Put Options: Effectively Manage Price Risk With This Tool

Financial markets have been abuzz with activity since the 17th century. While they’re a great place to make profit, the risk of losing money is also very real. Multiple asset classes are available for trading: Among them, options are considered a relatively low-risk investment. Traditionally, stock options are traded, but it’s hard to ignore crypto options, given the boom of cryptocurrency in the past few years.

While options can be tied to any asset (e.g., stocks or bonds), crypto options are specifically tied to the performance of crypto assets. As a result, a trader doesn't need to own an asset before buying or selling the option for it. With crypto options, investors of any portfolio size can participate in the crypto market and reap its benefits.

What Are Crypto Options?

Crypto options are financial derivative products that confer upon the trader the right (not the obligation) to buy or sell an underlying asset at a specified price or strike price after the premium is paid. An options contract usually lasts for a specific time period, within which the option must be exercised. This contract lapses on a particular date, known as the expiration date.

Crypto options trading is a way for options holders to be part of the crypto market without necessarily owning the crypto itself. Not only are crypto options cheaper than their underlying assets, they’re also perceived to be less risky. The low level of risk involved and high leverage potential are arguably the biggest draws for retail traders.

Apart from giving traders a way to predict or speculate on the financial value or price movements of assets in the market, options are also used by institutional investors for hedging. As cryptocurrency is a volatile asset class, crypto options have become a popular alternative for investors looking to get a slice of the crypto pie.

What Are Crypto Put Options?

Crypto put options are contracts that confer upon the option buyer the right (but not the obligation) to sell a specific amount of an underlying asset at a predetermined price within a particular time frame. The predetermined price is known as the strike price.

“Expiration time” refers to the time frame within which the options contract is still valuable. Once the expiration time has passed, the put option loses all its value.

Various underlying assets like stocks, bonds, indexes and futures can be traded using put options, by which the seller determines how the contract is run. The options buyer is required to pay the seller a specific fee on each share in order to purchase the contract. This fee is known as the premium.

Each crypto option is known as a contract, and it represents one of the same underlying assets. For example, one crypto option contract on BTC would be the same as controlling 1 BTC token. You do not have to own the underlying cryptocurrency to buy or sell put options.

A crypto put option — the opposite of a crypto call option — confers upon the user the right to sell an underlying stock at the strike price before the expiration date is reached. Several factors affect the price of a put option, including (but not limited to) the volatility of the crypto market, interest rates, time decay, and the value of the strike or specific price.

Generally, the value of a put option increases with a drop in the price of the underlying asset.

How a Crypto Put Option Works

A portion of a crypto put option’s value is tied to a fall in the price of the underlying stock. This means that the value of a put option increases with a decrease in the price of the underlying asset. A put option begins to lose value with a rise in the price of the asset to which it is tied. Following this, put options are used for hedging, or predicting a downward slope in the price of specific assets.

The concept of the protective put is one used by put options traders as a risk management strategy. The main function of a protective put is to make sure that the drop in the price of a particular asset doesn’t fall below a set level. You can decide to sell or buy a put option, and the transaction is carried out on a cryptocurrency exchange.

When buying a put option, the buyer predicts that the value of the asset will drop over a specified time frame before the expiration date. When selling a put option, the seller speculates that the value of the asset will rise or remain unchanged during the valid period of the contract, or before the option expires.

If the market price moves in favor of the options holder, they can decide to exercise their put by selling the underlying asset at the strike (or set) price. Fundamentally, options can be divided into two types: American-style options and European-style options.

American-style options allow the holder to exercise their option on or before the expiration date, while European style options only allow the holder to exercise their options on the date of expiration. If the market price remains the same or increases, the options sellers get the premium paid by the buyer.

A put option is said to be OTM (out of the money) if it has no intrinsic value at expiration. On the other hand, it is said to be ITM (in the money) if it still has intrinsic value at expiration.

Crypto Put Options vs. Crypto Call Options

Other than put options, the other main type of option is the call option, which increases in value as the price of the asset rises. Call options are the opposite of put options, but both types give holders the chance to earn a profit much higher than their investments.

A put option benefits from a decline in market price, while a call option benefits from a rise in the market value of the asset.

