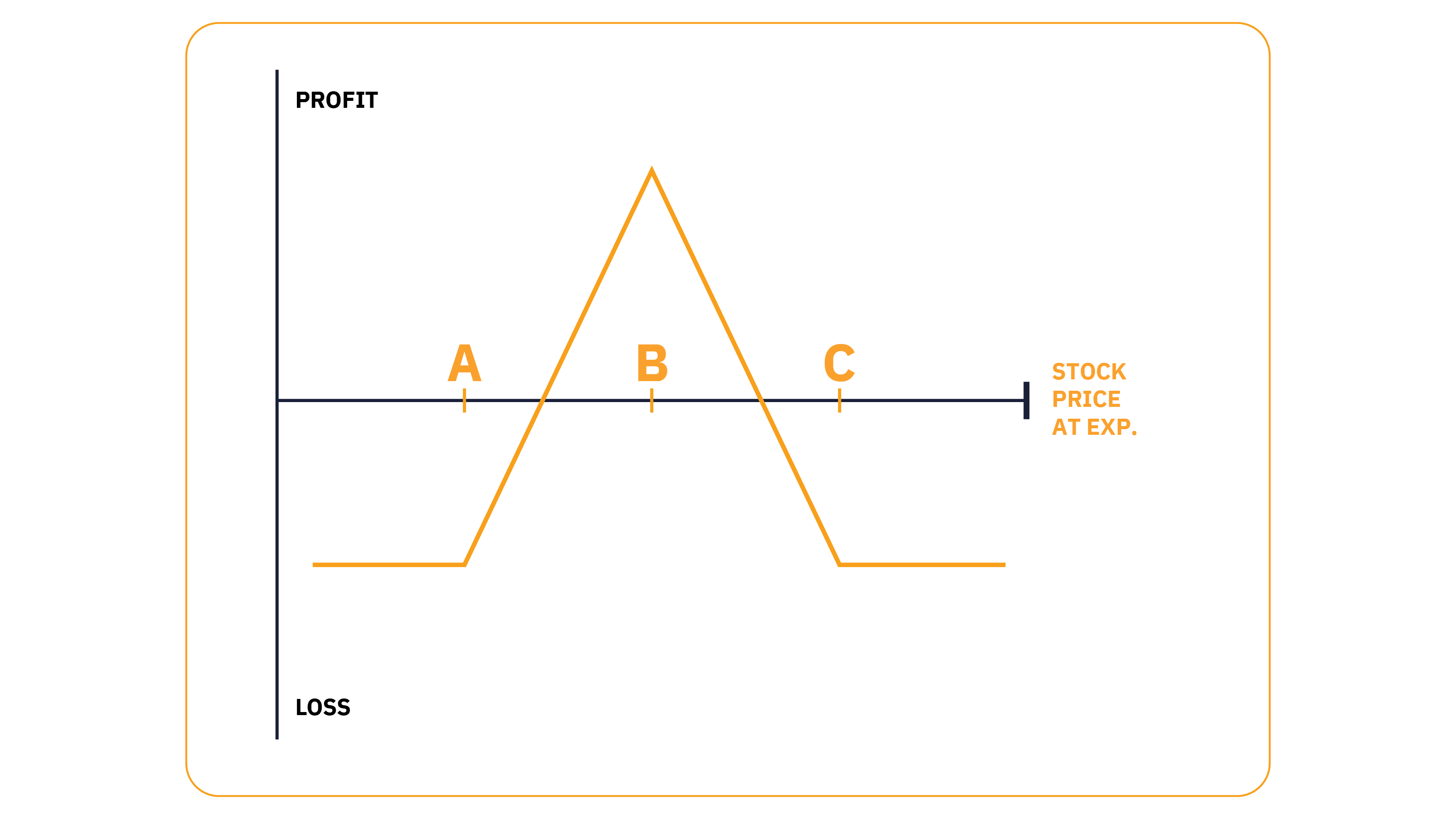

The butterfly Option is another way to profit from implied volatility. Its name comes from the shape of its payoff, which looks like a body with two wings. The butterfly has many variations, including the long put butterfly, the iron butterfly and the inverse skip strike butterfly.

Typically, butterfly strategies are used in a moderately bullish or bearish market, or when a trader doesn't expect the security’s price to move significantly in the future.

In theory, you can trade a butterfly using only calls or puts. However, to keep it simple, let's use a combination of both — a variation known as the reverse iron butterfly.

The strategy involves buying a put and call with the same strike price (usually ATM) and selling an OTM put and call, all with the same expiration dates.

Think of it as a straddle with limited upside if you're buying, and capped downside when selling. You might trade a reverse iron butterfly if you're looking for a low-risk way to profit from rising implied volatility.

The setup for the reverse iron butterfly (long volatility) looks something like this:

- Sell one OTM call, receiving a premium of $25

- Buy one ATM call costing $100

- Buy one ATM put costing $100

- Sell one OTM put, receiving a premium of $25

In this example, the cost is $150, which is the most you can lose (premium paid of $200 − premium received of $50).

Like the straddle, you can almost guarantee that one of the long strikes will expire ITM, so you're unlikely to lose all of your premium. The drawback is that you have a limited upside.

The most you can profit is the difference of the ATM and OTM strikes minus the premium.

The disadvantage of this trade is that, all things being equal, the at-the-money Options will lose value faster (time decay) than the OTM strikes. Because of this, many traders prefer the standard iron butterfly, which profits from time decay and low IV.

- Possible Profits: (ATM − OTM) − Premium

- Potential Losses: Restricted to the total premium paid (i.e., the cost of opening the position + commissions)

