Crypto Options: Why They Deserve a Place in Your Portfolio

In every financial market, contracts form the basis of things. Contracts are legally binding agreements designed to serve specific purposes and needs. In financial markets, contracts are crafted to make a profit and are also known as “financial instruments” — abstract tools made to generate profit.

One such instrument that’s been developed to make a profit is options. As with other derivatives, options contracts track the underlying asset's price, i.e., its value is dependent largely on other instruments' price (cash or derivatives). An option is a contract that empowers a party to buy/sell a financial instrument at a predetermined price, on or before a predetermined date.

Are There Options in Cryptocurrency?

In their bid to become mainstream, cryptocurrencies are adopting several financial processes and instruments, with options being one of the latest instruments to be integrated into the crypto ecosystem.

Investors favor crypto options because options hedge against existing risk and provide greater market exposure, diversifying one’s portfolio and enabling increased profit margins.

Apart from this, options also allow traders to use a small amount of money to control a larger position value (leverage). As only a small amount is involved, the ROI on options trading is much higher than that of other types of trading.

Yes, there are options in cryptocurrency, and this sector of the market has experienced tremendous growth in the past few years, with outstanding contracts racking up billions of dollars as a whole.

What Are Crypto Options?

Crypto options gives a person the privilege (not obligation) to buy or sell the underlying cryptocurrency at a preset price on or before the expiration date after a premium is purchased. They’re used by options traders for speculation (potential profit if the asset moves in your direction), or by investors for hedging. As we know, volatility is rife in the crypto market, making crypto options a popular choice for investors. Currently, the most popular crypto options are Bitcoin options and Ethereum options. Before we proceed, a couple of definitions are in order.

Premium: The amount a person pays to secure the rights provided by the contract.

Strike Price: The price at which a person has the right to buy the underlying asset (for a call option), or the price at which a person has the right to sell the underlying asset (for a put option).

Call and Put Options

There are two types of options contracts: Calls and Puts.

Call Options

When it comes to call options, you can either buy call options or sell call options.

Buying Call Options

When you buy a call option, you are essentially buying an underlying asset at a particular predetermined price, regardless of the market price before/at the contract’s expiration.

When speculating in the financial market, you can purchase a call option when you believe the market price at the contract expiration will be higher than the strike price. In short, you anticipate that the value of the options will increase — the more its value increases, the more you will earn.

Buying Call Options: Example

For example, Shaw purchases an Ethereum call option that will expire after a week, with a premium of 25 USDT and a strike price of $3,000. When the price of ETH moves from $3,000 to $3,200, he may decide to close his position before the validity period elapses, and his gross profit will be $175 [i.e., ($3,200-$3,000-$25)/market price at execution − strike price - premium].

Selling Call Options

On the other hand, call option selling (naked call) is carried out when a trader expects the price of the underlying wallet to remain flat or move lower.

Selling Call Options: Example

Given the example above, as long as the price at expiry does not go to/go below the strike price of $3,000, and the buyer does not exercise the contract, you will collect the full premium of 25 USDT.

A call option entitles you to buy an underlying asset at a particular predetermined price, regardless of the market price before/at the contract's expiration.

Put Options

Put options allows you to sell the underlying asset at a predetermined price before/at the expiration of the contract, regardless of the market price at that time.

Buying Put Options

Similar to calls, you can buy put options or sell put options. When you buy a put option, you are essentially selling the underlying asset at a predetermined price before/at the expiration of the contract, regardless of the market price at that time.

When trying to secure the gains of minting or investing, a person could enter a put option contract to ensure the asset retains substantial value. A speculator could also purchase a put option if they believe the price of the underlying asset class would be lower than the strike price, in order to make a profit, by repurchasing it at a lower price than the one at which they bought it.

Buying Put Options: Example

Take the example of Chris, who had 100 BTC when the price of 1 BTC was $48, 000. As she expected its price to fall, she bought a put option from her crypto exchange that gave her the right to sell her asset at a strike price of $45,000 after 2 weeks. When the price of BTC got to $40,000, Chris exercised her right and profited $5,000 as a result.