Selling both a call option and put option attracts a premium. In the event that the crypto market takes an unfavorable turn, the seller bears all the risks involved.

Example of a Crypto Put Option

Let’s say that Sandra, an investor, decides to buy a Bitcoin put option as a form of insurance over her position in Bitcoin. After a while, she speculates that a bear market is near, and she isn’t ready to forfeit more than 10% of her long position in Bitcoin.

Let’s assume Bitcoin is currently trading at $30,000 per coin, and Sandra purchases a put option that will give her the right to sell it at $27,000 within the next 2 years.

If, within 6 months, a 20% (500 points) loss is recorded, Sandra will have recovered 250 points simply by being able to sell at $27,000, rather than the current market price of $24,000, which is a loss of only 10%. Even if the market crashes to $0, Sandra will still only record a loss of 10%.

Conversely, if the market doesn’t drop within this time frame, Sandra can decide to let the put expire. If she does so, she will only lose the premium fee.

Buying and Selling Puts: Strategies and Examples

Long Put

This is a popular strategy used by traders. Here, the trader buys a “going long” put option in the hope that the market price will fall below the strike price at expiration. The benefit of this strategy is that in the event of a drastic price reduction, the trader can get back many times their initial investment.

Example

Stock Q trades for $30 per share, with a strike price of $30 with 4 months to expiration. The premium is $1 per share.

If, at expiration, the share price is $29, the put breaks even. If it is between $29 and $30, a net loss is recorded, as only a part of the option’s premium is recovered.

If the stock falls to less than $29, the trader gains $100 for every share they own. The lower the price, the higher the gain recorded by the trader. If the stock rises above $30, the put is rendered valueless, and the trader loses the option premium of $100.

Short Put

This is simply the opposite of the long put. Here, the trader sells a “going short” put in the hope that the asset price will rise above the strike price at the point of expiration. The seller of the put earns a premium in exchange for selling the put. This premium is the highest reward that can be obtained for trading a short put. If the asset price falls below the strike price, the trader is obligated to buy it back at the strike price.

Example

If stock A is trading at $40 per share, with a strike price of also $40 with 5 months to the expiration date. The premium is $1 per share.

If, at expiration, the share price is below $39, the put costs the trader $100 for every dollar loss. The lower the stock price, the greater the loss incurred by the trader. If the stock price rises above $40, the seller earns the full premium. If the market price falls between $39 and $40, the seller earns only a part of the premium.

Married Put

This is simply an upgrade of the long put. In this case, the trader buys both the underlying asset and a put option. This is a hedging technique. The trader expects the asset price to soar, but still wants a form of insurance in case the stock price declines. If the stock price actually declines, the long put covers the loss incurred.

Example

Stock P trades for $30 per share, with a strike price of $30 with six months to expiration and a total premium of $100. So, the trader buys 100 shares of P for a total of $3,000 and one put option for $100.

If at expiration, the share price is $29 or $30, the put breaks even, resulting in a net loss, as only a part of the premium is recovered. If the share price drops below $30, the long put covers the loss evenly. If the share price rises above $31, the net gain increases by $100 for every corresponding gain in price, although the put becomes valueless, and the trader loses the premium fee they paid.

Bull Put Spread

This strategy is very popular in options trading. The bull put spread is typically used when the call trader or call writer speculates on an increase in the future price of an underlying asset.

The key to using this strategy is to sell higher and buy lower. Simply put, you sell a put option with a higher strike price, and then buy another option with a lower strike. However, both options must have the same expiration date.

Although the risks involved here are minimal, they do still exist. If, at expiration, the asset price moves below the strike price, a loss will be recorded, as the two put options will be ITM.

Example

For instance, an institutional investor guesses that the price of Bitcoin — selling at, say, $20,000 per token — will increase within a month.

The investor can sell one put option for a $3,000 premium fee, with a strike price of $25,000 expiring in one month, and buy another put option for a premium fee of $1,000, with a strike price of $22,000, set to expire in one month.

Following this example, the investor gains a net profit of $2,000. The net profit is calculated as the difference between the two premium fees paid for the two options ($3,000 − $1,000 = $2,000).

Conversely, if the price of Bitcoin falls between the strike prices of $20,000 and $25,000 per token at the date of expiration, the institutional investor will record a loss.