Read more: Butterfly Spread: Stand to Profit With Limited Loss

Iron Condor

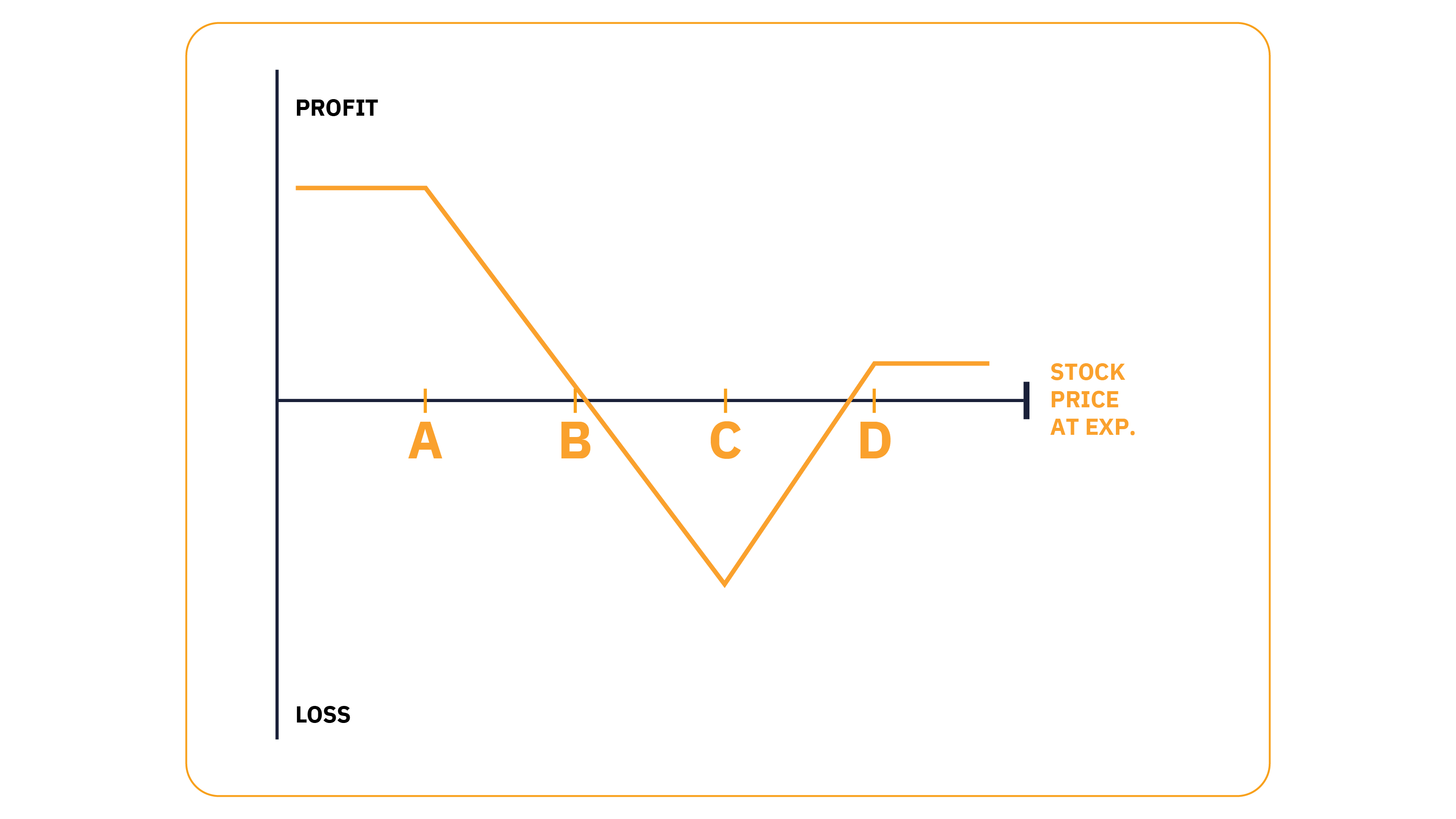

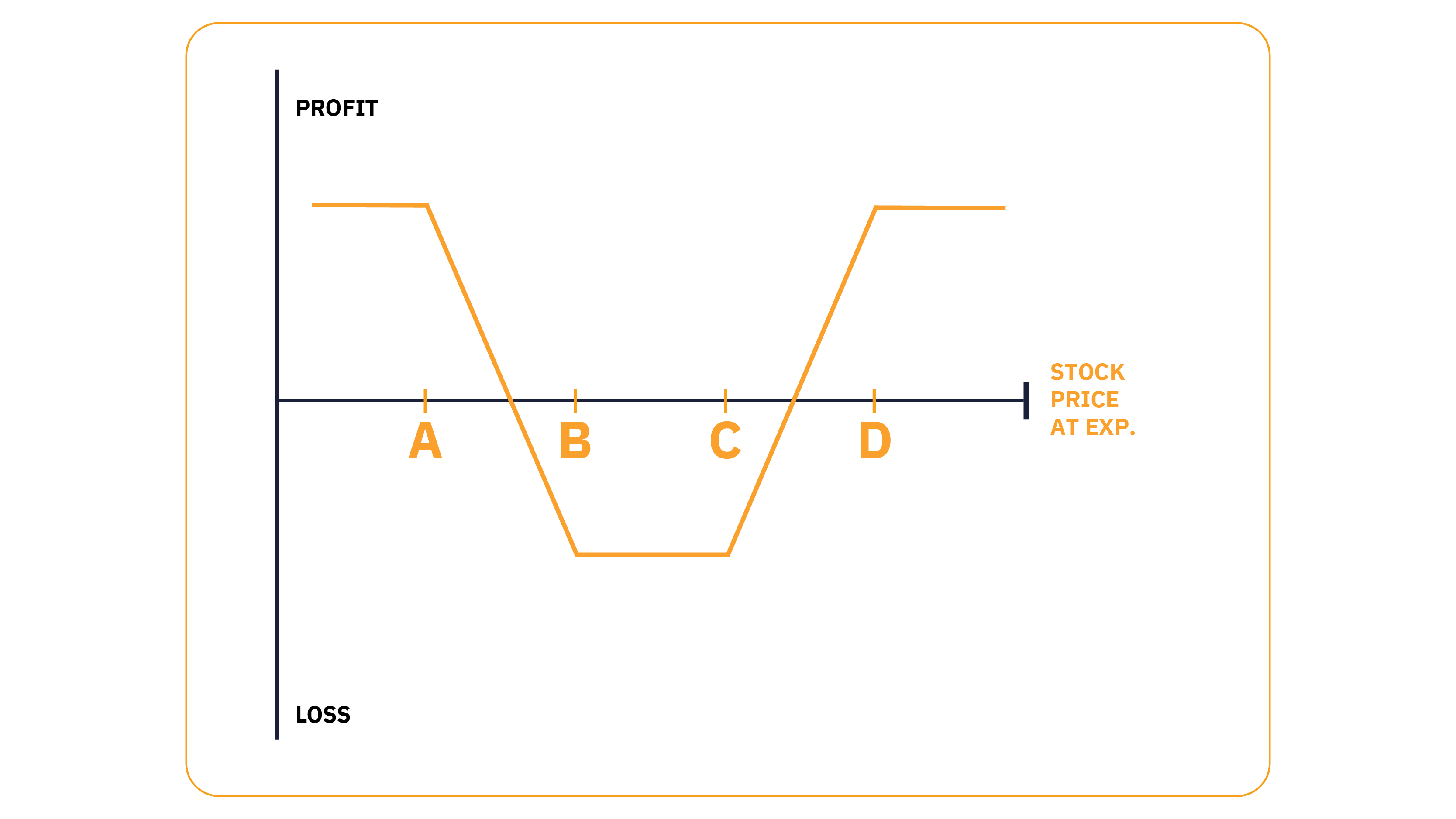

Iron Condor

Reverse Iron Condor

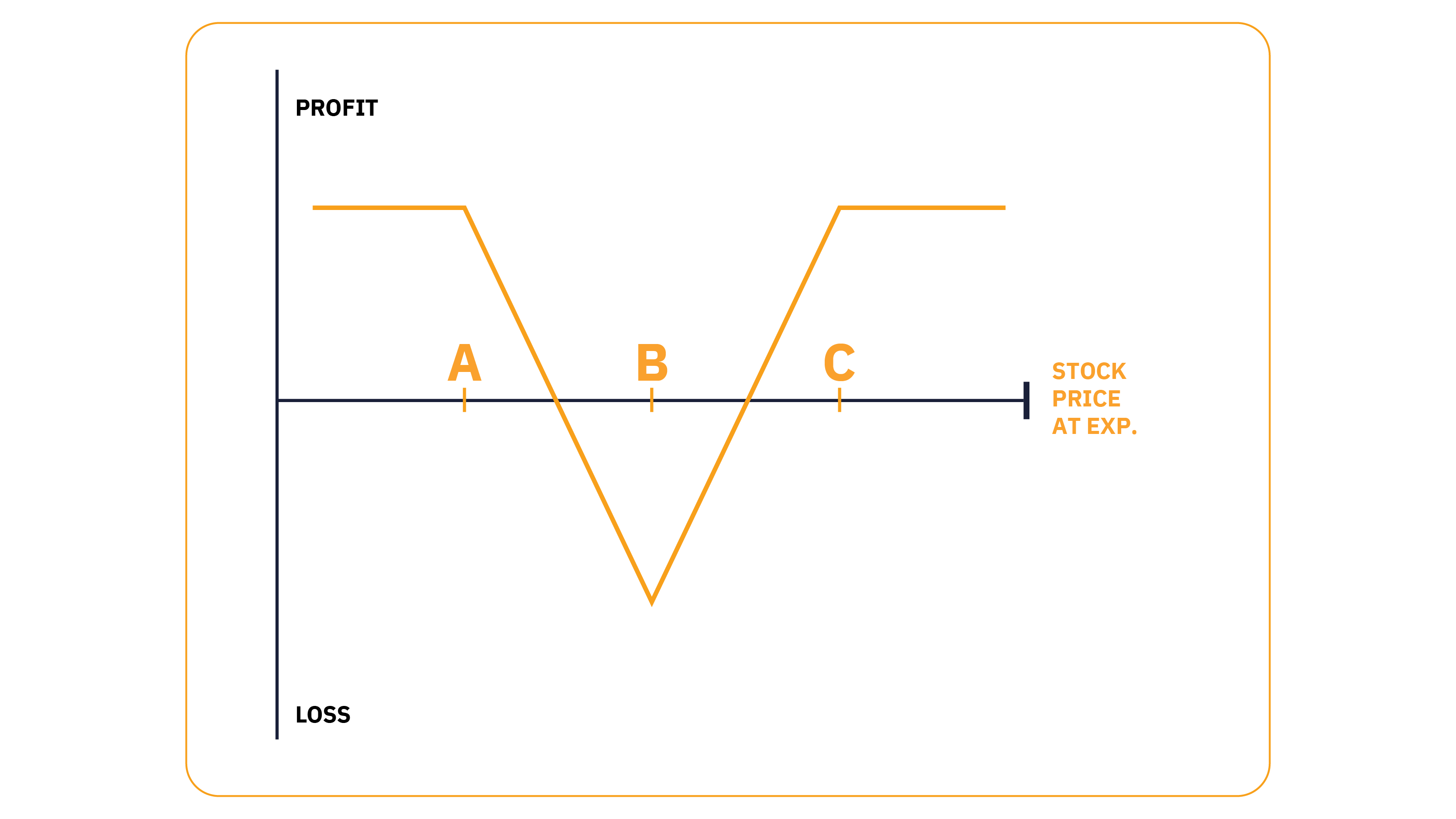

The iron condor is a great low-risk strategy for generating profits when you're unsure of direction.

In the same way we think of a butterfly as a straddle with wings, we can think of the iron condor as a strangle with wings. Like the butterfly, the iron condor profits from changes in implied volatility. The difference is that you use OTM strikes to set up the iron condor.

The best time to use the long iron condor is when you want a low-risk way to profit from little to no price movement.

To take advantage of time decay, it’s best to choose Options expiring in 30–45 days.

To set up the long iron condor:

- Sell one OTM call

- Buy one further OTM call

- Sell one OTM put

- Buy one further OTM put

Because the strikes sold are closer to the market, you receive a net credit to make the trade, which is the most you can make.

The best possible outcome is when the settlement price is between the short strikes, and all the Options expire worthless.

The maximum potential loss occurs if either of the outer strikes expires ITM.

- Potential Profits: When the settlement price is between the short strikes, and all the Options expire worthless