Selling Put Options

On the other hand, put option selling (naked put) is carried out when a trader expects the price of the underlying wallet to go up.

Selling Put Options: Example

Using the same example above, a trader who sells Chris the option is betting that the price of BTC will go up. If the price of 1 BTC goes up to more than $48, 000 e.g., $50, 000, at the date of expiry, the option will expire worthless and the seller will get to keep the full premium.

How Crypto Options Work

As contracts, options usually involve two parties: a trader and an exchange. An options seller places a contract order on the crypto exchange, with the expiration date and the strike price specified. Then, a buyer is matched with the order by the exchange.

To ensure fairness, the cost of the premium is determined by the amount of time remaining on a contract before its expiration, the volatility of the underlying asset, the market price of the underlying asset, and interest rates.

ITM vs. ATM vs. OTM

ITM is an abbreviation for "in the money.” This phrase is used when the price of an asset is in favor of the owner of the options contract. — i.e., the market price is higher than the strike price of a call option, or the current price is below the strike price of a put option.

ATM stands for "at the money." This means that the strike price and current price are equal.

OTM means "out of the money.'' In the context of a call option, it indicates that the strike price is higher than the market price. However, when it comes to a put option, OTM means that the strike price is lower than the market price.

Common Crypto Options Strategies

Bull Put Spread

This is a strategy regularly used in trading options. As its name implies, the bull put strategy is used when a trader or speculator believes that the underlying asset will experience a slight price increase.

The bull put spread can also be achieved with OTM i.e., selling a put option at a higher strike price and buying another put option at a lower strike price, with the same date of expiration (DTE).

The key here is that you want to sell the higher strike, and buy the lower strike. However, although the risks are fairly low, this strategy is not immune to risks. The potential loss would be the difference between the two strikes, minus the credit received.

If the asset price is lower than the strike price at the expiration, both put options will expire ITM, and a loss would be recorded.

Bull Put Spread Example

For example, a crypto investor is bullish on Bitcoin, whose current price is at $48, 000. The investor sells a put option for a premium of $2,400, at the strike price of $48,000 with a 1-month date to expiry (expiring in one month). Concurrently, he buys another put option for $800 with a strike price of $45,000 expiring in one month. The investor receives a net profit of $1,600 ($2,400-$800 premium paid) for the two options. This is called the “net credit” strategy.

If things go south and Bitcoin’s price drops to between $45,000 and $48,000 at the date of expiry a month later, the investor would likely make a loss. If Bitcoin’s price goes even more bearish and drops below $45,000, the investor would incur a max loss capped at $45,000 - $48,000 + $1,600 = -$1,400.

Bear Put Spread

This is the inverse of the bull put strategy. When an investor feels moderately bearish on an asset, the bear put spread is the right way to go, as it reduces cost and risk while simultaneously offering the chance to profit.

To execute this strategy, you buy a “buy put” option and simultaneously purchase a “sell put” option with a lower strike price. Both contracts need to be of the same asset and same expiration date.

Bear Put Spread Example

For example, if the asset is trading around $65, you can buy a strike put at that price (or around it) for $5 (this equals $500 as premium), while selling another put option that has a strike of $60 at $3 (this equals $300). Note that the two options are to be executed at the same time.

It’s ideal to place the orders as a spread to do this. The net debt is $2 per spread. The premium of $200 is the maximum loss that can be recorded. If the price drops to $50, you get a gross spread of $5, while the net spread is $3 (this equals $300).