The final price has an impact on the value of the investment. Here are the different possible scenarios (capped at a $3,000 loss and a $2,000 gain.)

$20,000 = −$3,000

$21,000 = −$2,000

$22,000= −$1,000

$23,000= $0

$24,000=$1,000

$25,000 = $2,000

Bear Put Spread

The bear put spread is applied when an investor predicts a decline in the price of an asset.

This strategy aims to reduce cost and risks, while also ensuring that the investor makes as much profit as possible.

To use this strategy, the investor first purchases a “buy put” option, after which they purchase a “sell put” option with a lesser strike price. For this to work, both options must be tied to the same underlying asset, and have the same expiration date.

Example

For instance, stock Q is trading around $350 and is bought at a $3 premium, with a total cost of $300 (100 x $3 = $300). A trader could buy it while also selling another put option at $330 at a $1 premium, with a total cost of $100 (100 x $1 = $100). The two options should, however, be executed simultaneously.

The option is calculated in spreads. The net debit spread is $2 (the price difference between the options, $3 - $1 = $2). The highest loss that can be incurred is the premium fee of $200 (i.e., $300 − $100 = $200).

By buying a put option and selling another, the trader spends $200 instead of $300 (from buying the $350 put alone). However, the profit potential is limited to [($350 - $330) x 100] - $200 = $1,800.

Should I Buy Puts In-the-Money (ITM) or Out-of-the-Money (OTM)?

Deciding to buy puts in-the-money (ITM) or out-of-the-money (OTM) is entirely dependent on your specific investment objectives, the level of capital at your disposal, your risk appetite and the interest rates. The price for ITM put options is higher than that of OTM put options. This is because ITM put options have a lot of intrinsic value, and confer on options traders the right to sell underlying assets at higher prices. However, the lower cost of out-of-the-money puts is due to the fact that they’re likely to be less profitable at expiration.

How Is Crypto Put Option Trading Different from Traditional Put Option Trading?

Traditional put trading requires the trader to own the underlying stock or asset to be sold.In contrast, in crypto put trading, the options trader is not obligated to own the particular asset before being able to sell or buy the option.

Traditional options require the holder to have a minimum trading fund, which is usually on the high side: The higher the fund, the higher the position held. However, with crypto put trading, options holders can acquire higher leverage positions with a small amount of capital.

Alternatives to Exercising a Crypto Put Option

A put option buyer isn’t obligated to hold a put option until it reaches expiration. As changes in the price of the underlying asset are recorded, the options premium fee will also be adjusted to reflect the reality of the current changes in price. The options buyer may decide to sell off their option in the options market. This is done in a bid either to make a profit, or minimize a loss. The outcome of this depends on the price variations recorded from the initial time of purchase.

Similarly, an option writer can perform the same action. If the asset records a higher price over the strike price, they may decide to leave it to expire. Doing so will ensure that they keep the entire premium. On the flip side, if the underlying asset fails, and its price drops lower than the strike price, the holder may decide to get out of their position by buying back the option to bypass making a loss. The profit or loss is calculated as the difference between the premium received and the premium paid to exit the position.

Buying Crypto Put Options

Crypto options are a derivative product that can be traded on Bybit. As of this writing (May 27, 2022), BTC options are available on the platform. Follow the steps below to get started.