- Potential Losses: Difference of Inner and Outer Strike Price − Net Premium Received

To profit from rising volatility, you’ll want to use the reverse iron condor. We'll get to that soon. First, let's jump to our fifth veteran trading strategy — the Christmas tree butterfly.

Read more: Iron Condor: A Flexible & Fixed-Risk Options Trading Strategy

Christmas Tree Butterfly

Christmas Tree Butterfly Spread With Calls

Christmas Tree Butterfly Spread (With Puts)

If you're feeling mildly bullish or bearish, the Christmas tree butterfly might be for you.

The best time to use this strategy is when you have a neutral-to-bullish view (Christmas tree butterfly call) or a neutral-to-bearish view (Christmas tree butterfly put).

Let's look at a bullish Christmas tree using calls.

- The first step is to buy an ATM 1x call Option. You then sell 3x calls two strikes higher, and buy 2x calls one strike above those. (If this seems confusing, that's because it is.) Let's see how it works in practice.

- Assuming BTC is trading at $30,000 and the strikes have $1,000 increments, a long call Christmas tree would look like this:

- Buy 1x $30,000 call — sell 3x $33,000 call — buy 2x $34,000 call.

- Ideally, you want BTC to settle as close to $33,000 as possible, without the $33,000 call expiring ITM.