Iron Condor

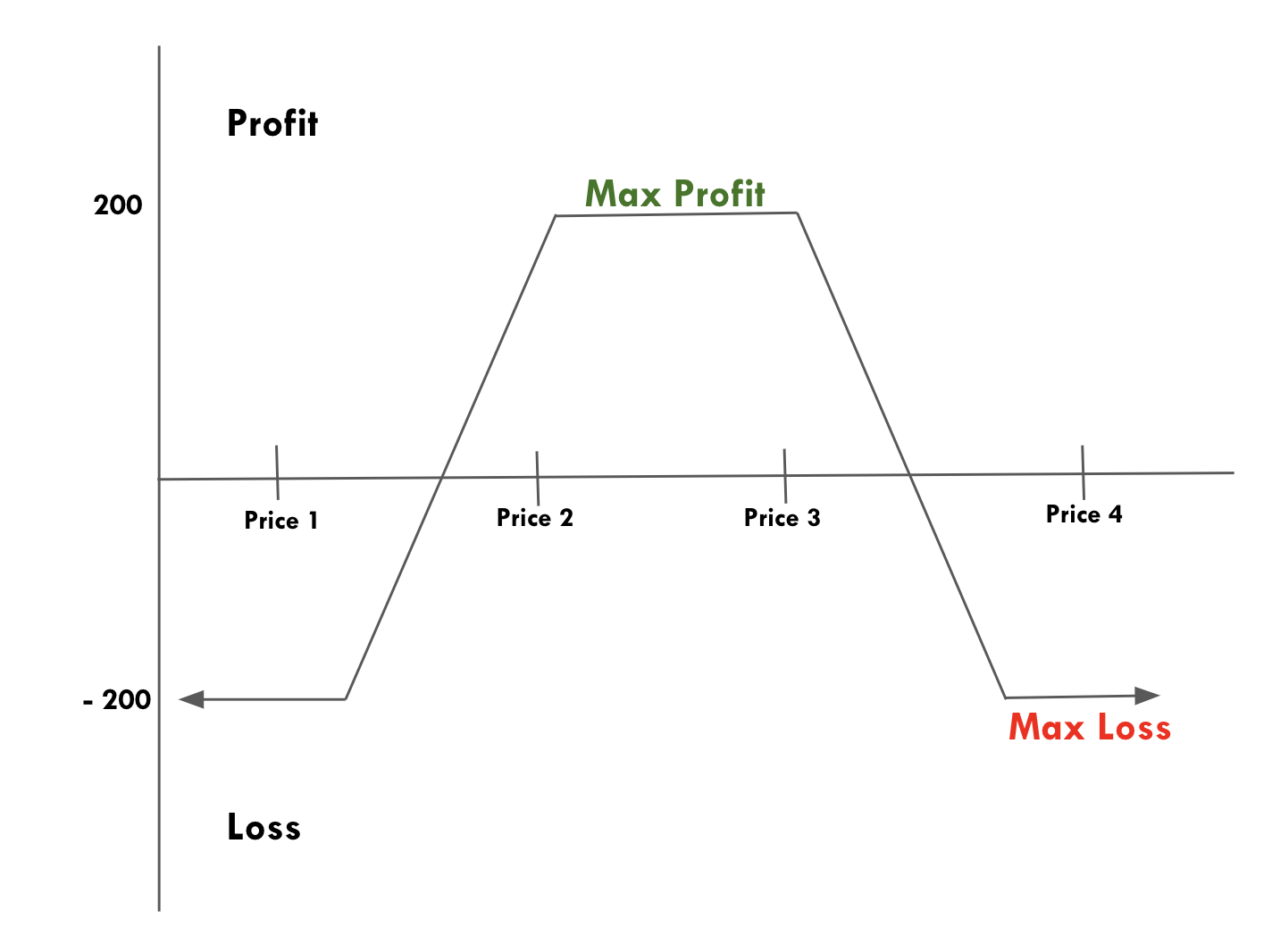

The iron condor strategy makes use of four contracts: two puts (a long and a short) and two calls (a long and a short). They’ll all have four strike prices and the same expiration date. It profits from low volatility (small moves in prices).

Here’s an example of the way it works:

Buy one call at $300

Sell one call at $280 ($20 in between)

Sell one put at $270

Buy one put at $250 ($20 in between)

Maximum profit with the iron condor is the total premium received for opening the four options positions. In contrast, a loss is a difference between the long put and short put strike prices or the long call and short call strike prices. Adding commissions and reducing the loss by the net premium received gives the maximum loss.

