Call Options: A Cost-Efficient Way to Earn on Your Assets

Traditional financial markets have been in existence for a long time, with assets such as stocks featuring as their key products. In recent years, however, cryptocurrency has made a significant impact on the finance scene, and is shaping up to be quite the competitor to traditional finance products.

Just like stock options, there are now crypto options, which allow traders to participate in the burgeoning cryptocurrency market without having to own any crypto themselves. Users can profit from the rise or fall of these options, which are tied to the performance of crypto assets.

What Are Crypto Options?

Crypto options are financial tools that confer upon an options owner the opportunity (though not the obligation) to buy or sell an underlying asset at a predetermined price 1) before the option reaches expiration, or 2) after a premium is bought.

The two most common types of crypto options are Bitcoin options and ETH options. This makes sense since Bitcoin and Ethereum are currently the two largest projects by market cap.

Although wildly popular, it’s no secret that the crypto ecosystem is plagued by volatility. Amid mounting interest in cryptocurrency, an increasing number of people are exploring crypto options as an alternative means to trading this volatile asset class.

Crypto options cost much less than the assets themselves, and come at a lower risk level than other asset classes. The perfect solution for trading digital assets, options give traders the opportunity to speculate on the future value of an underlying asset’s price, which can then be paid for in fiat or cryptocurrency. Investors also use options for hedging.

Before we proceed further, let’s take a look at a few key terms.

Premium: This is a special fee that needs to be paid to the seller before you can secure the rights to an option.

Strike Price: This simply refers to a fixed price above which a seller is not permitted to sell an option (for call options). In simple terms, it’s the price at which a buyer has the right to buy an asset.

“Strike price” can also mean the price below which a buyer is not permitted to buy an option (for put options). In simple terms, it’s the price at which a seller is permitted to sell an underlying asset.

Expiration time: This is the time before which an option is to be bought or sold. If this time is reached, the option loses its value.

What Are Crypto Call Options?

Typically, the value of options is tied to the performance of the underlying asset to which they’re attached. As mentioned earlier, crypto options are tied to the performance of crypto assets.

A crypto call option is a contract or tool that confers on a person the choice (rather than the obligation) to buy a specific asset at a preset price, on or before a certain time frame (known as the expiration date).

To buy a call option, the buyer must pay the seller a “premium fee.” Each crypto options contract is made up of one cryptocurrency, bought at a predetermined price. You don’t have to own the particular underlying asset before you can buy or sell its corresponding call option. It should be noted that this period of transaction lasts only for a specified time frame, as the buyer ought to exercise their call on or before the expiration date.

If you predict an increase in the market share of an option, you can decide to buy the call option instead. If the stock booms and the current value surpasses the strike price before reaching the expiration date, it would result in a profit.

If, on the other hand, the stock price records a decline, the buyer allows the call option to expire and the only loss is the option’s premium fee.

American-style options permit their holders to use or exercise the option anytime before the date of expiration. On the other hand, European-style options can only be exercised on the date of expiration.

How Does Crypto Call Options Work?

An options contract is usually a transaction that takes place between two parties: The options trader and the cryptocurrency exchange.

An option seller places the options contract on the cryptocurrency exchange with their specific price and expiration date. An interested buyer is then located and linked with the order on the options market.

To ensure transparency, the cost of the premium paid is calculated using different parameters — e.g., the time remaining before reaching expiration, market price, and volatility of the underlying asset alongside the interest rates.

An option is said to have intrinsic value if it’s still valuable at the point of expiration.

Example of a Call Option

Suppose the market price of a particular option is $90. The buyer holds a call option with a strike price of $70 at a premium fee of $5. The option has intrinsic value and is said to be “in the money” (ITM) because, at expiration, the buyer can buy 100 shares at $70, instead of the current market price of $90.

Intrinsic Value = Price of Underlying Asset - Strike Price

In this case, $90 − $70 = $20 gross profit. This simply implies that the option has an intrinsic value of $20 per share.

Similarly, the call option is referred to as “out of the money” (OTM) if it possesses no intrinsic value at expiration.