- The most you can lose is the cost of the trade (net debit), and the maximum profit is the difference that results when you subtract the 3x short strike and total premium cost from the long ATM strike.

- For the bearish Christmas tree butterfly with puts, you use the same approach with one ATM put and two OTM put strikes.

To calculate the maximum profit you can make, deduct the 3x short strike and total premium cost from the long ATM strike. Here’s the formula:

- Maximum Profit = Long ATM Strike − 3x Short Strike − Total Premium Cost

- The maximum loss you can incur from this strategy is the cost of the trade (net debit).

- Maximum Loss = Cost of the trade (net debit)

Part 5: How You Can Make Money When The Market Goes Sideways

Scenario 1: Neutral Market

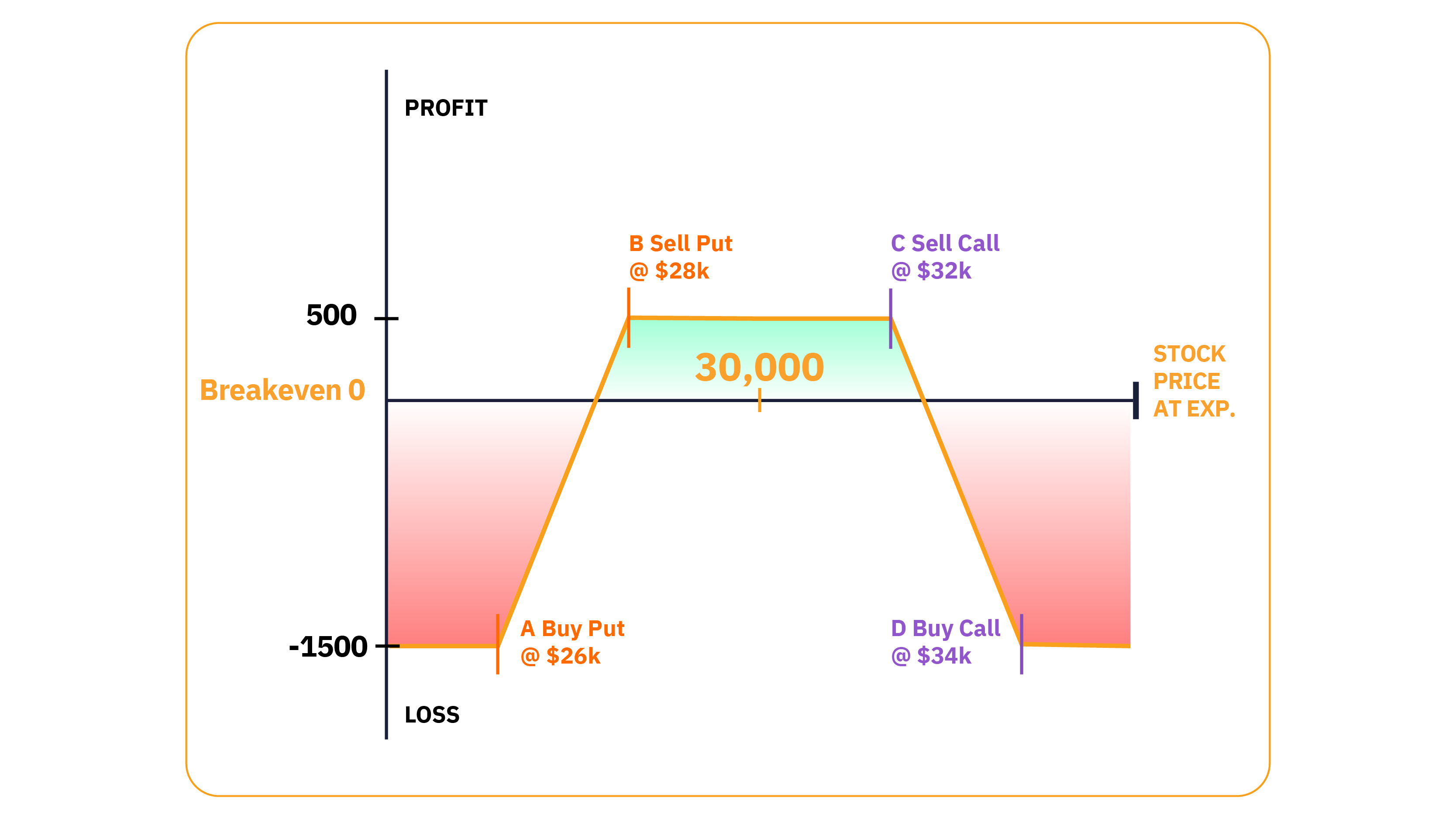

If you're looking for a low-risk, price-neutral strategy that profits from falling IV, use an iron condor Options strategy.

To make it price-neutral, you sell strikes at the same distance from the underlying and buy strikes further out (by the same distance again). Doing this gives you a symmetrical payoff.

Example:

If BTC is trading at $30,000, you may choose something like this:

- Buy one $26,000 put, costing $100 (A)

- Sell one $28,000 put, receiving a premium of $350 (B)

- Sell one $32,000 call, receiving a premium of $350 (C)

- Buy one $34,000 call, costing $100 (D)

You receive a net credit of $500, which is also the maximum potential profit.

The calculation of the net credit:

(Put spread $250) + (Call spread $250) = $500

The great thing about this trade is that you have a wide window to achieve maximum profit (between $28,000 and $32,000), and even more leeway before any losses are incurred (below $27,500 or above $32,500).

The worst possible outcome occurs when strike A or D expires ITM. Here, you lose $1,500 (maximum loss of $2,000 − premium profit of $500 = $1,500).

For the best chance of success, employ the iron condor when IV is high and expected to fall.

But which variation works best to hedge an underlying crypto portfolio — the iron condor or the reverse iron condor? The answer lies in how implied volatility (IV) reacts to different market conditions.

In most cases, implied volatility jumps when the market sells off quickly, as longs rush to liquidate positions. That's why the reverse iron condor (long volatility) works better than the standard iron condor for hedging your crypto portfolio against uncertainties.

If the market moves sharply lower, the put Options work as a bear put spread, helping offset the mark-to-market losses in the underlying asset.

This way, you can use the profits from the reverse iron condor to lower the purchase price of your BTC holding (original purchase price − profit from iron condor).