Step 1

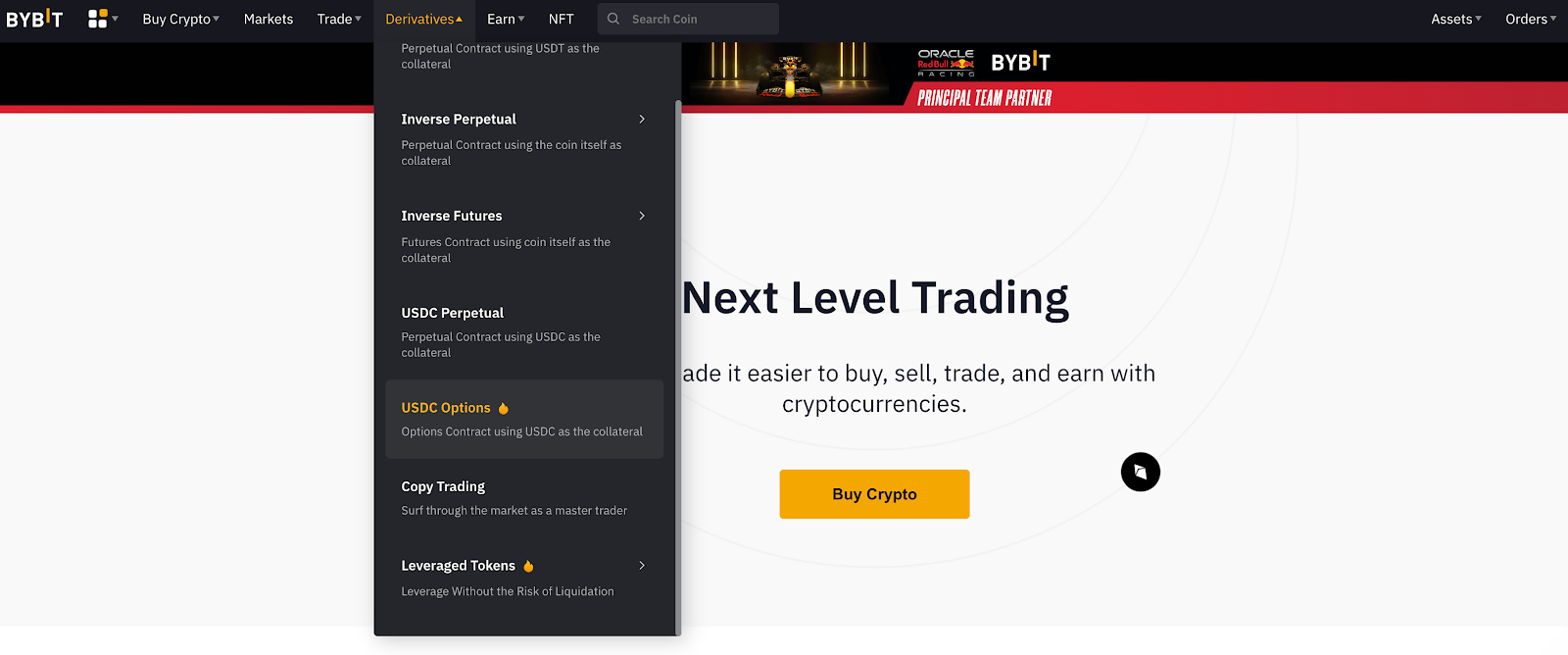

Visit the official Bybit website and select USDC Options → Derivatives.