Going by the above example, if the same stock price drops to $50, it would hold no intrinsic value, as no buyer will purchase for $70 when the market’s current price is $50. This renders the option valueless. The call seller only gets the premium paid ($5).

Aside from ITM and OTM, there’s a third possibility called “at the money” (ATM). An asset is said to be ATM when both the present market price and strike/fixed price are equal.

Example of a Crypto Call Option

Major examples of crypto call options include Bitcoin call options and Ethereum call options.

Bitcoin call options are financial derivative products that confer the right, rather than the obligation, to buy or sell Bitcoin at a specified price. Even though a premium is paid before purchase, BTC call options are much less expensive and riskier than ownership of the crypto itself. Ethereum call options function more or less in the same way.

Suppose the underlying price of a BTC option is $19,800. The buyer holds a call option with a strike price of $19,500, at a premium of $1,000.

Intrinsic Value = $19,800 - $19,500 = $300.

Going by the above example, if the price of BTC drops to $19,000, it would hold no intrinsic value, as no buyer will purchase for $19,500 when the market’s current price is $19,000. This renders the option valueless. The call seller only gets the premium paid ($1,000).

Crypto Put Options vs. Crypto Call Options

Aside from call options, there’s another set of equally popular options/trading derivatives known as put options. The put option confers upon a buyer the right to compel the seller of the put to buy shares of a specific or underlying asset from them at a set price (strike price).

The crypto put option is held with the hope of a decline in the market price of the crypto (to a value lower than the strike price.)

Call options are typically the opposite of put options. Here are some similarities and differences:

Call Options | Put Options |

Allow their holders to earn a large sum of profit | Allow their holders to earn a large sum of profit |

Depend on a boom in the price of the asset in the financial markets | Rely on a decline in the market value of the asset |

Involve a premium fee | Involve a premium fee (seller bears all the risks involved, in case there’s a downward movement in price) |

Should I Buy Calls In the Money (ITM) or Out of The Money (OTM)?

Both ITM and OTM methods come with their own set of benefits and disadvantages: Strictly speaking, neither one is preferable. Instead, both options and their different strike prices are part of the options chain, which includes several categories of traders, and option techniques or strategies.

The decision to purchase options ITM or OTM falls fully on you, so your choice should be guided by your prediction of the underlying security (whether its value will fall or rise). Additional factors include your current financial situation, and what you hope to accomplish at the end of the day (are you looking to actively trade, or are you in it for the long run?).

Crypto Call Options vs. Traditional Call Options

Crypto Call Options | Traditional Call Options |

Market runs around the clock | Market is typically open from Monday to Friday, from 9 am to 5 pm |

Extremely volatile; fall and rise frequently in price | Less volatile, with few extreme swings in price |

The volatility of the crypto options market can be both advantageous and disadvantageous to traders. If the market moves in favor of the options trader, they have the opportunity to profit handsomely from the difference between the strike and crypto price. On the other hand, if the market goes against the options trader, they suffer a significant loss.

Alternatives to Exercising a Crypto Call Option

Apart from call options, a trader can opt for either a futures or perpetual contract.

Options typically let you purchase an underlying crypto at a different price from the actual market price. You may also decide to buy or sell the asset. Using a futures contract, however, a user is compelled to perform this action. Simply explained, if the market doesn't move in favor of a futures contract, it will automatically be closed on the expiration date. This is done through the use of smart contracts.

Perpetual futures contracts (European-style options) typically have no expiration date, and traders can close their positions anytime. They can do so when they feel like they’ve made enough profit, or liquidate their positions if the market doesn't go according to their speculations.

Buying Crypto Call Options

Crypto options are a derivative product that can be traded on the Bybit exchange.

Follow the steps below to start trading crypto call options.

Step 1

Visit the official Bybit website and select USDC Options under Derivatives. You’ll be directed to the USDC Options trading page.