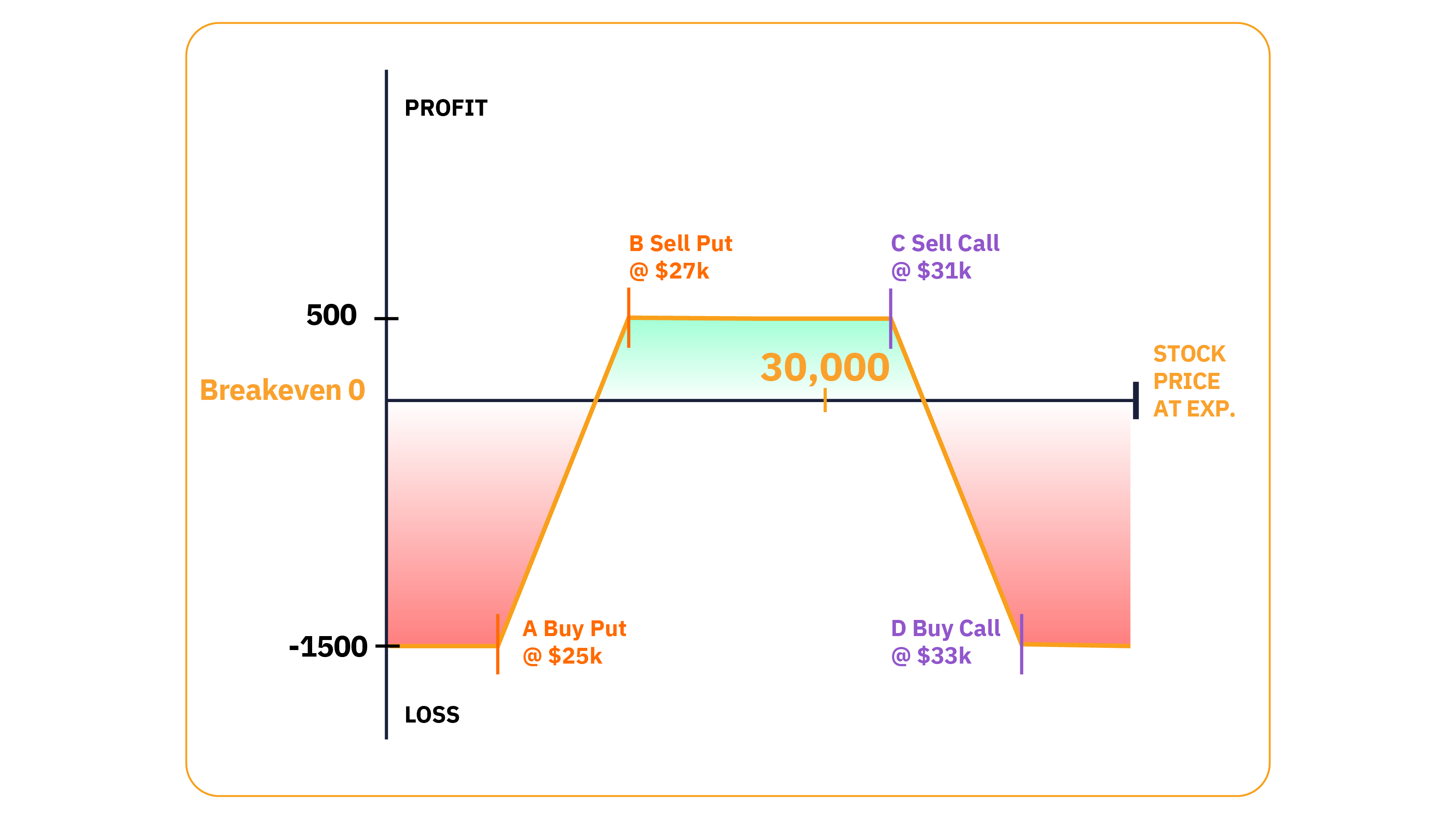

Scenario 2: Bearish Market

If you're after a low-risk, moderately bearish Options strategy that profits from falling IV — the iron condor could be the perfect play.

In this hypothetical scenario, BTC has been highly volatile in a wide trading range for the last month, and you expect the market will move much less in the coming weeks, causing IV to decrease.

You think a downside move is more likely than a rally, so you tweak the strike prices to reflect your neutral-to-bearish view.

Example:

Let’s assume BTC's current price is $30,000. Here’s how to set up an iron condor in a bear market:

- Buy one $25,000 put, costing $50 (A)

- Sell one $27,000 put, receiving a premium of $300 (B)

- Sell one $31,000 call, receiving a premium of $400 (C)

- Buy one $33,000 call, costing $150 (D)

While we can liken an iron condor to a short strangle strategy with limited downside, we can also think of it as two credit spreads ― in this example, a $27,000/$25,000 put credit spread and a $31,000/$33,000 call credit spread.

As with the neutral strategy, you have a $4,000 window to profit at expiration (between Strike B and Strike C). However, you'll notice that Strike C is closer to the underlying market price than Strike B. Therefore, you have more room on the downside before the trade reaches the breakeven point. It’s this characteristic that gives the trade a neutral-to-bearish bias.

Since strikes B and C have a combined premium of $700 ($300 + $400) and the outer strikes (A and D) have a combined premium of $200 ($50 + $150), the trade generates a net credit of $500.

Net Credit Put Spread (−$50 + $300) + Net Credit Call Spread ($400 − $150) = $500

Maximum Potential Profit: $500 Net credit between $27,000 (Strike B) and $31,000 (Strike C)

Upside Breakeven Point: Strike C + Net credit = $31,500

Downside Breakeven Point: Strike B − Net credit = $26,500

Upside Maximum Loss: Above $33,000 (Strike C − Strike D + Net credit = $1,500)

Downside Maximum Loss: Below $25,000 (Strike A − Strike B + Net credit = $1,500)

Here are some alternative strategies to profit from bearish markets:

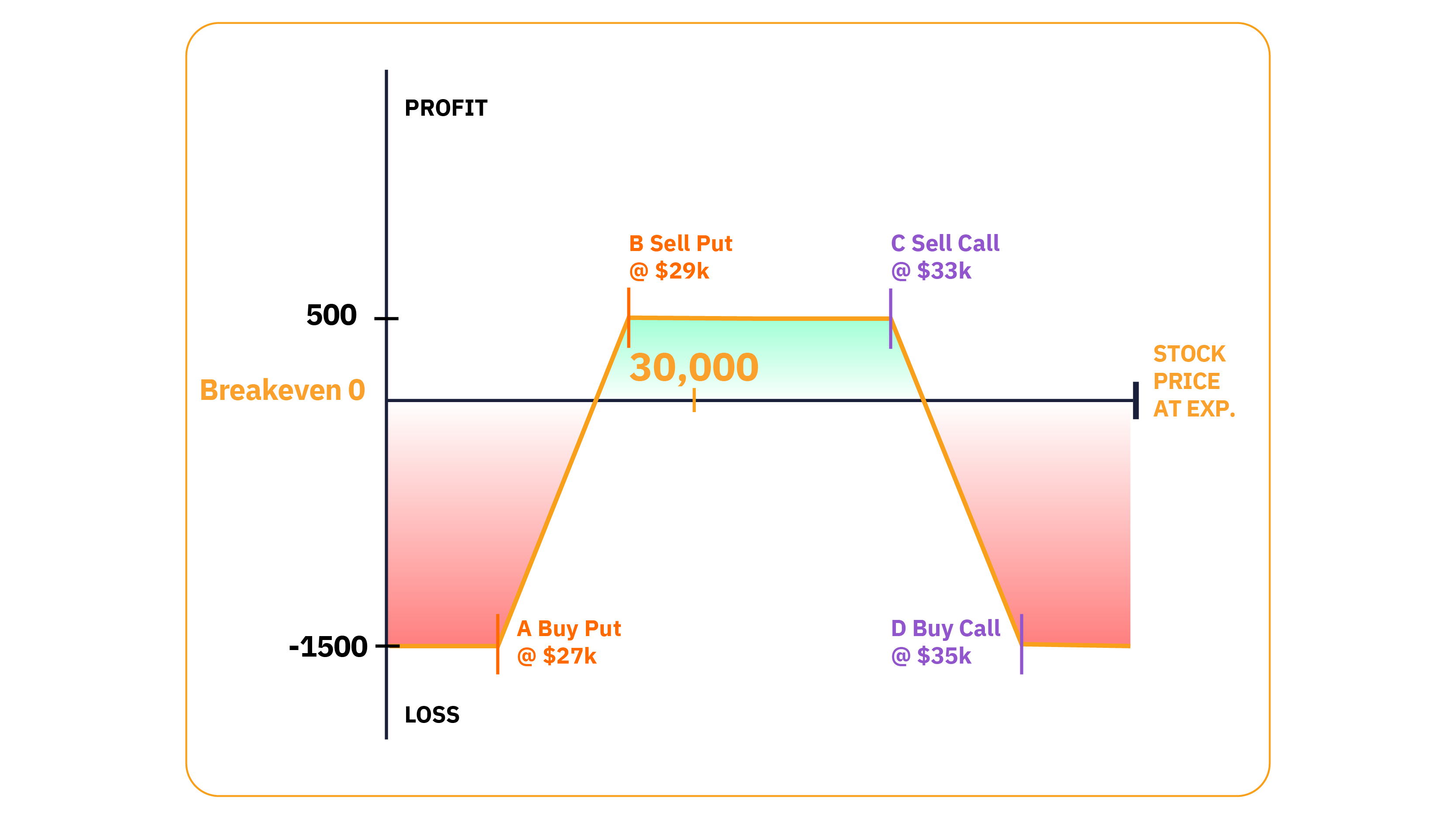

Scenario 3: Bullish Market

Here's how to use an iron condor to generate income when you expect IV to fall, and the market to trade sideways to slightly higher

In the same way you can alter the strikes to tilt the trade slightly bearish, we can change the condor’s profit range to reflect a neutral-to-bullish view.

In the following example, BTC's implied volatility has shot higher following a sharp move down, and you're expecting the market to stabilize or move moderately higher in the coming weeks.

You want to take advantage of the high Options premiums caused by the volatility spike, and you decide on the iron condor strategy to benefit from time decay and falling IV.

Ideally, you want the Options to expire in 30–45 days so they lose time value quicker.

Again, let’s assume BTC’s price is $30,000. Here’s how to set up an iron condor in a bull market.

Example:

- Buy one $27,000 put, costing $150 (A)

- Sell one $29,000 put, receiving a premium of $400 (B)

- Sell one $33,000 call, receiving a premium of $300 (C)

- Buy one $35,000 call, costing $50 (D)

Because you're selling the strikes closest to the market (B and C), you receive a net credit of $500.

The calculation of the net credit is as follows: (Sell Put option $400) − (Buy Put Option $150) + (Sell Call Option $300) − (Buy Call Option $50) = $500

Since you're collecting a premium, ideally you want all the strikes to expire OTM.

Selling Strike B closer to the underlying than Strike C skews the payoff to the right. Because of this, the breakeven point on the upside is further away than on the downside, giving you a bigger window to achieve maximum profitability if the market rises.

- Maximum Profit: Net credit of $500 between $29,000 (Strike B) and $33,000 (Strike C)

- Upside Breakeven Point: Strike C + Net credit = $33,500

- Downside Breakeven Point: Strike B − Net credit = $28,500

- Upside Maximum Loss: Above $35,000 (Strike C − Strike D + Net credit = $1,500)

- Downside Maximum Loss: Below $27,000 (Strike A − Strike B + Net credit = $1,500)

The drawback of titling the strategy to a bullish bias is that although you have a $4,000 window to achieve maximum profit, the breakeven on the downside is $1,500 away (Underlying Price − Strike B − Net Credit), as opposed to $3,500 on the upside (Underlying Price + Strike C + Net Credit).

Read more: Iron Condor: A Flexible & Fixed-Risk Options Trading Strategy

Here are a few alternative strategies to profit from bull markets:

Part 6: Top 5 Mistakes to Avoid When Trading Crypto Options

Whether you're a rookie or a veteran, you've learned different ways to profit from Options. Now, it’s time to discover Options trading mistakes everyone should avoid.

Mistake 1: Buying Options without considering market volatility

The first Options trading mistake is buying Options without paying attention to their price. Options are priced with implied volatility. Since the market’s future volatility is unknowable, Options may sometimes be priced too high. Thus, even though you may be directionally correct, you could still be wrong if the market doesn’t move enough to cover the premium paid.

Mistake 2: Selling Options without hedging or proper risk management

The second Options trading mistake relies only on naked shorting Options (selling OTM Options without hedging). While it’s true that Options sellers usually have a positive expected return, a short Options position during volatile markets —without proper risk management — can bankrupt even the most seasoned traders.

Mistake 3: Too many directional bets and a make-it-all-back-in-one-go mindset

Even most seasoned Options traders can incur large drawdowns, which may affect how the trader interprets the market, and that’s when emotions can take over. It’s fine to have large drawbacks, even for consistently profitable strategies. But if the market’s not going your way, don’t jump from longs to shorts and then back again. Take a break — maybe go to the Maldives for some sun and beach and come back fresh and rejuvenated.