Source: Bybit

Step 2

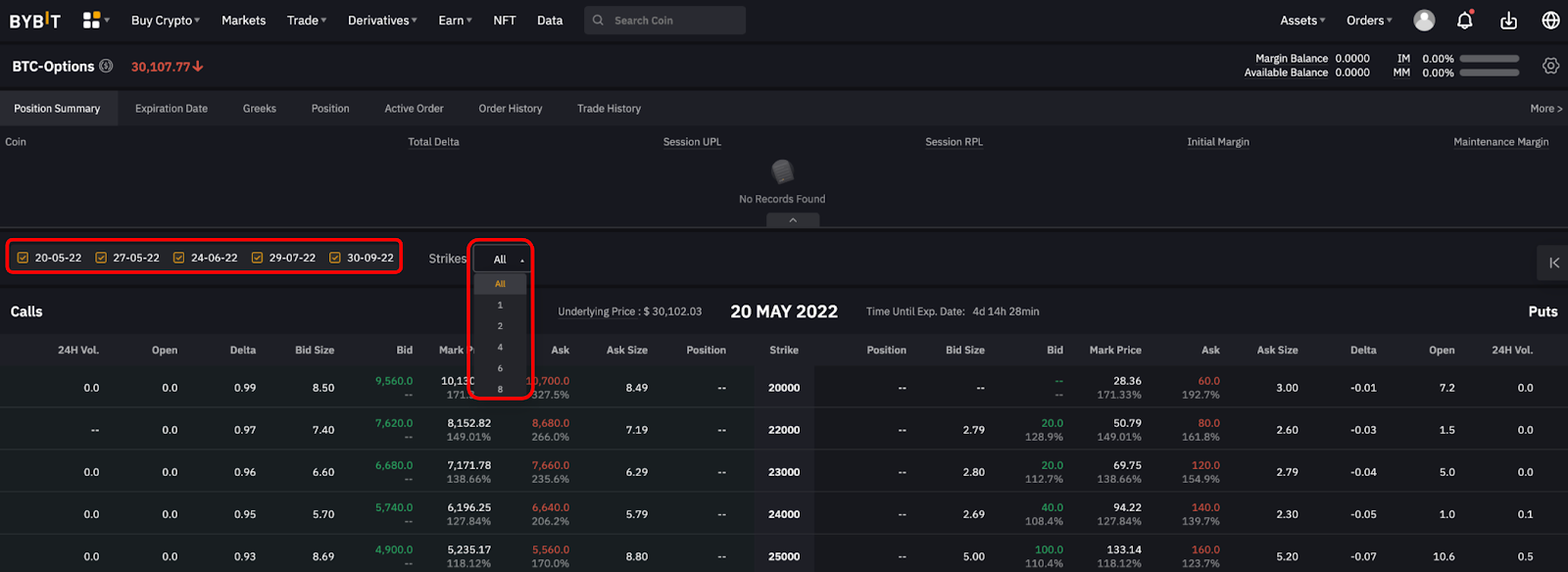

Pick the desired expiration date, or show all the expiration dates at once, and then pick one.