Source: Bybit

Step 2

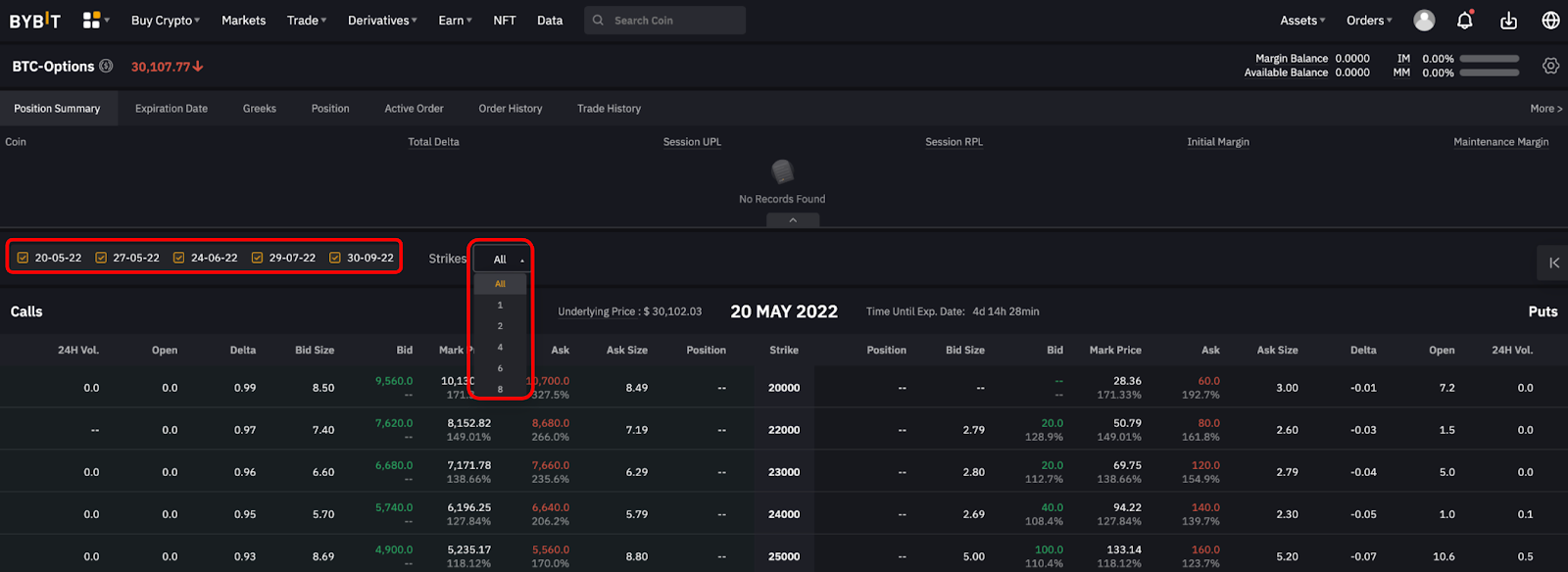

Select the desired expiration date (or show all the expiration dates at once)