American vs. European Style

The American-style options contract is a method where the execution of the contract can happen before the expiration date stated in the contract. In comparison, the European-style options contract requires that the contract be settled only after the contract's expiration.

Cash-Settled vs. Physically-Settled

A cash-settled options contract is a procedure of settlement in which the contract is settled by the cash equivalent of the underlying asset upon execution if the contract is in their favor. But physically-settled contracts are settlement styles in which the underlying asset is used to execute the contract.

For example, if Sandra closes her call options position that allows her to buy 10 Litecoins at a strike price of $136, and the market price is $170, instead of receiving a credit of $340 as gross profit ($170 - $136 × 10), she’s credited with the amount of Litecoins the profit can buy, which is 2 LTC ($170 + $170 = $340).

Crypto Options vs. Stock Options

In stock options trading, 1 contract is equivalent to 100 stocks. Thus, when the price of a stock goes up by $1, the investor profits $1 x 100 stocks = $100.

However, when it comes to crypto options trading, using BTC as an example, 1 contract = 1 BTC. When BTC’s price goes up by $1, the profit earned is $1 x 1 coin = $1. To get the same $100, an investor will have to buy 100 contracts or 100 BTC.

Options vs. Futures

These two financial derivatives are remarkably similar, as they both track underlying assets and allow people to speculate on them. They also allow traders to take long (call) and short (put) positions.

However, their features differ slightly in their modes of operation. Let's see how.

An options contract allows you to buy an underlying asset at a price other than the current market price. It also gives you the “option” of buying/selling the underlying asset. However, in a futures contract, this move is an obligation, a duty that isn't based on the holder's discretion. This means that if the market moves against the direction of a futures contract, the position will be closed at the expiration date. As it’s a type of smart contract, it can execute on its own.

Compared to options contracts, futures contracts are high-risk/high-reward. Unlike options contracts, where the maximum potential loss is limited to the premium paid for the contract, with a futures contract the loss depends on how much the price has moved away from your entry at the expiration date. The stakes are high with futures: While there’s potential to make a lot of money, you could potentially lose a lot of money as well.

Options vs. Perpetuals

Perpetual futures contracts (or simply perpetuals) are contracts with no expiration date. They allow traders to close their positions (if they’re gaining) at any time. At times, their positions may be liquidated if the market moves away from their predictions as a result of the leverage used to open such positions.

This means that all perpetual contracts are settled in cash, as there is no expiration date when they’ll be physically settled. That is, all perpetual contracts are American-style.

Where to Trade Crypto Options

- Bybit: Ranked #3 on CoinMarketCap for derivatives, Bybit officially added crypto options to its product list in May 2022. It currently carries BTC options.

- Deribit: This is the largest crypto options market by volume. It’s a BTC, ETH options market and only executes contracts at expiration. It settles options contracts in cash by crediting contract owners the cash equivalent of the underlying assets. It also offers up to 50 times leverage for option traders.

OKEx: This is another market in which to trade BTC and ETH options. Unlike Deribit, it settles contracts physically, but it doesn't allow the settlement of contracts before execution dates.

CME: The Chicago Mercantile Exchange (CME) is the largest crypto futures exchange, but it also carries options contracts. It uses cash settlement and executes contracts only at expiration.

Potential Risks

Regardless of one's experience, skill or luck, no one can predict future happenings accurately. There’s always a risk involved.

The leverage used in trading options contracts could lead to the loss of premium, due to small changes in price movement. Sudden market moves are also to be expected whenever whales enter the market, posing a risk to traders.

Fundamental changes could also affect the price of an underlying asset in shattering ways. A lawsuit, a scandal, a security breach — virtually anything — could radically redirect the price movement.

Closing Thoughts

The crypto-financial space is relatively new, and complex instruments are just gaining a foothold in blockchain technology-backed assets. The dearth of regulation is concrete proof of this assertion. However, we can't deny the potential that cryptocurrencies have in revolutionizing the financial space.

Options trading is widely gaining popularity in the crypto ecosystem. With potentially high-profit margins and calculated risk, consider adding crypto options to your portfolio for diversification.