Source: Bybit

Step 3

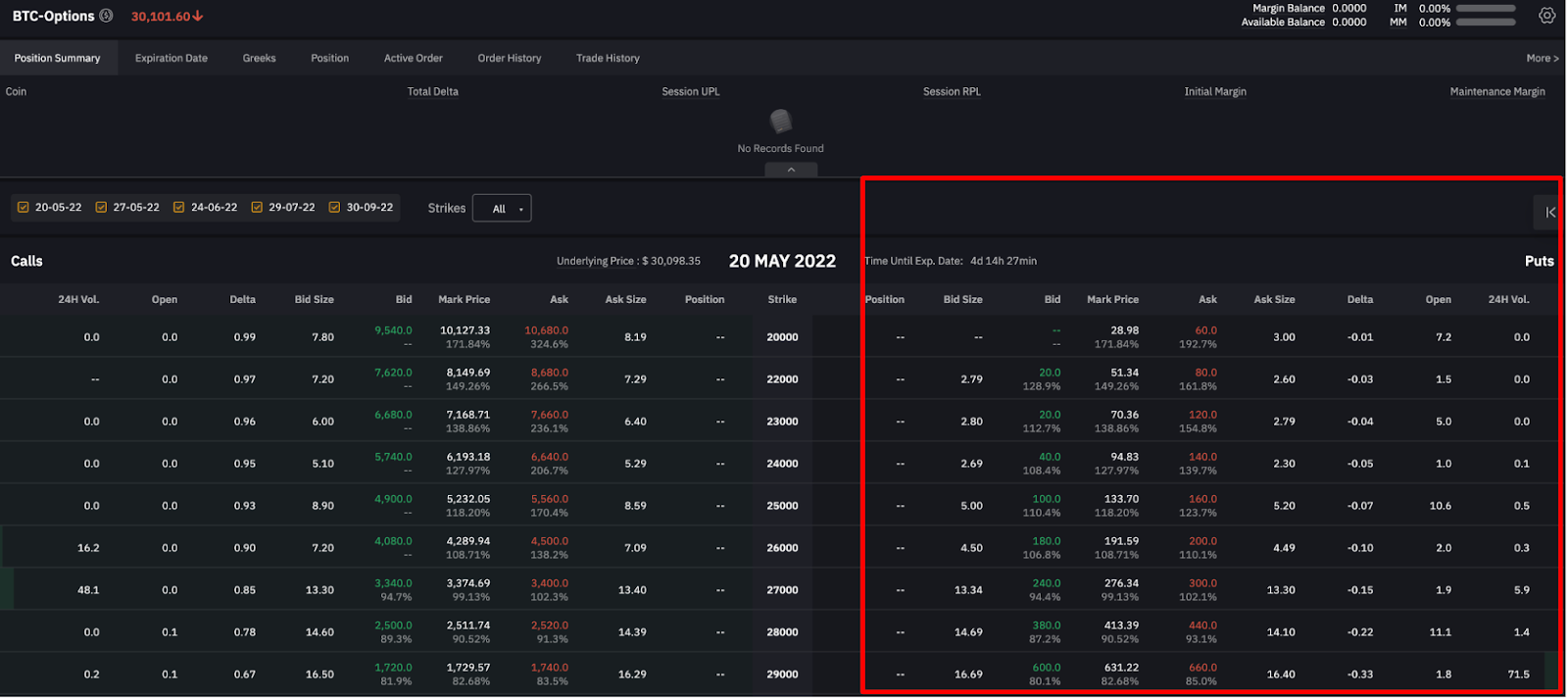

Choose the type of option you want to buy (in this case, Put Options.)