Source: Bybit

Step 3

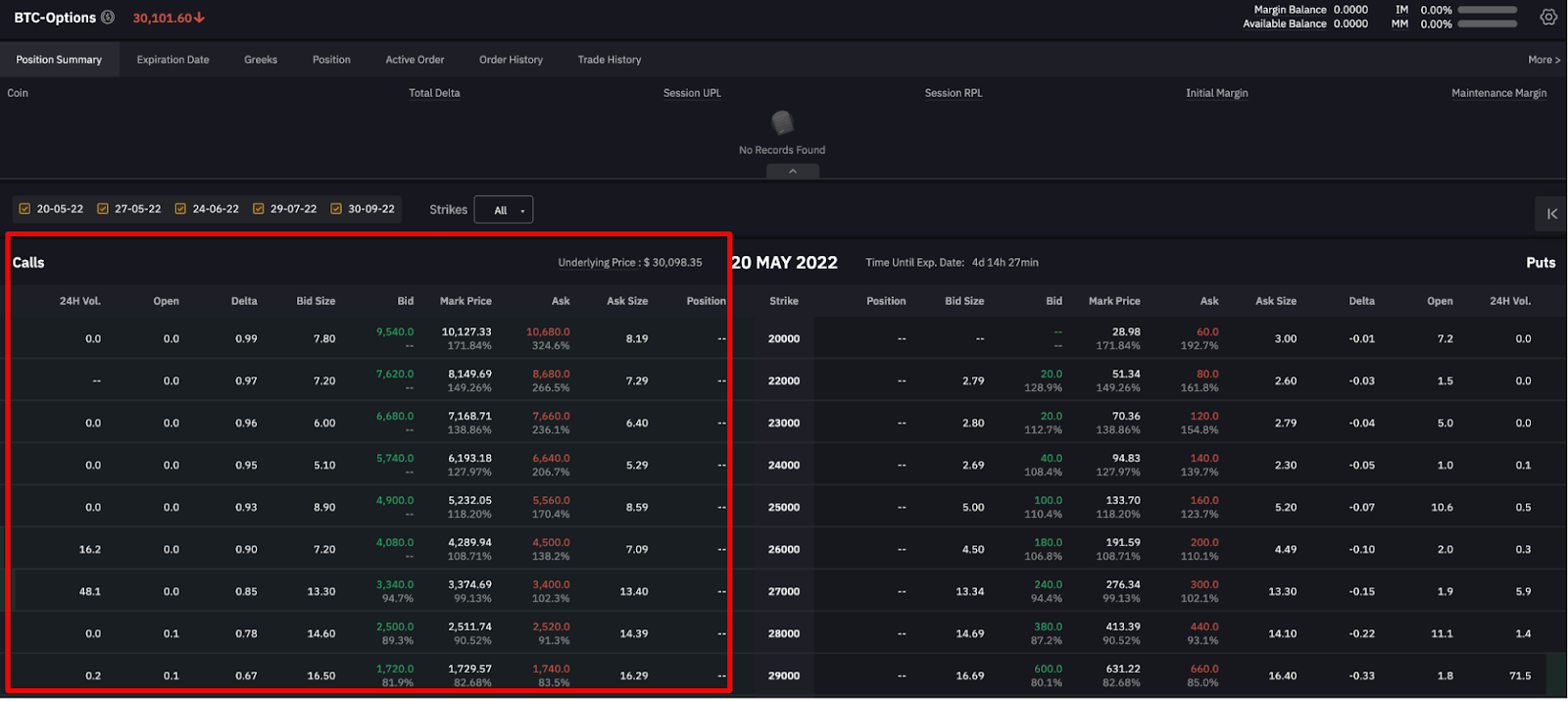

Choose the type of option you want to buy (in this case, Call Options.)