Mistake 4: Hesitating to trade long-dated Options

Don't let the price of long-dated Options scare you away from trading them.

Although long-dated Options aren’t the best way to take advantage of short-term price action, they work well for hedging long-term crypto holdings.

The shorter the expiration date, the harder it is to control risk. Even though theta decays more as expiration approaches (and makes money faster), the market is too volatile to price the Option correctly. Sometimes, short-dated Options are quoted much wider as well.

Instead of looking at the whole premium, see how much the Option will lose each day — and decide if that’s a price worth paying.

Mistake 5: Attempting complex trading strategies off-the-bat

Don't run before you can walk.

You might impress your friends by telling them about the 16-legged vol-crush, theta eater Options strategy you have running — but sometimes, less equals more.

Rather than overcomplicating things, express your view in the simplest way possible.

The best plan is to start slowly, gradually increasing in complexity as your knowledge and experience grows. The more legs you build, the more slippage cost (the cost of paying the market price) you may have to pay.

Part 7: Advantages and Risks of Crypto Options Trading

Advantages

- With a small deposit (premium), you can use leverage to supercharge your buying power and gain access to a larger amount of crypto assets than when buying outright — giving you more bang for your buck.

- They say timing is everything, but you don't need to be so precise when dealing with Options. To give yourself enough time to profit, you can trade Options contracts weeks/months into the future.

- If low risk and high profit are what you're looking for, then buying Options could be the answer — just ask the lucky trader who, in minutes, made over 1,300% just by trading Options.

Risks

- Buying Options is considered fairly low-risk, but there's no such thing as a free lunch. There’s always the risk of losing all your invested capital, and the market can be rather unforgiving, especially for beginner traders.

- Because Options lose value over time, most strike prices expire OTM with zero value.

- While buying Options is low-risk, we can't say the same for selling. Selling naked (unhedged) Options carries the same (high) risk as trading futures.

Part 8: Checklist: One-Week Plan to Get Started with Crypto Options Trading

Monday: Gain a basic understanding of Options.

Tuesday: Open an account with Bybit’s testnet. Get acquainted with various T&Cs (including Bybit’s margin fees) and promotions. Learn how to evaluate the ups and downs of the market.

Wednesday: Determine the amount of capital you have available.

Thursday: Be sure you can answer these questions: What’s your risk appetite? What’s the greatest amount of money you can afford to lose?

Friday: Decide on your contract holding period.

Saturday: Choose the right trading strategy for you.

Sunday: Wait for the right time to place a trade, and make your move.

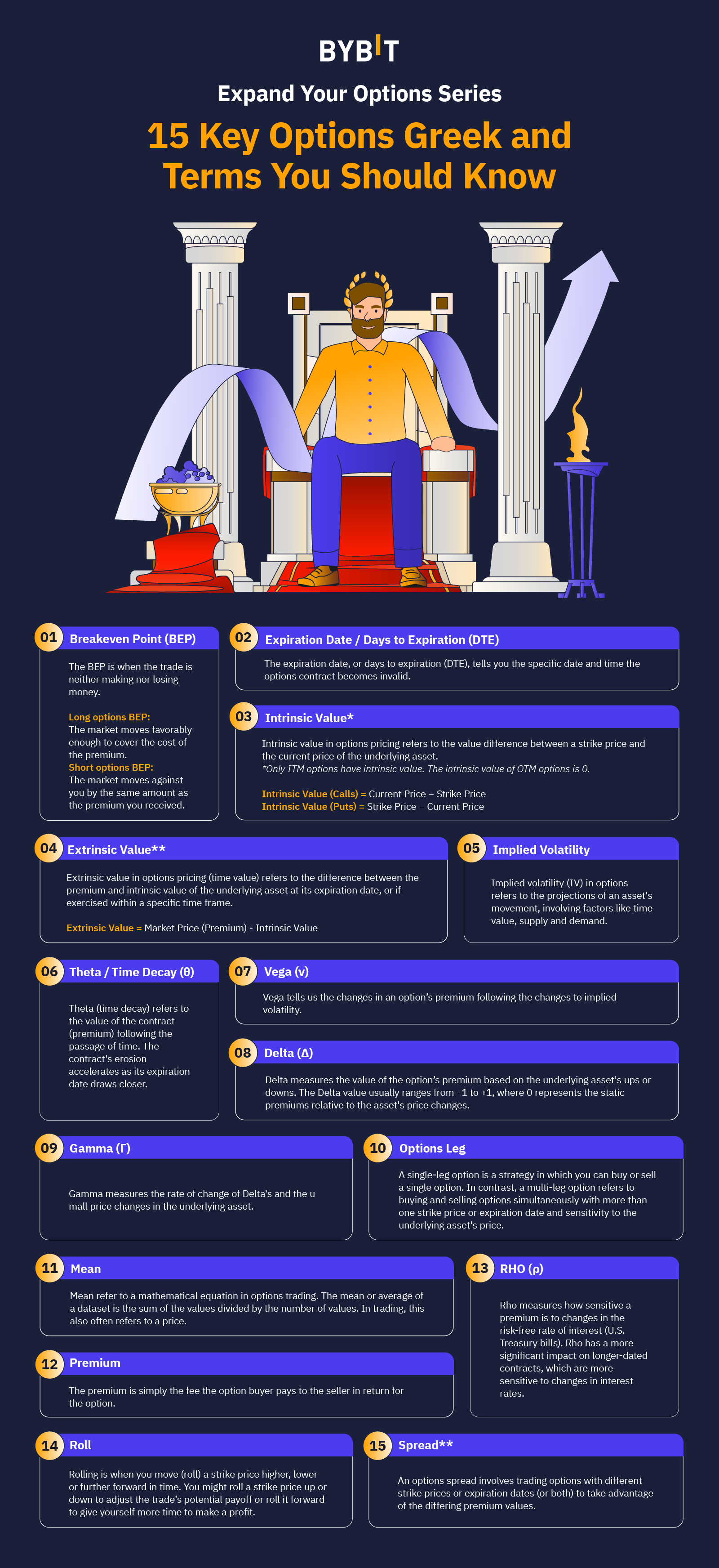

15 Key Options Greeks and Terms to Know

1. Breakeven Point

In order to consistently profit from trading, you need to know a trade's breakeven point.

The breakeven is the point when the trade is neither making nor losing money. For long Options, this is when the market moves favorably enough to cover the cost of your premium. A short Option breaks even when the market moves against you by the same amount as the premium you received.