Source: Bybit

Step 4

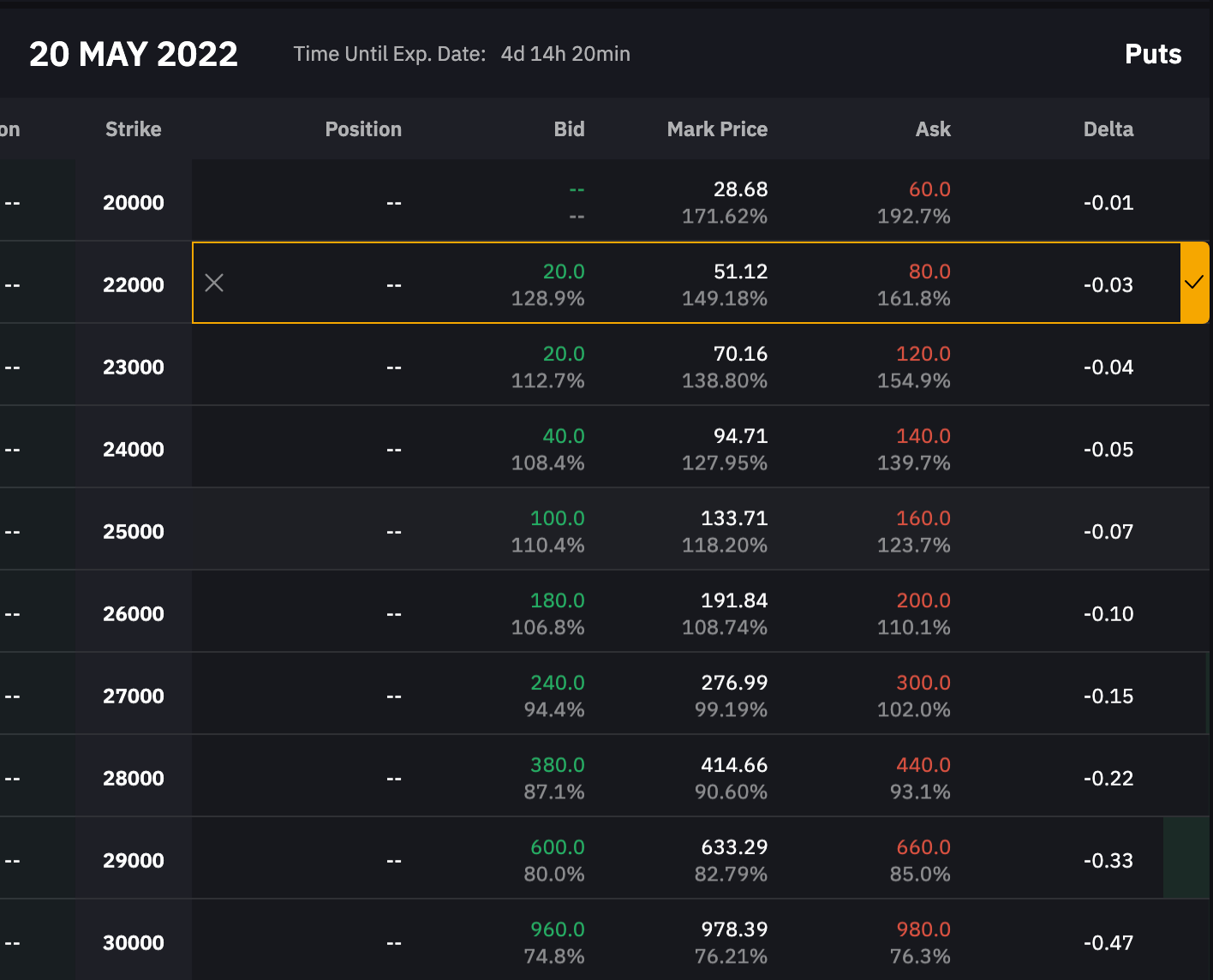

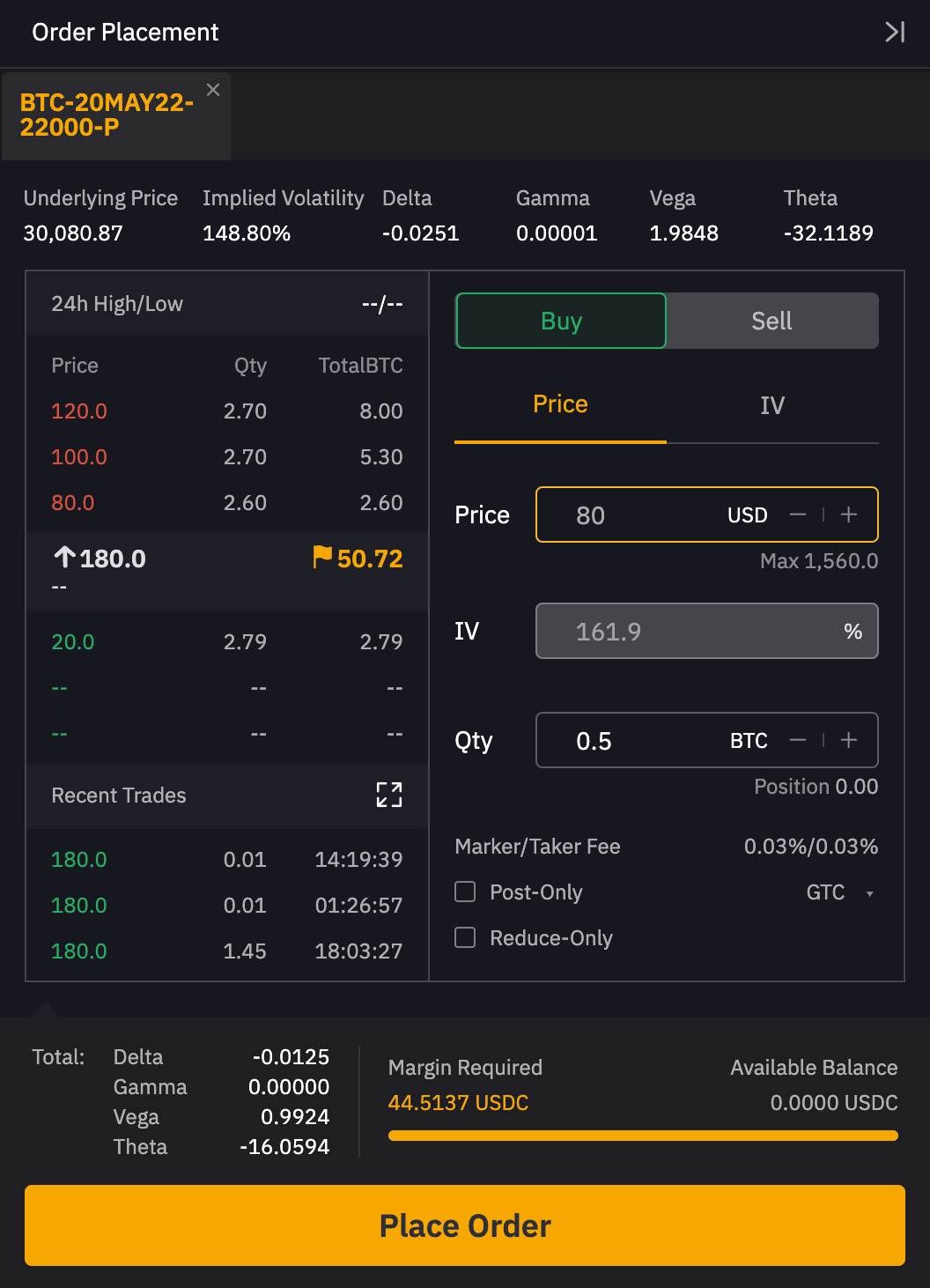

Review the details of the options and select the one you want to buy, either by price or action (buy or sell).