Source: Bybit

Step 4

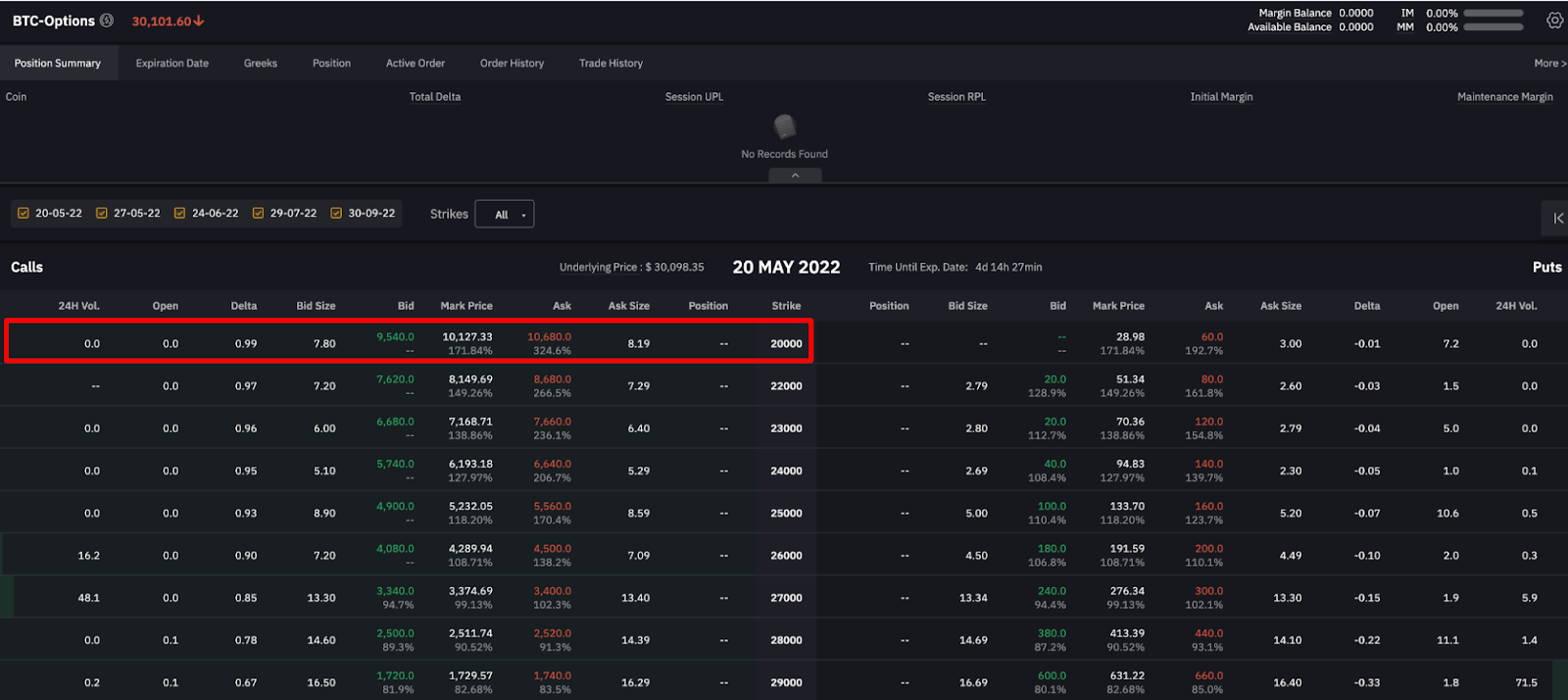

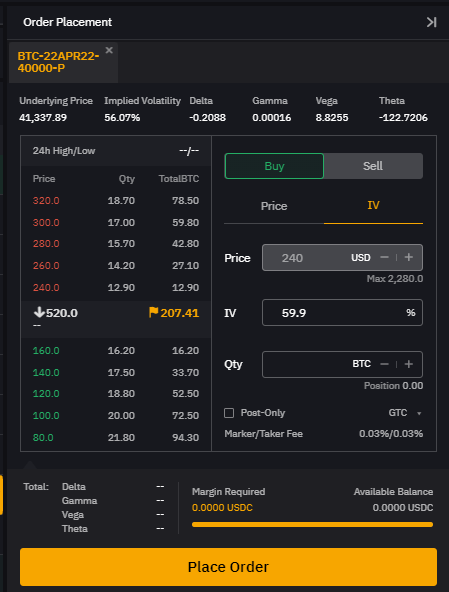

Select the details of the option you want to buy, either by price or action (buy or sell).

Source: Bybit

Step 5

Select Place Order. A confirmation tab will appear on the right side of your screen.

Source: Bybit

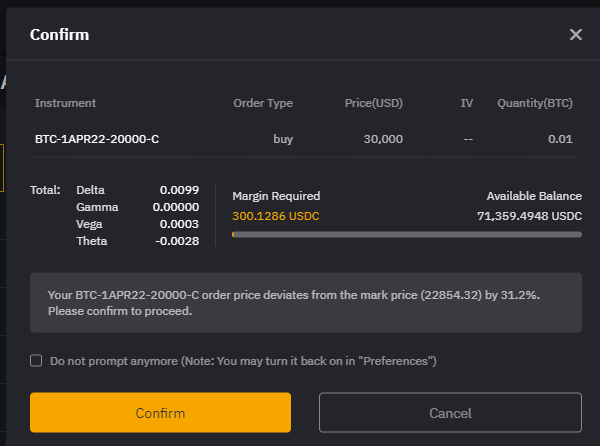

Step 6

Ensure that the information entered is correct, and select Confirm.

Source: Bybit

Closing Thoughts

Crypto options provide a way of participating in the crypto market without having to own crypto itself. While trading crypto options can be risky, they can definitely be a viable investment … with a clever combination of strategies and techniques in place, of course.

As cryptocurrency is gaining attention, it’s predicted that a boom will occur in the use of crypto options — and it’s not a matter of if, but rather when.