2. Expiration Date/Days to Expiration (DTE)

The expiration date tells you when the Option contract becomes void. Days to expiration (DTE) is simply the same thing expressed in a different manner.

3. Intrinsic Value

Intrinsic value is the value an Option would have if exercised immediately.

Say you buy a 1.0 BTC call Option with a strike price of $30,000. The call has intrinsic value when the price of BTC is above $30,000, and none below $30,000.

If BTC jumps to $35,000, the call Option has an intrinsic value of $5,000.

It’s important to remember that only ITM Options have intrinsic value. The intrinsic value of OTM Options is 0.

Intrinsic Value (Calls) = Current Price − Strike Price

Intrinsic Value (Puts) = Strike Price − Current Price

4. Extrinsic Value

Working out intrinsic value is easy — it's always the amount the Option is ITM. Extrinsic value, on the other hand, is trickier to calculate.

Extrinsic value is the part of a premium made up of implied volatility (IV) and days to expiration.

We know a BTC $30,000 call Option has $5,000 of intrinsic value when BTC is trading at $35,000. But depending on how volatile the market is and how long the Option has left to run, it could also have $1,000+ of extrinsic value.

Why? Because BTC could trade even higher before the expiration date.

You can think of extrinsic value as the amount over the intrinsic value which you pay for future opportunities.

Extrinsic Value = Market Price (Premium) − Intrinsic Value

5. Implied Volatility

Implied volatility (IV) is the Options market’s way of forecasting how much an asset will move.

An OTM Option on a volatile asset with big price swings is much more likely to expire with value than an Option on an asset that barely moves. Because of this, higher IV results in higher Option premiums, and vice versa.

You can work out exactly how much volatility will affect an Option by using vega.

6. Vega (𝝼)

Vega tells us how much an Option’s premium should change each time IV moves 1%.

Say a BTC call Option has a premium of $100, implied volatility of 50% and a vega of 0.20. If IV increases to 51%, the premium rises to $100.20 ($100 + $0.20). And if the IV drops from 50% to 49%, the same premium falls to $99.80 ($100 − $0.20).

7. Theta/Time Decay (θ)

Options contracts lose value as time passes. Theta (time decay) is how you measure this erosion.

For longer-dated Options, the time decay moves slowly, causing a small amount of the premium to disappear daily. But as expiration draws nearer, time decay gets faster and faster until the premium’s time value eventually reaches zero when it expires.

8. Delta (Δ)

Delta tells us how much an Option premium should change each time the underlying asset rises by $1.00.

Call Options always have a positive delta ranging between 0 and 1.0 (market up = premium up).

For puts, delta is always negative and ranges between −1.0 and 0 (market down = premium up).

We can jump back to the earlier $30,000 call to see delta in action.

When the price of BTC is equal to the strike price ($30,000), the Option is a coin-toss — it has the same chance of expiring ITM as it does OTM. That’s why ATM Options usually have deltas of +0.50/−0.50.

Here, if BTC goes up by $1.00, the premium rises by $0.50, and if BTC falls by $1.00, the premium loses $0.50.

Another way to look at it is that your exposure is equal to half a Bitcoin (1.0 BTC trade size × 0.50).

As time passes, if the Option is ITM, the delta will eventually reach 1.0 (at expiration), where your exposure is equal to 1.0 BTC.

9. Gamma (Γ)

Gamma tells us how much the delta will change when the underlying asset moves $1.00.

Gamma is highest for ATM Options, since they hang in the balance between profit and loss, especially as the Option gets closer to expiration.

10. Options Leg

An Options leg refers to each Option in a strategy.

A one-legged strategy is a lone put or call. Using two different Options together creates a two-legged play, and so on.

There's no limit to the number of legs you can combine when trading Options. However, managing a strategy with fewer legs is unquestionably easier than one resembling a centipede.

11. Mean

Walk onto any trading floor and you’ll hear people throwing around the terms “mean” and “average.” While they could be taken as insults in everyday life, in Options trading, they refer to a mathematical equation.

The mean or average of a dataset is the sum of the values divided by the number of values. In trading, this often refers to a price.

You’ve probably heard of dollar cost averaging (DCA), so let’s start there.

Here’s a hypothetical scenario: Say you decide to buy 0.2 BTC each month until you reach a total holding of 1.0 BTC. Using the individual prices and the number of purchases, we can calculate your average (or mean) purchase price as follows:

- Buy 0.20 BTC at $20,000

- Buy 0.20 BTC at $22,000

- Buy 0.20 BTC at $24,000

- Buy 0.20 BTC at $26,000

- Buy 0.20 BTC at $28,000

The first step is to add the costs together to find the sum of values ($20k + $22k + $24k + $26k + $28k = $120,000). Next, you divide $120,000 by the number of values, which in this case is the number of purchases ($120,000/5 = an average purchase price of $24,000).

12. Premium

The premium is simply the fee the Option buyer pays to the seller in return for the Option.

13. Rho (ρ)

Rho is one of the five Greeks (like delta, gamma and theta). Rho measures how sensitive a premium is to changes in the risk-free rate of interest (for U.S. Treasury bills).

Rho doesn’t have much impact on short-dated Options but can impact longer-dated contracts, which are more sensitive to changes in interest rates.

14. Roll

In Options trading, rolling is when you move (roll) a strike price higher, lower or further forward in time.

You might roll a strike price up or down to adjust the trade’s potential payoff, or roll it forward to give yourself more time to make a profit.

15. Spread

You’ll encounter the word “spread” many times when trading Options. Sometimes, it means the gap between the bid and ask prices (the bid-ask spread), and sometimes it means the difference in value between two strike prices or expiration dates.

An Option spread involves trading Options with different strike prices, expiration dates or both, in order to take advantage of the differing premium values.

Frequently Asked Questions (FAQ) About Hedging With Options

1. Can a Beginner Trade in Options?

Absolutely! With just a little knowledge, anyone can trade in Options. We’re here to help you on your journey.

2. Are There Options on Cryptocurrency?

Yes. Bybit offers a wide selection of crypto Options. At the moment, you can trade BTC, ETH and SOL Options on our platform.

3. How Do BTC Options Work?

To learn about the A to Z of Bitcoin Options, click here.

4. What’s the Best Way to Learn Options Trading?

The best way to learn Options trading is to take advantage of Bybit Learn’s free educational content. We take pride in providing you with the latest and best information available.

5. What’s The Safest Options Strategy?

The safest Options strategy is arguably a long Option, with limited downside. Remember, however, that your premium is at risk for all Options trading strategies.

.jpg)

.jpg)

.png)