Source: Bybit

Step 5

Select Place Order to reveal a confirmation tab.

Source: Bybit

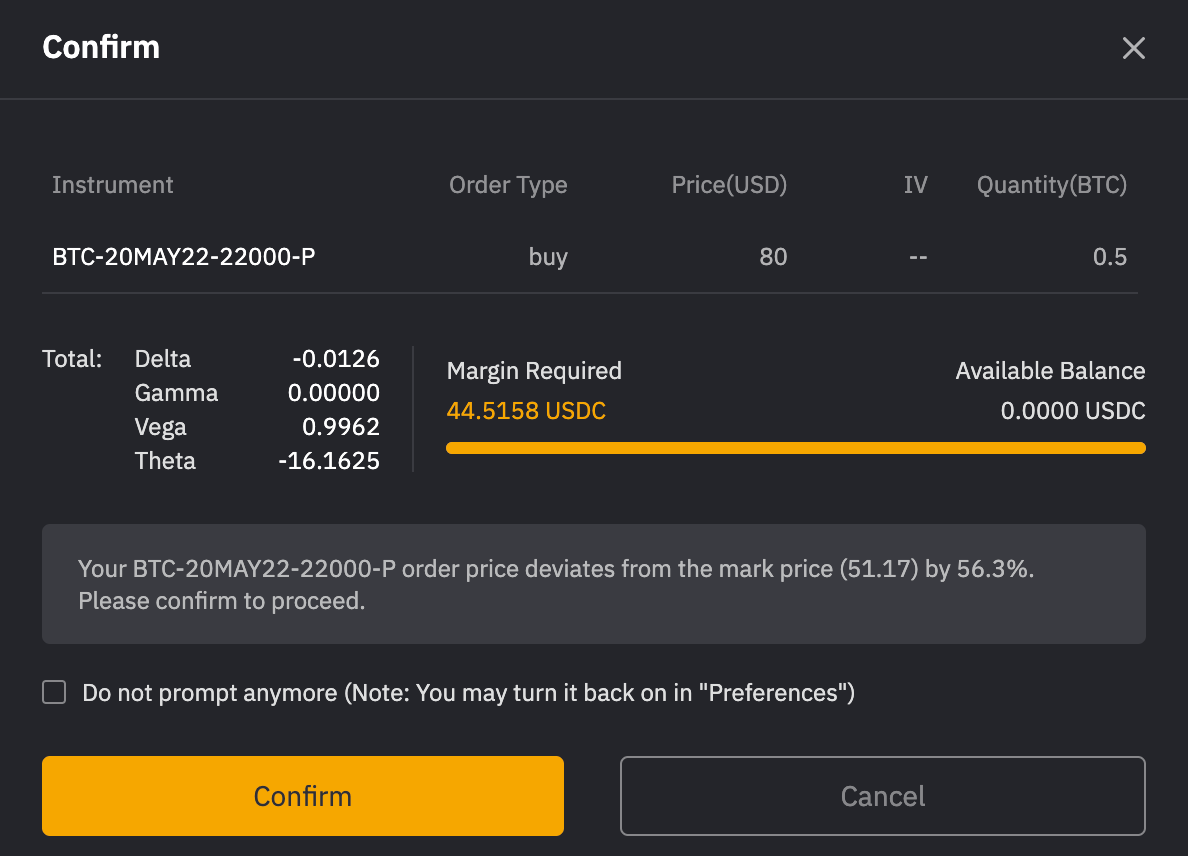

Step 6

Ensure that the information entered is correct, and click on Confirm.

Source: Bybit

Closing Thoughts

The crypto options market is an exciting one that provides a lower-risk avenue for making a profit off certain assets. Even though options can be risky, proper market study and the use of appropriate strategies are sure to significantly reduce/mitigate the risks involved. In the near future, more investors are expected to board the options train as cryptocurrency continues to gain attention on a global scale.